Schedule M Form 1040

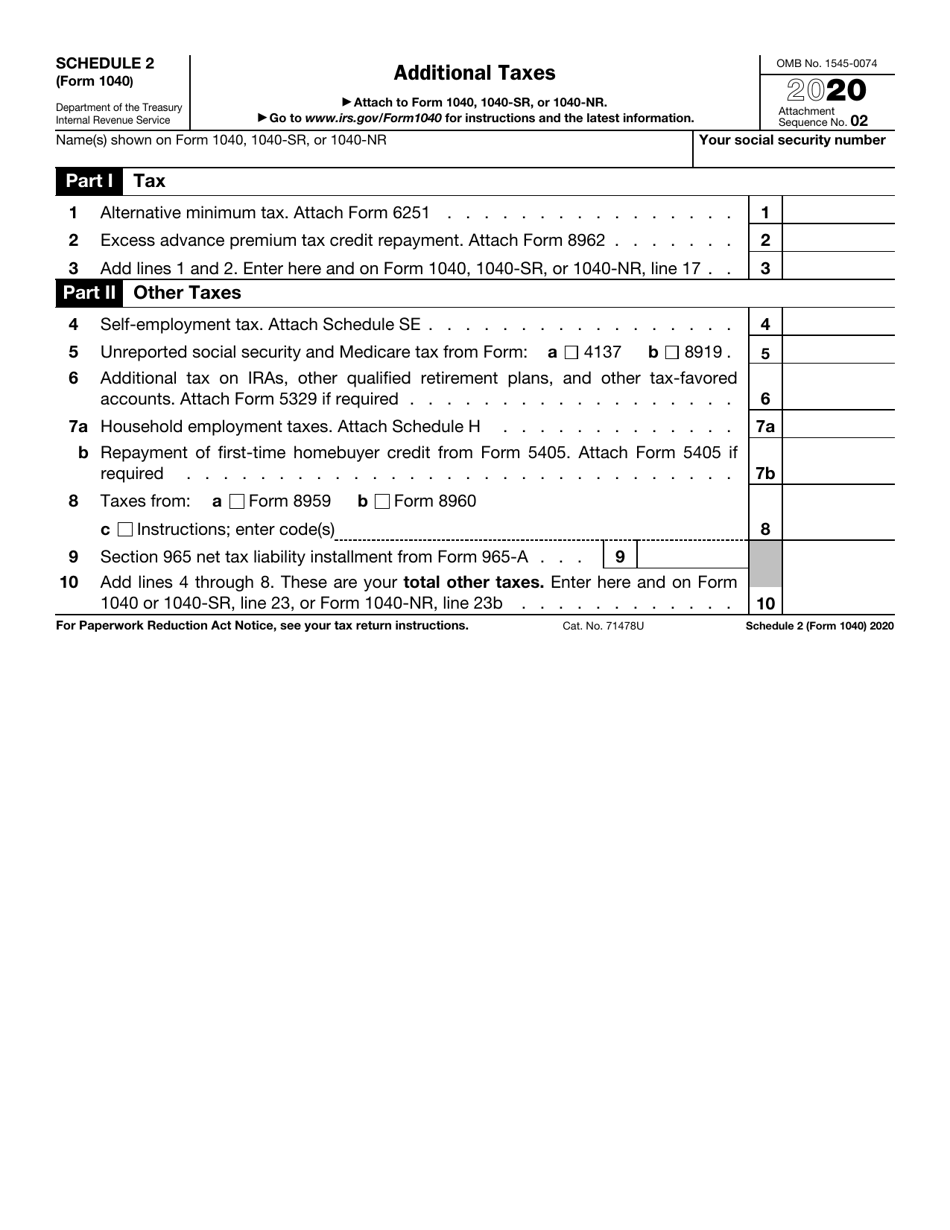

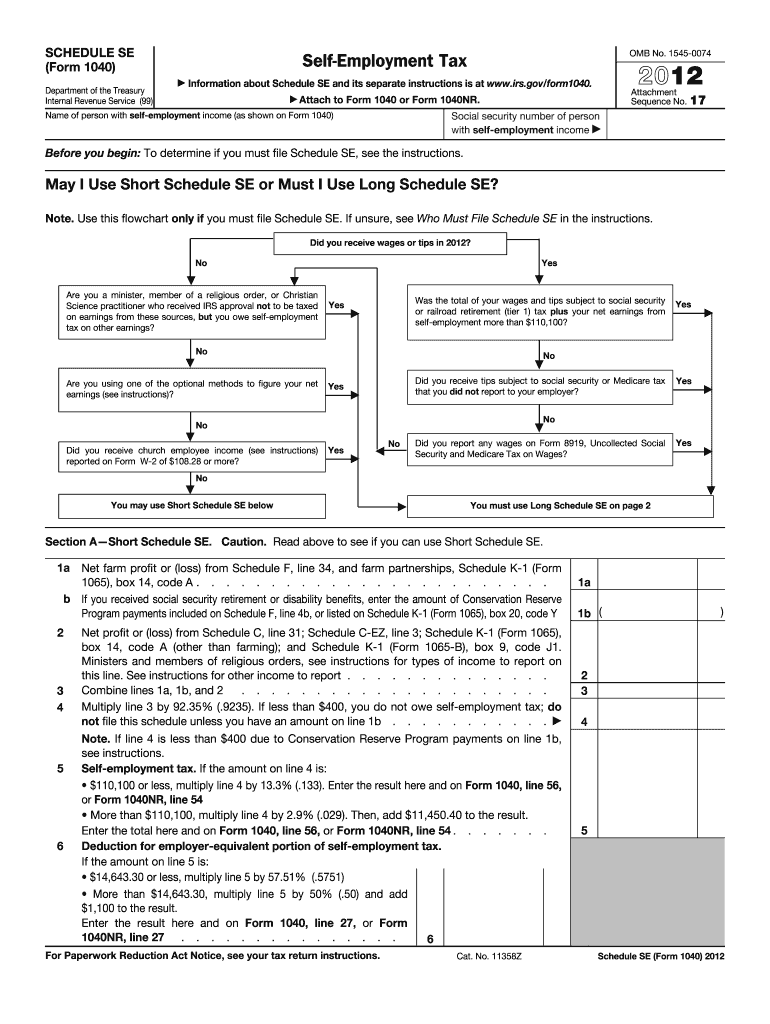

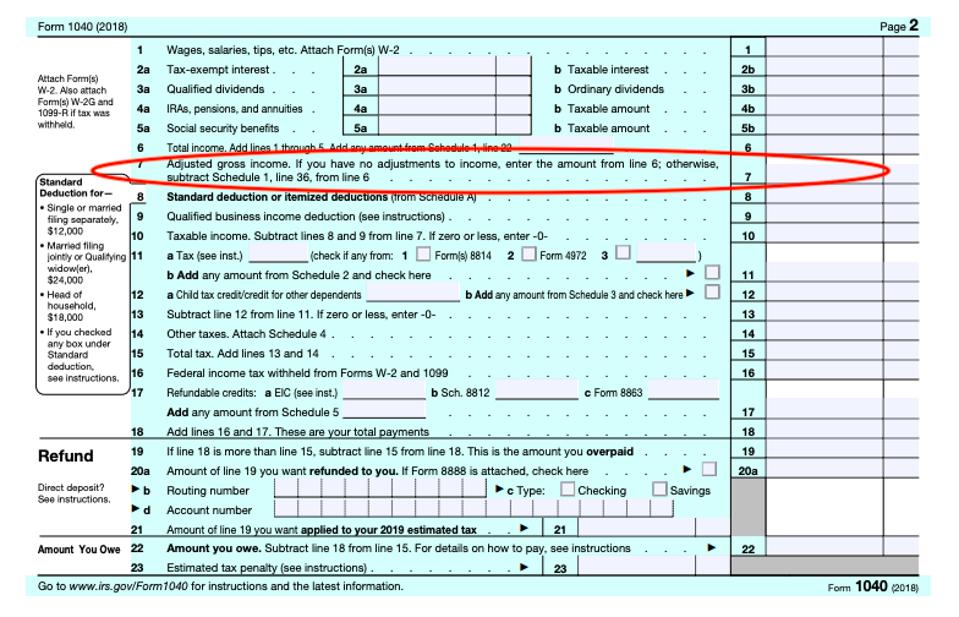

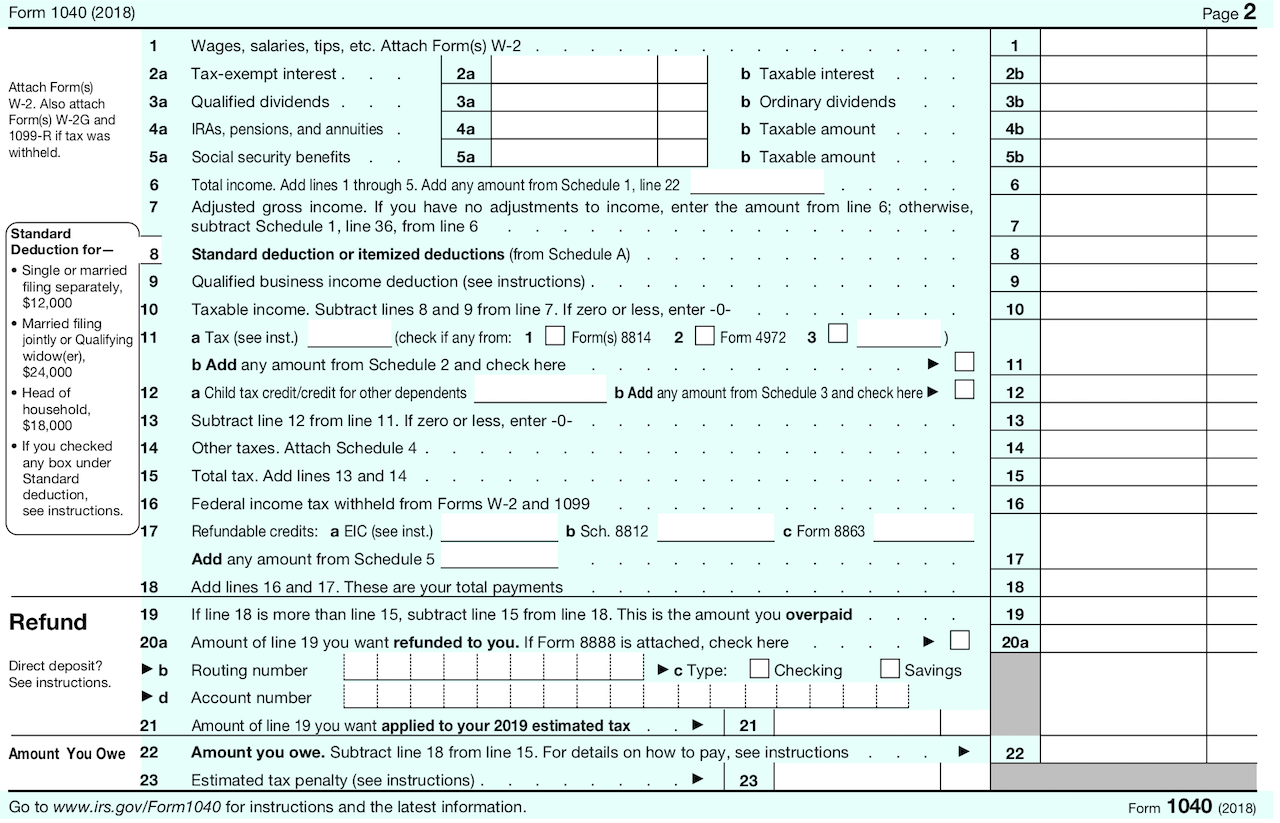

Schedule M Form 1040 - Information about form 1040, u.s. Enter your federal employer identification number. Web page last reviewed or updated: Web no, form 1040 and form 1099 are two different federal tax forms. Tax and other taxes. taxpayers who need to complete this form include: • part i of form 1040 schedule 3 is for nonrefundable credits, including the foreign tax credit, child and dependent care credit, education. Enter this amount on schedule 1, line 5 of your form. Web a simple tax return is one that's filed using irs form 1040 only, without having to attach any forms or schedules. Additions to income from line 10 of schedule m1m and line 9 of schedule m1mb (see. If you are claiming a net qualified disaster loss on form 4684, see the instructions for line 16. Web on line 29a through 29e, subtract line 28e from line 27e to get your total income or loss from schedule e. Select each schedule below to learn more. Tax and other taxes. taxpayers who need to complete this form include: Ask a tax professional anything right now. Enter this amount on schedule 1, line 5 of your form. Enter your federal employer identification number. Individual income tax return 2022 department of the treasury—internal revenue service. Web form 1040 schedule 2 includes two parts: Web the irs has released a new tax filing form for people 65 and older. Additions to income from line 10 of schedule m1m and line 9 of schedule m1mb (see. Only certain taxpayers are eligible. Individual income tax return 2022 department of the treasury—internal revenue service. Web form 1040 schedule 2 includes two parts: Select each schedule below to learn more. Attach to form 1040a or 1040. Web what are the schedules that go with form 1040? Enter your name as shown on your tax return. Ad forms, deductions, tax filing and more. Web a simple tax return is one that's filed using irs form 1040 only, without having to attach any forms or schedules. Web schedule m (form 1040a or 1040) department of the treasury internal. Individual income tax return, including recent updates, related forms and instructions. Form 1040 is a form that you fill out and send to the irs reporting your income, deductions,. Irs schedule 1 lists additional income sources such as taxable state. Web form 1040 schedule 2 includes two parts: Additions to income from line 10 of schedule m1m and line 9. Attach to form 1040a or 1040. Irs use only—do not write or staple in this. Web a simple tax return is one that's filed using irs form 1040 only, without having to attach any forms or schedules. Web schedule m (form 1040a or 1040) department of the treasury internal revenue service (99) making work pay credit. Enter your federal employer. Web on line 29a through 29e, subtract line 28e from line 27e to get your total income or loss from schedule e. Additions to income from line 10 of schedule m1m and line 9 of schedule m1mb (see. • part i of form 1040 schedule 3 is for nonrefundable credits, including the foreign tax credit, child and dependent care credit,. It has bigger print, less shading, and features. Questions answered every 9 seconds. Web on line 29a through 29e, subtract line 28e from line 27e to get your total income or loss from schedule e. Form 1040 is a form that you fill out and send to the irs reporting your income, deductions,. Ask a tax professional anything right now. It has bigger print, less shading, and features. • part i of form 1040 schedule 3 is for nonrefundable credits, including the foreign tax credit, child and dependent care credit, education. Only certain taxpayers are eligible. Enter your name as shown on your tax return. Form 1040 is a form that you fill out and send to the irs reporting. Individual income tax return 2022 department of the treasury—internal revenue service. Web form 1040 schedule 2 includes two parts: Web schedule m (form 1040a or 1040) department of the treasury internal revenue service (99) making work pay credit. Enter your name as shown on your tax return. A tax advisor will answer you now! Enter this amount on schedule 1, line 5 of your form. Web form 1040 schedule 2 includes two parts: Enter your name as shown on your tax return. Web what are the schedules that go with form 1040? Irs use only—do not write or staple in this. Form 1040 is a form that you fill out and send to the irs reporting your income, deductions,. Web on line 29a through 29e, subtract line 28e from line 27e to get your total income or loss from schedule e. If you are claiming a net qualified disaster loss on form 4684, see the instructions for line 16. Ad discover helpful information and resources on taxes from aarp. A tax advisor will answer you now! It has bigger print, less shading, and features. Ask a tax professional anything right now. Ad forms, deductions, tax filing and more. Use the tax calculator to estimate your tax refund or the amount you may owe the irs. Irs schedule 1 lists additional income sources such as taxable state. Information about form 1040, u.s. 52903q schedule m (form 1040a or 1040) 2010 (a) you have a net loss from a business, (b) you received a taxable scholarship or fellowship grant not reported on a. Web no, form 1040 and form 1099 are two different federal tax forms. Questions answered every 9 seconds. Web the irs has released a new tax filing form for people 65 and older.Do you need to submit a schedule 1, 2, and 3 along with your 1040 Tax

Irs Fillable Form 1040 IRS Form 1040NREZ Download Fillable PDF or

Irs Fillable Form 1040 The best way to do so is to stay aware of

Taxes From A To Z 2019 M Is For Medical Expenses

IRS Releases Draft Form 1040 Here’s What’s New For 2020

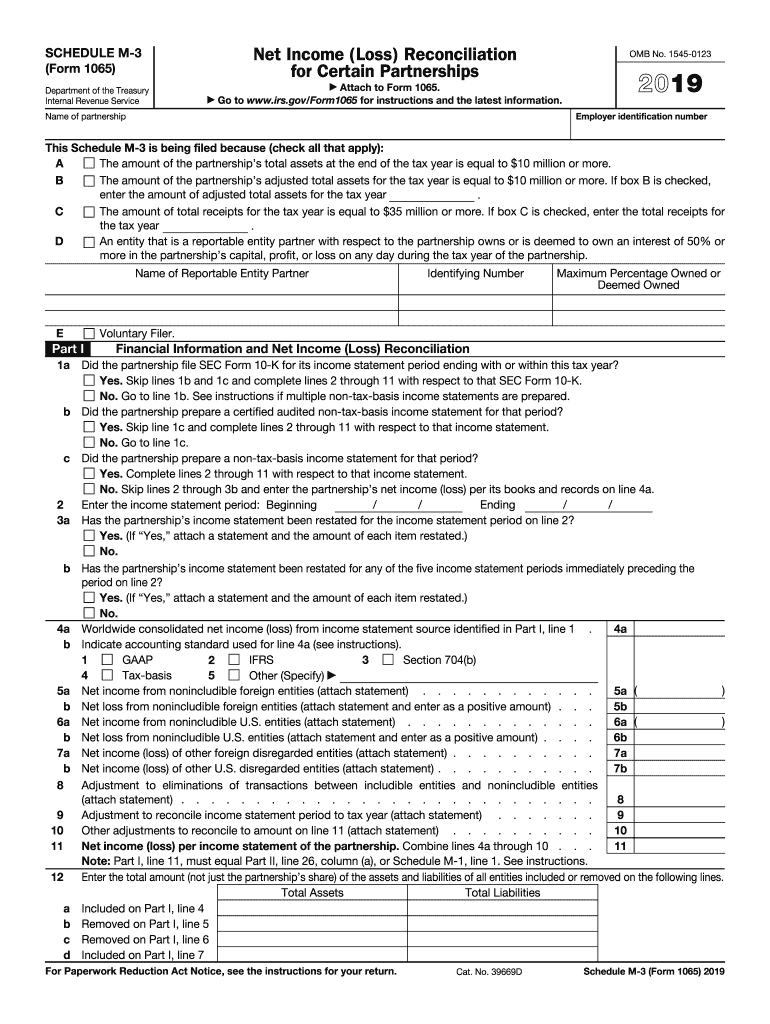

1065 3 Form Fill Out and Sign Printable PDF Template signNow

Irs Form 1040 Plus Schedules C And Se Schedule C Self Employment

Sba Form 1010c Printable & Fillable Sample in PDF

1040 Form 2020 📝 Get IRS 1040 Printable Form, Instructions, Fillable

IL DoR IL1040 Schedule M 20202022 Fill and Sign Printable Template

Related Post: