Schedule H Form 5471

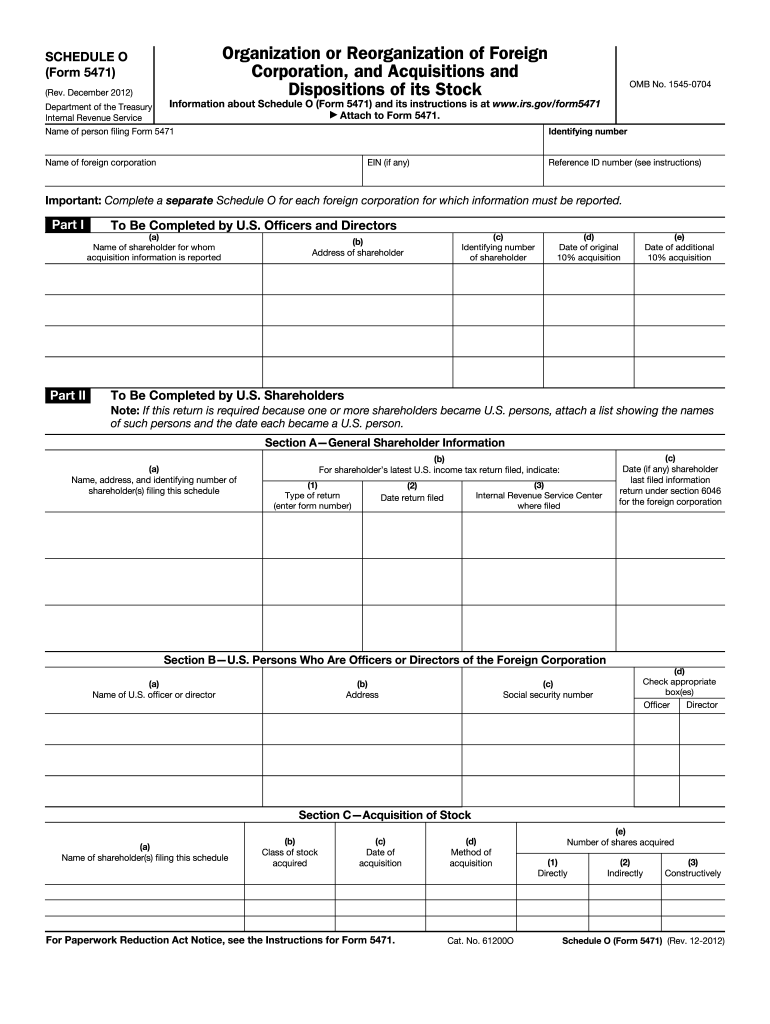

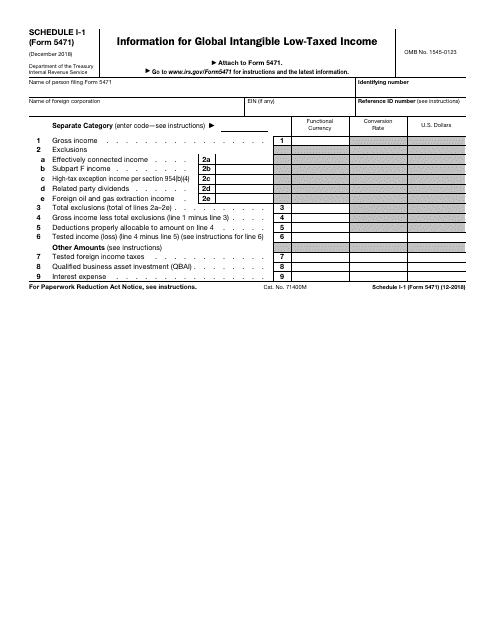

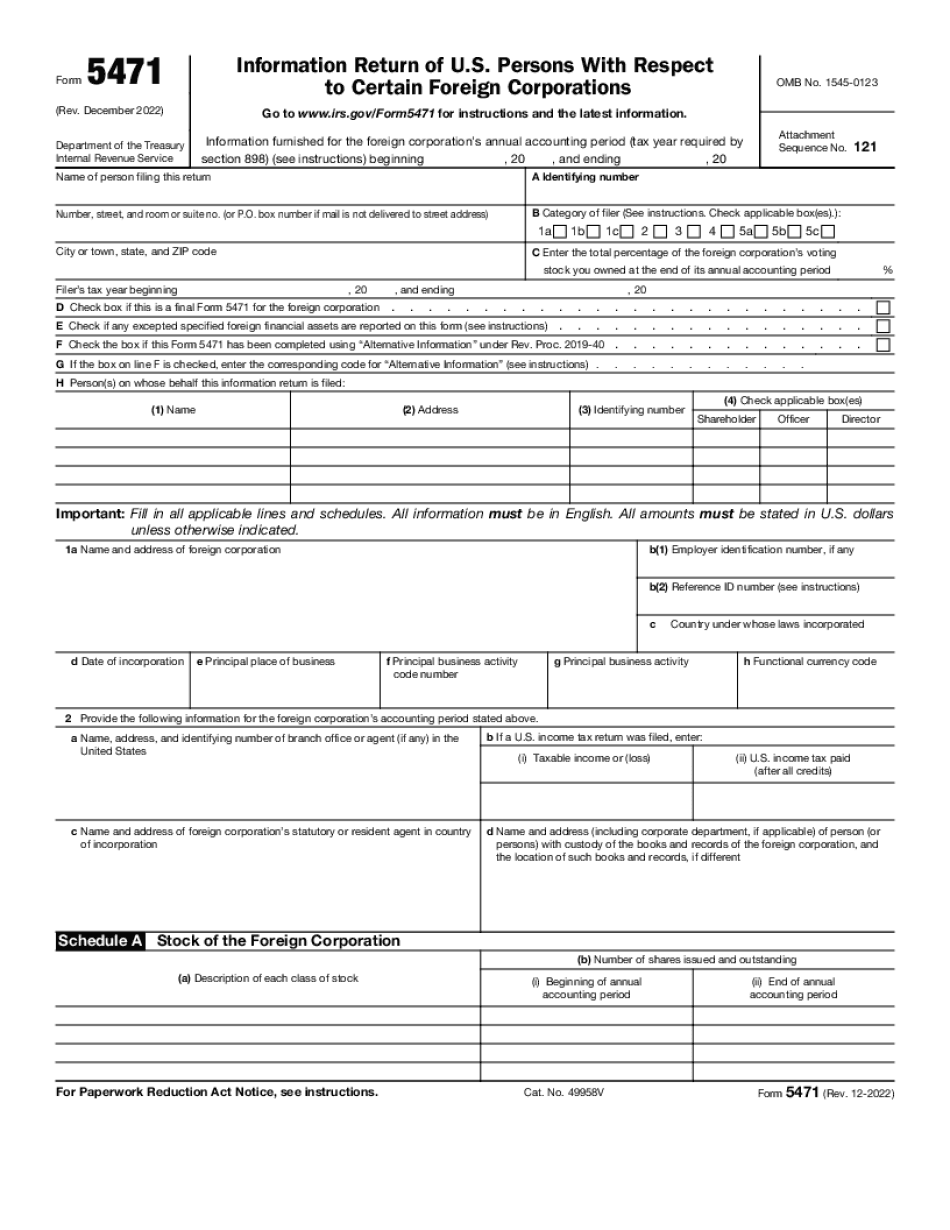

Schedule H Form 5471 - (4) check applicable box(es) (1) name (2) address (3) identifying number shareholder officer director d person(s). Form 5471 schedule h ; Schedule h (form 5471) (rev. December 2022) department of the treasury internal revenue service. Persons with respect to certain foreign. December 2021) current earnings and profits department of the treasury internal revenue service attach to form 5471. This article will assist you with generating. Solved•by intuit•31•updated april 07, 2023. Web schedule h (form 5471) (rev. On schedule q, should column (xi) net income tie to schedule h line 5 current earnings and profits? Web form 5471 schedule j; Web schedule h is used to report a foreign corporation’s current earnings and profits (“e&p”) for us tax purposes to the internal revenue service (“irs”). On schedule q, should column (xi) net income tie to schedule h line 5 current earnings and profits? Web an overview of schedule h of form 5471 schedule h is. Line 2g has been modified to update the references to schedule e, due to changes made to that schedule. Web schedule h is used to report a foreign corporation’s current earnings and profits (“e&p”) for us tax purposes to the internal revenue service (“irs”). Web changes to separate schedule h (form 5471). Web the golding & golding form 5471 instructions. December 2021) current earnings and profits department of the treasury internal revenue service attach to form 5471. December 2022) department of the treasury internal revenue service. This article will assist you with generating. Distributions from a foreign corporation keywords:. Form 5471 schedule h ; Schedule h (form 5471) (rev. Schedule r (form 5471) (december 2020) author: (4) check applicable box(es) (1) name (2) address (3) identifying number shareholder officer director d person(s). December 2022) department of the treasury internal revenue service. Complete a separate form 5471 and all applicable schedules for each applicable. Complete a separate form 5471 and all applicable schedules for each applicable. Web changes to separate schedule h (form 5471). There have been revisions to the form in both 2017 and. Web who must complete schedule h. Recently, the internal revenue service (“irs”) issued a. December 2021) current earnings and profits department of the treasury internal revenue service attach to form 5471. Web schedule h is used to report a foreign corporation’s current earnings and profits (“e&p”) for us tax purposes to the internal revenue service (“irs”). Web who must complete schedule h. Web schedule h (form 5471) (rev. (4) check applicable box(es) (1) name. Persons with respect to certain foreign. Complete a separate form 5471 and all applicable schedules for each applicable. Web an overview of schedule h of form 5471 schedule h is used to report a cfc’s current e&p. Web changes to separate schedule h (form 5471). (4) check applicable box(es) (1) name (2) address (3) identifying number shareholder officer director d. Web generating form 5471, information return of u.s. Schedule h (form 5471) (december 2018) author: On schedule q, should column (xi) net income tie to schedule h line 5 current earnings and profits? December 2022) department of the treasury internal revenue service. Schedule h is no longer completed separately for each applicable category of income. Form 5471 schedule h ; Schedule q & schedule r. Web schedule h is used to report a foreign corporation’s current earnings and profits (“e&p”) for us tax purposes to the internal revenue service (“irs”). There have been revisions to the form in both 2017 and. Web schedule h (form 5471), current earnings and profits. (4) check applicable box(es) (1) name (2) address (3) identifying number shareholder officer director d person(s). Ad signnow.com has been visited by 100k+ users in the past month Web changes to separate schedule h (form 5471). Recently, the internal revenue service (“irs”) issued a. Schedule h is now completed once,. Category 4 and category 5 filers complete schedule h. Web who must complete schedule h. Recently, the internal revenue service (“irs”) issued a. Schedule h (form 5471) (december 2018) author: Schedule r (form 5471) (december 2020) author: Ad signnow.com has been visited by 100k+ users in the past month Form 5471 schedule h ; On schedule q, should column (xi) net income tie to schedule h line 5 current earnings and profits? Schedule h is now completed once,. Web the irs makes significant changes to schedule h of form 5471 | sf tax counsel. Line 2g has been modified to update the references to schedule e, due to changes made to that schedule. Solved•by intuit•31•updated april 07, 2023. Web the golding & golding form 5471 instructions are designed to simplify your understanding of the reporting requirements. December 2022) department of the treasury internal revenue service. There have been revisions to the form in both 2017 and. Web generating form 5471, information return of u.s. Web schedule h (form 5471) (rev. Schedule q & schedule r. Schedule h is no longer completed separately for each applicable category of income. This article will assist you with generating.2012 form 5471 instructions Fill out & sign online DocHub

Substantial Compliance Form 5471 HTJ Tax

The Tax Times New Form 5471, Sch Q You Really Need to Understand

Form 5471 Schedule Form Fill Out and Sign Printable PDF Template

5471 Worksheet A

5471 Worksheet A

IRS Issues Updated New Form 5471 What's New?

Form 5471 Filing Requirements with Your Expat Taxes

Form 5471 Instructions 20222023 Fill online, Printable, Fillable Blank

IRS Form 5471 Schedule E and Schedule H SF Tax Counsel

Related Post: