Ss8 Tax Form

Ss8 Tax Form - Updated draft instructions for the. Web forms search the database of gsa forms, standard (sf) and optional (of) government forms. Web about the form. Employers engaged in a trade or business who pay compensation. The draft contains clarifications and additional documentary requirements. You only need to file your personal tax return (federal form 1040 and arizona form 140) and include your llc profits on the return. Complete, edit or print tax forms instantly. If the worker is paid for these services by a firm other than the one listed on this form, enter the name, address, and employer identification number of the payer. Web housing assistance payment contract and landlord/tenant lease. Estimate how much you could potentially save in just a matter of minutes. The draft contains clarifications and additional documentary requirements. It’s used to help determine the status of a current worker for federal employment taxes and income tax. Get ready for tax season deadlines by completing any required tax forms today. Estimate how much you could potentially save in just a matter of minutes. If you are requesting a. Complete, edit or print tax forms instantly. Employee's withholding certificate form 941; Web instructions for workers. Get ready for tax season deadlines by completing any required tax forms today. If you are requesting a. You only need to file your personal tax return (federal form 1040 and arizona form 140) and include your llc profits on the return. Employers engaged in a trade or business who pay compensation. It’s used to help determine the status of a current worker for federal employment taxes and income tax. Employee's withholding certificate form 941; Updated draft instructions. If you are requesting a. Used to file a return with the county treasurer for property subject to the. Employee's withholding certificate form 941; Web about the form. Ad if you owe more than $5,000 in back taxes tax advocates can help you get tax relief. Employee's withholding certificate form 941; Used to file a return with the county treasurer for property subject to the. If you are requesting a. Updated draft instructions for the. Estimate how much you could potentially save in just a matter of minutes. If you are requesting a. Web instructions for workers. It’s used to help determine the status of a current worker for federal employment taxes and income tax. Employers engaged in a trade or business who pay compensation. Updated draft instructions for the. Web instructions for workers. Ad if you owe more than $5,000 in back taxes tax advocates can help you get tax relief. If the worker is paid for these services by a firm other than the one listed on this form, enter the name, address, and employer identification number of the payer. Get ready for tax season deadlines by completing. Ad if you owe more than $5,000 in back taxes tax advocates can help you get tax relief. Employers engaged in a trade or business who pay compensation. If the worker is paid for these services by a firm other than the one listed on this form, enter the name, address, and employer identification number of the payer. Estimate how. Web about the form. Employee's withholding certificate form 941; If the worker is paid for these services by a firm other than the one listed on this form, enter the name, address, and employer identification number of the payer. Web a draft update of the instructions for the form the internal revenue service uses to make worker status determinations was. Get ready for tax season deadlines by completing any required tax forms today. You only need to file your personal tax return (federal form 1040 and arizona form 140) and include your llc profits on the return. If you are requesting a. Employee's withholding certificate form 941; Once a landlord and section 8 participant have agreed to become landlord and. Web a draft update of the instructions for the form the internal revenue service uses to make worker status determinations was released oct. Web instructions for workers. Updated draft instructions for the. Get ready for tax season deadlines by completing any required tax forms today. Estimate how much you could potentially save in just a matter of minutes. Used to file a return with the county treasurer for property subject to the. Once a landlord and section 8 participant have agreed to become landlord and renter, there are some. Ad access irs tax forms. Web about the form. Ad if you owe more than $5,000 in back taxes tax advocates can help you get tax relief. Web forms search the database of gsa forms, standard (sf) and optional (of) government forms. If the worker is paid for these services by a firm other than the one listed on this form, enter the name, address, and employer identification number of the payer. United states tax exemption form. You only need to file your personal tax return (federal form 1040 and arizona form 140) and include your llc profits on the return. It’s used to help determine the status of a current worker for federal employment taxes and income tax. If you are requesting a. Employers engaged in a trade or business who pay compensation. Complete, edit or print tax forms instantly. Employee's withholding certificate form 941; The draft contains clarifications and additional documentary requirements.Instructions For Form Ss8 Determination Of Worker Status For

20142021 Form IRS SS8 Fill Online, Printable, Fillable, Blank pdfFiller

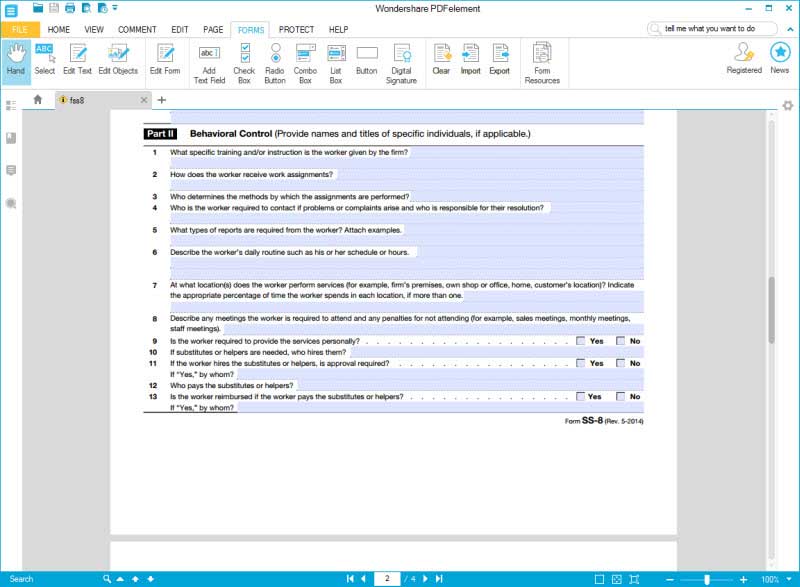

ss8 Internal Revenue Service Irs Tax Forms

form ss8 Employee or Independent Contractor?

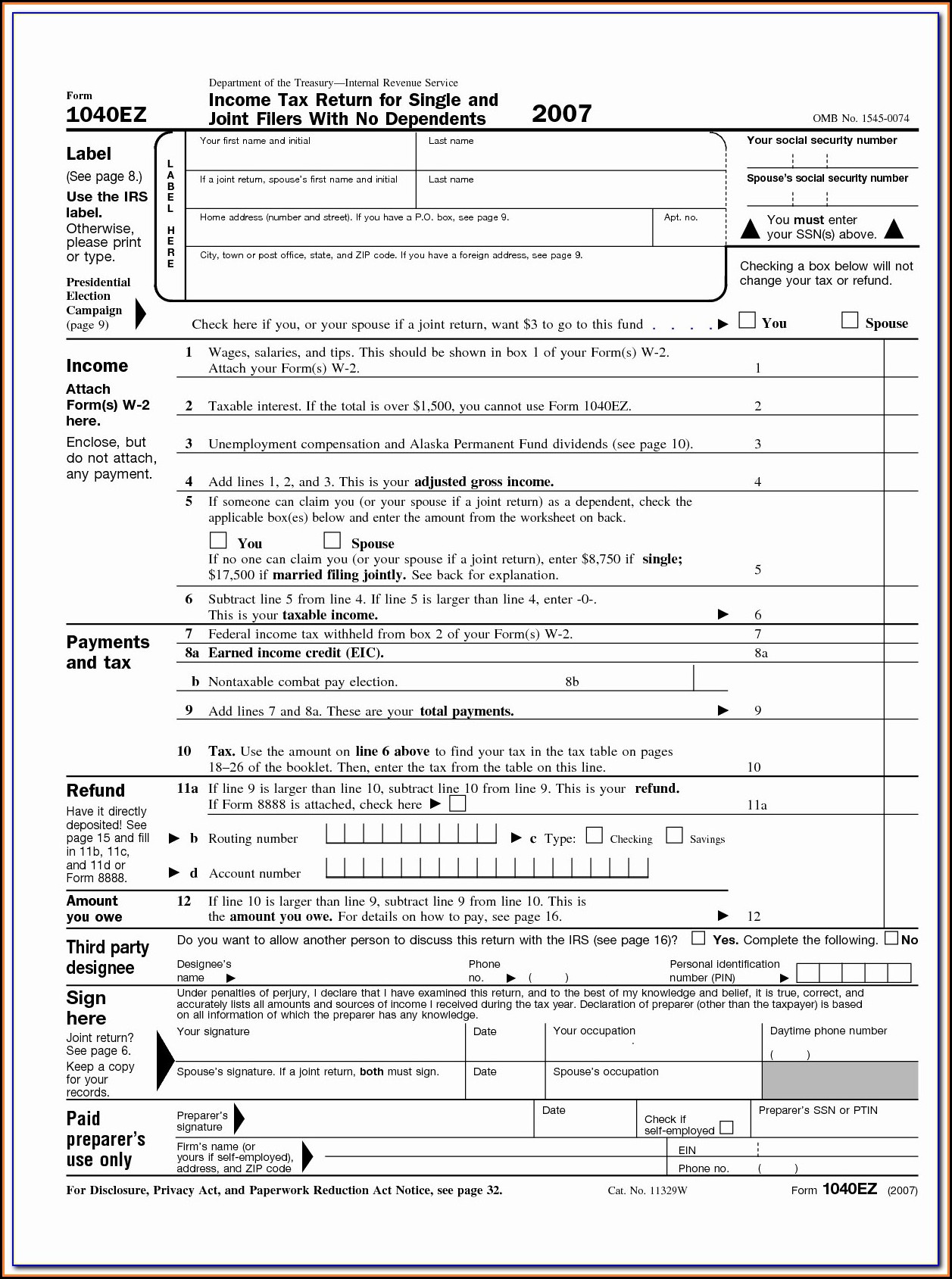

What Does A State Tax Form Look Like Fill and Sign Printable Template

Irs Printable Forms 1040ez Form Resume Examples xz204Nm2ql

Printable 2016 Tax Forms Master of Documents

IRS Form SS8 Fill Out With the Best Form Filler

IRS Form SS8 Fill Out With the Best Form Filler

Download Instructions for IRS Form SS8 Determination of Worker Status

Related Post: