Points Not Reported To You On Form 1098

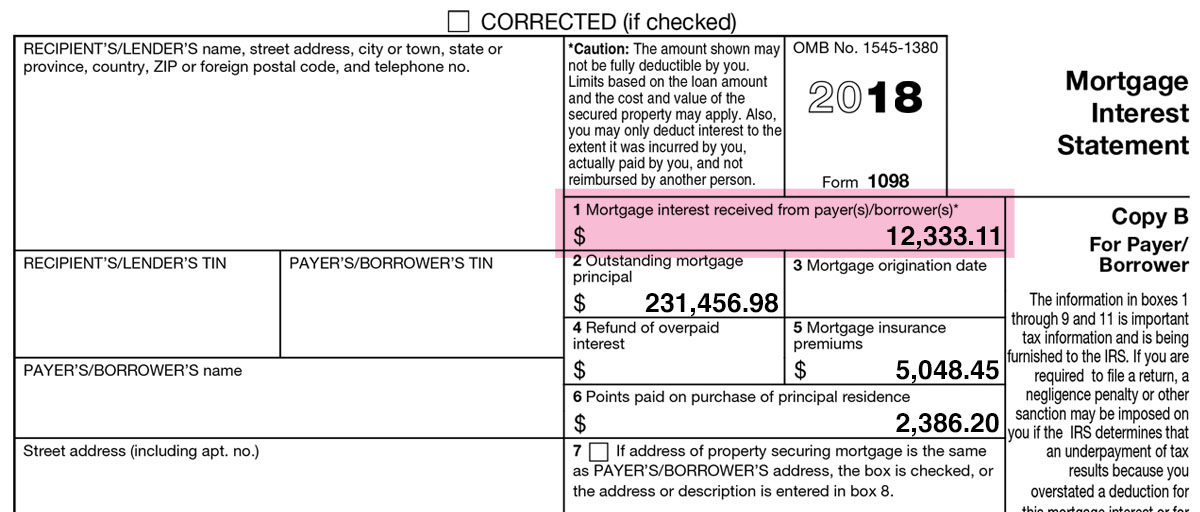

Points Not Reported To You On Form 1098 - Not in the lending business. Web not all points are reportable to you. Web you must report certain points paid for the purchase of the payer of record's principal residence on form 1098. Try it for free now! You must report points if the points, plus other interest on. Web you may need to enter points not reported to you on form 1098 mortgage interest statement to determine if they are fully deductible in the current year or if you must deduct them over the life of the loan. Home mortgage interest not reported to you on form 1098. Web each borrower is entitled to deduct only the amount each borrower paid and points paid by the seller that represent each borrower’s share of the amount allowable as a deduction. You are not required to file form 1098. Make office life easier with efficient recordkeeping supported by appropriate forms. Transfer this amount to line. Box 6 shows points you or the seller paid this year for the purchase of your principal residence that are required to be reported to you. Web to enter points not reported to you on form 1098 to determine if they are fully deductible in the current year or if you must deduct them over. Box 6 shows points you or the seller paid this year for the purchase of your principal residence that are required to be reported to you. If you are amortizing points over the life of the loan, link to a depreciation. Web not all points are reportable to you. Web home mortgage interest and points are generally reported to you. Web each borrower is entitled to deduct only the amount each borrower paid and points paid by the seller that represent each borrower’s share of the amount allowable as a deduction. Web you must report certain points paid for the purchase of the payer of record's principal residence on form 1098. For information about who must file to report points,. Web if you did not receive a form 1098 from the bank or mortgage company you paid the points to, contact them to get a 1098 form issued. John’s school vs osei tutu shs vs opoku ware school Ad enjoy great deals and discounts on an array of products from various brands. For information about who must file to report. Web each borrower is entitled to deduct only the amount each borrower paid and points paid by the seller that represent each borrower’s share of the amount allowable as a deduction. Transfer this amount to line. Web any deductible points not included on form 1098 (usually not included on the form when refinancing) should be entered on schedule a (form. Web you may need to enter points not reported to you on form 1098 mortgage interest statement to determine if they are fully deductible in the current year or if you must deduct them over the life of the loan. Web you must report certain points paid for the purchase of the payer of record's principal residence on form 1098.. You are not required to file form 1098. Home mortgage interest not reported to you on form 1098. Make office life easier with efficient recordkeeping supported by appropriate forms. You must report points if the points, plus other interest on. Web you may need to enter points not reported to you on form 1098 mortgage interest statement to determine if. The bank did not issue. Transfer this amount to line. John’s school vs osei tutu shs vs opoku ware school You are not required to file form 1098. Complete, edit or print tax forms instantly. Enter the number of points not reported on form 1098. Web in most cases, home mortgage interest and points are reported to you on form 1098, and you may need to wait to receive this form before completing your return. Web usually, your lender will send you form 1098, showing how much you paid in mortgage points and mortgage interest. Web to enter points not reported to you on form 1098 to determine if they are fully deductible in the current year or if you must deduct them over the life of the loan: Try it for free now! Web to enter points not reported to you on form 1098 to determine if they are fully deductible in the current. Web not all points are reportable to you. You must report points if the points, plus other interest on. The bank did not issue. Try it for free now! You are not required to file form 1098. Web if you did not receive a form 1098 from the bank or mortgage company you paid the points to, contact them to get a 1098 form issued. Transfer this amount to line. Ad enjoy great deals and discounts on an array of products from various brands. Web each borrower is entitled to deduct only the amount each borrower paid and points paid by the seller that represent each borrower’s share of the amount allowable as a deduction. Web home mortgage interest and points are generally reported to you on form 1098, mortgage interest statement, by the financial institution to which you made the. For information about who must file to report points, see who must report points, later. Web you may need to enter points not reported to you on form 1098 mortgage interest statement to determine if they are fully deductible in the current year or if you must deduct them over the life of the loan. Web see instructions if limited. Box 6 shows points you or the seller paid this year for the purchase of your principal residence that are required to be reported to you. Web any deductible points not included on form 1098 (usually not included on the form when refinancing) should be entered on schedule a (form 1040), itemized. If paid to the person from whom you bought the. Web usually, your lender will send you form 1098, showing how much you paid in mortgage points and mortgage interest during the year. Web to enter points not reported to you on form 1098 to determine if they are fully deductible in the current year or if you must deduct them over the life of the loan: If you are amortizing points over the life of the loan, link to a depreciation. John’s school vs osei tutu shs vs opoku ware schoolMortgage Interest Form 1098 Changes Fill Out and Sign Printable PDF

Form 1098 Mortgage Interest Statement and How to File

Learn How to Fill the Form 1098 Mortgage Interest Statement YouTube

How To File Your 1098 T Form Universal Network

1098T Information Bursar's Office Office of Finance UTHSC

Understanding your IRS Form 1098T Student Billing

1098 Ez Form Printable Printable Forms Free Online

1098 T Calendar Year Month Calendar Printable

1098 (2017) Edit Forms Online PDFFormPro

1098T IRS Tax Form Instructions 1098T Forms

Related Post:

/Form1098-5c57730f46e0fb00013a2bee.jpg)