Ut State Tax Extension Form

Ut State Tax Extension Form - File form 4868 and extend your 1040 deadline up to 6 months. Most tax year state extensions are due the april tax deadline. File your personal tax extension now! Generally, you have 3 years after the tax due date to file your return and be able to claim your tax refund. Official income tax website for the state of utah, with information about filing and paying your utah income taxes, and your income tax refund. You do not need to file an extension form, but we will assess penalties if you have not met the prepayment requirements (see below). Web six months to fi le a return without fi ling an extension form. Web individual income tax prepayment coupon mail to: Web utah state tax commission. Web individuals residing in utah are not required to file a separate extension form, the state of utah will automatically grant an extension for up to 6 months for individuals to file an income tax return with the state. 2% per month calculated on a daily basis. See instructions for line 41. File your personal tax extension now! Phoenix, az —the due date for the 2022 calendar year returns filed with extensions is almost here. While the irs requires you to file form 4868 to request a tax extension, each state has its own requirements for obtaining a similar. Online payments may include a service fee. You do not need to fi le an extension form, but we will assess penalties if you have not met the prepayment requirements (see below). Web an upcoming virtual workshop series for midwestern farm and ranch women will teach the basics of tax planning for agricultural operations. Web utah state tax commission. Use. For calendar year filers in most years, this date is april 15. Most tax year state extensions are due the april tax deadline. Secondary taxpayer name social security no. Use the instructions in pub 58, utah interest and penalties to calculate your penalty and interest. You do not need to fi le an extension form, but we will assess penalties. Web current utah state tax commission forms. No extension form is required. Web you get an automatic extension of up to six months to file your return. Web updated for tax year 2022 • october 8, 2023 11:28 am. If the address you are looking for is not on the utah state tax commission mailing addresses list, use the address. Web six months to fi le a return without fi ling an extension form. File extension in few minutes. You do not need to file an extension form, but we will assess penalties if you have not met the prepayment requirements (see below). Web updated for tax year 2022 • october 8, 2023 11:28 am. Use this form only to. Web you get an automatic extension of up to six months to file your return. Arizona corporate calendar year timely filers (forms 120, 120a, 99t. You do not need to fi le an extension form, but we will assess penalties if you have not met the prepayment requirements (see below). File form 4868 and extend your 1040 deadline up to. See instructions for line 41. Web individuals residing in utah are not required to file a separate extension form, the state of utah will automatically grant an extension for up to 6 months for individuals to file an income tax return with the state. Phoenix, az —the due date for the 2022 calendar year returns filed with extensions is almost. Pay all or some of your utah income taxes online via: After that date your refund would expire. Web individuals residing in utah are not required to file a separate extension form, the state of utah will automatically grant an extension for up to 6 months for individuals to file an income tax return with the state. If you cannot. If you cannot file on time, you can get a utah tax extension. If the address you are looking for is not on the utah state tax commission mailing addresses list, use the address printed on the form. File your personal tax extension now! See instructions for line 41. You get an automatic extension of up to six months to. File extension in few minutes. 4/13 primary taxpayer name social security no. Web an upcoming virtual workshop series for midwestern farm and ranch women will teach the basics of tax planning for agricultural operations. Online payments may include a service fee. File form 4868 and extend your 1040 deadline up to 6 months. Most tax year state extensions are due the april tax deadline. Web filing & paying your taxes. Web if you have been previously licensed for this rn or wpl in the state of utah, please list: See also payment agreement request. You do not need to fi le an extension form, but we will assess penalties if you have not met the prepayment requirements (see below). Arizona corporate calendar year timely filers (forms 120, 120a, 99t. You get an automatic extension of up to six months to fi le your return. Web updated for tax year 2022 • october 8, 2023 11:28 am. A tax extension gives you extra time to file. Phoenix, az —the due date for the 2022 calendar year returns filed with extensions is almost here. Prepayment requirements for filing extension Pay all or some of your utah income taxes online via: No extension form is required. Generally, you have 3 years after the tax due date to file your return and be able to claim your tax refund. Utah state tax commission • 210 north 1950 west • salt lake city, utah 84134 • tax.utah.gov. If you are filing your return or paying any tax late, you may owe penalties and interest. All extension returns must be fi led by oct. All extension returns must be filed by oct. 4/13 primary taxpayer name social security no. Web current utah state tax commission forms.Tax Extension Form Printable Printable Forms Free Online

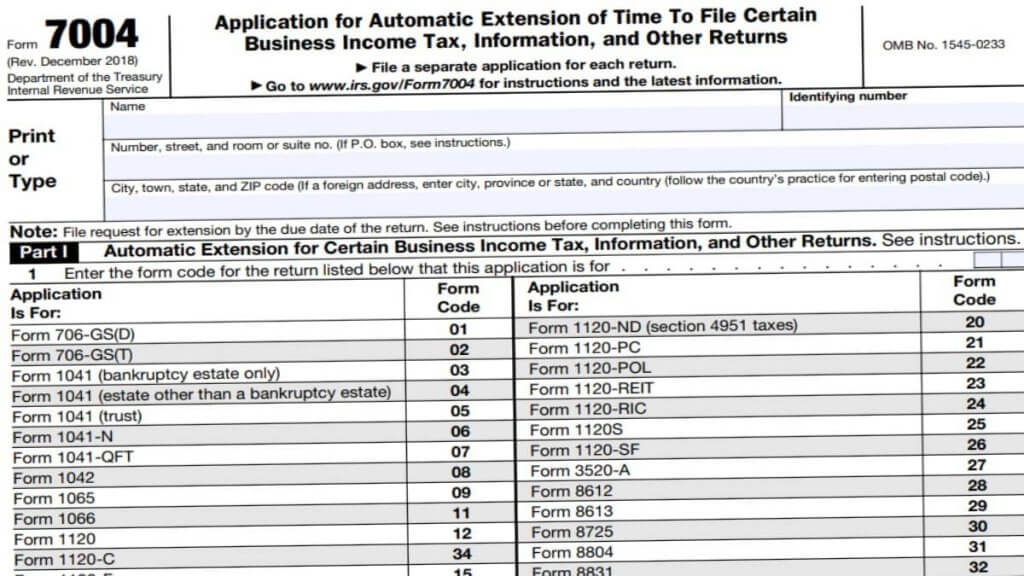

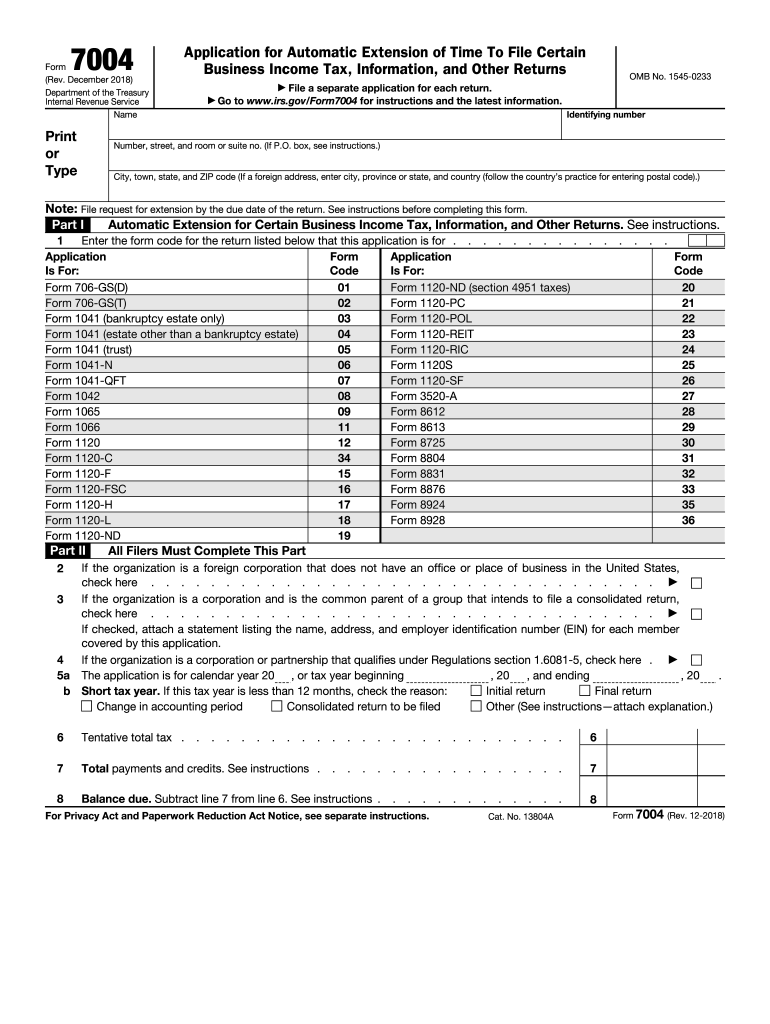

Business Tax Extension 7004 Form 2023

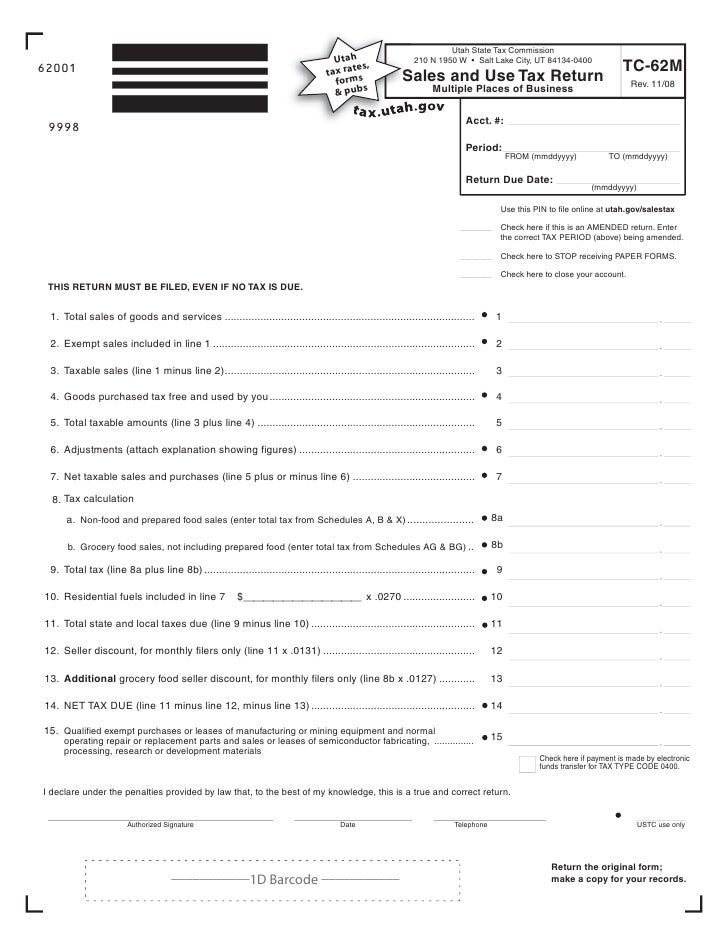

tax.utah.gov forms current tc tc62mprint

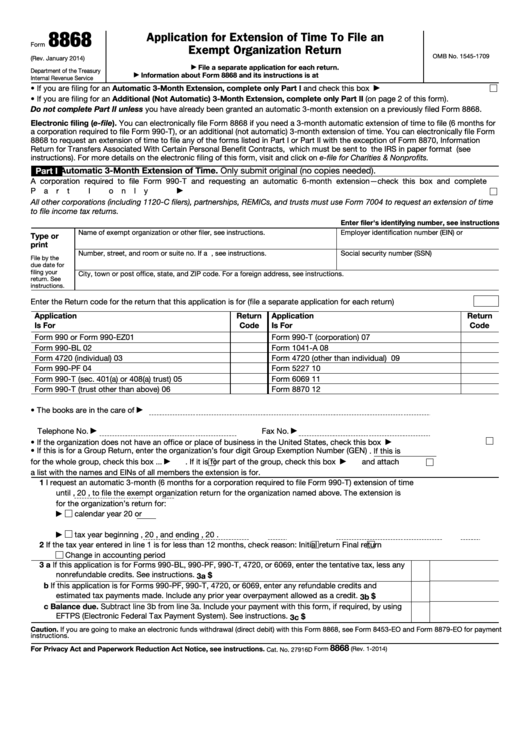

Fillable Form 8868 Utah Application For Extension Of Time To File An

Form 7004 Fill Out and Sign Printable PDF Template signNow

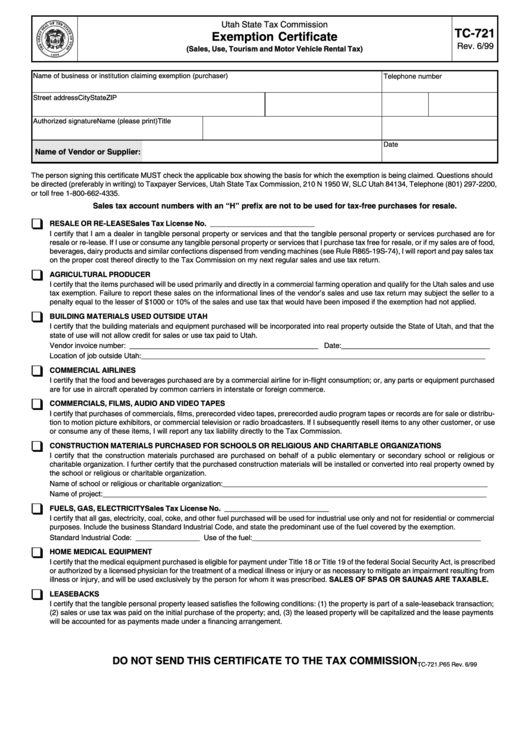

Tc721 Form Utah State Tax Commission Exemption Certificate printable

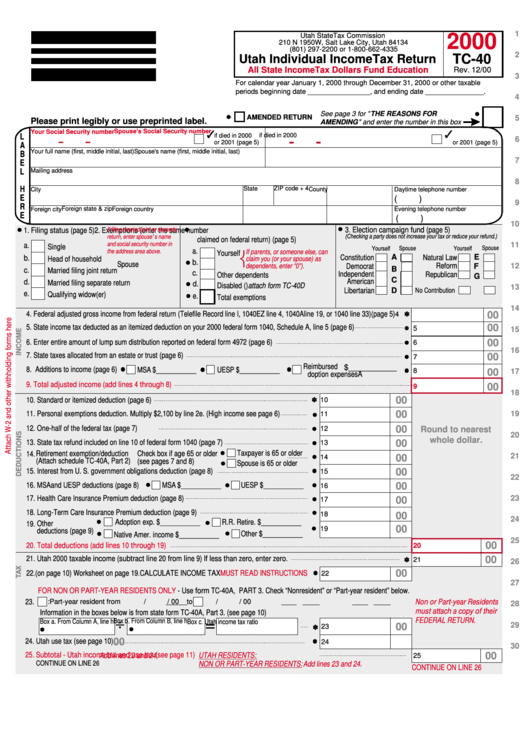

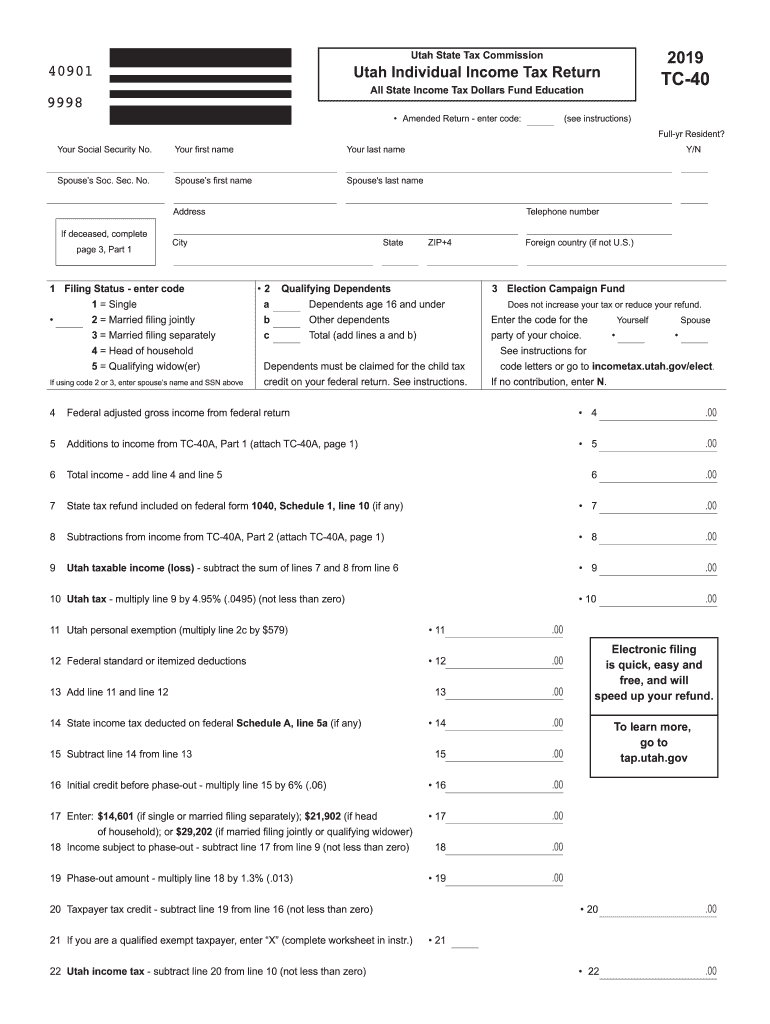

Form Tc40 Utah Individual Tax Return 2000 printable pdf

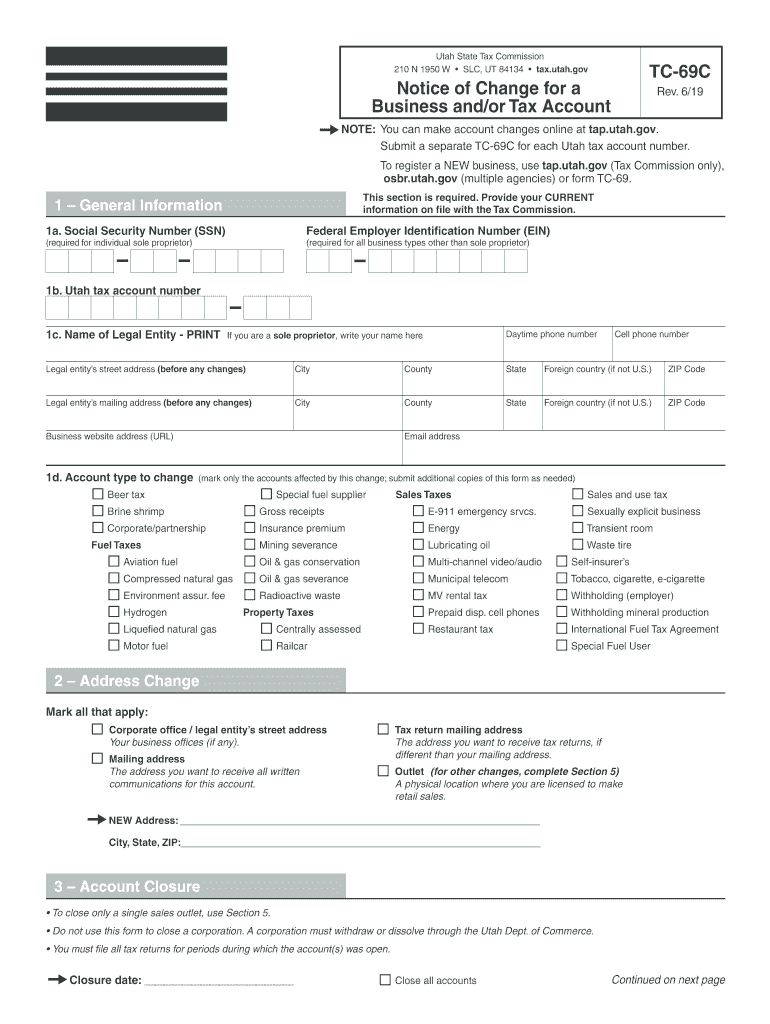

2019 Form UT TC69C Fill Online, Printable, Fillable, Blank pdfFiller

Printable State Tax Forms

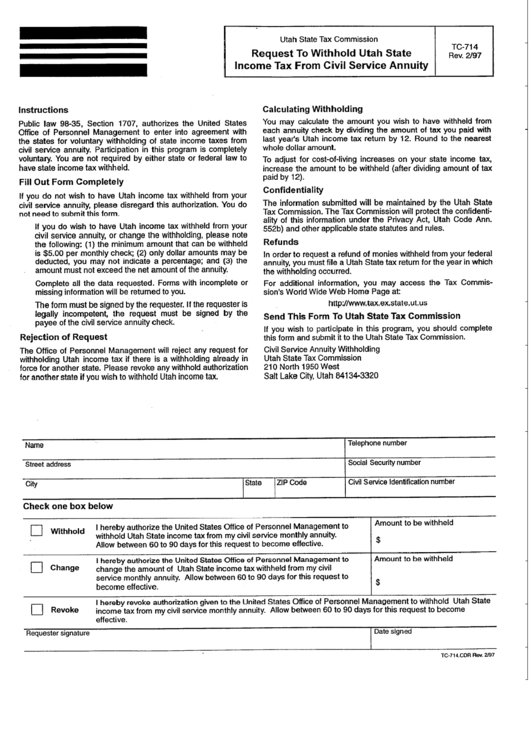

Fillable Form Tc715 Request To Withholding Utah State Tax

Related Post: