Ohio Form It 1140

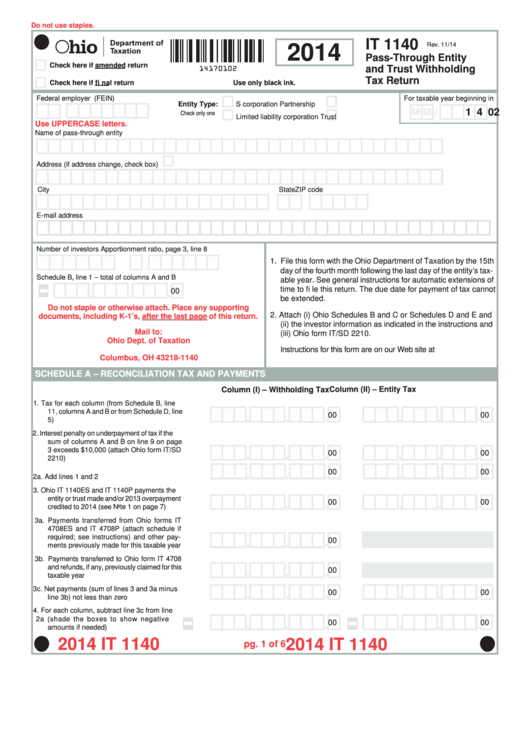

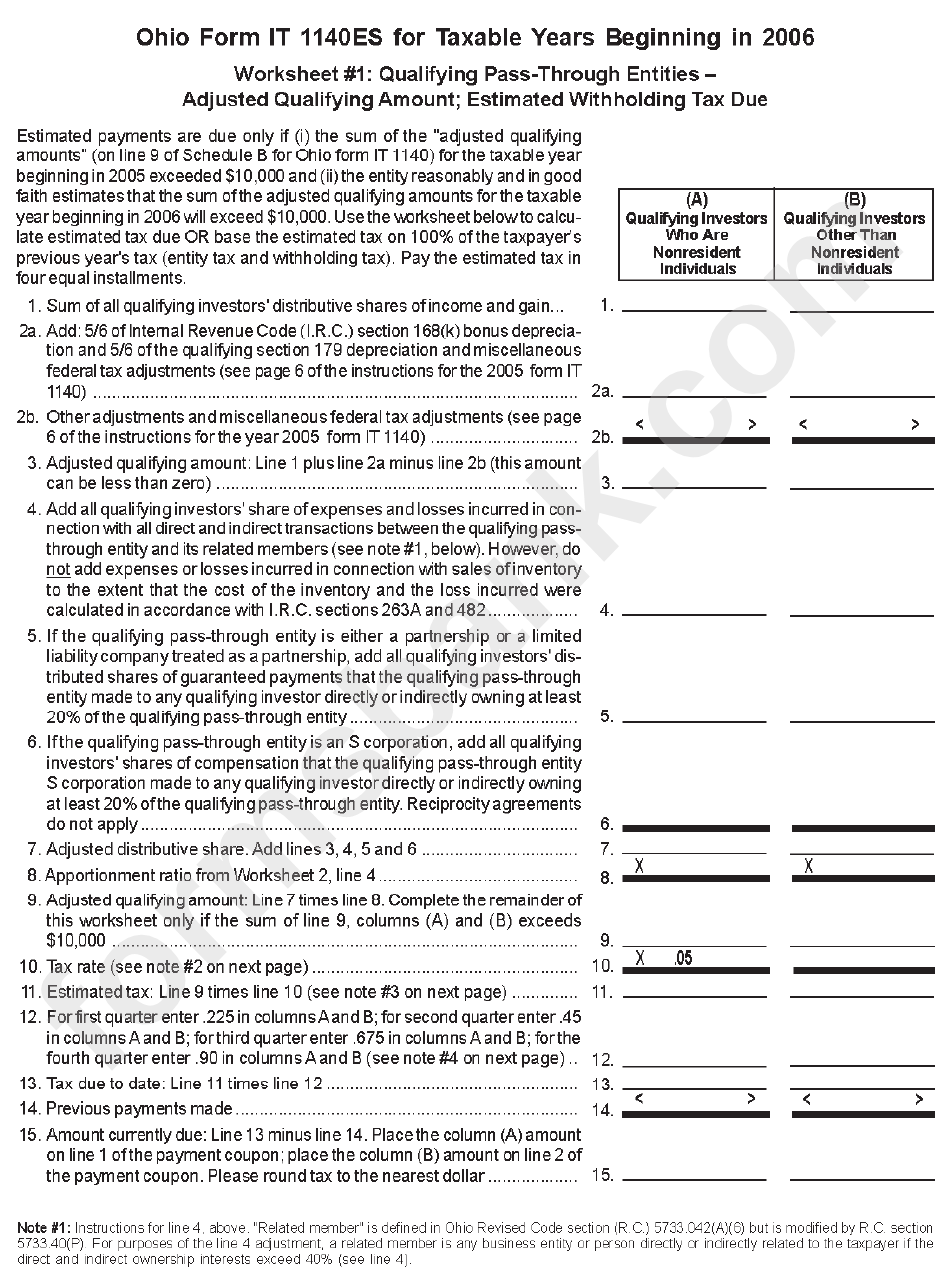

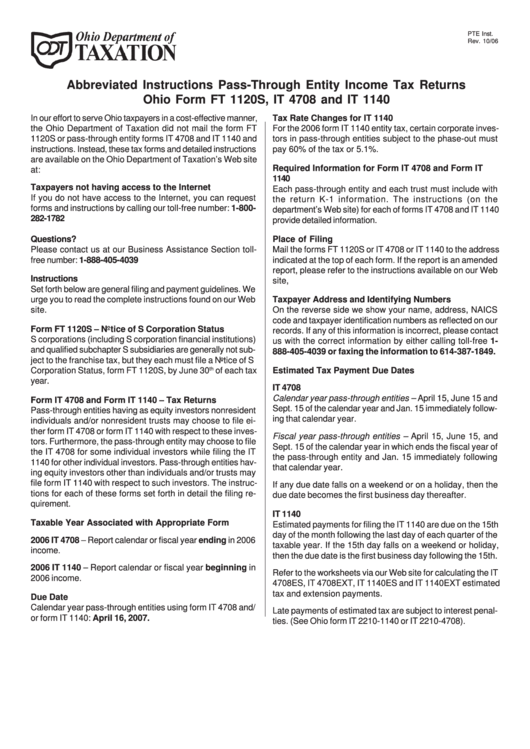

Ohio Form It 1140 - To get these returns to calculate, you must have a partner marked in view > partner information for the proper return. Instructions for this form are. Web the it 4738 will have a line to transfer estimated payments made on the it 1140 or it 4708 forms. The instructions give a detailed list of who is not a qualified investor, one of which is any. Of 7 do not write in this area; Ohio withholding overpayments can also be applied to the new. Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the revenue. Electronic filing for ohio it 1140. Read the following instructions to use cocodoc to start editing and filling out your ohio it 1140: The individual is required to file an it 1040 to claim the withholding. Web ohio it 1140 estimated (upc/electronic) payments and 2021 overpayment credited to 2022. Web 2021 ohio it 1140 rev. It will take several months for the department to process your paper return. Address check here if address changed. The individual is required to file an it 1040 to claim the withholding. Web go to ohio > form oh1. Web how to edit and sign ohio it 1140 online. Of 7 do not write in this area; This form is for income earned in tax year 2022, with tax returns due in april. From the input return tab, go to state & local ⮕ other forms ⮕ oh passthrough / composite rtrn. Web 2021 ohio it 1140 rev. 11/08/21 2021 it 1140 pg. Instructions for this form are. Web the it 4738 will have a line to transfer estimated payments made on the it 1140 or it 4708 forms. To get these returns to calculate, you must have a partner marked in view > partner information for the proper return. Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the revenue. Web the it 4738 will have a line to transfer estimated payments made on the it 1140 or it 4708 forms. Web ohio it 1040 and sd 100 forms. Web should the pte file the it 1140? The individual is required. Web form it 1140es is an ohio corporate income tax form. Electronic filing for ohio it 1140. For faster processing, we recommend you submit your return. Ohio withholding overpayments can also be applied to the new. Web the it 4738 will have a line to transfer estimated payments made on the it 1140 or it 4708 forms. 11/08/21 2021 it 1140 pg. Web should the pte file the it 1140? Of 7 do not write in this area; Web go to ohio > form oh1. It allows them to pay their estimated or final. The instructions give a detailed list of who is not a qualified investor, one of. Electronic filing for ohio it 1140. Web ohio it 1140 estimated (upc/electronic) payments and 2021 overpayment credited to 2022. Read the following instructions to use cocodoc to start editing and filling out your ohio it 1140: To start with, look for the “get form” button. Web ohio it 1040 and sd 100 forms. Instructions for this form are. The instructions give a detailed list of who is not a qualified investor, one of. Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the revenue. Web form it 1140es is an ohio corporate income tax form. Of 7 do not write in this area; The individual is required to file an it 1040 to claim the withholding. Web ohio it 1140 estimated (upc/electronic) payments and 2021 overpayment credited to 2022. To start with, look for the “get form” button. Read the following instructions to use cocodoc to start editing and filling out your ohio it 1140: Web we last updated ohio form it 1140 in february 2023 from the ohio department of taxation. Web how to edit and sign ohio it 1140 online. For faster processing, we recommend you submit your return. Web the it 4738 will have a line to transfer estimated payments made on the it 1140 or it 4708 forms. The individual is. Of 7 do not write in this area; The instructions give a detailed list of who is not a qualified investor, one of. Web should the pte file the it 1140? Read the following instructions to use cocodoc to start editing and filling out your ohio it 1140: From the input return tab, go to state & local ⮕ other forms ⮕ oh passthrough / composite rtrn. Web ohio it 1040 and sd 100 forms. 11/08/21 2021 it 1140 pg. A pte or trust with a calendar year end of 12/31/21 can extend the due date for filing the it 1140 to september 15, 2022, provided it qualifies for an irs. Web the it 1140 is a withholding form and does not satisfy the individual investor’s filing requirement. Web how to edit and sign ohio it 1140 online. The individual is required to file an it 1040 to claim the withholding. Web go to ohio > form oh1. Web the it 4738 will have a line to transfer estimated payments made on the it 1140 or it 4708 forms. Address check here if address changed. Ohio withholding overpayments can also be applied to the new. Ohio it 4708, it 4738 estimated (upc/ electronic). This form is for income earned in tax year 2022, with tax returns due in april. It will take several months for the department to process your paper return. A pte must file an ohio return to report and pay tax on behalf of its nonresident individual, trust, and pte investors. Web form it 1140es is an ohio corporate income tax form.Fillable Online 2017 Ohio IT 1040 Individual Tax Return Ohio

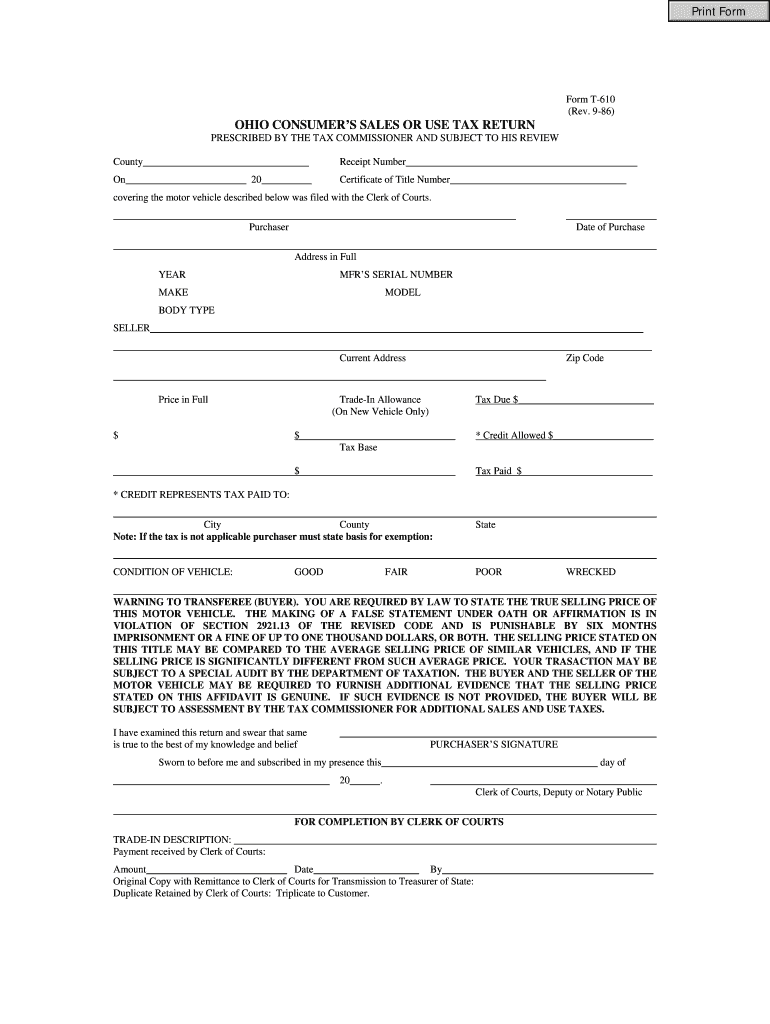

ohio consumers sales tax form Fill out & sign online DocHub

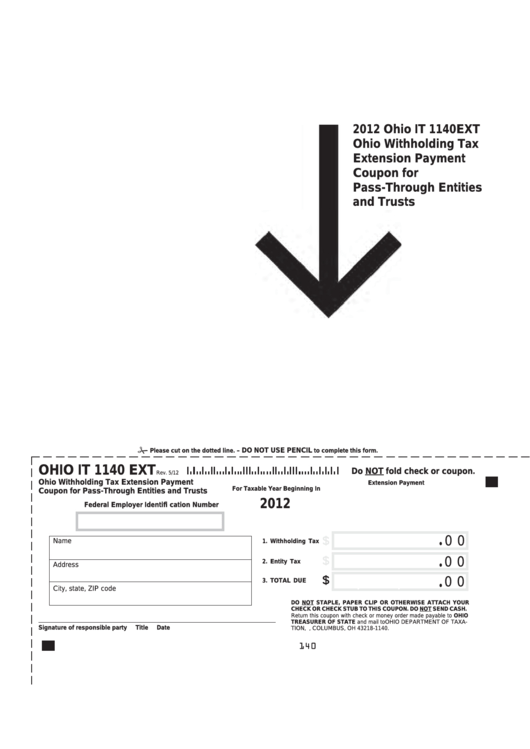

Fillable Ohio Form It 1140 Ext Ohio Withholding Tax Extension Payment

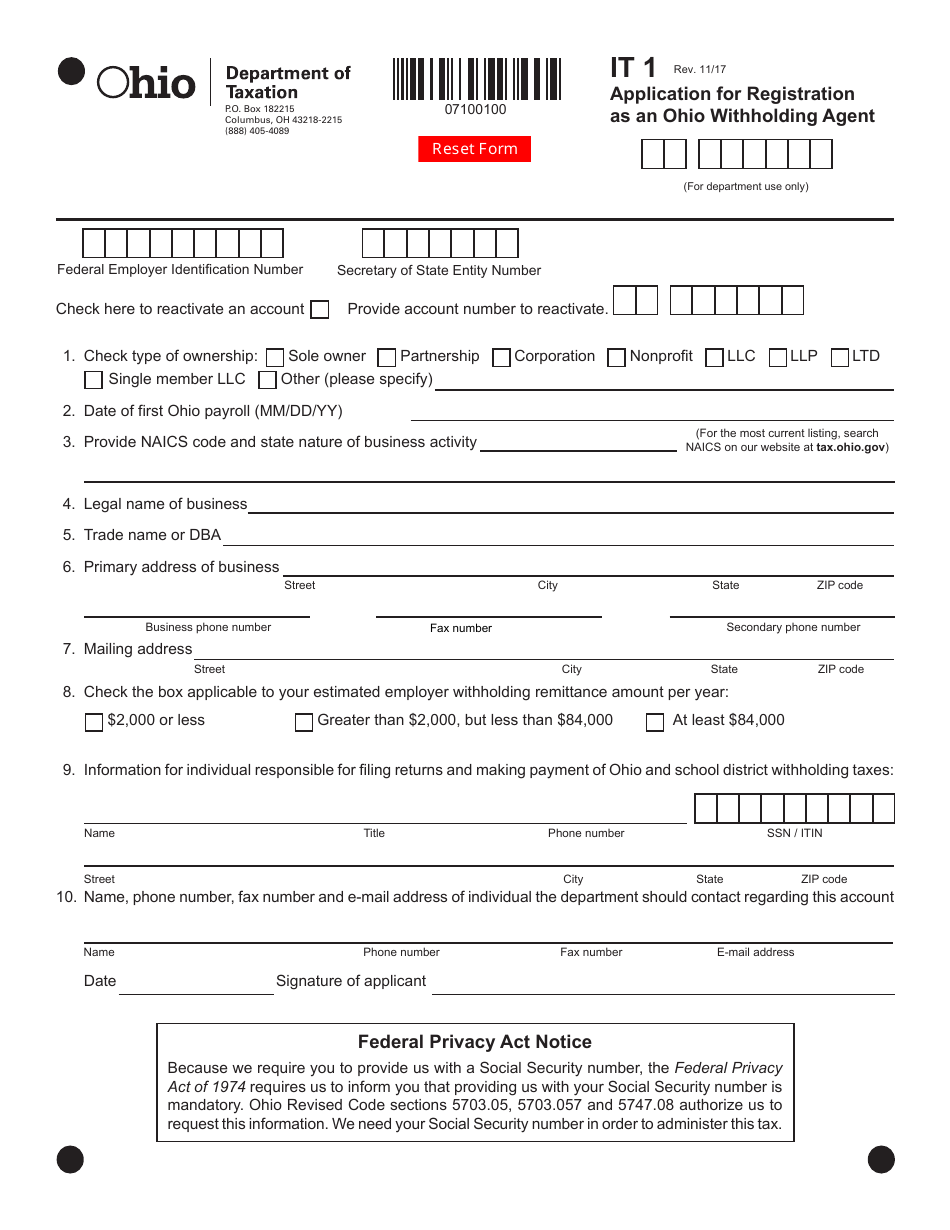

Form IT1 Fill Out, Sign Online and Download Fillable PDF, Ohio

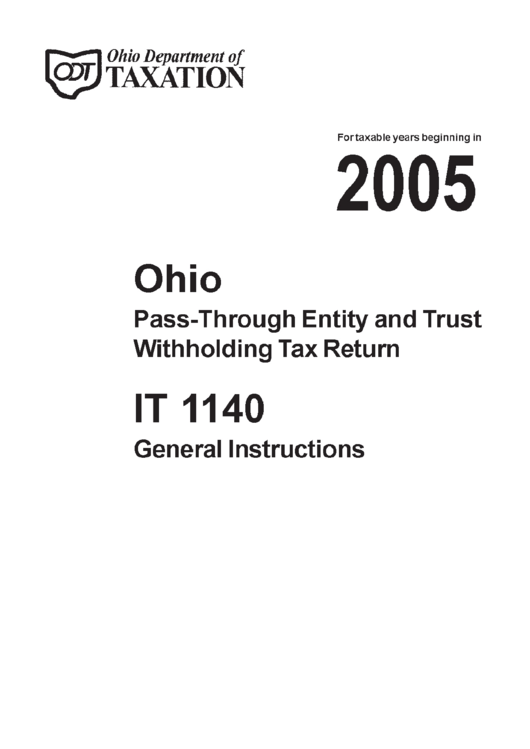

Instructions For PassThrough Entity And Trust Withholding Tax Return

Form It 1140 PassThrough Entity And Trust Withholding Tax Return

Ohio Form It 1140es For Taxable Years Beginning In 2006 printable pdf

Ohio Form Ft 1120s, It 4708 And It 1140 Abbreviated Instructions Pass

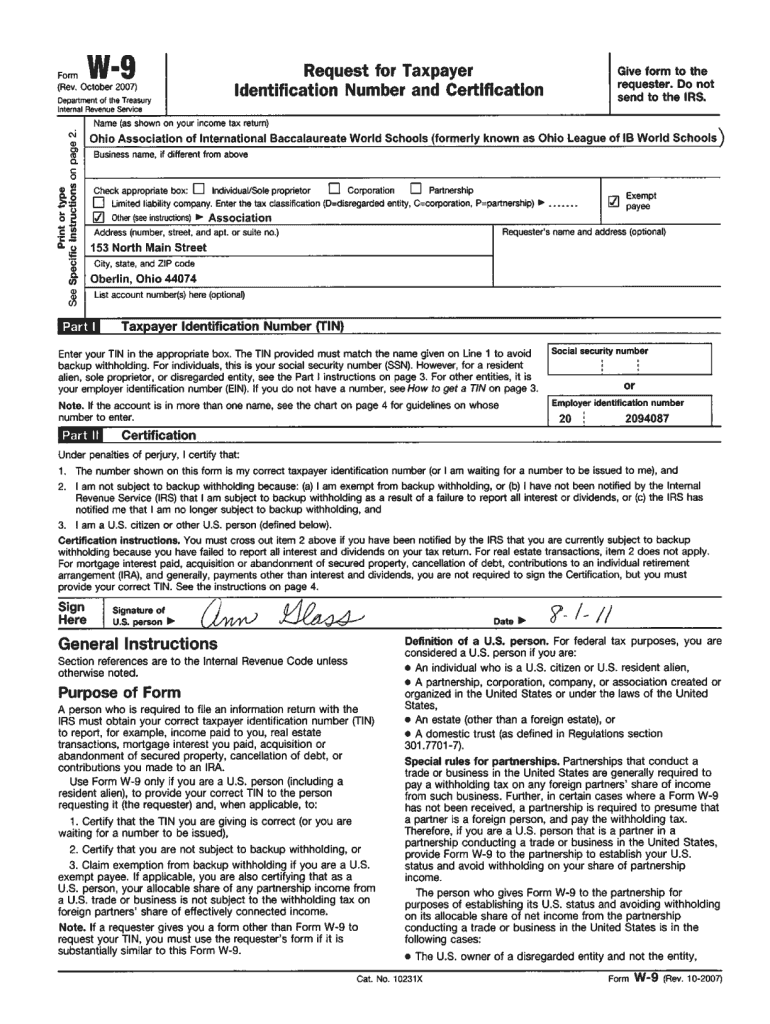

W 9 Form Fill Out and Sign Printable PDF Template signNow

Tax Printable Forms Printable Forms Free Online

Related Post: