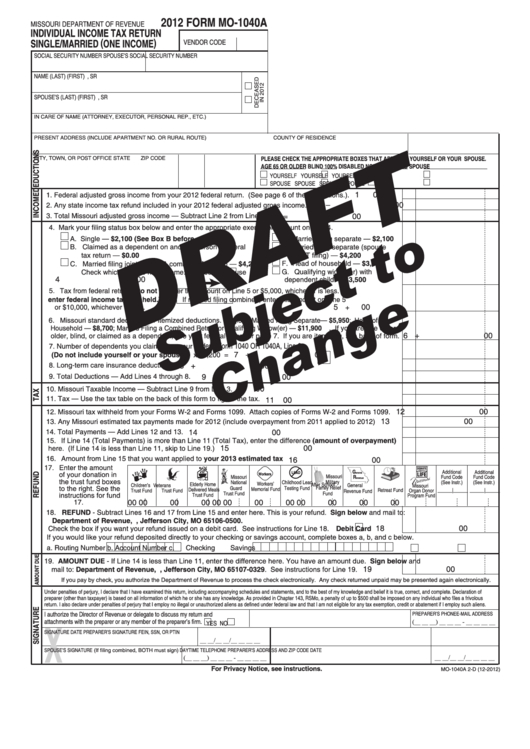

Missouri 1040A Form

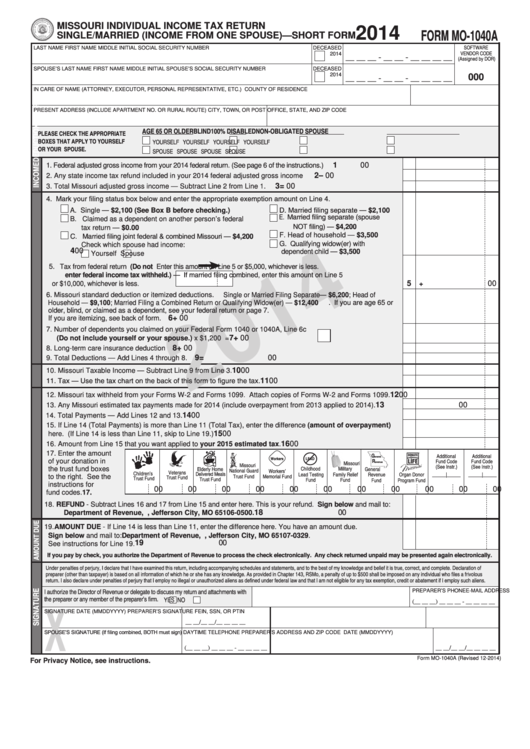

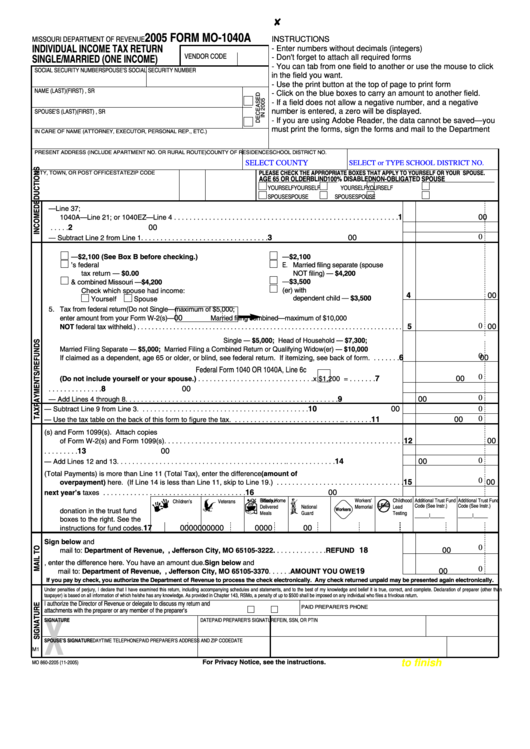

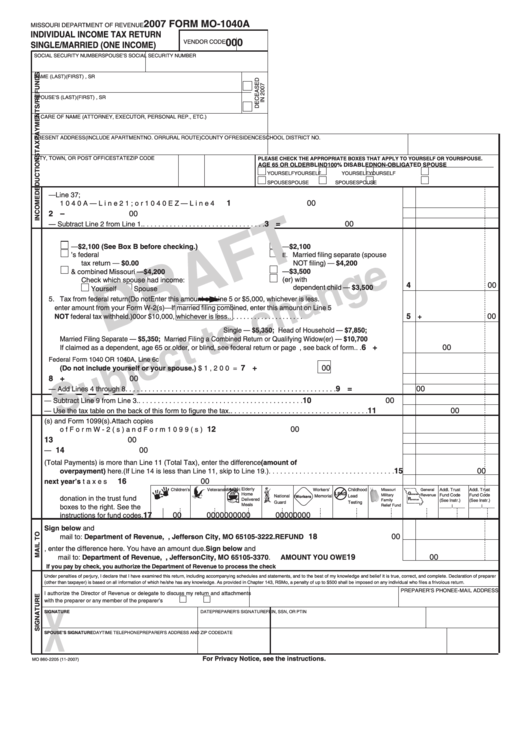

Missouri 1040A Form - Web short forms help you avoid becoming confused by tax laws and procedures that do not apply to you. For privacy notice, see instructions. Enter all required information in the required fillable fields. Single/married (income from one spouse) short form. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax. Tax deadline is april 18. You must be currently appointed by that individual, business, organization or agency to access that data or carry out that transaction on their behalf, and that appointment must. See page 4 for extensions. Select the web sample from the library. Handy tips for filling out. Web short forms help you avoid becoming confused by tax laws and procedures that do not apply to you. For privacy notice, see instructions. This form is for income earned in tax year 2022, with tax. Send filled & signed form or save. Web 2021 individual income tax return. Single/married (income from one spouse) short form. Select the web sample from the library. Open form follow the instructions. Enter the taxable income from your tax form and we will calculate your tax for you. Complete, edit or print tax forms instantly. Enter your status, income, deductions and credits and estimate your total taxes. Web short forms help you avoid becoming confused by tax laws and procedures that do not apply to you. Web 2022 individual income tax return. Enter the taxable income from your tax form and we will calculate your tax for you. See page 4 for extensions. See page 4 for extensions. Ad discover helpful information and resources on taxes from aarp. All missouri short forms allow the standard or itemized deduction. This form is for income earned in tax year 2022, with tax. Electronic filing is fast and easy. You must be currently appointed by that individual, business, organization or agency to access that data or carry out that transaction on their behalf, and that appointment must. All missouri short forms allow the standard or itemized deduction. Interest from direct obligations of the u.s. Web page last reviewed or updated: Save your changes and share 2018 mo tax return. You must be currently appointed by that individual, business, organization or agency to access that data or carry out that transaction on their behalf, and that appointment must. Single/married (income from one spouse) short form. This form is for income earned in tax year 2022, with tax returns due in april. Web page last reviewed or updated: See page 4. All missouri short forms allow the standard or itemized deduction. Enter all required information in the required fillable fields. Web 22 rows revision date. This form is for income earned in tax year 2022, with tax. Calculate your missouri tax using the online tax. Web complete mo1040a in several minutes by simply following the recommendations below: This form is for single or married taxpayers with. This form is for income earned in tax year 2022, with tax returns due in april. See page 4 for extensions. Single/married (income from one spouse) short form. Enter all required information in the required fillable fields. You must file your taxes yearly by april 15. Web 2022 individual income tax return. You must be currently appointed by that individual, business, organization or agency to access that data or carry out that transaction on their behalf, and that appointment must. Web short forms help you avoid becoming confused. Open form follow the instructions. See page 4 for extensions. Tax deadline is april 15. You must be currently appointed by that individual, business, organization or agency to access that data or carry out that transaction on their behalf, and that appointment must. Complete, edit or print tax forms instantly. Electronic filing is fast and easy. You must file your taxes yearly by april 15. Single/married (income from one spouse) short form. Interest from direct obligations of the u.s. Save your changes and share 2018 mo tax return. See page 4 for extensions. Web page last reviewed or updated: Select the template you want from the library of legal form samples. Complete, edit or print tax forms instantly. Handy tips for filling out. This form is for income earned in tax year 2022, with tax returns due in april. Easily sign the form with your finger. Enter your status, income, deductions and credits and estimate your total taxes. Enter all required information in the required fillable fields. You must be currently appointed by that individual, business, organization or agency to access that data or carry out that transaction on their behalf, and that appointment must. Web 2022 individual income tax return. Web short forms help you avoid becoming confused by tax laws and procedures that do not apply to you. Web 2021 individual income tax return. Web complete mo1040a in several minutes by simply following the recommendations below: This form is for single or married taxpayers with.Form Mo1040a Missouri Individual Tax Return Single/married

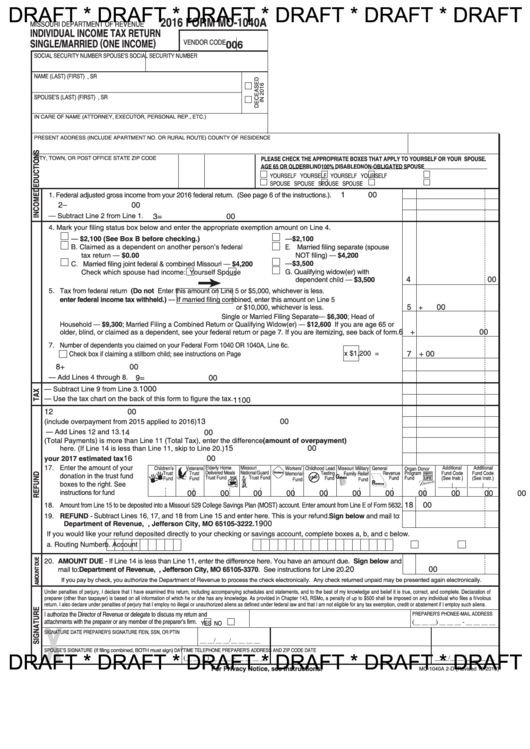

Form Mo1040a Draft Individual Tax Return Single/married (One

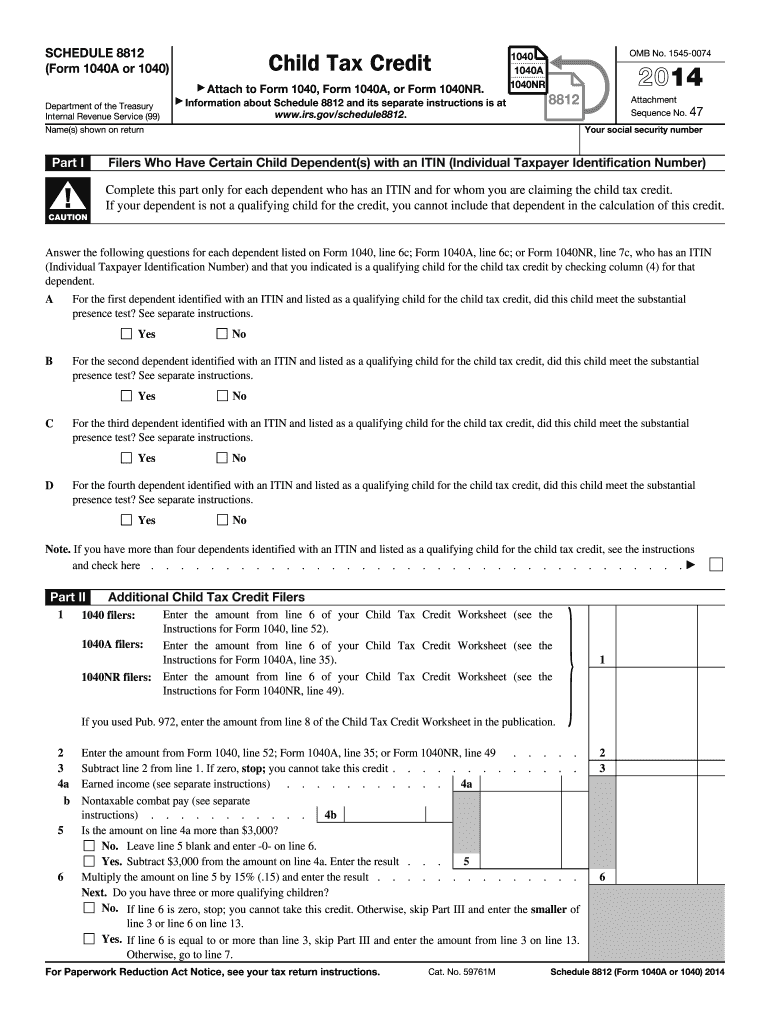

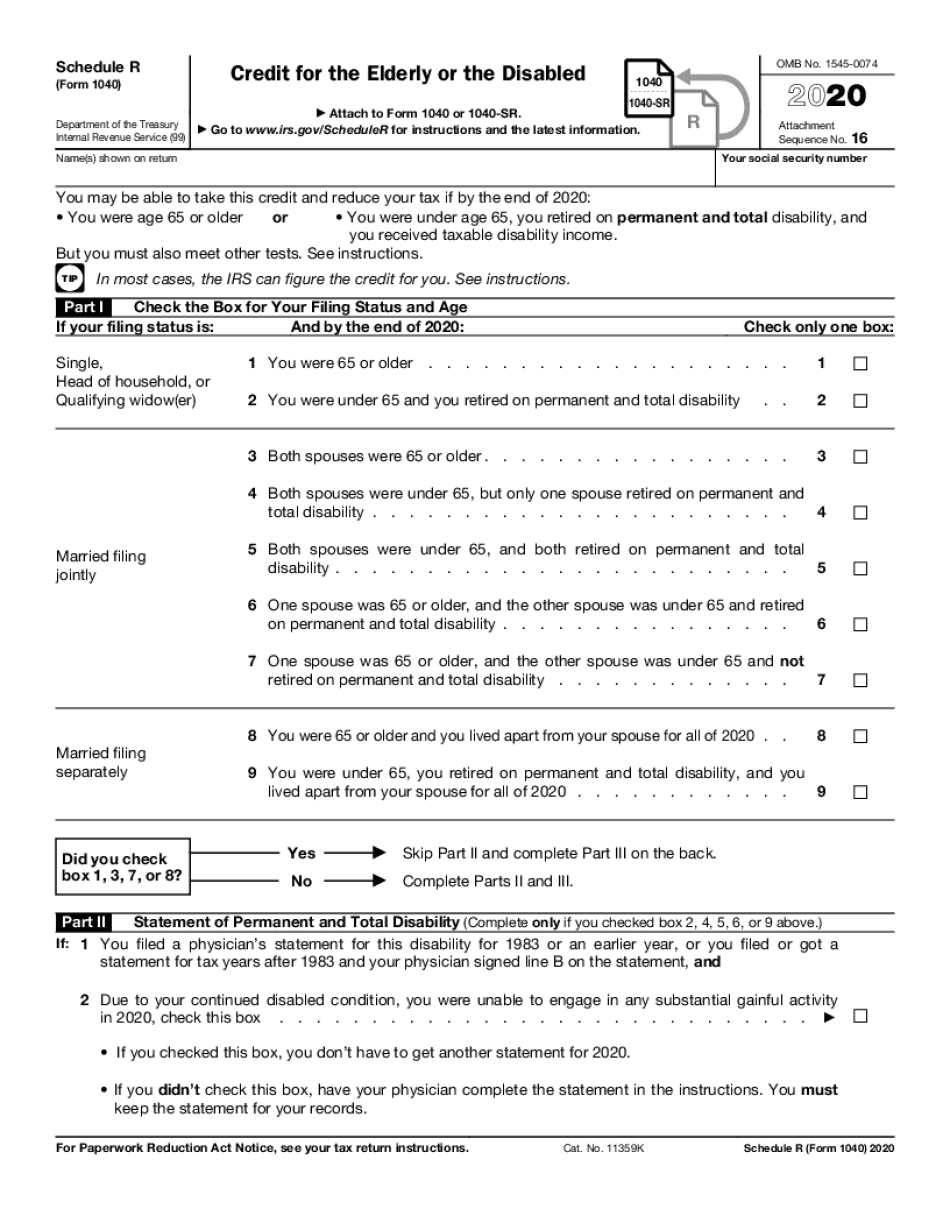

Schedule 8812 Form for Child Tax Credit (Form 1040A or 1040) 2014 DocHub

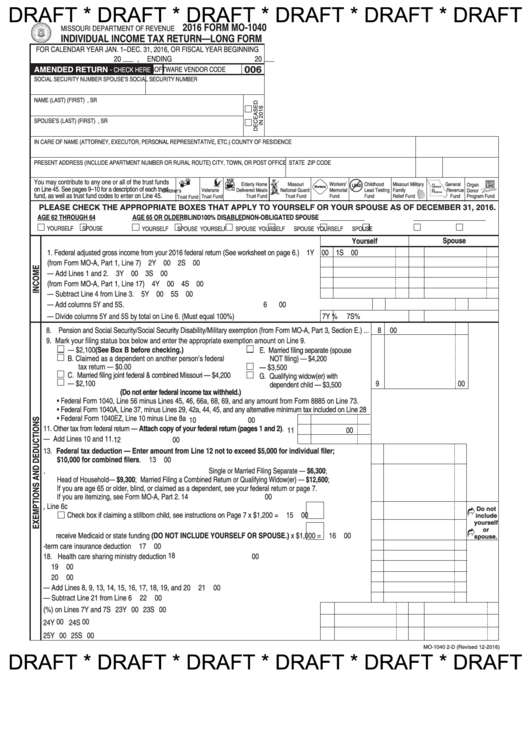

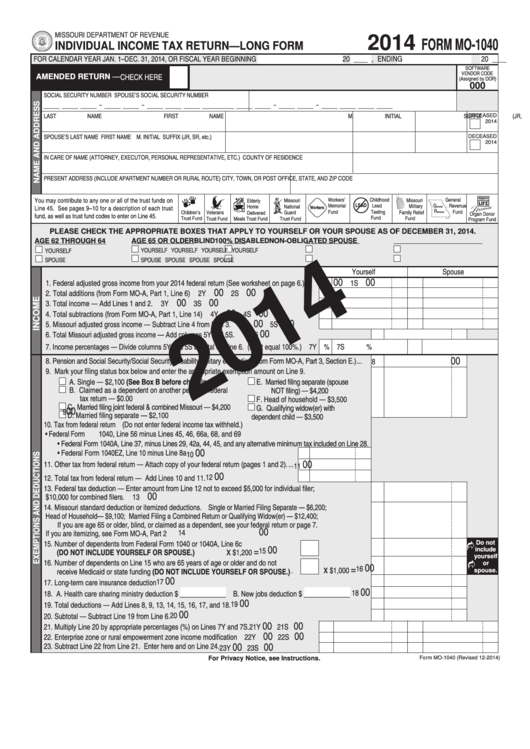

Form Mo1040 Draft Individual Tax Return (Long Form

Free Printable 1040a Tax Form Printable Templates

Fillable Form Mo1040a Missouri Individual Tax Return Single

Form Mo1040 Individual Tax Return Long Form 2014

Form Mo1040a Draft Individual Tax Return Single/married (One

Form Mo1040a Draft Individual Tax Return Single/married (One

Form Mo1040A Missouri Department Of Revenue Edit, Fill, Sign

Related Post: