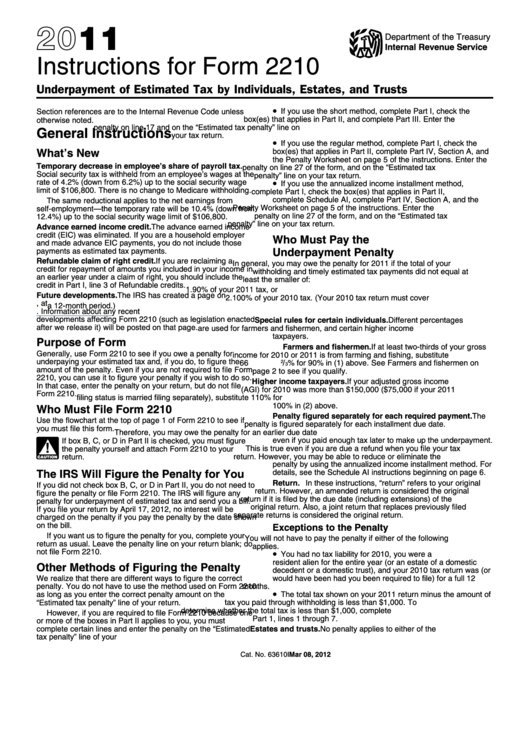

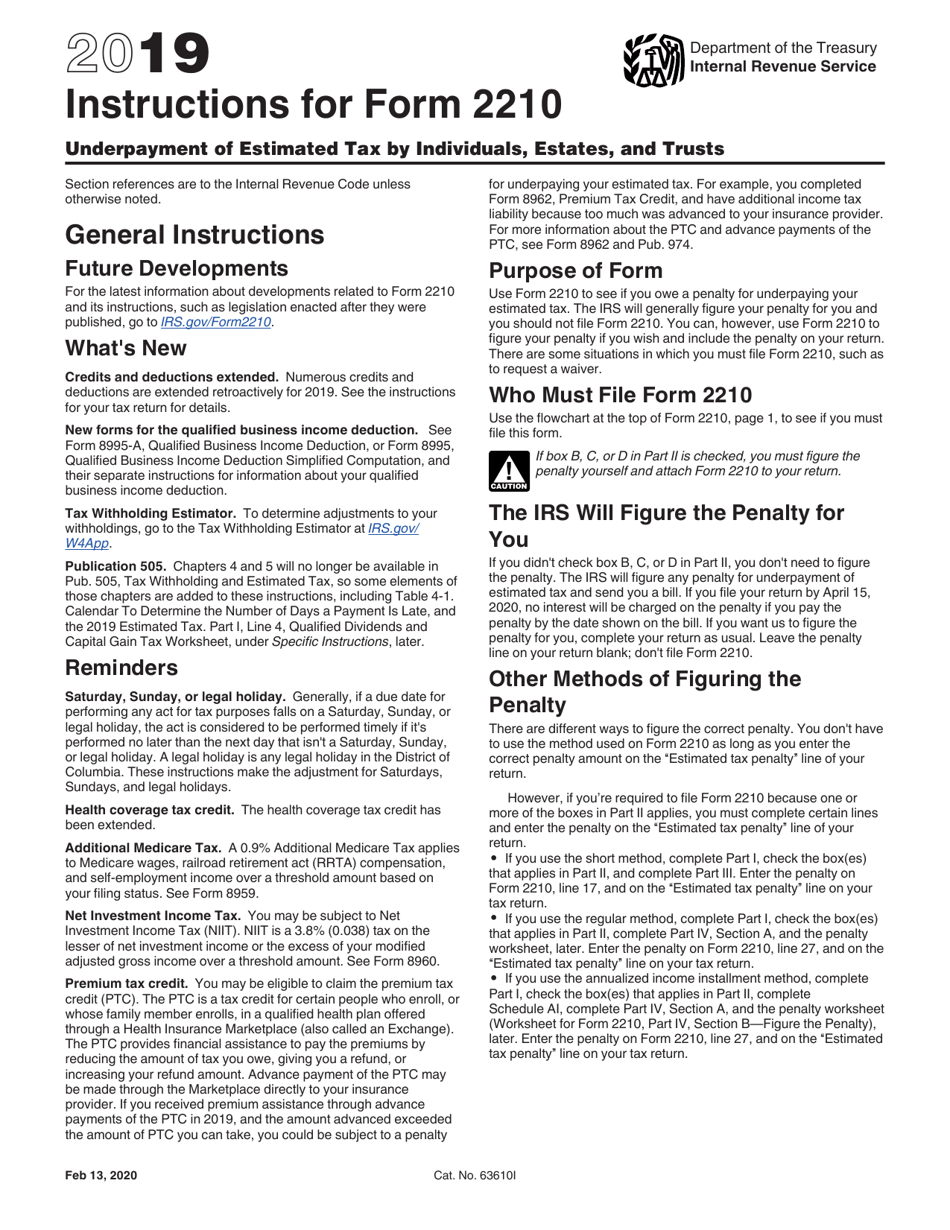

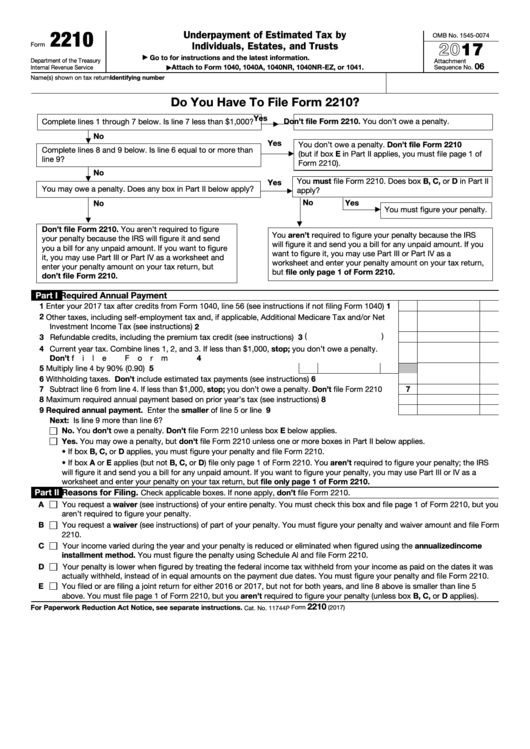

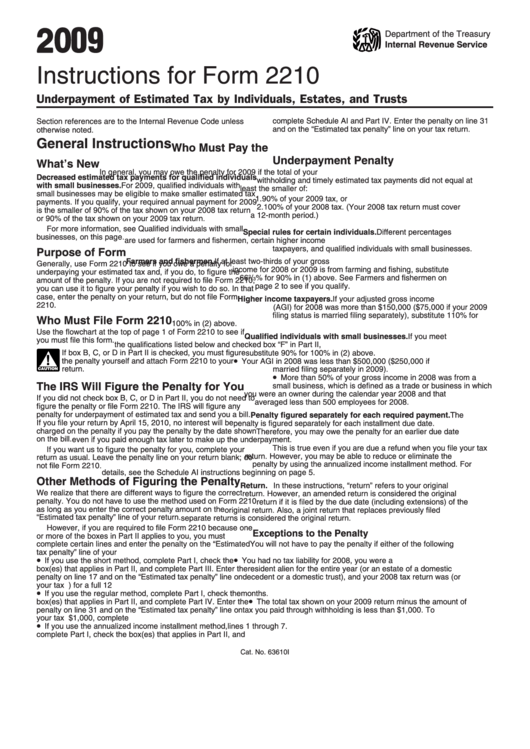

Tax Form 2210 Instructions

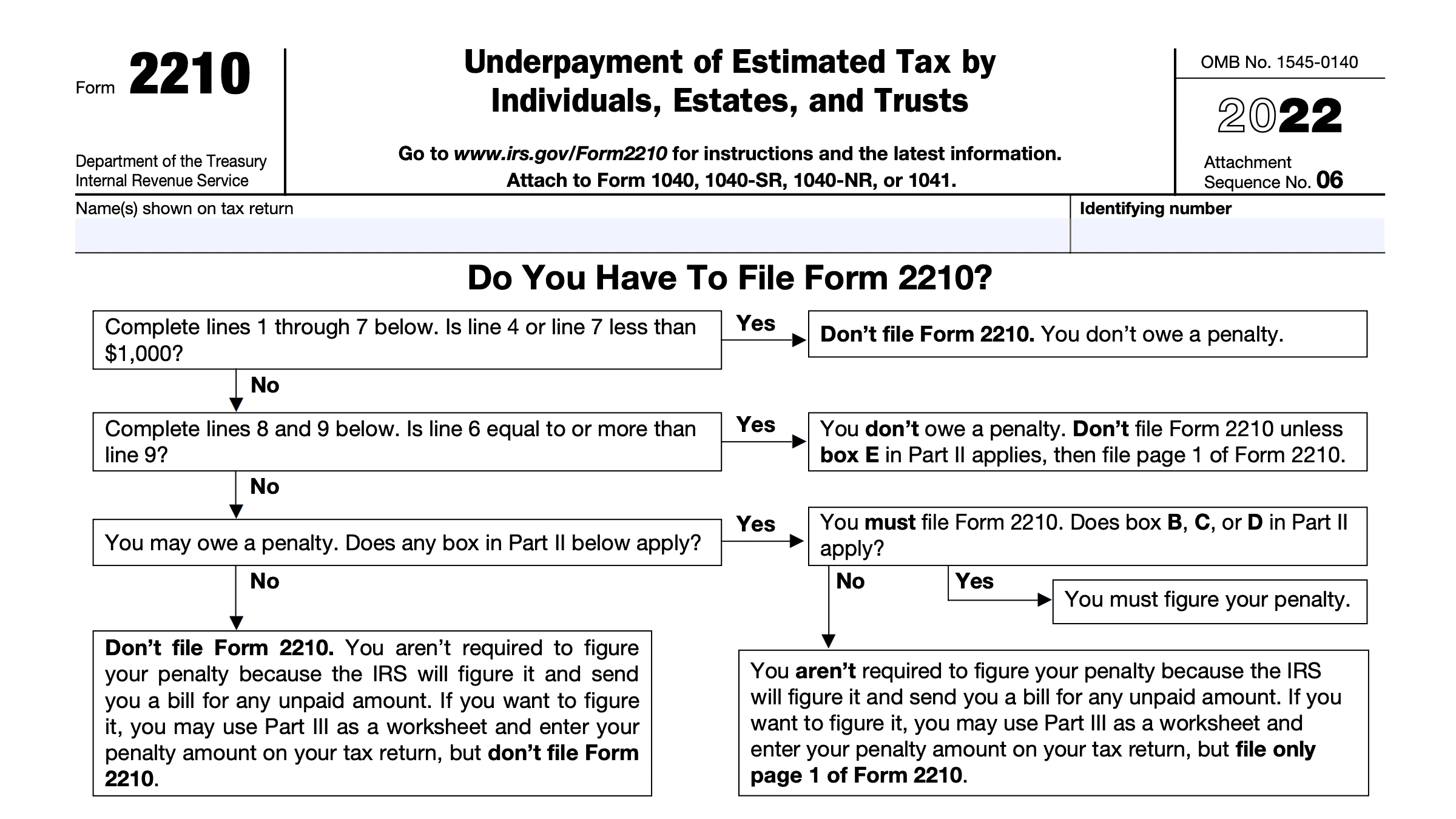

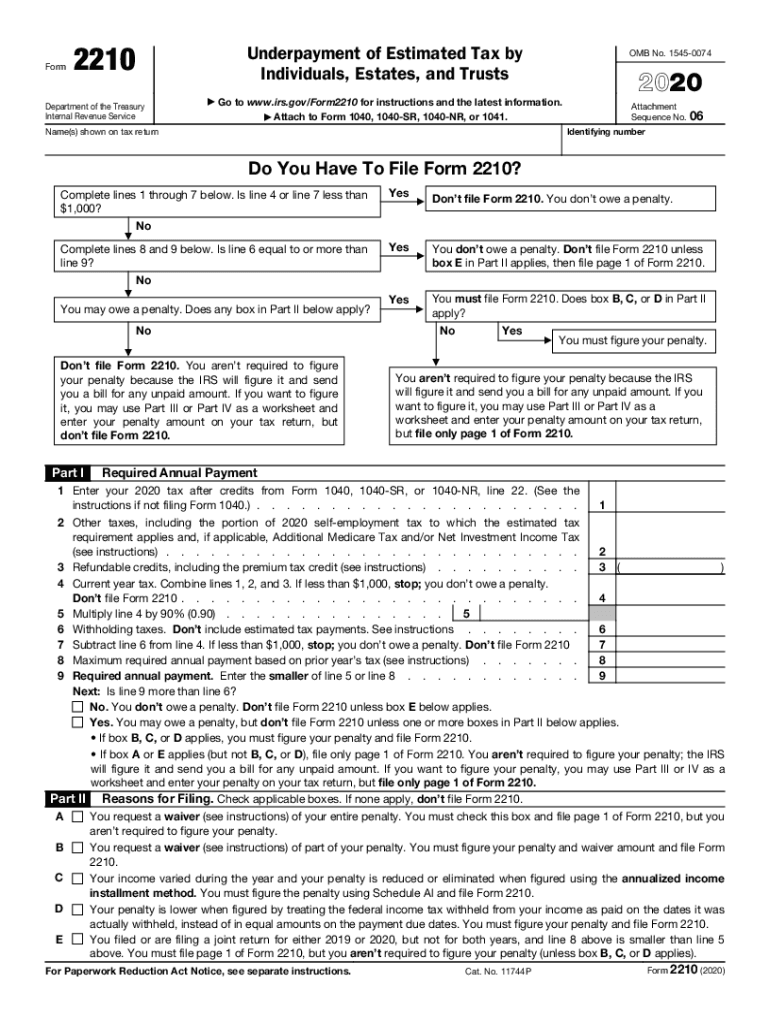

Tax Form 2210 Instructions - The irs will generally figure your penalty for you and you should not file. Web failure to make correct estimated payments can result in interest or penalties. Web you or your spouse (if you file a joint return) retired in the past 2 years after reaching age 62 or became disabled and you had reasonable cause to. Web information about form 2210 and its separate instructions is at www.irs.gov/form2210. In order to make schedule ai available, part ii of form 2210 underpayment of estimated tax by. Web purpose of form use form 2210 to see if you owe a penalty for underpaying your estimated tax. Web to complete form 2210, you must enter your prior year tax which is found on line 24 of your prior year 1040 and check any corresponding boxes if they relate to your situation. Ad access irs tax forms. Underpayment of estimated tax by individuals, estates, and trusts. Department of the treasury internal revenue service. Underpayment of estimated tax by individuals, estates, and trusts. Web purpose of form use form 2210 to see if you owe a penalty for underpaying your estimated tax. Web use form 2210 to determine the amount of underpaid estimated tax and resulting penalties as well as for requesting a waiver of the penalties. Department of the treasury internal revenue service.. Complete, edit or print tax forms instantly. Web instructions fillable forms if you’re filing an income tax return and haven’t paid enough in income taxes throughout the tax year, you may be filling out irs form. Form 2210 is used by individuals (as well as estates and trusts) to determine if a penalty is. You can also use the worksheet. Reminders saturday, sunday, or legal holiday. About the individual income tax the irs and most states collect a personal income tax, which is. Ad if you owe more than $5,000 in back taxes tax advocates can help you get tax relief. Ad access irs tax forms. Web purpose of form use form 2210 to see if you owe a penalty. Ad if you owe more than $5,000 in back taxes tax advocates can help you get tax relief. Get ready for tax season deadlines by completing any required tax forms today. Web failure to make correct estimated payments can result in interest or penalties. Enjoy great deals and discounts on an array of products from various brands. Web form 2210. In order to make schedule ai available, part ii of form 2210 underpayment of estimated tax by. Even if you are not. For paperwork reduction act notice, see separate instructions. Web information about form 2210 and its separate instructions is at www.irs.gov/form2210. Web irs form 2210, underpayment of estimated tax by individuals, estates, and trusts, is a tax document that. Future developments for the latest information about developments related to form 2210 and its instructions, such as legislation enacted after they were published, go to irs.gov/form2210. 6 multiply line 5 amount by 25% (.25) for amount required for each. Web how do i add form 2210? You can also use the worksheet in the instructions for form 2210. The irs. Web use form 2210 to determine the amount of underpaid estimated tax and resulting penalties as well as for requesting a waiver of the penalties. Get ready for tax season deadlines by completing any required tax forms today. Web how do i add form 2210? Web to complete form 2210, you must enter your prior year tax which is found. Web general instructions future developments for the latest information about developments related to form 2210 and its instructions, such as legislation enacted after they were. In order to make schedule ai available, part ii of form 2210 underpayment of estimated tax by. This penalty is different from the penalty for. Web to complete form 2210, you must enter your prior. Web form 2210 is used to determine how much you owe in underpayment penalties on your balance due. Irs form 2210(underpayment of estimated tax by individuals, estates, and. The irs will generally figure your penalty for you and you should not file. This penalty is different from the penalty for. Solved•by turbotax•2479•updated january 13, 2023. Web purpose of form use form 2210 to see if you owe a penalty for underpaying your estimated tax. Web form 2210 is used to calculate a penalty when the taxpayer has underpaid on their estimated taxes (quarterly es vouchers). Solved•by turbotax•2479•updated january 13, 2023. Department of the treasury internal revenue service. Generally, if a due date for performing any. Department of the treasury internal revenue service. The irs will generally figure your penalty for you and you should not file. Web you or your spouse (if you file a joint return) retired in the past 2 years after reaching age 62 or became disabled and you had reasonable cause to. Ad access irs tax forms. This penalty is different from the penalty for. The irs will generally figure your penalty for you and you should not. You can also use the worksheet in the instructions for form 2210. Reminders saturday, sunday, or legal holiday. Web failure to make correct estimated payments can result in interest or penalties. In order to make schedule ai available, part ii of form 2210 underpayment of estimated tax by. Web to complete form 2210, you must enter your prior year tax which is found on line 24 of your prior year 1040 and check any corresponding boxes if they relate to your situation. Web 5 minimum withholding and estimated tax payment required for tax year 2022 $ (lesser of line 2 and 4). Underpayment of estimated tax by individuals, estates, and trusts. Generally, use form 2210 to see if you owe a penalty for underpaying your estimated tax and, if you do, to figure the amount of the penalty. Get ready for tax season deadlines by completing any required tax forms today. Web you must file page 1 of form 2210, but you aren’t required to figure your penalty (unless box b, c, or d applies). Web how do i add form 2210? Web information about form 2210 and its separate instructions is at www.irs.gov/form2210. Future developments for the latest information about developments related to form 2210 and its instructions, such as legislation enacted after they were published, go to irs.gov/form2210. Web general instructions future developments for the latest information about developments related to form 2210 and its instructions, such as legislation enacted after they were.Instructions For Form 2210 Underpayment Of Estimated Tax By

Download Instructions for IRS Form 2210 Underpayment of Estimated Tax

Ssurvivor Irs Form 2210 Ai Instructions

Fillable Form 2210 Underpayment Of Estimated Tax By Individuals

Instructions For Form 2210 Underpayment Of Estimated Tax By

IRS Form 2210 Instructions Underpayment of Estimated Tax

Instructions For Form 2210 Underpayment Of Estimated Tax By

Instructions For Form 2210 2008 printable pdf download

2210 Form 2022 2023

IRS 2210 2020 Fill out Tax Template Online US Legal Forms

Related Post: