Missouri Gas Tax Refund Form 4925

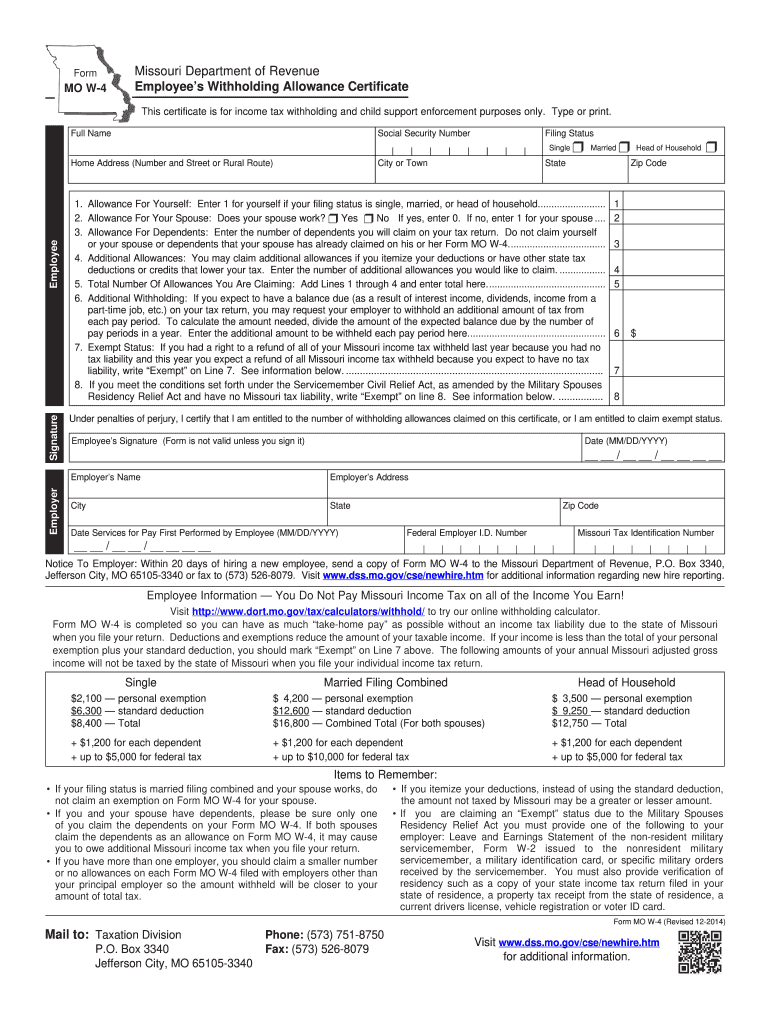

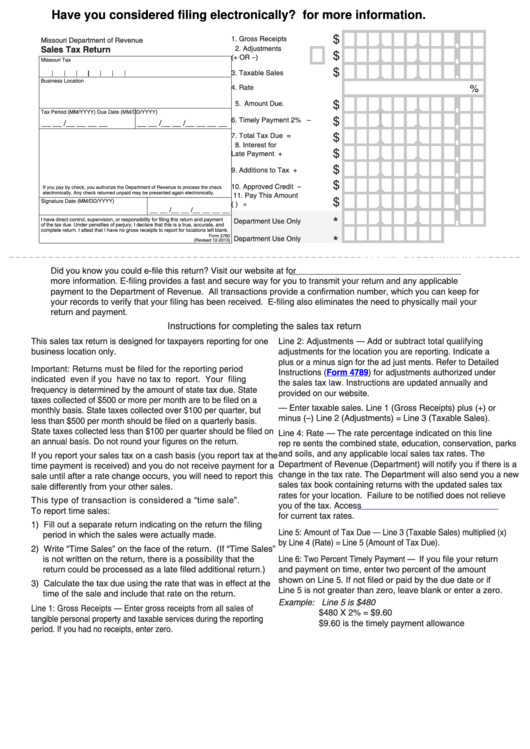

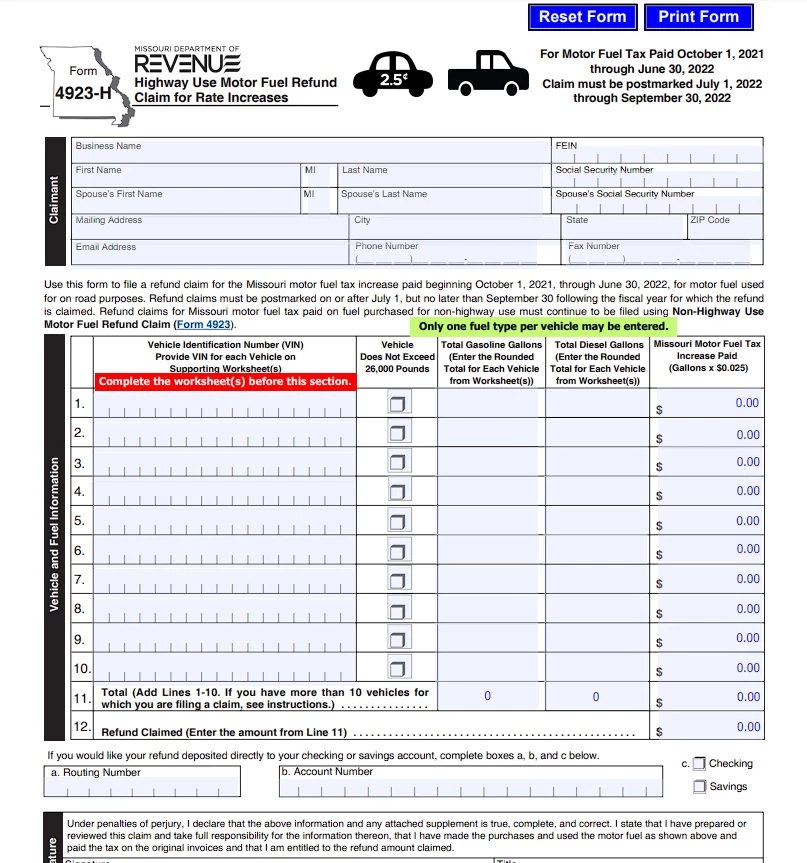

Missouri Gas Tax Refund Form 4925 - Web the first of five annual gas tax increases of 2.5 cents per gallon takes effect, reaching a total increase of 12.5 cents by 2025. Web tax rate $0.17 schedule a — marine fuel purchases by county. Web california firm with $4 billion in revenue moves in. Use this schedule to report the number of gallons of gasoline purchased before october 1, 2021, rounded to. Refund claims must be submitted on. The increases were approved in senate. Form 4924, motor fuel tax refund application, must be. Then you will need to go to the missouri. 7:20 pm cdt july 15, 2022. The form must be submitted, or postmarked, by sept. Web for that work, drivers will receive a $0.025 refund for every gallon of gas submitted and approved. Motor fuel refund claim (note: Web california firm with $4 billion in revenue moves in. Form 4924, motor fuel tax refund application, must be. The form must be submitted, or postmarked, by sept. Web the first of five annual gas tax increases of 2.5 cents per gallon takes effect, reaching a total increase of 12.5 cents by 2025. Web you may not apply for a refund claim until july 1, 2022, however you will need to begin saving records of each purchase occurring on or after oct. Web seller, number of gallons purchased. Web download my return template use this link to download a preformatted excel spreadsheet, enter your return information and come back later to upload and file your return. Refund claims must be submitted on. Web california firm with $4 billion in revenue moves in. Web first, you will need to have all the receipts from any gas purchase made between. The form must be submitted, or postmarked, by sept. 7:20 pm cdt july 15, 2022. Refund claims must be submitted on. Then you will need to go to the missouri. Web the first of five annual gas tax increases of 2.5 cents per gallon takes effect, reaching a total increase of 12.5 cents by 2025. Then you will need to go to the missouri. Motor fuel refund claim (note: The increases were approved in senate. Web the first of five annual gas tax increases of 2.5 cents per gallon takes effect, reaching a total increase of 12.5 cents by 2025. Refund claims must be submitted on. Form 4924, motor fuel tax refund application, must be. Web use this form to file a refund claim for the missouri motor fuel tax increase paid beginning july 1, 2022, through june 30, 2023, for motor fuel used for on road purposes. Web tax rate $0.17 schedule a — marine fuel purchases by county. Web you may not apply for. Web seller, number of gallons purchased and price per gallon, missouri fuel tax and sales tax, if applicable, as separate items. The form must be submitted, or postmarked, by sept. The missouri department of revenue said as of july 15,. 7:20 pm cdt july 15, 2022. Web you may not apply for a refund claim until july 1, 2022, however. 7:20 pm cdt july 15, 2022. Louis — you still have time to file a claim for a gas tax refund. In the form drivers need to include the vehicle identification. Then you will need to go to the missouri. Form 4924, motor fuel tax refund application, must be. The missouri department of revenue said as of july 15,. Refund claims must be submitted on. Web the first of five annual gas tax increases of 2.5 cents per gallon takes effect, reaching a total increase of 12.5 cents by 2025. 7:20 pm cdt july 15, 2022. In the form drivers need to include the vehicle identification. For optimal functionality, save the form to your computer before completing or printing. Web seller, number of gallons purchased and price per gallon, missouri fuel tax and sales tax, if applicable, as separate items. Senate bill 262 allows purchasers of motor fuel for highway use to request a refund of the missouri motor fuel tax increase paid annually. Use this. Use this schedule to report the number of gallons of gasoline purchased before october 1, 2021, rounded to. The form must be submitted, or postmarked, by sept. Web use this form to file a refund claim for the missouri motor fuel tax increase(s) paid beginning october 1, 2021, through june 30, 2022, for motor fuel used for on road. Web seller, number of gallons purchased and price per gallon, missouri fuel tax and sales tax, if applicable, as separate items. Web use this form to file a refund claim for the missouri motor fuel tax increase paid beginning july 1, 2022, through june 30, 2023, for motor fuel used for on road purposes. The missouri department of revenue said as of july 15,. 7:20 pm cdt july 15, 2022. Web for that work, drivers will receive a $0.025 refund for every gallon of gas submitted and approved. Louis — you still have time to file a claim for a gas tax refund. Refund claims must be submitted on. Form 4924, motor fuel tax refund application, must be. For optimal functionality, save the form to your computer before completing or printing. The increases were approved in senate. Web anne marie moy, department of revenue director of strategy and communications, said the department will have a refund claim form available on its. Web download my return template use this link to download a preformatted excel spreadsheet, enter your return information and come back later to upload and file your return. Web first, you will need to have all the receipts from any gas purchase made between october 1, 2021 and june 30, 2022. Senate bill 262 allows purchasers of motor fuel for highway use to request a refund of the missouri motor fuel tax increase paid annually. Web tax rate $0.17 schedule a — marine fuel purchases by county. Web the bill also allows missourians to request a refund once a year for refunds on the gas tax in the following amounts. Web you may not apply for a refund claim until july 1, 2022, however you will need to begin saving records of each purchase occurring on or after oct.2020 Form MO MO1041 Fill Online, Printable, Fillable, Blank pdfFiller

Tax Return Form 1099 Missouri Department of Revenue 2014 Fill Out and

Fantastic Receipt Template For Missouri Expoughment Glamorous Receipt

Here's how to get a refund for Missouri's gas tax increase Howell

20152022 Form MO DoR MOMWP Fill Online, Printable, Fillable, Blank

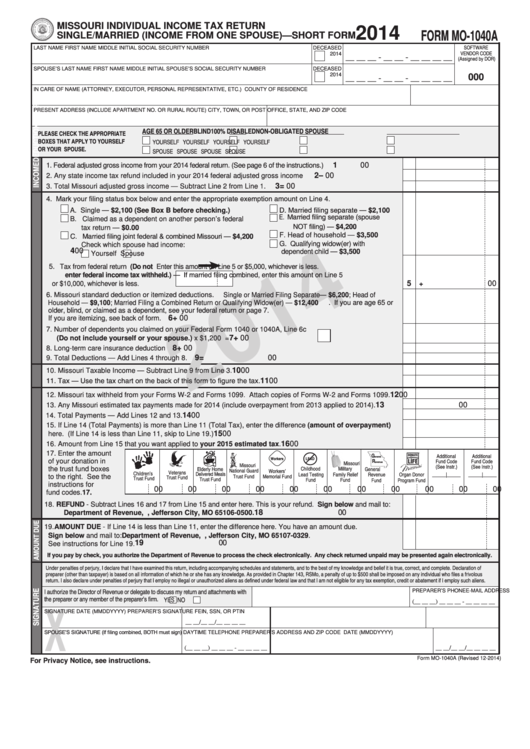

Form Mo1040a Missouri Individual Tax Return Single/married

Save your receipts! Refund available for increased Missouri gas tax

Here's How to Claim Your Missouri Gas Refund on July 1st

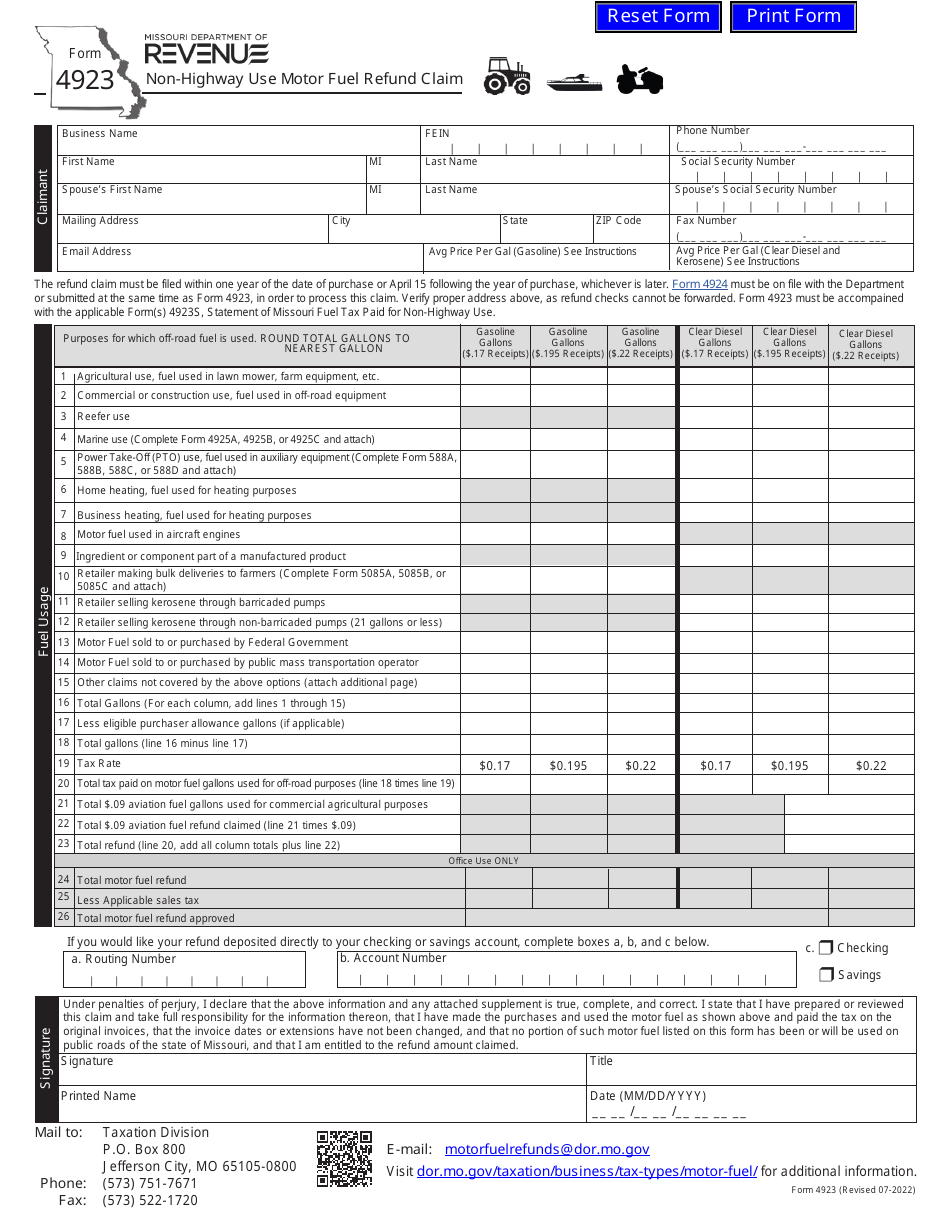

Form 4923 Download Fillable PDF or Fill Online Nonhighway Use Motor

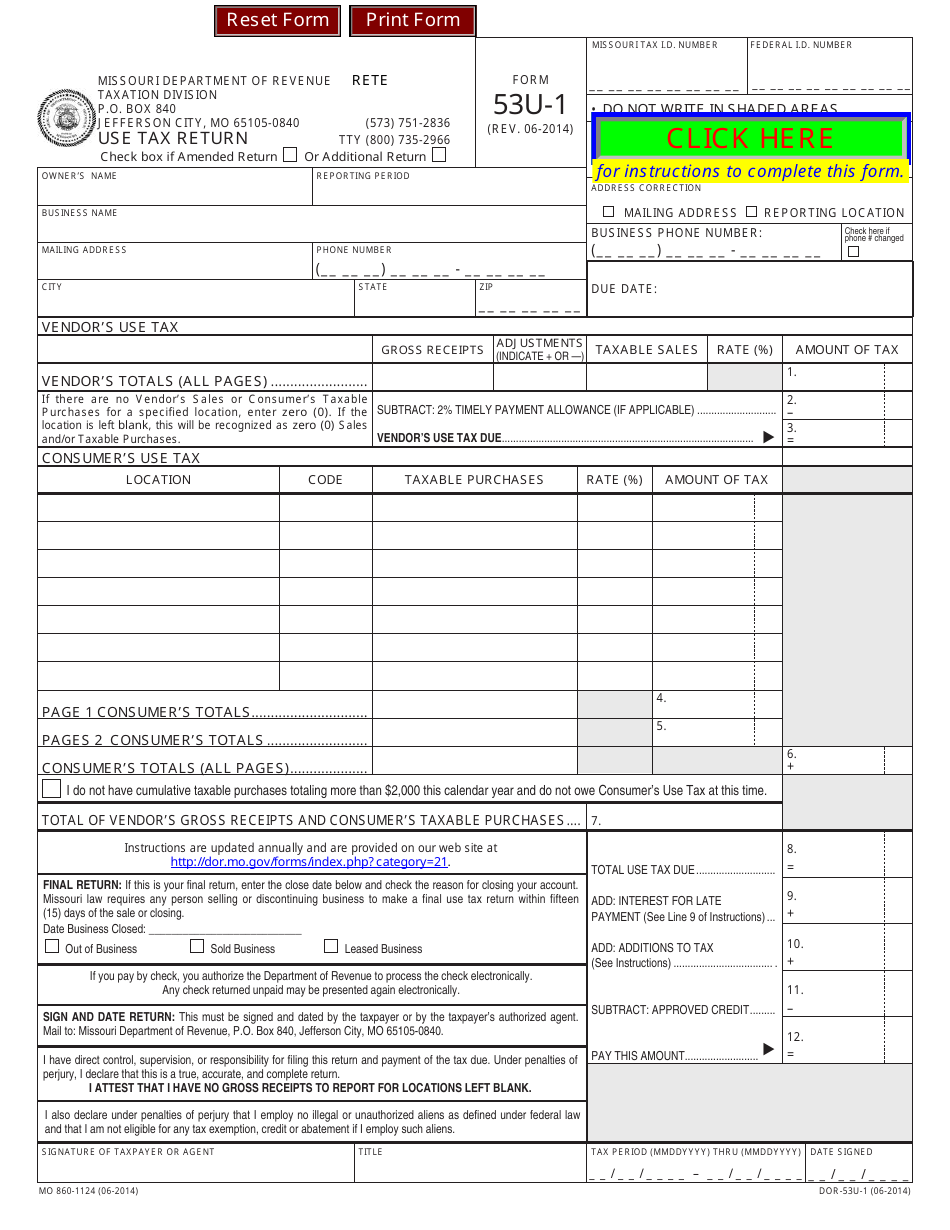

Form 53u1 Fill Out, Sign Online and Download Fillable PDF, Missouri

Related Post: