Utah State Tax Form Tc 40

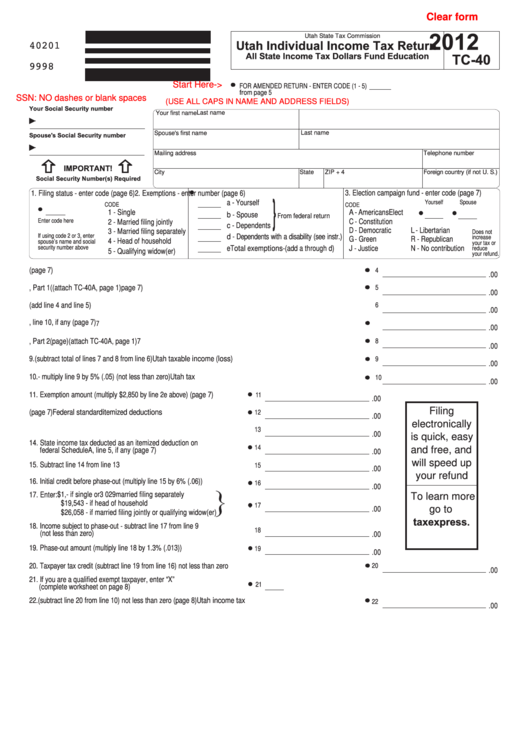

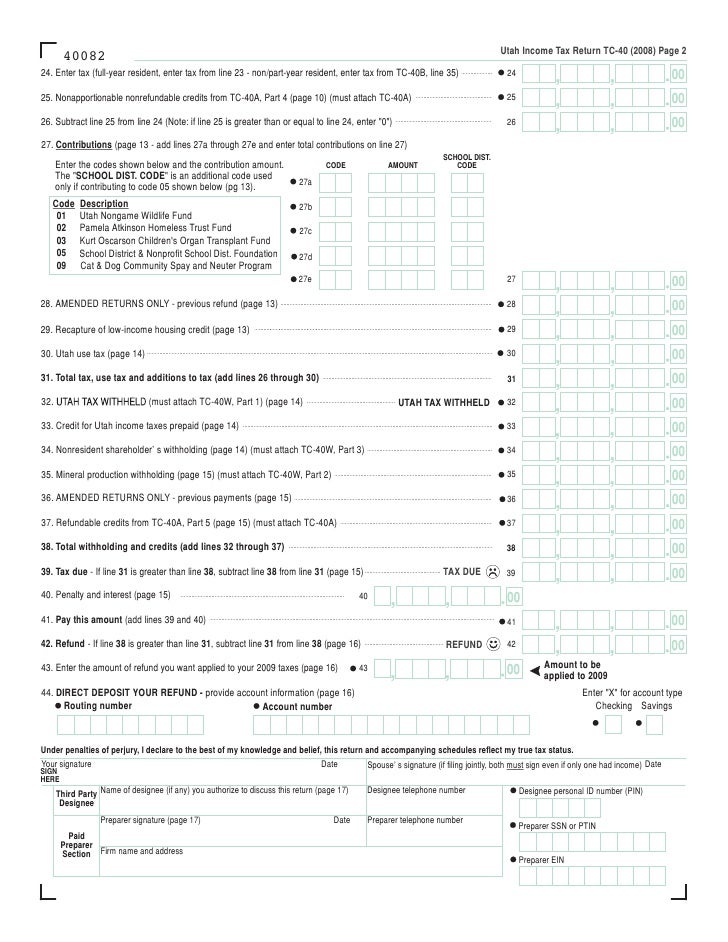

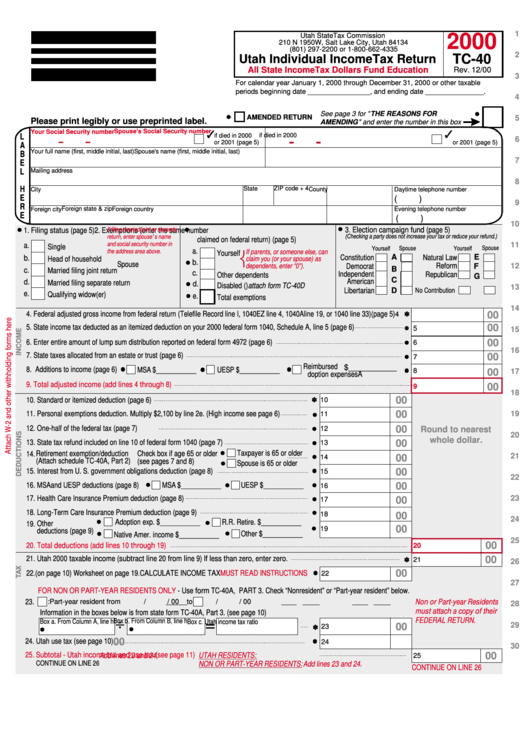

Utah State Tax Form Tc 40 - Web utah state tax commission. Round to 4 decimal places. Web utah state tax commission. All state income tax dollars support education, children and individuals with disabilities. The 2023 utah legislature passed hb 54, limiting the utah ear ned income tax credit to the amount of utah income earned. Utah individual income tax return. † utah earned income tax credit: All state income tax dollars support education, children and individuals with disabilities. It appears you don't have a pdf plugin for this browser. 2 enter “x” if you were born on or before dec. Filing your income tax return doesn't need to be complex or difficult. It appears you don't have a pdf plugin for this browser. Web utah state tax commission. All state income tax dollars fund education. Utah — utah individual income tax return. Want a refund of any income tax overpaid. The 2023 utah legislature passed hb 54, lowering the individual income tax rate from 4.85 percent to 4.65 percent. The 2023 utah legislature passed hb 54, limiting the utah ear ned income tax credit to the amount of utah income earned. Utah individual income tax return. It appears you don't have a. Also see residency and domicile. Web † utah tax rate: The 2023 utah legislature passed hb 54, lowering the individual income tax rate from 4.85 percent to 4.65 percent. All state income tax dollars support education, children and individuals with disabilities. Web utah state tax commission. Utah individual income tax return. It appears you don't have a pdf plugin for this browser. 3 = married filing separately. 4 multiply line 3 by $450. Also see residency and domicile. The state income tax rate is displayed. To fi le a utah return, fi rst complete your federal return, even 2 qualifying dependents 3 election campaign fund. Printable utah state tax forms for the 2022 tax year will be based on income earned between january 1, 2022 through december 31, 2022. 3 enter the total number of x’s on line. All state income tax dollars fund education. Want a refund of any income tax overpaid. It appears you don't have a pdf plugin for this browser. 6 nontaxable interest income (from 1040, line 2a) (see instr.). 4 multiply line 3 by $450. • social security benefi ts tax credit: 2 qualifying dependents 3 election campaign fund. The 2021 utah legislature passed hb 86, creating an apportionable, Utah individual income tax return. The utah income tax rate for tax year 2022 is 4.85%. To fi le a utah return, fi rst complete your federal return, even 3 = married filing separately. Web utah state tax commission. † utah earned income tax credit: Utah individual income tax return. Web utah state tax commission. Also see residency and domicile. Printable utah state tax forms for the 2022 tax year will be based on income earned between january 1, 2022 through december 31, 2022. All state income tax dollars support education, children and individuals with disabilities. Web file online for the fastest refund. 6 nontaxable interest income (from 1040, line 2a) (see instr.). The 2021 utah legislature passed hb 86, creating an apportionable, All state income tax dollars support education, children and individuals with disabilities. Web utah state tax commission. 2 qualifying dependents 3 election campaign fund. 3 enter the total number of x’s on line 2. The 2021 utah legislature passed hb 86, creating an apportionable, Utah individual income tax return. Round to 4 decimal places. Utah individual income tax return. The state income tax rate is displayed. 4 multiply line 3 by $450. All state income tax dollars fund education. Web utah state tax commission. 3 = married filing separately. Also see residency and domicile. 2 qualifying dependents 3 election campaign fund. • social security benefi ts tax credit: How to obtain income tax and related forms and schedules. All state income tax dollars support education, children and individuals with disabilities. Want a refund of any income tax overpaid. The utah income tax rate for tax year 2022 is 4.85%. 6 nontaxable interest income (from 1040, line 2a) (see instr.). Web † utah tax rate: † utah earned income tax credit:Fillable Form Tc40 Utah Individual Tax Return 2012

tax.utah.gov forms current tc tc40hd

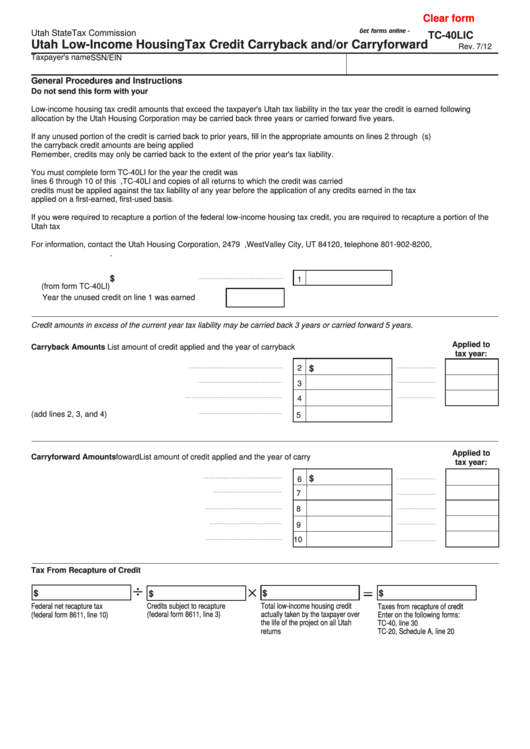

Fillable Form Tc40lic Utah Housing Tax Credit Carryback

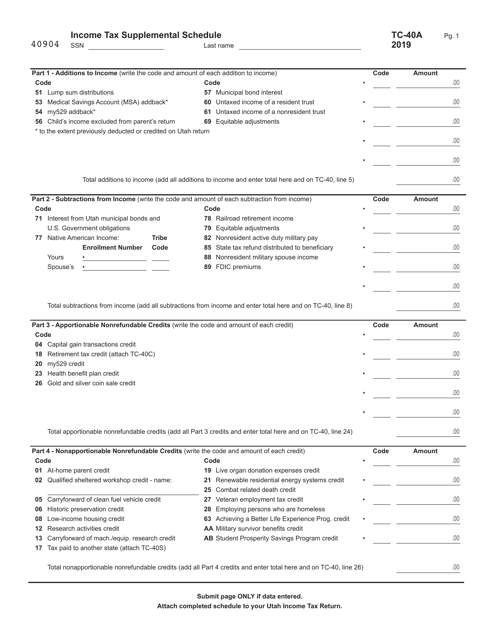

Form TC40A Schedule A 2019 Fill Out, Sign Online and Download

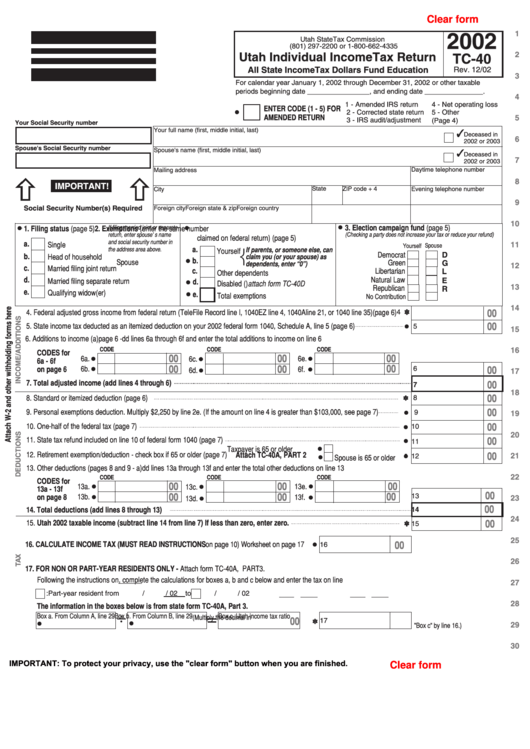

Fillable Form Tc40 Utah Individual Tax Return 2002

tax.utah.gov forms current tc tc40wplain

tax.utah.gov forms current tc tc40plain

2011 Form UT TC40 Fill Online, Printable, Fillable, Blank pdfFiller

Form Tc40 Utah Individual Tax Return 2000 printable pdf

tax.utah.gov forms current tc tc40

Related Post: