Td Ameritrade Removal Of Excess Form

Td Ameritrade Removal Of Excess Form - Web if you do not have a roth ira, please complete the roth ira application found at tdameritrade.com. Ira recharacterization is used to change a traditional ira. Removal of excess after tax filing. English deutsch français español português italiano român nederlands latina dansk svenska norsk magyar. Web yes no type of distribution direct td ameritrade clearing, inc. If this contribution is to be reallocated to a following tax year, please notify your. Web obtain receiving custodian’s transfer form. If the account has margin and/or options privileges, please complete. We want to make sure you have answers to your most frequently asked. Download important brokerage forms, agreements, disclosures, and other pdfs quickly from td ameritrade’s form library. Do not sign in section 11, and please only sign in section 12. Removal of excess after tax filing. If you’ve contributed too much to your ira for a given year, you’ll need to contact your bank or investment company to request the withdrawal of the excess ira. Web deadline for removal of excess contribution: Web i received a corrected. Web deadline to remove excess or recharacterize ira contributions made for 2022 if you filed your return by april 18, 2023 Web page 3 of 3 tda 10 f 01/23 td ameritrade client authorization (required) all td ameritrade account holders (clients or trustees) as indicated 4 by the account. If you’ve contributed too much to your ira for a given. Web i received a corrected consolidated 1099 tax form after i had already filed my taxes. Removal of excess after tax filing. Find, download, and print important brokerage forms, agreements, pdf files, and disclosures from our form library. We want to make sure you have answers to your most frequently asked. Web if you do not have a roth ira,. To distribute the amount requested for the following reason (check only one box): If you’ve contributed too much to your ira for a given year, you’ll need to contact your bank or investment company to request the withdrawal of the excess ira. Find, download, and print important brokerage forms, agreements, pdf files, and disclosures from our form library. Web deadline. English deutsch français español português italiano român nederlands latina dansk svenska norsk magyar. Roth ira withdrawal rules allow you to get rid of excess contribution amounts without penalty—as long as you take care. Web page 3 of 3 tda 10 f 01/23 td ameritrade client authorization (required) all td ameritrade account holders (clients or trustees) as indicated 4 by the. Web i received a corrected consolidated 1099 tax form after i had already filed my taxes. Find, download, and print important brokerage forms, agreements, pdf files, and disclosures from our form library. Web deadline to remove excess or recharacterize ira contributions made for 2022 if you filed your return by april 18, 2023 If you’ve contributed too much to your. Web if you do not have a roth ira, please complete the roth ira application found at tdameritrade.com. Web adjusted closing balance is your ira’s closing balance prior to the removal of excess, plus any distributions (including rollovers, transfers, and recharacterizations). Web obtain receiving custodian’s transfer form. Do not sign in section 11, and please only sign in section 12.. If the account has margin and/or options privileges, please complete. Web what if i withdraw an excess contribution? If you’ve contributed too much to your ira for a given year, you’ll need to contact your bank or investment company to request the withdrawal of the excess ira. Web deadline to remove excess or recharacterize ira contributions made for 2022 if. Removal of excess after tax filing. Do not sign in section 11, and please only sign in section 12. English deutsch français español português italiano român nederlands latina dansk svenska norsk magyar. We want to make sure you have answers to your most frequently asked. Download important brokerage forms, agreements, disclosures, and other pdfs quickly from td ameritrade’s form library. Web yes no type of distribution direct td ameritrade clearing, inc. Web obtain receiving custodian’s transfer form. Web adjusted closing balance is your ira’s closing balance prior to the removal of excess, plus any distributions (including rollovers, transfers, and recharacterizations). Web deadline to remove excess or recharacterize ira contributions made for 2022 if you filed your return by april 18,. Web adjusted closing balance is your ira’s closing balance prior to the removal of excess, plus any distributions (including rollovers, transfers, and recharacterizations). Download important brokerage forms, agreements, disclosures, and other pdfs quickly from td ameritrade’s form library. Web obtain receiving custodian’s transfer form. We want to make sure you have answers to your most frequently asked. If this contribution is to be reallocated to a following tax year, please notify your. If the account has margin and/or options privileges, please complete. English deutsch français español português italiano român nederlands latina dansk svenska norsk magyar. To distribute the amount requested for the following reason (check only one box): Web if you do not have a roth ira, please complete the roth ira application found at tdameritrade.com. Web what if i withdraw an excess contribution? Web page 3 of 3 tda 10 f 01/23 td ameritrade client authorization (required) all td ameritrade account holders (clients or trustees) as indicated 4 by the account. To view and print files properly, please be sure to. Roth ira withdrawal rules allow you to get rid of excess contribution amounts without penalty—as long as you take care. Web i received a corrected consolidated 1099 tax form after i had already filed my taxes. Ira recharacterization is used to change a traditional ira. Web deadline for removal of excess contribution: Web deadline to remove excess or recharacterize ira contributions made for 2022 if you filed your return by april 18, 2023 Do not sign in section 11, and please only sign in section 12. If you’ve contributed too much to your ira for a given year, you’ll need to contact your bank or investment company to request the withdrawal of the excess ira. Find, download, and print important brokerage forms, agreements, pdf files, and disclosures from our form library.Fill Free fillable TD Ameritrade PDF forms

How Long Does It Take To Withdraw Money From Ameritrade? Johnson

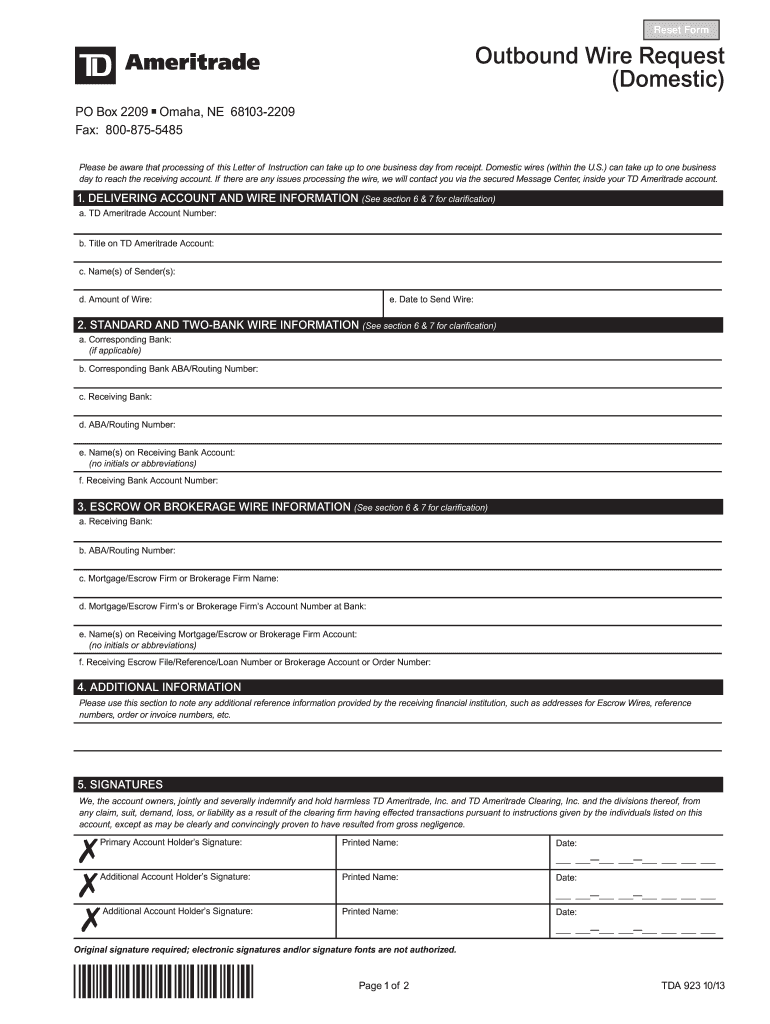

Letter Of Instruction Td Ameritrade Fill Online, Printable, Fillable

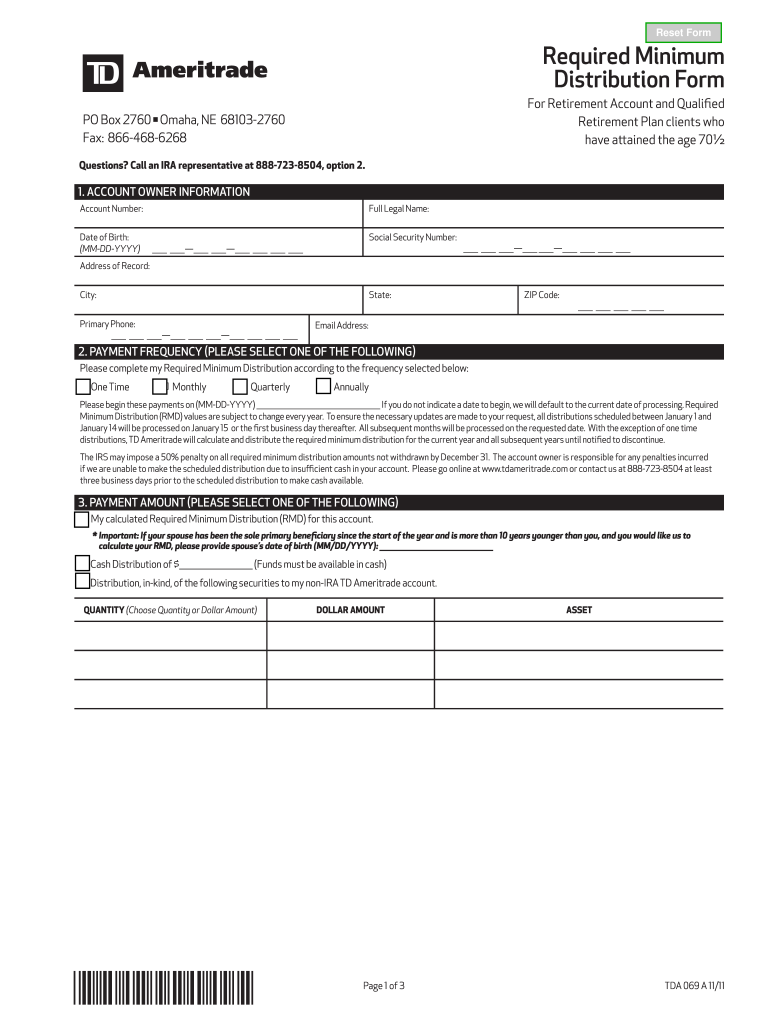

Td Ameritrade Rmd Form Fill Out and Sign Printable PDF Template signNow

Fill Free fillable TD Ameritrade PDF forms

Fill Free Fillable Ira Distribution Request Form (td Ameritrade) Pdf

Fill Free fillable TD Ameritrade PDF forms

Fill Free fillable TD Ameritrade PDF forms

Fill Free fillable TD Ameritrade PDF forms

Fill Free fillable TD Ameritrade PDF forms

Related Post: