Mn State Income Tax Form

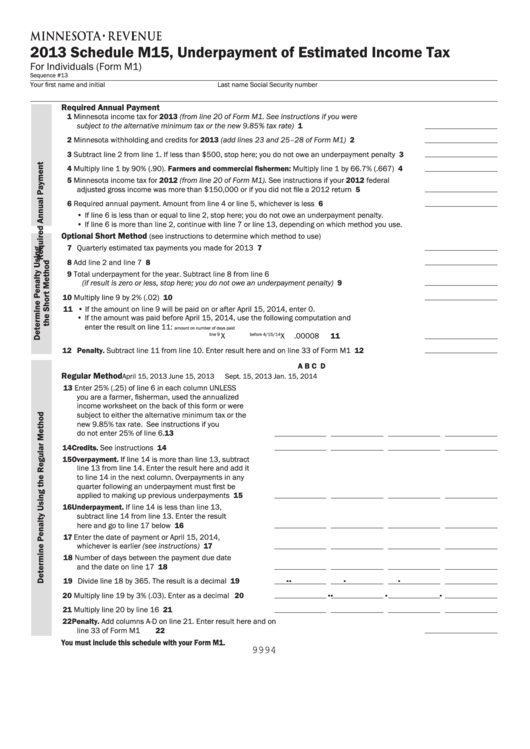

Mn State Income Tax Form - Web 2021 form m1, individual income tax. Ad premium state tax software. Web the irmaa is calculated on a sliding scale with five income brackets topping out at $500,000 and $750,000 for individual and joint filing, respectively. • get forms, instructions, and fact sheets • get answers to your questions • check on your. A copy of the federal form 1040, including a copy of schedule c or. Web we last updated minnesota form m1 instructions in february 2023 from the minnesota department of revenue. Web minnesota has a state income tax that ranges between 5.35% and 9.85%, which is administered by the minnesota department of revenue. Web if you are due a property tax refund or state income tax refund, we will apply it to your deferred property tax total and notify you when this happens. This credit can reduce the taxes you. Explore these zero income tax states. Cookies are required to use this site. The due date for 2022 returns is april 18, 2023. • get forms, instructions, and fact sheets • get answers to your questions • check on your. You can get minnesota tax forms either by mail or in person. Web 2021 form m1, individual income tax. Tate income tax • state income tax. Minnesota individual income tax applies to residents and nonresidents who meet the state's minimum filing requirements. You can also look for forms by category below the search box. Use this tool to search for a specific tax form using the tax form number or name. Web minnesota has a state income tax that. Web we last updated the minnesota individual income tax instructions (form m1) in february 2023, so this is the latest version of form m1 instructions, fully updated for tax year. A copy of the federal form 1040, including a copy of schedule c or. Web 2021 form m1, individual income tax. Find free tax preparation help; You may qualify for. Web file an income tax return; Web we last updated the minnesota individual income tax instructions (form m1) in february 2023, so this is the latest version of form m1 instructions, fully updated for tax year. Explore these zero income tax states. These 2021 forms and more are available: The due date for 2022 returns is april 18, 2023. You may qualify for free electronic filing if your. Web minnesota has a state income tax that ranges between 5.35% and 9.85%. This form is for income earned in tax year 2022, with tax. A copy of the federal form 1040, including a copy of schedule c or. For individuals free income tax filing and help • get forms, instructions, and fact sheets • get answers to your questions • check on your. Your first name and initial. You can get minnesota tax forms either by mail or in person. When does an employee complete form w. Tate income tax • state income tax. You can also look for forms by category below the search box. A copy of the federal form 1040, including a copy of schedule c or. This form is for income earned in tax year 2022, with tax. You must file yearly by april 17. Web earned income tax credit. You can get minnesota tax forms either by mail or in person. Web form m1 is the most common individual income tax return filed for minnesota residents. Web file an income tax return; These 2021 forms and more are available: Web minnesota has a state income tax that ranges between 5.35% and 9.85%. Web earned income tax credit. We offer information and resources to help individuals: When does an employee complete form w. Web if you are due a property tax refund or state income tax refund, we will apply it to your deferred property tax total and notify you when this happens. Web we last updated minnesota form m1 instructions in february. Web minnesota’s net general fund receipts for the first quarter of fy 2024 are now estimated to total $6.385 billion, $400 million (6.7 percent) more than forecast in the february 2023. Web 2021 form m1, individual income tax. File and pay minnesota income taxes. Web [email protected] corporate franchise (income) tax minnesota department of revenue mail station 5140 st. Web you. You can also look for forms by category below the search box. Web we last updated the minnesota individual income tax instructions (form m1) in february 2023, so this is the latest version of form m1 instructions, fully updated for tax year. Web if you are due a property tax refund or state income tax refund, we will apply it to your deferred property tax total and notify you when this happens. File and pay minnesota income taxes. Web find information on how to file and pay your taxes, access free tax preparation assistance, and track your refund. Web [email protected] corporate franchise (income) tax minnesota department of revenue mail station 5140 st. You may qualify for free electronic filing if your. The due date for 2022 returns is april 18, 2023. Complete, edit or print tax forms instantly. Web the irmaa is calculated on a sliding scale with five income brackets topping out at $500,000 and $750,000 for individual and joint filing, respectively. When does an employee complete form w. File for a property tax refund; This form is for income earned in tax year 2022, with tax. Web amount of wages, tips, and other compensation subject to state income tax for the calendar year for the state in box 15. Web form m1 is the most common individual income tax return filed for minnesota residents. These 2021 forms and more are available: Web we last updated minnesota form m1 instructions in february 2023 from the minnesota department of revenue. Web find a form. A copy of the federal form 1040, including a copy of schedule c or. Web minnesota’s net general fund receipts for the first quarter of fy 2024 are now estimated to total $6.385 billion, $400 million (6.7 percent) more than forecast in the february 2023.Fillable Schedule M15 Underpayment Of Estimated Tax

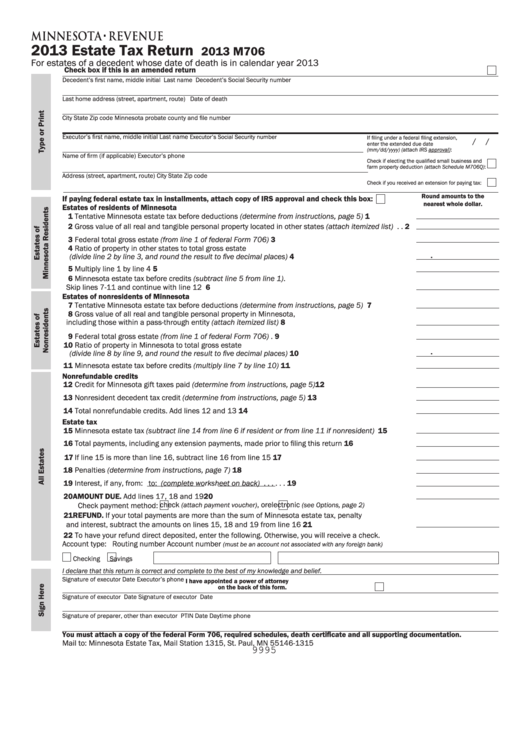

Fillable Form M706 Estate Tax Return Minnesota Department Of

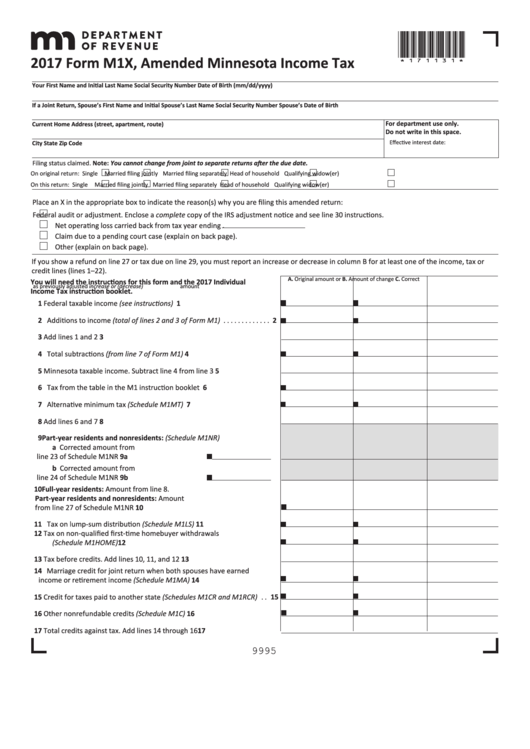

Fillable Form M1x Amended Minnesota Tax 2017 printable pdf

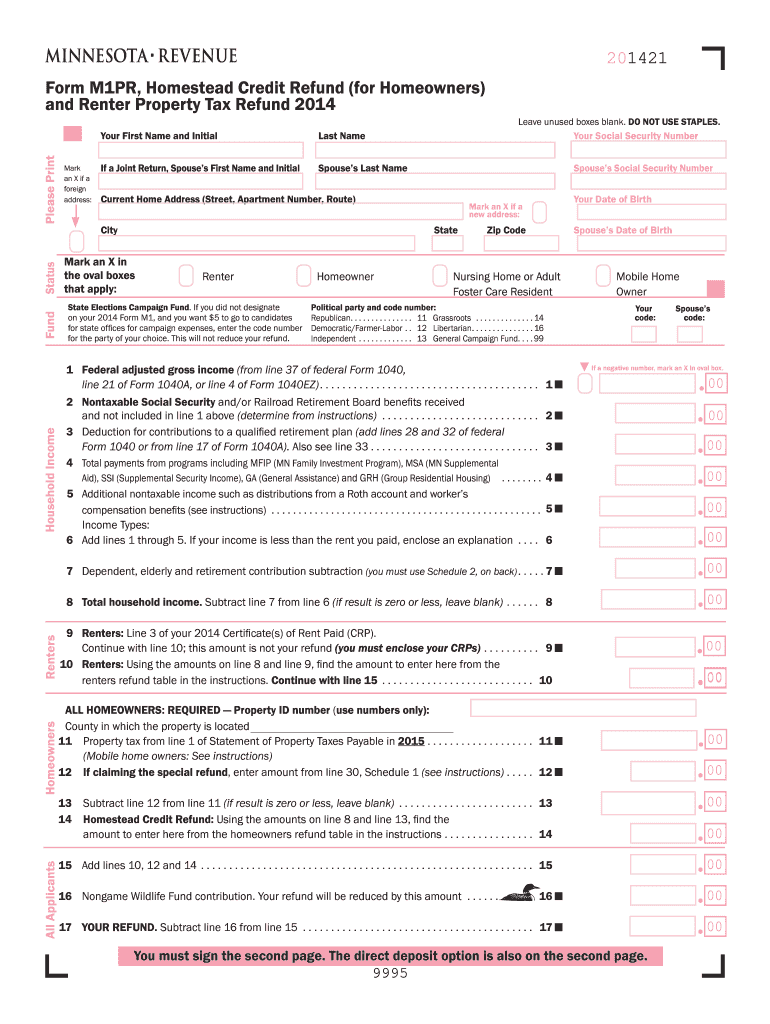

MN DoR M1PR 2014 Fill out Tax Template Online US Legal Forms

2020 Minnesota Minnesota Tax Withholding Fill Out, Sign Online

2016 Form MN M1W Fill Online, Printable, Fillable, Blank pdfFiller

Fill Free fillable Minnesota Department of Revenue PDF forms

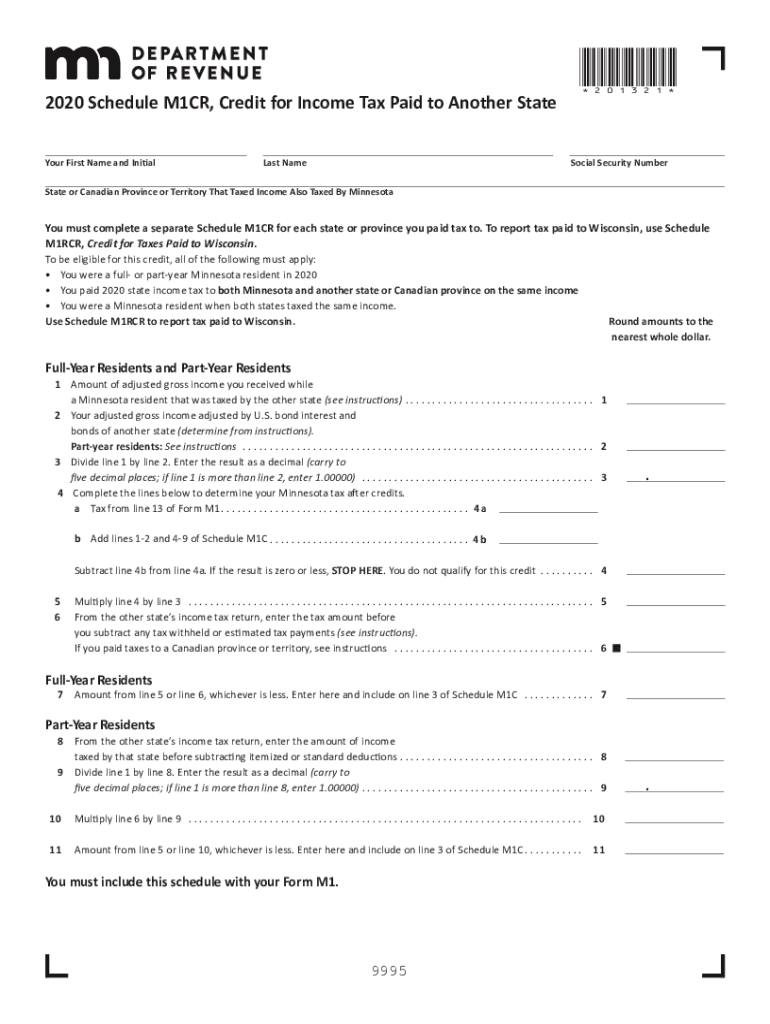

Schedule M1Cr Fill Out and Sign Printable PDF Template signNow

Minnesota tax forms Fill out & sign online DocHub

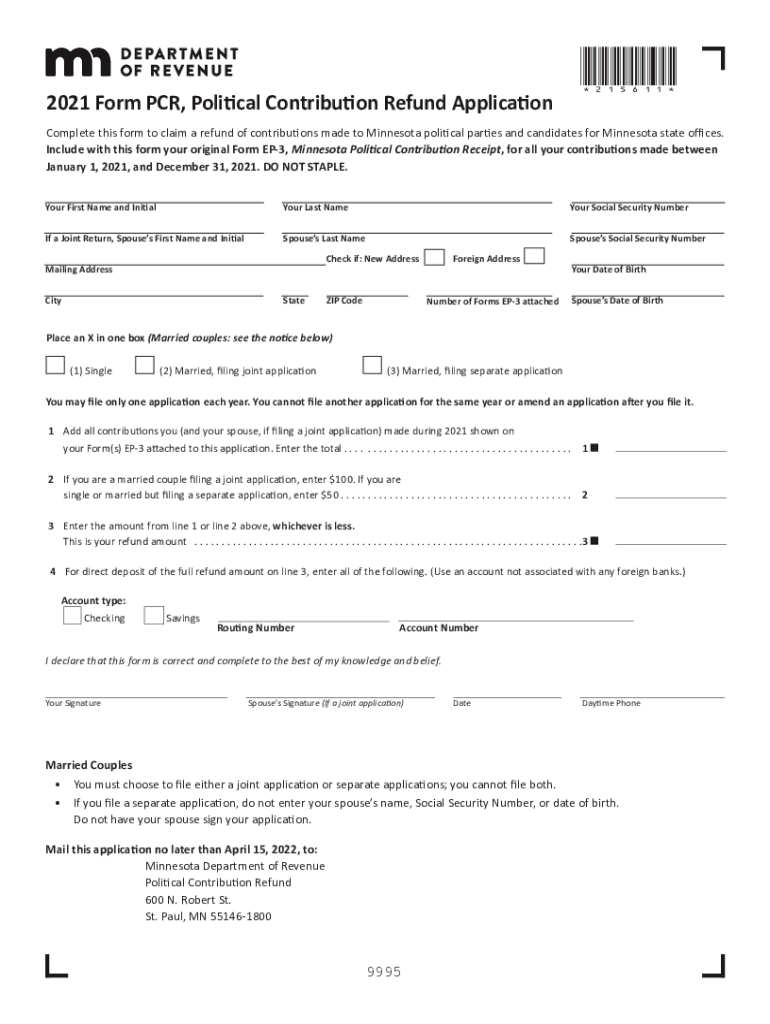

MN DoR PCR 20212022 Fill out Tax Template Online US Legal Forms

Related Post: