S Corp Extension Form

S Corp Extension Form - Web about form 7004, application for automatic extension of time to file certain business income tax, information, and other returns. Web many states choose to follow the federal income tax requirements for s corps, but some require you to file additional state forms to be recognized as an s corp. Web request your extension to file by paying your balance due on our free online tax portal, mydorway, at dor.sc.gov/pay. The original due date for this. Once the form 7004 is. Application for automatic extension of time to file corporation,. Select business income tax paymentto get started. Arizona s corporation income tax return. Application for automatic extension of time to file certain business income tax,. Inclusion of federal return with arizona return the department requests that. Web corporate tax forms; Once the form 7004 is. Arizona s corporation income tax return. Submit the form to the irs. Web you can extend filing form 1120s when you file form 7004. For calendar year corporations, the due date is march 15, 2023. Web comptroller's office 1600 west monroe phoenix, az 85007 filing an extension. Use form 7004 to request an automatic 6. • an s corporation that pays wages to employees typically files irs form 941 for. Web corporations filing form 100s, california s corporation franchise or income tax return and. Application for automatic extension of time to file by the original due date of the return. Web there are three steps to filing an extension for s corporation taxes: Arizona income tax return for s corporations. Once the form 7004 is. Use form 7004 to request an automatic 6. Submit the form to the irs. Web comptroller's office 1600 west monroe phoenix, az 85007 filing an extension. Application for automatic extension of time to file by the original due date of the return. Web the franchise tax board and the irs opted to push the deadline from april 18 to oct. Once the form 7004 is. Arizona s corporation income tax return. Web you can extend filing form 1120s when you file form 7004. Web many states choose to follow the federal income tax requirements for s corps, but some require you to file additional state forms to be recognized as an s corp. Application for automatic extension of time to file by the original due. Use form 7004 to request an automatic 6. The original due date for this. Web • an s corporation can obtain an extension of time to file by filing irs form 7004. Web request your extension to file by paying your balance due on our free online tax portal, mydorway, at dor.sc.gov/pay. Application for automatic extension of time to file. To file an extension on a return, corporations use arizona form 120ext. Web you can extend filing form 1120s when you file form 7004. Application for automatic extension of time to file certain business income tax,. • an s corporation that pays wages to employees typically files irs form 941 for. Once the form 7004 is. Web there are three steps to filing an extension for s corporation taxes: Arizona income tax return for s corporations. Web • an s corporation can obtain an extension of time to file by filing irs form 7004. December 2018) department of the treasury internal revenue service. Lastly, you can also choose to file an s corp tax extension by. Web you can extend filing form 1120s when you file form 7004. Enter code 25 in the box on form 7004, line 1. • an s corporation that pays wages to employees typically files irs form 941 for. Web s corp extension. Web file this form to request an extension to file forms 120, 120a, 120s, 99, 99t, or 165. Complete either a form 7004 or 1120. The maximum length of time for an extension granted to an s corporation remains 6 months. December 2018) department of the treasury internal revenue service. Submit the form to the irs. Application for automatic extension of time to file by the original due date of the return. Arizona s corporation income tax return. Web tax professionals will also be able to file s corp extensions by utilizing tax applications. For calendar year corporations, the due date is march 15, 2023. Inclusion of federal return with arizona return the department requests that. Web the franchise tax board and the irs opted to push the deadline from april 18 to oct. Web corporations filing form 100s, california s corporation franchise or income tax return and certain accompanying forms and schedules. Web comptroller's office 1600 west monroe phoenix, az 85007 filing an extension. Web file this form to request an extension to file forms 120, 120a, 120s, 99, 99t, or 165. Web there are three steps to filing an extension for s corporation taxes: Now, federal filers have another month to file. Submit the form to the irs. The maximum length of time for an extension granted to an s corporation remains 6 months. Arizona income tax return for s corporations. Web request your extension to file by paying your balance due on our free online tax portal, mydorway, at dor.sc.gov/pay. • an s corporation that pays wages to employees typically files irs form 941 for. Web you can extend filing form 1120s when you file form 7004. Lastly, you can also choose to file an s corp tax extension by printing out. December 2018) department of the treasury internal revenue service. Enter code 25 in the box on form 7004, line 1. Web this is a reminder that the extended due date to file form 100s, california s corporation franchise or income tax return, is september 15, 2021.Why to Form the Scorporation? Everything You Need to Know About the

SCorp Extension of time Extension Tax Blog

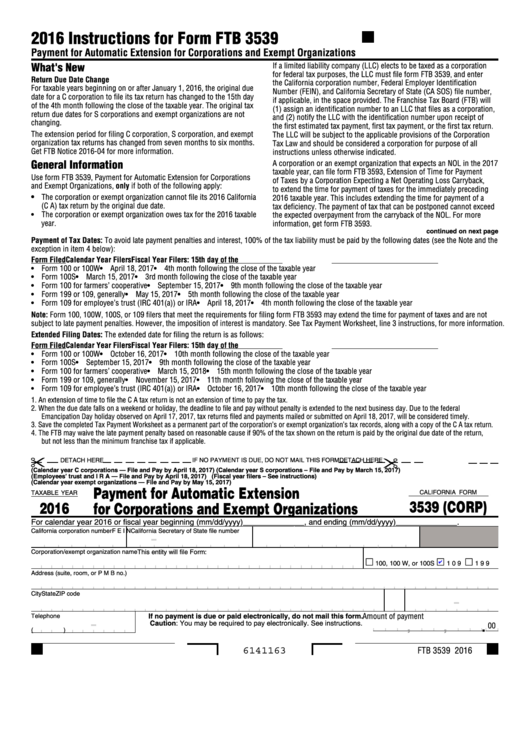

Fillable California Form 3539 (Corp) Payment For Automatic Extension

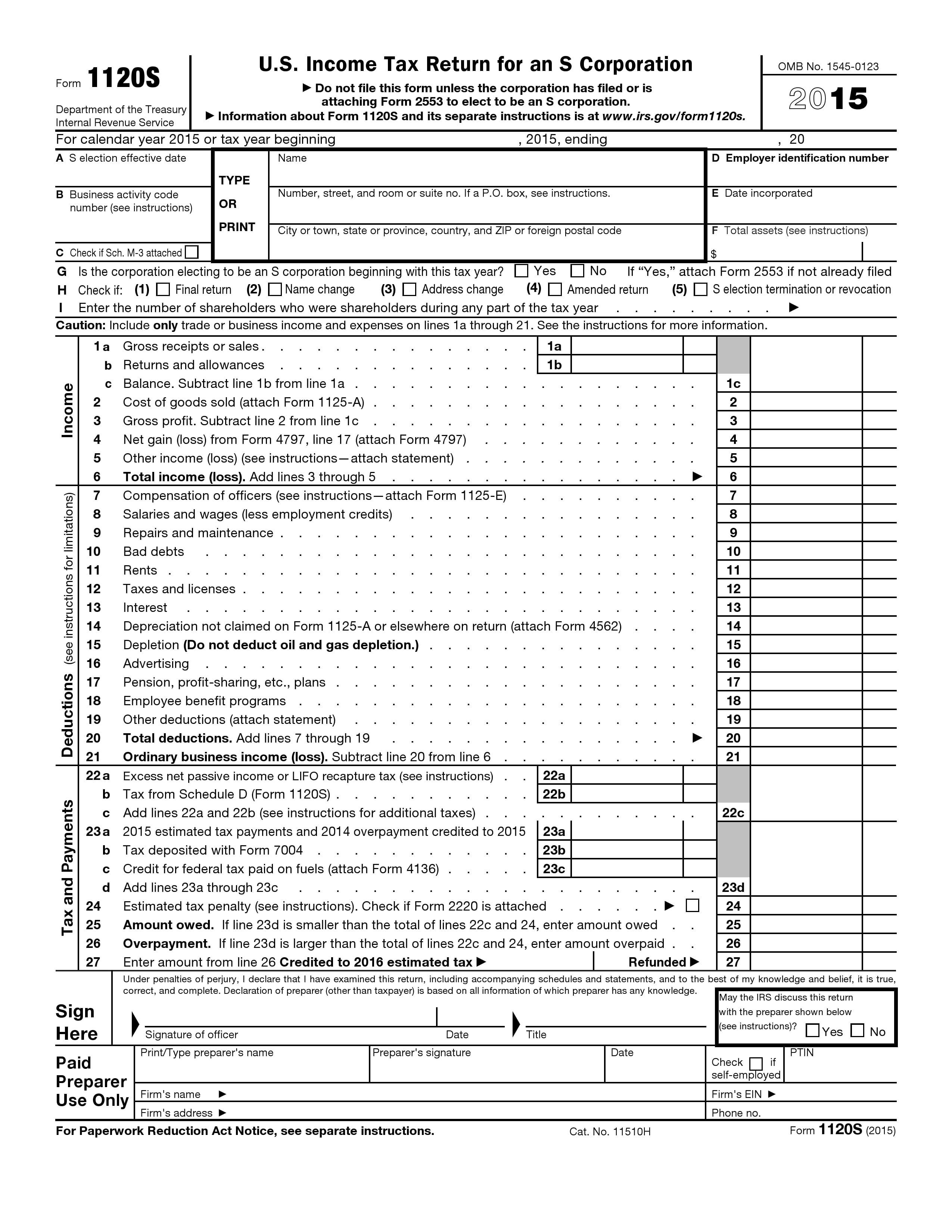

Free U.S. Tax Return for an S Corporation Form 1120S PDF

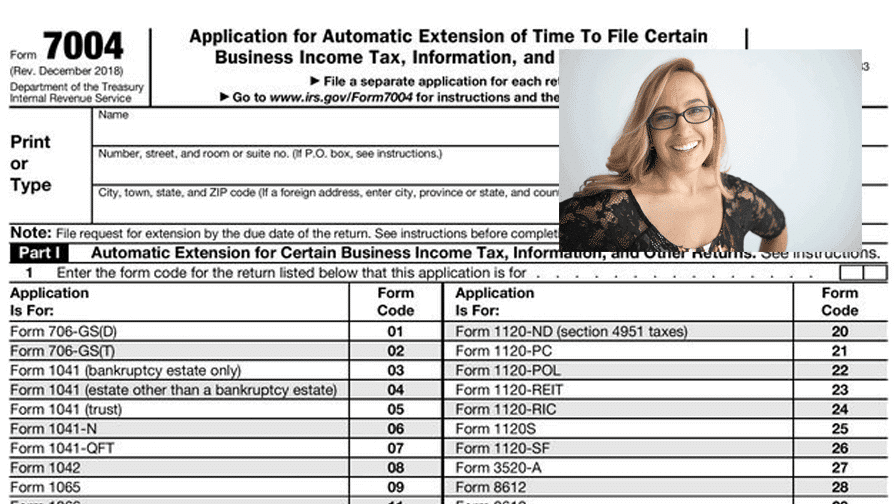

Form 7004 S Corporation Tax Extensions Bette Hochberger, CPA, CGMA

How To File A Tax Extension For An SCorporation? YouTube

How to File an Extension for Your SubChapter S Corporation

How to File a Free S Corp Extension YouTube

Delaware S Corp Extension Form Best Reviews

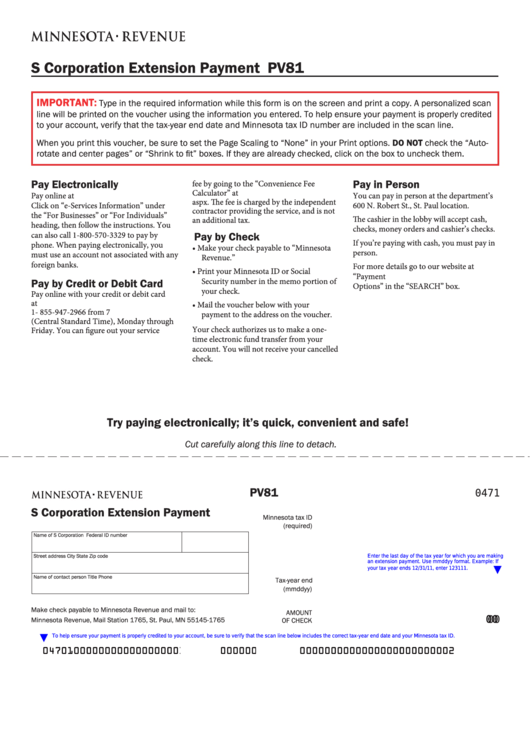

Fillable Form Pv81 S Corporation Extension Payment printable pdf download

Related Post: