Tamu Hotel Tax Exempt Form

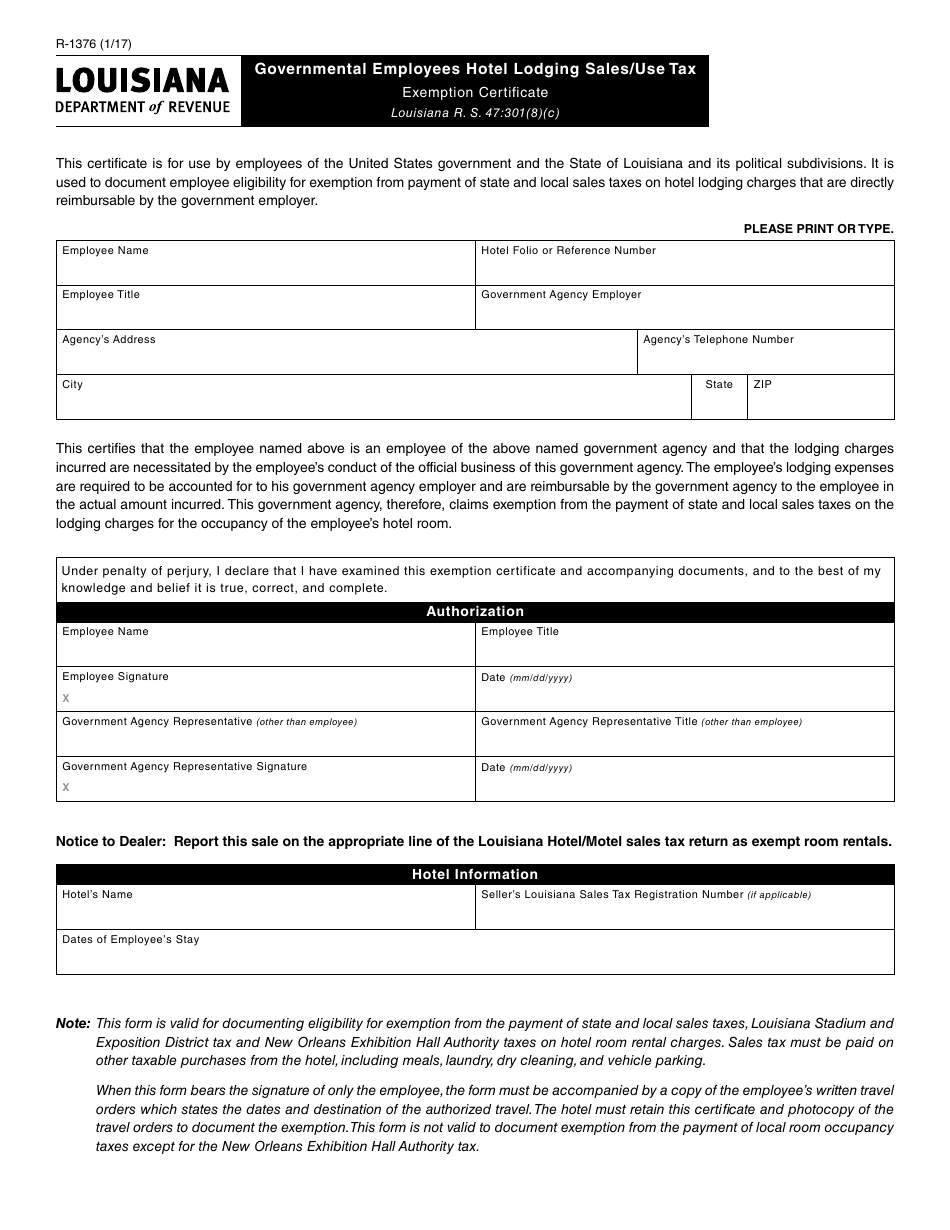

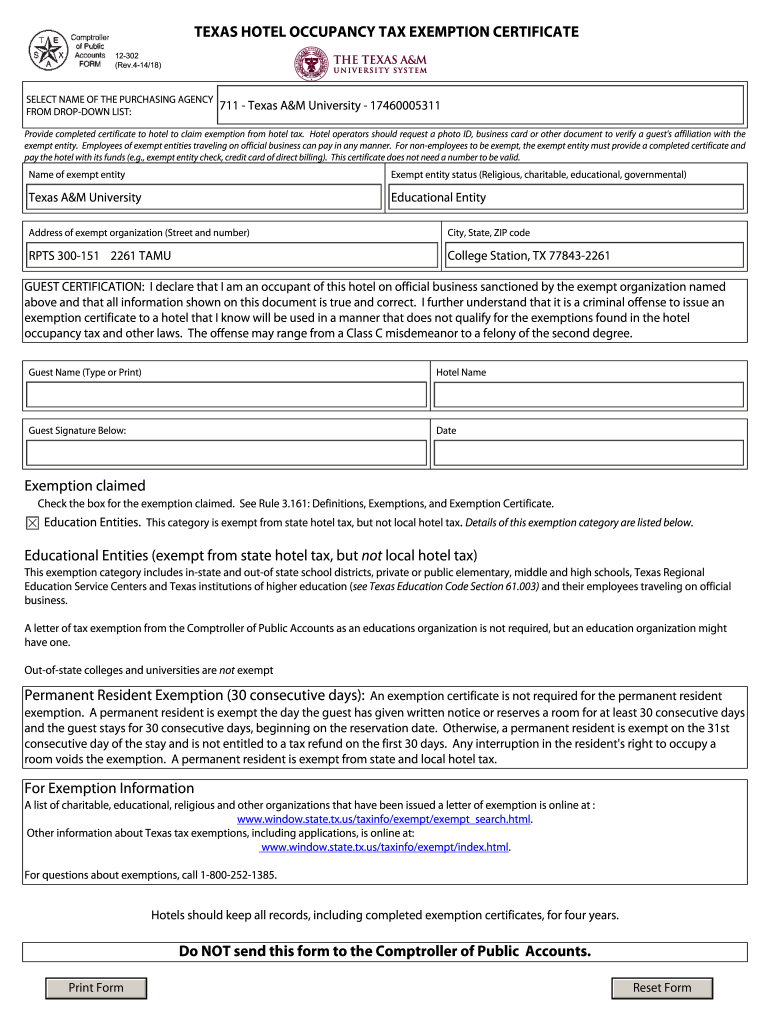

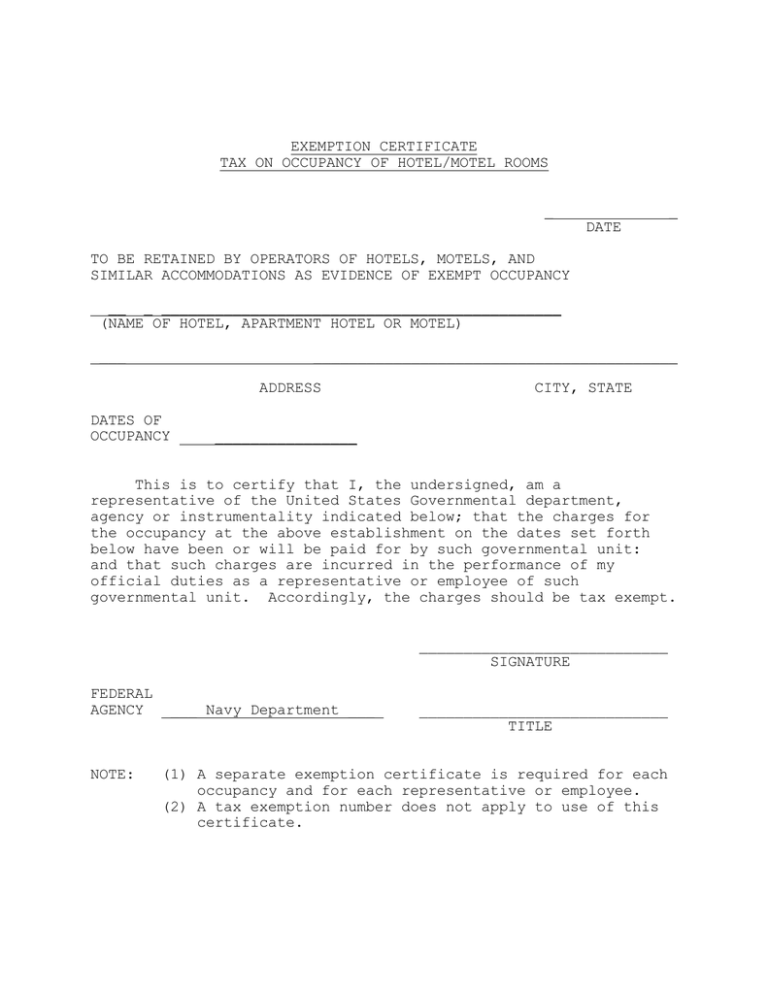

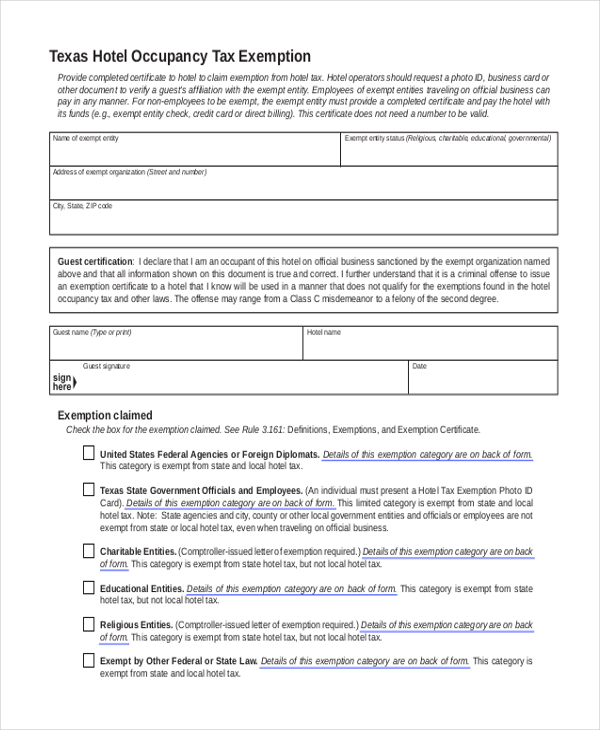

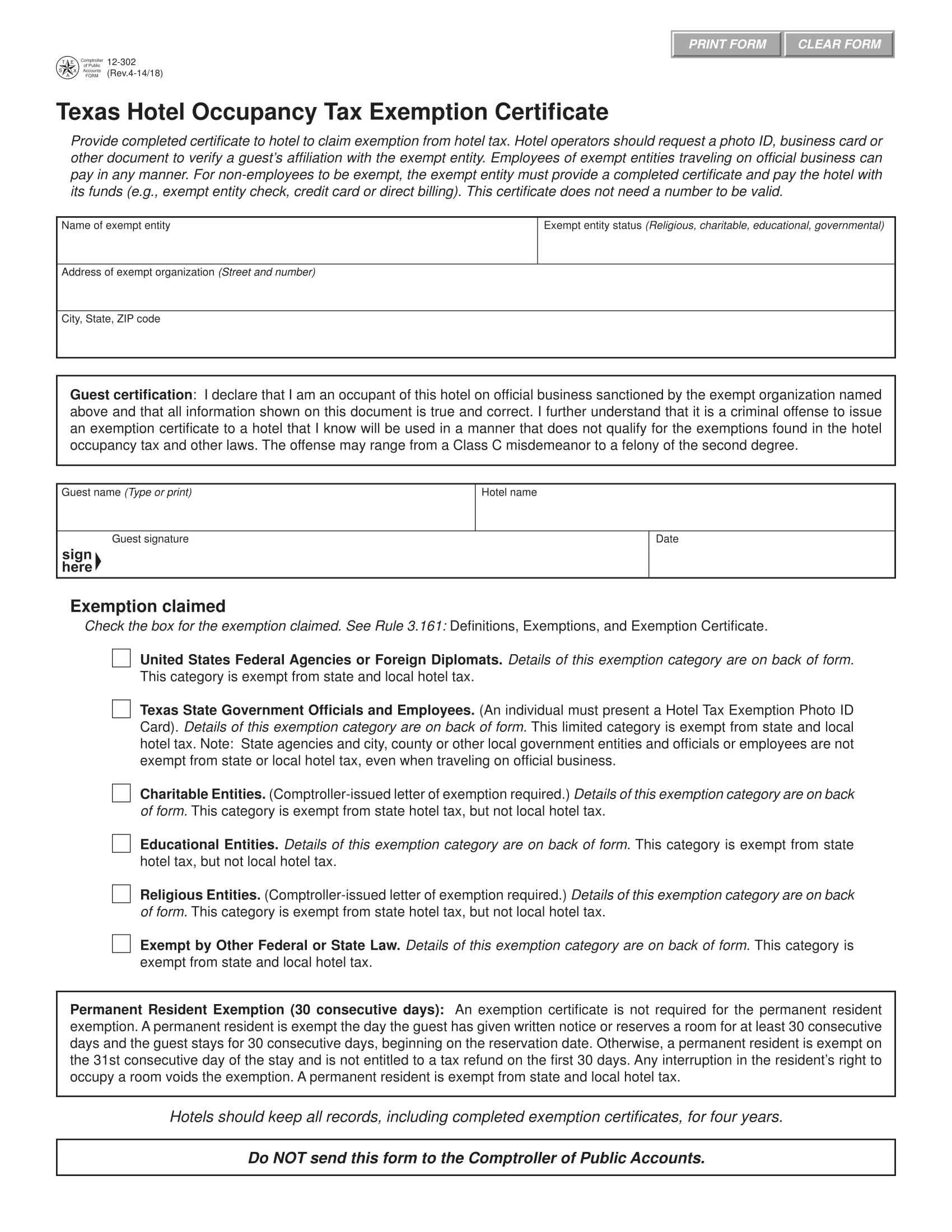

Tamu Hotel Tax Exempt Form - Factoring transaction privilege tax when a business “factors” transaction privilege tax, it means. Texas motor vehicle rental tax exemption form. Web is tamu tax exempt? Provide completed certificate to hotel to claim exemption from hotel tax. Provide completed certificate to hotel to claim exemption from hotel tax. Provide completed certificate to hotel to claim exemption from hotel tax. Easily sign the form with your finger. United states tax exemption form; This certificate is for business only, not to be used for private purposes, under penalty of law. Options for sales tax charged. Web tamu and tamug travel forms. Factoring transaction privilege tax when a business “factors” transaction privilege tax, it means. Provide completed certificate to hotel to claim exemption from hotel tax. Web tamu hotel tax exemption form. Documentation in lieu of receipt. Other state tax exemption forms. This certificate is for business only, not to be used for private purposes, under penalty of law. Does a hotel occupancy tax exist in texas? Web the purpose of this form is to provide a lodging operator with the documentation pursuant to a.r.s. Documentation in lieu of receipt. This form should be used for both direct billing accounts and rentals paid by the employee. Documentation in lieu of receipt. Open form follow the instructions. Web texas hotel occupancy tax exemption certificate. Web city tax is reported separately. Provide completed certificate to hotel to claim exemption from hotel tax. Web texas hotel occupancy tax exemption certificate. Texas motor vehicle rental tax exemption form. Web the purpose of this form is to provide a lodging operator with the documentation pursuant to a.r.s. Documentation in lieu of receipt. This form should be used for both direct billing accounts and rentals paid by the employee. When traveling within the state of texas, using local funds or state funds, we are considered exempt from the texas hotel occupancy tax. Web hotel occupancy tax exemption. Web state employees should provide the texas sales and use tax exemption certificate form to the. Factoring transaction privilege tax when a business “factors” transaction privilege tax, it means. United states tax exemption form; This certificate is for business only, not to be used for private purposes, under penalty of law. Web i, the purchaser named above, claim an exemption from payment of sales and use taxes for the purchase of taxable items described below or. Web the purpose of this form is to provide a lodging operator with the documentation pursuant to a.r.s. United states tax exemption form; Easily sign the form with your finger. Web texas hotel occupancy tax exemption certificate. Web state employees should provide the texas sales and use tax exemption certificate form to the vendor when making a purchase. Does a hotel occupancy tax exist in texas? Hotel occupancy tax exemption form. Web texas hotel occupancy tax exemption certificate. When staying at a hotel within the state of texas, employees are exempt from the texas hotel occupancy tax. Web hotel occupancy tax exemption. Texas motor vehicle rental tax exemption form. Easily sign the form with your finger. Some states will offer sales tax, and/or state hotel tax, and/or state vehicle rental tax exemptions to other sales tax exempt entities (e.g. This certificate is for business only, not to be used for private purposes, under penalty of law. Get tamu hotel tax exemption form. Get tamu hotel tax exemption form. Motor vehicle rental exemption certificate. Does a hotel occupancy tax exist in texas? Web i, the purchaser named above, claim an exemption from payment of sales and use taxes for the purchase of taxable items described below or on the attached order or invoice form:. Web the purpose of this form is to provide. Provide completed certificate to hotel to claim exemption from hotel tax. This certificate is for business only, not to be used for private purposes, under penalty of law. Web tamu hotel tax exemption form. Factoring transaction privilege tax when a business “factors” transaction privilege tax, it means. When staying at a hotel within the state of texas, employees are exempt from the texas hotel occupancy tax. Web united states tax exemption form. Does a hotel occupancy tax exist in texas? Open form follow the instructions. Motor vehicle rental exemption certificate. Web state employees should provide the texas sales and use tax exemption certificate form to the vendor when making a purchase. Hotel occupancy tax exemption form. Web texas hotel occupancy tax exemption certificate. Texas hotel occupancy tax exempt form. Easily sign the form with your finger. Web hotel occupancy tax exemption. Documentation in lieu of receipt. Web texas hotel occupancy tax exemption certificate. Provide completed certificate to hotel to claim exemption from hotel tax. Get tamu hotel tax exemption form. Provide completed certificate to hotel to claim exemption from hotel tax.Hotel Tax Exempt Form

Hotel Tax Exempt Form

Texas hotel tax exempt form 2014 Fill out & sign online DocHub

Hotel Tax Exempt Form

Texas Hotel Tax Exempt Form Fillable Printable Forms Free Online

Ohio hotel tax exempt form Fill out & sign online DocHub

California Hotel Occupancy Tax Exemption Certificate

FREE 8+ Sample Tax Exemption Forms in PDF MS Word

Tax Exempt Form Fill Out And Sign Printable PDF Template SignNow

Hotel Tax Exempt Form

Related Post: