Partnership Extension Form

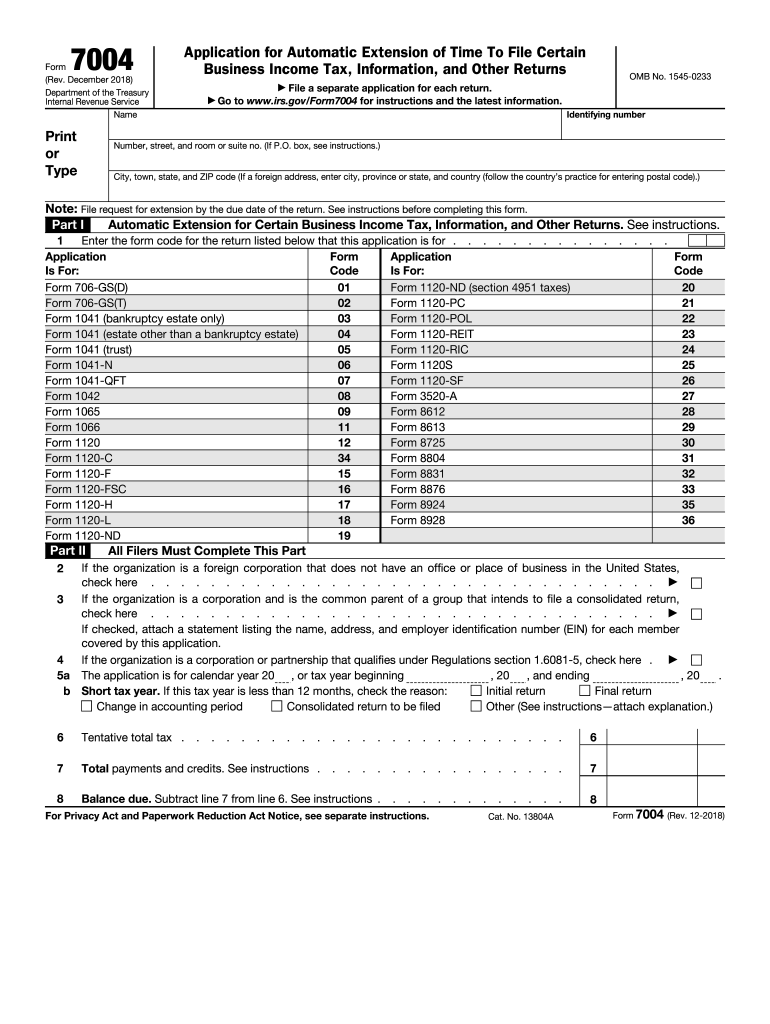

Partnership Extension Form - Web if your business is organized as a partnership, your income tax return or extension is due by the 15th day of the 3rd month after the end of your tax year. Web forms for partnerships. Web a florida partnership is a partnership doing business, earning income, or existing in florida. Provide your basic business details such as business name, address, and tin. Contact us to get a paper form if you can't file online. Application for automatic extension of time to file corporation, partnership, and exempt organization returns. Web partnership tax forms and instructions. Use an automatic extension form to make a payment if both of the following apply: Web if a partnership cannot file form 565, partnership return of income, by the return’s due date, the partnership is granted an automatic seven month extension. File request for extension by the due date. Web a florida partnership is a partnership doing business, earning income, or existing in florida. When must the 7004 be filed? Provide your basic business details such as business name, address, and tin. The partnership, as an entity, may need to file the forms below. Web only individuals, partnerships and fiduciaries filing a calendar year return can request extensions online. Provide your basic business details such as business name, address, and tin. To ensure you are able to view and fill out forms, please save forms to your computer and use the latest version of adobe acrobat. Web to request a 1065 extension, you need to fill out form 7004 with the below information. Web only individuals, partnerships and fiduciaries. To ensure you are able to view and fill out forms, please save forms to your computer and use the latest version of adobe acrobat. A 1065 extension must be filed by midnight local time on the normal due date of the. Web partnership tax forms and instructions. Web if a partnership cannot file form 565, partnership return of income,. Web partnership tax forms and instructions. Web about form 1065, u.s. Partnerships file an information return to report their income, gains, losses, deductions, credits, etc. To ensure you are able to view and fill out forms, please save forms to your computer and use the latest version of adobe acrobat. Web if a partnership cannot file form 565, partnership return. Partnerships file an information return to report their income, gains, losses, deductions, credits, etc. Web forms for partnerships. If an extension has been granted for federal purposes, the extension is also granted for alabama purposes; An extension to file your tax return is not an extension to pay. Use an automatic extension form to make a payment if both of. Contact us to get a paper form if you can't file online. Web forms for partnerships. A 1065 extension must be filed by midnight local time on the normal due date of the. Web application for automatic extension of time to file certain business income tax, information, and other returns. Web file form 7004, application for automatic extension of time. To file for an llc extension, file form 7004: Partnerships file an information return to report their income, gains, losses, deductions, credits, etc. If an extension has been granted for federal purposes, the extension is also granted for alabama purposes; The partnership, as an entity, may need to file the forms below. Application for automatic extension of time to file. Web if a partnership cannot file form 565, partnership return of income, by the return’s due date, the partnership is granted an automatic seven month extension. Web information about form 7004, application for automatic extension of time to file certain business income tax, information, and other returns, including recent updates, related. Web file form 7004, application for automatic extension of. A 1065 extension must be filed by midnight local time on the normal due date of the. When must the 7004 be filed? To file for an llc extension, file form 7004: To ensure you are able to view and fill out forms, please save forms to your computer and use the latest version of adobe acrobat. Use an automatic. A 1065 extension must be filed by midnight local time on the normal due date of the. File request for extension by the due date. Web about form 1065, u.s. Contact us to get a paper form if you can't file online. Web select the appropriate form from the table below to determine where to send the form 7004, application. Web a florida partnership is a partnership doing business, earning income, or existing in florida. Web forms for partnerships. The partnership, as an entity, may need to file the forms below. When must the 7004 be filed? Electronic filing and payment options. Web select the appropriate form from the table below to determine where to send the form 7004, application for automatic extension of time to file certain business. Web if a partnership cannot file form 565, partnership return of income, by the return’s due date, the partnership is granted an automatic seven month extension. A 1065 extension must be filed by midnight local time on the normal due date of the. Use an automatic extension form to make a payment if both of the following apply: Web only individuals, partnerships and fiduciaries filing a calendar year return can request extensions online. Web file form 7004, application for automatic extension of time to file certain business income tax, information, and other returns, to request an extension of time to file. Provide your basic business details such as business name, address, and tin. Web if your business is organized as a partnership, your income tax return or extension is due by the 15th day of the 3rd month after the end of your tax year. Application for automatic extension of time to file certain business income tax information, and other returns. Web to request a 1065 extension, you need to fill out form 7004 with the below information. Web application for automatic extension of time to file certain business income tax, information, and other returns. Web about form 1065, u.s. Application for automatic extension of time to file corporation, partnership, and exempt organization returns. Contact us to get a paper form if you can't file online. Web partnership tax forms and instructions.Form 7004 Fill Out and Sign Printable PDF Template signNow

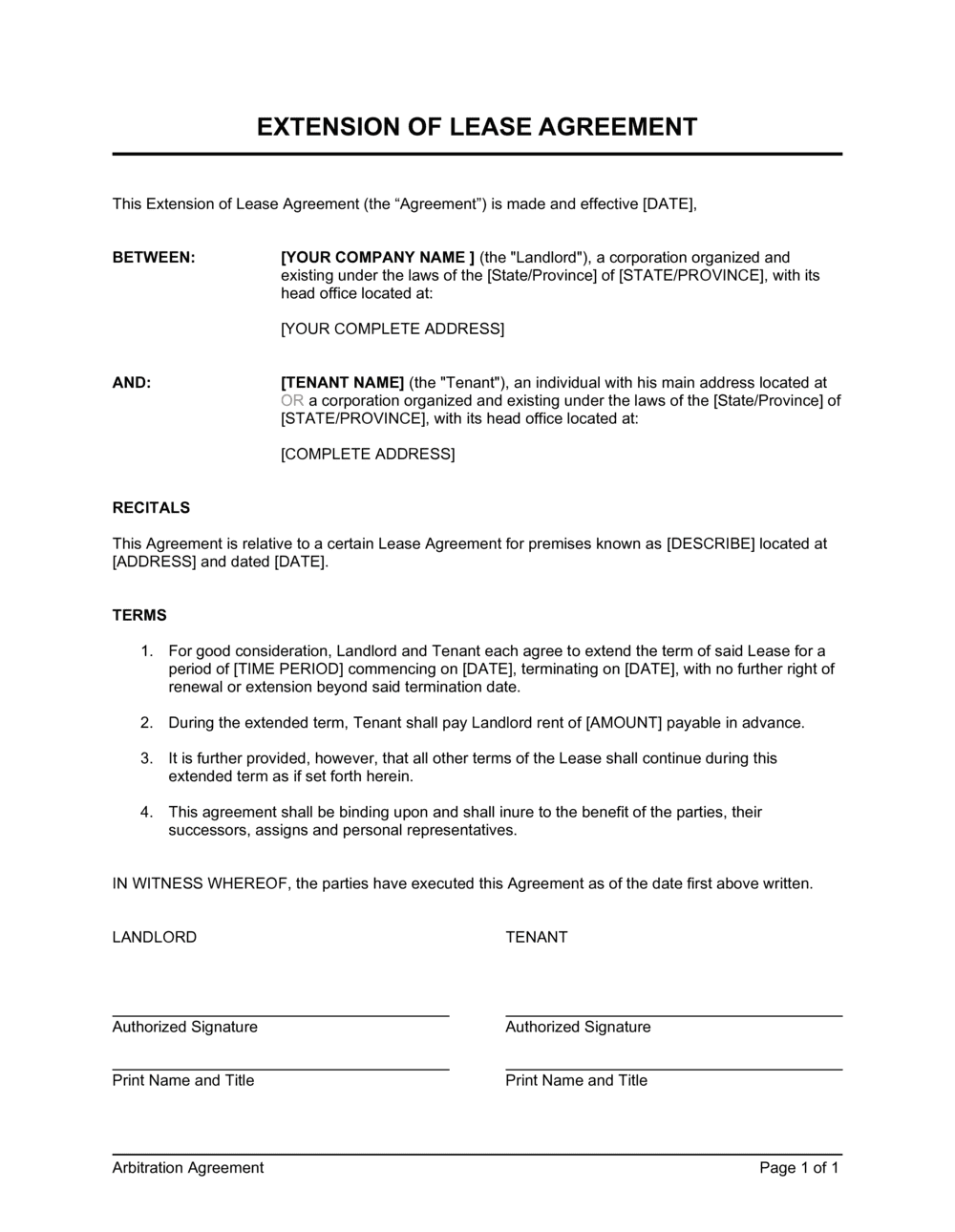

Free Printable Lease Extension Agreement Printable World Holiday

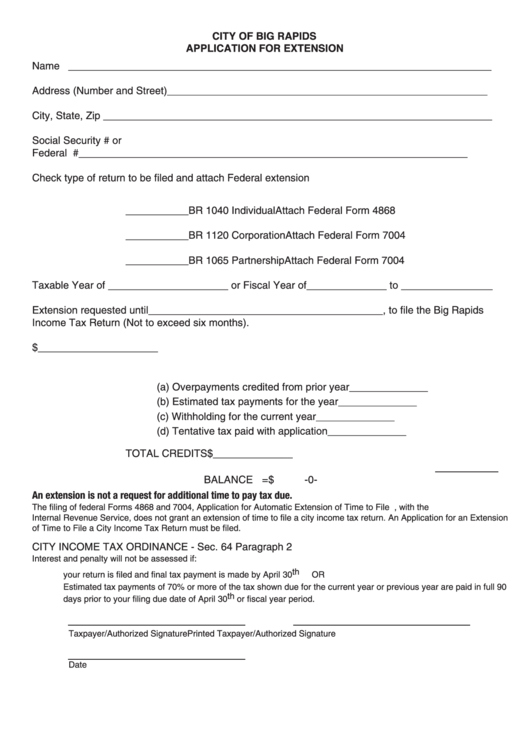

2014 Application For Extension Form printable pdf download

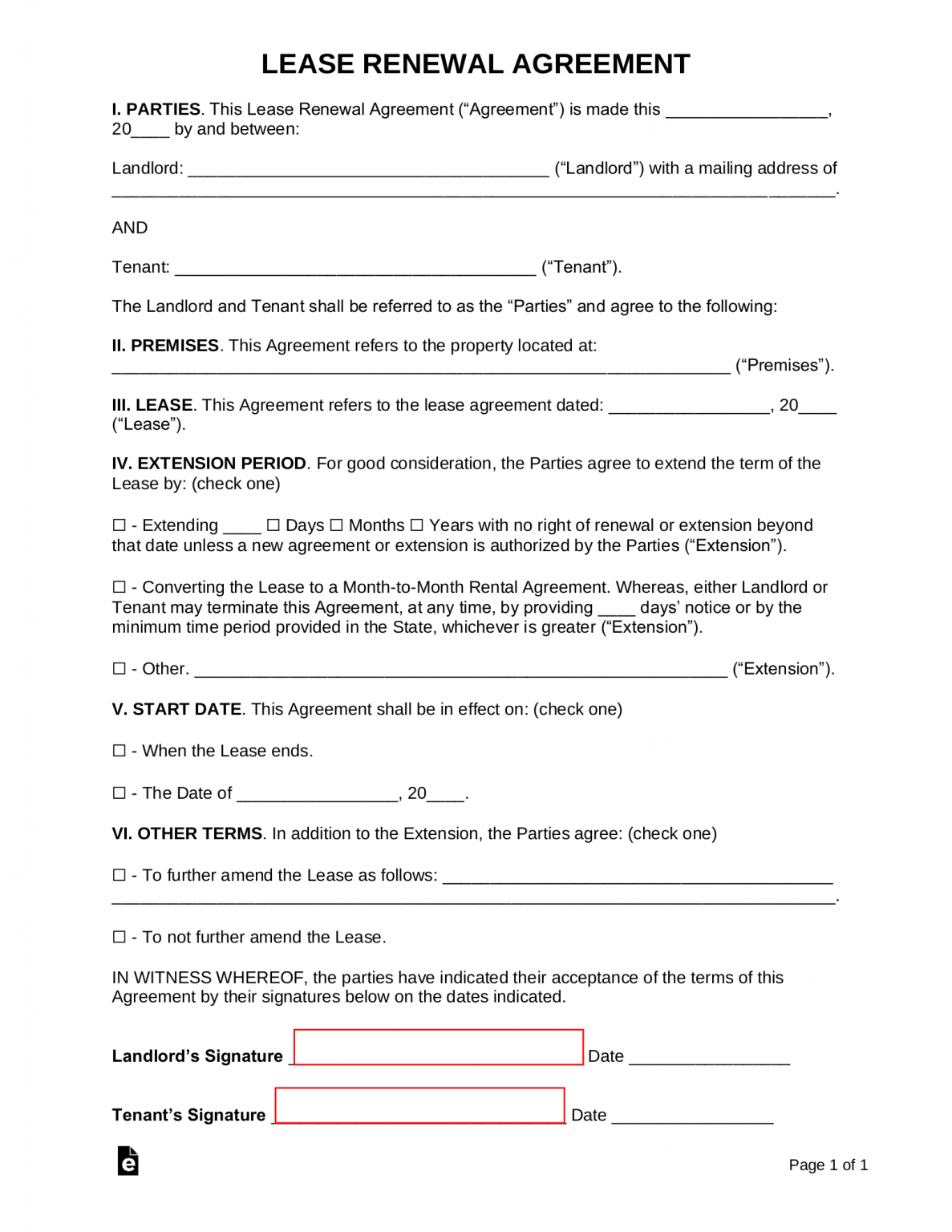

Free Printable Lease Extension Agreement Printable World Holiday

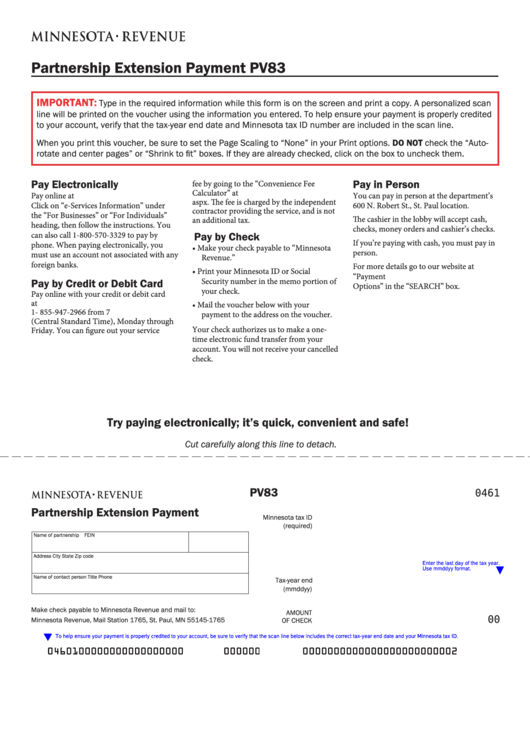

Fillable Form Pv83 Partnership Extension Payment printable pdf download

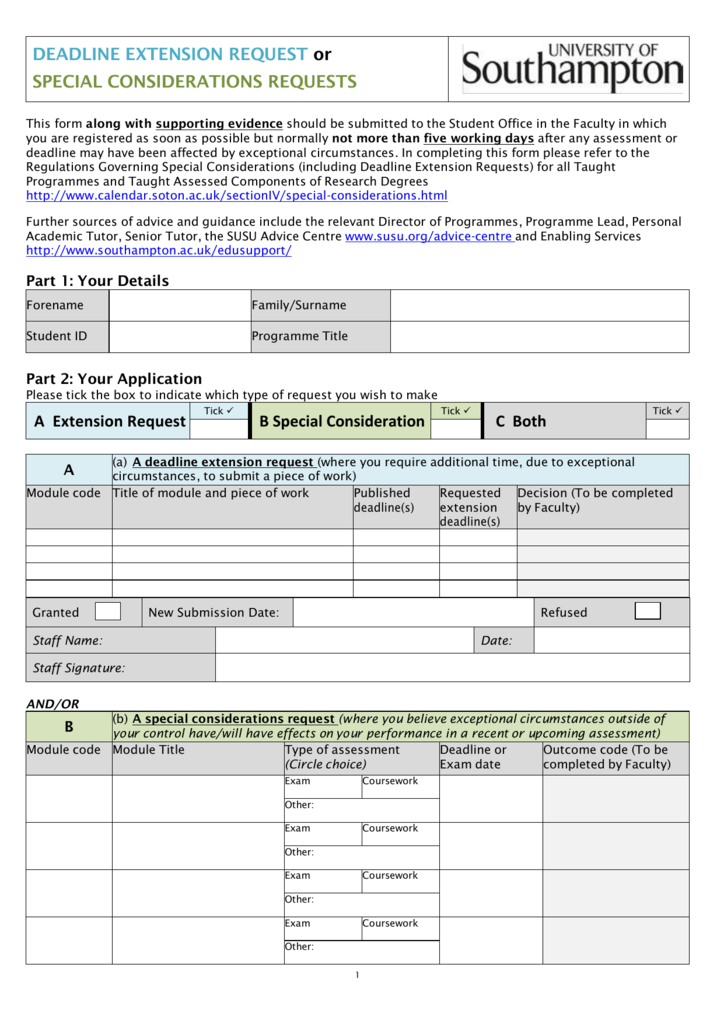

A Extension Request

FREE 15+ Sample Partnership Agreement Templates in PDF MS Word

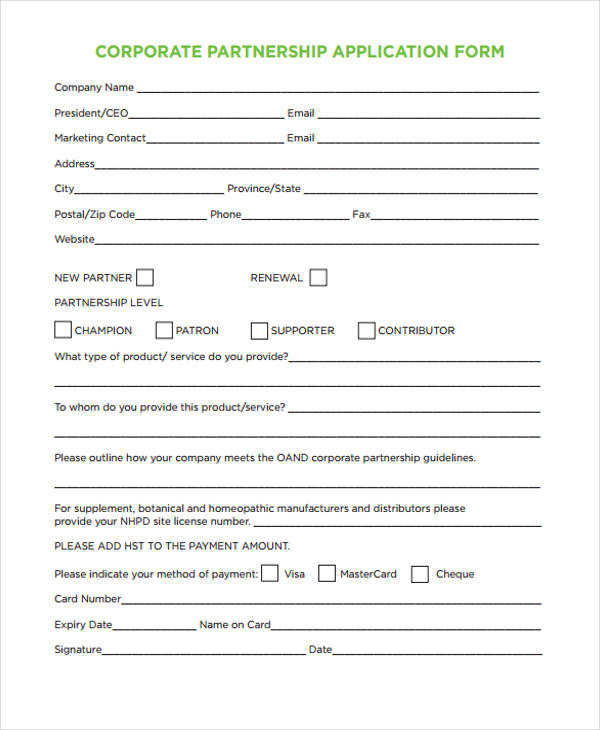

FREE 13+ Sample Partnership Application Forms in PDF MS Word

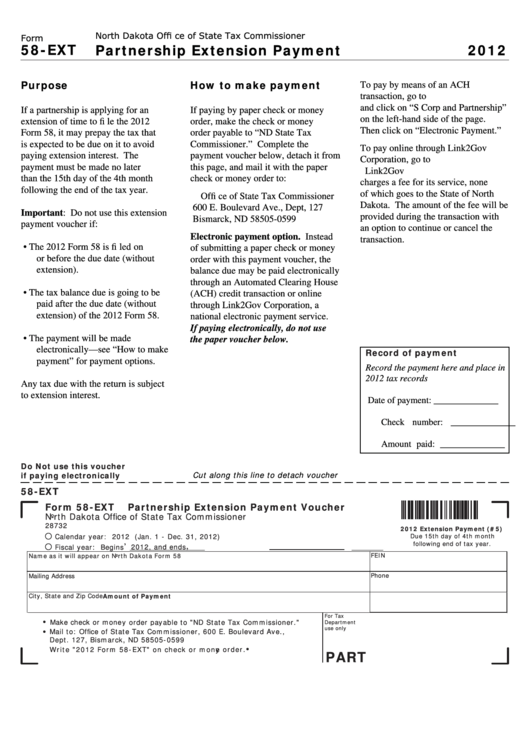

Fillable Form 58Ext Partnership Extension Payment 2012 printable

extension contract agreement Doc Template pdfFiller

Related Post: