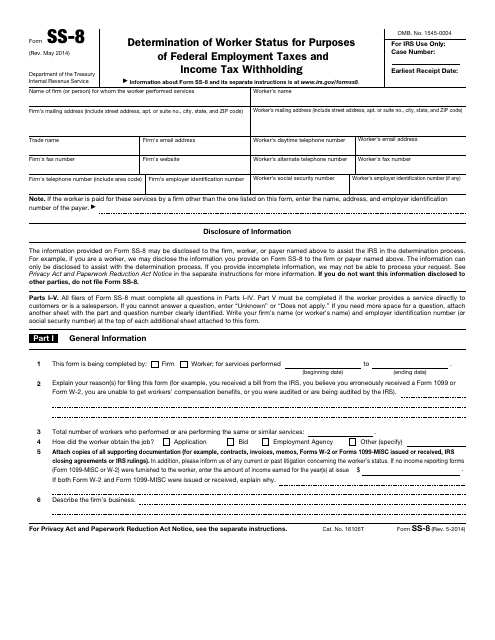

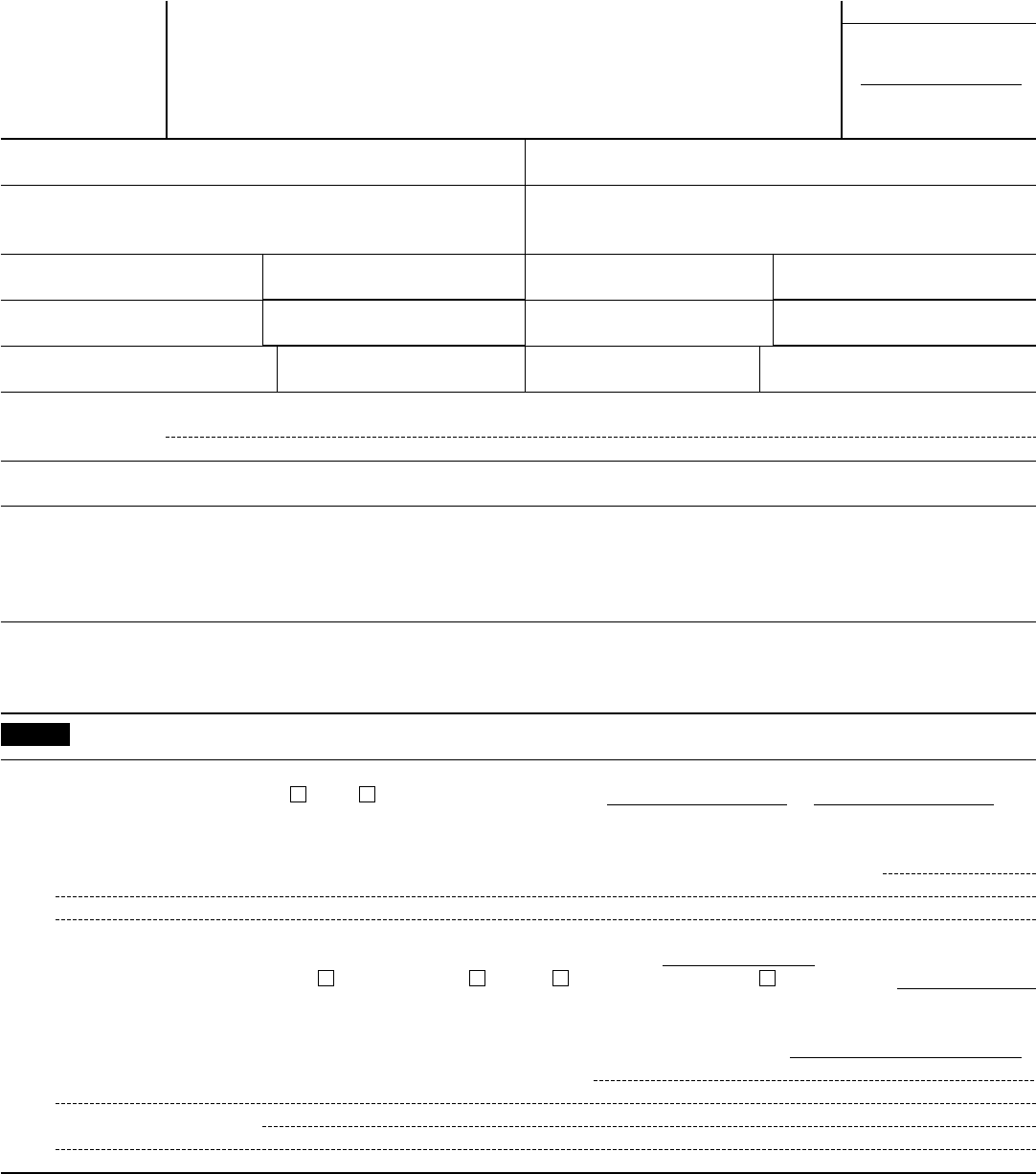

Ss-8 Tax Form

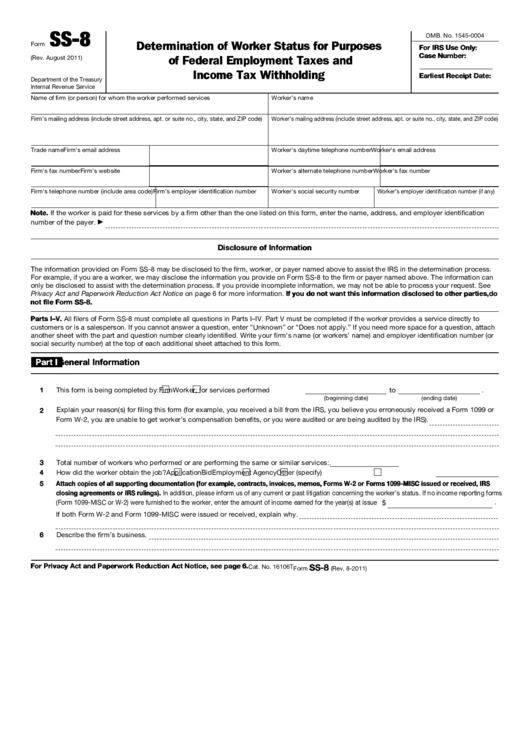

Ss-8 Tax Form - Web a draft update of the instructions for the form the internal revenue service uses to make worker status determinations was released oct. Every penny from your 401(k), ira, pension and social security counts when you’re retired. Find state level tax details. Web the social security administration said that would raise the average monthly payments by more than $50. Determination of worker status for purposes of federal employment taxes and income. Updated draft instructions for the. Get ready for tax season deadlines by completing any required tax forms today. Web 51 rows individual tax return form 1040 instructions; Need proof you get social security benefits? Web 1 best answer. May 2014) department of the treasury internal revenue service. Web 1 best answer. Determination of worker status for purposes of federal employment taxes and income. Web a draft update of the instructions for the form the internal revenue service uses to make worker status determinations was released oct. Learn more from the experts at h&r block. Get ready for tax season deadlines by completing any required tax forms today. Web the social security administration said that would raise the average monthly payments by more than $50. It’s used to help determine the status of a current worker for federal employment taxes and income tax. Here are the average new payments for 2024,. Ad get your proof. Web 1 best answer. If your business properly classifies workers as independent contractors, don’t panic if a worker. Find state level tax details. Determination of worker status for purposes of federal employment taxes and income. The draft contains clarifications and additional documentary requirements. Web about the form. Every penny from your 401(k), ira, pension and social security counts when you’re retired. Access your benefits letter online today. The draft contains clarifications and additional documentary requirements. Get ready for tax season deadlines by completing any required tax forms today. Find state level tax details. Determination of worker status for purposes of federal employment taxes and income. Updated draft instructions for the. Learn more from the experts at h&r block. If your business properly classifies workers as independent contractors, don’t panic if a worker. Need proof you get social security benefits? Ad get your proof of income letter online with a free my social security account. Learn more from the experts at h&r block. Web 51 rows individual tax return form 1040 instructions; May 2014) department of the treasury internal revenue service. Web the social security administration said that would raise the average monthly payments by more than $50. Here are the average new payments for 2024,. Web about the form. Determination of worker status for purposes of federal employment taxes and income. Web a draft update of the instructions for the form the internal revenue service uses to make worker status. Find state level tax details. Get ready for tax season deadlines by completing any required tax forms today. Web the final version of an update to the instructions for the form used to request a worker’s classification for federal tax purposes was released march 21 by the internal. Here are the average new payments for 2024,. It’s used to help. Web about the form. Learn more from the experts at h&r block. Web 51 rows individual tax return form 1040 instructions; Updated draft instructions for the. Access your benefits letter online today. It’s used to help determine the status of a current worker for federal employment taxes and income tax. Learn more from the experts at h&r block. May 2014) department of the treasury internal revenue service. Determination of worker status for purposes of federal employment taxes and income. Web a draft update of the instructions for the form the internal revenue. Web the social security administration said that would raise the average monthly payments by more than $50. Web the final version of an update to the instructions for the form used to request a worker’s classification for federal tax purposes was released march 21 by the internal. May 2014) department of the treasury internal revenue service. Updated draft instructions for the. Every penny from your 401(k), ira, pension and social security counts when you’re retired. Ad get your proof of income letter online with a free my social security account. Here are the average new payments for 2024,. Web 1 best answer. Access your benefits letter online today. It’s used to help determine the status of a current worker for federal employment taxes and income tax. Determination of worker status for purposes of federal employment taxes and income. If your business properly classifies workers as independent contractors, don’t panic if a worker. Web a draft update of the instructions for the form the internal revenue service uses to make worker status determinations was released oct. Get ready for tax season deadlines by completing any required tax forms today. Find state level tax details. Learn more from the experts at h&r block. Web about the form. Web 51 rows individual tax return form 1040 instructions; Need proof you get social security benefits? The draft contains clarifications and additional documentary requirements.IRS Form SS8 Fill out With the Best Form Filler

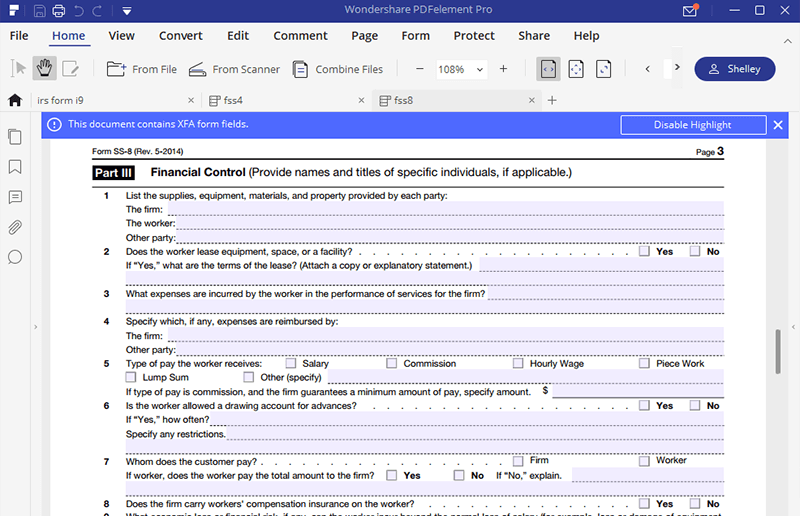

Form SS8 Determination of Worker Status of Federal Employment Taxes

ss8 Internal Revenue Service Irs Tax Forms

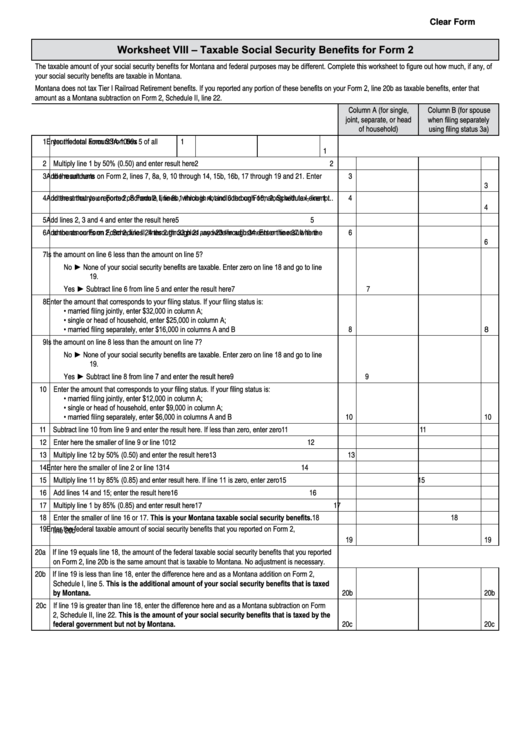

Fillable Worksheet ViiiTaxable Social Security Benefits For Form 2

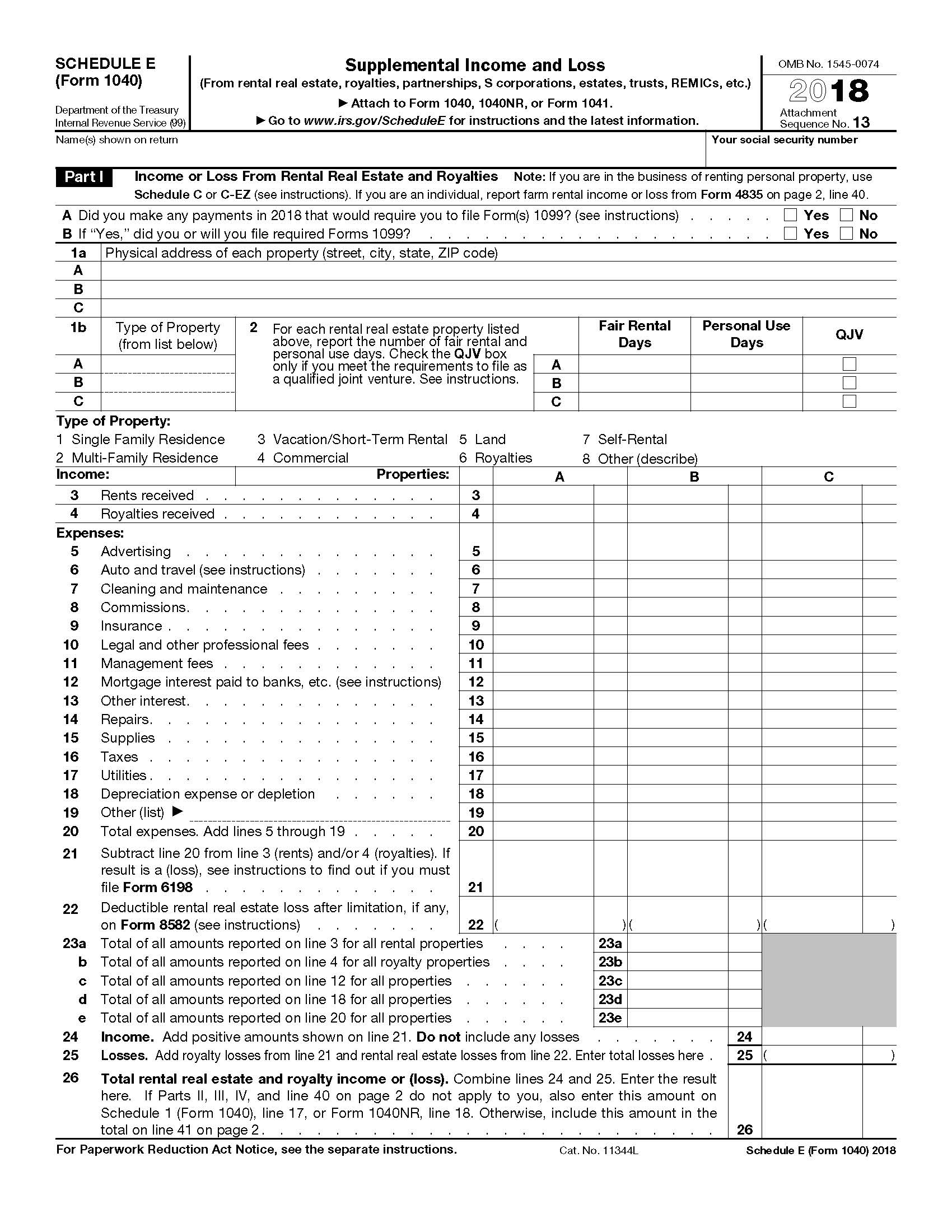

2018 IRS Tax Forms 1040 Schedule E (Supplement And Loss) U.S

Fillable Form Ss8 Determination Of Worker Status For Purposes Of

IRS Form SS8 Fill Out With the Best Form Filler

Fillable Irs Form Ss 4 Printable Forms Free Online

Form SS8 Edit, Fill, Sign Online Handypdf

form w Withholding Tax Social Security Number

Related Post: