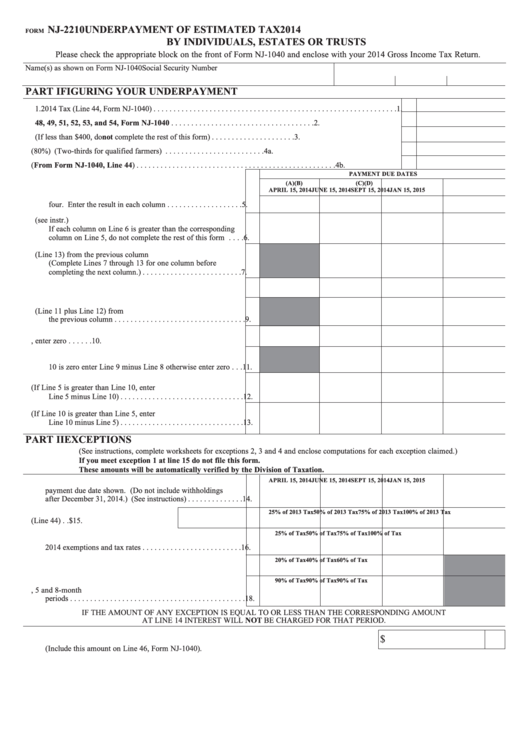

Nj Form 2210

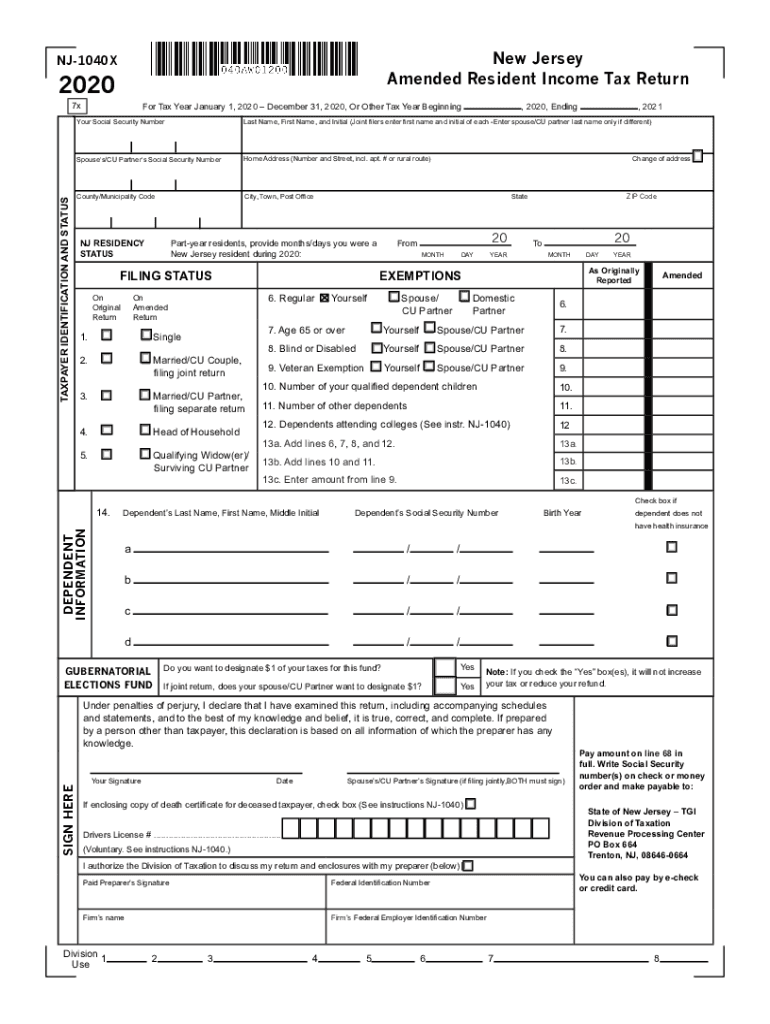

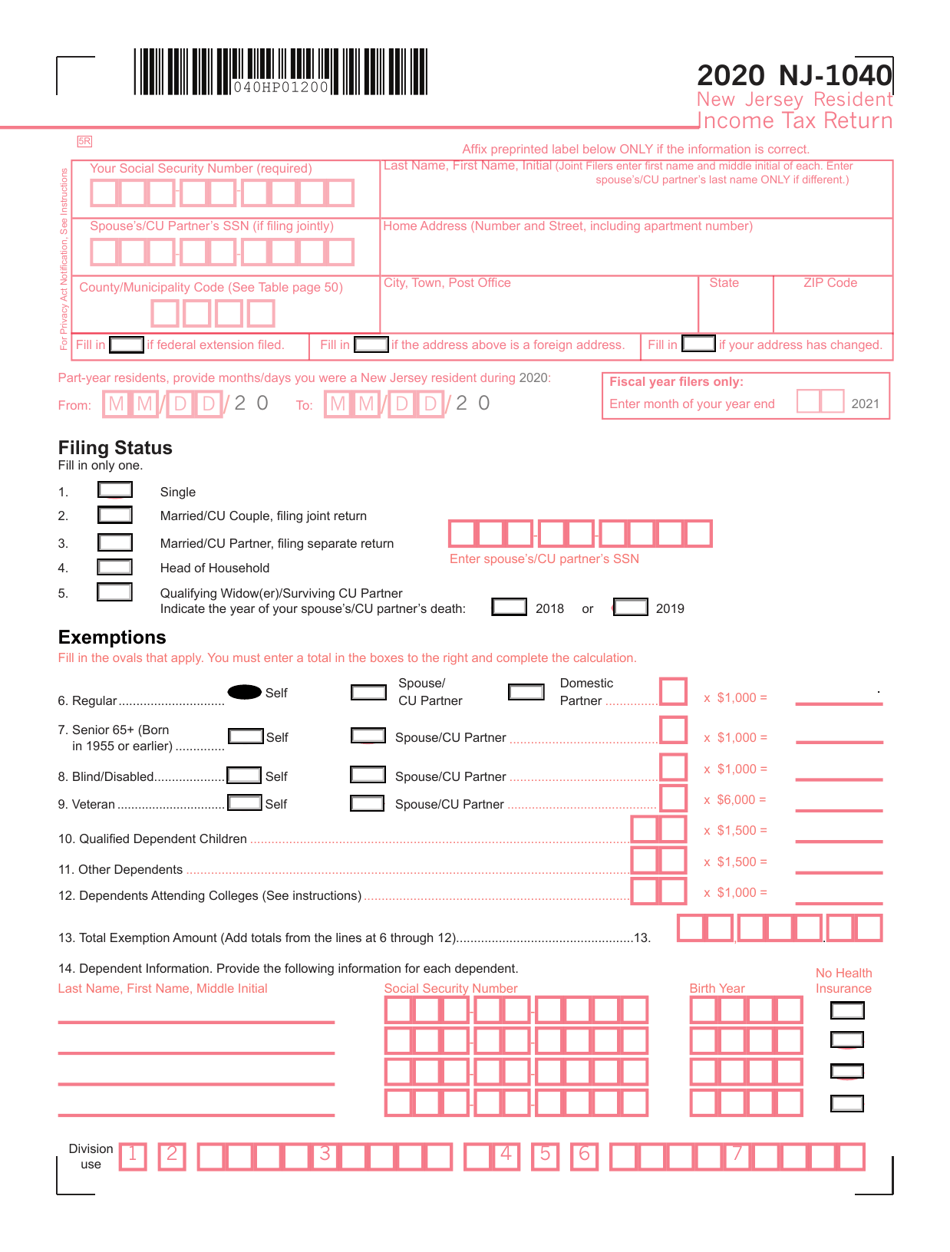

Nj Form 2210 - This form is for income earned in tax year 2022, with tax returns due in april. Estates and trusts are subject to interest on underpayment of estimated. Web application for extension of time to file income tax return. Estimated income tax payment voucher for 2023. Involved parties names, addresses and phone numbers. Use form 2210 to see if you owe a penalty for underpaying your estimated tax. Web use form 2210 to determine the amount of underpaid estimated tax and resulting penalties as well as for requesting a waiver of the penalties. Web my nj state return had an underpayment penalty that was added based on nj form 2210. Complete part i, figuring your underpayment, to determine if you have. Underpayment of estimated tax by individuals, estates, or trusts. Complete part i, figuring your underpayment, to determine if you have. Estates and trusts are subject to interest on underpayment of estimated. This form is for income earned in tax year 2022, with tax returns due in april. Fill out the empty fields; Estates and trusts are subject to interest on underpayment of estimated. Involved parties names, addresses and phone numbers. Estates and trusts are subject to interest on underpayment of estimated. When i opened the form, i noticed that the program did not have. Web use form 2210 to determine the amount of underpaid estimated tax and resulting penalties as well as for requesting a waiver of the penalties. This form is for. This form is for income earned in tax year 2022, with tax returns due in april. Involved parties names, addresses and phone numbers. When i opened the form, i noticed that the program did not have. Web you or your spouse (if you file a joint return) retired in the past 2 years after reaching age 62 or became disabled. When you log into the nj. Ad uslegalforms.com has been visited by 100k+ users in the past month Estates and trusts are subject to interest on underpayment of estimated. Underpayment of estimated tax by individuals, estates, or trusts. Underpayment of estimated tax by individuals, estates, or trusts. Underpayment of estimated tax by individuals, estates, or trusts. Web use form 2210 to determine the amount of underpaid estimated tax and resulting penalties as well as for requesting a waiver of the penalties. Involved parties names, addresses and phone numbers. Ad uslegalforms.com has been visited by 100k+ users in the past month Web application for extension of time to. When i opened the form, i noticed that the program did not have. Ad uslegalforms.com has been visited by 100k+ users in the past month Underpayment of estimated tax by individuals, estates, or trusts. Complete part i, figuring your underpayment, to determine if you have. Use form 2210 to see if you owe a penalty for underpaying your estimated tax. Estimated income tax payment voucher for 2023. Estates and trusts are subject to interest on underpayment of estimated. Web application for extension of time to file income tax return. Ad uslegalforms.com has been visited by 100k+ users in the past month Underpayment of estimated tax by individuals, estates, or trusts. Estates and trusts are subject to interest on underpayment of estimated. Estates and trusts are subject to interest on underpayment of estimated. Web application for extension of time to file income tax return. Estimated income tax payment voucher for 2023. When i opened the form, i noticed that the program did not have. Complete part i, figuring your underpayment, to determine if you have. Underpayment of estimated tax by individuals, estates, or trusts. Ad uslegalforms.com has been visited by 100k+ users in the past month When i opened the form, i noticed that the program did not have. Involved parties names, addresses and phone numbers. Estates and trusts are subject to interest on underpayment of estimated. Estimated income tax payment voucher for 2023. Estates and trusts are subject to interest on underpayment of estimated. The irs will generally figure your penalty for you and you should not file. This form is for income earned in tax year 2022, with tax returns due in april. Web you or your spouse (if you file a joint return) retired in the past 2 years after reaching age 62 or became disabled and you had reasonable cause to underpay or pay. Underpayment of estimated tax by individuals, estates, or trusts. Web use form 2210 to determine the amount of underpaid estimated tax and resulting penalties as well as for requesting a waiver of the penalties. When you log into the nj. Use form 2210 to see if you owe a penalty for underpaying your estimated tax. The irs will generally figure your penalty for you and you should not file. Ad signnow.com has been visited by 100k+ users in the past month Estimated income tax payment voucher for 2023. Complete part i, figuring your underpayment, to determine if you have. Involved parties names, addresses and phone numbers. Web my nj state return had an underpayment penalty that was added based on nj form 2210. When i opened the form, i noticed that the program did not have. Underpayment of estimated tax by individuals, estates, or trusts. Estates and trusts are subject to interest on underpayment of estimated. Underpayment of estimated tax by individuals, estates, or trusts. This form is for income earned in tax year 2022, with tax returns due in april. Fill out the empty fields; Web application for extension of time to file income tax return. Ad uslegalforms.com has been visited by 100k+ users in the past month Estates and trusts are subject to interest on underpayment of estimated.1040 Nj State Form Fill Out and Sign Printable PDF Template signNow

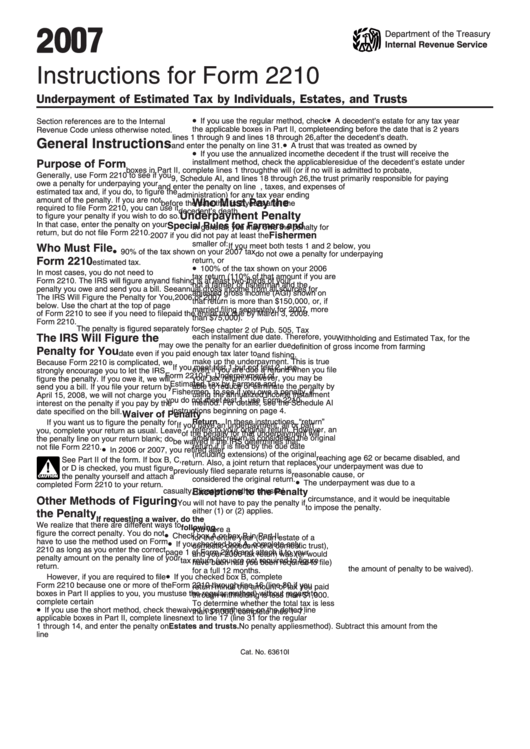

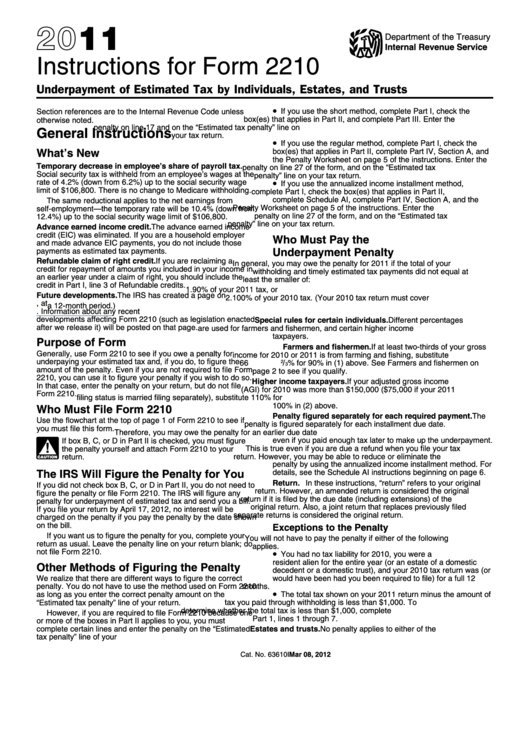

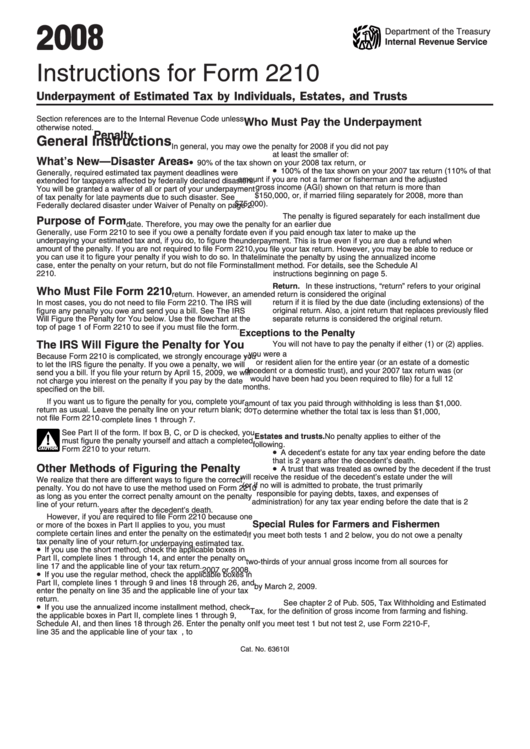

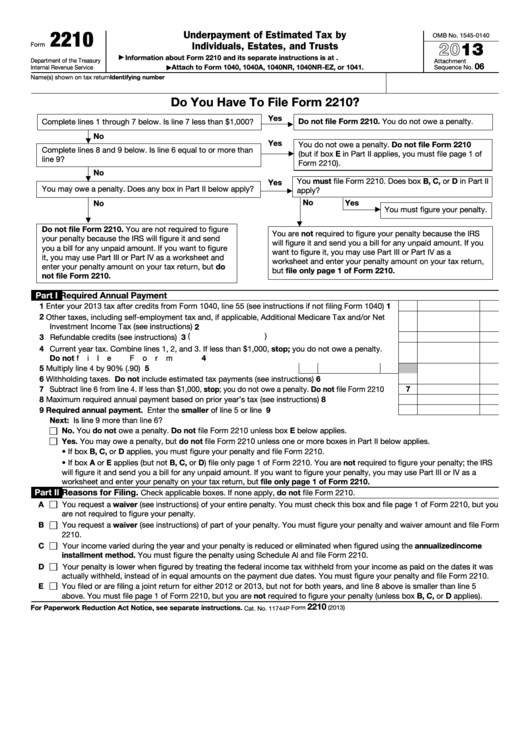

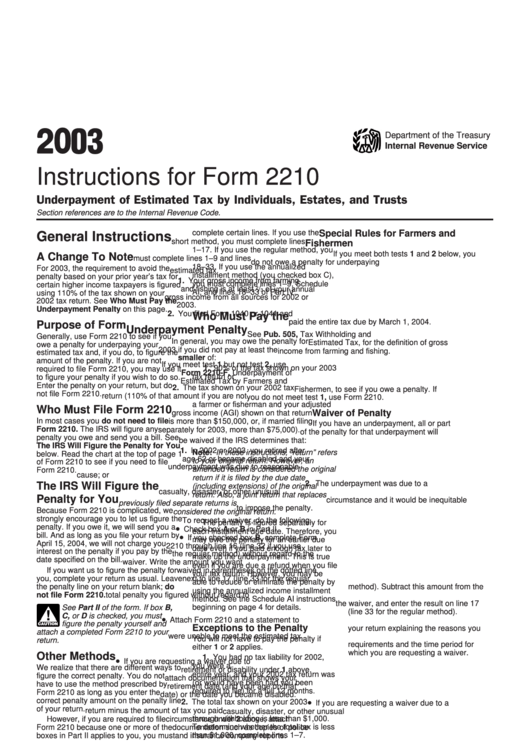

Instructions For Form 2210 Underpayment Of Estimated Tax By

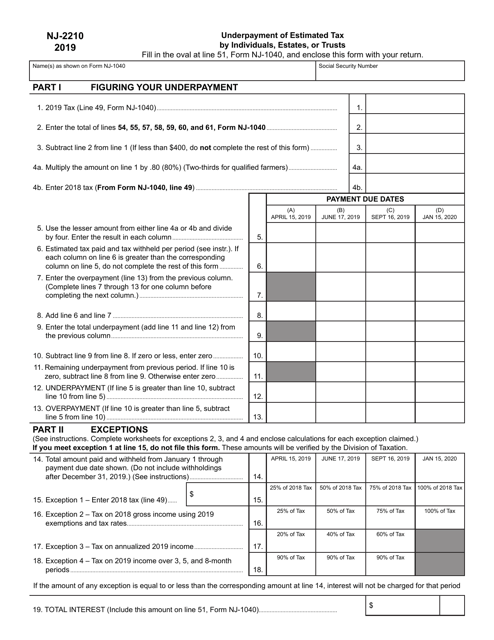

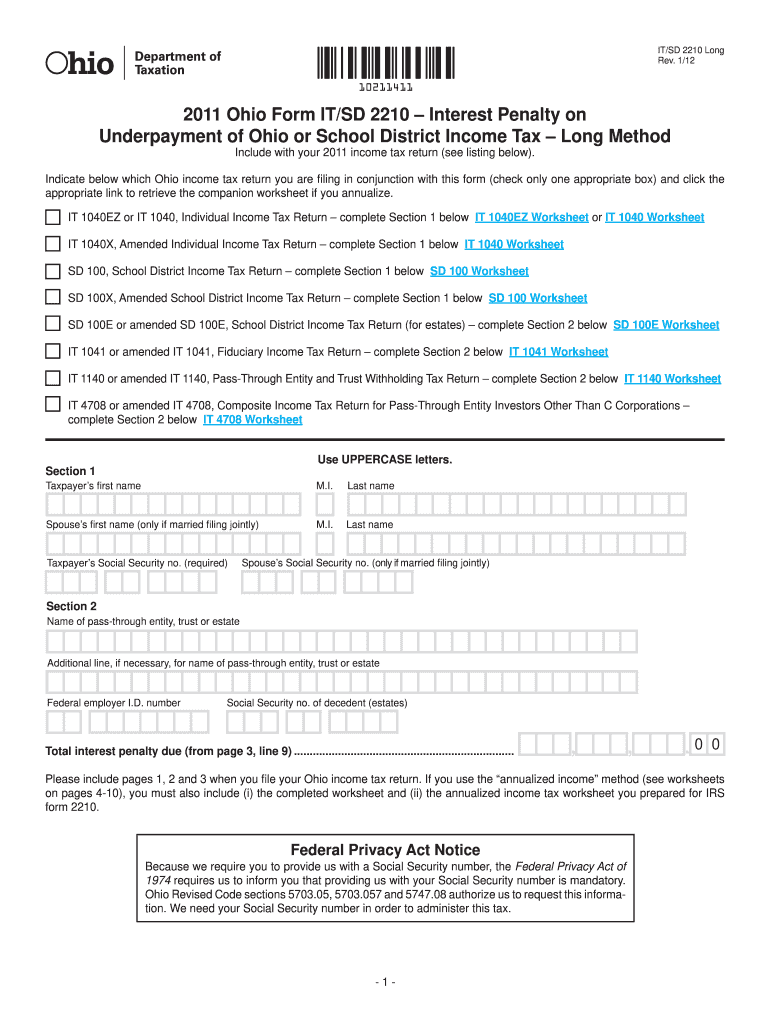

Form NJ2210 Download Fillable PDF or Fill Online Underpayment of

Instructions For Form 2210 Underpayment Of Estimated Tax By

Instructions For Form 2210 2008 printable pdf download

2210 Form Fill Out and Sign Printable PDF Template signNow

Form NJ1040 Download Fillable PDF or Fill Online New Jersey Resident

Fillable Form 2210 Underpayment Of Estimated Tax By Individuals

Fillable Form Nj2210 Underpayment Of Estimated Tax By Individuals

Instructions For Form 2210 Underpayment Of Estimated Tax By

Related Post: