Property Type Code Form 6252

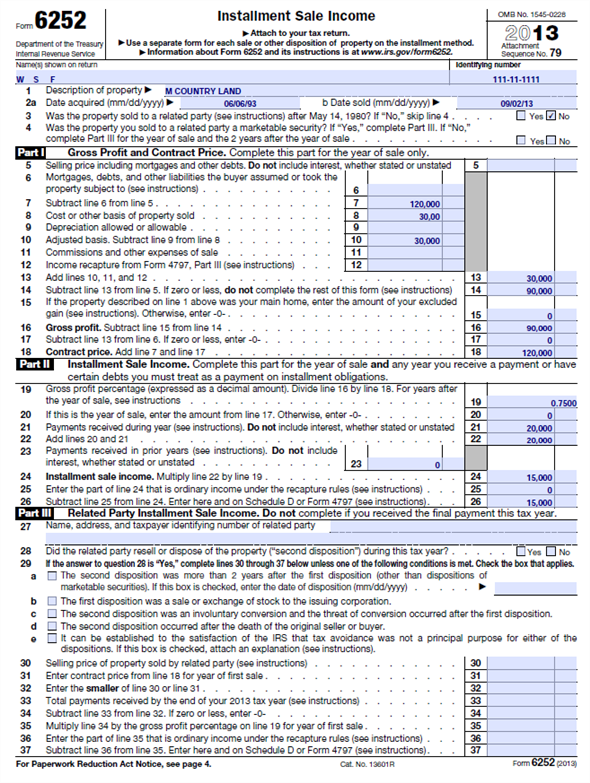

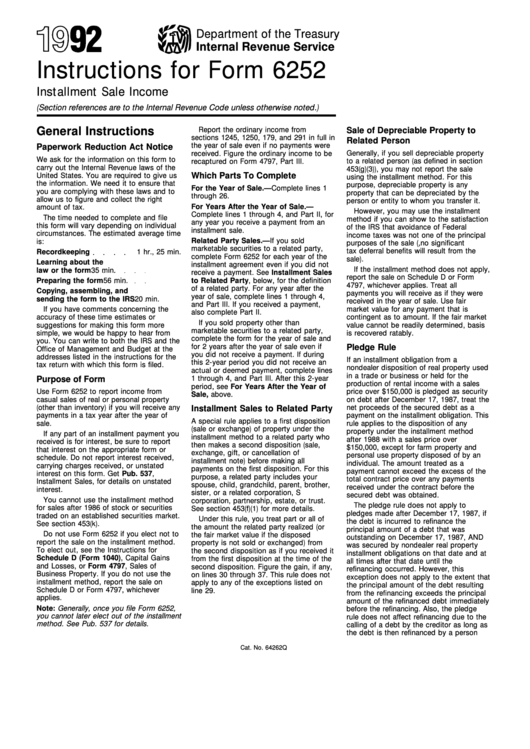

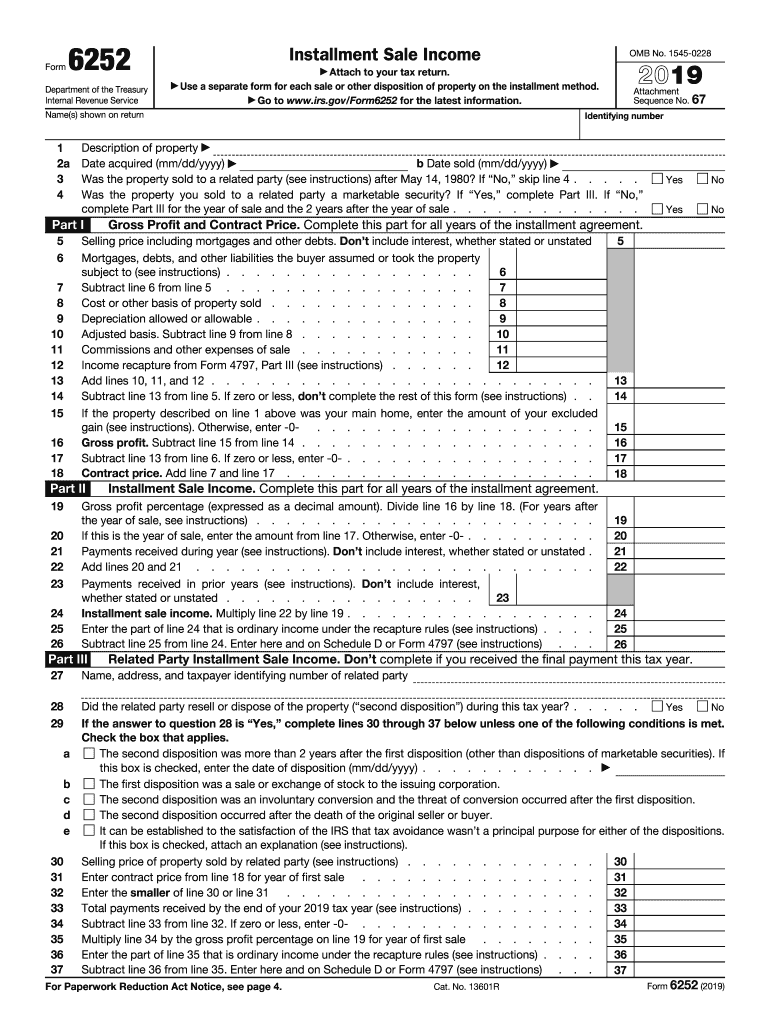

Property Type Code Form 6252 - Form 6252 ask for property type code? Web if an owner of real property consents to the proposed correction, or consents to the correction but disputes the proposed valuation or legal classification as provided on the. Web how to generate form 6252 for a current year installment sale in lacerte. Web how to enter a prior or current year installment sale (form 6252) in proconnect tax. Ad signnow.com has been visited by 100k+ users in the past month Common questions about form 6252 in proseries. Department of the treasury internal revenue service. An installment sale is one that allows the buyer to pay for a property over time. Sale by an individual of. Web generally, you will use form 6252 to report installment sale income from casual sales of real or personal property during the tax year. Use this form to report income from an installment sale on the installment method. Department of the treasury internal revenue service. Free downloads of customizable forms. Attach to your tax return. Web irs form 6252 reports the profits from selling a personal or business asset through an installment plan. Beginning in tax year 2019,. Free downloads of customizable forms. Web irs form 6252 reports the profits from selling a personal or business asset through an installment plan. Where do i find that ,the choice is 1,2,3,4, view solution in original post. Web how to generate form 6252 for a current year installment sale in lacerte. Go to the input return tab. Attach to your tax return. Enter one of the following codes, based upon the circumstances of the installment sale. Generally, an installment sale is a disposition of property where at least one payment is received after the end of the tax. If form 6252 doesn't generate after. An installment sale is one that allows the buyer to pay for a property over time. Generally, an installment sale is a disposition of property where at least one payment is received after the end of the tax. Beginning in tax year 2019,. Web irs form 6252 reports the profits from selling a personal or business asset through an installment. Web irs form 6252 reports the profits from selling a personal or business asset through an installment plan. To enter a current year installment sale follow these steps: Solved•by intuit•8•updated 1 year ago. Use this form to report income from an installment sale on the installment method. Irs tax form 6252 is a form that you must use to report. The installment method can be used to defer some tax on capital gains, as. Web 1 best answer. Beginning in tax year 2019,. Generally, an installment sale is a disposition of property where at least one payment is received after the end of the tax. Irs tax form 6252 is a form that you must use to report income you've. Web 1 best answer. If form 6252 doesn't generate after. Solved•by intuit•8•updated 1 year ago. Web form 6252 helps you figure out how much of the money you received during a given tax year was a return of capital, how much was a gain and how much was. Web use form 6252 to report income from casual sales of real. For the purposes of any contract, deed, or covenant for the transfer of real property executed subsequent to the effective date of this section, a residential facility which. Web use form 6252 to report income from casual sales of real or personal property (other than inventory) if you will receive any payments in a tax year after the year of. Web up to 10% cash back form 6252, installment sale income. Sale property is timeshare or residential lot. For the seller, it allows them to defer. The installment method can be used to defer some tax on capital gains, as. Enter one of the following codes, based upon the circumstances of the installment sale. You will also have to report the installment. Solved•by intuit•8•updated 1 year ago. An installment sale is one that allows the buyer to pay for a property over time. Taxpayers should only file this form if they realize gains. Ad signnow.com has been visited by 100k+ users in the past month Web form 6252 helps you figure out how much of the money you received during a given tax year was a return of capital, how much was a gain and how much was. Taxpayers should only file this form if they realize gains. An installment sale is one that allows the buyer to pay for a property over time. Use this form to report income from an installment sale on the installment method. Free downloads of customizable forms. Common questions about form 6252 in proseries. Sale property is timeshare or residential lot. Web generally, you will use form 6252 to report installment sale income from casual sales of real or personal property during the tax year. The information in this section applies to all of the forms used to report sales of assets. Web 1 best answer. Form 6252 ask for property type code? To enter a current year installment sale follow these steps: Department of the treasury internal revenue service. If form 6252 doesn't generate after. Web up to 10% cash back form 6252, installment sale income. Enter one of the following codes, based upon the circumstances of the installment sale. Sale by an individual of. Ad signnow.com has been visited by 100k+ users in the past month Use a separate form for each sale or other disposition of. Web irs form 6252 reports the profits from selling a personal or business asset through an installment plan.2019 Form 6252 Fill Out and Sign Printable PDF Template signNow

Schedule D Printable Form Printable Forms Free Online

Form 6252 Installment Sale (2015) Free Download

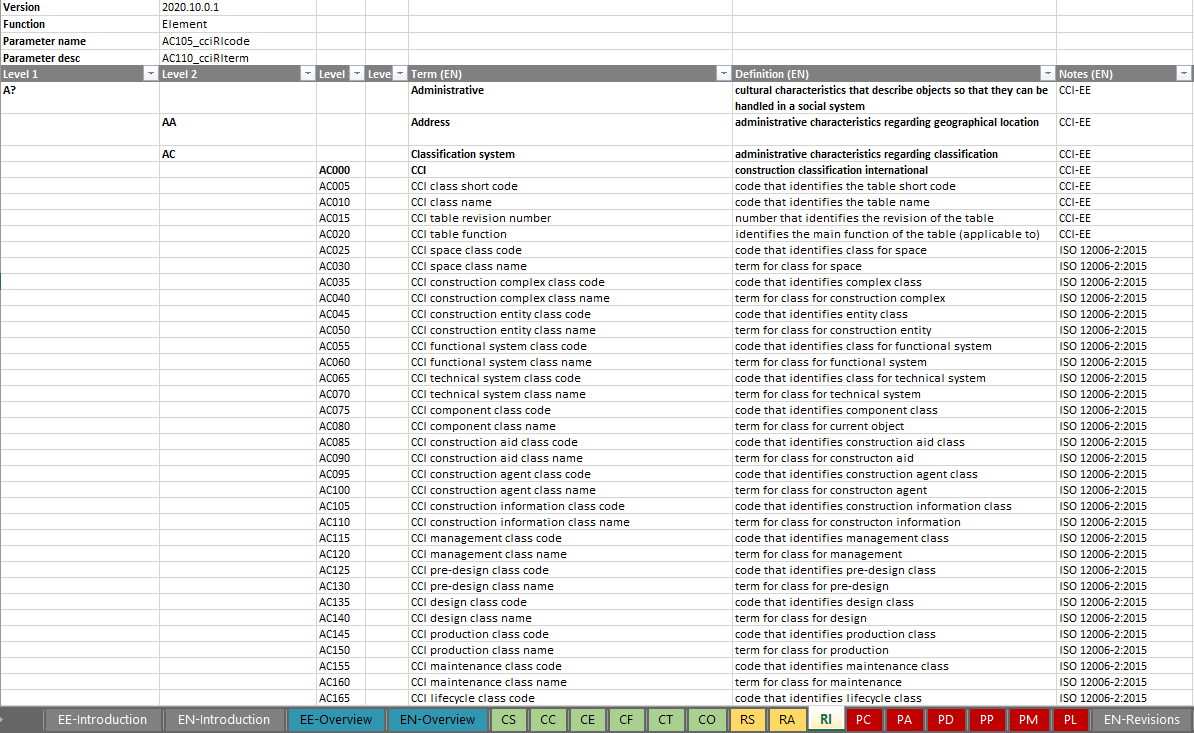

Construction classification Archives FlowBIM

Southwestern Federal Taxation 2015 38th Edition Textbook Solutions

Form 6252 Installment Sale (2015) Free Download

Fill Free fillable Form 6252 Installment Sale 2019 PDF form

Instructions For Form 6252 printable pdf download

What Is a 6252 Tax Form and What Is It Used For?

Form 6252 Installment Sale (2015) Free Download

Related Post:

:max_bytes(150000):strip_icc()/ScheduleD-CapitalGainsandLosses-1-d651471c24974ac79739e2ef580b1c35.png)