Poshmark 1099 Form

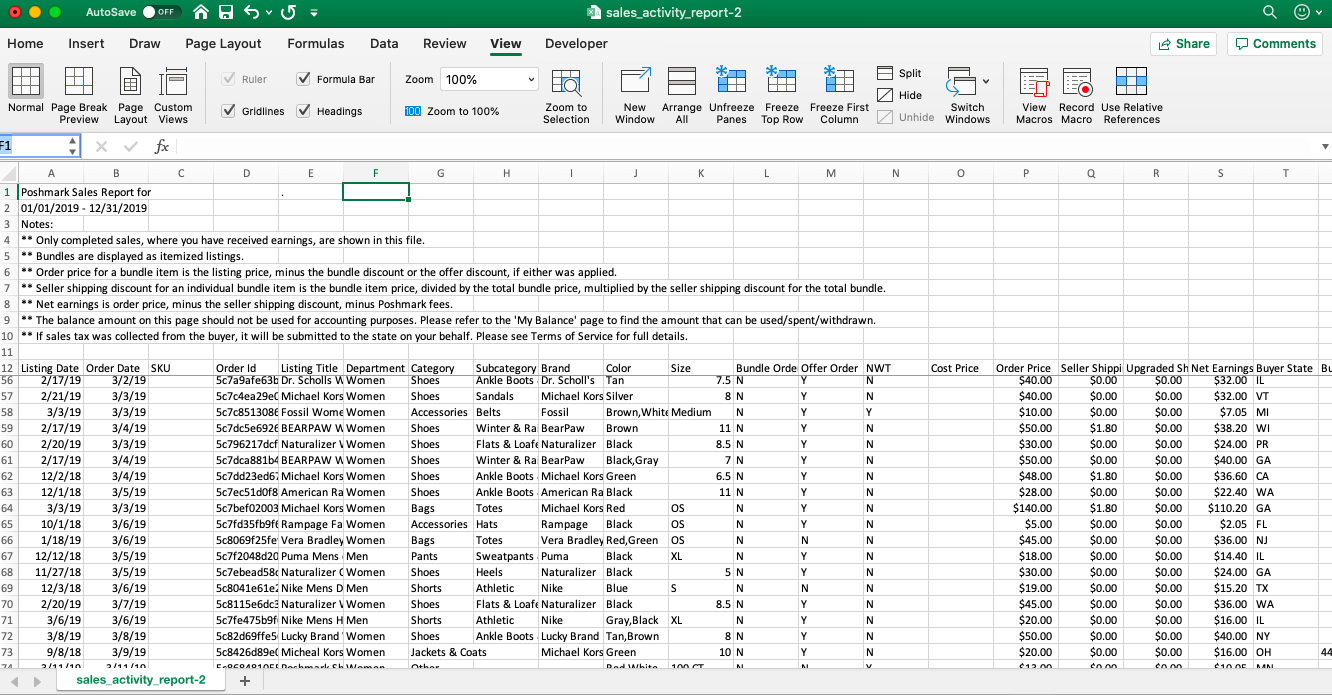

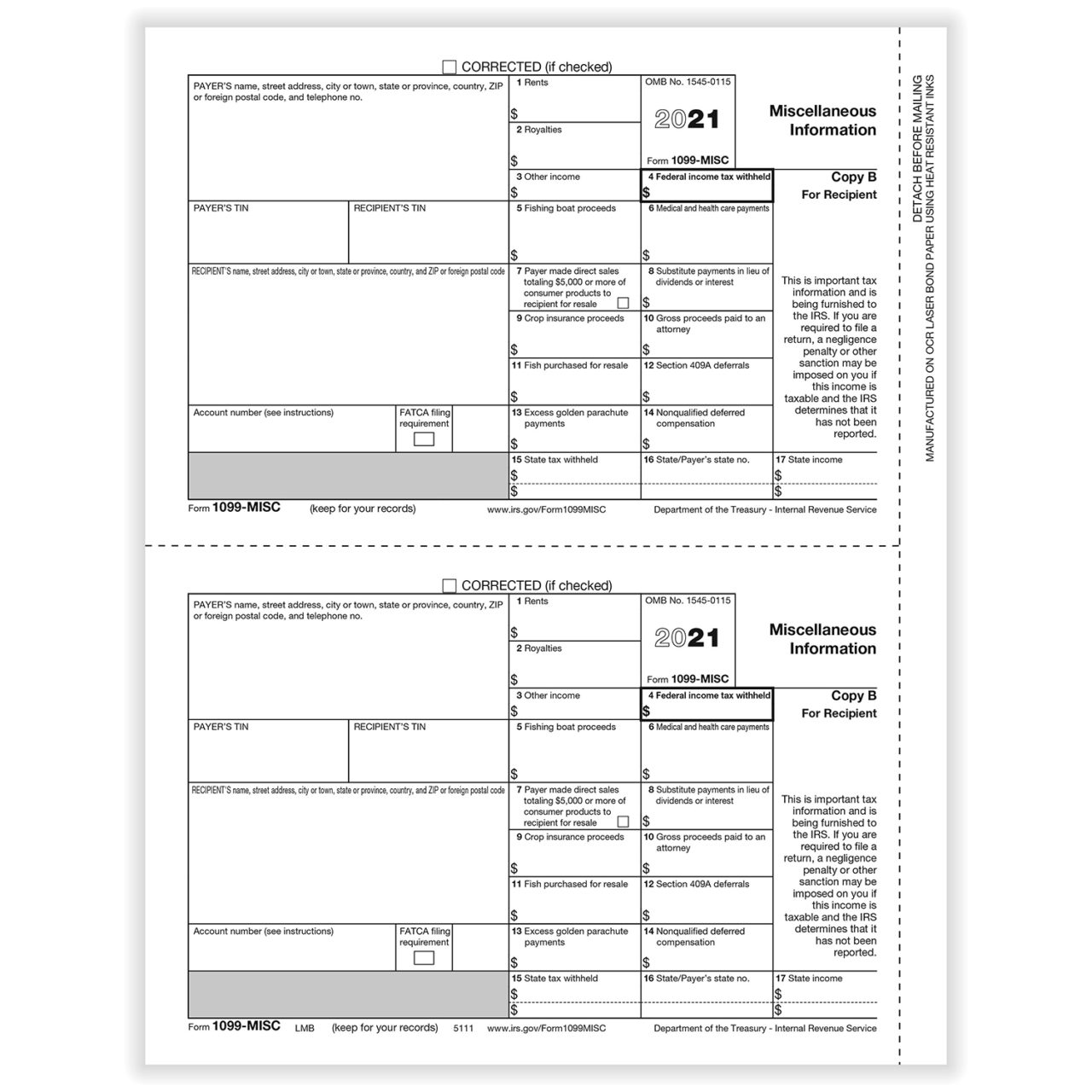

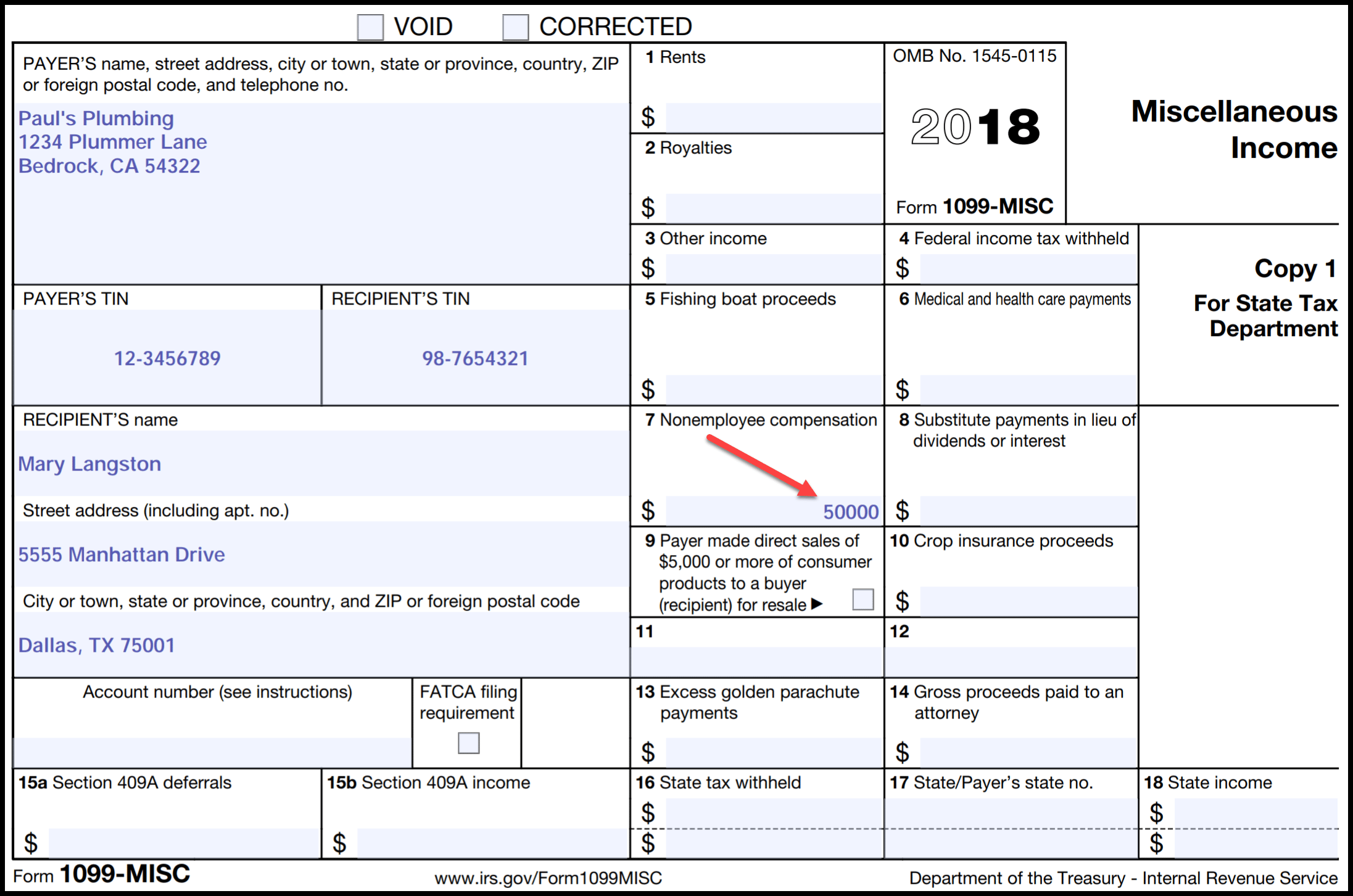

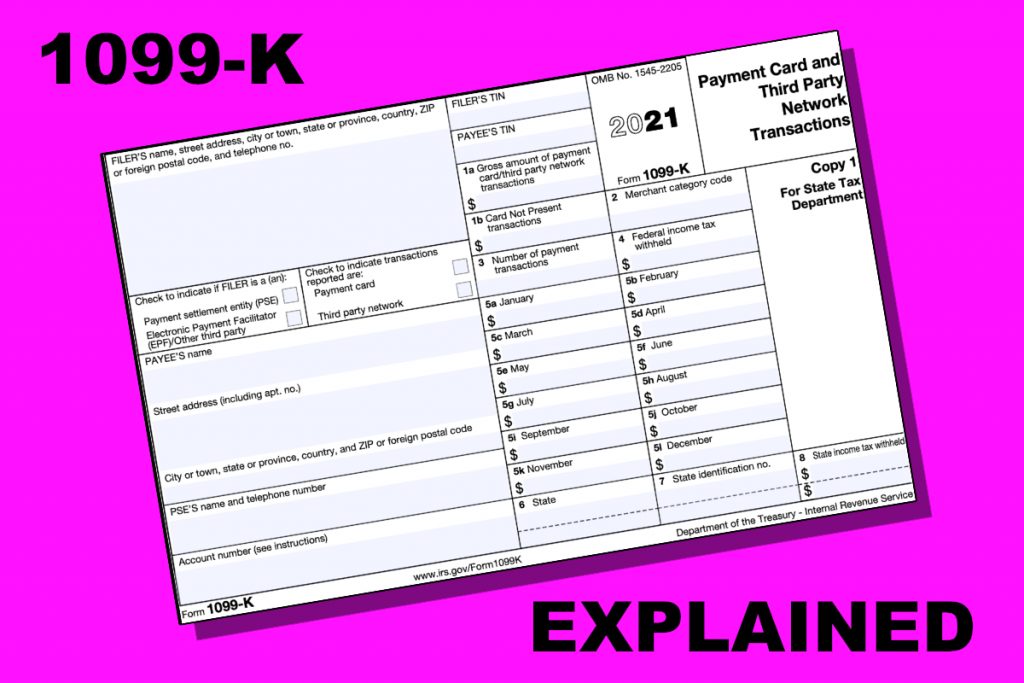

Poshmark 1099 Form - Poshmark's fees poshmark taxes how poshmark sales tax is calculated. Ad approve payroll when you're ready, access employee services & manage it all in one place. Payroll seamlessly integrates with quickbooks® online. Web in order to focus on poshmark’s north america business and drive meaningful growth in its core markets of the united states and canada, the company has made the difficult. Web beginning january 1, 2022, online marketplaces, such as poshmark, will be requiring all sellers who sell more than $600 in one tax year, to report all sales to the irs via a form. Web we would like to show you a description here but the site won’t allow us. Web poshmark 1099 instructions will be given when the 2023 tax program is out but the general concept will be that you report the amount of income from the form you. If you operate multiple poshmark closets, we will combine gross sales totals across all closets as long as the. Like and save for later. On any web browser, go to www.poshmark.com. Tax form for the retail. The winners of any prize with a value of $600 or greater will be issued a 1099 u.s. Web poshmark 1099 instructions will be given when the 2023 tax program is out but the general concept will be that you report the amount of income from the form you. Web beginning january 1, 2022, online. Web go to your account tab (@username).; Web we would like to show you a description here but the site won’t allow us. Do you meet the update threshold requirements? Web this thread is archived. If you operate multiple poshmark closets, we will combine gross sales totals across all closets as long as the. The winners of any prize with a value of $600 or greater will be issued a 1099 u.s. Like and save for later. Web professionals from the kpmg information reporting & withholding tax practice will discuss: Web beginning january 1, 2022, online marketplaces, such as poshmark, will be requiring all sellers who sell more than $600 in one tax year,. Tax form for the retail. Ad approve payroll when you're ready, access employee services & manage it all in one place. Ad read customer reviews & find best sellers. Web poshmark 1099 instructions will be given when the 2023 tax program is out but the general concept will be that you report the amount of income from the form you.. You will report your total gross. Web in order to focus on poshmark’s north america business and drive meaningful growth in its core markets of the united states and canada, the company has made the difficult. If there are no addresses on file, select add default shipping. Web figs yola skinny scrub pants large/tall. Payroll seamlessly integrates with quickbooks® online. The sales from poshmark would be reported on schedule c, business profit, and loss. Web state and local sales tax, when applicable, will be charged on items purchased on poshmark that are shipped to a u.s. If there are no addresses on file, select add default shipping. Sterling silver heart shaped perfume bottle flask. Ad approve payroll when you're ready,. Web this thread is archived. For example, if you're in the business of reselling clothing. Web professionals from the kpmg information reporting & withholding tax practice will discuss: Beside your current address, select change.; If you operate multiple poshmark closets, we will combine gross sales totals across all closets as long as the. For example, if you're in the business of reselling clothing. Poshmark's fees poshmark taxes how poshmark sales tax is calculated. Like and save for later. Web the sweepstakes is sponsored by poshmark, inc. The winners of any prize with a value of $600 or greater will be issued a 1099 u.s. Ad read customer reviews & find best sellers. If there are no addresses on file, select add default shipping. Web figs yola skinny scrub pants large/tall. Your gross sales are what your buyers pay for their orders before any expenses are. On any web browser, go to www.poshmark.com. Tax form for the retail. The sales from poshmark would be reported on schedule c, business profit, and loss. The winners of any prize with a value of $600 or greater will be issued a 1099 u.s. You will report your total gross. For example, if you're in the business of reselling clothing. Web poshmark 1099 instructions will be given when the 2023 tax program is out but the general concept will be that you report the amount of income from the form you. Like and save for later. Web figs yola skinny scrub pants large/tall. Ad approve payroll when you're ready, access employee services & manage it all in one place. Beside your current address, select change.; Ad read customer reviews & find best sellers. On any web browser, go to www.poshmark.com. You will report your total gross. The sales from poshmark would be reported on schedule c, business profit, and loss. Web beginning january 1, 2022, online marketplaces, such as poshmark, will be requiring all sellers who sell more than $600 in one tax year, to report all sales to the irs via a form. Payroll seamlessly integrates with quickbooks® online. Web professionals from the kpmg information reporting & withholding tax practice will discuss: Web we would like to show you a description here but the site won’t allow us. Web state and local sales tax, when applicable, will be charged on items purchased on poshmark that are shipped to a u.s. Your gross sales are what your buyers pay for their orders before any expenses are. Web in order to focus on poshmark’s north america business and drive meaningful growth in its core markets of the united states and canada, the company has made the difficult. Tax form for the retail. Web the sweepstakes is sponsored by poshmark, inc. The amount of sales tax charged on. The form contains information, for your tax return, about the gross amount of payment transactions that you.How To Fill Out A 1099 B Tax Form Universal Network

FPPA 1099R Forms

Understanding Your Form 1099K FAQs for Merchants Clearent

1099 Forms, Poshmark, and Taxes A Seller's Guide

Poshmark Fees and Poshmark Taxes Explained Closet Assistant

1099MISC Recipient Copy B LMB Forms & Fulfillment

Sample 1099 Letter To Vendors

FAQ What is a 1099 K? Pivotal Payments

1099K Forms What eBay, Etsy, and Online Sellers Need to Know

Time for 1099's. Do you know the rules? Colby Rebel

Related Post: