Tax Extension Form For Llc

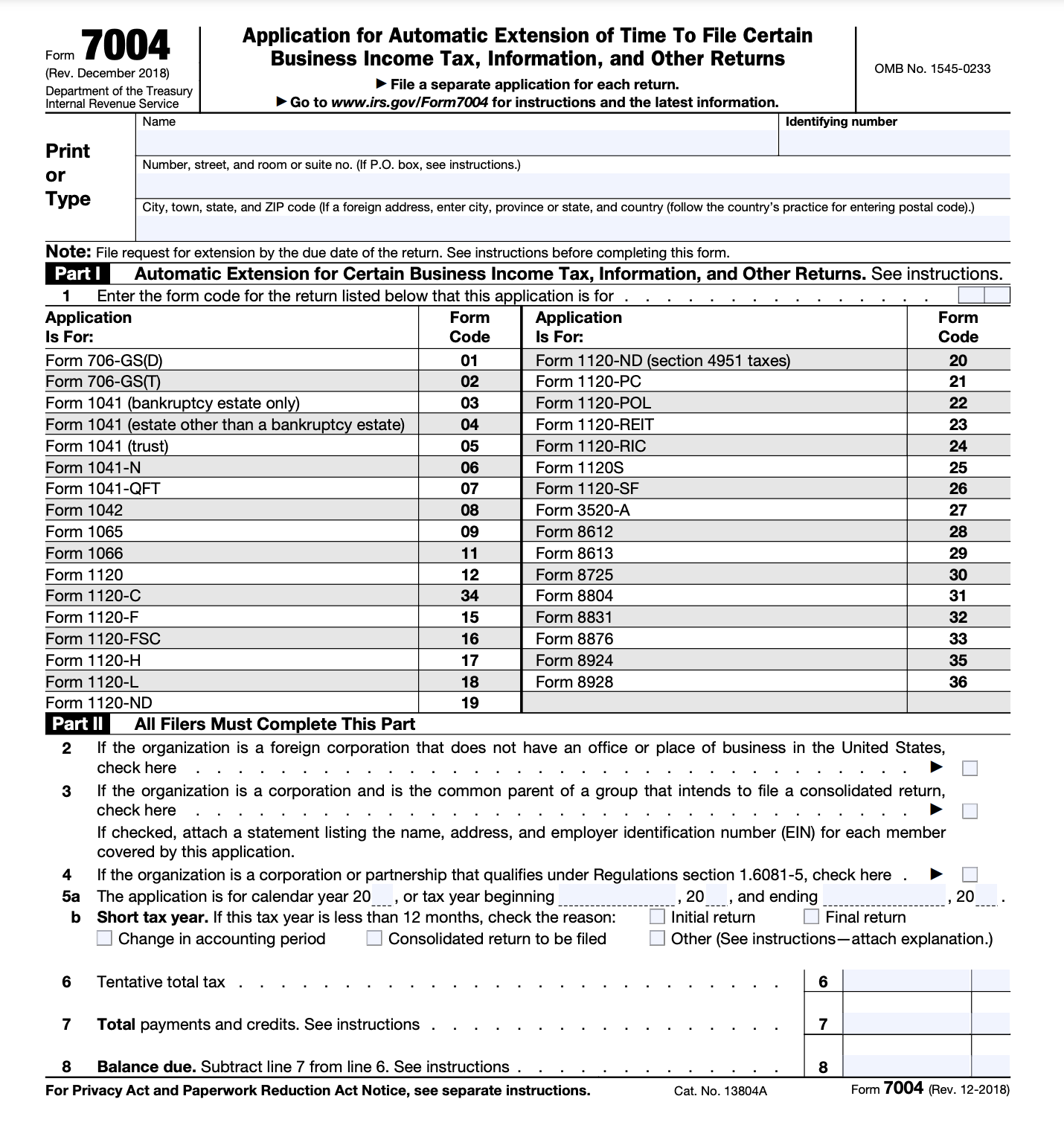

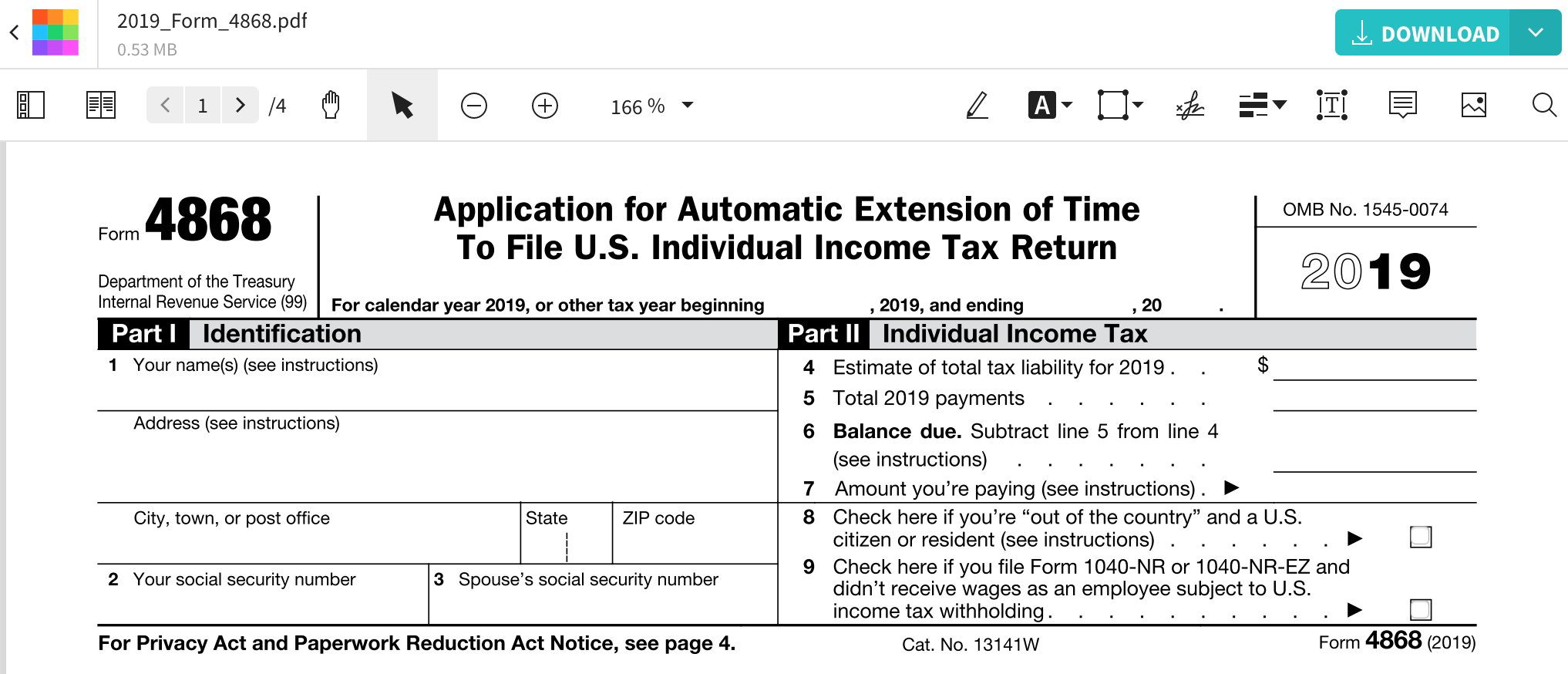

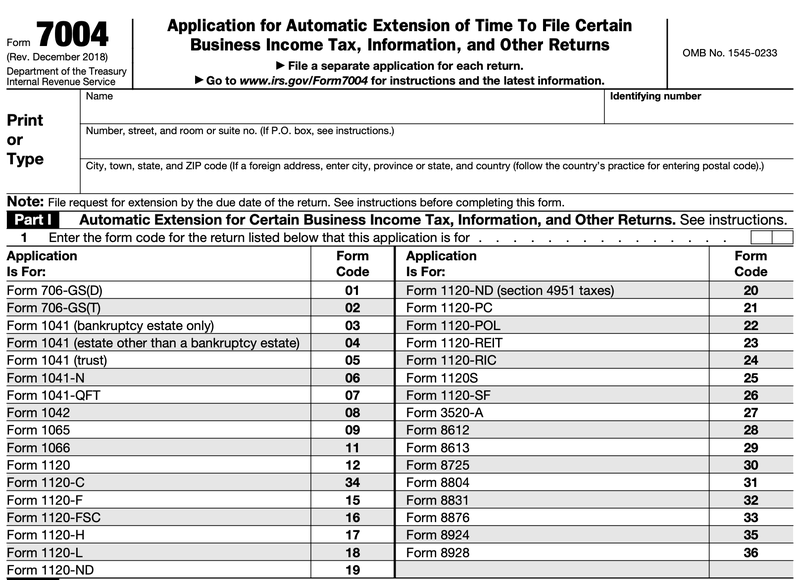

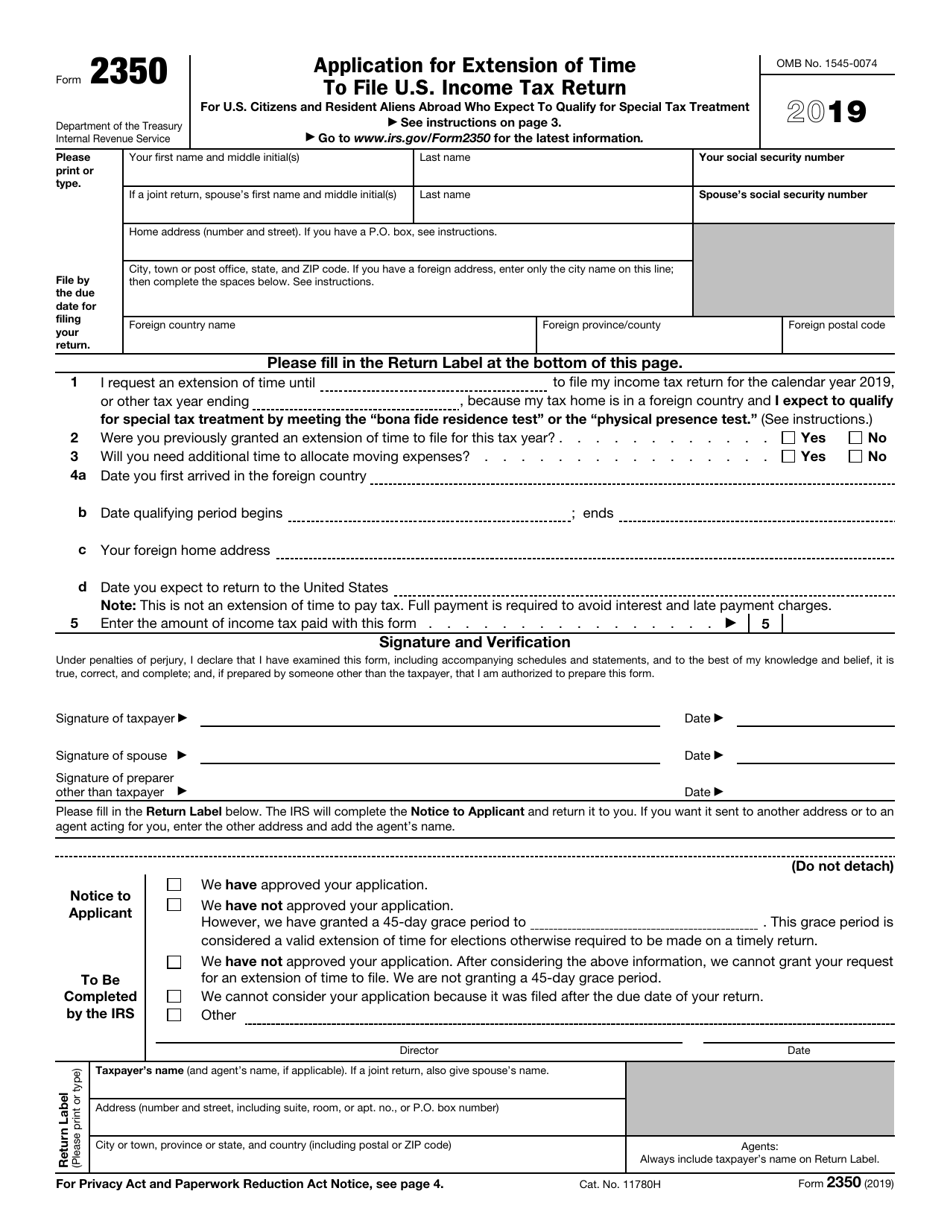

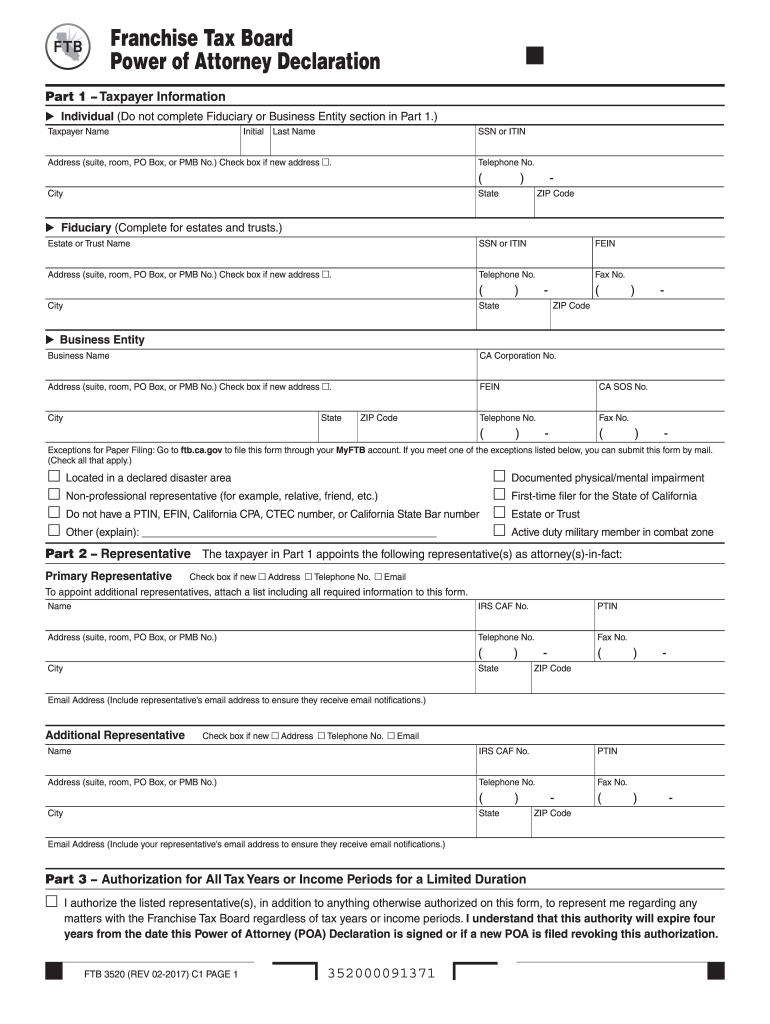

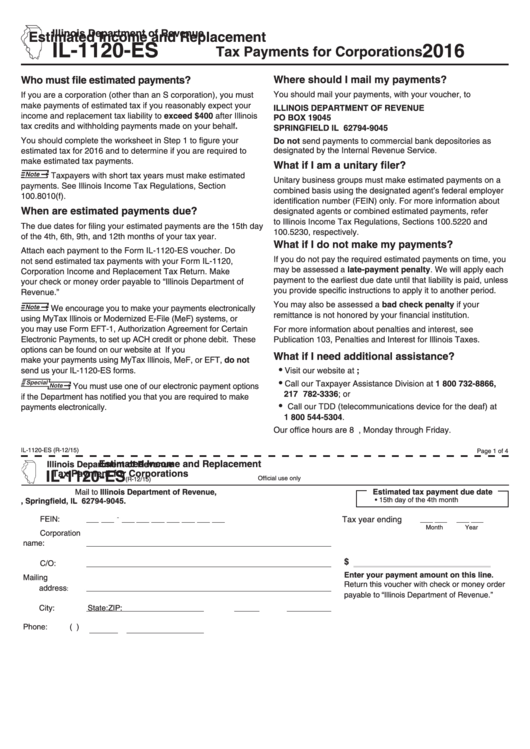

Tax Extension Form For Llc - Web to file for an llc extension, file form 7004: Individual income taxpayers who received a filing. Application for automatic extension of time to file certain business income tax information, and other returns. Web form 7004 is used to request an automatic extension to file the certain returns. This form requests an extension for partnerships as well as llcs. Web 20 rows corporate tax forms. Web if you need an extension for llc with regard to paying your business tax return, you must fill out form 7004. Submit your extension request form; Web corporations, partnerships, s corporations, and fiduciaries can now electronically file their income taxes to the arizona department of revenue (ador). Web if your llc does not qualify for an automatic extension, you can still request one by filing form 7004 with the irs. Web application for automatic extension of time to file certain business income tax, information, and other returns 7004 note: You can use this form to obtain up to six months. Web to file for an llc extension, file form 7004: Complete the extension request form; Application for automatic extension of time to file certain business income tax information, and other. Select the right extension form; File request for extension by the due date of. Submit your extension request form; Web file this form to request an extension to file forms 120, 120a, 120s, 99, 99t, or 165. This form requests an extension for partnerships as well as llcs. Estimate the tax you owe; Web 20 rows corporate tax forms. Instantly find & download legal forms drafted by attorneys for your state. There’s less than a week until the oct. Complete the extension request form; Phoenix, az —the due date for the 2022 calendar year returns filed with extensions is almost here. Instantly find & download legal forms drafted by attorneys for your state. Web an llc that does not want to accept its default federal tax classification, or that wishes to change its classification, uses form 8832, entity classification election. Web form 7004 is. Individual income taxpayers who received a filing. This form requests an extension for partnerships as well as llcs. The llc needs to file a 1065 partnership return and. One year of de registered agent service, full llc registration & a local business address! Web file this form to request an extension to file forms 120, 120a, 120s, 99, 99t, or. Create an account in expressextensin or log in to your existing. Web to file for an llc extension, file form 7004: Web corporations, partnerships, s corporations, and fiduciaries can now electronically file their income taxes to the arizona department of revenue (ador). Estimate the tax you owe; Web the taxpayer will be liable for the extension underpayment penalty if at. Individual income taxpayers who received a filing. Web if your llc does not qualify for an automatic extension, you can still request one by filing form 7004 with the irs. Web you can use irs free file at irs.gov/freefile to request an automatic filing extension or file form 4868, application for automatic extension of time to file. Complete the extension. This form requests an extension for partnerships as well as llcs. Web to file an extension for your llc through expressextension, follow the steps below: Web an llc that does not want to accept its default federal tax classification, or that wishes to change its classification, uses form 8832, entity classification election. Ad top 5 llc services online (2023). One. Web 20 rows corporate tax forms. File request for extension by the due date of. For federal income tax purposes, a single. You can use this form to obtain up to six months. This form requests an extension for partnerships as well as llcs. Phoenix, az —the due date for the 2022 calendar year returns filed with extensions is almost here. The llc needs to file a 1065 partnership return and. Application for automatic extension of time to file certain business income tax information, and other returns. Web an llc that does not want to accept its default federal tax classification, or that wishes. Web 20 rows corporate tax forms. Web application for automatic extension of time to file certain business income tax, information, and other returns 7004 note: This form requests an extension for partnerships as well as llcs. Create an account in expressextensin or log in to your existing. In the wake of last winter’s. Web the taxpayer will be liable for the extension underpayment penalty if at least 90 percent of the tax liability disclosed by the return has not been paid by the original. Application for automatic extension of time to file certain business income tax information, and other returns. Web corporations, partnerships, s corporations, and fiduciaries can now electronically file their income taxes to the arizona department of revenue (ador). 16, 2023 — the internal revenue service today further postponed tax deadlines for most california taxpayers to nov. Individual income taxpayers who received a filing. Web to file for an llc extension, file form 7004: Web file this form to request an extension to file forms 120, 120a, 120s, 99, 99t, or 165. Ad top 5 llc services online (2023). Web if you need an extension for llc with regard to paying your business tax return, you must fill out form 7004. Ad our local experts know the ins & outs of registering a delaware llc. One year of de registered agent service, full llc registration & a local business address! Corporation income tax returns are due by the 15 th day of the 4 th month following the end of the taxable year — or april 15 for. Web to file an extension for your llc through expressextension, follow the steps below: For federal income tax purposes, a single. You can use this form to obtain up to six months.What is Form 7004 and How to Fill it Out Bench Accounting

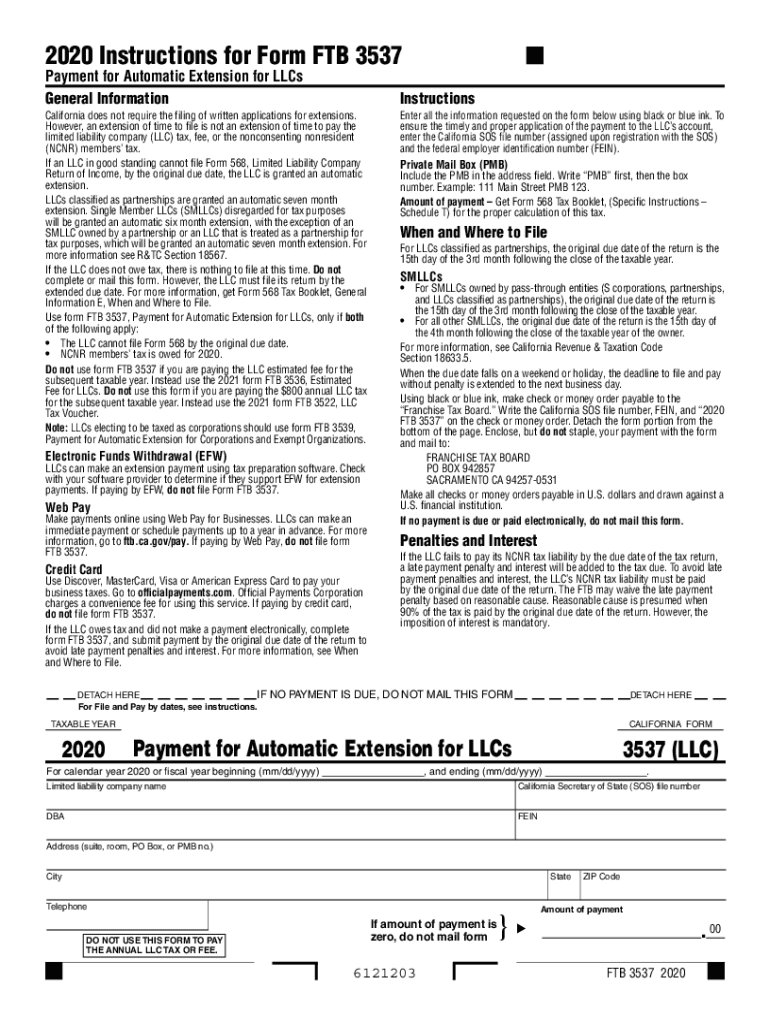

2020 Form CA FTB 3537 Fill Online, Printable, Fillable, Blank pdfFiller

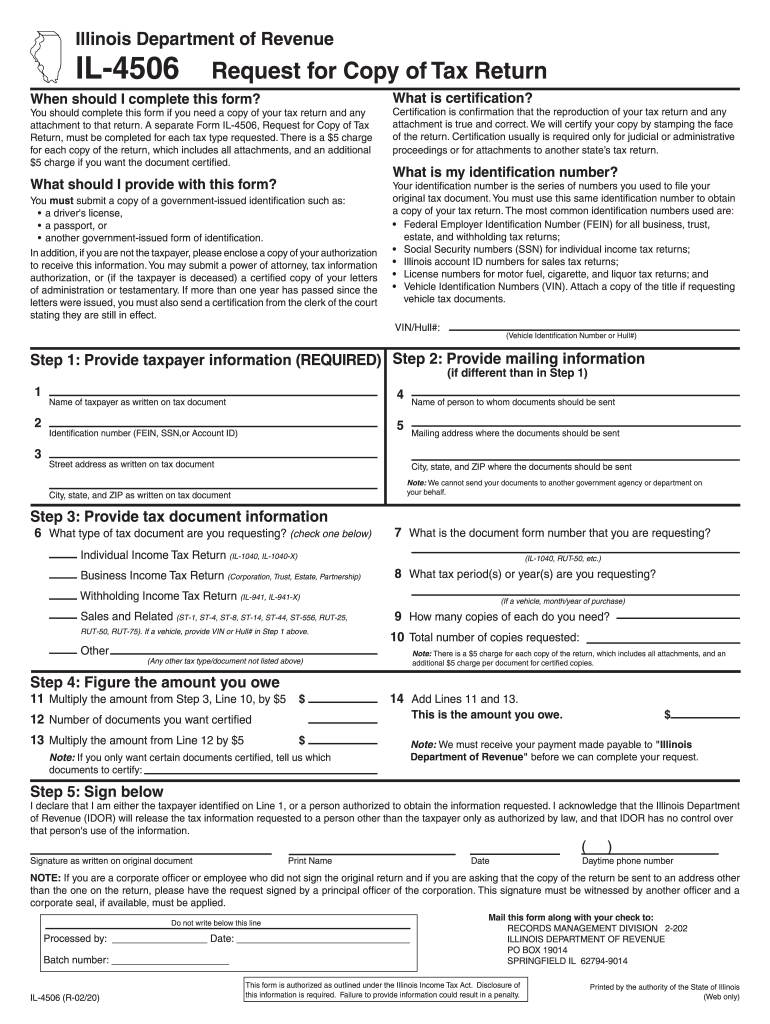

Illinois Dept Of Revenue Forms Fill Out and Sign Printable PDF

Free Printable Tax Extension Form Printable Forms Free Online

tax extension form 2019 Fill Online, Printable, Fillable Blank irs

How to File a Business Tax Extension in 2021 The Blueprint

IRS Form 2350 2019 Fill Out, Sign Online and Download Fillable PDF

2016 tax extension form corporations pipeolpor

2016 tax extension form corporations pipeolpor

Federal Extension Is In Effect Fill Out and Sign Printable PDF

Related Post: