Missouri Tax Extension Form

Missouri Tax Extension Form - If you owe state tax, you can. Sign into your efile.com account and check acceptance by the irs. Complete, edit or print tax forms instantly. Check your irs tax refund status. Web missouri income tax, you may file an extension by filing. Web form 4868, application for automatic extension of time to file u.s. Ad access irs tax forms. An automatic extension of time to file will be granted until october 17, 2022. Get ready for tax season deadlines by completing any required tax forms today. Attach a copy federal extension (form 4868). Separate requests must be made for. Web the missouri extension to file a corporate tax return is a separate form. Complete, edit or print tax forms instantly. Web renew your missouri license plates, register your vehicle and reserve your personalized license plate. An automatic extension of time to file will be granted until october 17, 2022. You seek a missouri extension exceeding the federal. Get ready for tax season deadlines by completing any required tax forms today. Web missouri income tax, you may file an extension by filing. If you owe mo income taxes, you will either have to submit a mo. Attach a copy federal extension (form 4868). Web attach a copy of the federal extension to the missouri return when filed. You seek a missouri extension exceeding the federal. Individual income tax return individual tax filers, regardless of income, can use irs. Separate requests must be made for. Attach a copy federal extension (form 4868). Check your irs tax refund status. An automatic extension of time to file will be granted until october 17, 2022. Web if you owe mo income taxes, you will either have to submit a mo tax return or extension by the april 18, 2023 tax deadline in order to avoid late filing penalties. Individual income tax return individual tax filers,. Individual income tax return individual tax filers, regardless of income, can use irs. Web make an extension payment; Web individual and composite income tax filers will be granted an automatic extension of time to file until october 15, 2021. Ad access irs tax forms. You seek a missouri extension exceeding the federal. Separate requests must be made for. Web missouri grants an automatic extension of time to file to any individual, partnership, or fiduciary if you filed a federal extension. Web form 4868, application for automatic extension of time to file u.s. Web attach a copy of the federal extension to the missouri return when filed. Sign into your efile.com account and. Web missouri grants an automatic extension of time to file to any individual, partnership, or fiduciary if you filed a federal extension. Web individual and composite income tax filers will be granted an automatic extension of time to file until october 15, 2021. Get ready for tax season deadlines by completing any required tax forms today. Web the missouri extension. Individual income tax return individual tax filers, regardless of income, can use irs. Pay all or some of your missouri income taxes online via: An automatic extension of time to file will be granted until october 17, 2022. Get ready for tax season deadlines by completing any required tax forms today. If filing a fiscal year return enter the beginning. Check your irs tax refund status. Get ready for tax season deadlines by completing any required tax forms today. Web an extension of time to file only applies to your missouri state income tax due date, an extension also needs to be filed with the irs to extend your federal tax due date. Web make an extension payment; An automatic. You seek a missouri extension exceeding the federal. Web renew your missouri license plates, register your vehicle and reserve your personalized license plate. Web missouri income tax, you may file an extension by filing. Web individual and composite income tax filers will be granted an automatic extension of time to file until october 15, 2021. Web if you owe mo. An automatic extension of time to file will be granted until october 17, 2022. Check your irs tax refund status. If you owe state tax, you can. Web make an extension payment; Complete, edit or print tax forms instantly. If you owe mo income taxes, you will either have to submit a mo. Web form 4868, application for automatic extension of time to file u.s. Web an extension of time to file only applies to your missouri state income tax due date, an extension also needs to be filed with the irs to extend your federal tax due date. Web individual and composite income tax filers will be granted an automatic extension of time to file until october 15, 2021. Web the missouri extension to file a corporate tax return is a separate form. Sign into your efile.com account and check acceptance by the irs. Get ready for tax season deadlines by completing any required tax forms today. Pay all or some of your missouri income taxes online via: Addition to tax and interest calculator; Web missouri income tax, you may file an extension by filing. Individual income tax return individual tax filers, regardless of income, can use irs. If filing a fiscal year return enter the beginning. Web attach a copy of the federal extension to the missouri return when filed. Web if you owe mo income taxes, you will either have to submit a mo tax return or extension by the april 18, 2023 tax deadline in order to avoid late filing penalties. You seek a missouri extension exceeding the federal.Tax Extension Form Printable Printable Forms Free Online

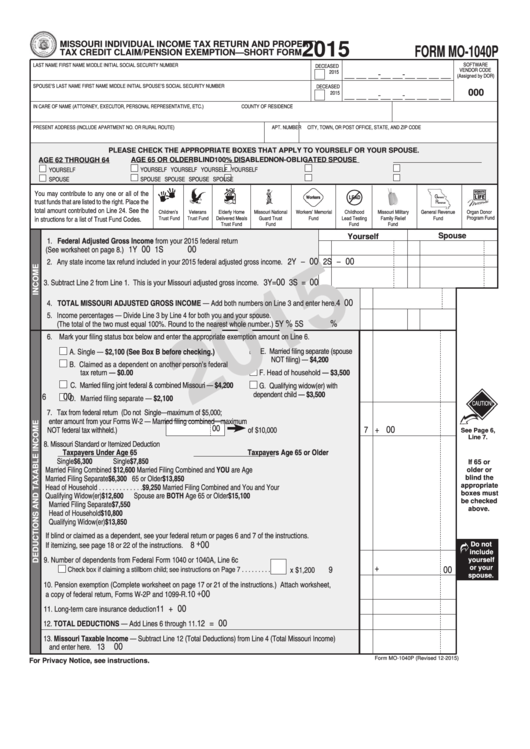

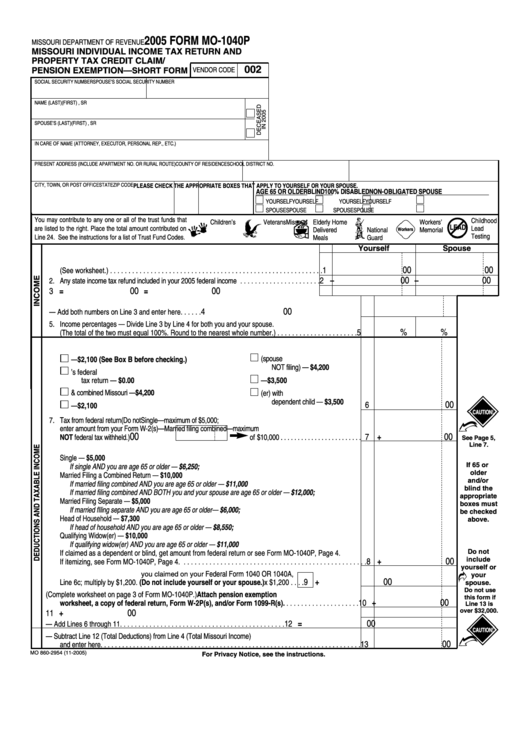

Form Mo1040p Missouri Individual Tax Return And Property Tax

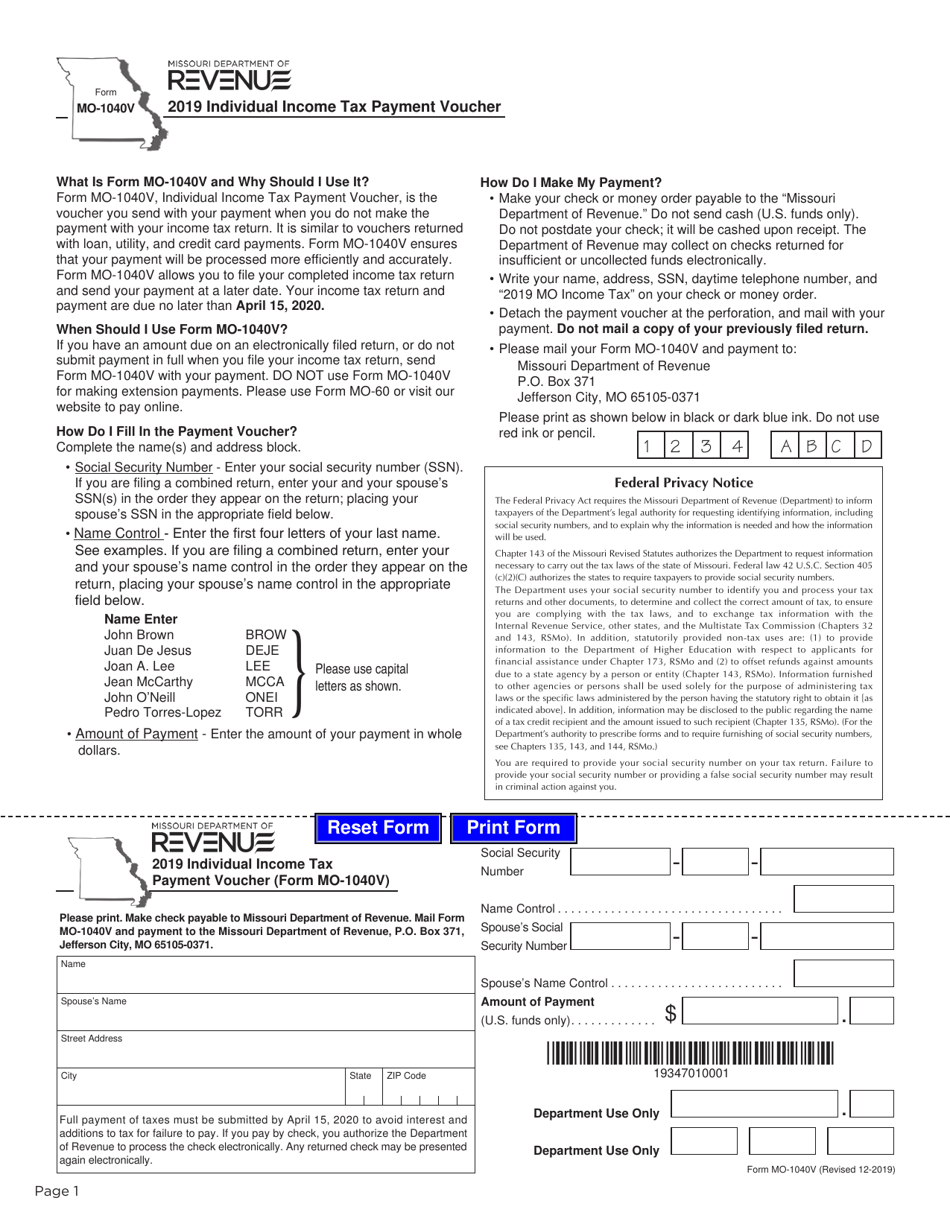

Form MO1040V Download Fillable PDF or Fill Online Individual

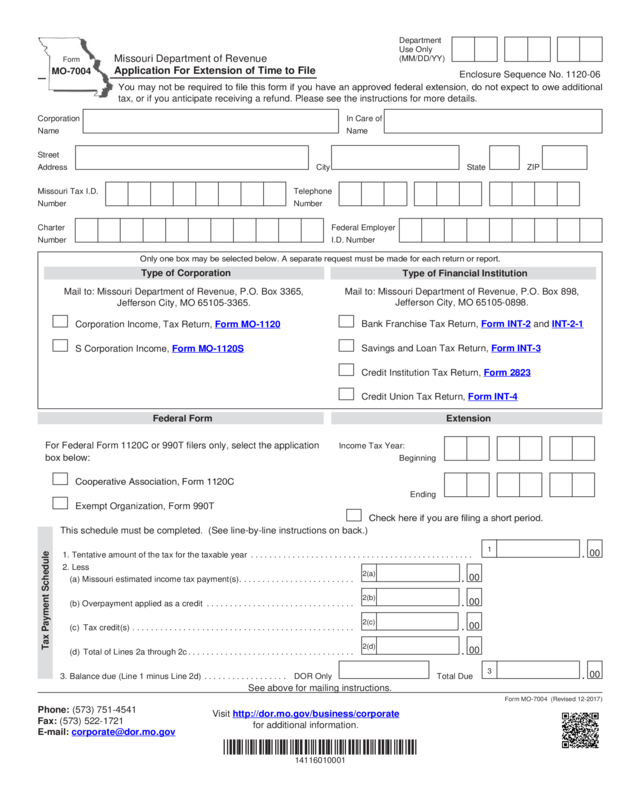

Form Mo7004 Application For Extension Of Time To File Edit, Fill

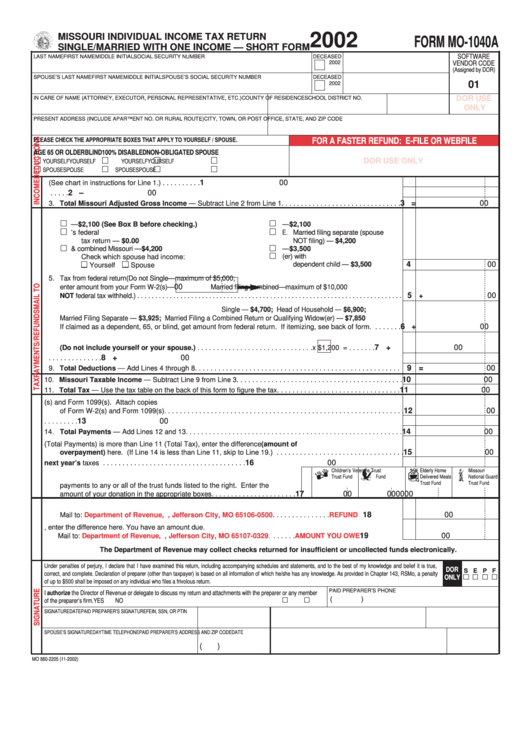

Form Mo1040a Missouri Individual Tax Return Single/married

Fillable Form Mo1040p Missouri Individual Tax Return And

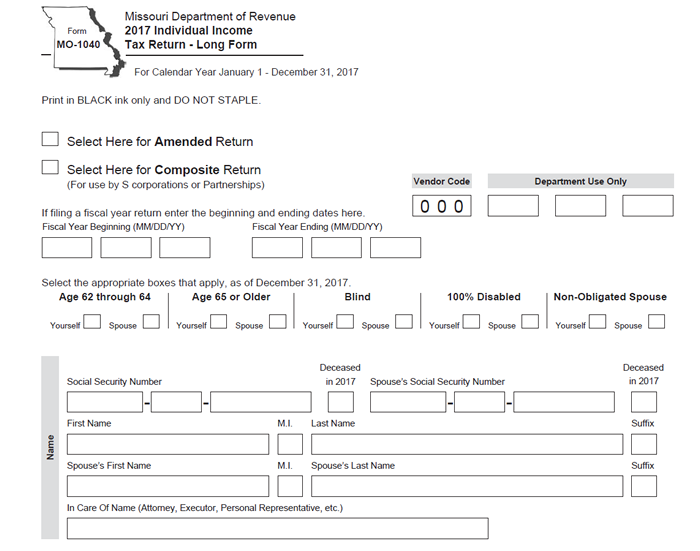

New Forms

Printable Mo State Tax Forms Printable Form 2021

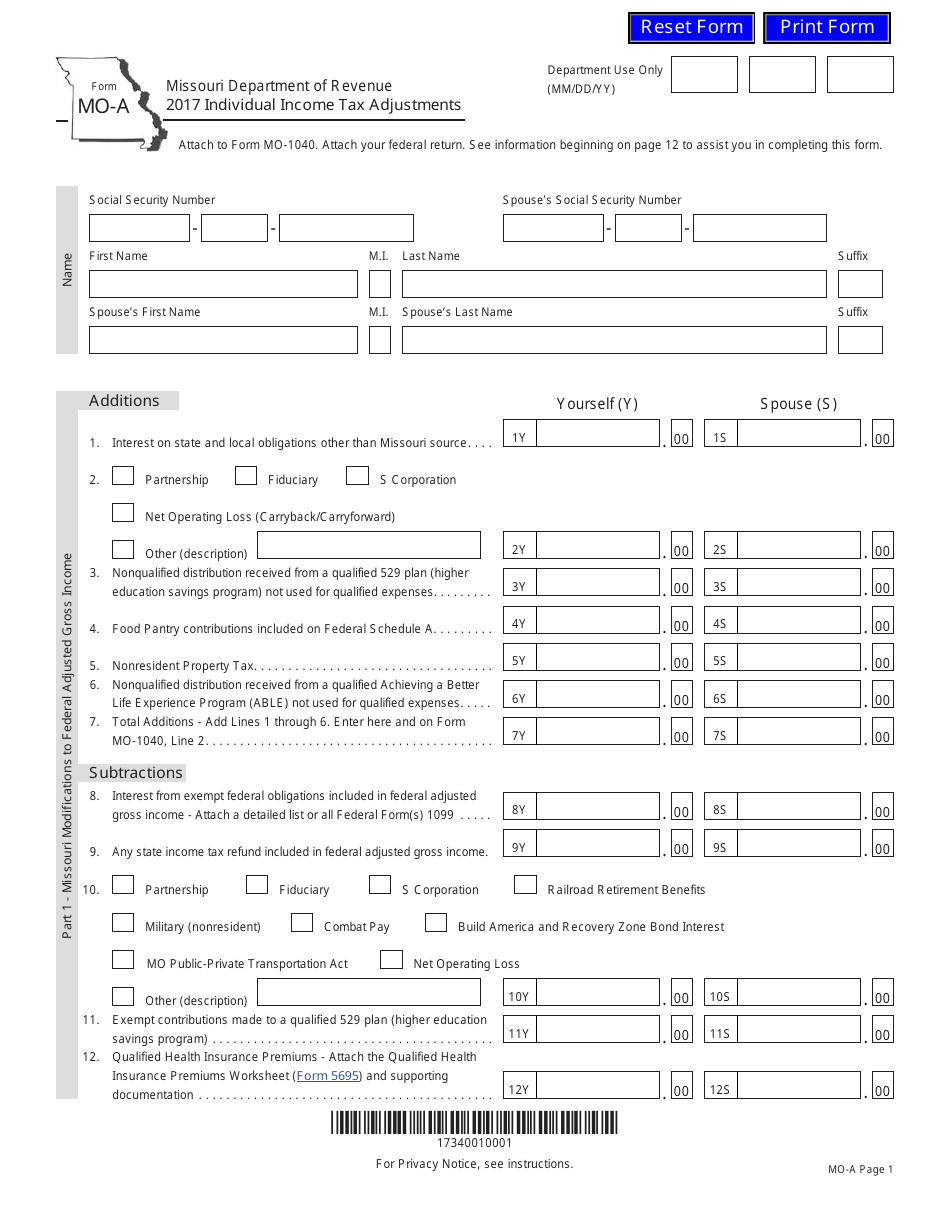

Form MOA Download Fillable PDF or Fill Online Individual Tax

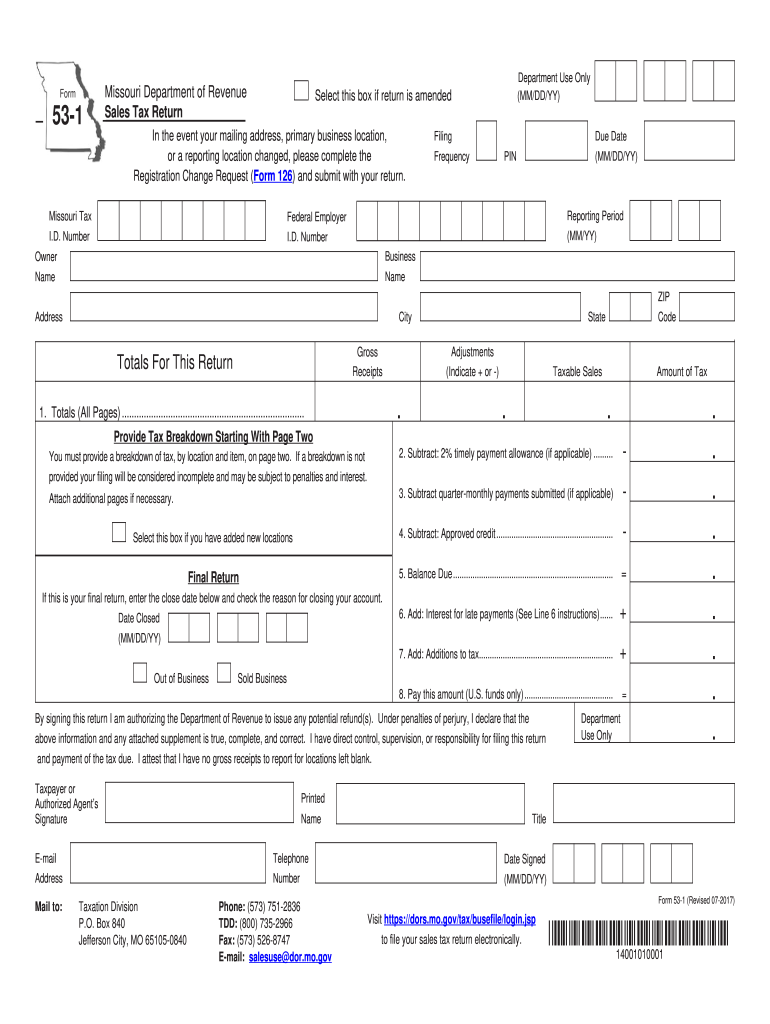

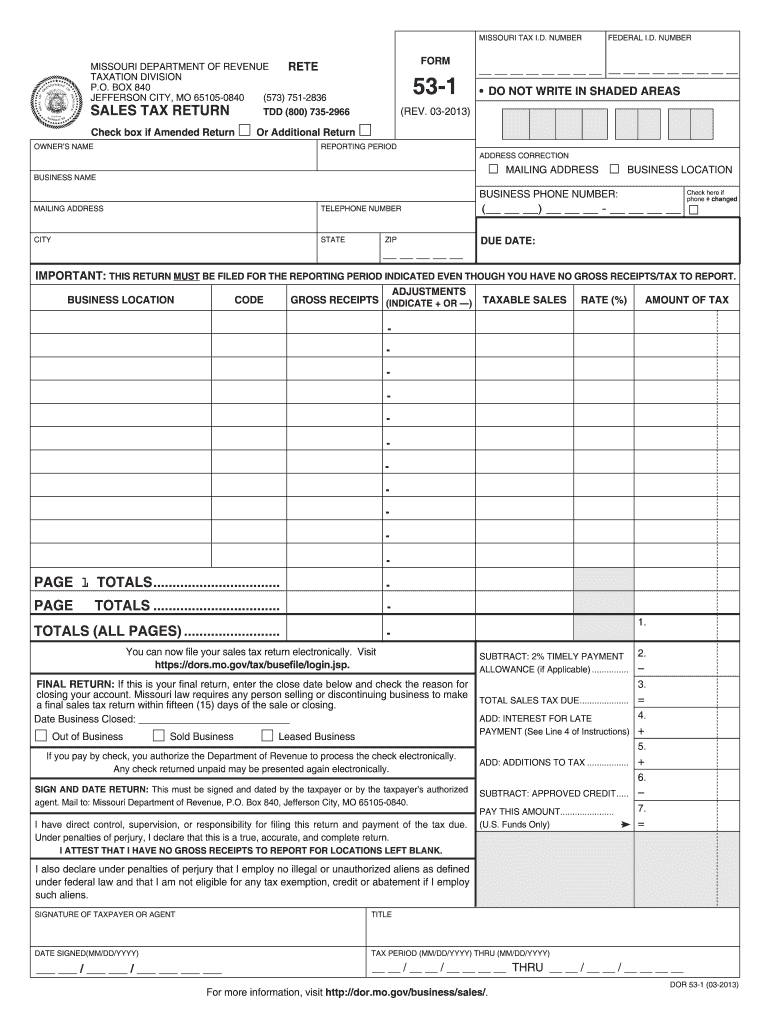

Missouri Sales Tax Form 53 1 Instruction Fill Out and Sign Printable

Related Post: