Maryland Tax Extension Form

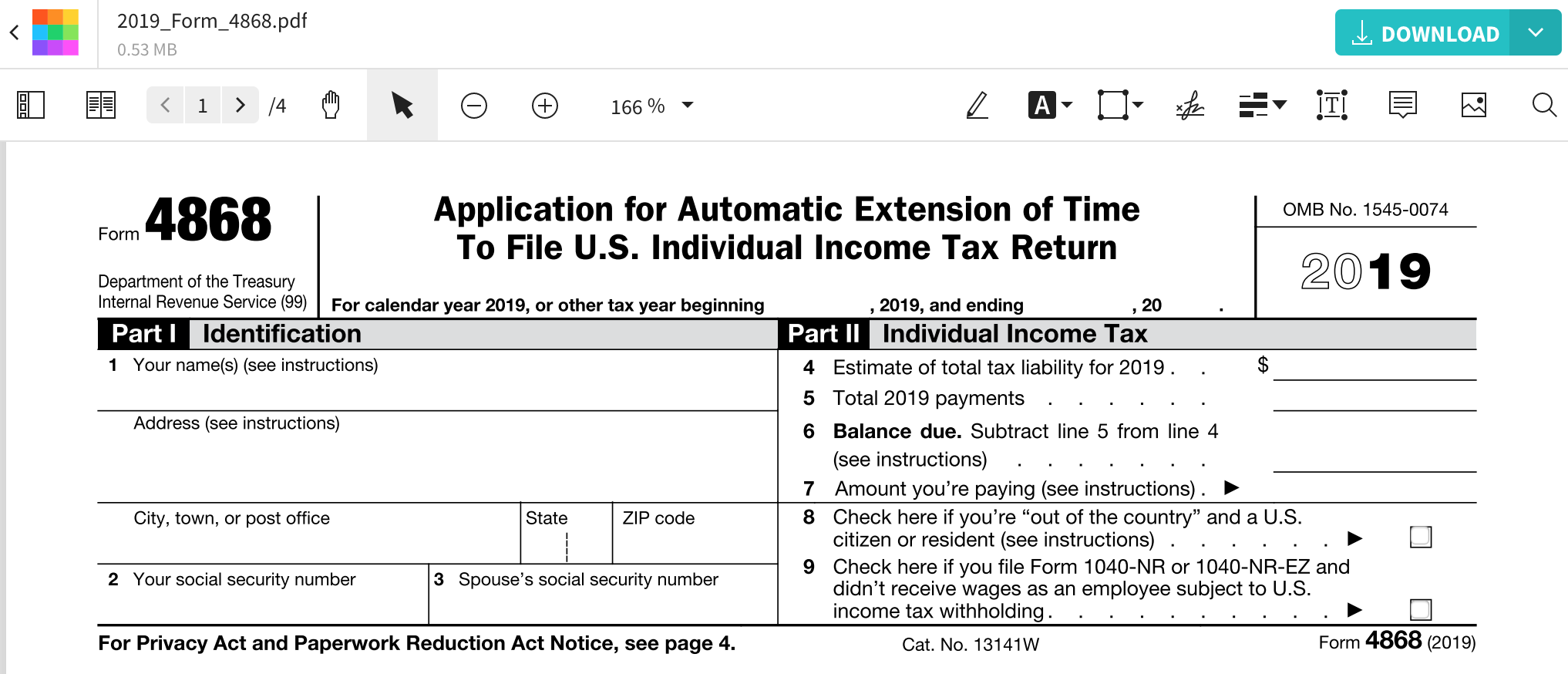

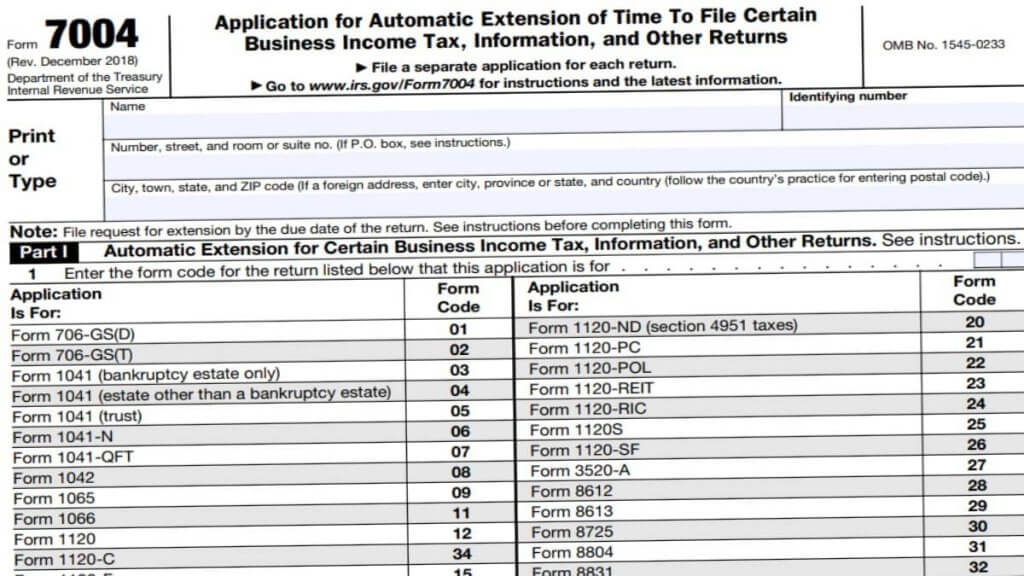

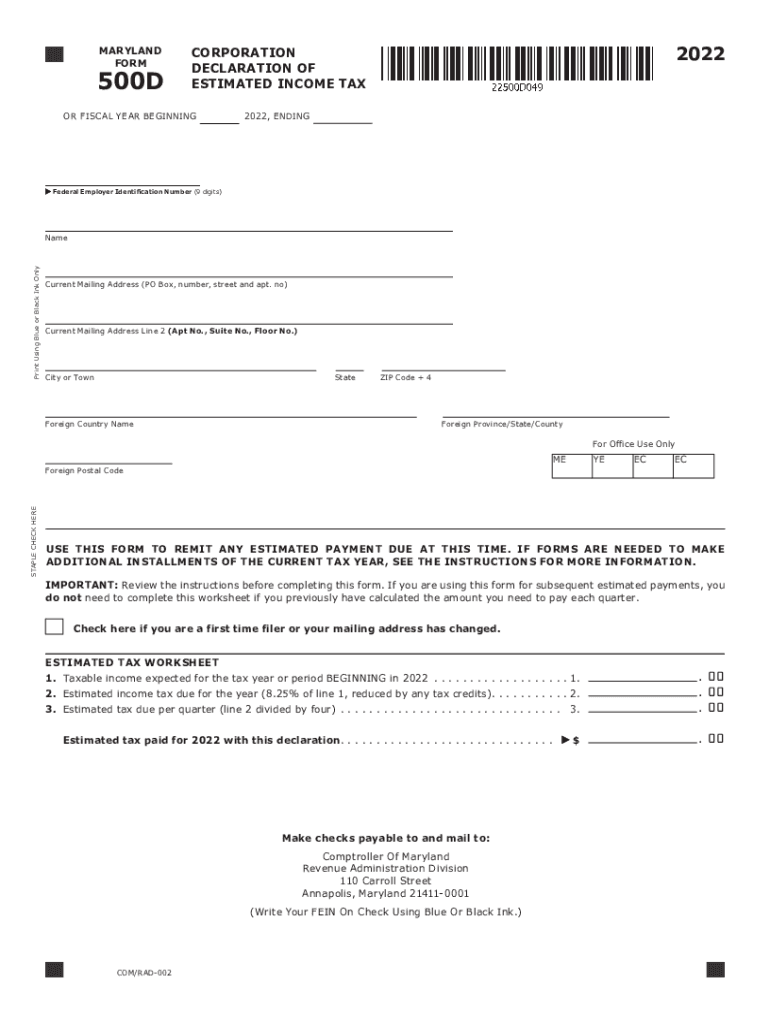

Maryland Tax Extension Form - Interest fill in form 504e correctly; Payment with resident return (502). File it by the due. Payment with nonresident return (505). To get the extension you must: Maryland department of assessments and taxation. Web individuals residing in maryland are not required to file a separate extension form if they owe zero maryland tax and have a valid federal tax extension (irs form. Web businesses that request a two month filing extension through sdat's online extension system will have a deadline of june 15, 2022. (there is a service charge) set up an individual. Web for assistance determining which form(s) to file click here : Web payment voucher with instructions and worksheet for individuals sending check or money order for any balance due on a form 502 or form 505, estimated tax payments, or. (there is a service charge) set up an individual. Payment with resident return (502). Make a credit card payment. Fill in form 504e correctly; Complete, edit or print tax forms instantly. To get the extension you must: Fill in form 504e correctly; Web payment voucher with instructions and worksheet for individuals sending check or money order for any balance due on a form 502 or form 505, estimated tax payments, or. The applications and forms below are in pdf format.in order to use any. Payment with resident return (502). Maryland department of assessments and taxation. If you have an approved federal tax extension ( irs form 4868 ), you will automatically receive a maryland tax extension. Web welcome to the comptroller of maryland's internet extension request filing system. File it by the due. The applications and forms below are in pdf format.in order to use any of the individual forms, you must first download to your computer the form you wish to. Businesses can file the 500e or. If you have an approved federal tax extension ( irs form 4868 ), you will automatically receive a maryland tax extension. In this case, you. Web for assistance determining which form(s) to file click here : To get the extension you must: Businesses can file the 500e or. Maryland department of assessments and taxation. Complete, edit or print tax forms instantly. In this case, you do not. Filing this form extends the time to file your return, but does not extend the time to pay. Web request an extension of time to file. Businesses can file the 500e or. Web businesses that request a two month filing extension through sdat's online extension system will have a deadline of june 15, 2022. This system allows instant online electronic filing of the 500e/510e forms. Filing this form extends the time to file your return, but does not extend the time to pay. (there is a service charge) set up an individual. Ad outgrow.us has been visited by 10k+ users in the past month Fill in form 504e correctly; Get ready for tax season deadlines by completing any required tax forms today. This system allows instant online electronic filing of the 500e/510e forms. Web businesses that request a two month filing extension through sdat's online extension system will have a deadline of june 15, 2022. File it by the due. If you have an approved federal tax extension (. Filing this form extends the time to file your return, but does not extend the time to pay. File it by the due. Maryland department of assessments and taxation. This system allows instant online electronic filing of the 500e/510e forms. Ad outgrow.us has been visited by 10k+ users in the past month Payment with nonresident return (505). File it by the due. (there is a service charge) set up an individual. To get the extension you must: The applications and forms below are in pdf format.in order to use any of the individual forms, you must first download to your computer the form you wish to. Maryland department of assessments and taxation. Web businesses that request a two month filing extension through sdat's online extension system will have a deadline of june 15, 2022. Filing this form extends the time to file your return, but does not extend the time to pay. 12:07 pm est jan 28, 2022. Businesses can file the 500e or. Complete, edit or print tax forms instantly. The extension request filing system allows businesses to instantly file for an extension online. Get ready for tax season deadlines by completing any required tax forms today. Web payment voucher with instructions and worksheet for individuals sending check or money order for any balance due on a form 502 or form 505, estimated tax payments, or. Fill in form 504e correctly; Web request an extension of time to file. (there is a service charge) set up an individual. Web individuals residing in maryland are not required to file a separate extension form if they owe zero maryland tax and have a valid federal tax extension (irs form. Resident maryland tax return : Web welcome to the comptroller of maryland's internet extension request filing system. To get the extension you must: File it by the due. To get the extension you must: Web maryland tax extension form: Payment with nonresident return (505).Best Providers in Maryland

Unifirst Financials & Tax Consultants Reston, VA Patch

Maryland form 502d 2019 Fill out & sign online DocHub

2023 Irs Form 4868 Printable Forms Free Online

Maryland Tax Extension How to File MD State Tax Extension

112 Butterfly Dr 60, Taneytown, MD 21787 MLS MDCR2016408 Redfin

Business Tax Extension 7004 Form 2023

What you need to know about the tax file extension deadline

Maryland dept of revenue 500d Fill out & sign online DocHub

Maryland State Tax Withholding Form 2023 Printable Forms Free Online

Related Post: