Rut-50 Illinois Form

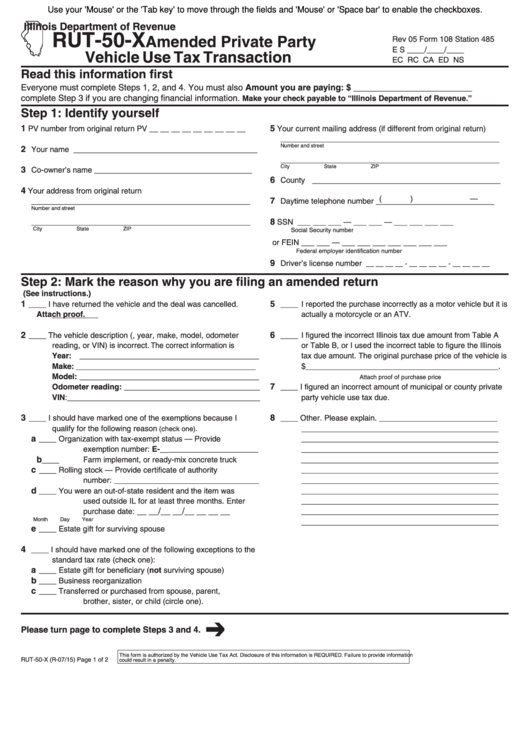

Rut-50 Illinois Form - Office of the illinois secretary of state vehicle. Web make your check payable to “illinois department of revenue.” this form is authorized by the vehicle use tax act. Web if you recently purchased and have not titled or registered the vehicle you are bringing into illinois, you must complete a tax form. It is known as the private party vehicle use tax, which means that it taxes you for a vehicle. If purchased from a dealer, you must complete. In addition to state and county. Web illinois collects a 7.25% state sales tax rate on the purchase of all vehicles. Easily sign the form with your finger. Get ready for tax season deadlines by completing any required tax forms today. This government document is issued by department of revenue for use in illinois. All documentation and fees must be submitted under one cover to: These forms are available at the offices of the illinois secretary of. Web if you recently purchased and have not titled or registered the vehicle you are bringing into illinois, you must complete a tax form. In addition to state and county. Local government private party vehicle use tax. Office of the illinois secretary of state vehicle. Get illinois rut 50 printable forms. Get tax form rut 50. Web the illinois department of revenue dec. Vehicles titled and registered in another jurisdiction three months prior to moving to illinois are exempt from illinois tax. Tax due based on vehicle age. In addition to state and county. If purchased from a dealer, you must complete. Get tax form rut 50. It is known as the private party vehicle use tax, which means that it taxes you for a vehicle. Office of the illinois secretary of state vehicle. It is known as the private party vehicle use tax, which means that it taxes you for a vehicle. Send filled & signed form or save. Disclosure of this information is required. Easily sign the form with your finger. All documentation and fees must be submitted under one cover to: Get illinois rut 50 printable forms. There is also between a 0.25% and 0.75% when it comes to county tax. Web the illinois department of revenue dec. Easily fill out pdf blank, edit, and sign them. Save or instantly send your ready documents. If a recently purchased vehicle has not been titled or registered in this. Disclosure of this information is required. If you need to obtain the forms prior to. Web if you recently purchased and have not titled or registered the vehicle you are bringing into illinois, you must complete a tax form. All documentation and fees must be submitted under one cover to: In other words, you should file this form if you purchased or acquired by gift or. Web with the proper tax form. Easily sign the form with your finger. Illinois rut 50 printable forms. Web the illinois department of revenue dec. Tax due for certain exceptions. Illinois rut 50 printable forms. Easily sign the form with your finger. These forms are available at the offices of the illinois secretary of. Vehicles titled and registered in another jurisdiction three months prior to moving to illinois are exempt from illinois tax. An amended tax form (rut 25x, rut 50x or st556x). Get illinois rut 50 printable forms. Local government private party vehicle use tax charts. If you need to obtain the forms prior to. All documentation and fees must be submitted under one cover to: It is known as the private party vehicle use tax, which means that it taxes you for a vehicle. Get illinois rut 50 printable forms. Tax due based on vehicle age. There is also between a 0.25% and 0.75% when it comes to county tax. If a recently purchased vehicle has not been titled or registered in this. Office of the illinois secretary of state vehicle. An amended tax form (rut 25x, rut 50x or st556x). Send filled & signed form or save. Illinois rut 50 printable forms. Open form follow the instructions. Easily sign the form with your finger. Local government private party vehicle use tax charts. This government document is issued by department of revenue for use in illinois. Get ready for tax season deadlines by completing any required tax forms today. In other words, you should file this form if you purchased or acquired by gift or. It is known as the private party vehicle use tax, which means that it taxes you for a vehicle. Get illinois rut 50 printable forms. Open form follow the instructions. All documentation and fees must be submitted under one cover to: There is also between a 0.25% and 0.75% when it comes to county tax. Get tax form rut 50. Web illinois collects a 7.25% state sales tax rate on the purchase of all vehicles. Vehicles titled and registered in another jurisdiction three months prior to moving to illinois are exempt from illinois tax. Easily fill out pdf blank, edit, and sign them.Rut50 Printable Form

Tax Form Rut50 Printable

Tax Form Rut50 Printable

Tax Form Rut50 Printable

Tax Form Rut50 Printable Customize and Print

Tax Form Rut50 Printable Printable Word Searches

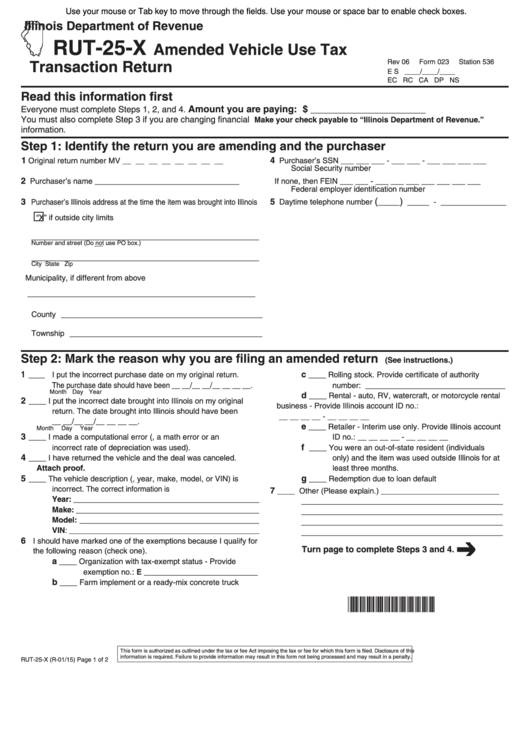

2010 Form IL RUT50XFill Online, Printable, Fillable, Blank pdfFiller

Tax Form Rut50 Printable Printable Word Searches

Top Illinois Form Rut50 Templates free to download in PDF format

Tax Form Rut50 Printable Printable Templates

Related Post: