Schedule B Form 1040 Instructions

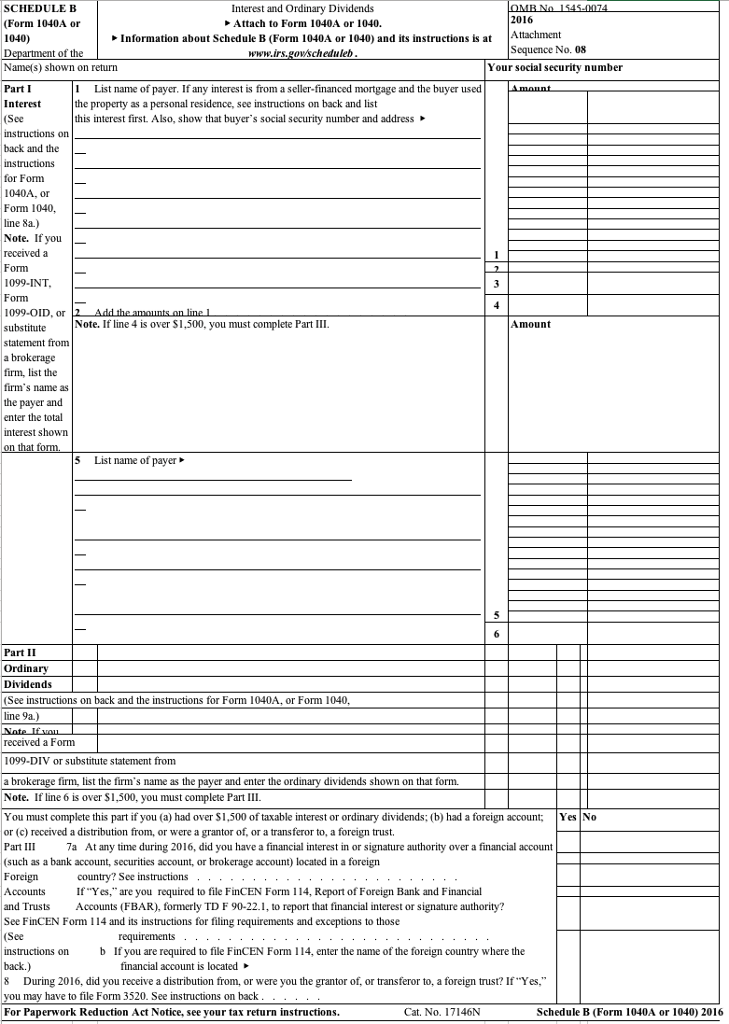

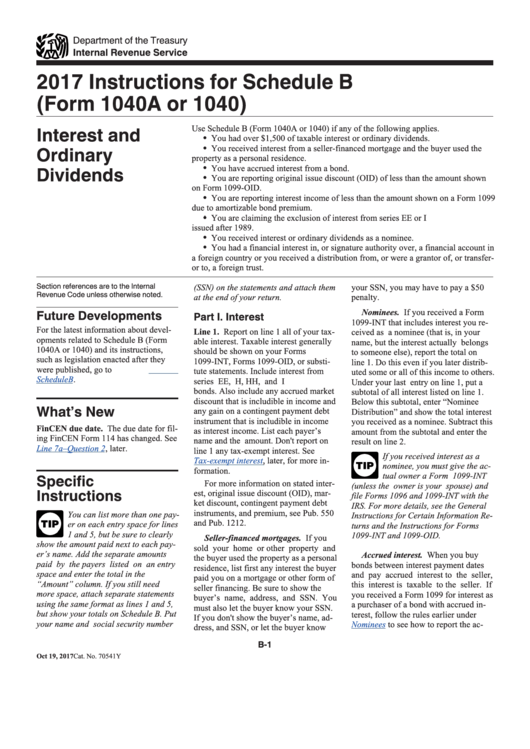

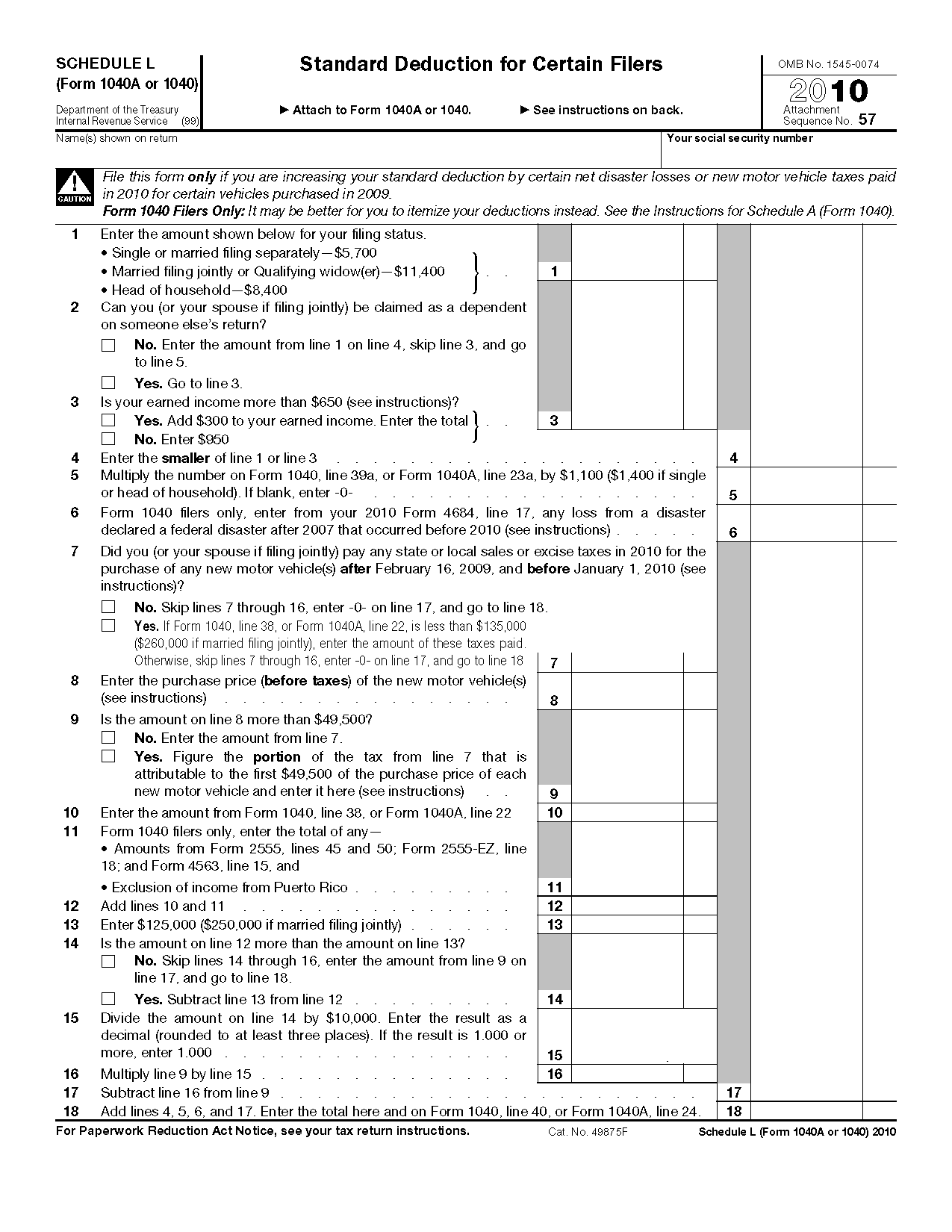

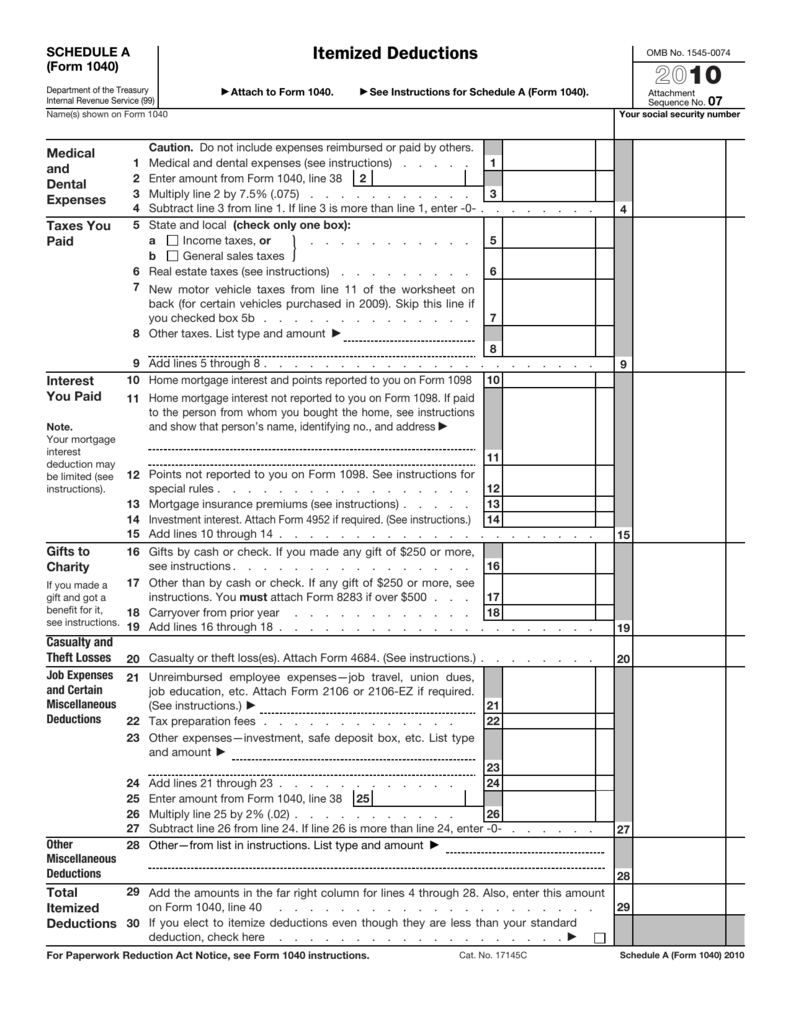

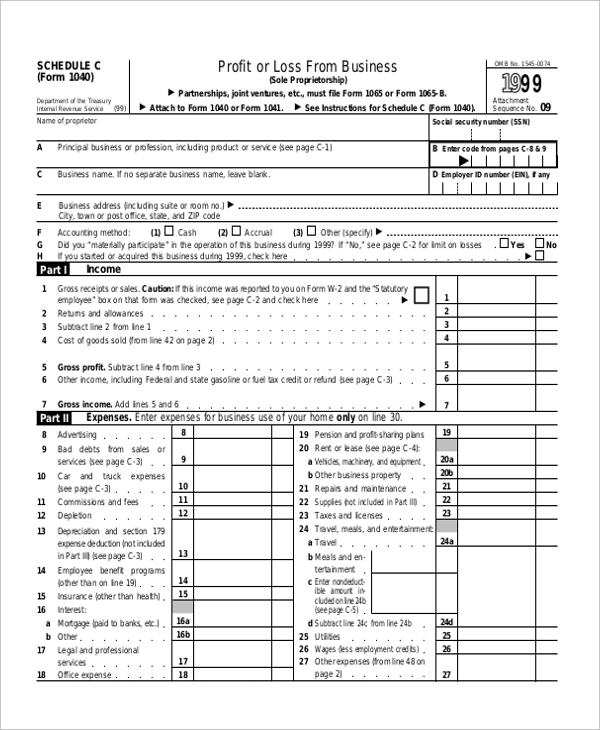

Schedule B Form 1040 Instructions - Use schedule b (form 1040) if any of the following applies. 7.3k views 2 years ago irs forms & schedules. (form 1040) interest and ordinary dividends. 1040 schedule b is an auxiliary tax form that serves as an extension to. If you or someone in your family was. Use schedule c (form 1040) to report income or (loss) from a business. •you had over $1,500 of taxable interest or ordinary. Questions answered every 9 seconds. Complete a separate line for the amounts allocated to each of your clients. What exactly is form 1040 schedule b? It's most often used to identify interest and dividend income. Use the tax calculator to estimate your tax refund or the amount you may owe the irs. Ad discover helpful information and resources on taxes from aarp. Schedule b reports the interest and dividend income you receive during the tax year. Web irs schedule b instructions. Web read the instructions before you complete schedule r (form 940). Web information about schedule b (form 1040), interest and ordinary dividends, including recent updates, related forms, and instructions on how to file. Certain expenses, payments, contributions, fees, etc. Web popular forms & instructions; 7.3k views 2 years ago irs forms & schedules. Web information about schedule b (form 1040), interest and ordinary dividends, including recent updates, related forms, and instructions on how to file. Use the tax calculator to estimate your tax refund or the amount you may owe the irs. Web popular forms & instructions; Web schedule b is a form you file with your regular income tax return by april. Use schedule c (form 1040) to report income or (loss) from a business. Web listen to this article. Web irs schedule b instructions. Web schedule b is a form you file with your regular income tax return by april 15 (or october 15 with an extension). Schedule b department of the treasury internal revenue service (99) go 1 interest. Schedule b reports the interest and dividend income you receive during the tax year. Use the tax calculator to estimate your tax refund or the amount you may owe the irs. Use schedule b (form 1040) if any of the following applies. Ad a tax advisor will answer you now! Www.irs.gov/scheduleb for instructions and the latest information. •you had over $1,500 of taxable interest or ordinary. Web 2022 instructions for schedule binterest and ordinary dividends use schedule b (form 1040) if any of the following applies. By forrest baumhover october 13, 2023 reading time: What exactly is form 1040 schedule b? Complete a separate line for the amounts allocated to each of your clients. Web listen to this article. (form 1040) interest and ordinary dividends. Web for form 1040, use schedule b to report interest and ordinary dividend income. Web read the instructions before you complete schedule r (form 940). You had over $1,500 of taxable interest or ordinary dividends. Type or print within the boxes. Web for form 1040, use schedule b to report interest and ordinary dividend income. You have accrued interest from a bond. What exactly is form 1040 schedule b? Web adjustments to income section of form 1040, schedule 1. Web information about schedule b (form 1040), interest and ordinary dividends, including recent updates, related forms, and instructions on how to file. Schedule b department of the treasury internal revenue service (99) go 1 interest. Web read the instructions before you complete schedule r (form 940). Web schedule b is a form you file with your regular income tax return. You have accrued interest from a bond. You had over $1,500 of taxable interest or ordinary dividends. Complete a separate line for the amounts allocated to each of your clients. Use schedule c (form 1040) to report income or (loss) from a business. Web irs schedule b instructions. Questions answered every 9 seconds. For complete filing requirements and instructions from the irs, see about schedule b. Www.irs.gov/scheduleb for instructions and the latest information. Schedule b department of the treasury internal revenue service (99) go 1 interest. What exactly is form 1040 schedule b? Web schedule b is a form you file with your regular income tax return by april 15 (or october 15 with an extension). Complete a separate line for the amounts allocated to each of your clients. Ad a tax advisor will answer you now! 7.3k views 2 years ago irs forms & schedules. Web read the instructions before you complete schedule r (form 940). (form 1040) interest and ordinary dividends. Web for instructions and the latest information. Web irs schedule b instructions. Ad discover helpful information and resources on taxes from aarp. Use schedule b (form 1040) if any of the following applies. Certain expenses, payments, contributions, fees, etc. By forrest baumhover october 13, 2023 reading time: Schedule b reports the interest and dividend income you receive during the tax year. Web why isn't lacerte generating the schedule b? •you had over $1,500 of taxable interest or ordinary.Solved Complete the SCHEDULE B (Form 1040A of 1040) for the

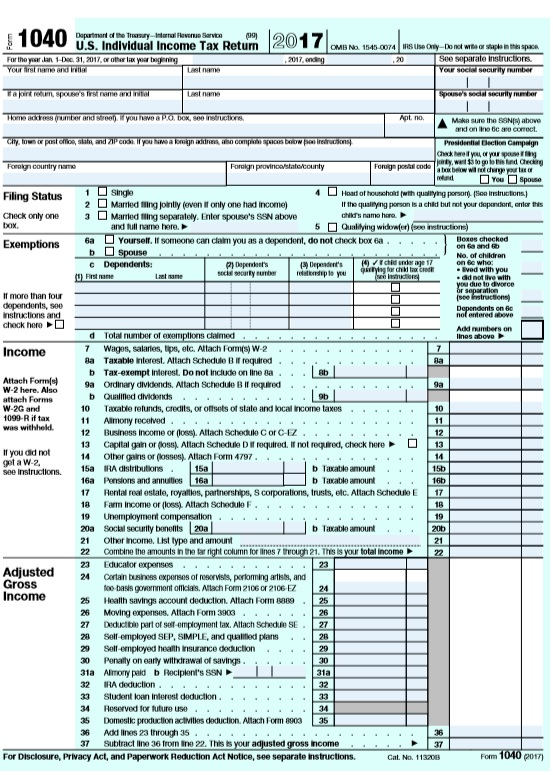

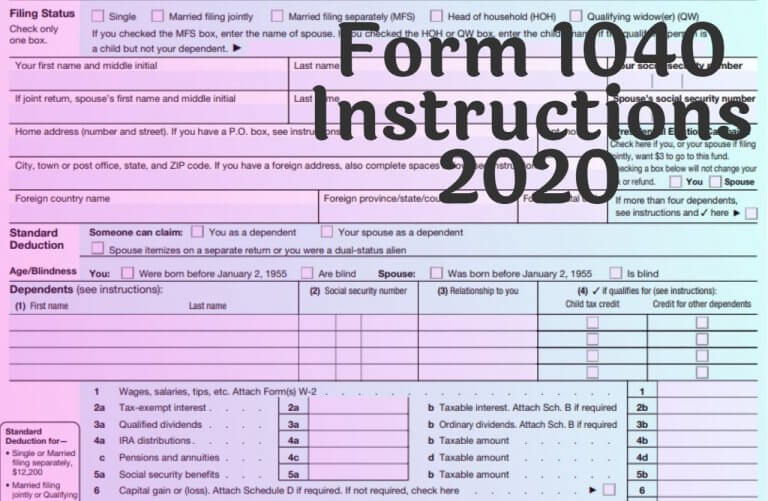

1040 (2022) Internal Revenue Service

Instructions for Form 1040,

Instructions For Schedule B (Form 1040a Or 1040) Interest And

Irs 1040 Form 2020 Printable IRS 1040 2018 Fill and Sign Printable

Solved How To Fill Out Schedule B, Form 1040 And Qualifie...

Form 1040 Schedule B Instruction 1040 Form Printable

Irs 1040 Form 2020 Pdf 1040ez Form Fill Out And Sign Printable Pdf

IRS 1040 Schedule B 2019 Fill out Tax Template Online US Legal Forms

Form 1040 Instructions 2020

Related Post: