Nebraska Ptc Form

Nebraska Ptc Form - Web form ptc nebraska property tax credit. Web apply for the refundable credits using the 2022 nebraska property tax credit form. Web taxpayers are eligible to claim credits by filing the nebraska property tax incentive act credit computation, form ptc, with their nebraska income or financial. Web form ptc must be filed with the nebraska income tax or financial institution tax return on which the credit is claimed or the school district property tax paid is distributed. Web to claim the credit, you’ll need to include form ptc 2022 with your taxes. Get ready for tax season deadlines by completing any required tax forms today. Web the nebraska property tax incentive act credit computation, form ptc, is used to identify parcels and compute a tax credit for school district property tax paid. Web to claim your income tax credits, you will need to file form ptc. You can file those years on. Web which nebraska property tax credit, form ptc should i file? Use this form with the forms noted below to. Web taxpayers are eligible to claim credits by filing the nebraska property tax incentive act credit computation, form ptc, with their nebraska income or financial. Get ready for tax season deadlines by completing any required tax forms today. Web to claim the credit, you’ll need to include form ptc 2022 with. Web form ptc must be filed with the nebraska income tax or financial institution tax return on which the credit is claimed or the school district property tax paid is distributed. You must file the form ptc for the same tax year as the income tax return on which the credit is claimed. Web form ptc, property tax incentive act. Use this form with the forms noted below to. Web which nebraska property tax credit, form ptc should i file? Find out more information here and direct questions to nebraska taxpayer. Web your social security number spouse’s social security number high school district code. For taxable years beginning on or after january 1, 2020, a property tax incentive act credit. Web enter the allowable dollar amount of taxes paid on each parcel on form ptc—nebraska property tax incentive act credit computation: Web form ptc must be filed with the nebraska income tax or financial institution tax return on which the credit is claimed or the school district property tax paid is distributed. If you didn’t claim the credit in 2020. (1) single (2) married, filing jointly. Web which nebraska property tax credit, form ptc should i file? For this, you’ll need the tax dollar amount you paid on each piece of property towards schools and community. The nebraska property tax credit, form ptc, is used to identify parcels and compute a tax credit for nebraska school district and community college. 2022 nebraska property tax credit, form ptc. Web enter the allowable dollar amount of taxes paid on each parcel on form ptc—nebraska property tax incentive act credit computation: Get ready for tax season deadlines by completing any required tax forms today. The nebraska property tax credit, form ptc, is used to identify parcels and compute a tax credit for nebraska. The nebraska property tax incentive act credit computation, form ptc, is used to identify parcels and compute a tax credit for school district property tax paid. Web taxpayers are eligible to claim credits by filing the nebraska property tax incentive act credit computation, form ptc, with their nebraska income or financial. Use this form with the forms noted below to. 2021 nebraska property tax incentive act credit computation, form ptc. Web form ptc must be filed with the nebraska income tax or financial institution tax return on which the credit is claimed or the school district property tax paid is distributed. (1) single (2) married, filing jointly. Web step 2 enter the dollar amount of taxes paid on each parcel. You can file those years on. The nebraska property tax credit, form ptc, is used to identify parcels and compute a tax credit for nebraska school district and community college property taxes. Web to claim the credit, you’ll need to include form ptc 2022 with your taxes. Web apply for the refundable credits using the 2022 nebraska property tax credit. For this, you’ll need the tax dollar amount you paid on each piece of property towards schools and community. Web to claim your income tax credits, you will need to file form ptc. Ad download or email ne form 21 & more fillable forms, register and subscribe now! For taxable years beginning on or after january 1, 2020, a property. Web your social security number spouse’s social security number high school district code. Use this form with the forms noted below to claim the property tax credits. Web to claim the credit, you’ll need to include form ptc 2022 with your taxes. You must file the form ptc for the same tax year as the income tax return on which the credit is claimed. Web to claim your income tax credits, you will need to file form ptc. 2021 nebraska property tax incentive act credit computation, form ptc. Web the nebraska property tax incentive act credit computation, form ptc, is used to identify parcels and compute a tax credit for school district property tax paid. 2022 nebraska property tax credit, form ptc. Use this form with the forms noted below to. Get ready for tax season deadlines by completing any required tax forms today. Web you may only use the 2021 form ptcx if you filed an original 2021 form 1040n with nebraska and failed to claim the school district property tax credit on your original. Web form ptc must be filed with the nebraska income tax or financial institution tax return on which the credit is claimed or the school district property tax paid is distributed. For this, you’ll need the tax dollar amount you paid on each piece of property towards schools and community. Social security number or nebraska id number. Web taxpayers are eligible to claim credits by filing the nebraska property tax incentive act credit computation, form ptc, with their nebraska income or financial. The nebraska property tax credit, form ptc, is used to identify parcels and compute a tax credit for nebraska school district and community college property taxes. You can file those years on. Web form ptc must be filed with the nebraska income tax or financial institution tax return on which the credit is claimed or the school district property tax paid is distributed. Web form ptc, property tax incentive act credit, is available on turbotax. If you didn’t claim the credit in 2020 or 2021 it’s not too late!Ptcfor renewal requirements 2019 Fill out & sign online DocHub

mo 1040a fillable 2019 Fill out & sign online DocHub

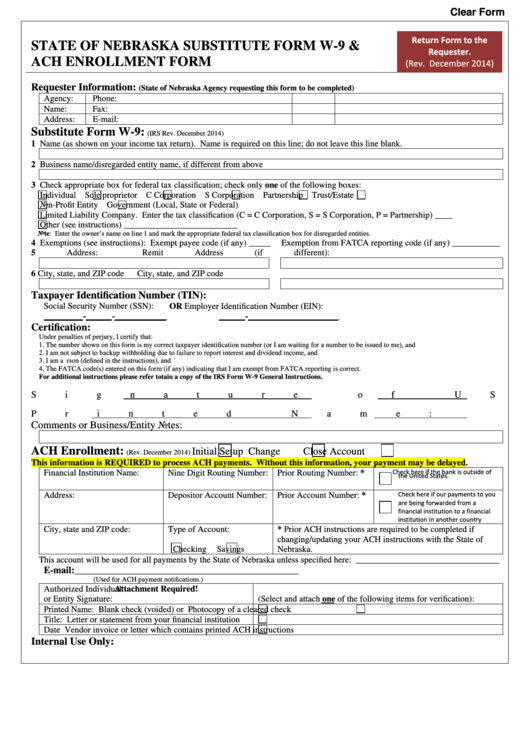

Fillable State Of Nebraska Substitute Form W9 & Ach Enrollment Form

Solved Nebraska form PTC 2020

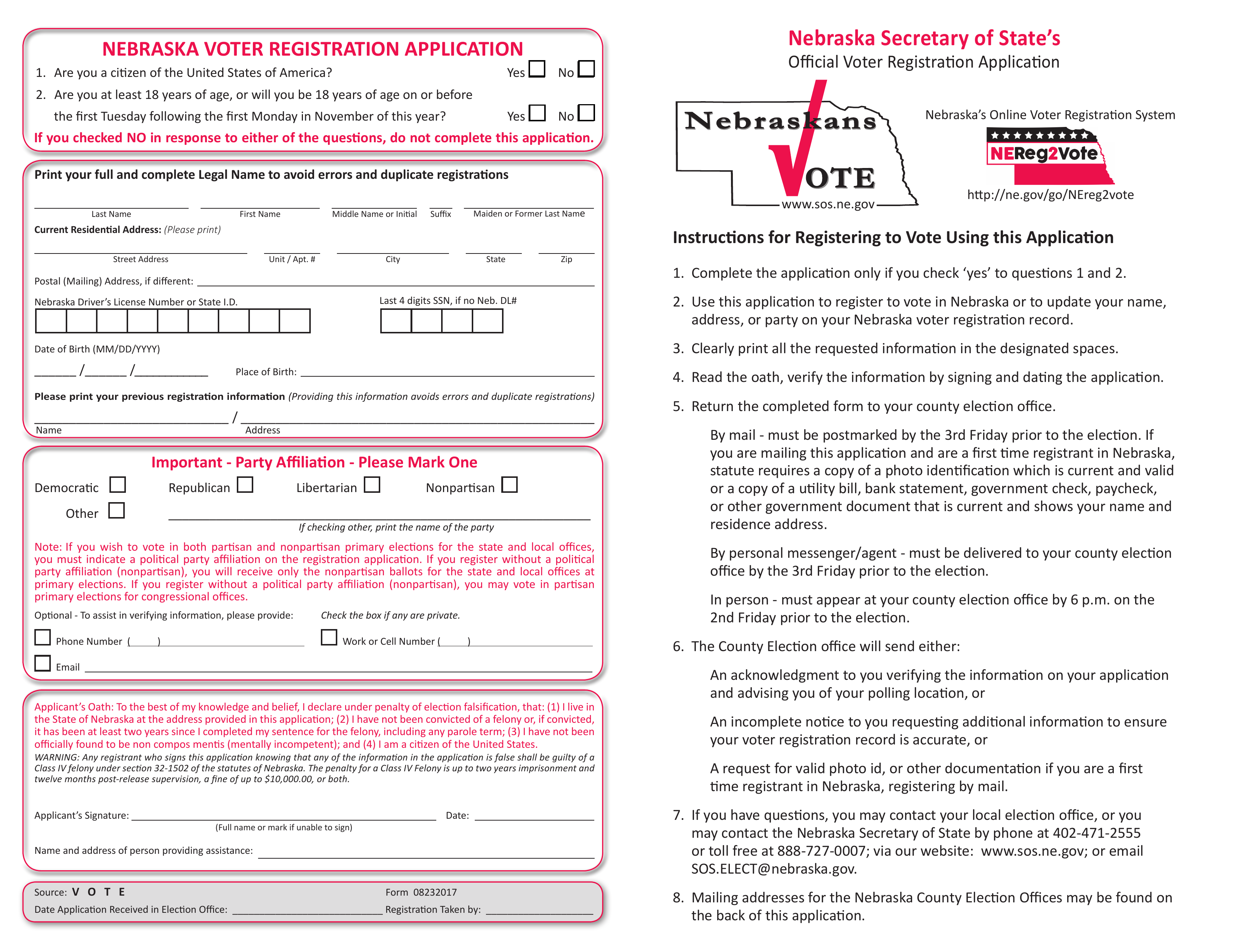

Free Nebraska Voter Registration Form Register to Vote in NE PDF

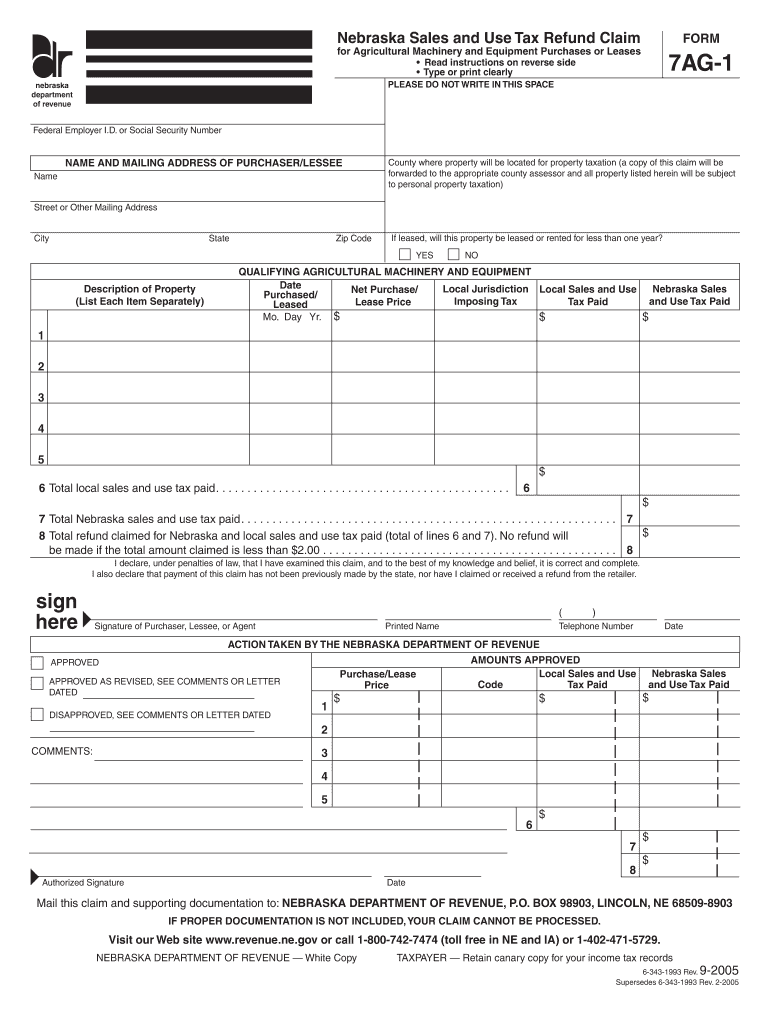

Nebraska 1 Form Fill Out and Sign Printable PDF Template signNow

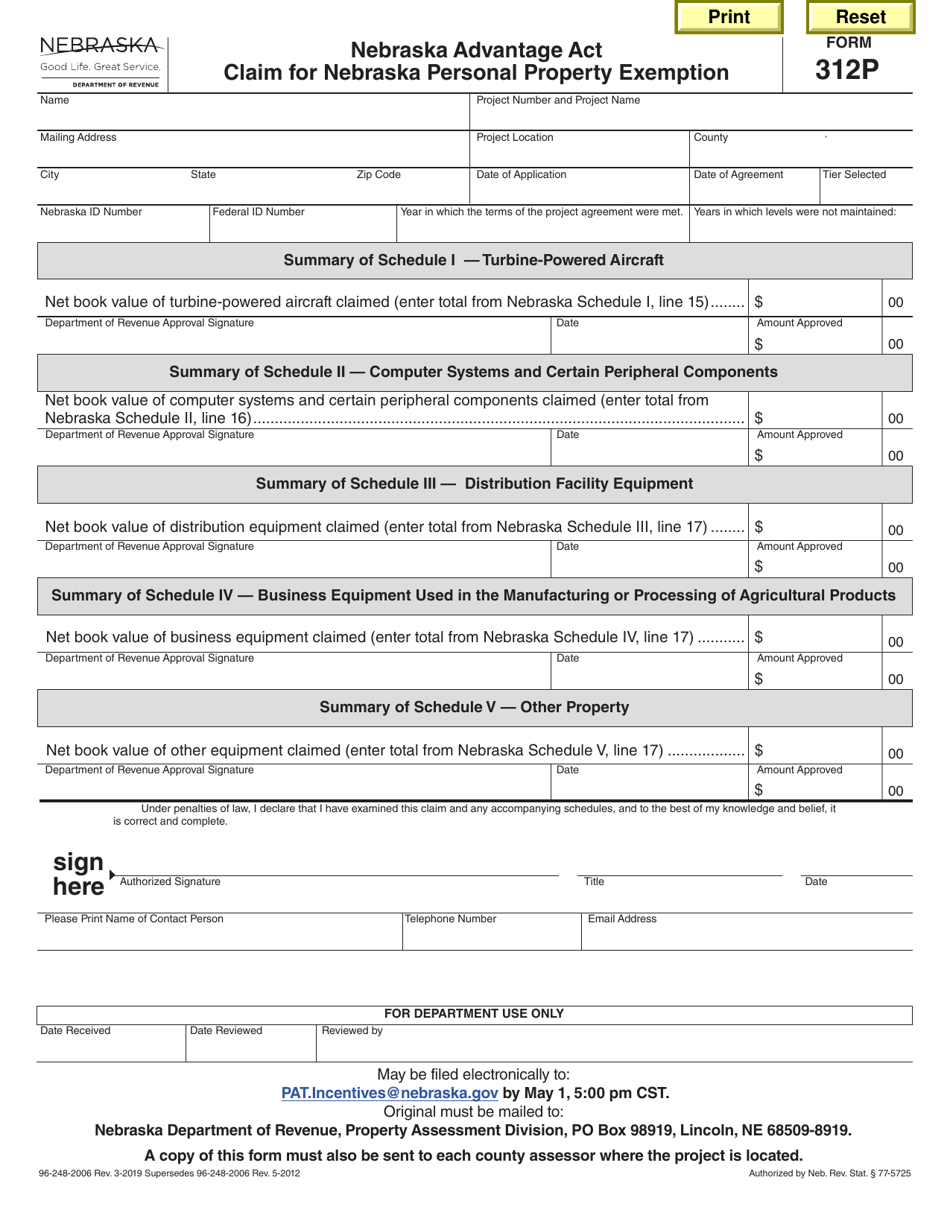

Form 312P Fill Out, Sign Online and Download Fillable PDF, Nebraska

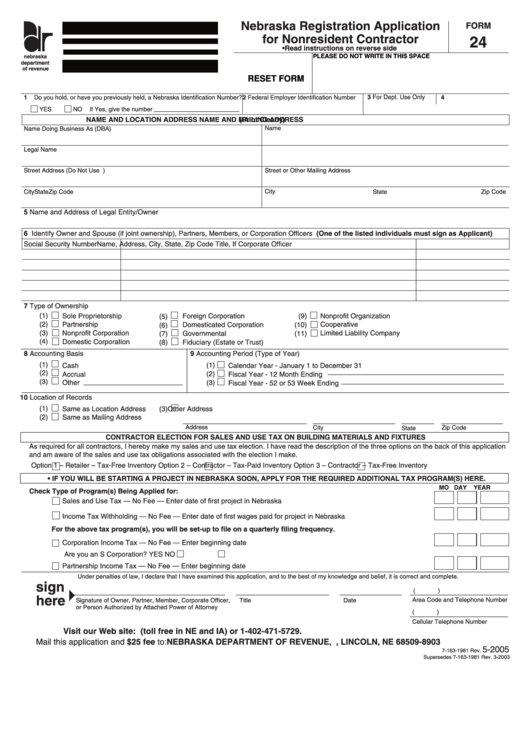

Fillable Form 24 Nebraska Registration Application For Nonresident

Nebraska Form 6 20202022 Fill and Sign Printable Template Online

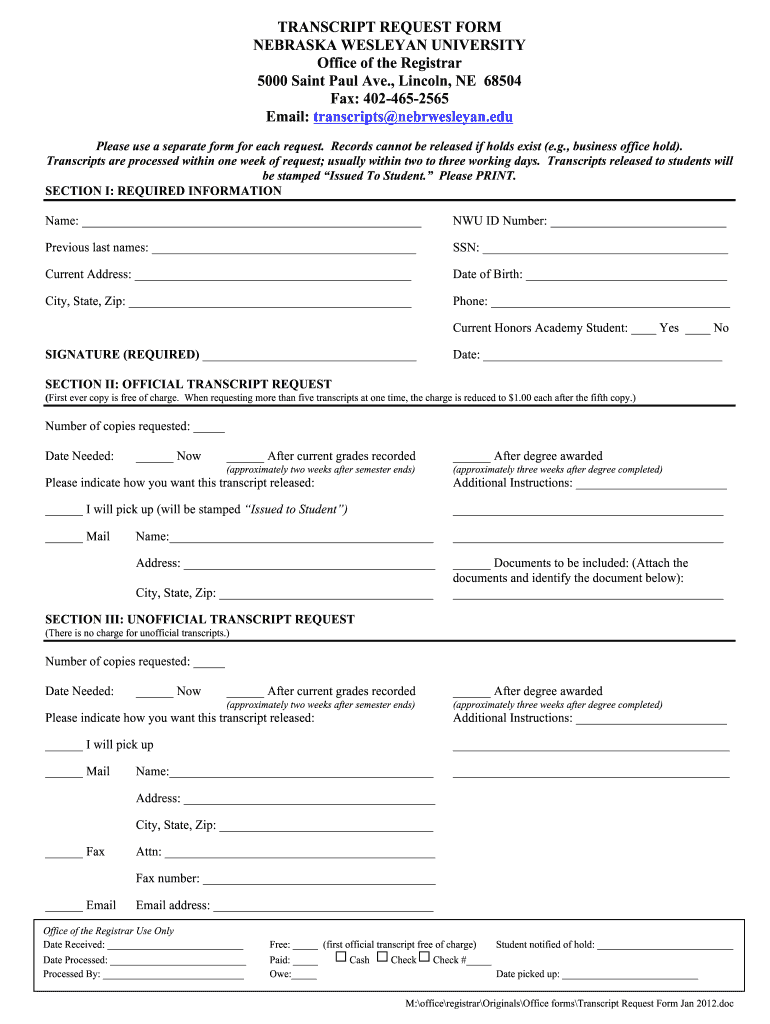

Nebraska Wesleyan University Transcript Request Form 20122021 Fill

Related Post: