Schedule J Form 1120

Schedule J Form 1120 - Tax computation and payment.19 schedule k. Web see instructions total tax (schedule j, part i, line 11) 2020 net 965 tax liability paid (schedule j, part ii, line 12) total payments, credits, and section 965 net. Dividends, inclusions, and special deductions.17 schedule j. Free, easy returns on millions of items. Taxact® business 1120 (2022 online edition) is the easiest way to file a 1120! Ad browse & discover thousands of brands. Lines 1 and 2, form 1120. Web for more information: Web form 1120 must be filed by the 15th day of the third month after the end of your corporation's tax year. Web fincen form 114 is not a tax form, do not file it with your return. December 2020) department of the treasury internal revenue service. Dividends, inclusions, and special deductions.17 schedule j. Members of a controlled group (form 1120 only). B did any individual or estate own directly 20% or more, or own, directly or indirectly, 50% or more. Web for more information: December 2020) department of the treasury internal revenue service. Members of a controlled group (form 1120 only). Here’s where you calculate your c corporation’s tax liability. Web schedule j (form 5471) (rev. Accumulated earnings & profits (e&p) of controlled foreign. Taxact® business 1120 (2022 online edition) is the easiest way to file a 1120! Ad easy, fast, secure & free to try! B did any individual or estate own directly 20% or more, or own, directly or indirectly, 50% or more. Web if “yes,” complete part i of schedule g (form 1120) (attach schedule g). Dividends, inclusions, and special deductions.17. Web if “yes,” complete part i of schedule g (form 1120) (attach schedule g). Ad easy guidance & tools for c corporation tax returns. Web see instructions total tax (schedule j, part i, line 11) 2020 net 965 tax liability paid (schedule j, part ii, line 12) total payments, credits, and section 965 net. Tax computation and payment.19 schedule k.. Dividends, inclusions, and special deductions.17 schedule j. Schedule j is where you’ll calculate the corporation’s tax liability. Check the “yes” box if the corporation is a specified domestic entity that is required to file form. Ad browse & discover thousands of brands. Accumulated earnings & profits (e&p) of controlled foreign. Do your past year business tax for tax year 2021 to 2000 easy, fast, secure & free to try! B did any individual or estate own directly 20% or more, or own, directly or indirectly, 50% or more. Tax computation and payment.19 schedule k. You enter your tax credits on schedule j. Free, easy returns on millions of items. Tax computation and payment.19 schedule k. Web fincen form 114 is not a tax form, do not file it with your return. Accumulated earnings & profits (e&p) of controlled foreign. You’ll start by multiplying the taxable income calculated on page 1 by the. Web use schedule j (form 1040) to elect to figure your 2022 income tax by averaging, over. Free, easy returns on millions of items. A member of a controlled group, as. Accumulated earnings & profits (e&p) of controlled foreign. Web form 1120 must be filed by the 15th day of the third month after the end of your corporation's tax year. Lines 1 and 2, form 1120. Web fincen form 114 is not a tax form, do not file it with your return. Web use schedule j (form 1040) to elect to figure your 2022 income tax by averaging, over the previous 3 years (base years), all or part of your 2022 taxable income from your trade or. Lines 1 and 2, form 1120. December 2020) department. Members of a controlled group (form 1120 only). Web if “yes,” complete part i of schedule g (form 1120) (attach schedule g). Dividends, inclusions, and special deductions.17 schedule j. Free shipping on qualified orders. Web fincen form 114 is not a tax form, do not file it with your return. You would file by march 31 of the following year if your. You enter your tax credits on schedule j. Tax computation and payment.19 schedule k. A member of a controlled group, as. Schedule j is where you’ll calculate the corporation’s tax liability. Web use schedule j (form 1040) to elect to figure your 2022 income tax by averaging, over the previous 3 years (base years), all or part of your 2022 taxable income from your trade or. Web fincen form 114 is not a tax form, do not file it with your return. B did any individual or estate own directly 20% or more, or own, directly or indirectly, 50% or more. Ad easy guidance & tools for c corporation tax returns. Web for more information: Web if “yes,” complete part i of schedule g (form 1120) (attach schedule g). December 2020) department of the treasury internal revenue service. Dividends, inclusions, and special deductions.17 schedule j. Web schedule j (form 5471) (rev. Members of a controlled group (form 1120 only). You’ll start by multiplying the taxable income calculated on page 1 by the. Ad browse & discover thousands of brands. Dividends, inclusions, and special deductions.17 schedule j. Check the “yes” box if the corporation is a specified domestic entity that is required to file form. Lines 1 and 2, form 1120.IRS Form 1120 Complete this Form with PDFelement

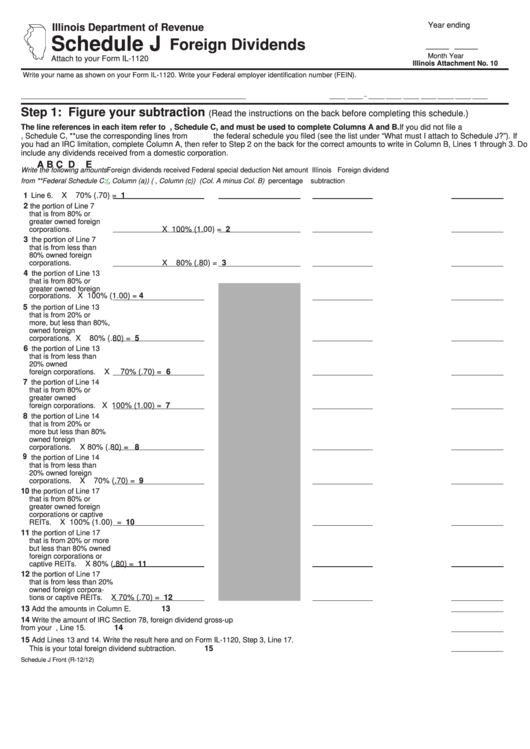

Schedule J Attach To Your Form Il1120 Foreign Dividends printable

Form 1120F U.S. Tax Return of a Foreign Corporation (2014

Schedule J 'Tax computation and Payment' on Form 1120 for tax years

1120s Other Deductions Worksheet Promotiontablecovers

Form 1120 Schedule J Instructions

3.11.16 Corporate Tax Returns Internal Revenue Service

K1 Basis Worksheet

IRS Form 1120S Schedule K1 Download Fillable PDF or Fill Online

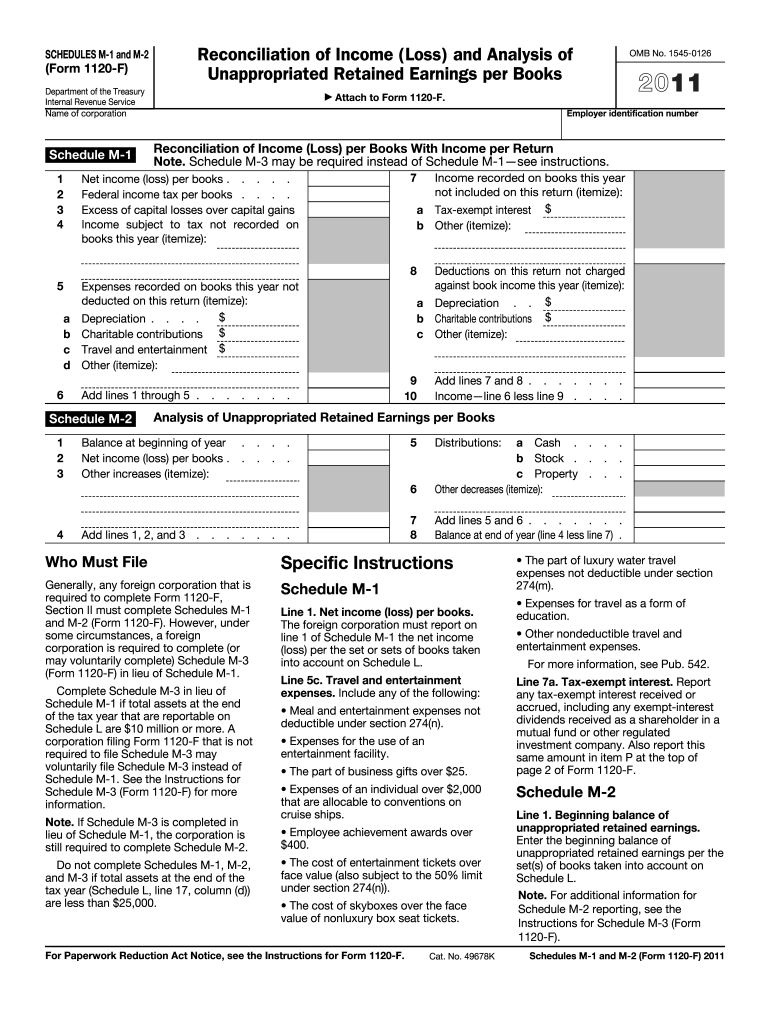

Form 1120 M 2 Fill Out and Sign Printable PDF Template signNow

Related Post: