Utah Tc-40 Form

Utah Tc-40 Form - Utah individual income tax return instructions: How to amend a 2022 return. Attach completed schedule to your utah income tax return. We will update this page with a new version of the form for 2024 as soon as it is made available by the utah government. Silver lake, big cottonwood canyon, by colton matheson. 3 ssn last name 2020 / / / / /.00.00.00.00.00.00. Utah individual income tax return. Web ustc original form utah state tax commission utah individual income tax return all state income tax dollars support education, children and individuals with disabilities. Web follow these steps to calculate your utah tax: All state income tax dollars support education, children and individuals with disabilities. We will update this page with a new version of the form for 2024 as soon as it is made available by the utah government. Attach completed schedule to your utah income tax return. All state income tax dollars support education, children and individuals with disabilities. Web follow these steps to calculate your utah tax: How to amend a 2022. Write the code and amount of each subtraction from income in part 2. To learn more, go to tap.utah.gov.00.00.00.00. Web this form is for income earned in tax year 2022, with tax returns due in april 2023. For more information about the utah income tax, see the utah income tax page. Utah individual income tax return. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax refund of excess withheld income or a tax payment if the withholding does not cover the taxpayer's entire liability. Who must file a utah return; Other utah individual. Shopping online is easy, but it’s not free. To learn more, go to tap.utah.gov.00.00.00.00. Web this form is for income earned in tax year 2022, with tax returns due in april 2023. For more information about the utah income tax, see the utah income tax page. Attach completed schedule to your utah income tax return. All state income tax dollars support education, children and individuals with disabilities. Other utah individual income tax forms: Utah loses tax revenue every year to online sales. 3 ssn last name 2020 / / / / /.00.00.00.00.00.00. Web you must amend your utah return within 90 days of the irs’s final determination. Utah individual income tax return instructions: Who must file a utah return; This form is for income earned in tax year 2022, with tax returns due in april 2023. Write the code and amount of each subtraction from income in part 2. Web ustc original form utah state tax commission utah individual income tax return all state income tax dollars. Write the code and amount of each subtraction from income in part 2. Utah individual income tax return instructions: Enter the corrected figures on the return and/or schedules. Other utah individual income tax forms: Silver lake, big cottonwood canyon, by colton matheson. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax refund of excess withheld income or a tax payment if the withholding does not cover the taxpayer's entire liability. To learn more, go to. Utah individual income tax. Web this form is for income earned in tax year 2022, with tax returns due in april 2023. Follow the links below for more information. Shopping online is easy, but it’s not free. This form is for income earned in tax year 2022, with tax returns due in april 2023. For more information about the utah income tax, see the. Write the code and amount of each subtraction from income in part 2. Follow the links below for more information. To learn more, go to. For more information about the utah income tax, see the utah income tax page. Web you must amend your utah return within 90 days of the irs’s final determination. We will update this page with a new version of the form for 2024 as soon as it is made available by the utah government. Utah individual income tax return. Attach completed schedule to your utah income tax return. Who must file a utah return; We will update this page with a new version of the form for 2024 as soon as it is made available by the utah government. How to amend a 2022 return. Utah individual income tax return instructions: Other utah individual income tax forms: How to obtain income tax and related forms and schedules. Write the code and amount of each subtraction from income in part 2. Web follow these steps to calculate your utah tax: Follow the links below for more information. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax refund of excess withheld income or a tax payment if the withholding does not cover the taxpayer's entire liability. Enter the corrected figures on the return and/or schedules. All state income tax dollars support education, children and individuals with disabilities. Silver lake, big cottonwood canyon, by colton matheson. Web ustc original form utah state tax commission utah individual income tax return all state income tax dollars support education, children and individuals with disabilities. 3 ssn last name 2020 / / / / /.00.00.00.00.00.00. Shopping online is easy, but it’s not free. For more information about the utah income tax, see the utah income tax page.UT TC40 Forms & Instructions 20202021 Fill and Sign Printable

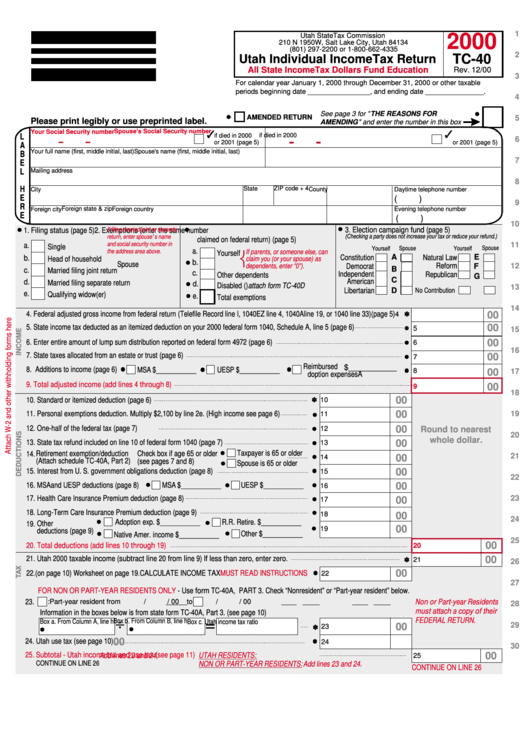

Form Tc40 Utah Individual Tax Return 2000 printable pdf

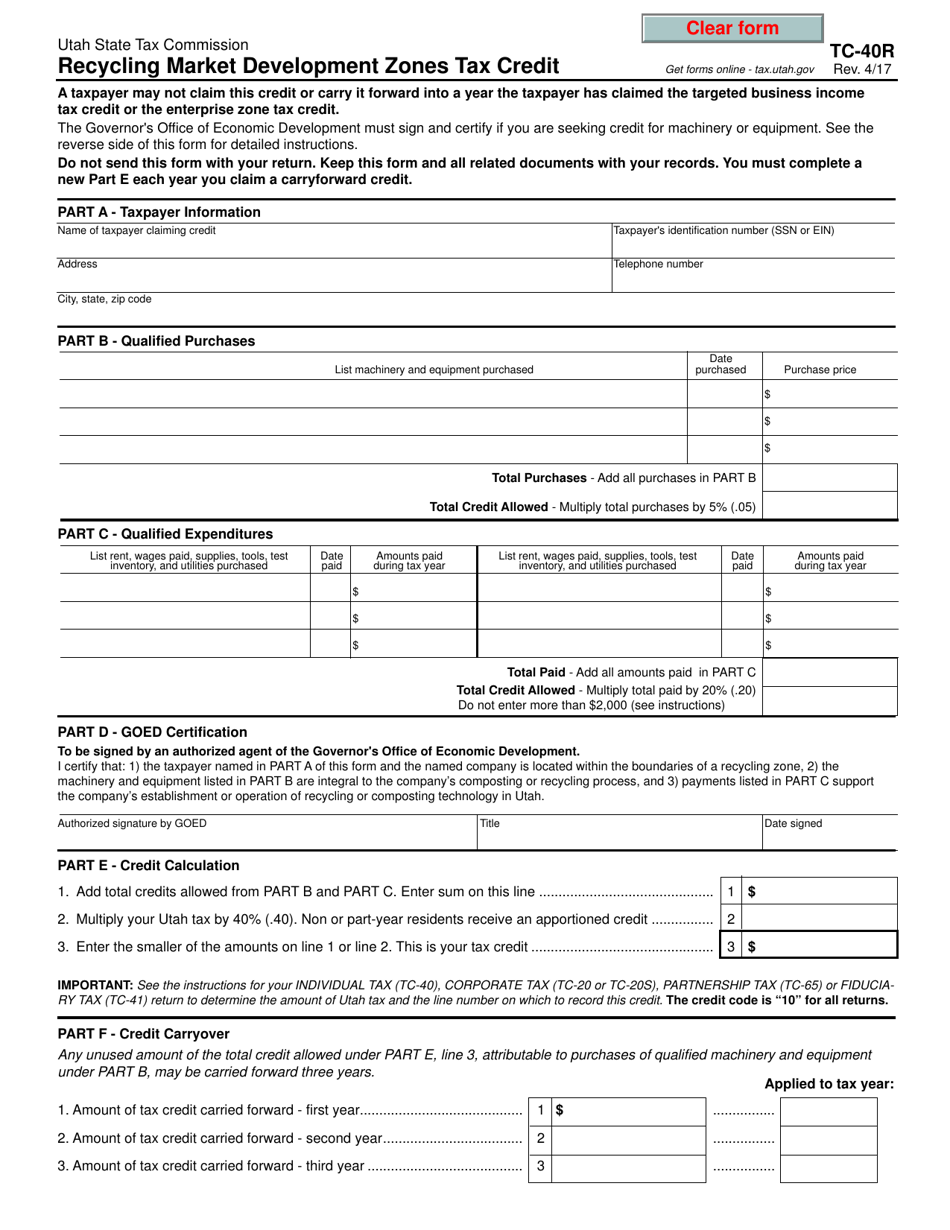

Form TC40R Download Fillable PDF or Fill Online Recycling Market

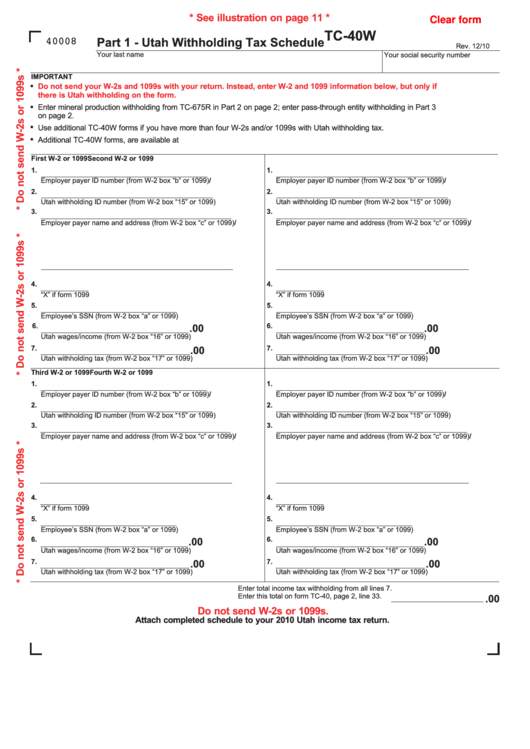

Fillable Form Tc40w Utah Withholding Tax Schedule printable pdf download

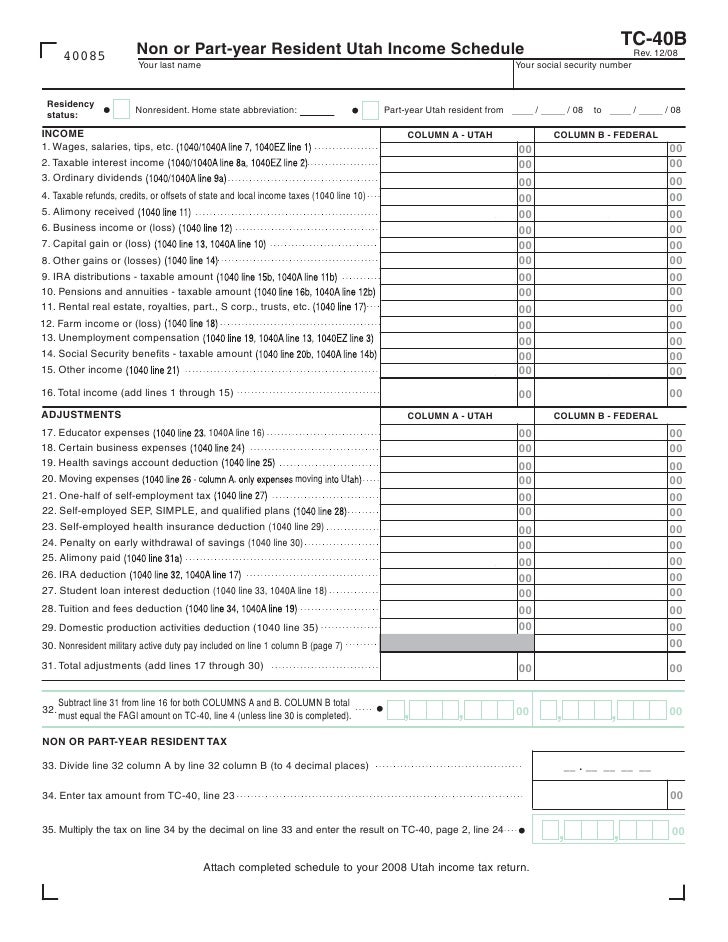

tax.utah.gov forms current tc tc40bplain

tax.utah.gov forms current tc tc40hd

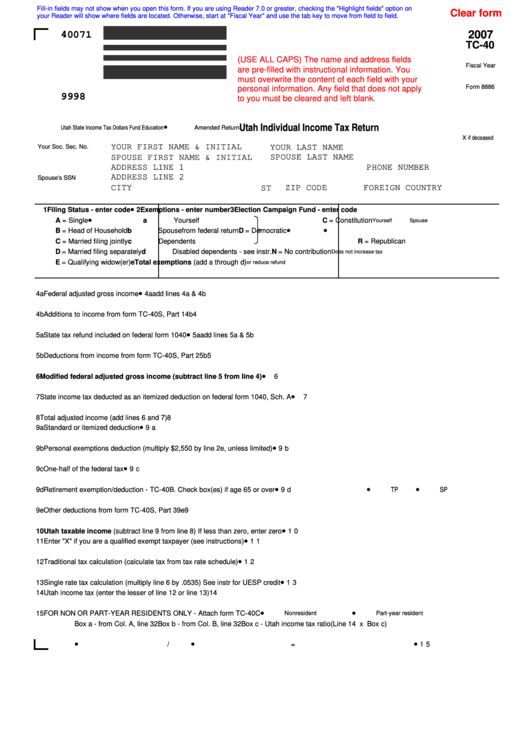

Fillable Form Tc40 Utah Individual Tax Return 2007

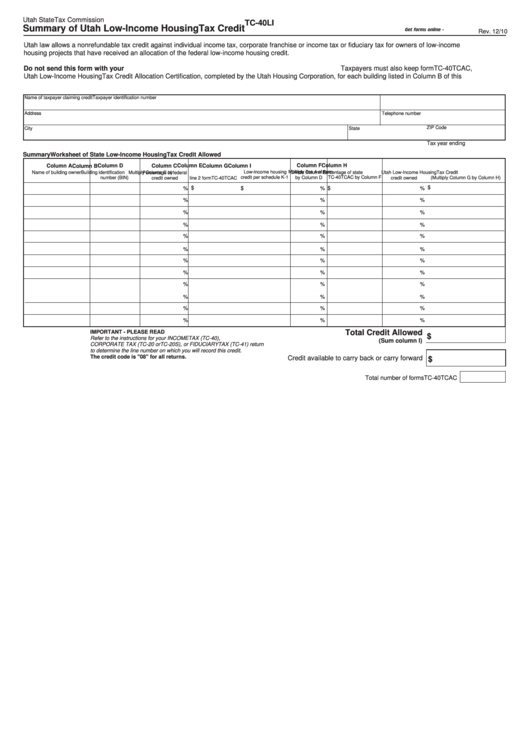

UT TC40LI 20202022 Fill and Sign Printable Template Online US

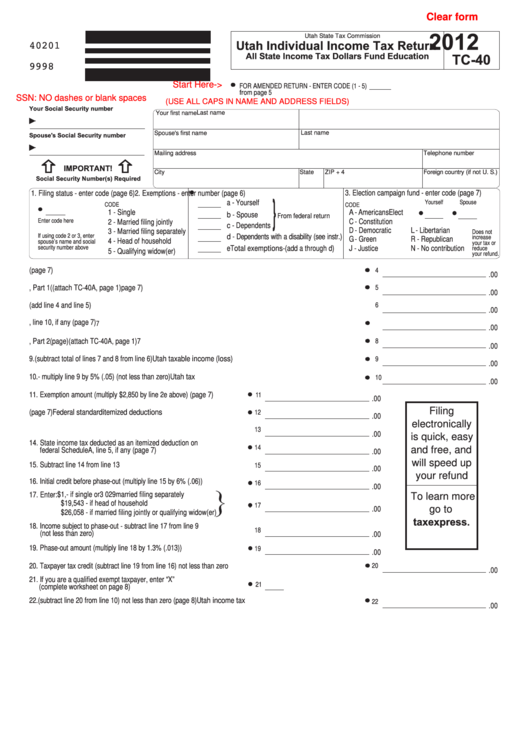

Fillable Form Tc40 Utah Individual Tax Return 2012

Fillable Form Tc40li Summary Of Utah Housing Tax Credit

Related Post: