Nc Sales And Use Tax Form

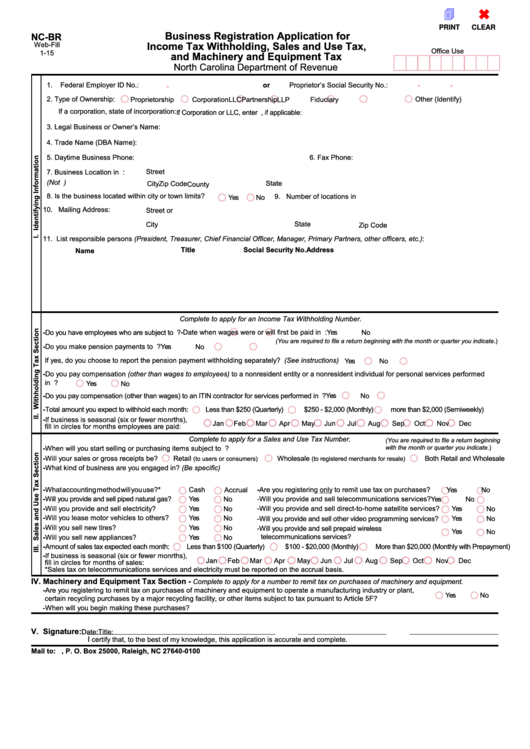

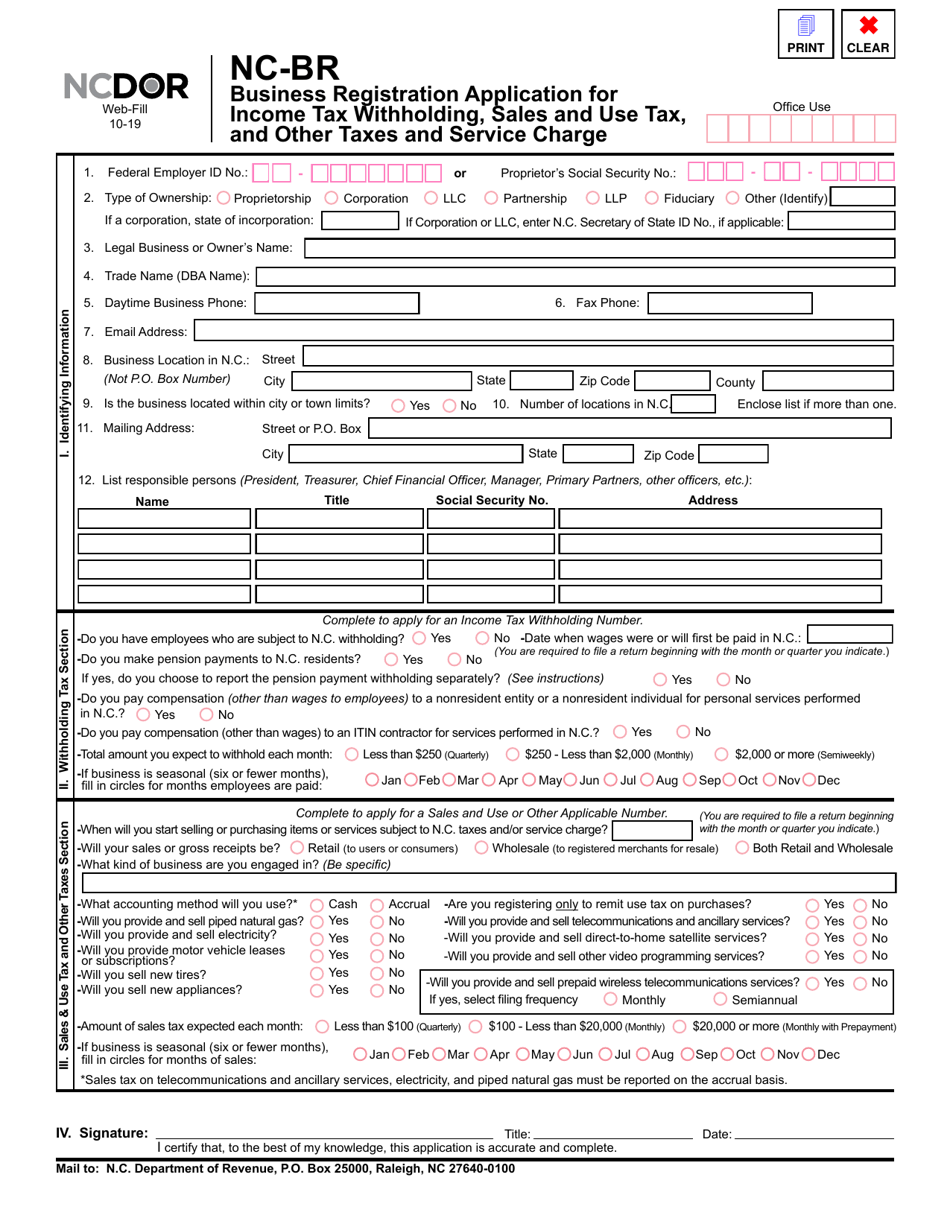

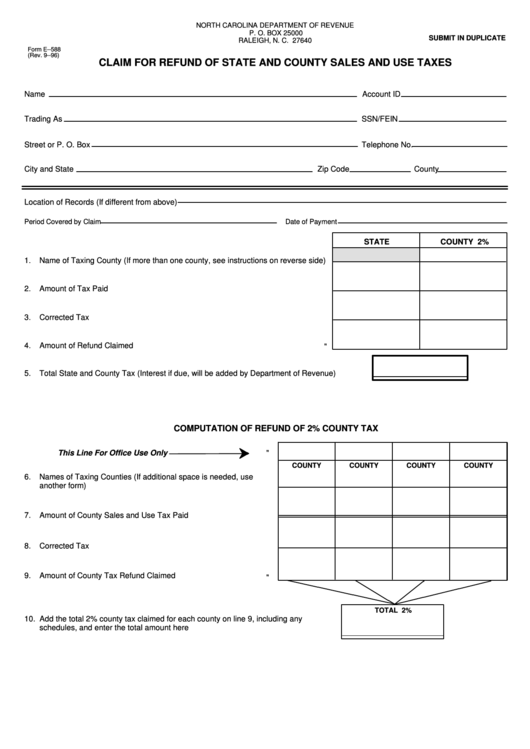

Nc Sales And Use Tax Form - Application for state agency exemption number for sales and use taxes. If your sales and use tax filing frequency. This tutorial video provides step by step instructions for filing and paying the sales and use. Ad our tax preparers will ensure that your tax returns are complete, accurate and on time. We strongly encourage you to use the. Ad collect and report on exemption certificates quickly to save your company time and money. Legal business or owner’s name: Application for direct pay permit, sales and use taxes for tangible. Not all states allow all exemptions listed on this form. Using this system allows us to process your. Application for state agency exemption number for sales and use taxes. Legal business or owner’s name: Streamline the entire lifecycle of exemption certificate management. Taxpayers who have a filing frequency of monthly with prepayment are. This tutorial video provides step by step instructions for filing and paying the sales and use. Streamline the entire lifecycle of exemption certificate management. Proprietorship if a corporation, state of incorporation: General sales and use tax; Who should register for sales and use tax? Streamline the entire lifecycle of exemption certificate management. Application for state agency exemption number for sales and use taxes. Using this system allows us to process your. Streamline the entire lifecycle of exemption certificate management. If your sales and use tax filing frequency. Web sales and use tax. Application for state agency exemption number for sales and use taxes. Streamline the entire lifecycle of exemption certificate management. If your sales and use tax filing frequency. Overview of sales and use taxes; Using this system allows us to process your. Ad our tax preparers will ensure that your tax returns are complete, accurate and on time. Streamline the entire lifecycle of exemption certificate management. The registry of sales and use tax numbers contains the names and account id and sst ids, as applicable, of all active sales and. Finding it harder than ever to file efficiently without risking costly errors?. General sales and use tax; Legal business or owner’s name: Ad collect and report on exemption certificates quickly to save your company time and money. Complete, edit or print tax forms instantly. Who should register for sales and use tax? Complete, edit or print tax forms instantly. Using this system allows us to process your. Web sales and use tax return form: Web registry of sales and use tax numbers. The registry of sales and use tax numbers contains the names and account id and sst ids, as applicable, of all active sales and. General sales and use tax; Legal business or owner’s name: The registry of sales and use tax numbers contains the names and account id and sst ids, as applicable, of all active sales and. Ad collect and report on exemption certificates quickly to save your company time and money. Overview of sales and use taxes; Ad our tax preparers will ensure that your tax returns are complete, accurate and on time. Complete, edit or print tax forms instantly. Legal business or owner’s name: Overview of sales and use taxes; Who should register for sales and use tax? Web sales and use tax. Legal business or owner’s name: Streamline the entire lifecycle of exemption certificate management. If so, click here to view a step by step video tutorial. Ad collect and report on exemption certificates quickly to save your company time and money. Legal business or owner’s name: Ad our tax preparers will ensure that your tax returns are complete, accurate and on time. Streamline the entire lifecycle of exemption certificate management. The registry of sales and use tax numbers contains the names and account id and sst ids, as applicable, of all active sales and. Web sales and use tax return form: Application for state agency exemption number for sales and use taxes. Overview of sales and use taxes; Complete, edit or print tax forms instantly. Web every person engaged in business in north carolina is required to collect and pay sales or use tax on retail sales or leases of tangible personal property and certain digital property. Ad collect and report on exemption certificates quickly to save your company time and money. Application for direct pay permit, sales and use taxes for tangible. Proprietorship if a corporation, state of incorporation: Taxpayers who have a filing frequency of monthly with prepayment are. If so, click here to view a step by step video tutorial. Who should register for sales and use tax? Using this system allows us to process your. Ad collect and report on exemption certificates quickly to save your company time and money. Not all states allow all exemptions listed on this form. Web sales and use tax. Finding it harder than ever to file efficiently without risking costly errors?Fillable Form NcBr Business Registration Application For Tax

Form NCBR Download Fillable PDF or Fill Online Business Registration

Certificados imprimibles de exención de impuestos sobre las ventas de

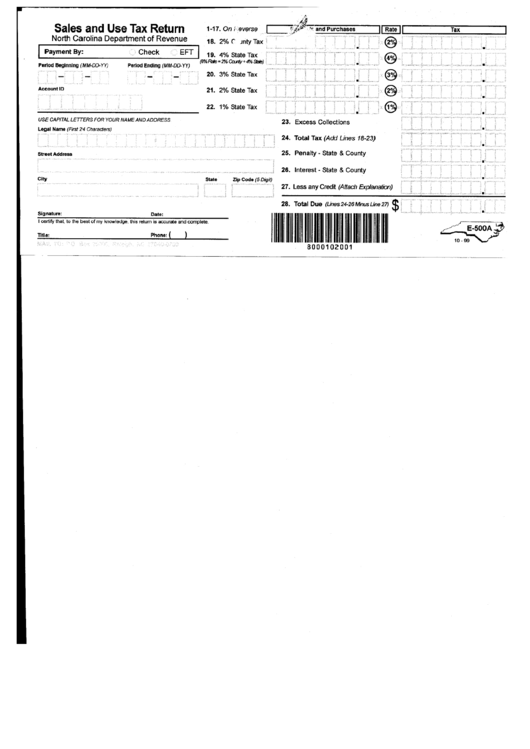

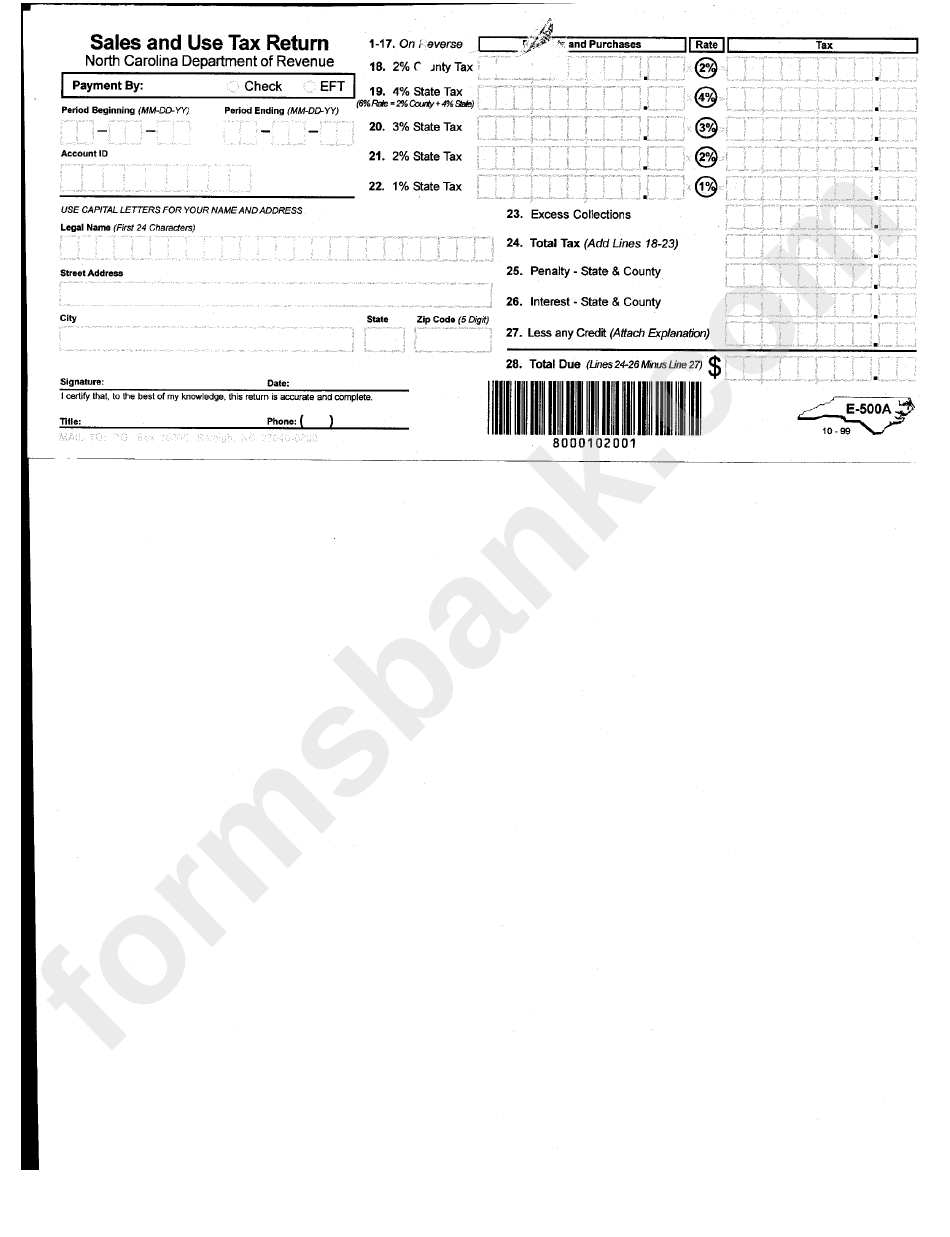

Form E500a Sales And Use Tax Return North Carolina Department Of

2007 Form NC DoR E595E Fill Online, Printable, Fillable, Blank pdfFiller

Nc department of revenue sales and use tax e500 form pdf download 2008

2015 Form NC DoR BC775 Fill Online, Printable, Fillable, Blank

Top 20 Nc Sales And Use Tax Form Templates free to download in PDF format

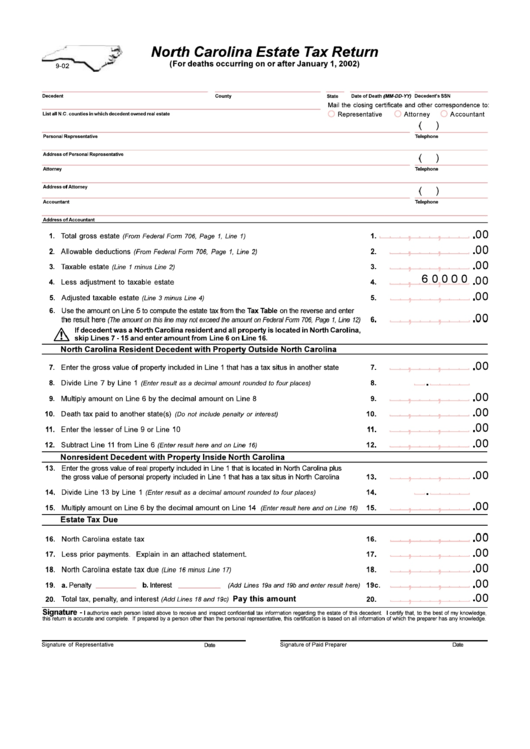

North Carolina Estate Tax Return Form printable pdf download

Form E500a Sales And Use Tax Return North Carolina Department Of

Related Post: