Ny Tax Extension Form

Ny Tax Extension Form - You must submit this voucher with your payment if you file a balance due extension online using. Web new york tax extension form: Phoenix, az —the due date for the 2022 calendar year returns filed with extensions is almost here. Web to claim exemption from withholding for new york state personal income tax (and new york city and yonkers personal income tax, if applicable), you must meet the conditions. Complete, edit or print tax forms instantly. To avoid possible penalties, you should estimate and. You must file your extension request on or before the filing deadline of your return. Citizen or resident files this form to request. Get more information if you need to apply for an extension of time to file your return. Who must use this form. If you are using a screen reading program, select listen to have the number announced. Who must use this form. Complete, edit or print tax forms instantly. If you can't file your federal tax return by the april 18, 2023, deadline, request an extension. Web your extension will not be valid if you fail to pay 80% of your total. You must submit this voucher with your payment if you file a balance due extension online using. Web new york tax extension form: Some states including wisconsin, alabama and california offer automatic extensions to file your state income. There’s less than a week until the oct. To avoid possible penalties, you should estimate and. Web video instructions and help with filling out and completing new york state extension form. Phoenix, az —the due date for the 2022 calendar year returns filed with extensions is almost here. Taxpayers have until the end of the night monday to meet the irs deadline for filing a late tax return. Web how to file online. Citizen or resident. Web video instructions and help with filling out and completing new york state extension form. Form 4868, application for automatic extension of time to file u.s. Web if you need more time to file your federal tax returns, you can request an extension using form 4868. Web how to file online. Web the following security code is necessary to prevent. You must file your extension request on or before the filing deadline of your return. You must submit this voucher with your payment if you file a balance due extension online using. Get ready for tax season deadlines by completing any required tax forms today. This video will help you deal with the new york state extension without any problems.. If you can't file your federal tax return by the april 18, 2023, deadline, request an extension. Citizen or resident files this form to request. Taxpayers have until the end of the night monday to meet the irs deadline for filing a late tax return. New york income tax extension. Web video instructions and help with filling out and completing. Web automatic extension of time to file for individuals. Get more information if you need to apply for an extension of time to file your return. Web extension forms by filing status. Web while you will get more time to file your return, an extension does not grant you more time to pay your taxes. Web the following security code. You must submit this voucher with your payment if you file a balance due extension online using. An extension gives you until october 16, 2023, to file your 2022 federal. Sign into your efile.com account and check acceptance by the irs. To avoid possible penalties, you should estimate and. Citizen or resident files this form to request. There’s less than a week until the oct. To use our online services, create an account, log in, and select file a. Citizen or resident files this form to request. This video will help you deal with the new york state extension without any problems. Web automatic extension of time to file for individuals. New york income tax extension. Web while you will get more time to file your return, an extension does not grant you more time to pay your taxes. Web new york — taxpayers in new york who are on the verge of missing tuesday’s deadline to file 2022 income tax returns can request an extension from the. Complete, edit or. Web the new york state excise tax increased on september 1, 2023. This form allows you to get an additional six months to file. Web new york — taxpayers in new york who are on the verge of missing tuesday’s deadline to file 2022 income tax returns can request an extension from the. Web income tax applications for filing extensions. You must file your extension request on or before the filing deadline of your return. Web if you need more time to file your federal tax returns, you can request an extension using form 4868. Web video instructions and help with filling out and completing new york state extension form. If you are using a screen reading program, select listen to have the number announced. Check your irs tax refund status. New york income tax extension. Get ready for tax season deadlines by completing any required tax forms today. Web while you will get more time to file your return, an extension does not grant you more time to pay your taxes. To avoid possible penalties, you should estimate and. An extension gives you until october 16, 2023, to file your 2022 federal. Web your extension will not be valid if you fail to pay 80% of your total tax liability through withholding, estimated tax payments or with your extension. Web automatic extension of time to file for individuals. Web if you need guidance in completing this form, reach out to your grants coordinator. Who must use this form. Get more information if you need to apply for an extension of time to file your return. Taxpayers have until the end of the night monday to meet the irs deadline for filing a late tax return.IRS Form 8868 Fill Out, Sign Online and Download Fillable PDF

FREE 7+ Sample Federal Tax Forms in PDF

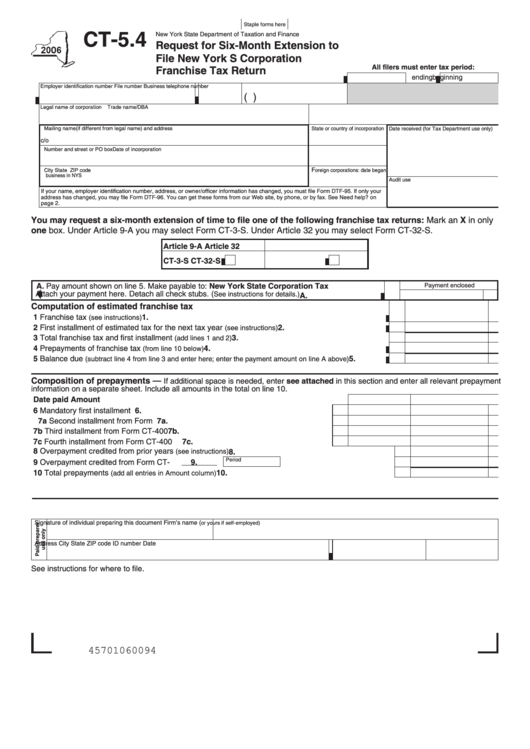

Fillable Form Ct5.4 Request For SixMonth Extension To File New York

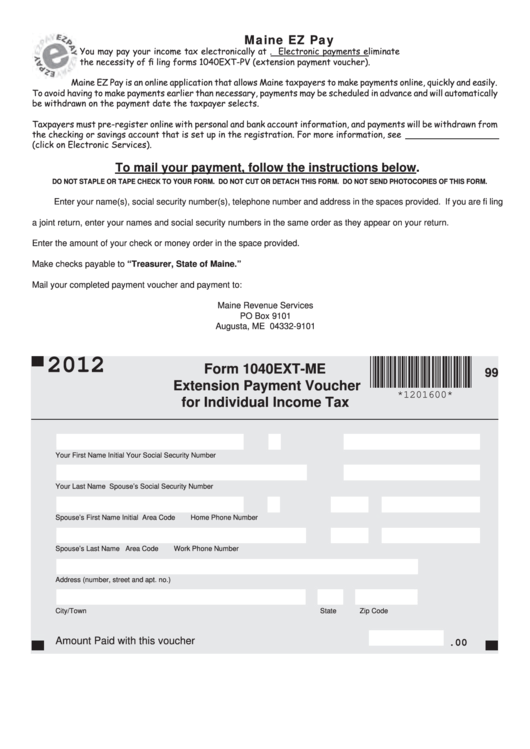

Fillable Form 1040extMe Extension Payment Voucher For Individual

Do these 2 things to get your New York state tax refund 2 weeks sooner

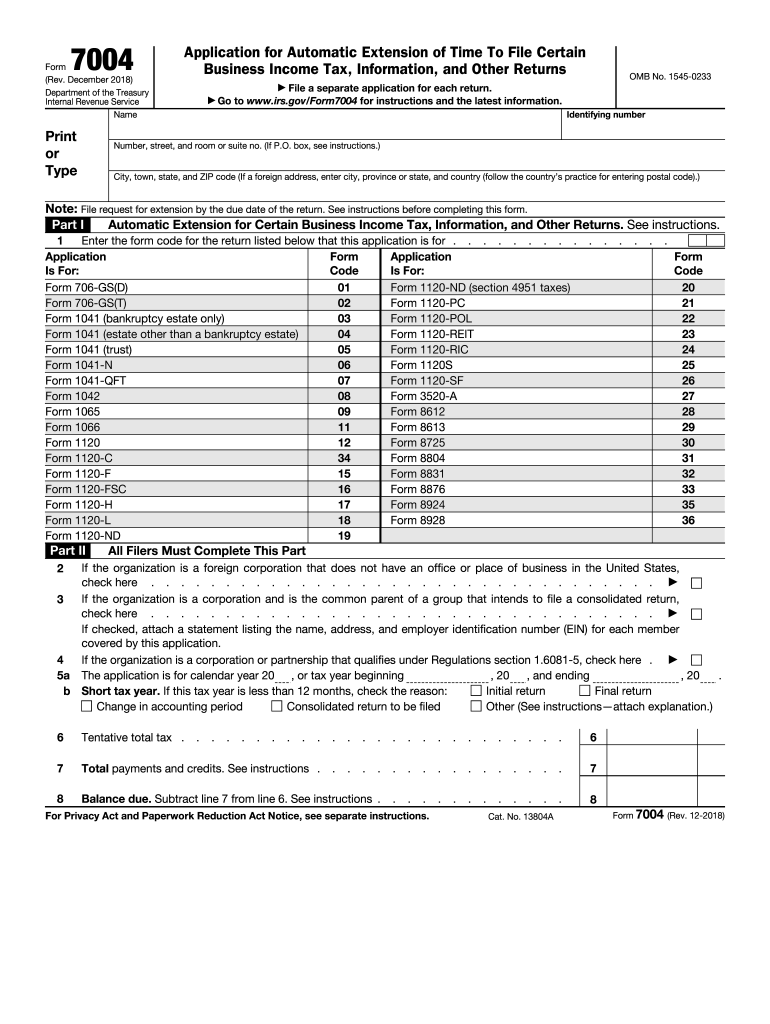

Form 7004 Fill Out and Sign Printable PDF Template signNow

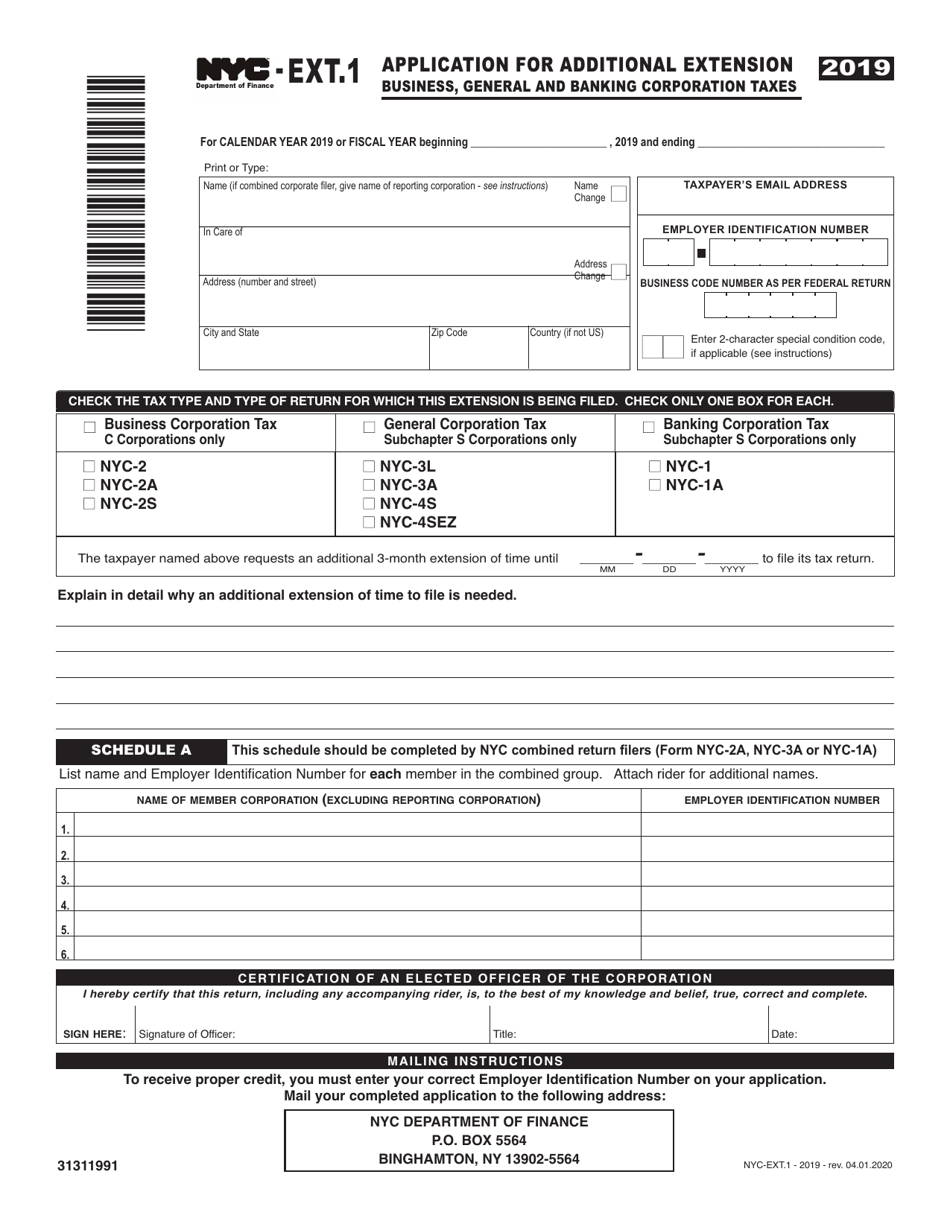

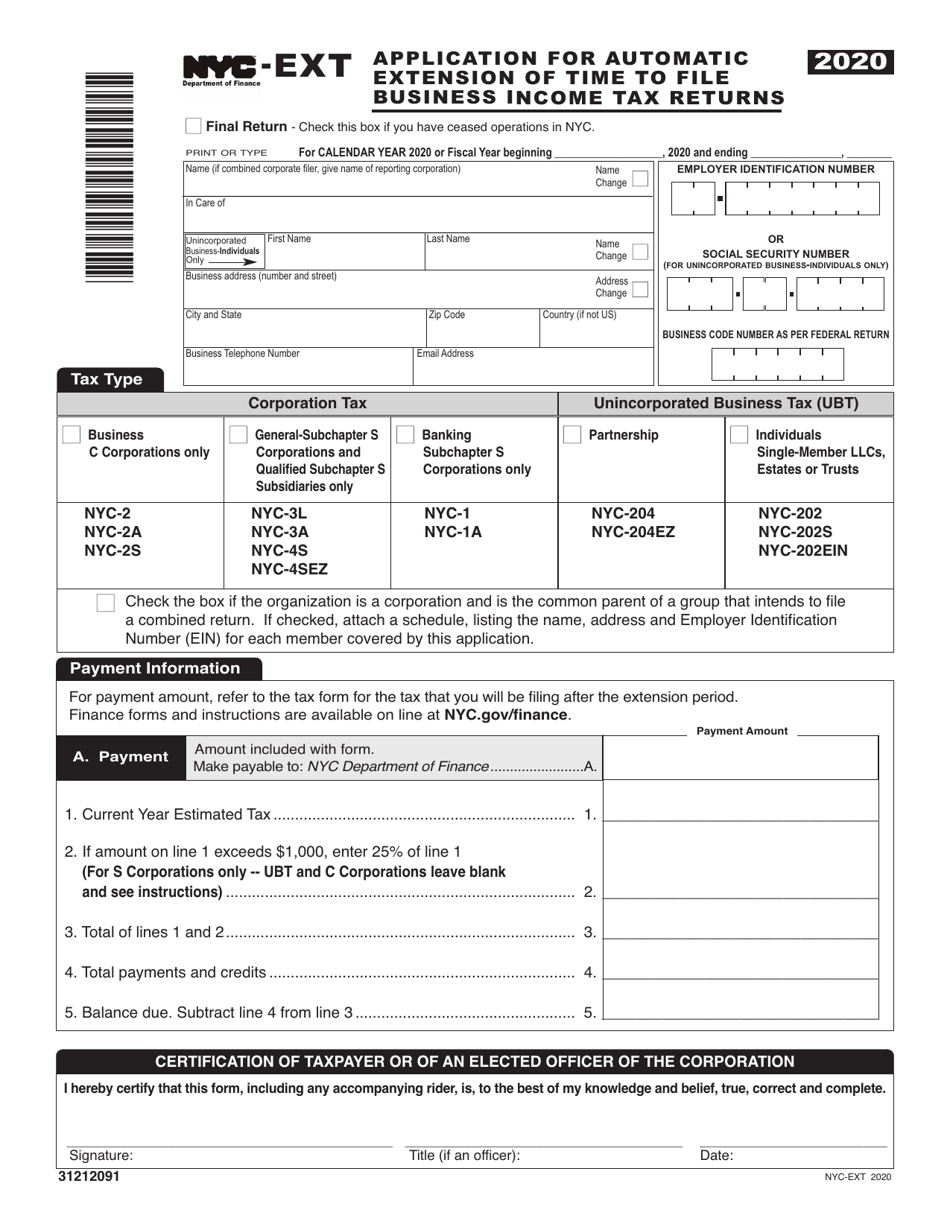

Form NYCEXT.1 Download Printable PDF or Fill Online Application for

Ny Tax Exempt Form Fill and Sign Printable Template Online US Legal

Form NYCEXT Download Printable PDF or Fill Online Application for

Tax Extension 2021 Form Tax Day 2021 Here's how to file an extension

Related Post: