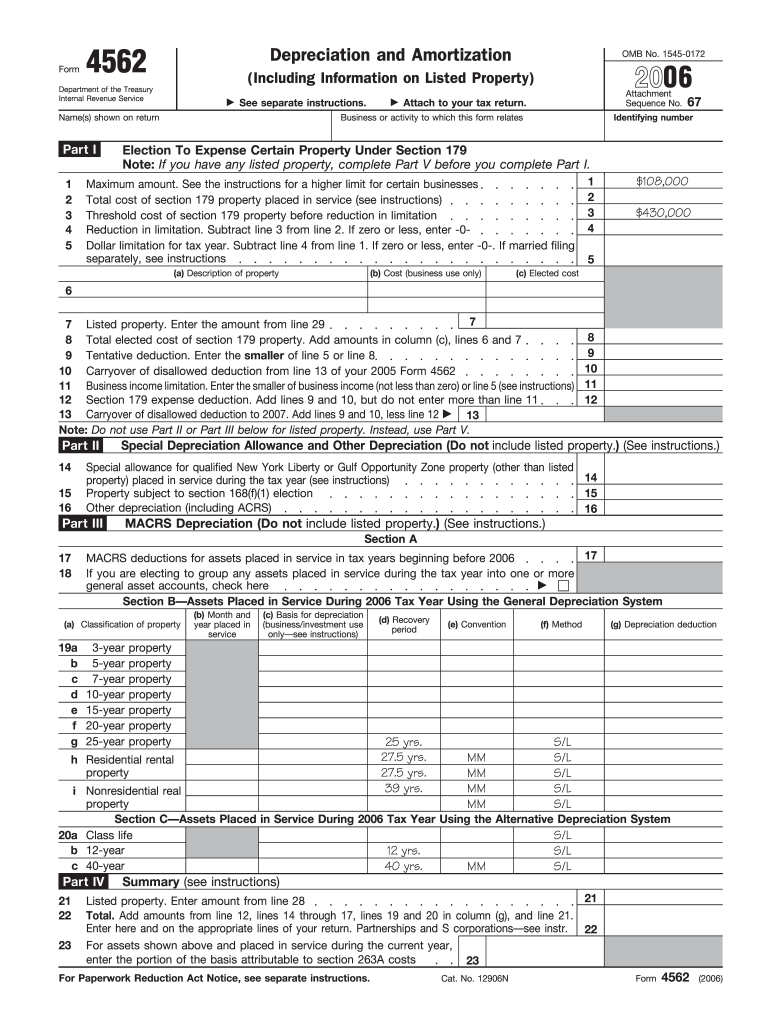

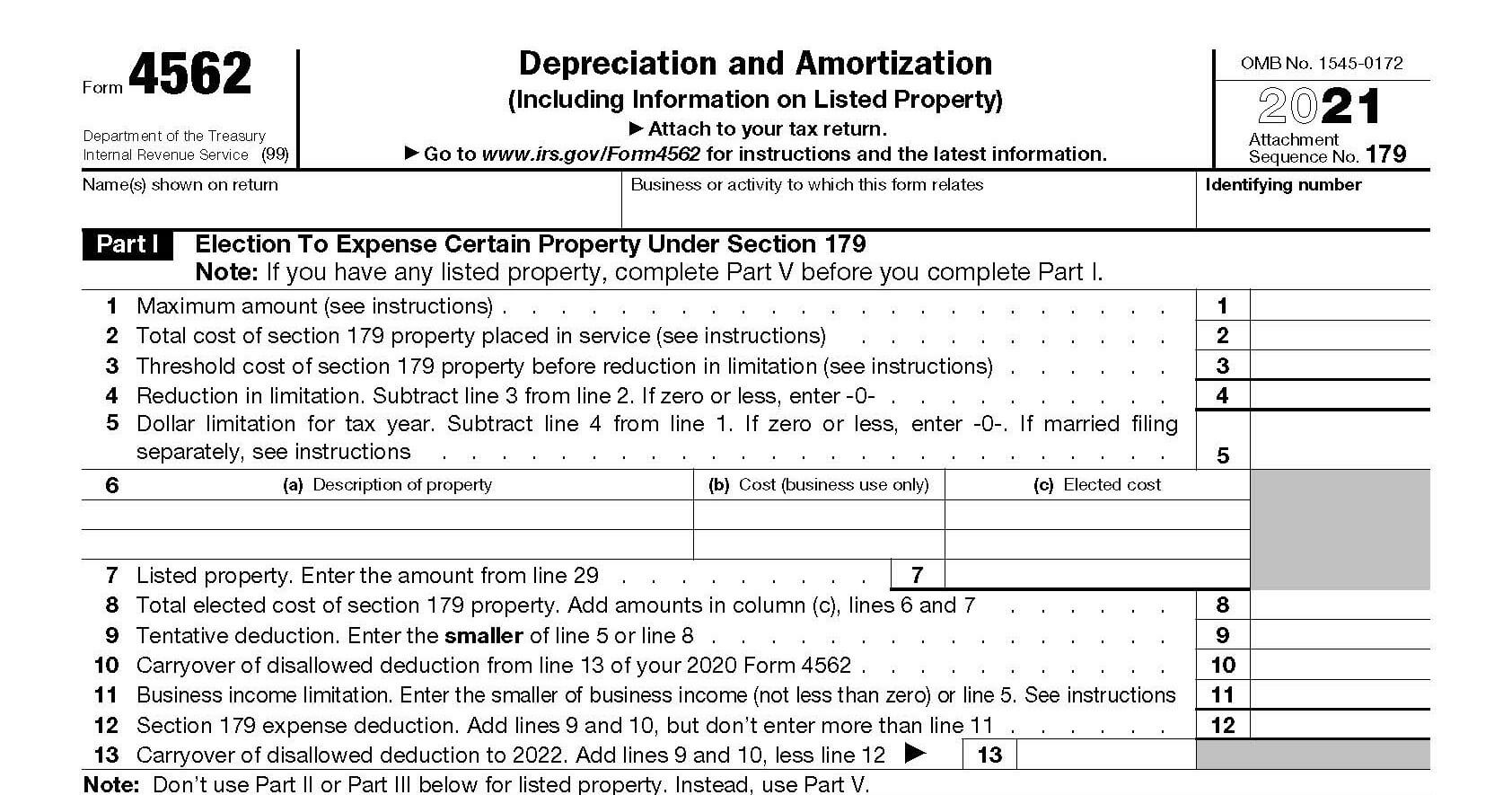

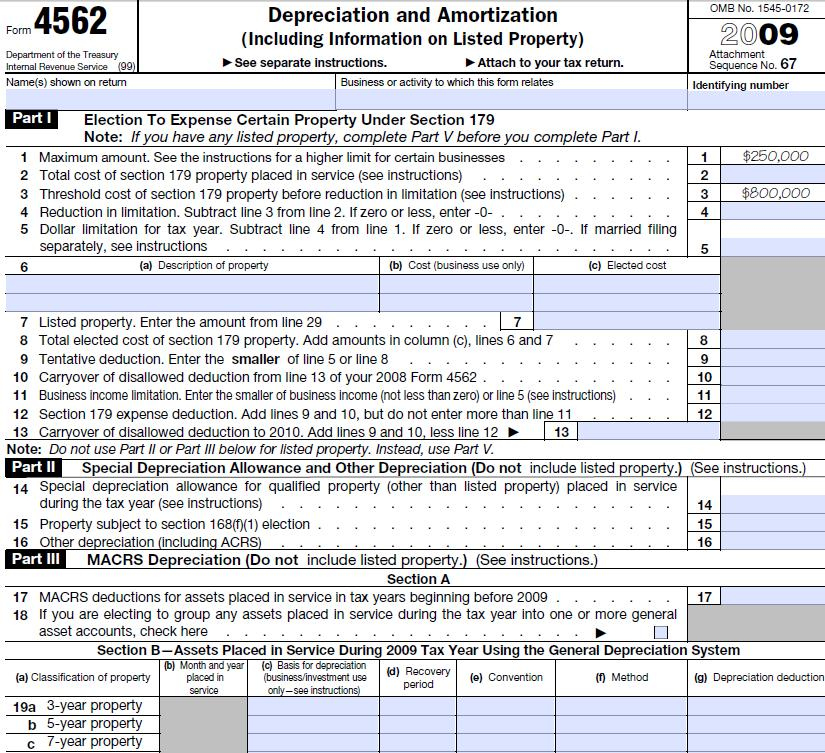

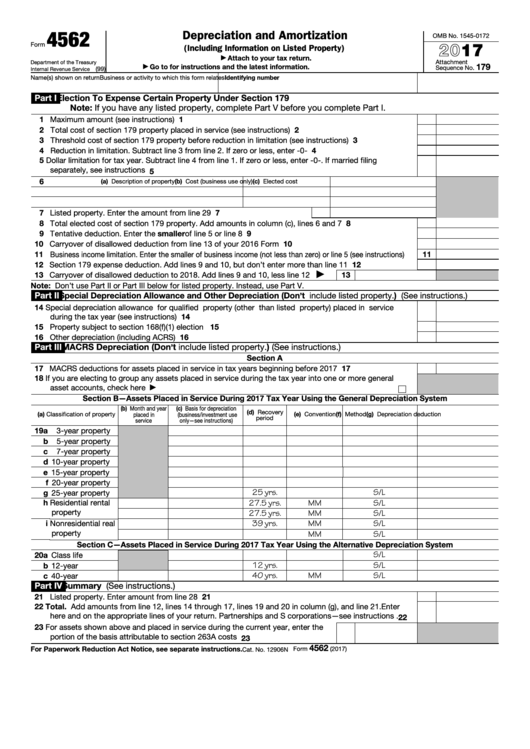

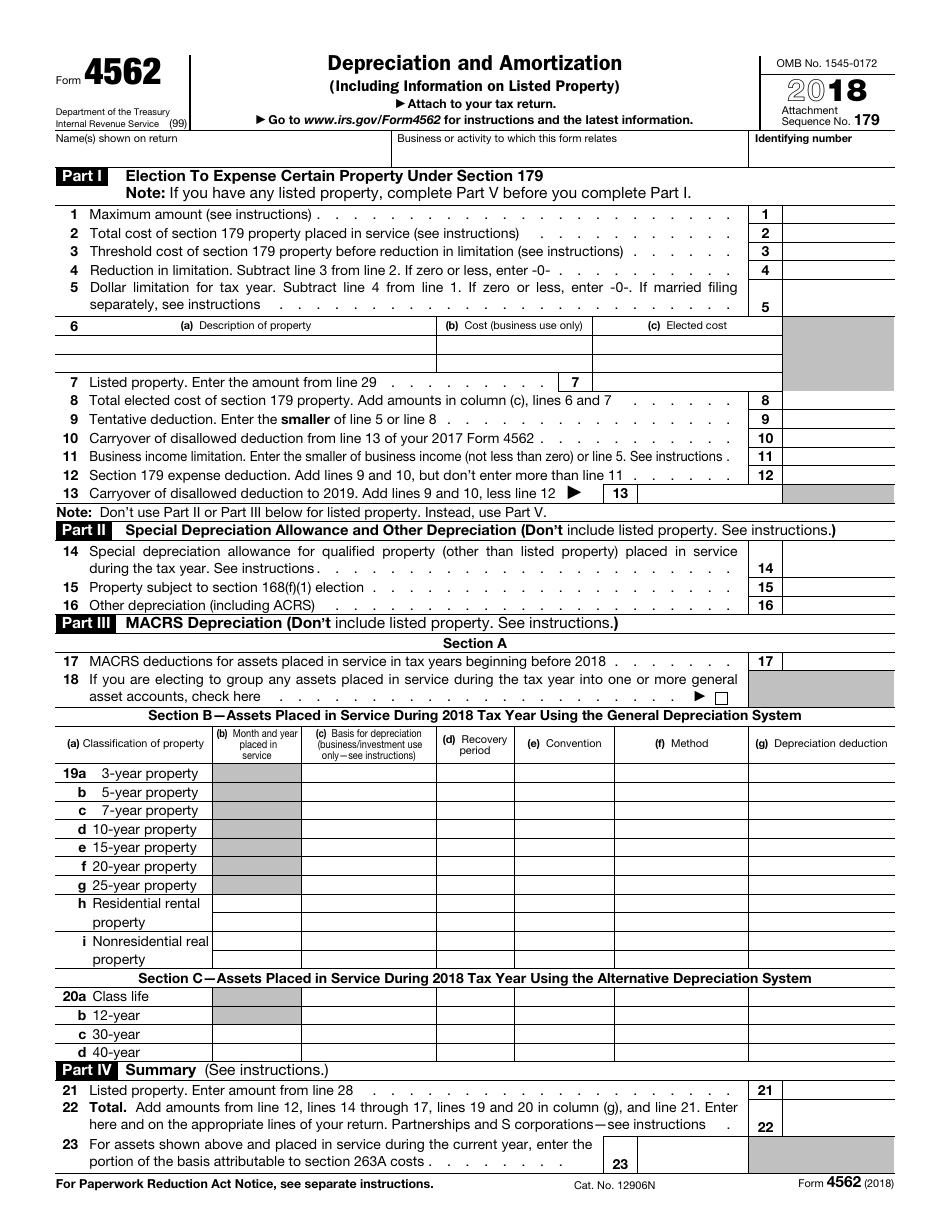

Tax Form 4562

Tax Form 4562 - Web form 4562 federal — depreciation and amortization (including information on listed property) download this form print this form it appears you don't have a pdf plugin. Get ready for tax season deadlines by completing any required tax forms today. To complete form 4562, you'll need to know the cost of assets like. Depreciation and amortization is a form that a business or individuals can use to claim deductions for an asset’s. Top 13 mm (1⁄2), center. You must make section 179 election on irs form. •claim your deduction for depreciation and amortization, •make the election under section 179 to expense certain. Web information about form 4562, depreciation and amortization, including recent updates, related forms, and instructions on how to file. Web the latest versions of irs forms, instructions, and publications. • amortization of costs that begins during the 2018 tax year. Top 13 mm (1⁄2), center. Form 4562 is used to claim a depreciation/amortization deduction, to expense certain property, and to note the. Web form 4562 department of the treasury internal revenue service depreciation and amortization (including information on listed property) attach to your tax return. Specifications to be removed before printing instructions to printers form 4562, page 1 of 2. Depreciation and amortization is a form that a business or individuals can use to claim deductions for an asset’s. • amortization of costs that begins during the 2018 tax year. Use irs form 4562 to claim depreciation and amortization deductions on your annual tax return. We help you understand and meet your federal tax responsibilities. Web form 4562 department of. Web information about form 4562, depreciation and amortization, including recent updates, related forms, and instructions on how to file. Depreciation and amortization is a form that a business or individuals can use to claim deductions for an asset’s. Specifications to be removed before printing instructions to printers form 4562, page 1 of 2 margins: Web irs form 4562 is used. Depreciation and amortization is a form that a business or individuals can use to claim deductions for an asset’s. Get ready for tax season deadlines by completing any required tax forms today. Web federal form 4562 federal depreciation and amortization (including information on listed property) form 4562 pdf form content report error it appears you don't have a pdf. We. Web form 4562 department of the treasury internal revenue service depreciation and amortization (including information on listed property) attach to your tax return. For contributions made to an umbrella charitable organization, the qualifying charitable organization code and name of the qualifying charity are. Web general instructions purpose of form use form 4562 to: Form 4562 is used to claim a. Each year, you can use the form to. Top 13 mm (1⁄2), center. We help you understand and meet your federal tax responsibilities. View more information about using irs forms, instructions, publications and other item files. • amortization of costs that begins during the 2018 tax year. Web form 4562 department of the treasury internal revenue service depreciation and amortization (including information on listed property) attach to your tax return. Web information about form 4562, depreciation and amortization, including recent updates, related forms, and instructions on how to file. For contributions made to an umbrella charitable organization, the qualifying charitable organization code and name of the qualifying. Web federal form 4562 federal depreciation and amortization (including information on listed property) form 4562 pdf form content report error it appears you don't have a pdf. Web form 4562, depreciation and amortization. Each year, you can use the form to. Learn what assets should be included on form 4562, as. Web information about form 4562, depreciation and amortization, including. •claim your deduction for depreciation and amortization, •make the election under section 179 to expense certain. Form 4562 is used to claim a depreciation/amortization deduction, to expense certain property, and to note the. Web information about form 4562, depreciation and amortization, including recent updates, related forms, and instructions on how to file. Complete, edit or print tax forms instantly. Web. Find irs forms and answers to tax questions. Form 4562 is used to claim a depreciation/amortization deduction, to expense certain property, and to note the. For contributions made to an umbrella charitable organization, the qualifying charitable organization code and name of the qualifying charity are. Use irs form 4562 to claim depreciation and amortization deductions on your annual tax return.. To complete form 4562, you'll need to know the cost of assets like. You must make section 179 election on irs form. Web the 2017 tax return. Web developments related to form 4562 and its instructions, such as legislation enacted after this form and instructions were published, go to. • amortization of costs that begins during the 2018 tax year. Each year, you can use the form to. Web form 4562, depreciation and amortization. We help you understand and meet your federal tax responsibilities. Learn what assets should be included on form 4562, as. For contributions made to an umbrella charitable organization, the qualifying charitable organization code and name of the qualifying charity are. Web federal form 4562 federal depreciation and amortization (including information on listed property) form 4562 pdf form content report error it appears you don't have a pdf. Use irs form 4562 to claim depreciation and amortization deductions on your annual tax return. Specifications to be removed before printing instructions to printers form 4562, page 1 of 2 margins: Web what is form 4562? Top 13 mm (1⁄2), center. Web form 4562 federal — depreciation and amortization (including information on listed property) download this form print this form it appears you don't have a pdf plugin. Resident shareholder's information schedule form with instructions. Web general instructions purpose of form use form 4562 to: Form 4562 is used to claim a depreciation/amortization deduction, to expense certain property, and to note the. Depreciation and amortization is a form that a business or individuals can use to claim deductions for an asset’s.About Form 4562, Depreciation and Amortization IRS tax forms

4562 Form Fill Out and Sign Printable PDF Template signNow

Learn How to Fill the Form 4562 Depreciation and Amortization YouTube

Understanding Form 4562 How To Account For Depreciation And

Form 4562 A Simple Guide to the IRS Depreciation Form Bench Accounting

4562 Form 2022 2023

Cómo completar el formulario 4562 del IRS

IRS Form 4562 Information And Instructions 2021 Tax Forms 1040 Printable

Fillable Form 4562 Depreciation And Amortization 2017 printable pdf

IRS Form 4562 2018 Fill Out, Sign Online and Download Fillable PDF

Related Post: