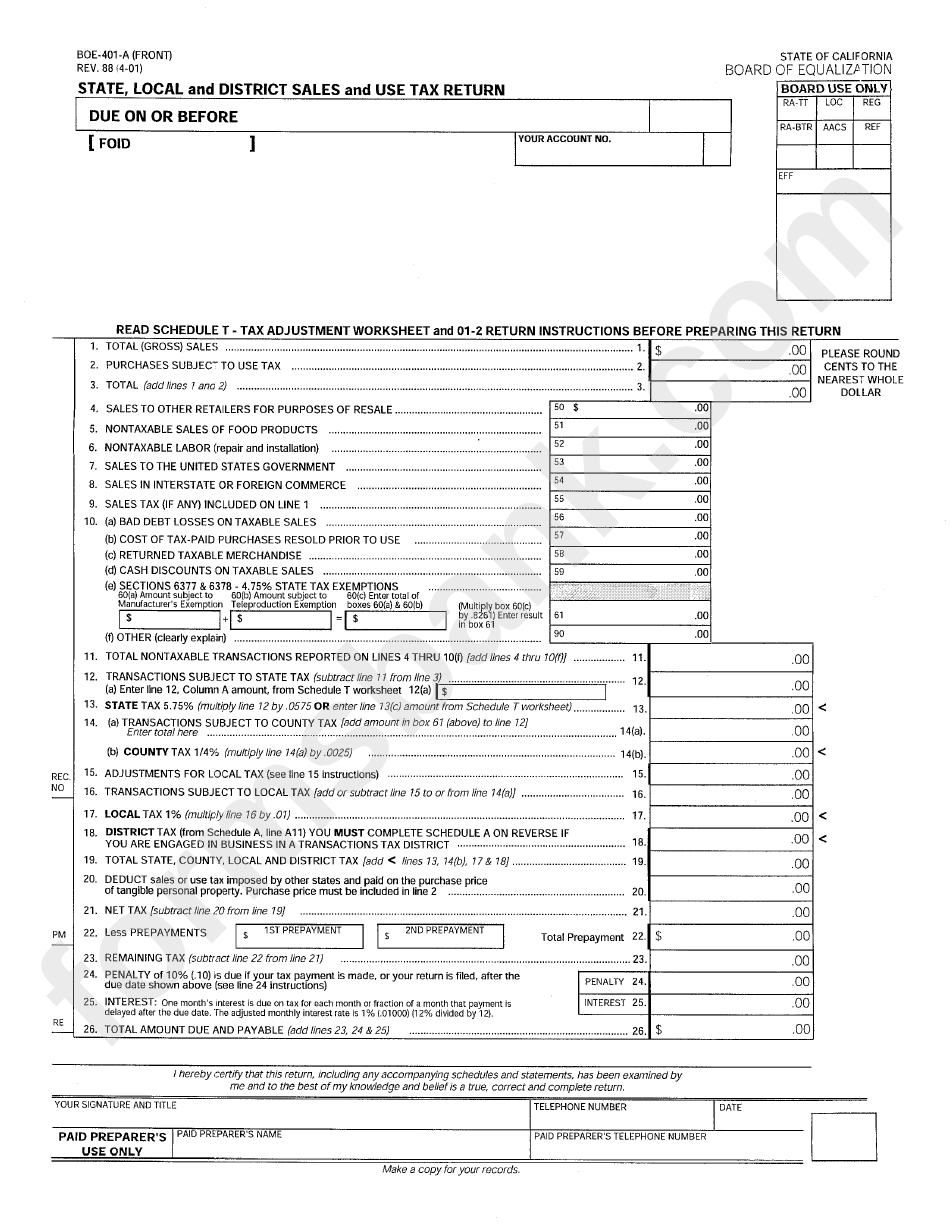

Sales Tax Return Form California

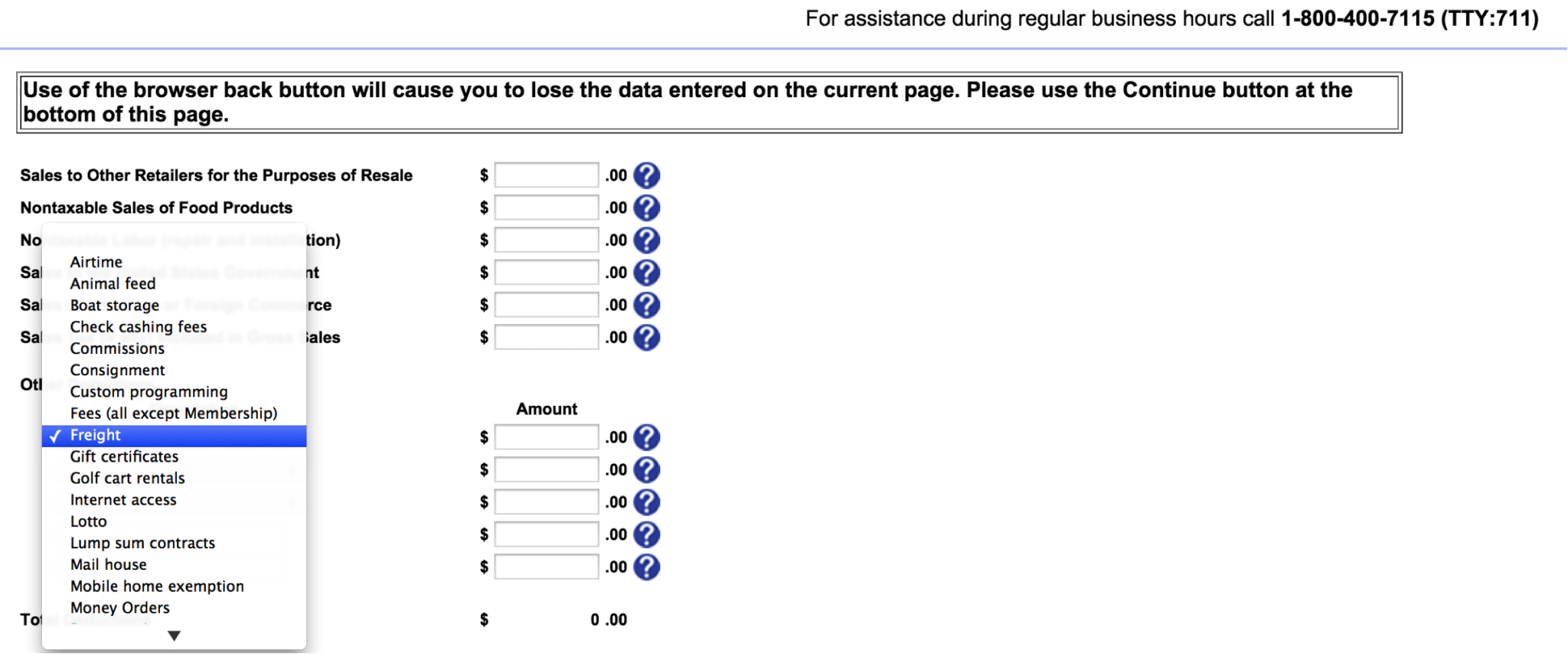

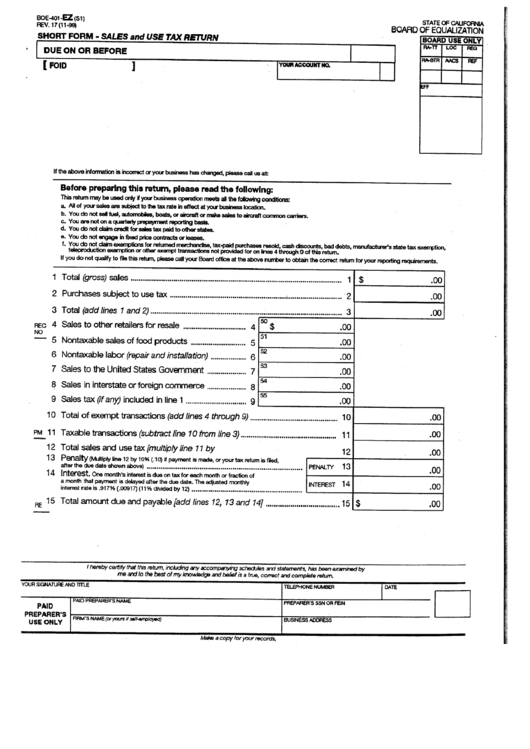

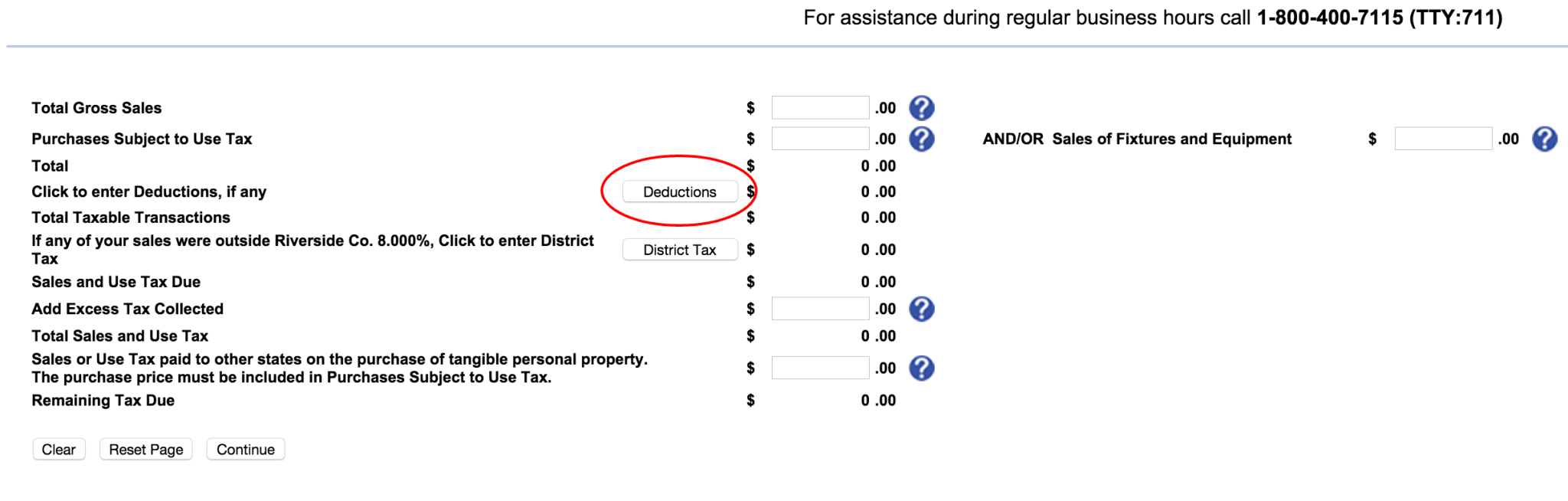

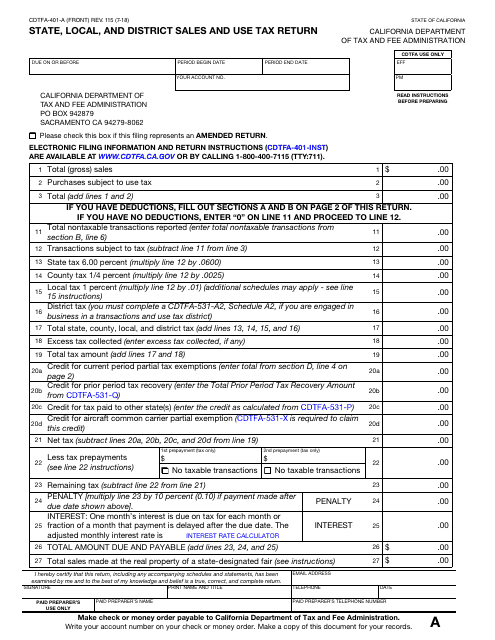

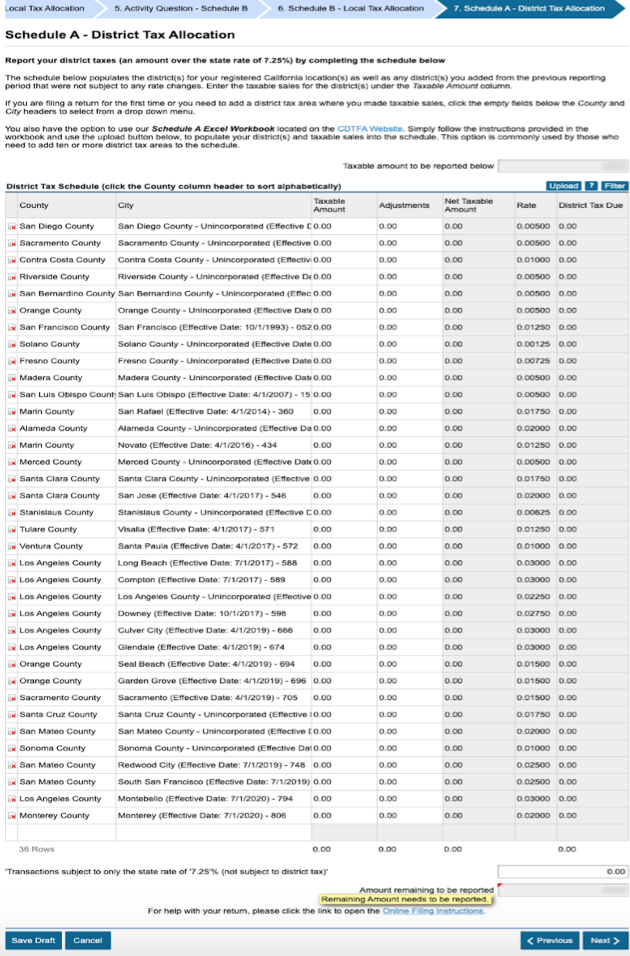

Sales Tax Return Form California - California city and county sales and use tax rates. Web the instructions provided with california tax forms are a summary of california tax law and are only intended to aid taxpayers in preparing their state income tax returns. Visit the irs website or. Audit determination and refund section, mic:39 california. Web due date for california state tax returns and payments moved to november 16, 2023. If you are stuck or have. Most retailers, even occasional sellers of tangible goods, are required to register to collect sales or use tax in california. Web send your sales and use tax claim for refund and supporting documents, including amended returns to: California department of tax and fee administration. Ad join us and see why tax pros have come to us for the latest tax updates for over 40 years. Determining where district taxes are in effect: Web you must report district taxes on schedule a of your sales and use tax return. More sales and use tax. Web simplified income, payroll, sales and use tax information for you and your business If you are stuck or have. If you are stuck or have. Ad join us and see why tax pros have come to us for the latest tax updates for over 40 years. Federal income and payroll tax. Web sales and use tax. More sales and use tax. You can easily file your return online. California city and county sales and use tax rates. Get ready for tax season deadlines by completing any required tax forms today. The cdtfa provides california taxpayers a convenient method for filing their sales and use tax returns and paying amounts owed through service providers. Audit determination and refund section, mic:39 california. Ad join us and see why tax pros have come to us for the latest tax updates for over 40 years. A claim for refund is a request for reimbursement of amounts previously paid. Web send your sales and use tax claim for refund and supporting documents, including amended returns to: File a return or prepayment. If you are stuck. State, local, and district sales. You can easily file your return online. Web the california franchise tax board confirmed that most californians have until nov. Web sales and use tax forms and publications basic forms. Web simplified income, payroll, sales and use tax information for you and your business Web sales and use tax forms and publications basic forms. If you are stuck or have. Web you must report district taxes on schedule a of your sales and use tax return. Web federal income and payroll tax; Audit determination and refund section, mic:39 california. Determining where district taxes are in effect: You can easily file your return online. Web the cdtfa assigns a filing frequency (quarterly prepay, quarterly, monthly, fiscal yearly, yearly) based on your reported sales tax or your anticipated taxable sales. Help us improve our tax forms. Web sales and use tax. Web the california franchise tax board confirmed that most californians have until nov. How to get help filing a california sales tax return. Most retailers, even occasional sellers of tangible goods, are required to register to collect sales or use tax in california. A claim for refund is a request for reimbursement of amounts previously paid. Sales and use tax. Sales and use tax and special taxes and fees; 16, 2023, to file and pay their 2022 state taxes to avoid penalties. We consistently offer best in class solutions to you & your client's tax problems. Most retailers, even occasional sellers of tangible goods, are required to register to collect sales or use tax in california. If you are stuck. Web sales and use tax forms and publications basic forms. We consistently offer best in class solutions to you & your client's tax problems. Help us improve our tax forms. Web sales and use tax. California department of tax and fee administration. Help us improve our tax forms. More sales and use tax. Sales and use tax and special taxes and fees; Web the cdtfa assigns a filing frequency (quarterly prepay, quarterly, monthly, fiscal yearly, yearly) based on your reported sales tax or your anticipated taxable sales. Get ready for tax season deadlines by completing any required tax forms today. How to get help filing a california sales tax return. Outsource your compliance responsibilities to a certified service provider with model 1. 16, 2023, to file and pay their 2022 state taxes to avoid penalties. File a return or prepayment. Audit determination and refund section, mic:39 california. Filing your return online is an easy and eficient method of filing. Most retailers, even occasional sellers of tangible goods, are required to register to collect sales or use tax in california. A seller’s permit is issued to business. Web you must report district taxes on schedule a of your sales and use tax return. Web short form—sales and use tax return. California department of tax and fee administration. State, local, and district sales. If you are stuck or have. A claim for refund is a request for reimbursement of amounts previously paid. California city and county sales and use tax rates.How to File a Sales Tax Return in California

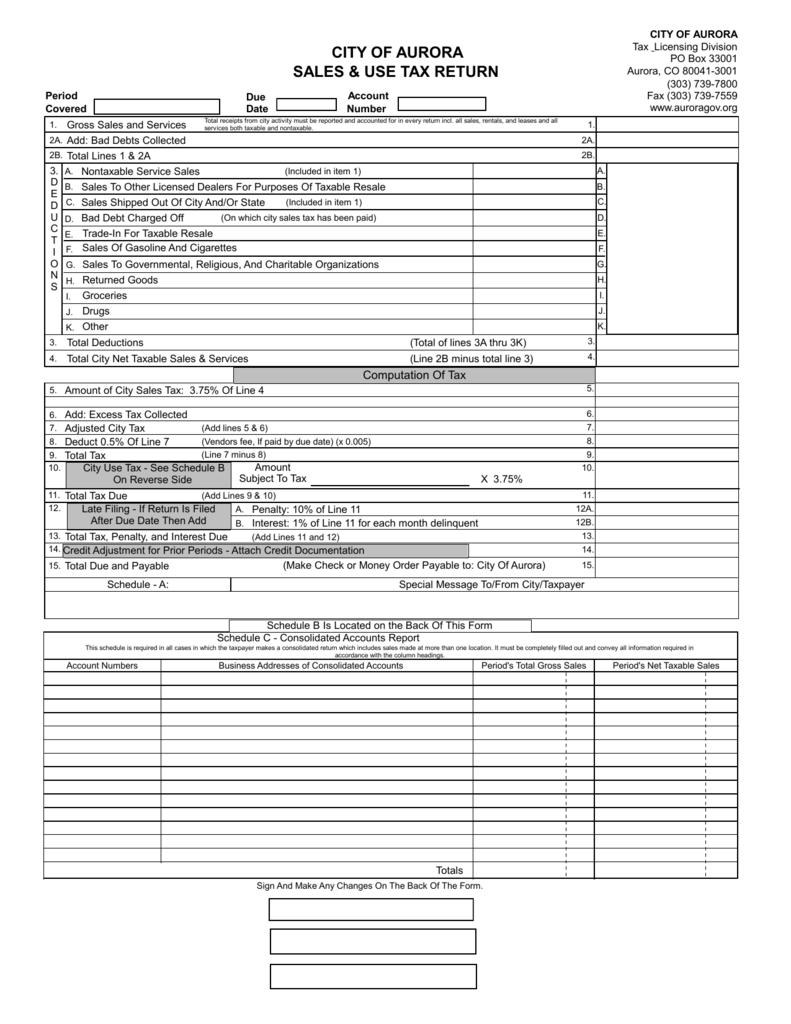

Short Form Sales And Use Tax Return Board Of Equalization State

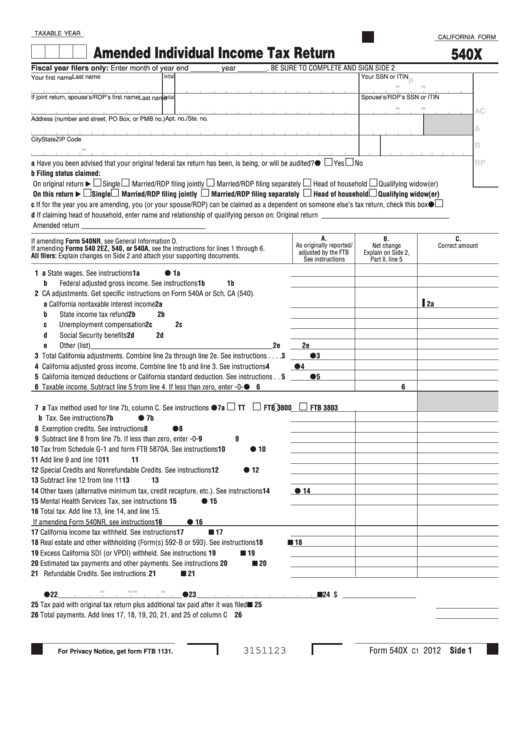

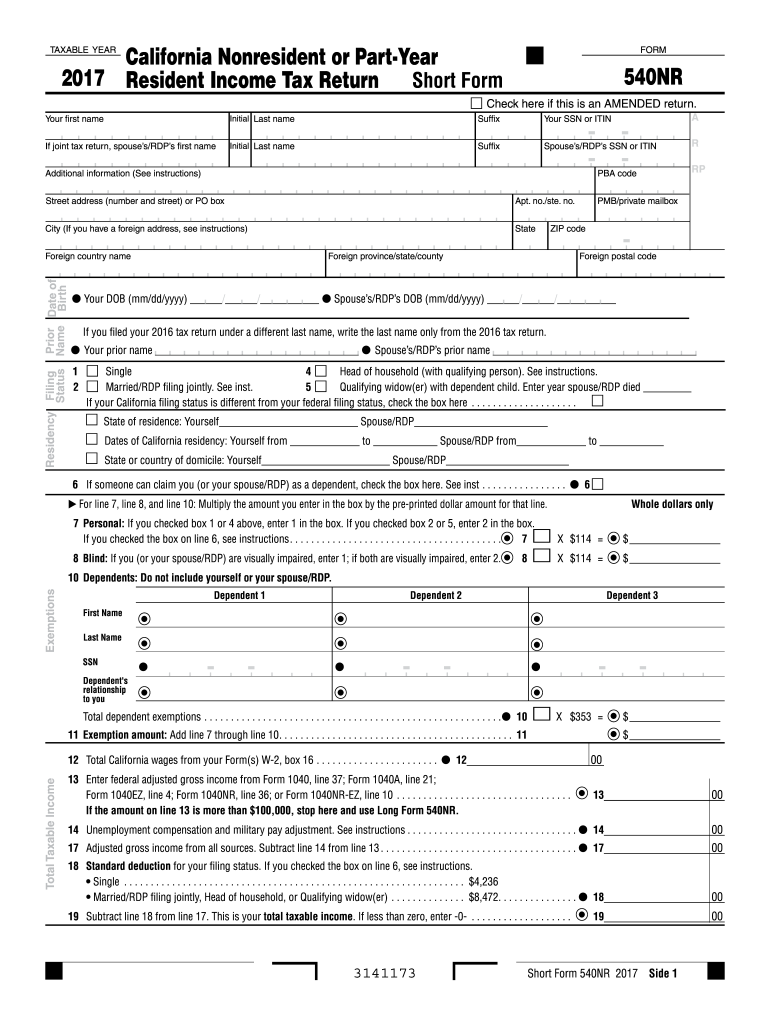

Fillable California Form 540x Amended Individual Tax Return

How to File a Sales Tax Return in California

Form CDTFA401A Download Fillable PDF or Fill Online State, Local, and

How to File a California Sales Tax Return TaxJar

How to File a Quarterly Sales Tax Return in California TaxJar

2017 Form CA FTB 540NR Short Fill Online, Printable, Fillable, Blank

Sales and Use Tax Return Form

Form Boe401A State, Local And District Sales And Use Tax Return

Related Post: