Nebraska Sales Tax Exemption Form

Nebraska Sales Tax Exemption Form - Complete, edit or print tax forms instantly. Ad collect and report on exemption certificates quickly to save your company time and money. Check one c purchase for resale. Or rental of the atv or utv is exempt from sales. Ad collect and report on exemption certificates quickly to save your company time and money. Web nebraska sales and use tax for farmers and ranchers can be a difficult subject. Web in nebraska, you’ll need to obtain the certificate of exemption form from the department of revenue. Web hereby certify that the purchase, lease, or rental by the above purchaser is exempt from the nebraska sales tax for the following reason: New state sales tax registration application exemption Web forms purchase card. States require their vendors to retain additional documentation in addition to a copy of the tax exemption card. For example, certain states require foreign missions. Ad taxes certification registration application for new businesses. New state sales tax registration application exemption Web sales of any form of animal life, the products of which ordinarily constitute food for human consumption (for example,. Get ready for tax season deadlines by completing any required tax forms today. Web exempt from payment of the nebraska sales tax by qualifying for one of the six enumerated categories of exemption (shown to the right). Save or instantly send your ready. Ad collect and report on exemption certificates quickly to save your company time and money. Web to. Streamlined sales tax certificate of exemption. Web we last updated the streamlined sales tax agreement certificate of exemption in april 2023, so this is the latest version of form f0003, fully updated for tax year 2022. Check one purchase for resale. Form 13, section b must be filed by persons or organizations exempt from payment of the nebraska sales tax. Web nebraska sales and use tax for farmers and ranchers can be a difficult subject. Nebraska sales and use tax statement. Form 13, section b must be filed by persons or organizations exempt from payment of the nebraska sales tax by qualifying. Check one c purchase for resale. Web i hereby certify that the purchase, lease, or rental by the. Web who may file an exempt sale certificate. For example, certain states require foreign missions. Complete, edit or print tax forms instantly. Web file your nebraska and local sales and use tax return, form 10, online. Streamline the entire lifecycle of exemption certificate management. Get ready for tax season deadlines by completing any required tax forms today. Web nebraska sales and use tax for farmers and ranchers can be a difficult subject. Ad taxes certification registration application for new businesses. Streamlined sales tax certificate of exemption. Web we last updated the streamlined sales tax agreement certificate of exemption in april 2023, so this is. New state sales tax registration application exemption Web forms purchase card. Streamline the entire lifecycle of exemption certificate management. Easily fill out pdf blank, edit, and sign them. Nebraska sales and use tax statement. Nebraska sales and use tax statement. Streamlined sales tax certificate of exemption. States require their vendors to retain additional documentation in addition to a copy of the tax exemption card. For example, certain states require foreign missions. When purchasing or leasing depreciable agricultural machinery and equipment for commercial. Web code, ch.1, § 012 the nebraska department of revenue (dor) is publishing the following sales tax exemption list of most exemptions and separate regulations that define,. Check one c purchase for resale. Or rental of the atv or utv is exempt from sales. Streamlined sales tax certificate of exemption. Web who may file an exempt sale certificate. Web any qualified nonprofit organization wishing to make tax exempt purchases of property or taxable services, to be used by and for the purposes of the exempt facility or activities,. Check one c purchase for resale. Web nebraska sales and use tax for farmers and ranchers can be a difficult subject. Web hereby certify that the purchase, lease, or rental. Web forms purchase card. Easily fill out pdf blank, edit, and sign them. Get ready for tax season deadlines by completing any required tax forms today. Web we last updated the streamlined sales tax agreement certificate of exemption in april 2023, so this is the latest version of form f0003, fully updated for tax year 2022. Ad collect and report on exemption certificates quickly to save your company time and money. Ad collect and report on exemption certificates quickly to save your company time and money. Check one purchase for resale. Streamline the entire lifecycle of exemption certificate management. New state sales tax registration application exemption Web i hereby certify that the purchase, lease, or rental by the above purchaser is exempt from the nebraska sales tax for the following reason: Web nebraska department of revenue, property assessment division. Web who may file an exempt sale certificate. When purchasing or leasing depreciable agricultural machinery and equipment for commercial. Web code, ch.1, § 012 the nebraska department of revenue (dor) is publishing the following sales tax exemption list of most exemptions and separate regulations that define,. Web sales of any form of animal life, the products of which ordinarily constitute food for human consumption (for example, cattle, sheep, swine, baby chicks, turkey poults, poultry, and. Ad taxes certification registration application for new businesses. Check one c purchase for resale. Streamline the entire lifecycle of exemption certificate management. Form 13, section b must be filed by persons or organizations exempt from payment of the nebraska sales tax by qualifying. For example, certain states require foreign missions.Tax Exempt Form Fill Online, Printable, Fillable, Blank pdfFiller

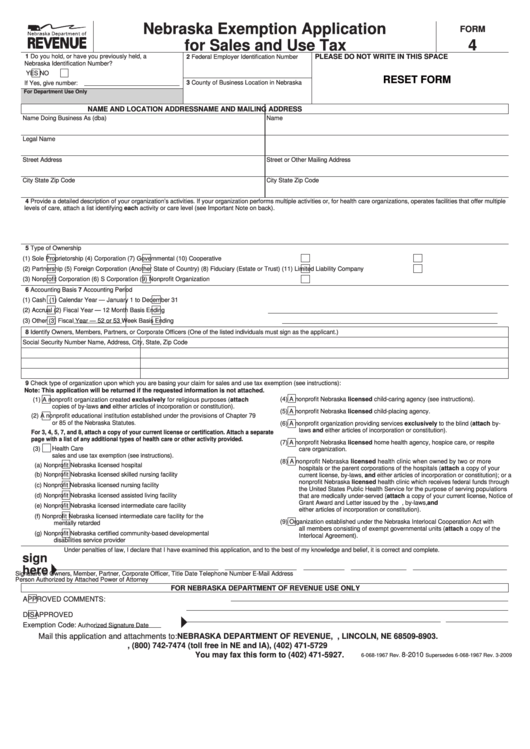

Fillable Form 4 Nebraska Exemption Application For Sales And Use Tax

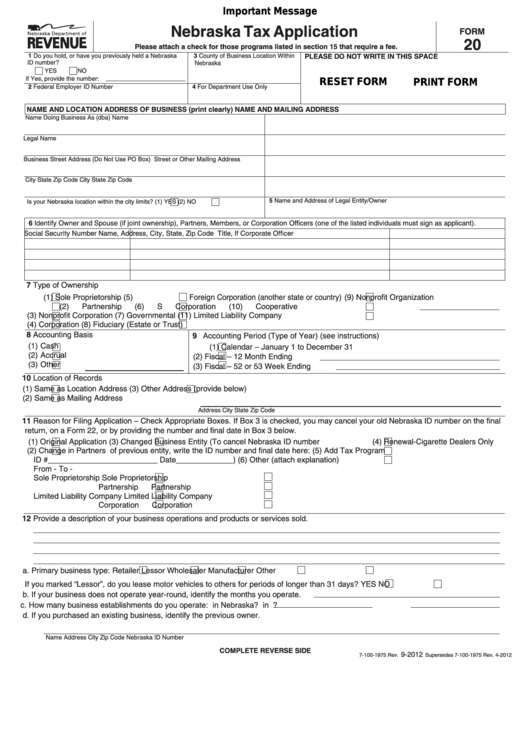

Fillable Form 20 Nebraska Tax Application printable pdf download

How to get a Nebraska Resale Certificate [2023 Guide

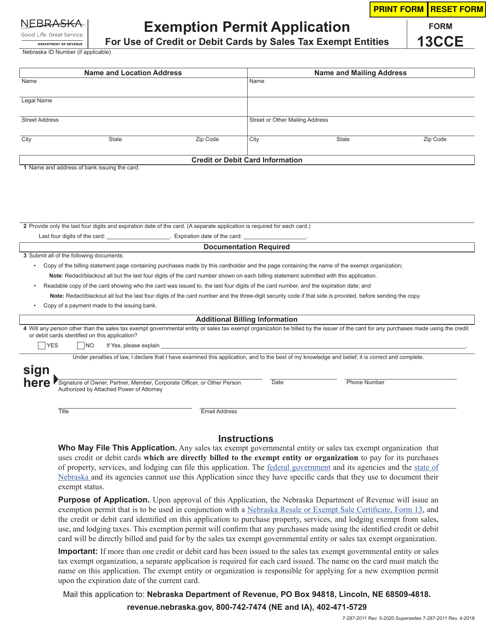

Form 13CCE Download Fillable PDF or Fill Online Exemption Permit

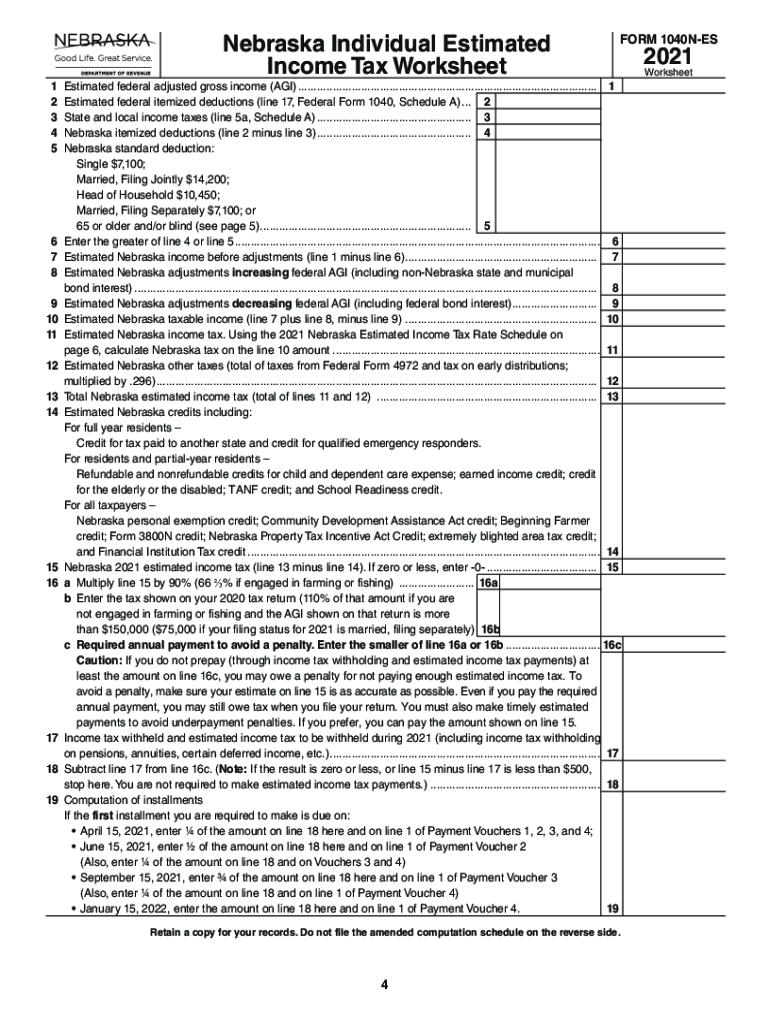

Nebraska Form Estimated Tax Fill Out and Sign Printable PDF Template

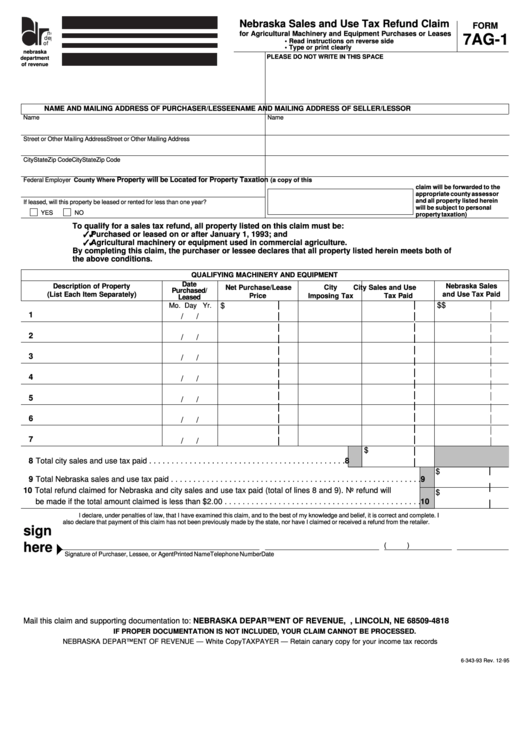

Form 7ag1 Nebraska Sales And Use Tax Refund Claim printable pdf download

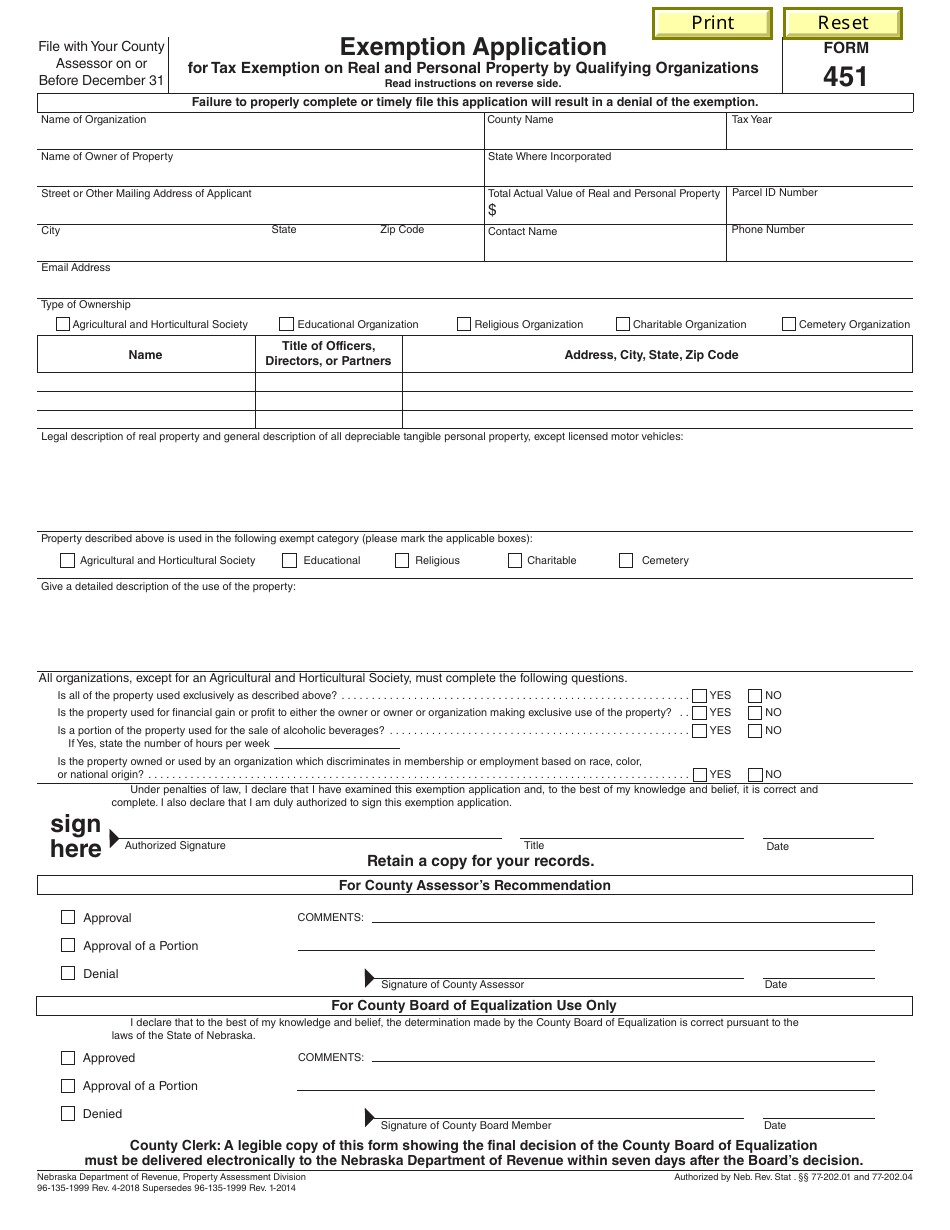

Form 451 Download Fillable PDF or Fill Online Exemption Application for

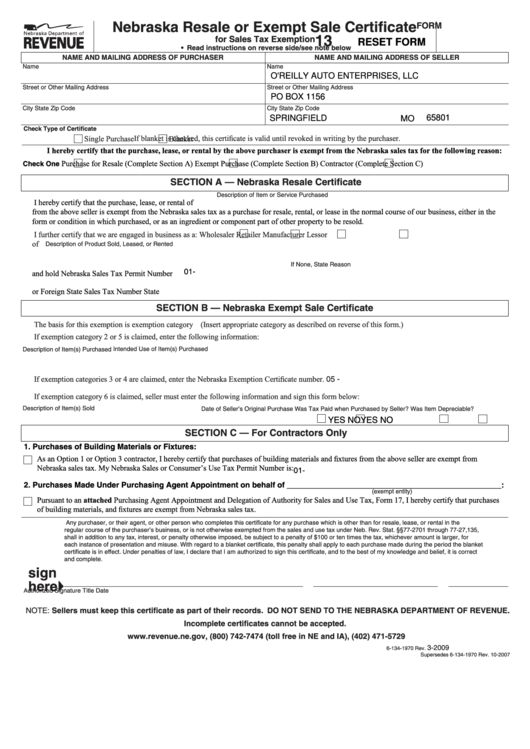

Fillable Form 13 Nebraska Resale Or Exempt Sale Certificate For Sales

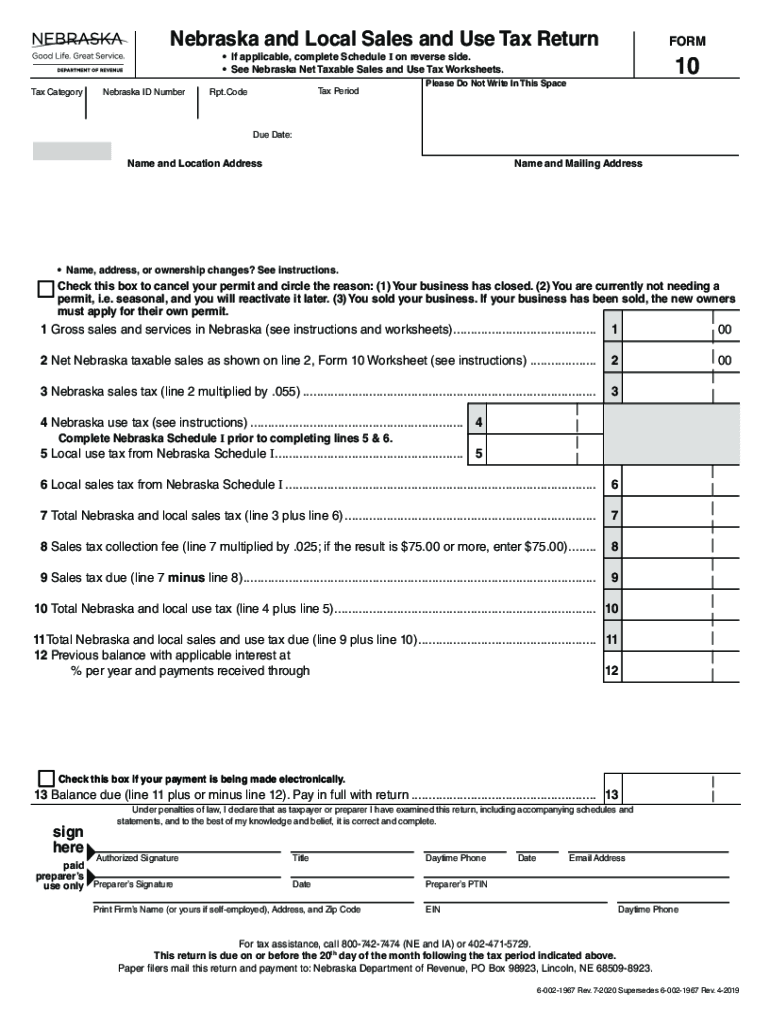

State Of Nebraska Local Sales And Use Tax Return Form 10 Fill Out and

Related Post: