Taxslayer Form 8949

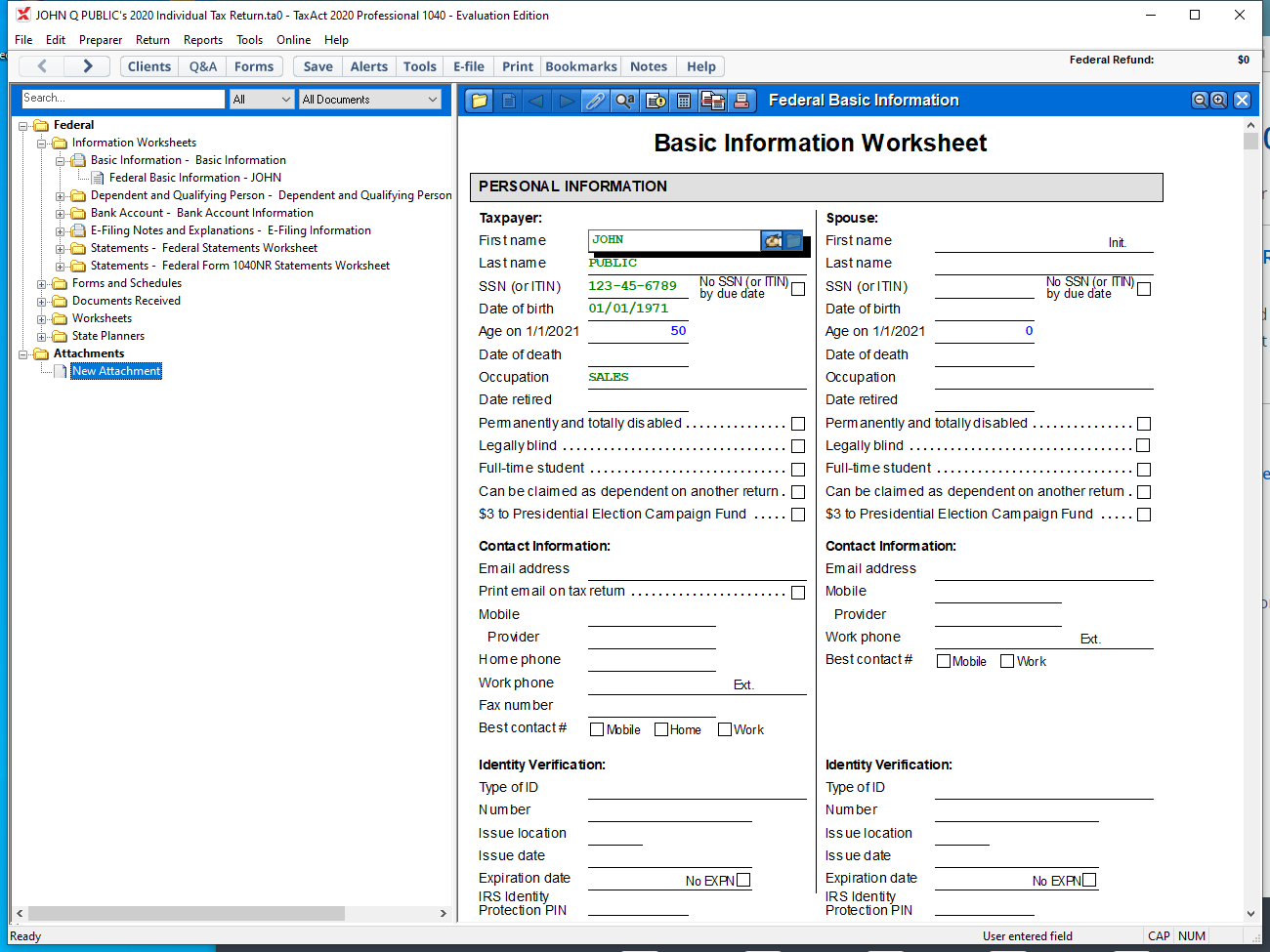

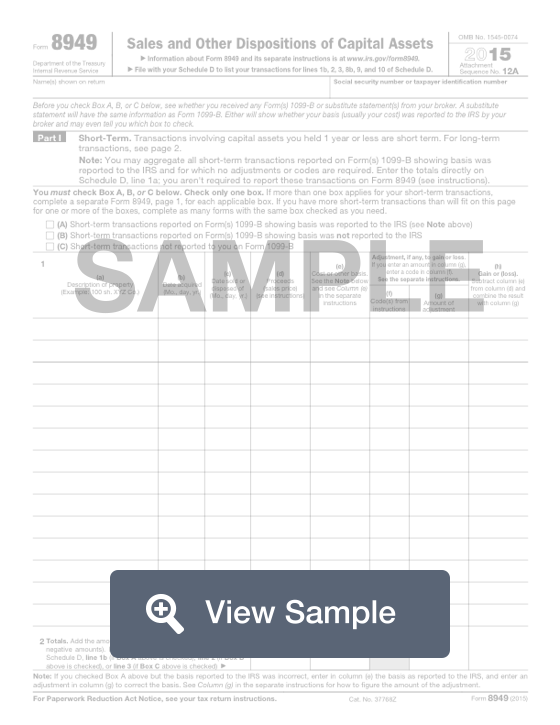

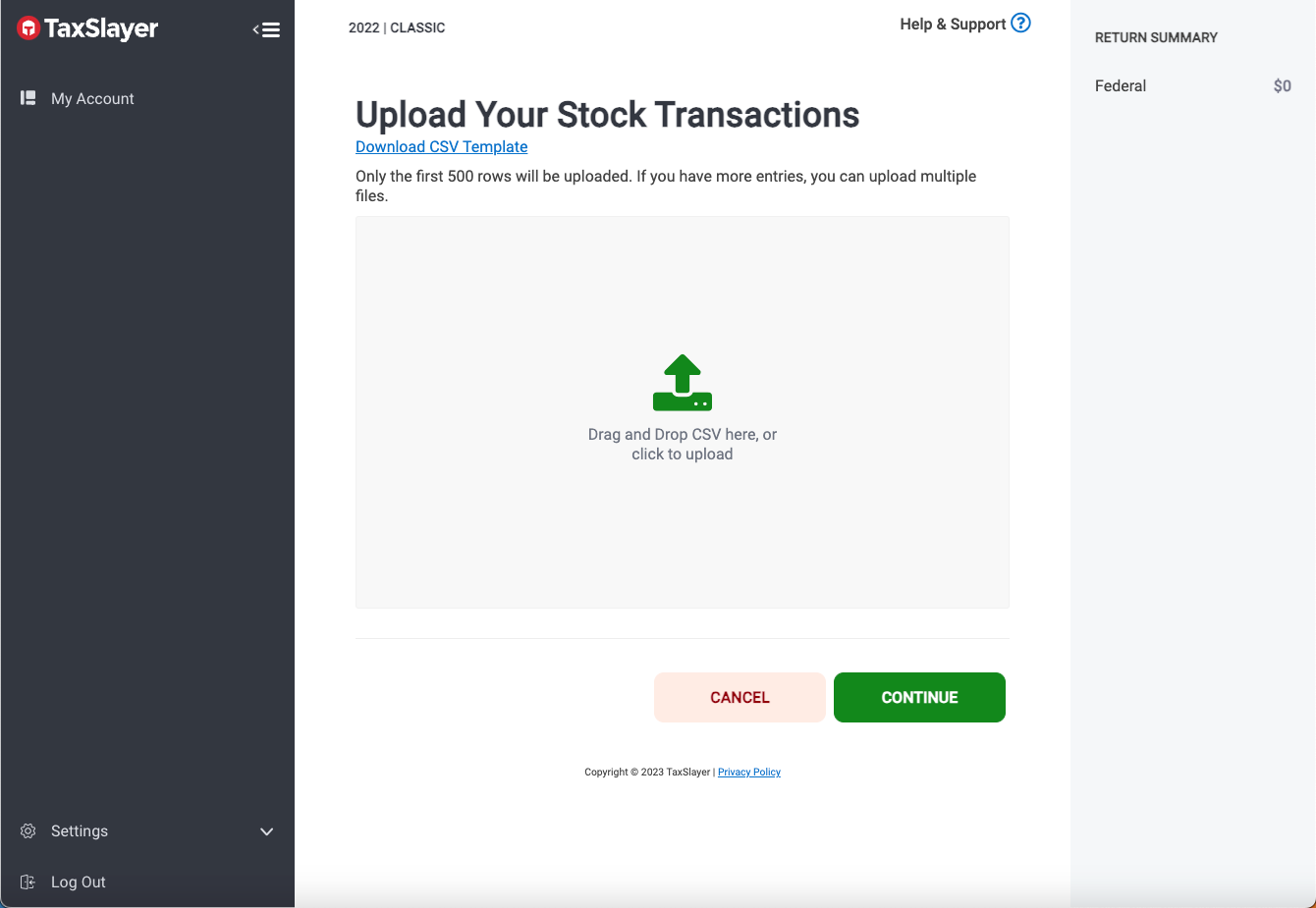

Taxslayer Form 8949 - These forms work together to help you calculate your capital gains and. Form 8949(sales and other dispositions of capital assets) records the details of. To attach a pdf copy of these transactions, from the main menu of the tax. Stocks, mutual funds, cryptocurrency, collectibles, etc. Gain from involuntary conversion (other. Information about form 8949, sales and other dispositions of capital assets, including recent updates, related forms. A substitute statement will have the same. Start your free taxwise trial today! Solved•by turbotax•6711•updated 6 days ago. Web how does form 8949 work? A substitute statement will have the same. Based on review of taxslayer’s software by doughroller. Income (select my forms) investments. Form 8949 is not a direct entry form within our program. Here is more information on how tax form 8949 is used from the irs: Form 8949(sales and other dispositions of capital assets) records the details of. Web file form 8949 with the schedule d for the return you are filing. Stocks, mutual funds, cryptocurrency, collectibles, etc. Form 8949 is used to report the following information: Ad prepare more returns with greater accuracy. Web taxact® will complete form 8949 for you and include it in your tax return submission. Web page last reviewed or updated: Single tax office or multiple locations, taxwise is designed to meet your needs. To attach a pdf copy of these transactions, from the main menu of the tax. Form 8949 is not a direct entry form within our. Here is more information on how tax form 8949 is used from the irs: Web to enter a wash sale on form 8949 in taxslayer pro, from the main menu of the tax return (form 1040), select: Income capital gains and losses capital gains and loss. The sale or exchange of a capital asset not reported elsewhere in the tax. The features you want, the price you expect, the refund you deserve. Form 8949(sales and other dispositions of capital assets) records the details of. See below for a list of all of the federal tax forms. Single tax office or multiple locations, taxwise is designed to meet your needs. Web gain, form 8949 will show the adjustment as a negative. Form 8949 is used to report the following information: The investments section, may be located by. Web forms 8949 and schedule d will be generated automatically based on the entries. Web how does form 8949 work? Form 8949(sales and other dispositions of capital assets) records the details of. Form 8949 is used to report the following information: Web taxact® will complete form 8949 for you and include it in your tax return submission. See below for a list of all of the federal tax forms. Form 8949 is not a direct entry form within our program. Based on review of taxslayer’s software by nerdwallet. Web you will report the totals of form 8949 on schedule d of form 1040. The most common section of the program used to generate form 8949, is the investments section. The sale or exchange of a capital asset not reported. Form 8949 is not a direct entry form within our program. See below for a list of all of. Form 8949(sales and other dispositions of capital assets) records the details of. The sale or exchange of a capital asset not reported. Ad prepare more returns with greater accuracy. Ad prepare more returns with greater accuracy. Web to enter a wash sale on form 8949 in taxslayer pro, from the main menu of the tax return (form 1040), select: Web forms 8949 and schedule d will be generated automatically based on the entries. Web to enter a wash sale on form 8949 in taxslayer pro, from the main menu of the tax return (form 1040), select: Income capital gains and losses capital gains and loss. Form 8949 is a supplementary form for schedule d. Web how does form 8949. Web forms 8949 and schedule d will be generated automatically based on the entries. Web how does form 8949 work? Form 8949(sales and other dispositions of capital assets) records the details of. Web use form 8949 to report sales and exchanges of capital assets. See below for a list of all of the federal tax forms. To get the transaction information into your return, select from the 6 options described. Form 8949 is a supplementary form for schedule d. Based on review of taxslayer’s software by doughroller. Capital gains and losses occur when a taxpayer sells a capital. The most common section of the program used to generate form 8949, is the investments section. Information about form 8949, sales and other dispositions of capital assets, including recent updates, related forms. Single tax office or multiple locations, taxwise is designed to meet your needs. Web taxact® will complete form 8949 for you and include it in your tax return submission. When you report the sale of the newly purchased stock, you will adjust the basis. Web page last reviewed or updated: Here is more information on how tax form 8949 is used from the irs: Income (select my forms) investments. The sale or exchange of a capital asset not reported elsewhere in the tax return. Ad prepare more returns with greater accuracy. Single tax office or multiple locations, taxwise is designed to meet your needs.In the following Form 8949 example,the highlighted section below shows

To review Tess's completed Form 8949 and Schedule D IRS.gov

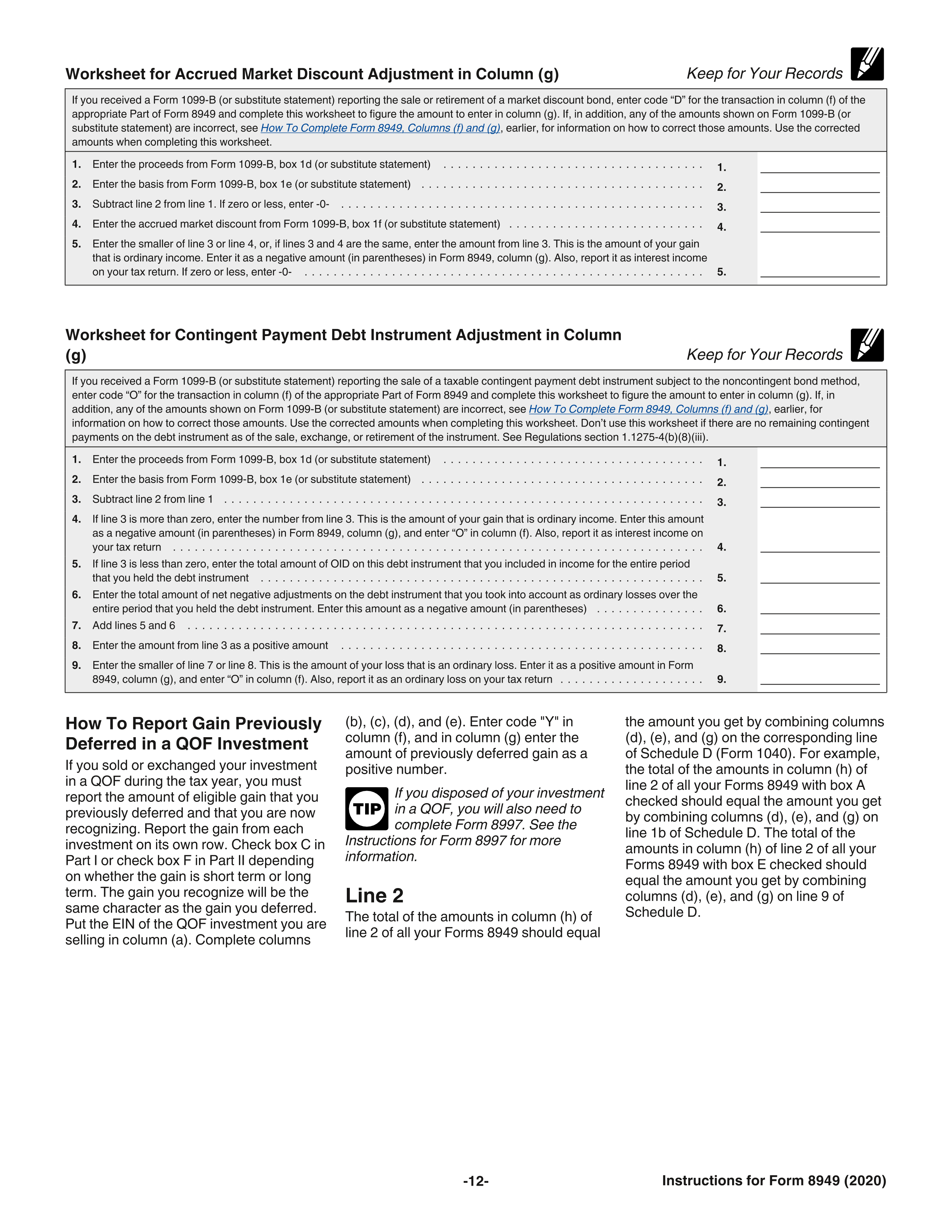

IRS Form 8949 instructions.

IRS 8949 2022 Form Printable Blank PDF Online

Cryptocurrency Taxes Overview How to Report Your Gains and Losses

Form 8949 Reporting for Users of Tax Act Professional Tax Software

Online Generation Of Schedule D And Form 8949 For 10 00 2021 Tax

Fillable Irs Form 8949 Printable Forms Free Online

Fillable IRS Form 8949 Printable PDF Sample FormSwift

How to Integrate Outputs with TaxSlayer

Related Post: