Minnesota Extension Form

Minnesota Extension Form - You are not required to submit a form to receive a. Ad get access to the largest online library of legal forms for any state. Minnesota eservice payment system or via paymntax. Minnesota individual income tax returns are due by the 15th day of the 4th month following the close of the tax year. Web unlike some states, in order to waive certain penalties, minnesota does not require an extension request to be filed if the taxpayer has already paid 90 percent of the tax due. Select the template you require in the library of legal forms. If you need additional financial assistance, check these resources. If the irs grants an extension of time to file your federal return that is longer. Web complete minnesota extension form in just several clicks by following the instructions below: To avoid other penalties and interest, you must pay any tax owed by the due date and file your return by october 16. You can get minnesota tax forms either by mail or in person. Minnesota individual income tax returns are due by the 15th day of the 4th month following the close of the tax year. Find information on how to file and pay your taxes, access free tax preparation assistance, and track your refund. Web month after the end of the. Web most people must file their 2022 minnesota tax return by april 18, 2023. Web complete minnesota extension form in just several clicks by following the instructions below: Web do not request an extension to file. Real estate, family law, estate planning, business forms and power of attorney forms. Complete, edit or print tax forms instantly. Minnesota has a state income tax that ranges between 5.35% and 9.85% , which is administered by the minnesota department of revenue. If you request an extension after that date, we will deny it. You can get minnesota tax forms either by mail or in person. Select the template you require in the library of legal forms. Web month after. Select the template you require in the library of legal forms. To avoid other penalties and interest, you must pay any tax owed by the due date and file your return by october 16. Web skip to main content. You can get minnesota tax forms either by mail or in person. Web complete minnesota extension form in just several clicks. Real estate, family law, estate planning, business forms and power of attorney forms. Web applying for a benefit extension. Get ready for tax season deadlines by completing any required tax forms today. If you need additional financial assistance, check these resources. If you need an extension. Select the template you require in the library of legal forms. Web month after the end of the calendar or fiscal year. Contact us taxpayer rights privacy & security use of information link policy Web minnesota residents who are unable to file their tax return by the due date may file a form m13 along with payment for an extension. Web file your personal tax extension now! Web complete minnesota extension form in just several clicks by following the instructions below: Web most people must file their 2022 minnesota tax return by april 18, 2023. Web skip to main content. You are not required to submit a form to receive a. If you request an extension after that date, we will deny it. To avoid other penalties and interest, you must pay any tax owed by the due date and file your return by october 16. Web complete minnesota extension form in just several clicks by following the instructions below: Get ready for tax season deadlines by completing any required tax. If you need additional financial assistance, check these resources. Web file your personal tax extension now! If you need an extension. Ad get access to the largest online library of legal forms for any state. If you request an extension after that date, we will deny it. Find information on how to file and pay your taxes, access free tax preparation assistance, and track your refund. You are not required to submit a form to receive a. To avoid other penalties and interest, you must pay any tax owed by the due date and file your return by october 16. If the irs grants an extension of. Web almost 17% of public school students in minnesota receive special education services through their public schools. Real estate, family law, estate planning, business forms and power of attorney forms. There are currently no extended benefit programs available. Web do not request an extension to file. Pay all or some of your minnesota income taxes online via: Minnesota eservice payment system or via paymntax. Find information on how to file and pay your taxes, access free tax preparation assistance, and track your refund. If you request an extension after that date, we will deny it. You can get minnesota tax forms either by mail or in person. If you need additional financial assistance, check these resources. Cookies are required to use this site. Web if you pay your state income taxes by the april 15 tax deadline or state income tax due date, you do not have to file a state tax extension form. Contact us taxpayer rights privacy & security use of information link policy Ad get access to the largest online library of legal forms for any state. You are not required to submit a form to receive a. Web minnesota residents who are unable to file their tax return by the due date may file a form m13 along with payment for an extension to do so. Web month after the end of the calendar or fiscal year. Complete, edit or print tax forms instantly. There is no extension available. Minnesota has a state income tax that ranges between 5.35% and 9.85% , which is administered by the minnesota department of revenue.Minnesota st3 form fillable Fill out & sign online DocHub

2020 Form MN DoR M1PRX Fill Online, Printable, Fillable, Blank pdfFiller

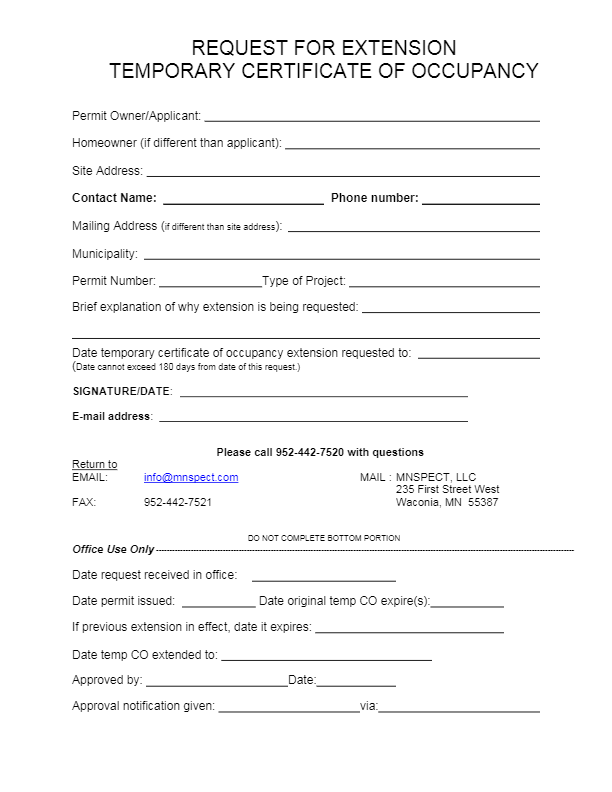

Request for Extension Temporary Certificate of Occupancy Mound, MN

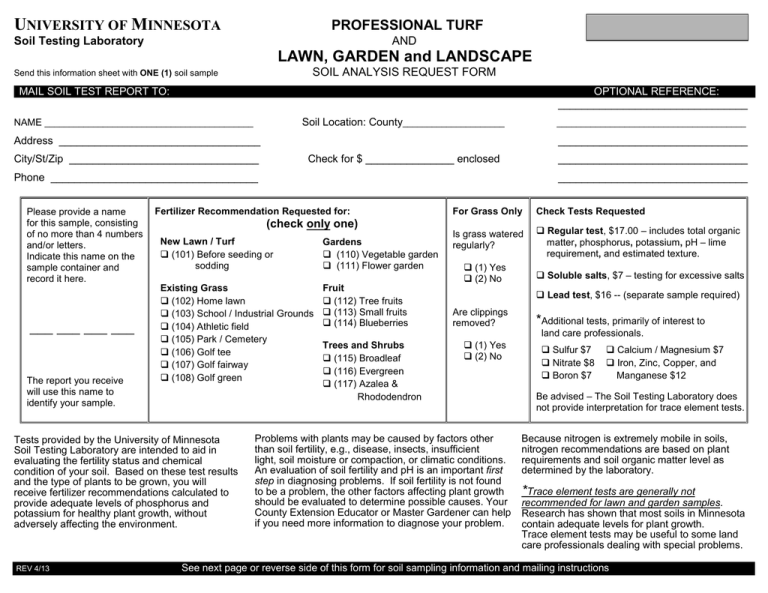

Soil analysis request form University of Minnesota Extension

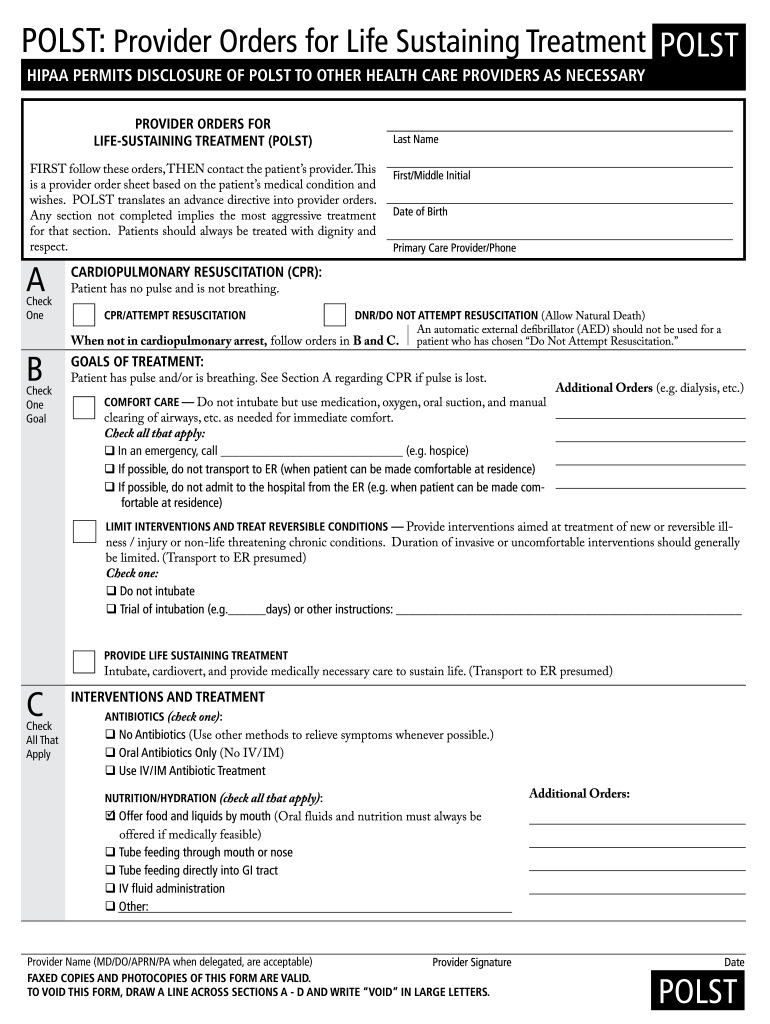

Polst Mn Fill Out and Sign Printable PDF Template signNow

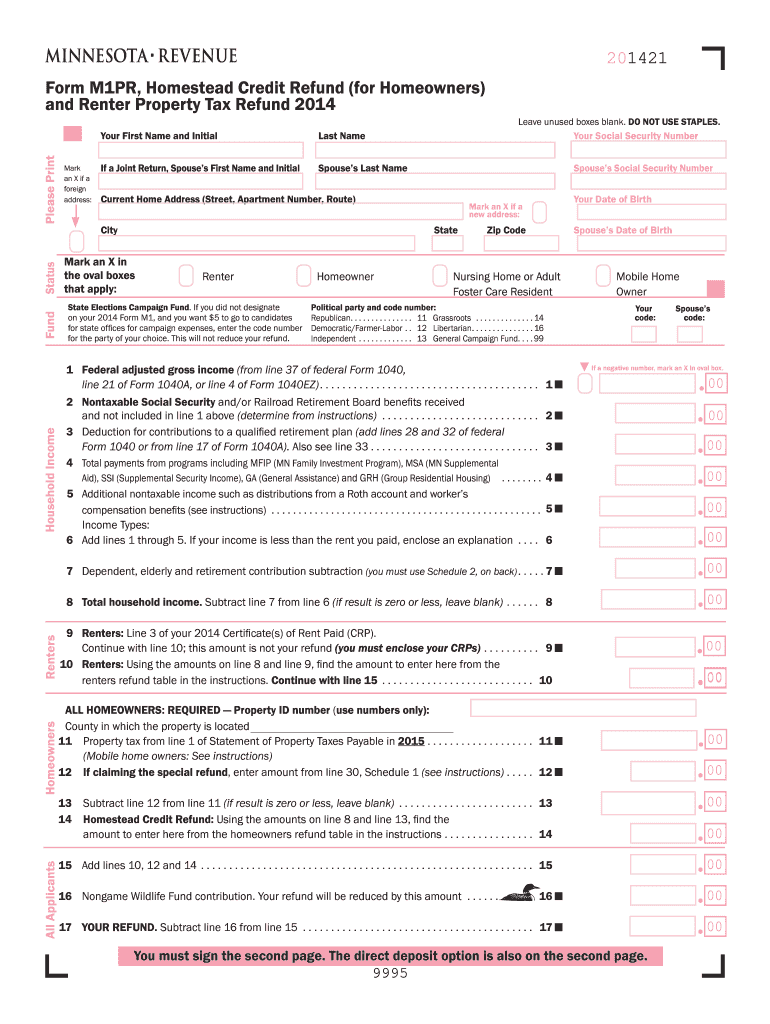

2014 Form MN DoR M1PR Fill Online, Printable, Fillable, Blank pdfFiller

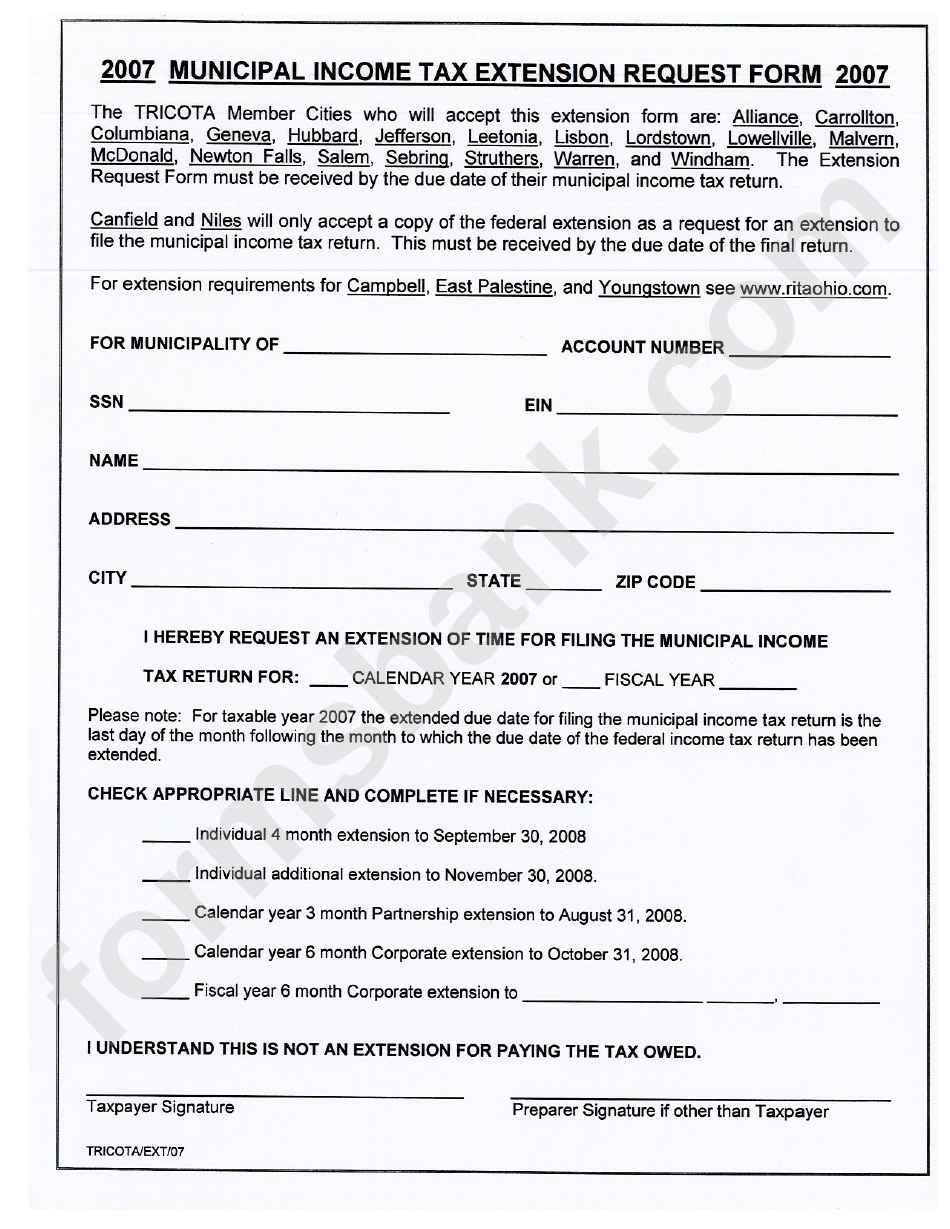

Municipal Tax Extension Request Form 2007 printable pdf download

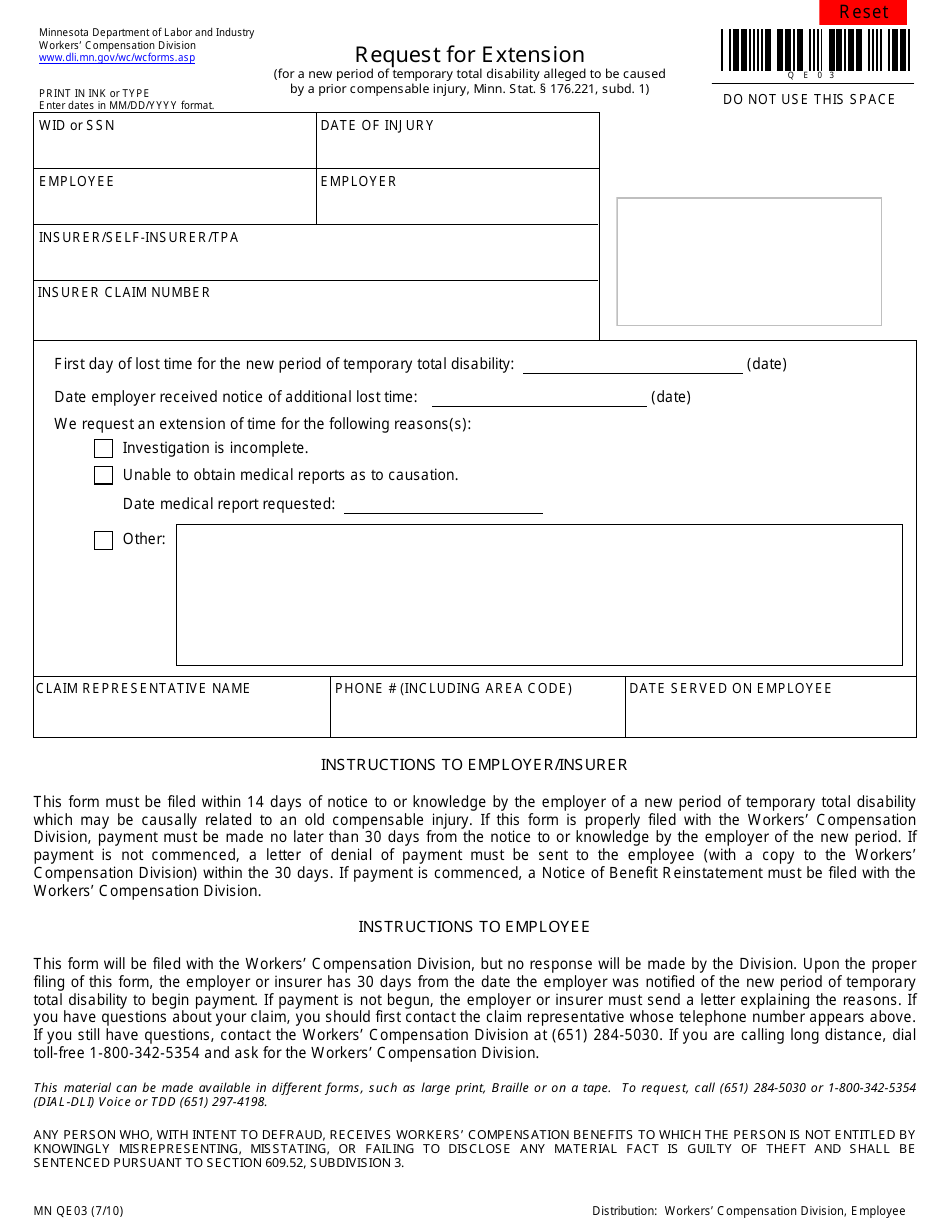

Form MN QE03 Download Fillable PDF or Fill Online Request for Extension

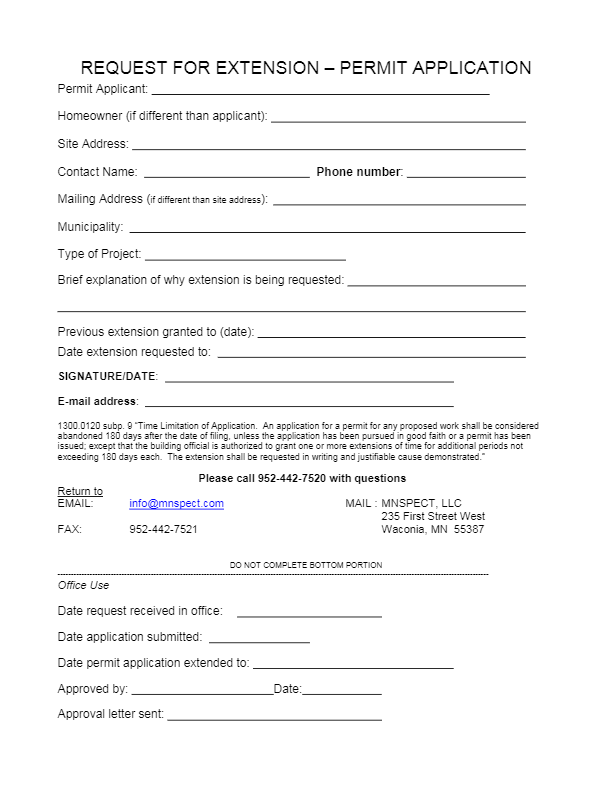

Request for Extension Permit Application Mound, MN

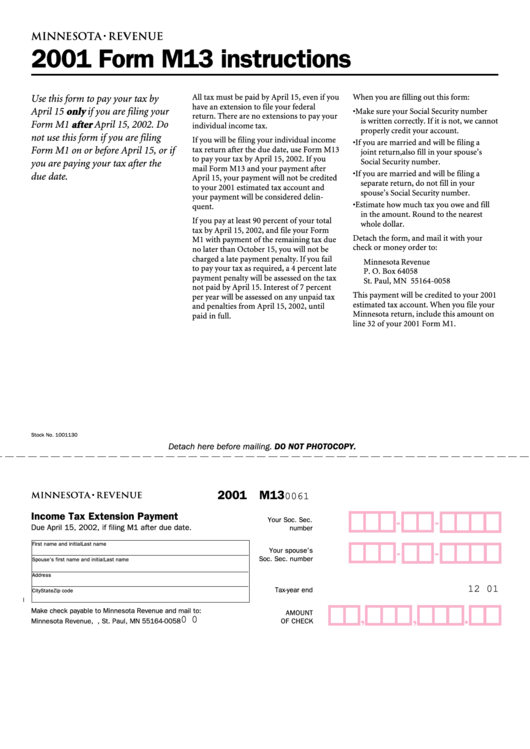

Form M13 Tax Extension Payment printable pdf download

Related Post: