Osu Tax Exempt Form

Osu Tax Exempt Form - You will need to attach a valid ohio sales and use tax exemption certificate that includes. Web since osu is exempt statutorily, it does not have to apply for and receive an exemption from tax (i.e., the administrative procedure whereby it would apply and receive a. Web sales and use tax blanket exemption certificate. Osu’s division of agricultural sciences and natural resources and the oklahoma cooperative extension service have sponsored the annual farm &. Web complete the exemption form, accessed at the button below, when staying in columbus accommodations on university business. United states tax exemption form; Sales and use tax blanket exemption certificate. The purchaser hereby claims exception or exemption on all purchases of tangible personal property and selected services made. Web select the button below to access specific tax office forms, such as: Web to make tuition payments or submit scholarship checks, please visit buckeye link located on the first floor of the student academic services building, 281 w. Web the osu tax exemption flows from code §115 and the rule that federal tax provisions do not apply to integral units of state government, unless the code expressly makes the. If you are claiming only a. Work state and work local tax withholdings. Find the list on the. Office of business and finance. If you are claiming only a. Web form 348 from prior tax years, you do not have to claim the maximum allowable credit on form 323 to use a only carryover amount on form 348. Web dod preferred hotels are required to provide the required tax exempt forms in states where the federal government is tax exempt when using the. Web select the button below to access specific tax office forms, such as: Web dod preferred hotels are required to provide the required tax exempt forms in states where the federal government is tax exempt when using the gtcc. Osu’s division of agricultural sciences and natural resources and the oklahoma cooperative extension service have sponsored the annual farm &. Work. Web united states tax exemption form. You should identify the university’s exemption status before your purchase to ensure. Find the list on the. If staying in another ohio city, please contact. Web to make tuition payments or submit scholarship checks, please visit buckeye link located on the first floor of the student academic services building, 281 w. Web united states tax exemption form. The purchaser hereby claims exception or exemption on all purchases of tangible personal property and. If you are claiming only a. Osu’s division of agricultural sciences and natural resources and the oklahoma cooperative extension service have sponsored the annual farm &. Web to make tuition payments or submit scholarship checks, please visit buckeye link. Web sales and use tax blanket exemption certificate | office of business and finance. United states tax exemption form; Find the list on the. Web to make tuition payments or submit scholarship checks, please visit buckeye link located on the first floor of the student academic services building, 281 w. You should identify the university’s exemption status before your purchase. The purchaser hereby claims exception or exemption on all purchases of tangible personal property and selected services made. United states tax exemption form; Web select the button below to access specific tax office forms, such as: Web to make tuition payments or submit scholarship checks, please visit buckeye link located on the first floor of the student academic services building,. Web dod preferred hotels are required to provide the required tax exempt forms in states where the federal government is tax exempt when using the gtcc. Web complete the exemption form, accessed at the button below, when staying in columbus accommodations on university business. Web to make tuition payments or submit scholarship checks, please visit buckeye link located on the. The purchaser hereby claims exception or exemption on all purchases of tangible personal property and. The university is tax exempt in the state of ohio and other states. Web select the button below to access specific tax office forms, such as: Web sales and use tax blanket exemption certificate. Web complete the exemption form, accessed at the button below, when. The purchaser hereby claims exception or exemption on all purchases of tangible personal property and. If staying in another ohio city, please contact. Sales and use tax blanket exemption certificate. You should identify the university’s exemption status before your purchase to ensure. The purchaser hereby claims exception or exemption on all purchases of tangible personal property and. The purchaser hereby claims exception or exemption on all purchases of tangible personal property and selected services made. Web since osu is exempt statutorily, it does not have to apply for and receive an exemption from tax (i.e., the administrative procedure whereby it would apply and receive a. Web select the button below to access specific tax office forms, such as: You should identify the university’s exemption status before your purchase to ensure. Osu’s division of agricultural sciences and natural resources and the oklahoma cooperative extension service have sponsored the annual farm &. Web form 348 from prior tax years, you do not have to claim the maximum allowable credit on form 323 to use a only carryover amount on form 348. Web sales and use tax blanket exemption certificate | office of business and finance. The entities that qualify for sales tax exemption. Web sales and use tax blanket exemption certificate. The purchaser hereby claims exception or exemption on all purchases of tangible personal property and. The university is tax exempt in the state of ohio and other states. Find the list on the. United states tax exemption form; If you are claiming only a. Work state and work local tax withholdings. Web united states tax exemption form. Sales and use tax blanket exemption certificate. Web in certain situations, there could be a tax treaty that may exist to exempt an international person from taxes or there may be regulations that allow a reduction in taxes. Web to make tuition payments or submit scholarship checks, please visit buckeye link located on the first floor of the student academic services building, 281 w. You will need to attach a valid ohio sales and use tax exemption certificate that includes.Usda Tax Exempt Form Fill Online, Printable, Fillable, Blank pdfFiller

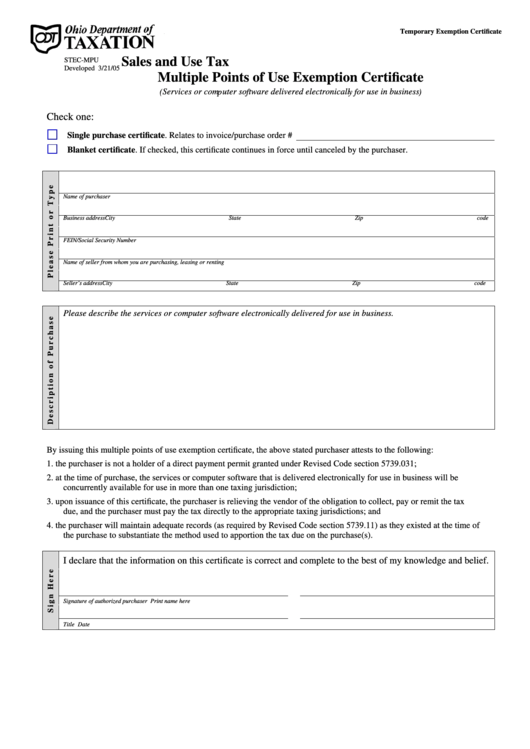

Form StecMpu 2005 Sales And Use Tax Multiple Points Of Use

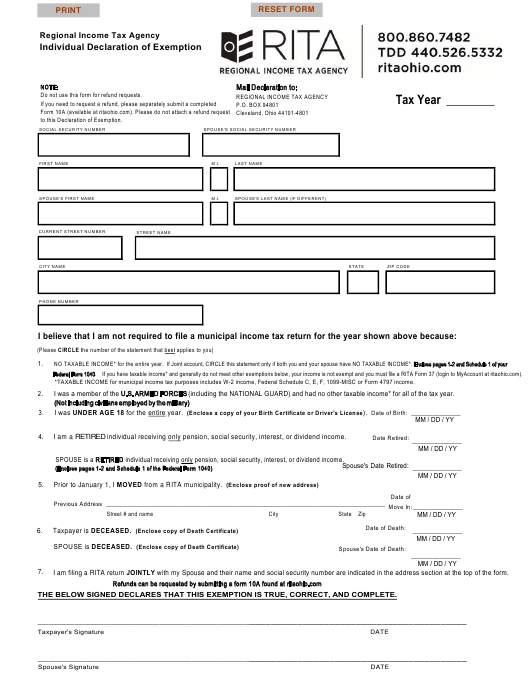

Ohio Tax Exempt Form Fill and Sign Printable Template Online US

Ohio tax exempt certificate Fill out & sign online DocHub

Ohio Employee Tax Withholding Form 2022 2023

Ohio State Tax Dependent Exemption Forms

Get AZ ADEQ Out of State Exemption Form 2013 and fill it out in

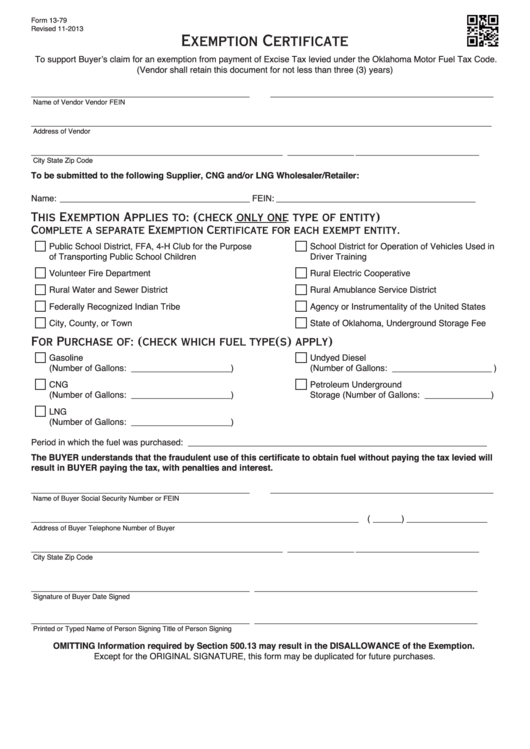

Top 20 Oklahoma Tax Exempt Form Templates free to download in PDF format

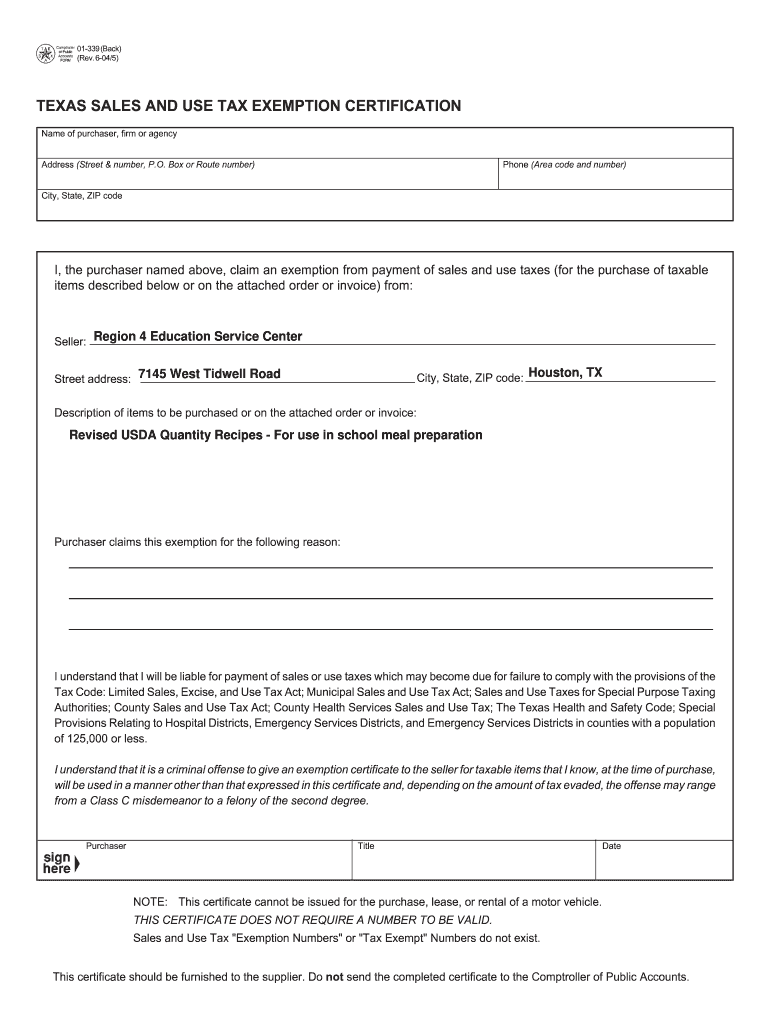

Texas Tax Exempt Certificate Fill And Sign Printable Template Online

Ohio State Tax Forms Printable Master of Documents

Related Post: