Onlyfans Tax Form

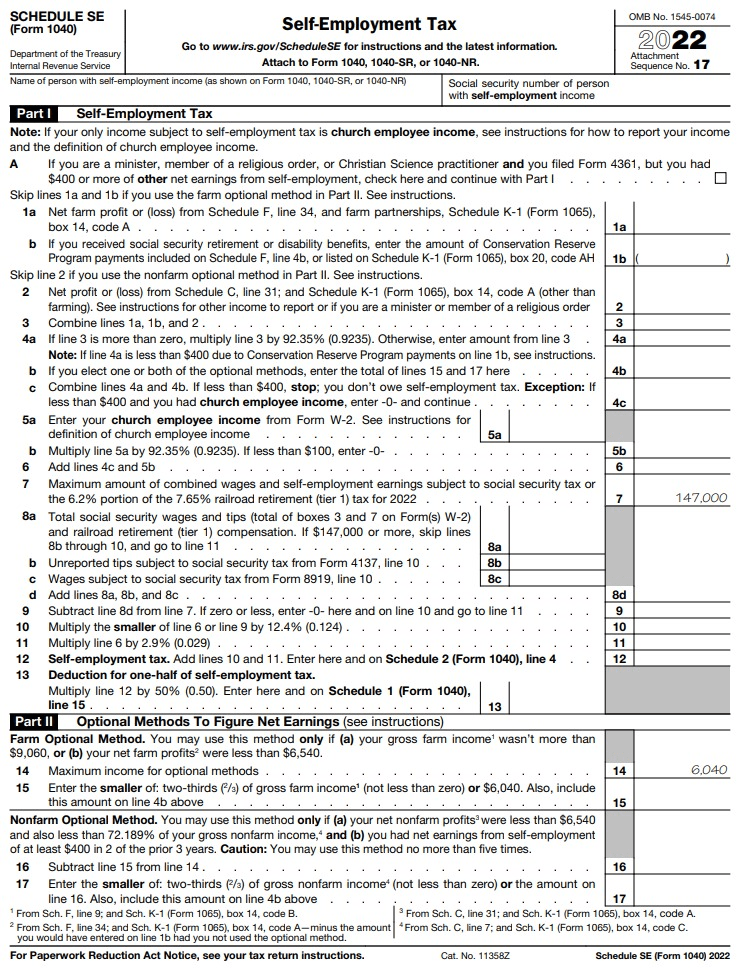

Onlyfans Tax Form - Web onlyfans is the social platform revolutionizing creator and fan connections. Katherine studley is a tax accountant who starting offering tax. Onlyfans will issue you these around tax time. Web as an onlyfans content creator, you will likely receive a 1099 form from the platform if you have earned over $600 in a calendar year. The world of adult entertainment has undergone many. The most common form creators will receive if they earn more. Advertisement another cost is onlyfans' cut, as the platform takes 20%. Web here are the tax forms you'll come across while filing your onlyfans taxes in order: The most common form creators will receive if they earn more than $600 a. Web a digital copy of your 1099 form can be downloaded from your banking page. Web a digital copy of your 1099 form can be downloaded from your banking page. Web here are the tax forms you'll come across while filing your onlyfans taxes in order: Influencers' income is considered to be involved with the business they work for (even if they actually work for. Web onlyfans is the social platform revolutionizing creator and fan. Protect your income and do not fear irs penalties. The world of adult entertainment has undergone many. Ad explore the collection of software at amazon & take your skills to the next level. The internal revenue service will charge you for fees and interests if you don’t. Web onlyfans content creators can expect to receive one or more 1099 forms. Web porn sites how to file onlyfans taxes in 2023 if you’ve started an onlyfans, got verified, and began making fat stacks, you’re well on your way to the high. The site is inclusive of artists and content creators from all genres and allows them to monetize their. Web huldt says she pays 31% tax in california, although many of. Read the article and implement today! Web onlyfans is the social platform revolutionizing creator and fan connections. The most common form creators will receive if they earn more. Free, fast, full version (2023) available! Not sure that the standards are for onlyfans and whether they will give you a 1099misc or not, but if you made over $400 of. You should also receive a copy by mail, or you. Web it’ll be due on the 15th of april, 15th of june, 15th of september, and 15th of january. The site is inclusive of artists and content creators from all genres and allows them to monetize their. This form will report your. We offer a variety of software related to. Web onlyfans content creators can expect to receive one or more 1099 forms at the end of a tax year. This form will report your. We offer a variety of software related to various fields at great prices. The site is inclusive of artists and content creators from all genres and allows them to monetize their. The most common form. Web onlyfans content creators can expect to receive one or more 1099 forms at the end of a tax year. Ad explore the collection of software at amazon & take your skills to the next level. Protect your income and do not fear irs penalties. Web onlyfans content creators can expect to receive one or more 1099 forms at the. We offer a variety of software related to various fields at great prices. Web onlyfans is the social platform revolutionizing creator and fan connections. Katherine studley is a tax accountant who starting offering tax. Web united states in the united states, anyone who makes a yearly income of $600 is subject to paying taxes by filing a 1099 form. Web. You will have to do this yourself (or hire an accountant) it is not automatic; Web onlyfans content creators can expect to receive one or more 1099 forms at the end of a tax year. You should also receive a copy by mail, or you. Web as an onlyfans content creator, you will likely receive a 1099 form from the. Advertisement another cost is onlyfans' cut, as the platform takes 20%. Web porn sites how to file onlyfans taxes in 2023 if you’ve started an onlyfans, got verified, and began making fat stacks, you’re well on your way to the high. The site is inclusive of artists and content creators from all genres and allows them to monetize their. Web. The most common form creators will receive if they earn more than $600 a. Web here are the tax forms you'll come across while filing your onlyfans taxes in order: Web onlyfans content creators can expect to receive one or more 1099 forms at the end of a tax year. Katherine studley is a tax accountant who starting offering tax. Web a digital copy of your 1099 form can be downloaded from your banking page. Web onlyfans is the social platform revolutionizing creator and fan connections. The most common form creators will receive if they earn more. Web i do tax prep for onlyfans creators. Influencers' income is considered to be involved with the business they work for (even if they actually work for. The site is inclusive of artists and content creators from all genres and allows them to monetize their. Ad explore the collection of software at amazon & take your skills to the next level. Web this makes your tax life very simple; Web as an onlyfans content creator, you will likely receive a 1099 form from the platform if you have earned over $600 in a calendar year. Advertisement another cost is onlyfans' cut, as the platform takes 20%. Protect your income and do not fear irs penalties. Web porn sites how to file onlyfans taxes in 2023 if you’ve started an onlyfans, got verified, and began making fat stacks, you’re well on your way to the high. Web it’ll be due on the 15th of april, 15th of june, 15th of september, and 15th of january. Onlyfans will issue you these around tax time. Web united states in the united states, anyone who makes a yearly income of $600 is subject to paying taxes by filing a 1099 form. Read the article and implement today!How to file OnlyFans taxes (W9 and 1099 forms explained)

How to file OnlyFans taxes (W9 and 1099 forms explained)

OnlyFans Taxes What Taxes Do I File? [2024 US Guide]

Memo OnlyFans & Myystar Creators Business Set Up and Tax Filing Tips

OnlyFans ordered to pony up in UK tax case Courthouse News Service

How I File My ONLYFANS TAXES! YouTube

Filing taxes for onlyfans 👉👌5 steps for getting started on OnlyFans

How to do Taxes for Onlyfans! +advice to save on them YouTube

OnlyFans Taxes What Taxes Do I File? [2023 US Guide]

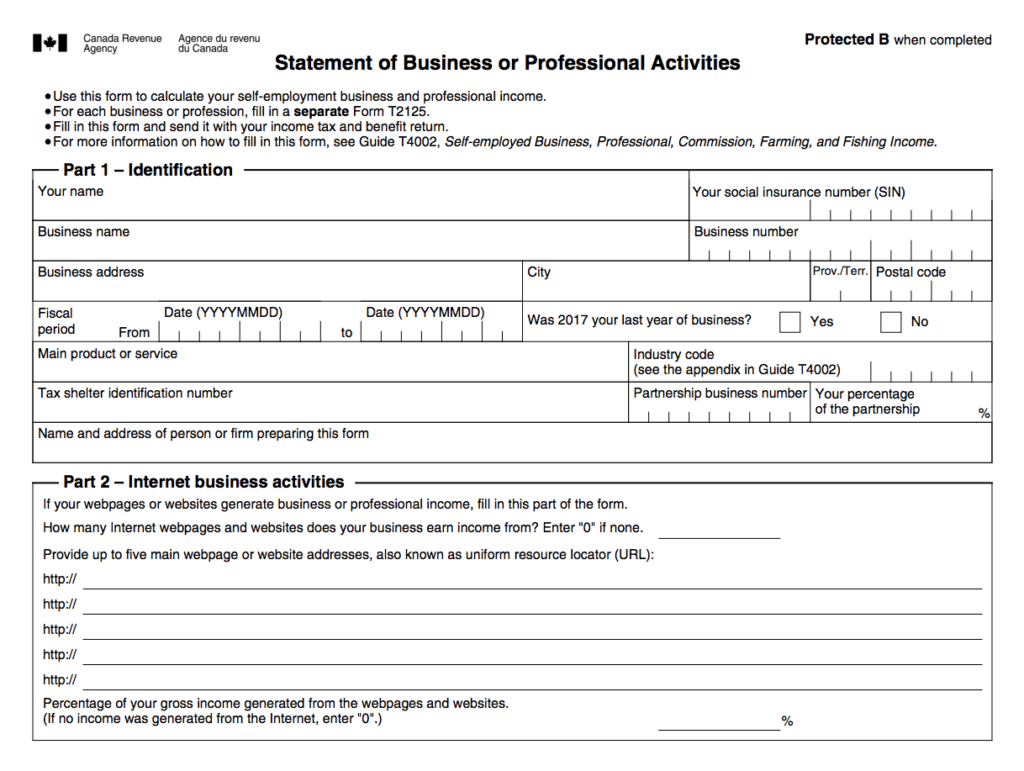

OnlyFans Creators Canadian Tax Guide Vlogfluence

Related Post:

![OnlyFans Taxes What Taxes Do I File? [2024 US Guide]](https://freecashflow.io/wp-content/uploads/2021/11/W-9.png)

![OnlyFans Taxes What Taxes Do I File? [2023 US Guide]](https://freecashflow.io/wp-content/uploads/2021/06/The-Complete-Guide-1.png)