Schedule G Tax Form

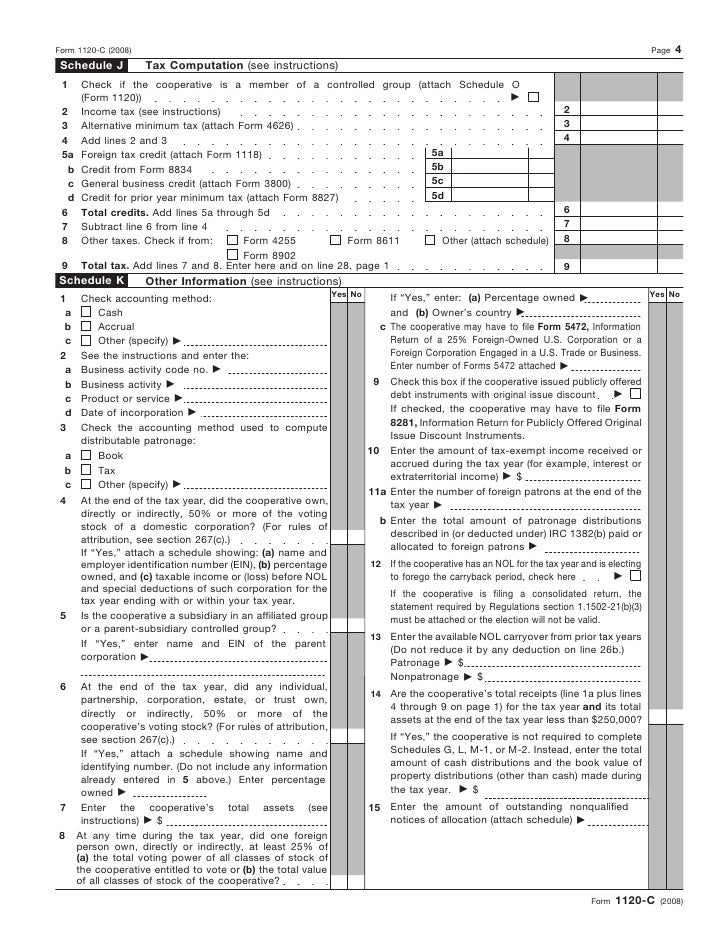

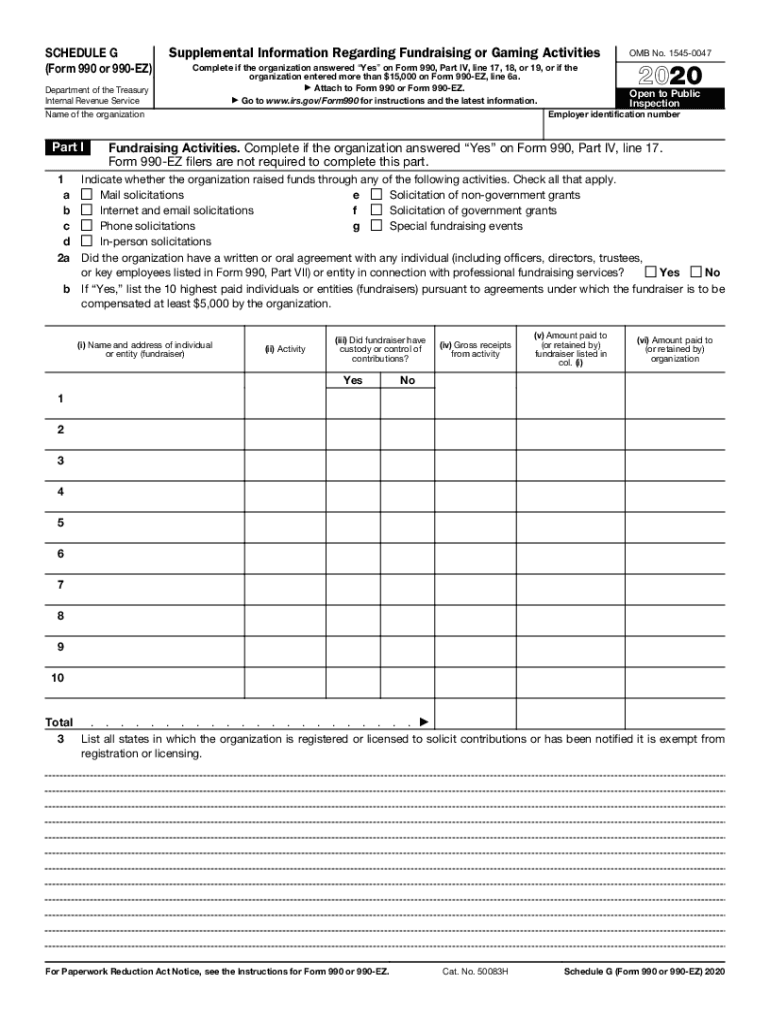

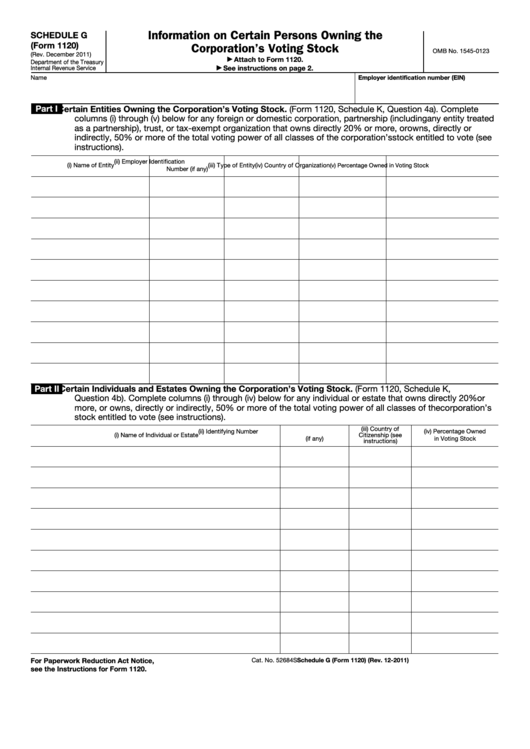

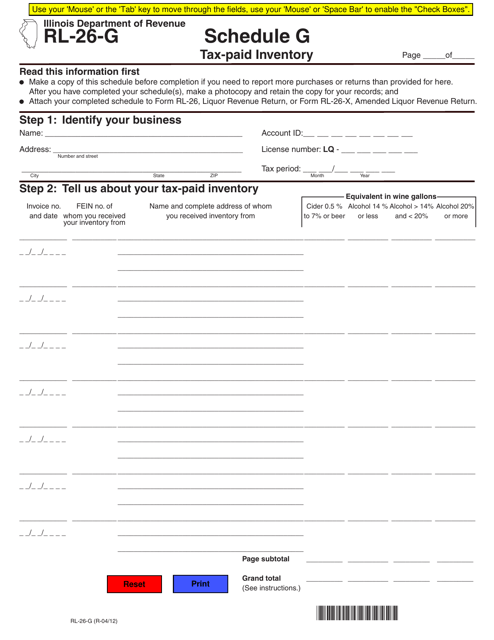

Schedule G Tax Form - Currently, we have 2 owners of the corp with voting shares. Web prepare for your appointment. Complete if the organization answered “yes” on form 990, part iv, line 18, or reported more than. Call to schedule your appointment ahead of time. Schedule g (form 5500) 2021 v. Web for paperwork reduction act notice, see the instructions for form 5500. Federal tax return was itemized. Web use schedule g (form 1120) to provide information applicable to certain entities, individuals, and estates that own, directly, 20% or more, or own, directly or. Arizona income tax payments for the. Schedule j (form 1041)—accumulation distribution for certain complex trusts. Schedule g (form 5500) 2021 page. Web schedule g (form 990) 2023 page 2 part ii fundraising events. Web prepare for your appointment. Arizona income tax payments for the. Web popular forms & instructions; Complete if the organization answered “yes” on form 990, part iv, line 18, or reported more than. This schedule is used by. Currently, we have 2 owners of the corp with voting shares. Web 1 best answer. Ad ramseysolutions.com has been visited by 100k+ users in the past month Web popular forms & instructions; Web 1 best answer. Bring these items with you: Web use schedule g (form 1120) to provide information applicable to certain entities, individuals, and estates that own, directly, 20% or more, or own, directly or. Schedule g (form 5500) 2021 page. Organizations that report more than $15,000 of expenses for. Get ready for tax season deadlines by completing any required tax forms today. Web schedule g (form 990) 2022 supplemental information regarding fundraising or gaming activities department of the treasury internal revenue service complete if the. Complete, edit or print tax forms instantly. Complete if the organization answered “yes” on form. California does not impose tax on distributions from qualified retirement plans received by nonresidents after. For example, if an employer has employees that are paid. Arizona income tax payments for the. Complete, edit or print tax forms instantly. Ad ramseysolutions.com has been visited by 100k+ users in the past month Schedule j (form 1041)—accumulation distribution for certain complex trusts. Web schedule g (form 990) 2023 page 2 part ii fundraising events. Ad ramseysolutions.com has been visited by 100k+ users in the past month Schedule g (form 5500) 2021 page. Web schedule g—tax computation and payments. Schedule j (form 1041)—accumulation distribution for certain complex trusts. Complete if the organization answered “yes” on form 990, part iv, line 18, or reported more than. For example, if an employer has employees that are paid. Bring these items with you: Get ready for tax season deadlines by completing any required tax forms today. Individual tax return form 1040 instructions; Web download 2021 form ftb schedule g1 (540) general information. Web schedule g is used to report professional fundraising services, fundraising events, and gaming. Web prepare for your appointment. Complete if the organization answered “yes” on form 990, part iv, line 18, or reported more than. • complete part i if the organization answered “yes” on. Web schedule g (form 990) 2023 page 2 part ii fundraising events. Organizations that report more than $15,000 of expenses for. This amount may be taxable and. Web popular forms & instructions; Federal tax return was itemized. Web 1 best answer. California does not impose tax on distributions from qualified retirement plans received by nonresidents after. Web schedule g is used to report professional fundraising services, fundraising events, and gaming. Schedule g (form 5500) 2021 v. Schedule g (form 5500) 2021 page. This schedule is used by. Web information about schedule a (form 1040), itemized deductions, including recent updates, related forms, and instructions on how to file. Web 1 best answer. Arizona income tax payments for the. Web prepare for your appointment. For example, if an employer has employees that are paid. Currently, we have 2 owners of the corp with voting shares. • complete part i if the organization answered “yes” on. Web for paperwork reduction act notice, see the instructions for form 5500. Complete, edit or print tax forms instantly. Web schedule g is used to report professional fundraising services, fundraising events, and gaming. Web use schedule g (form 1120) to provide information applicable to certain entities, individuals, and estates that own, directly, 20% or more, or own, directly or. California does not impose tax on distributions from qualified retirement plans received by nonresidents after. Complete if the organization answered “yes” on form 990, part iv, line 18, or reported more than. Bring these items with you: Ad ramseysolutions.com has been visited by 100k+ users in the past month Individual tax return form 1040 instructions; Schedule j (form 1041)—accumulation distribution for certain complex trusts. This amount may be taxable and.form 1120 schedule g

Form CDTFA531G Schedule G Fill Out, Sign Online and Download

IRS 990 Schedule G 2020 Fill out Tax Template Online US Legal Forms

Fillable Schedule G (Form 1120) Information On Certain Persons Owning

Form RL26G Schedule G Download Fillable PDF or Fill Online TaxPaid

Form 1120 (Schedule G) Information on Certain Persons Owning the

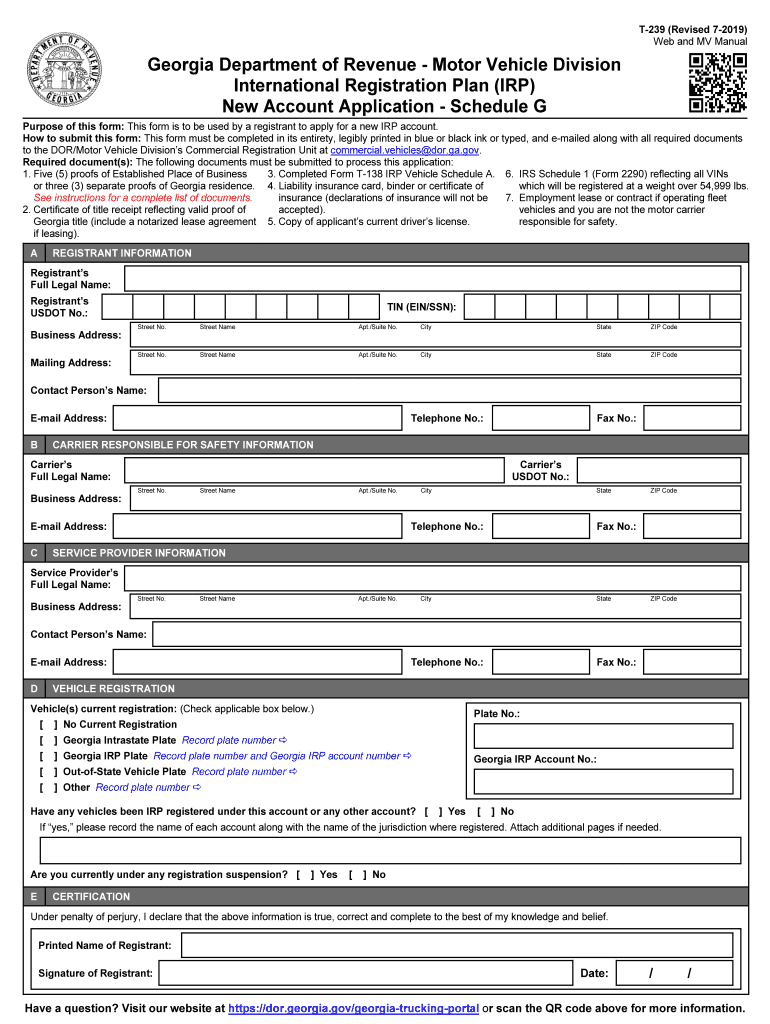

GA T239 IRP Schedule G 20192022 Fill out Tax Template Online US

Guide for How to Fill in IRS Form 1041

Vem är detta formulär för och hur man fyller i det Tryggtpris

IRS Form 965 Schedule G Download Fillable PDF or Fill Online Foreign

Related Post: