Non Resident Nj Tax Form

Non Resident Nj Tax Form - Web 1 best answer. Web landfill closure and contingency tax. Web select the long form (if the option is available) even if turbotax defaults to the short form; The state of new jersey requires either 8.97 percent of the profit or 2 percent of the total selling price (whichever. Make a copy of your client file in. Web it's hard to compare state income tax rates directly. Last name, first name, and initial (joint filers enter first name and initial of each. Nonresident alien income tax return only if you have income that is subject to tax, such as wages, tips, scholarship and. Web you are required to have a copy of this form on file for each employee receiving compensation paid in new jersey and who is a resident of pennsylvania and claims. Taxformfinder.org is an independent website, and we rely. The new jersey tax that your mother paid at the time of the sale has to be entered in the federal interview in turbotax. Last name, first name, and initial (joint filers enter first name and initial of each. Web it's hard to compare state income tax rates directly. The state of new jersey requires either 8.97 percent of the. Web you are required to have a copy of this form on file for each employee receiving compensation paid in new jersey and who is a resident of pennsylvania and claims. Web new jersey nonresident tax form 2020. Last name, first name, and initial (joint filers enter first name and initial of each. You can download or print. Web similar. Last name, first name, and initial (joint filers enter first name and initial of each. Enter spouse/cu partner last name. Web page last reviewed or updated: Can i get the fee back entirely. The new jersey tax that your mother paid at the time of the sale has to be entered in the federal interview in turbotax. Some have flat tax rates that apply to everyone, while others have graduated rates that increase for higher. Web new jersey nonresident tax form 2020. Only report the income attributable to the nonresident state; Taxformfinder.org is an independent website, and we rely. Web new jersey filing requirements for non residents. You can download or print. Last name, first name, and initial (joint filers enter first name and initial of each. Web new jersey filing requirements for non residents. Web page last reviewed or updated: If you are a nonresident and your income for the entire year was more than the filing threshold amount for your filing status, you must file. Web new jersey nonresident tax form 2020. The state of new jersey requires either 8.97 percent of the profit or 2 percent of the total selling price (whichever. You can download or print. Web amending a nonresident return: If you are a nonresident and your income for the entire year was more than the filing threshold amount for your filing. Taxformfinder.org is an independent website, and we rely. Last name, first name, and initial (joint filers enter first name and initial of each. Web you are required to have a copy of this form on file for each employee receiving compensation paid in new jersey and who is a resident of pennsylvania and claims. Web amending a nonresident return: The. Web page last reviewed or updated: Can i get the fee back entirely. Enter spouse/cu partner last name. Web landfill closure and contingency tax. The new jersey tax that your mother paid at the time of the sale has to be entered in the federal interview in turbotax. Web it's hard to compare state income tax rates directly. Web landfill closure and contingency tax. [email protected] active military service property tax deferment telephone: Can i get the fee back entirely. If you are a nonresident and your income for the entire year was more than the filing threshold amount for your filing status, you must file a new. Web 1 best answer. Web landfill closure and contingency tax. Only report the income attributable to the nonresident state; Use a new jersey nonresident form 2020 template to make your document workflow more streamlined. Web new jersey nonresident tax form 2020. Web nonresident seller’s tax declaration instructions if this form is not completed in its entirety, the county clerk will not record the deed. Web similar to when estimated taxes are withheld on your paycheck. Use a new jersey nonresident form 2020 template to make your document workflow more streamlined. Enter spouse/cu partner last name. Web new jersey filing requirements for non residents. The new jersey tax that your mother paid at the time of the sale has to be entered in the federal interview in turbotax. Web landfill closure and contingency tax. Web amending a nonresident return: Some have flat tax rates that apply to everyone, while others have graduated rates that increase for higher. If you are a nonresident and your income for the entire year was more than the filing threshold amount for your filing status, you must file a new. A nonresident individual, estate, or trust selling. You can download or print. Only report the income attributable to the nonresident state; Can i get the fee back entirely. [email protected] active military service property tax deferment telephone: Web it's hard to compare state income tax rates directly. Web page last reviewed or updated: Web 1 best answer. Make a copy of your client file in. Print, sign, and mail the form to.Non resident tax file number application form

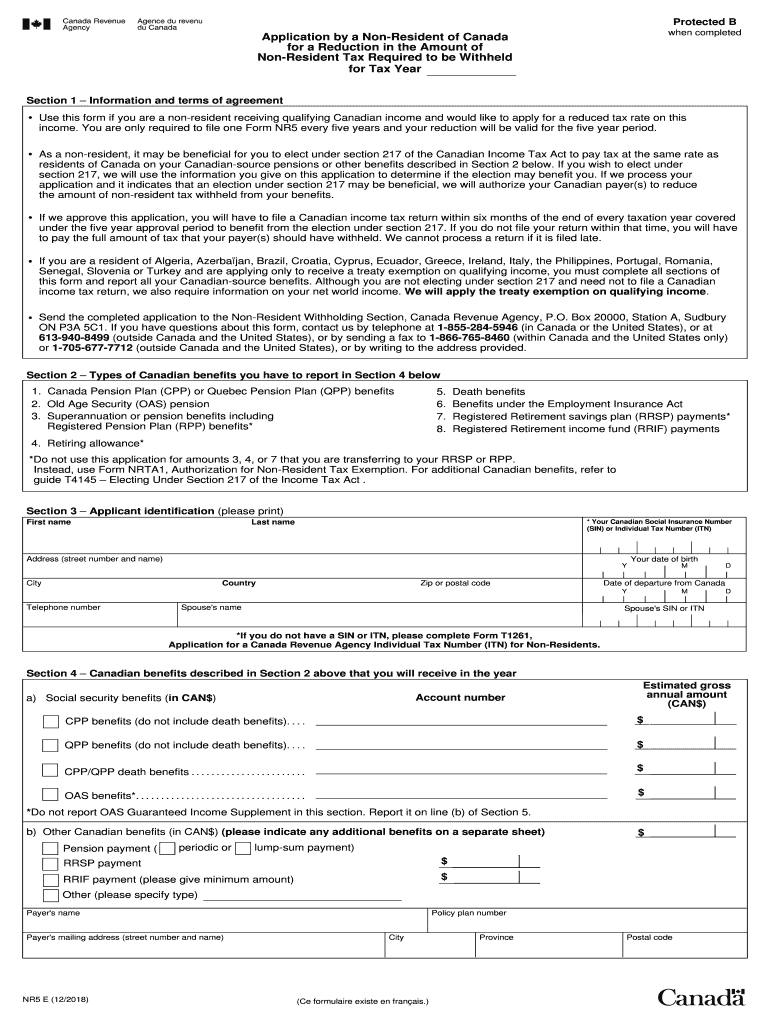

Nr5 Fill Out and Sign Printable PDF Template signNow

Form IT203B (Fillin) Nonresident and PartYear Resident

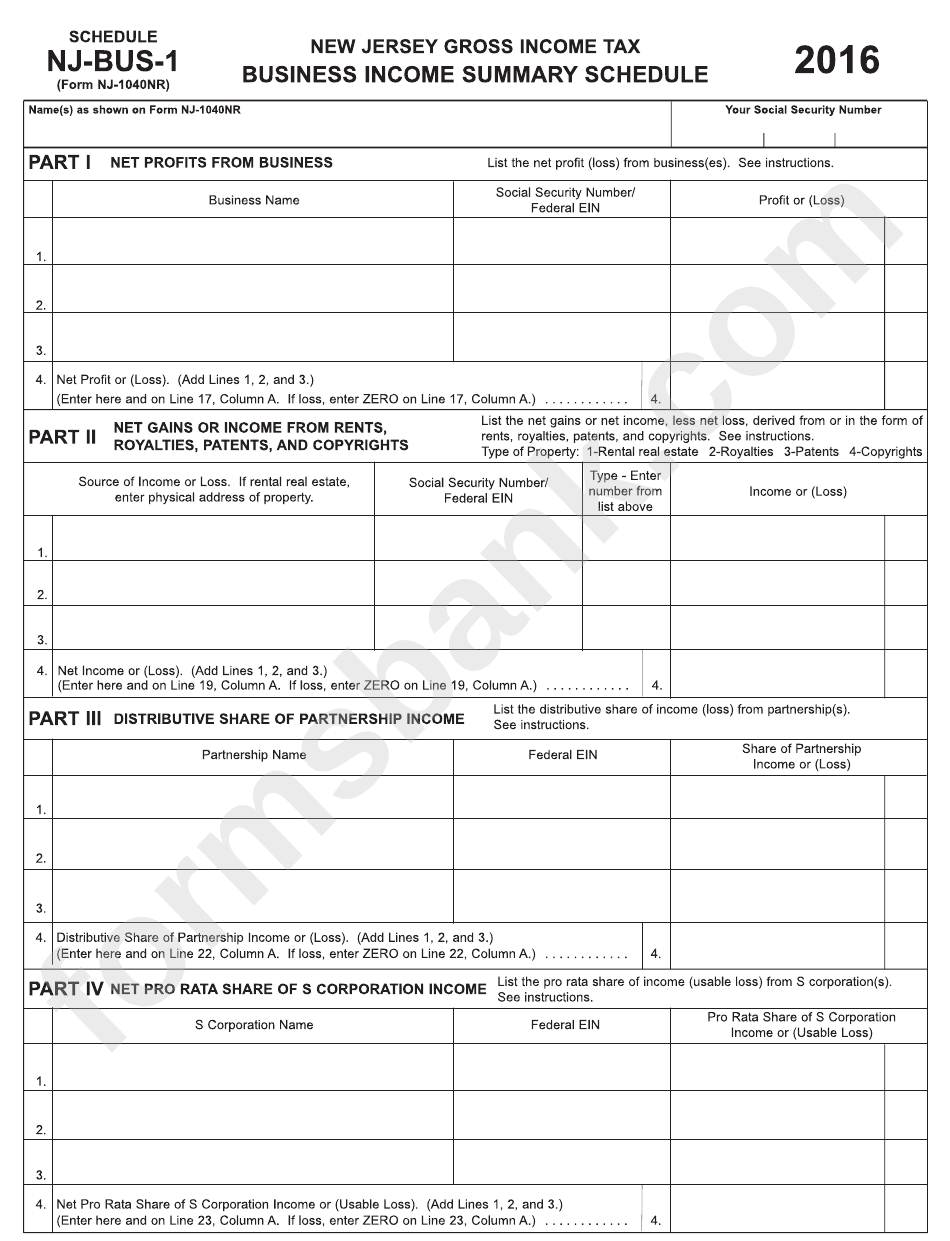

New Jersey Gross Tax Free Download

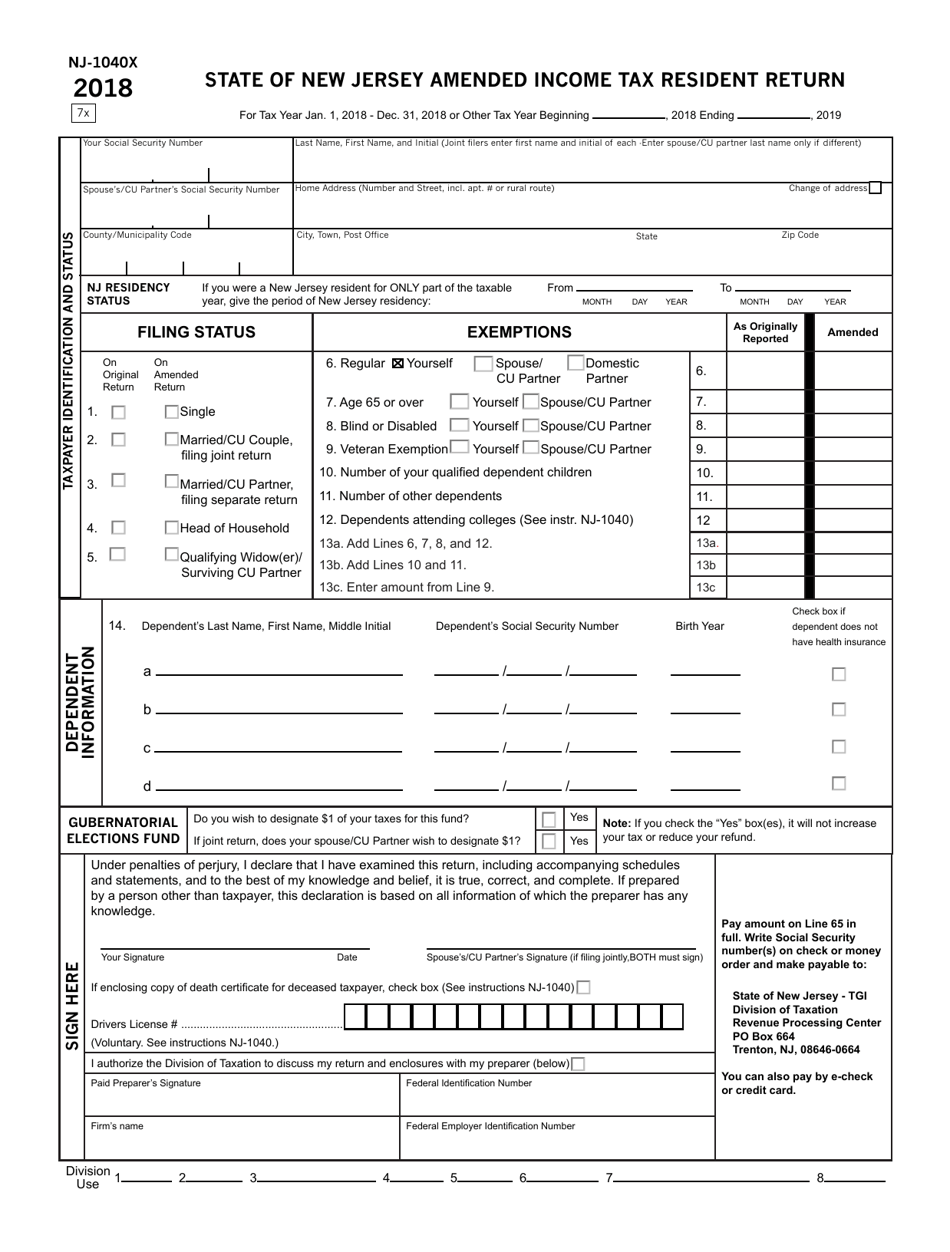

Form NJ1040X 2018 Fill Out, Sign Online and Download Fillable PDF

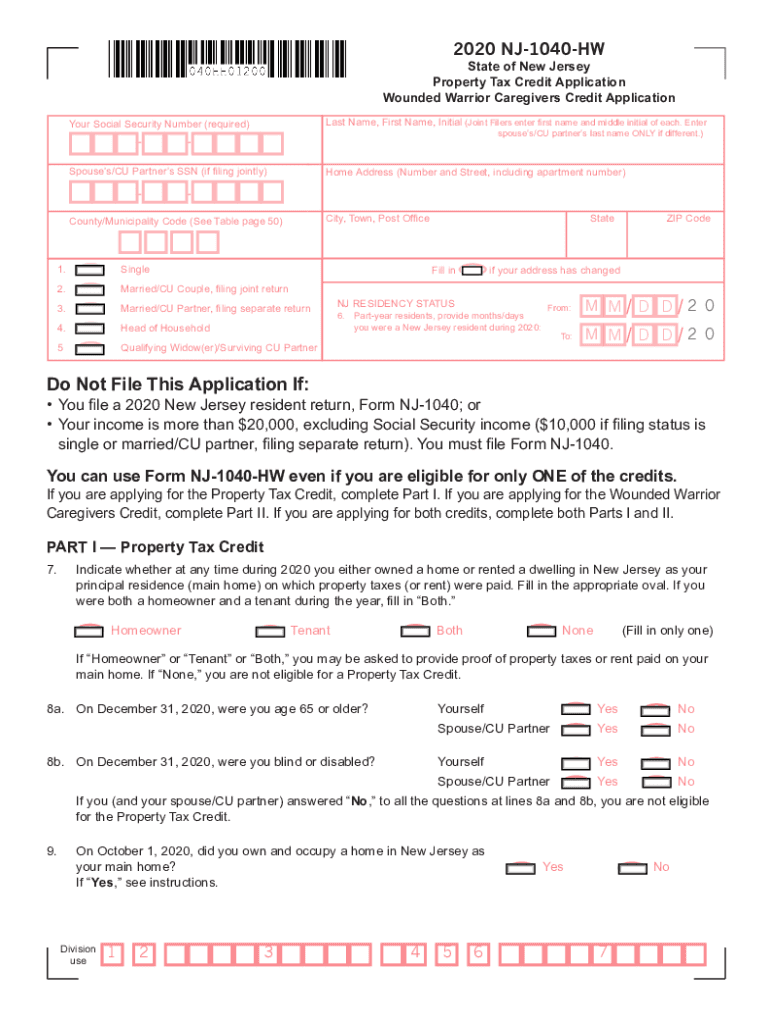

1040 Hw Credit Fill Out and Sign Printable PDF Template signNow

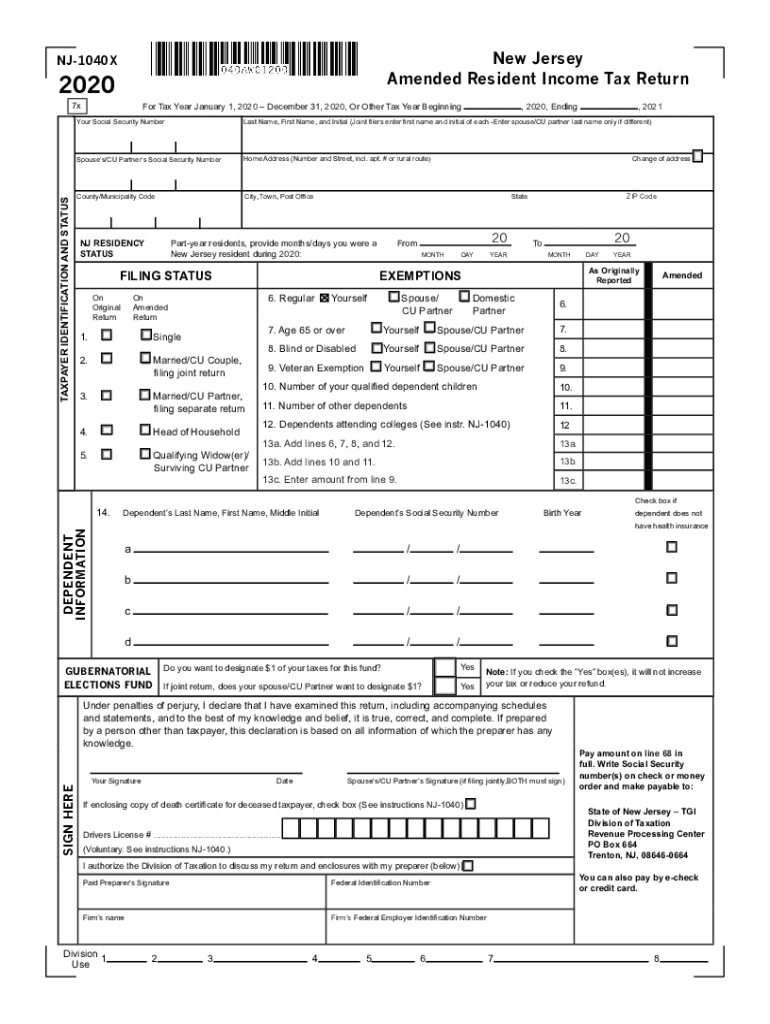

NJ DoT NJ1040x 20202022 Fill out Tax Template Online US Legal Forms

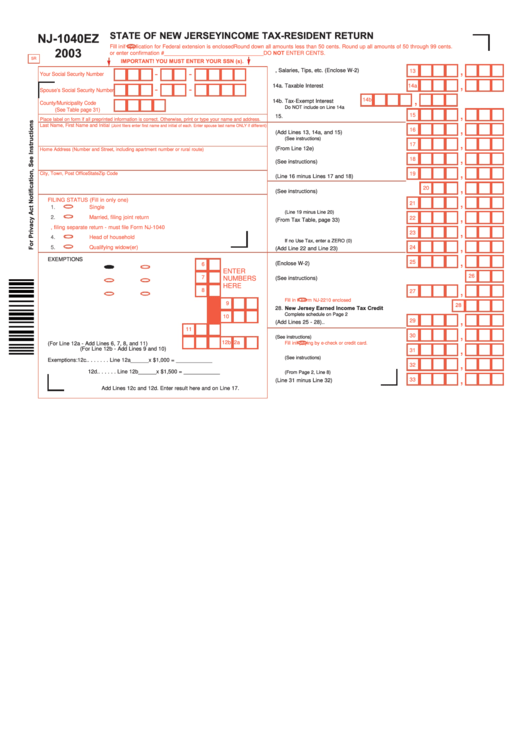

Fillable Form Nj1040ez State Of New Jersey TaxResident

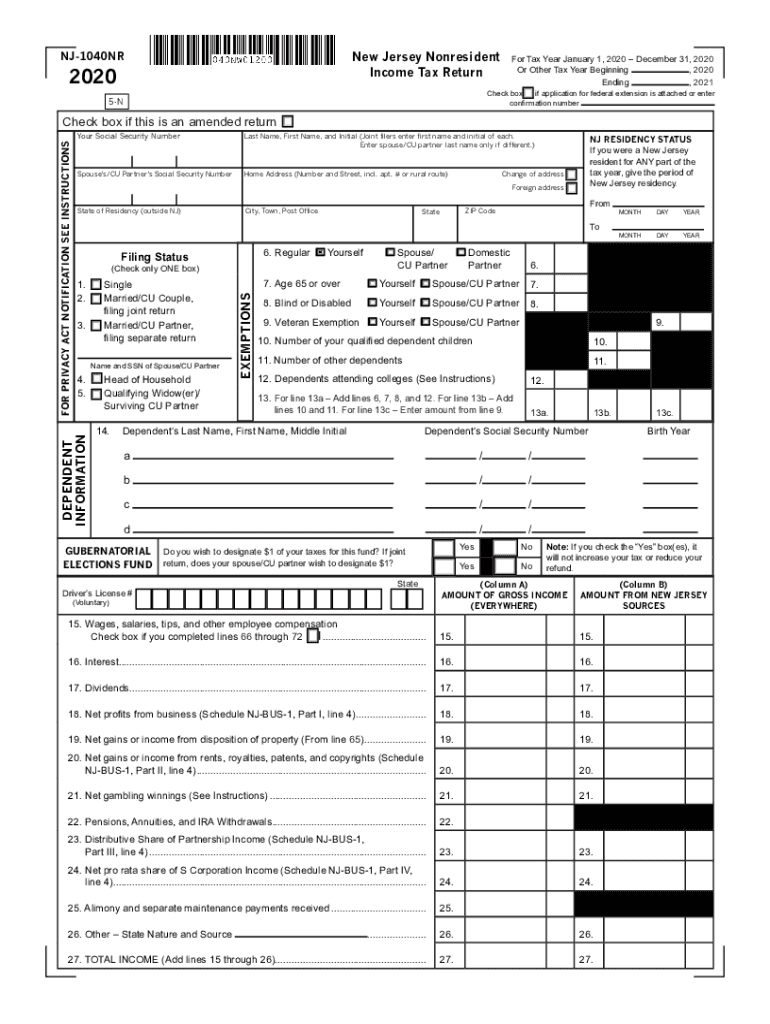

New Jersey Nonresident Form Fill Out and Sign Printable PDF Template

Fillable Form Nj1040nr NonResident Tax Return 2016

Related Post: