Quickbook Direct Deposit Form

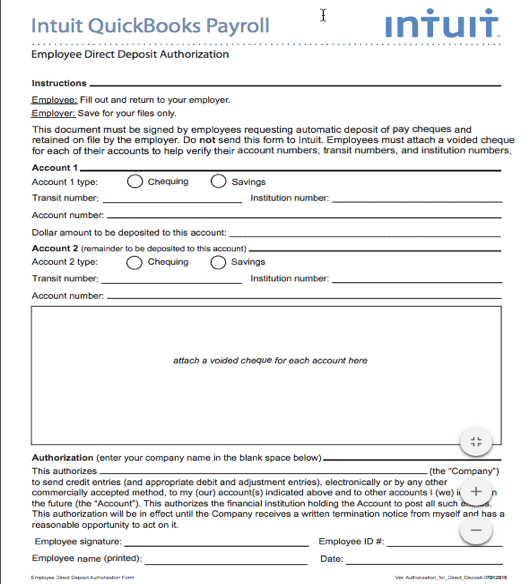

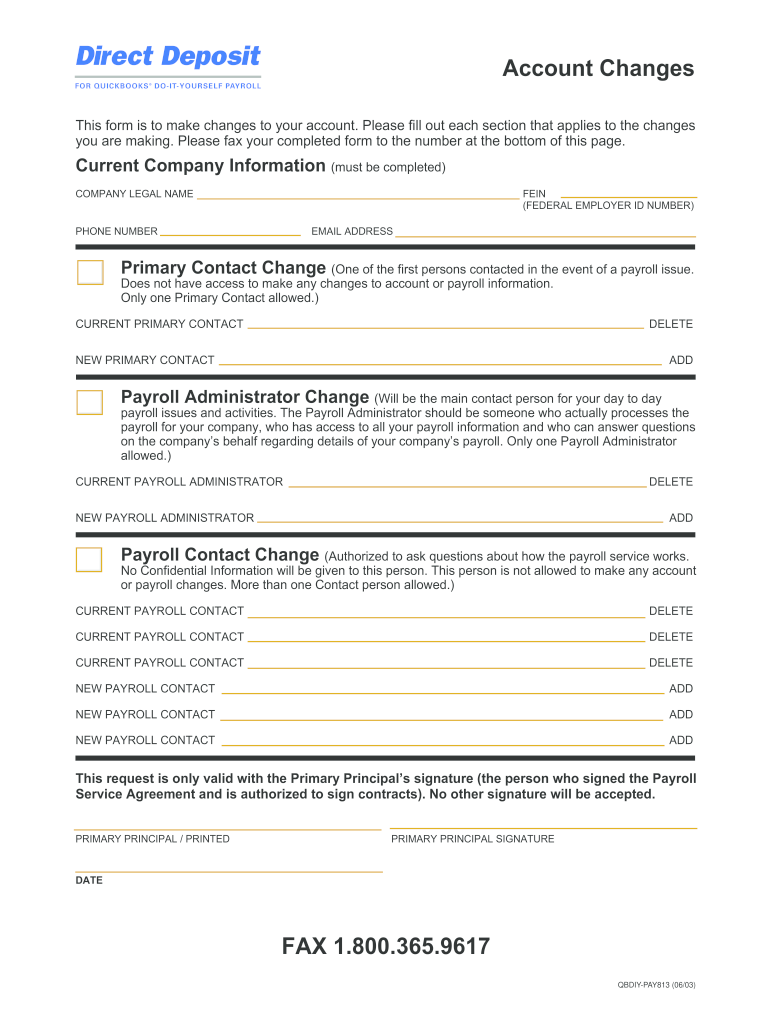

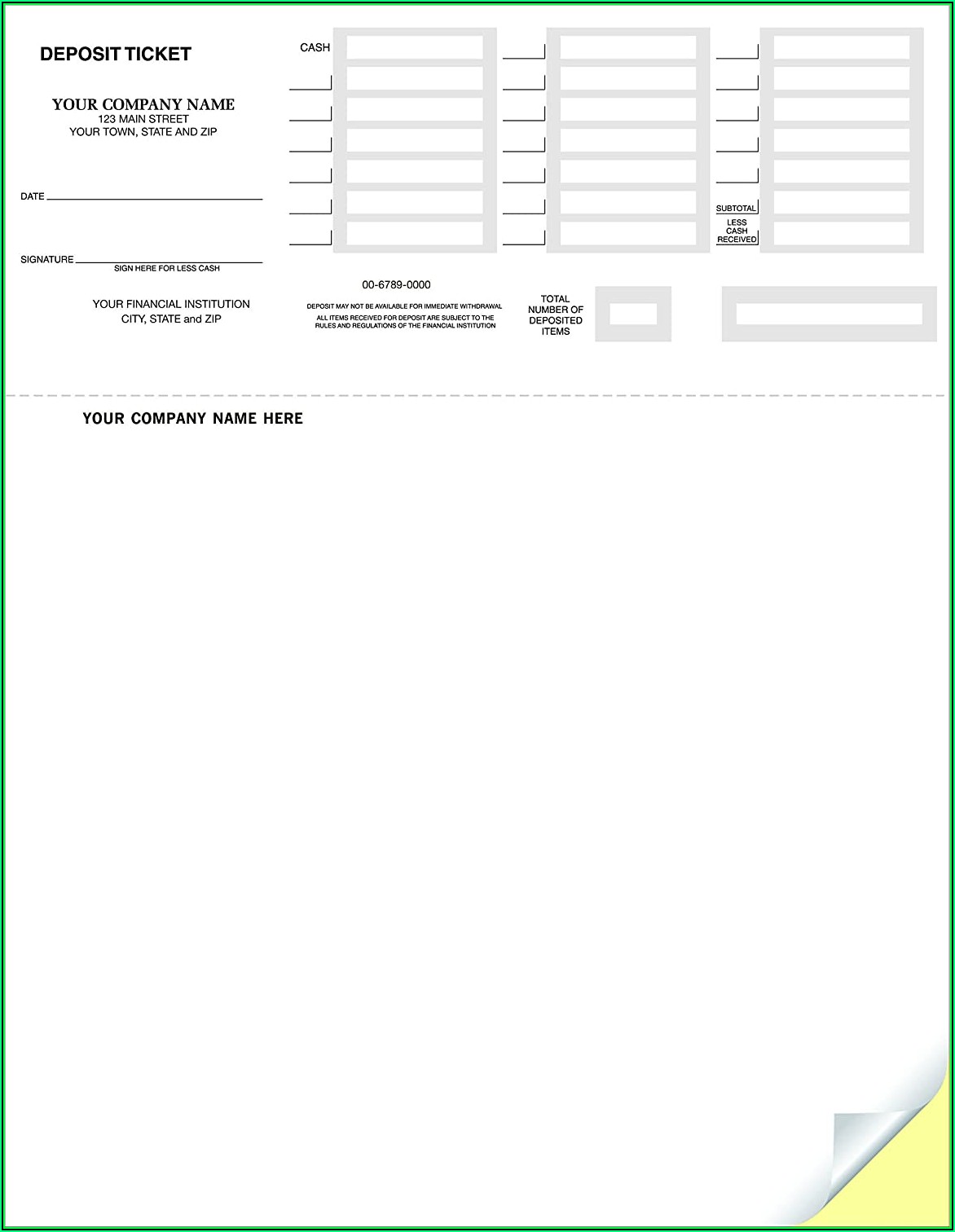

Quickbook Direct Deposit Form - Get a direct deposit authorization form have. All services backed by tax guarantee Business name, address, and ein principal. Web solved•by quickbooks•13•updated may 01, 2023. Automatic federal and state tax filings. Web employee direct deposit info. Web we’ll walk you through everything you need to know about direct deposit, including its benefits and potential drawbacks, and how to set up payroll for direct. Learn how and when to send direct deposit paychecks to process payroll on time in quickbooks payroll. Additional documentation such as bank. Check your subscription for details. Request a direct deposit limit increase. Business name, address, and ein principal. Ease your accounting burdens & try xero™! Choose the small pencil icon beside of pay. Web employee direct deposit info. Get a direct deposit authorization form have. Submit an online request to increase your direct deposit security limit. Web learn how to set up direct deposit for independent contractors in quickbooks online payroll and quickbooks desktop payroll. Choose the small pencil icon beside of pay. There are fees to use direct deposit. Web this document must be signed by employees requesting automatic deposit of paychecks and retained on file by the employer. Web click on employees in the workers (sometimes called the payroll) menu. Ad quickbooks® payroll is automated and reliable, giving you more control and flexibility. Remove the checkmark use direct. Payroll seamlessly integrates with quickbooks® online. Click the payroll info tab, and then click direct deposit. Submit an online request to increase your direct deposit security limit. Direct deposit payroll allows small businesses to pay. Ease your accounting burdens & try xero™! Gather your business, bank, and principal officer info to set up direct deposit for your company, you’ll need the following info: Quickbooks payroll offers direct deposit at no. Click the workers tab, then select employees. Get a direct deposit authorization form have. Learn how and when to send direct deposit paychecks to process payroll on time in quickbooks payroll. Select the employee from the list you'd like to enter direct deposit info for. Submit an online request to increase your direct deposit security limit. Web solved•by quickbooks•13•updated may 01, 2023. Payroll seamlessly integrates with quickbooks® online. Request a direct deposit limit increase. Payroll seamlessly integrates with quickbooks® online. Web learn how to set up direct deposit for independent contractors in quickbooks online payroll and quickbooks desktop payroll. The easy to use software your business needs to invoice + get paid faster. Business name, address, and ein principal. Set up your company payroll for direct deposit see set up your company payroll for direct deposit for detailed steps. Web. Gather your business, bank, and principal officer info to set up direct deposit for your company, you’ll need the following info: Ad get financial visibility & grow your small business with xero™. Click the payroll info tab, and then click direct deposit. Submit an online request to increase your direct deposit security limit. Click on the employee’s name for whom. Set up your company payroll for direct deposit see set up your company payroll for direct deposit for detailed steps. Gather your business, bank, and principal officer info to set up direct deposit for your company, you’ll need the following info: Request a direct deposit limit increase. Ease your accounting burdens & try xero™! Web the intuit (quickbooks) payroll direct. Payroll seamlessly integrates with quickbooks® online. Verify your bank account for security purposes, when you provide your initial bank information during signup, intuit makes two small withdrawals of less than $1.00 each. From the review and create paychecks window while paying employees, select the open paycheck detail button. Track sales & sales tax. Gather your business, bank, and principal officer. Automatic federal and state tax filings. Verify your bank account for security purposes, when you provide your initial bank information during signup, intuit makes two small withdrawals of less than $1.00 each. The easy to use software your business needs to invoice + get paid faster. Web learn how to set up direct deposit for independent contractors in quickbooks online payroll and quickbooks desktop payroll. Do not send this form to intuit. Payroll so easy, you can set it up & run it yourself. Remove the checkmark use direct. Additional documentation such as bank. Learn how and when to send direct deposit paychecks to process payroll on time in quickbooks payroll. Request a direct deposit limit increase. Web direct deposit bank account change form complete, print, sign and contact intuit desktop payroll support to send the completed form. Click on the employee’s name for whom you wish to enter the details. Direct deposit payroll allows small businesses to pay. Get a direct deposit authorization form have. Ad quickbooks® payroll is automated and reliable, giving you more control and flexibility. Reconcile in a few clicks. Business name, address, and ein principal. There are fees to use direct deposit. With quickbooks payroll, you can use direct. Web employee direct deposit info.Quickbooks Direct Deposit Form lasopatea

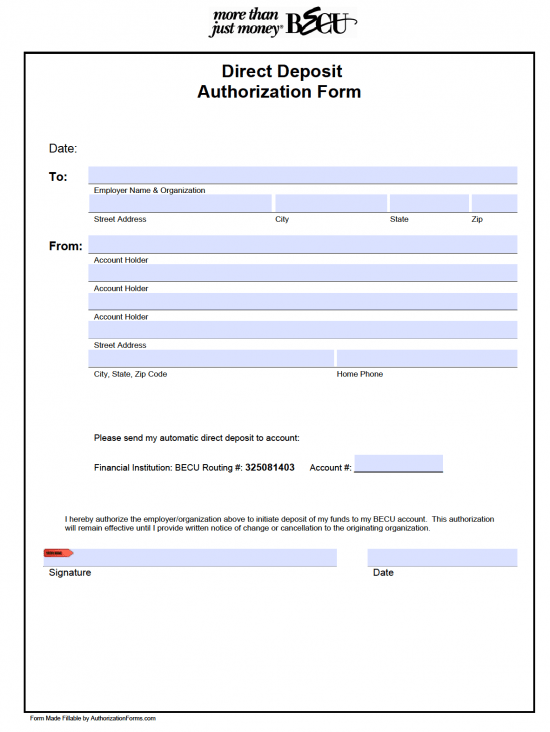

free direct deposit authorization form pdf word eforms free key bank

10 quickbooks direct deposit form intuit direct deposit download 7

10+ Quickbooks Direct Deposit Form Intuit Direct Deposit [DOWNLOAD]

10 quickbooks direct deposit form intuit direct deposit download 7

7+ Quickbooks Direct Deposit Form Editable [Doc, PDF] Partnership For

7+ Quickbooks Direct Deposit Form Editable [Doc, PDF] Partnership For

10+ Quickbooks Direct Deposit Form Intuit Direct Deposit [DOWNLOAD]

10 quickbooks direct deposit form intuit direct deposit download 7

7+ Quickbooks Direct Deposit Form Free Download [Word, PDF]

Related Post:

![10+ Quickbooks Direct Deposit Form Intuit Direct Deposit [DOWNLOAD]](https://i2.wp.com/www.elseviersocialsciences.com/wp-content/uploads/2017/10/1-7.png?fit=791%2C1024)

![7+ Quickbooks Direct Deposit Form Editable [Doc, PDF] Partnership For](https://www.partnershipforlearning.org/wp-content/uploads/2021/07/Screenshot-2021-07-08-at-7.07.36-PM.png)

![7+ Quickbooks Direct Deposit Form Editable [Doc, PDF] Partnership For](https://www.partnershipforlearning.org/wp-content/uploads/2021/07/Screenshot-2021-07-08-at-7.01.48-PM.png)

![10+ Quickbooks Direct Deposit Form Intuit Direct Deposit [DOWNLOAD]](https://i0.wp.com/www.printabletemplateslab.com/wp-content/uploads/2017/10/5-5.jpg?resize=667%2C1024)

![7+ Quickbooks Direct Deposit Form Free Download [Word, PDF]](https://www.opensourcetext.org/wp-content/uploads/2020/09/ddf-1-768x557.png)