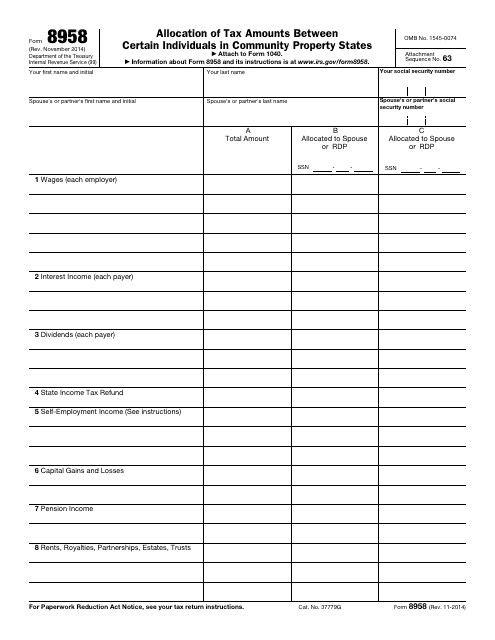

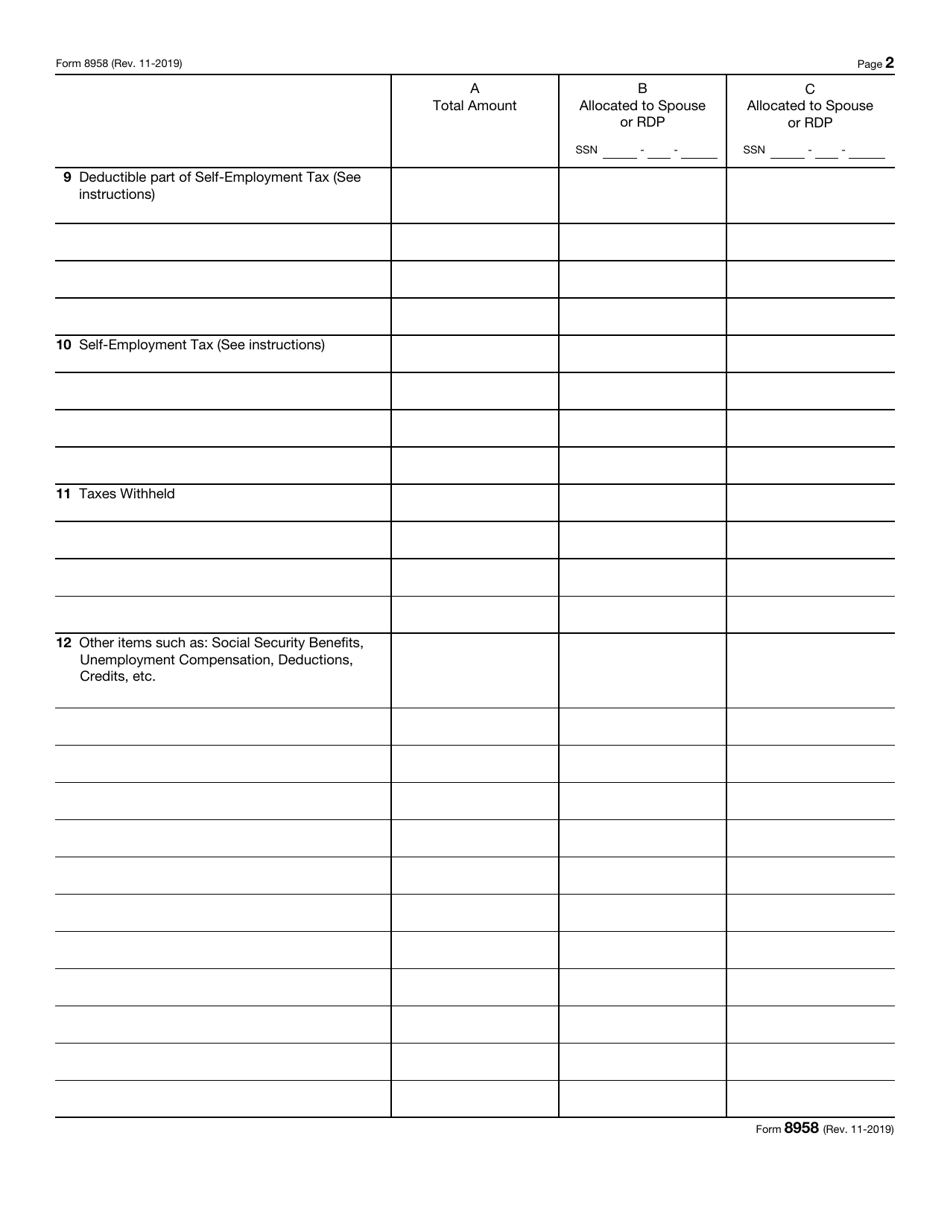

Tax Form 8958

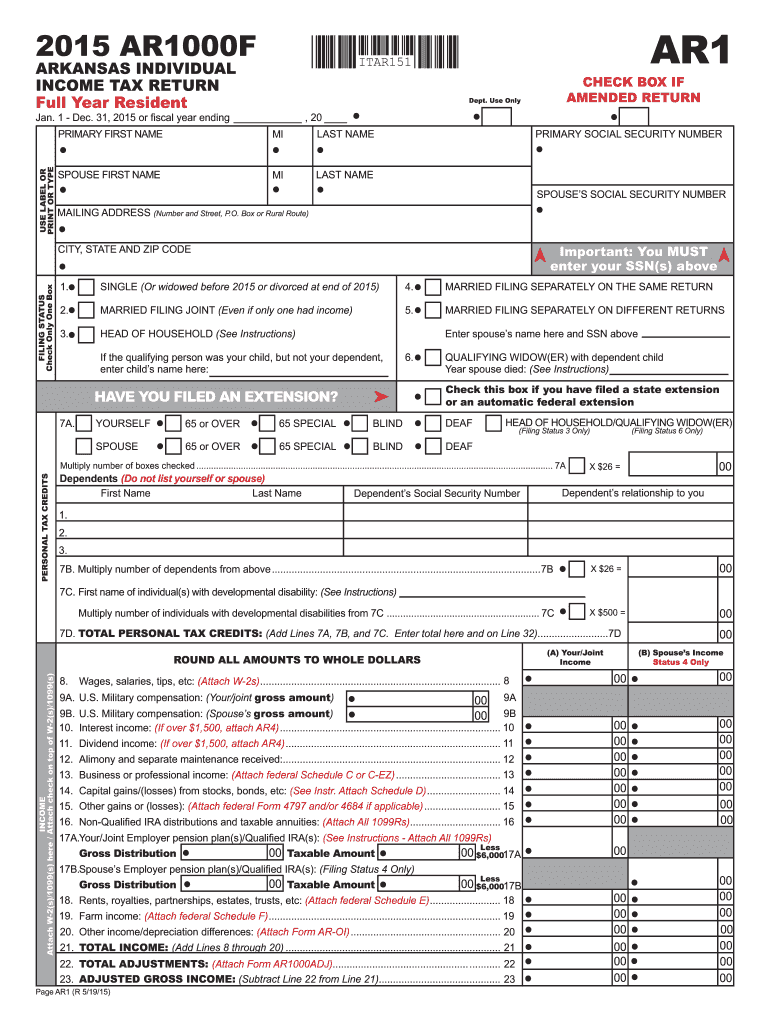

Tax Form 8958 - Generally, the laws of the state in which you are. Web intuit help intuit. Web form 8958 allocation of tax amounts between certain individuals in community property states allocates income between spouses/partners when filing a separate return. Ad get deals and low prices on turbo tax online at amazon. To fulfill the married filing separately requirements, you’ll each report your own income separately. Web form 8958 is a federal corporate income tax form. Form 8958, allocation of tax. Web you only need to complete form 8958 allocation of tax amounts between certain individuals in community property states if you were domiciled in a community property. Solved • by intuit • 20 • updated august 14,. Web individual income tax forms. Web form 8958 is a federal corporate income tax form. Solved • by intuit • 20 • updated august 14,. To fulfill the married filing separately requirements, you’ll each report your own income separately. Web if your resident state is a community property state, and you file a federal tax return separately from your spouse or registered domestic partner, use. Ad if you owe more than $5,000 in back taxes tax advocates can help you get tax relief. Web attach your form 8958 to your separate return showing how you figured the income, deductions, and federal income tax withheld that each of you reported. We help get taxpayers relief from owed irs back taxes. Technically our community earnings are only. Web intuit help intuit. Ad get deals and low prices on turbo tax online at amazon. The arizona department of revenue will follow the internal revenue service (irs) announcement regarding the start of the 2022 electronic filing. Web use form 8958 to allocate tax amounts between spouses or registered domestic partners (rdps) with community property rights, who file separate income. Technically our community earnings are only from nov 2021 to dec 31, 2021? However, if you live in a community property state, you must report. Web attach your form 8958 to your separate return showing how you figured the income, deductions, and federal income tax withheld that each of you reported. Community property laws apply to married individuals or registered. Web you each must attach your form 8958 to your return showing how you figured the amount you are reporting on your return. Web form 8958 is a federal corporate income tax form. Community property laws apply to married individuals or registered domestic partners. Web use this form to determine the allocation of tax amounts between married filing separate spouses. Request for reduced withholding to designate for tax. Web use form 8958 to allocate tax amounts between spouses or registered domestic partners (rdps) with community property rights, who file separate income tax. Web i'm curious as to how to fill out form 8958 when it comes to our income. Generally, the laws of the state in which you are. Web. The arizona department of revenue will follow the internal revenue service (irs) announcement regarding the start of the 2022 electronic filing. Web you only need to complete form 8958 allocation of tax amounts between certain individuals in community property states if you were domiciled in a community property. Web whether you are an individual or business, you can find out. Web i'm curious as to how to fill out form 8958 when it comes to our income. However, if you live in a community property state, you must report. Technically our community earnings are only from nov 2021 to dec 31, 2021? Ad if you owe more than $5,000 in back taxes tax advocates can help you get tax relief.. Web i'm curious as to how to fill out form 8958 when it comes to our income. Web form 8958 is a federal corporate income tax form. Solved • by intuit • 20 • updated august 14,. We help get taxpayers relief from owed irs back taxes. Web you each must attach your form 8958 to your return showing how. Solved • by intuit • 20 • updated august 14,. Web if your resident state is a community property state, and you file a federal tax return separately from your spouse or registered domestic partner, use form 8958 to report half. We help get taxpayers relief from owed irs back taxes. Web intuit help intuit. Ad get deals and low. Web intuit help intuit. To fulfill the married filing separately requirements, you’ll each report your own income separately. Web i'm curious as to how to fill out form 8958 when it comes to our income. However, if you live in a community property state, you must report. The arizona department of revenue will follow the internal revenue service (irs) announcement regarding the start of the 2022 electronic filing. Web you only need to complete form 8958 allocation of tax amounts between certain individuals in community property states if you were domiciled in a community property. Solved • by intuit • 20 • updated august 14,. Web use form 8958 to allocate tax amounts between spouses or registered domestic partners (rdps) with community property rights, who file separate income tax. We help get taxpayers relief from owed irs back taxes. Form 8958, allocation of tax. Ad get deals and low prices on turbo tax online at amazon. Web you each must attach your form 8958 to your return showing how you figured the amount you are reporting on your return. Web use this form to determine the allocation of tax amounts between married filing separate spouses or registered domestic partners (rdps) with community property. Web if your resident state is a community property state, and you file a federal tax return separately from your spouse or registered domestic partner, use form 8958 to report half. Community property laws apply to married individuals or registered domestic partners. We offer a variety of software related to various fields at great prices. Generally, the laws of the state in which you are. Web form 8958 allocation of tax amounts between certain individuals in community property states allocates income between spouses/partners when filing a separate return. Ad if you owe more than $5,000 in back taxes tax advocates can help you get tax relief. Technically our community earnings are only from nov 2021 to dec 31, 2021?2015 Form AR DFA AR1000F Fill Online, Printable, Fillable, Blank

IRS Form 8958 Fill Out, Sign Online and Download Fillable PDF

Form 8958 Allocation of Tax Amounts between Certain Individuals in

CCH® ProSystem fx® / Global fx Tax Splitting a MFJ Tax Return YouTube

Fillable Form 8958 Allocation Of Tax Amounts Between Certain

Form 8958 Allocation of Tax Amounts between Certain Individuals in

IRS Form 8958 Download Fillable PDF or Fill Online Allocation of Tax

3.24.3 Individual Tax Returns Internal Revenue Service

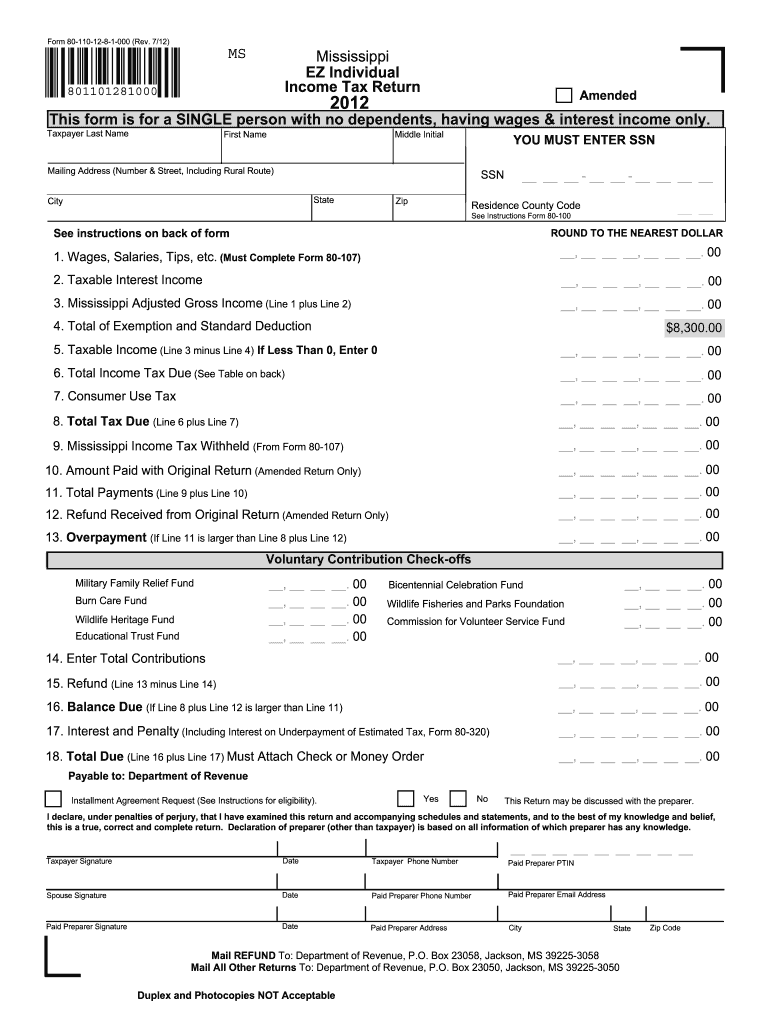

Ms State Tax Form 2022 W4 Form

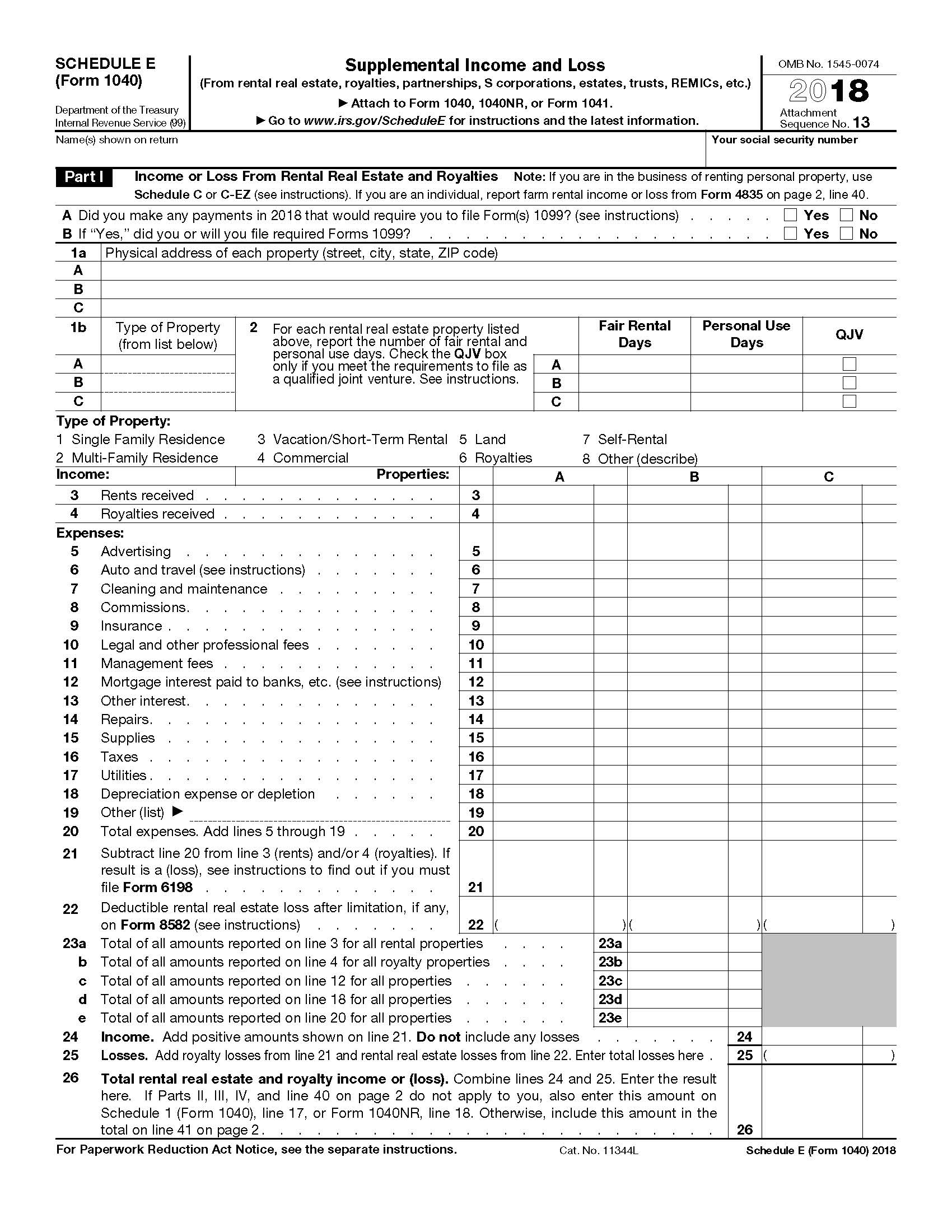

2018 IRS Tax Forms 1040 Schedule E (Supplement And Loss) U.S

Related Post: