Schedule K-1 Form 1065 Codes

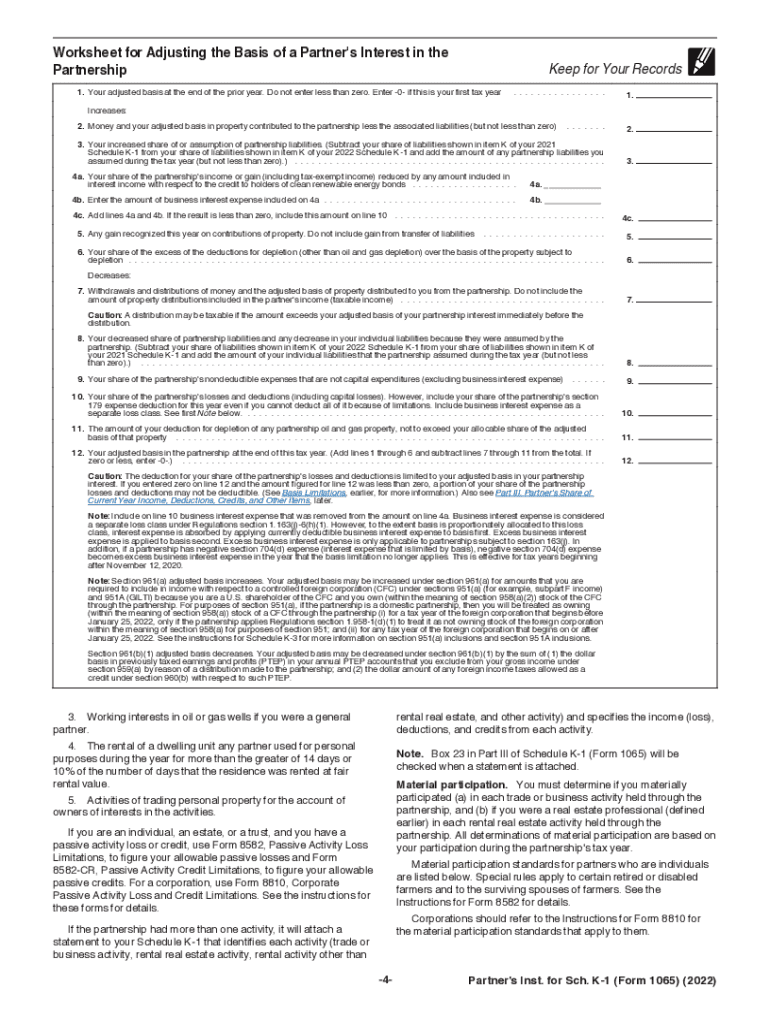

Schedule K-1 Form 1065 Codes - Ad get ready for tax season deadlines by completing any required tax forms today. Web after completing schedule b, you can move on to schedule k. For calendar year 2022, or tax year beginning / / 2022. Ending / / partner’s share of. Department of the treasury internal revenue service. If you were a more. As mike9241 posted you have until 4/15/26 to amend your 2022. Department of the treasury internal revenue service. Taxact® business 1065 (2022 online edition) is the easiest way to file a 1065! Web recovery startup business, before january 1, 2022). If there is a positive amount reported to you in this box, please report the amount as it is reported to you. Complete, edit or print tax forms instantly. Determine whether the income (loss) is passive or nonpassive and enter on. Solved•by intuit•141•updated may 18, 2023. Page numbers refer to this instruction. Per irs instructions for form 1116 foreign tax credit (individual, estate, or trust), starting on page 5: Web recovery startup business, before january 1, 2022). Web after completing schedule b, you can move on to schedule k. Department of the treasury internal revenue service. If you were a more. The difference is that form 1065 is a. Ad file partnership and llc form 1065 fed and state taxes with taxact® business. Ending / / partner’s share of. Department of the treasury internal revenue service. For calendar year 2021, or tax year beginning / / 2021. Department of the treasury internal revenue service. As mike9241 posted you have until 4/15/26 to amend your 2022. If there is a positive amount reported to you in this box, please report the amount as it is reported to you. Page numbers refer to this instruction. For calendar year 2021, or tax year beginning / / 2021. As mike9241 posted you have until 4/15/26 to amend your 2022. Web recovery startup business, before january 1, 2022). Per irs instructions for form 1116 foreign tax credit (individual, estate, or trust), starting on page 5: For calendar year 2021, or tax year beginning / / 2021. Determine whether the income (loss) is passive or nonpassive and enter on. The difference is that form 1065 is a. Per the worksheet instructions for form 1040, schedule 1, line 16: Web while schedule k is found on page 4 of form 1065 and is essentially a summary schedule of all the partners’ shares of the partnership’s income, credits, deductions, and more. Ad get ready for tax season deadlines by completing any. As mike9241 posted you have until 4/15/26 to amend your 2022. Department of the treasury internal revenue service. Ad file partnership and llc form 1065 fed and state taxes with taxact® business. Ad get ready for tax season deadlines by completing any required tax forms today. Per irs instructions for form 1116 foreign tax credit (individual, estate, or trust), starting. Web to enter box 13, codes a, b, c, d, e, f, g, i, k, l, m, o, or q. Taxact® business 1065 (2022 online edition) is the easiest way to file a 1065! Per the worksheet instructions for form 1040, schedule 1, line 16: Complete, edit or print tax forms instantly. The difference is that form 1065 is a. Department of the treasury internal revenue service. For calendar year 2019, or tax year beginning. Ending / / partner’s share of. Ad file partnership and llc form 1065 fed and state taxes with taxact® business. As mike9241 posted you have until 4/15/26 to amend your 2022. Ending / / partner’s share of. Web while schedule k is found on page 4 of form 1065 and is essentially a summary schedule of all the partners’ shares of the partnership’s income, credits, deductions, and more. If you were a more. Ending / / partner’s share of. Page numbers refer to this instruction. The difference is that form 1065 is a. Department of the treasury internal revenue service. Ad get ready for tax season deadlines by completing any required tax forms today. Web while schedule k is found on page 4 of form 1065 and is essentially a summary schedule of all the partners’ shares of the partnership’s income, credits, deductions, and more. Taxact® business 1065 (2022 online edition) is the easiest way to file a 1065! 4 digit code used to identify the software developer whose application produced the bar code. Ending / / partner’s share of. Determine whether the income (loss) is passive or nonpassive and enter on. Complete, edit or print tax forms instantly. Web recovery startup business, before january 1, 2022). Page numbers refer to this instruction. Ad file partnership and llc form 1065 fed and state taxes with taxact® business. If you were a more. Web after completing schedule b, you can move on to schedule k. For calendar year 2021, or tax year beginning / / 2021. Per irs instructions for form 1116 foreign tax credit (individual, estate, or trust), starting on page 5: Department of the treasury internal revenue service. Ending / / partner’s share of. Department of the treasury internal revenue service. Per the worksheet instructions for form 1040, schedule 1, line 16:IRS releases drafts of the new Form 1065, Schedule K1 Accounting Today

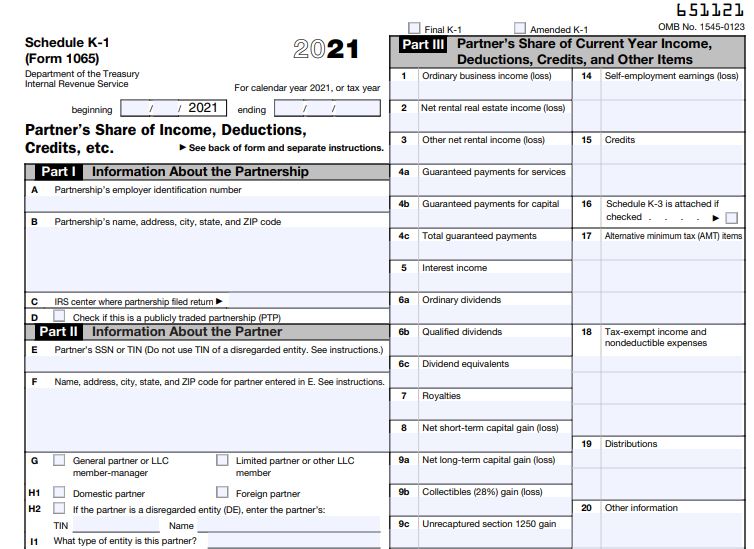

IRS Form 1065 Schedule K1 (2021) Partner’s Share of

Box 14 Code A Of Irs Schedule K1 (form 1065) Fafsa Armando Friend's

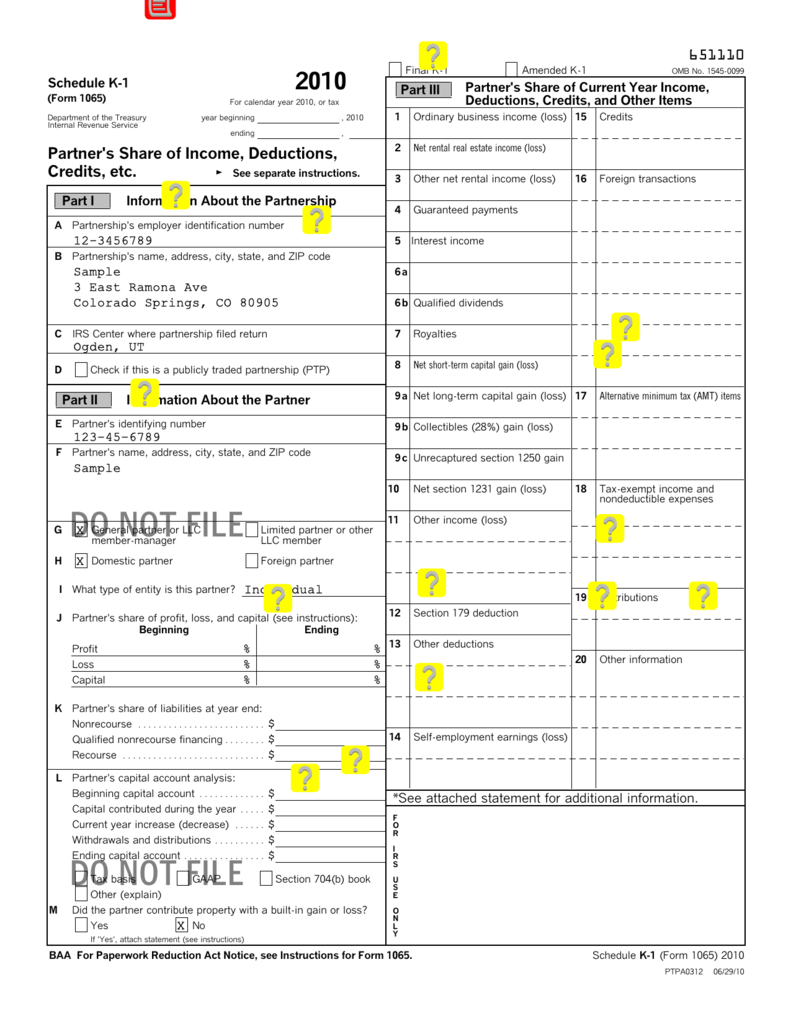

Schedule K1, Form 1065, for Investors in the 2020 Tax Year

Form 1065 (Schedule K1) Partner's Share of Deductions and

Box 14 [Code A] of IRS Schedule K1 (Form 1065) outlined

2How to complete 2021 IRS Form 1065 and Schedule K1 For your LLC

Schedule K1 Form 1065 Box 16 Codes Armando Friend's Template

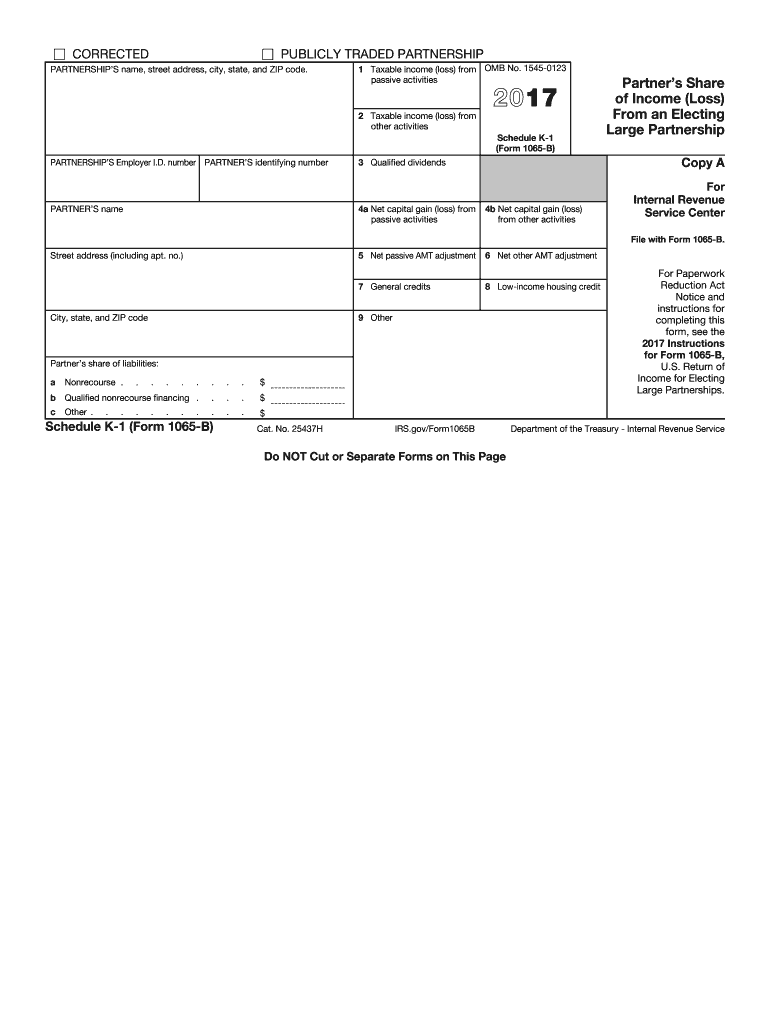

IRS Schedule K1 (1065B) 2017 Fill out Tax Template Online US

2017 Form 1065 Instructions Fill Out and Sign Printable PDF Template

Related Post: