Notice Of Deficiency Waiver Form 5564

Notice Of Deficiency Waiver Form 5564 - Web if you agree, sign the enclosed form 5564 and mail or fax it to the address or fax number listed on the letter. Web what is irs form 5564? If you are making a payment, include it with the form. This form notifies the irs that you agree with the proposed additional tax due. Web this letter is your notice of deficiency, as required by law. Online / digital waiver forms for parties, sporting events & more. Web you should review the complete audit report enclosed with your letter. Tax court in washington d.c. You should determine if you agree with the proposed changes or wish to file a petition with. This form lets the internal. Web if you agree with the notice of deficiency and don’t wish to challenge it, then simply sign form 5564, the notice of deficiency waiver, and send it back to the. We received information that is different from what you reported on your tax return. If the irs believes that you owe more tax than what was reported on your. Ad formswift.com has been visited by 100k+ users in the past month Along with notice cp3219a, you should receive form 5564. Web this letter is your notice of deficiency, as required by law. This may result in an increase or decrease in your tax. Web to help ensure that your case is properly processed, please enclose the following items when. Web the notice of deficiency must state the last day when a petition must be filed with the tax court. Web you should determine if you agree with the proposed changes or wish to file a petition with the tax court to dispute the adjustments made by the irs. Contact the third party that furnished the. Web this letter is. Contact the third party that furnished the. This form notifies the irs that you agree with the proposed additional tax due. If you agree with the. We received information that is different from what you reported on your tax return. Ad quick & easy waiver forms for parties, sporting events & more. Online / digital waiver forms for parties, sporting events & more. What is irs form 5564? Web what is irs form 5564? This form notifies the irs that you agree with the proposed additional tax due. Web to help ensure that your case is properly processed, please enclose the following items when you mail your petition to the tax court: If you agree with the changes, sign the enclosed form 5564, notice of. Web if the deficiency is because they made a mistake on their tax return, like marking an allowance they do not qualify for or typing their income incorrectly, they will. Get your free trial today. Irs form 5564 is included when the federal tax agency. You do. This form lets the internal. Web 1 best answer. If the irs believes that you owe more tax than what was reported on your tax return, the irs. You have the right to challenge this determination in u.s. If you are making a payment, include it with the form. Online / digital waiver forms for parties, sporting events & more. Web if the deficiency is because they made a mistake on their tax return, like marking an allowance they do not qualify for or typing their income incorrectly, they will. This form notifies the irs that you agree with the proposed additional tax due. Irs form 5564 is included. Along with notice cp3219a, you should receive form 5564. Web this letter is your notice of deficiency, as required by law. A copy of any notice of deficiency,. Web to help ensure that your case is properly processed, please enclose the following items when you mail your petition to the tax court: Web you should determine if you agree with. In over 36 years working with. Web if the deficiency is because they made a mistake on their tax return, like marking an allowance they do not qualify for or typing their income incorrectly, they will. Web if you agree with the notice of deficiencies proposed increase in tax, consider filling the irs notice of deficiency waiver form 5564. Tax. This may result in an increase or decrease in your tax. We received information that is different from what you reported on your tax return. Get your free trial today. Web the notice of deficiency must state the last day when a petition must be filed with the tax court. If you agree with the. In over 36 years working with. Web this letter is your notice of deficiency, as required by law. Web what is irs form 5564? If the irs believes that you owe more tax than what was reported on your tax return, the irs. Online / digital waiver forms for parties, sporting events & more. You should determine if you agree with the proposed changes or wish to file a petition with. If you agree with the changes, sign the enclosed form 5564, notice of. Ad formswift.com has been visited by 100k+ users in the past month You have the right to challenge this determination in u.s. Ad quick & easy waiver forms for parties, sporting events & more. Contact the third party that furnished the. Web 1 best answer. Web mail or fax form 5564 back to the address on the notice by the deadline along with the new information you feel disputes the notice. Web you should review the complete audit report enclosed with your letter. Web this notice is referred to as a “90 day letter.” gilbert az taxpayers have a right to file a petition with the u.s.borang cp58 2018 Julia Peake

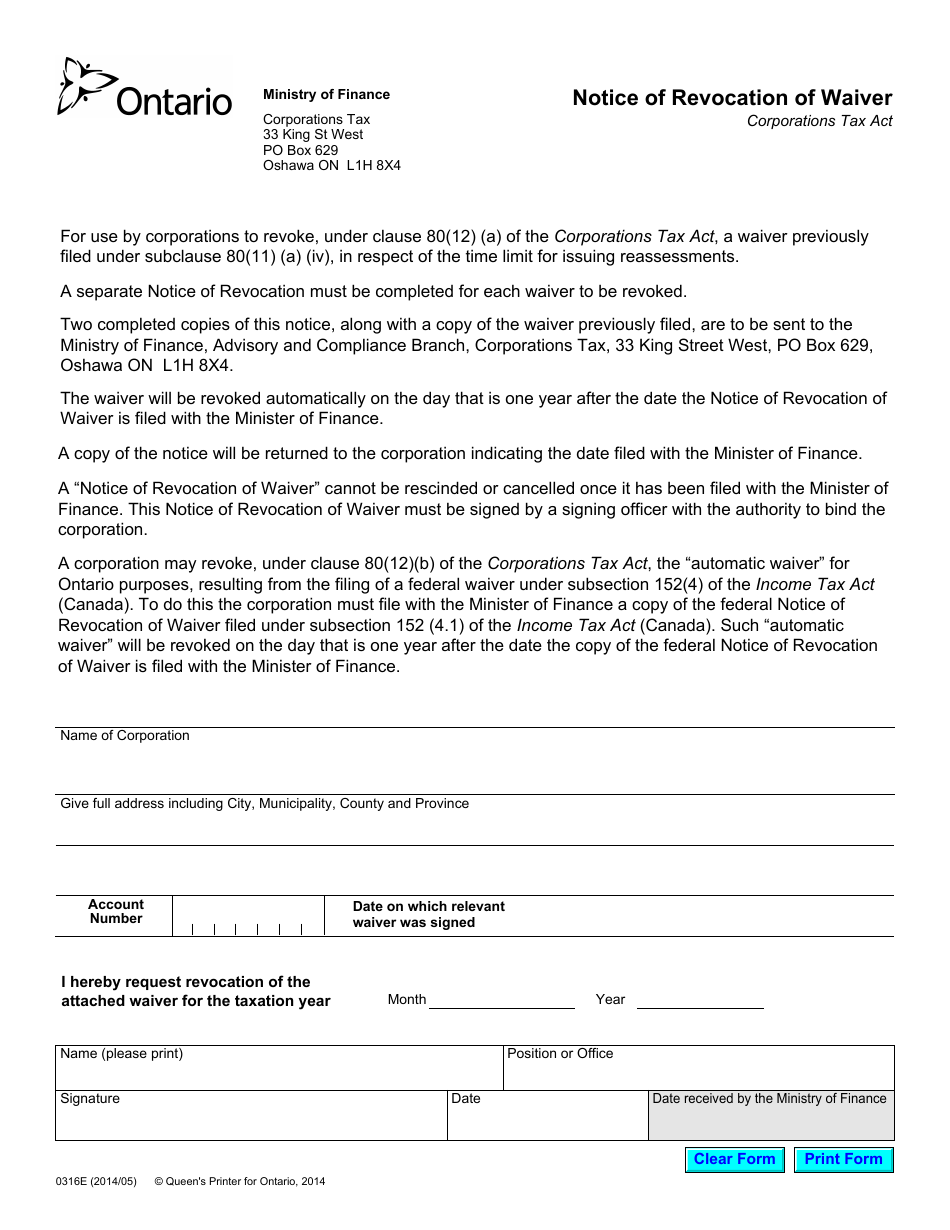

Form 0316E Download Fillable PDF or Fill Online Notice of Revocation of

IRS Audit Letter CP3219A Sample 1

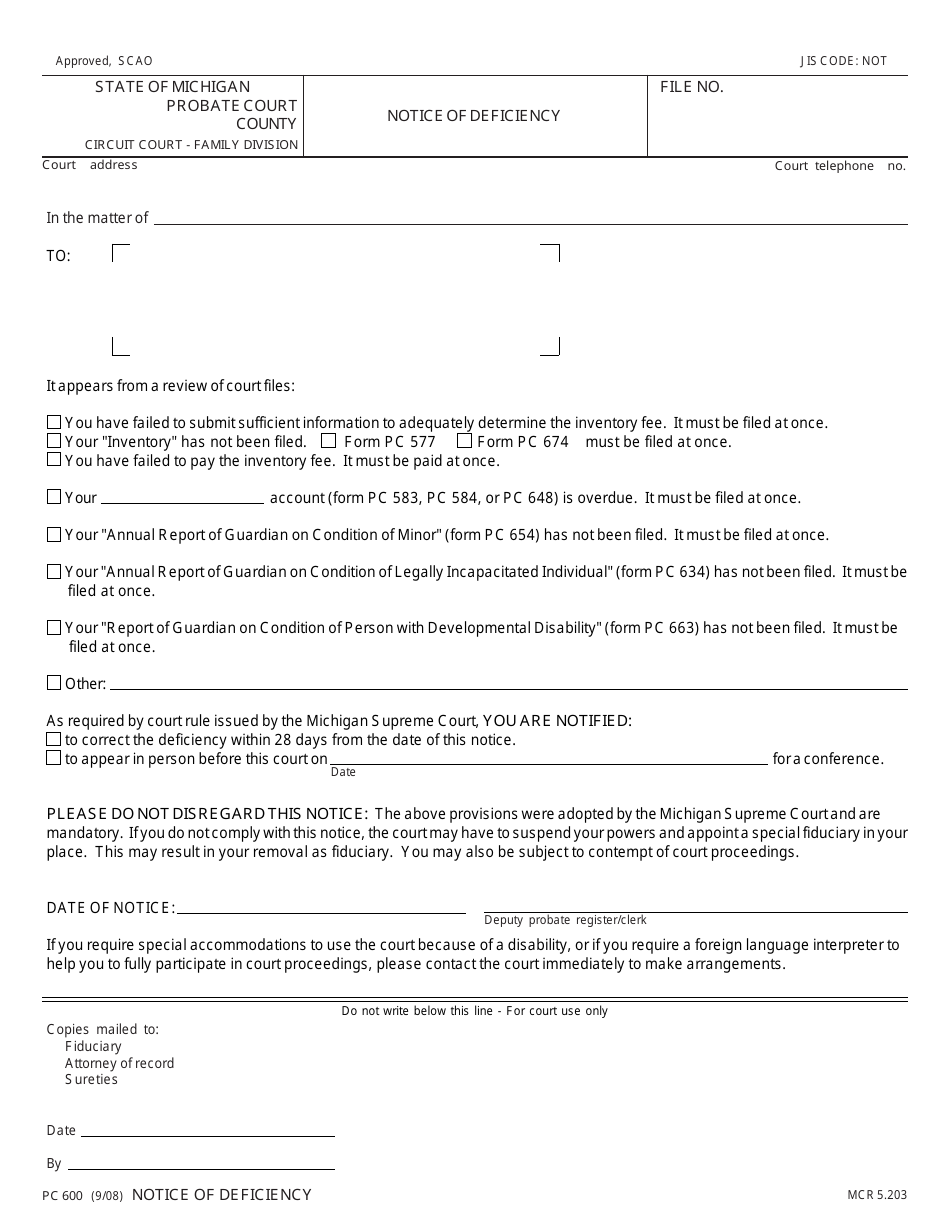

Form PC600 Download Fillable PDF or Fill Online Notice of Deficiency

Delinquency Notice Template Master Template

Irs Form 5564 Pdf Fill Online, Printable, Fillable, Blank pdfFiller

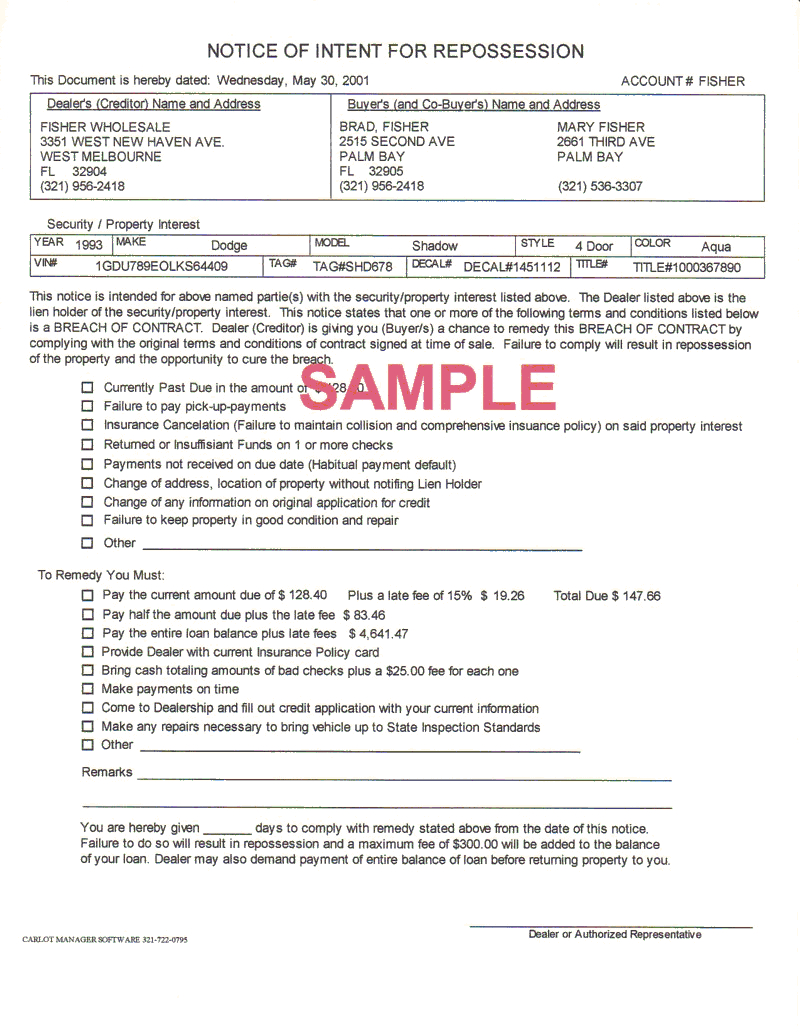

Car Repossession Dispute Letter Template Samples Letter Template Vrogue

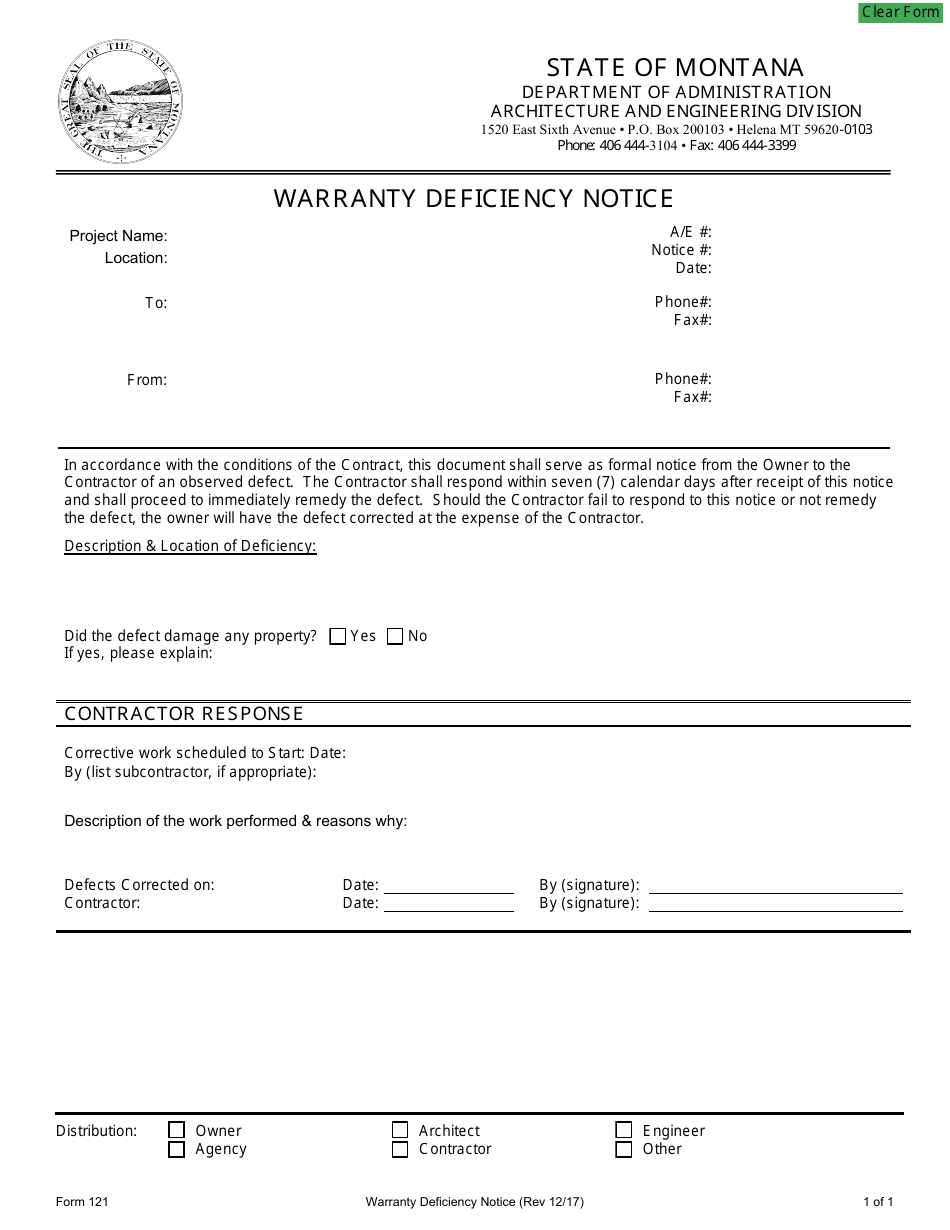

Form 121 Download Fillable PDF or Fill Online Warranty Deficiency

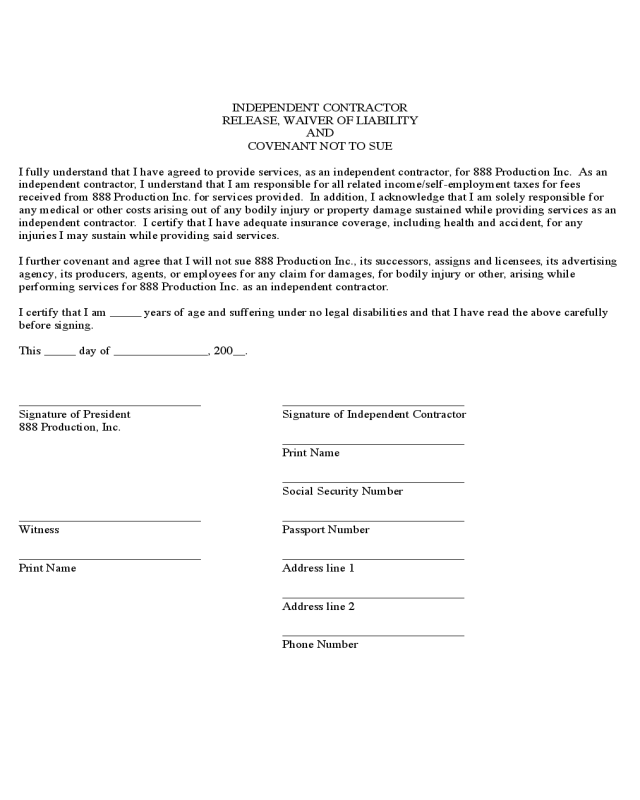

Contractor Liability Waiver Template Master of Documents

IRS “Notice of Deficiency” addressed to Michael Jackson Estate (08/20

Related Post: