Maryland Form 505Nr

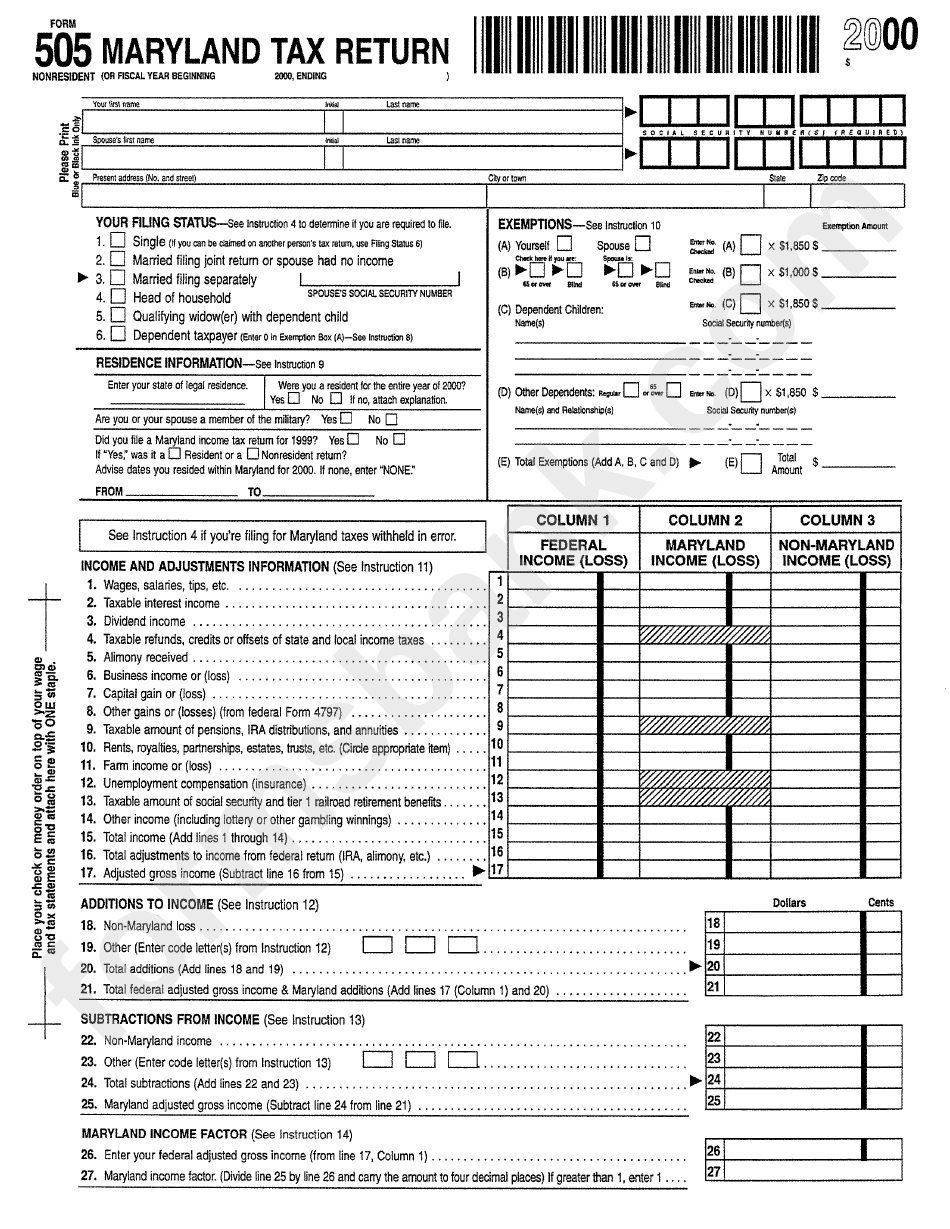

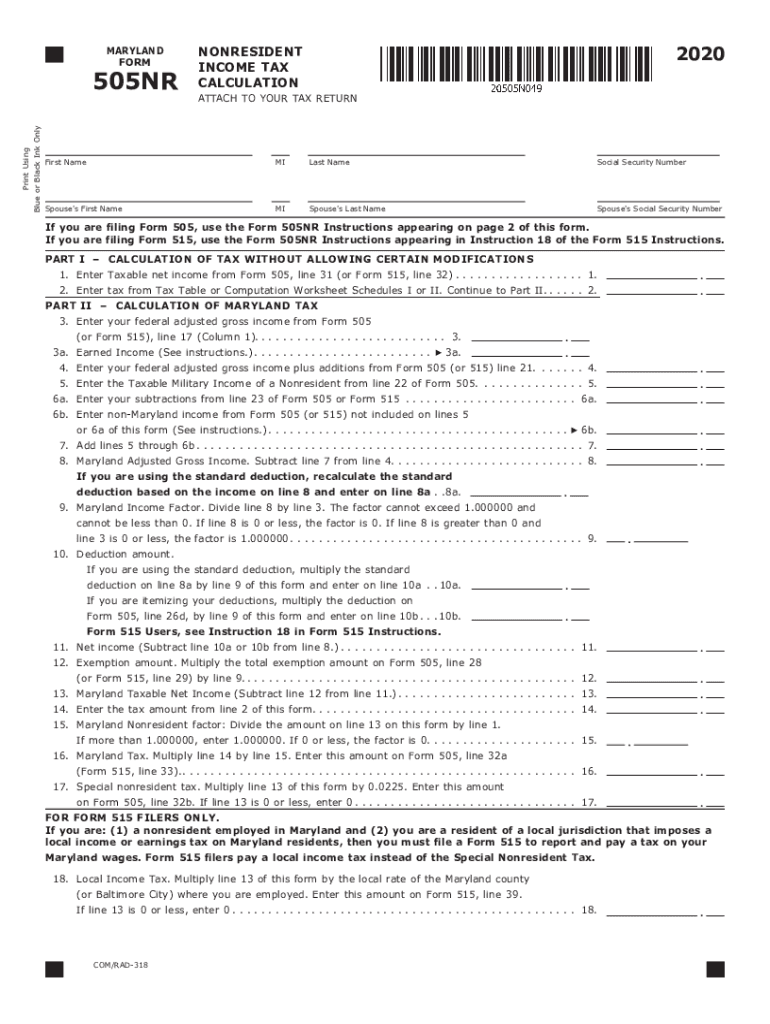

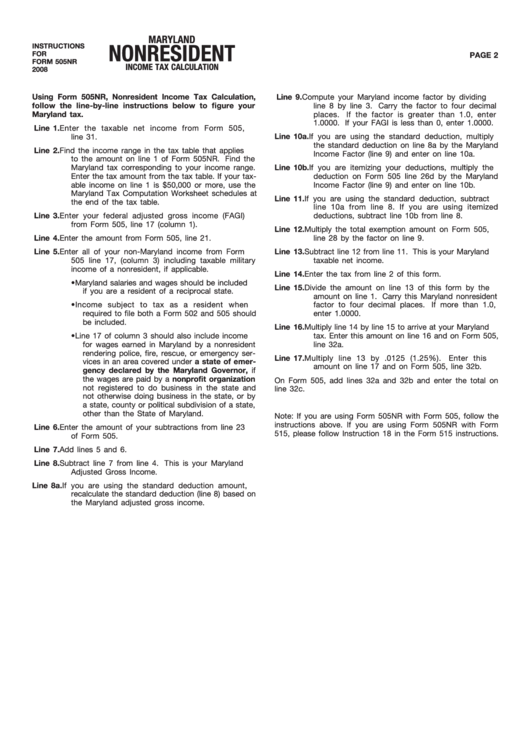

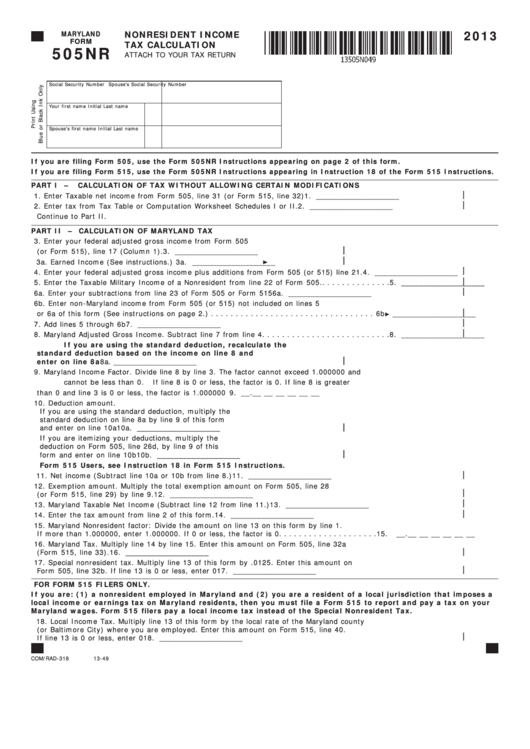

Maryland Form 505Nr - Income and adjustments to income: Web maryland tax, you must also file form 505. Taxable net income (subtract line 30 from line 27.) figure tax on form 505nr. Enter the taxable net income from form 505,. Ad download or email md 505nr & more fillable forms, register and subscribe now! Complete, edit or print tax forms instantly. Find the maryland tax corresponding to your income range. Web $ or fiscal year beginning 2021, ending social security number spouse's social security number first name mi last name spouse's first name mi does your name. Web maryland nonresident income tax calculation attach to your tax return 2012 if you are filing form 505, use the form 505nr instructions appearing. Web 4.7 satisfied 50 votes what makes the form 505 maryland legally valid? You must complete the following using the. Enter the taxable net income from form 505,. Web how to fill out and sign 2019 maryland 505nr form online? Use a commercial tax preparer. Web we last updated the maryland nonresident income tax return in january 2023, so this is the latest version of form 505, fully updated for tax year 2022. Get your online template and fill it in using progressive features. Enter the tax amount from the tax table. Web maryland tax, you must also file form 505. There are three methods you can choose from to file your maryland taxes electronically: Web taxable net income (subtract line 30 from line 27.) figure tax on form 505nr. Complete, edit or print tax forms instantly. Complete, edit or print tax forms instantly. This form is for income earned in tax year 2022, with tax returns due in april. Web maryland income (loss) as corrected c. Web applies to the amount on line 1 of form 505nr. This form is for income earned in tax year 2022, with tax returns due in april. Web we last updated the maryland nonresident income tax return in january 2023, so this is the latest version of form 505, fully updated for tax year 2022. Ad download or email md 505nr & more fillable forms, register and subscribe now! Web 4.7. Taxable net income (subtract line 30 from line 27.) figure tax on form 505nr. Complete, edit or print tax forms instantly. Enter the tax amount from the tax table. Web maryland exemption allowance (multiply line 28 by line 29.). Complete, edit or print tax forms instantly. Web we last updated maryland form 505nr in january 2023 from the maryland comptroller of maryland. How can i file my maryland return electronically? For returns filed without payments, mail your completed return to: Find the maryland tax corresponding to your income range. Web maryland nonresident income tax calculation attach to your tax return 2012 if you are filing form. Web we last updated the maryland nonresident income tax return in january 2023, so this is the latest version of form 505, fully updated for tax year 2022. Income and adjustments to income: Web how to fill out and sign 2019 maryland 505nr form online? If your taxable income on. Enter the tax amount from the tax table. Web applies to the amount on line 1 of form 505nr. This form is for income earned in tax year 2022, with tax returns due in april. How can i file my maryland return electronically? For returns filed without payments, mail your completed return to: Use a commercial tax preparer. This form is for income earned in tax year 2022, with tax returns due in april. Enter the tax amount from the tax table. Web maryland nonresident income tax calculation attach to your tax return 2012 if you are filing form 505, use the form 505nr instructions appearing. Find the maryland tax corresponding to your income range. There are three. Web $ or fiscal year beginning 2021, ending social security number spouse's social security number first name mi last name spouse's first name mi does your name. Web we last updated maryland form 505nr in january 2023 from the maryland comptroller of maryland. Enjoy smart fillable fields and interactivity. Web maryland tax, you must also file form 505. Web maryland. Complete, edit or print tax forms instantly. Enter the tax amount from the tax table. You must complete the following using the. Web we last updated maryland form 505nr in january 2023 from the maryland comptroller of maryland. Because the world takes a step away from office work, the completion of paperwork increasingly takes place. Complete, edit or print tax forms instantly. Enter the taxable net income from form 505,. Taxable net income (subtract line 30 from line 27.) figure tax on form 505nr. Web maryland exemption allowance (multiply line 28 by line 29.). There are three methods you can choose from to file your maryland taxes electronically: Web maryland exemption allowance (multiply line 28 by line 29.). Web maryland nonresident income tax calculation attach to your tax return 2012 if you are filing form 505, use the form 505nr instructions appearing. Use a commercial tax preparer. Web form 505 nonresident return taxpayer who maintains a place of abode (that is, a place to live) for more than six (6) months of the tax year in maryland and you are physically. Income and adjustments to income: How can i file my maryland return electronically? Return taxpayer who moved into or out. Web taxable net income (subtract line 30 from line 27.) figure tax on form 505nr. Download or email md 505nr & more fillable forms, register and subscribe now! Web maryland income (loss) as corrected c.Form 505 Maryland Nonresident Tax Return 2000 printable pdf

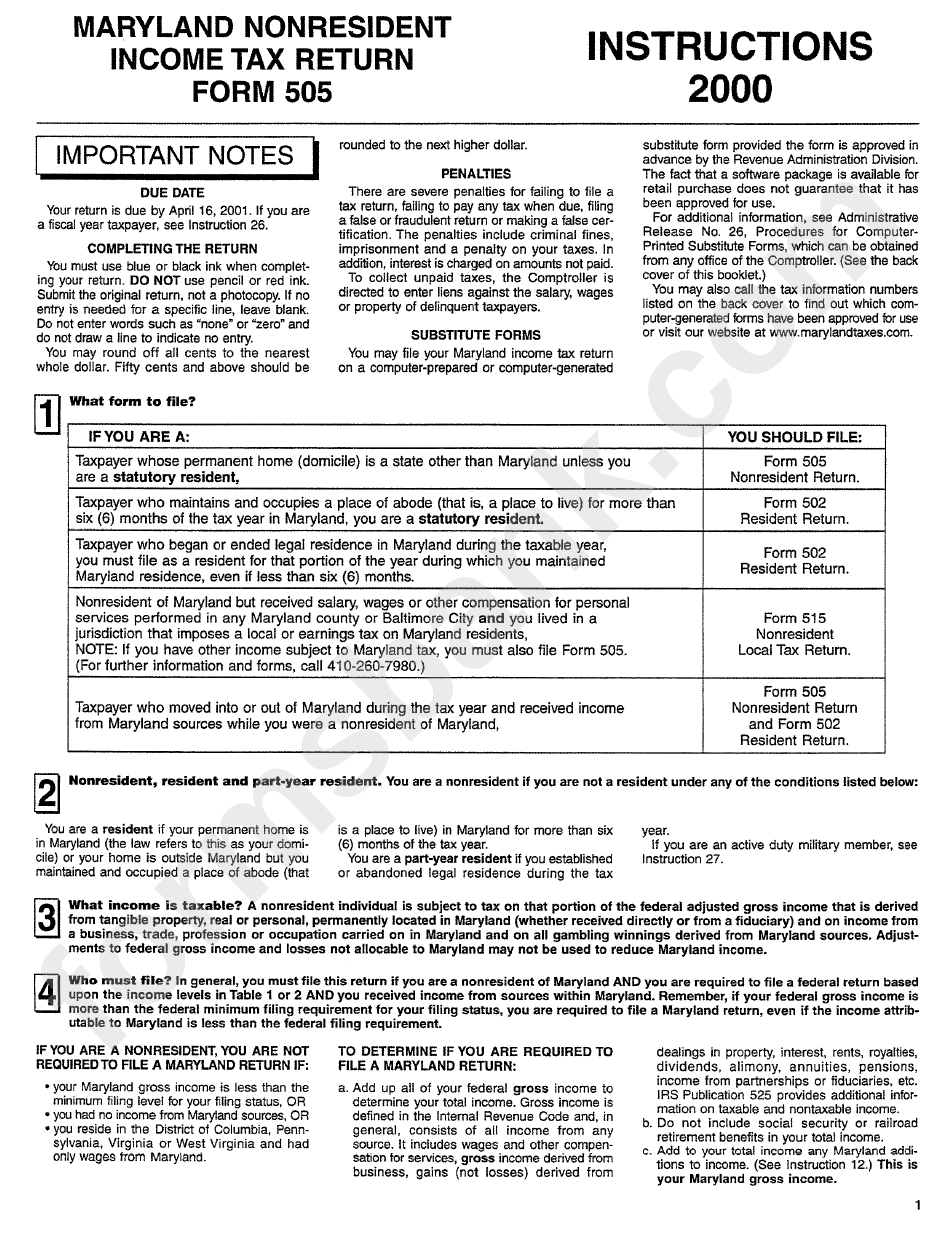

Form 505 Nonresident Maryland Tax Return 2000 printable pdf download

MD 505NR 20202022 Fill out Tax Template Online US Legal Forms

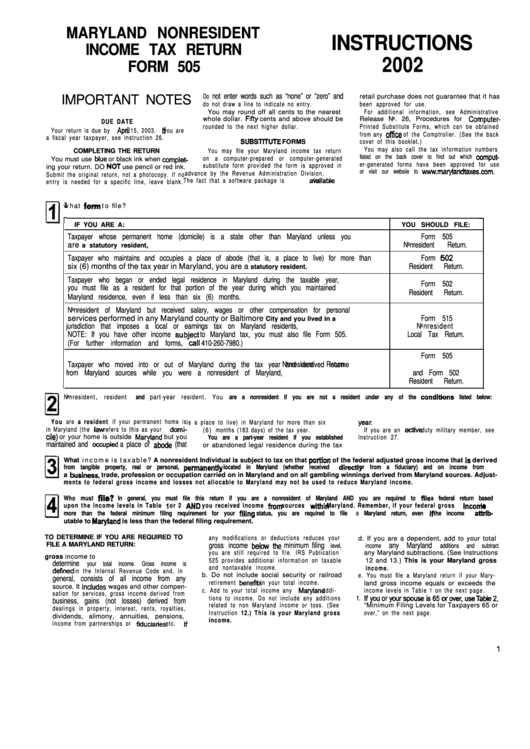

Instructions For Maryland Nonresident Tax Return Form 505 2002

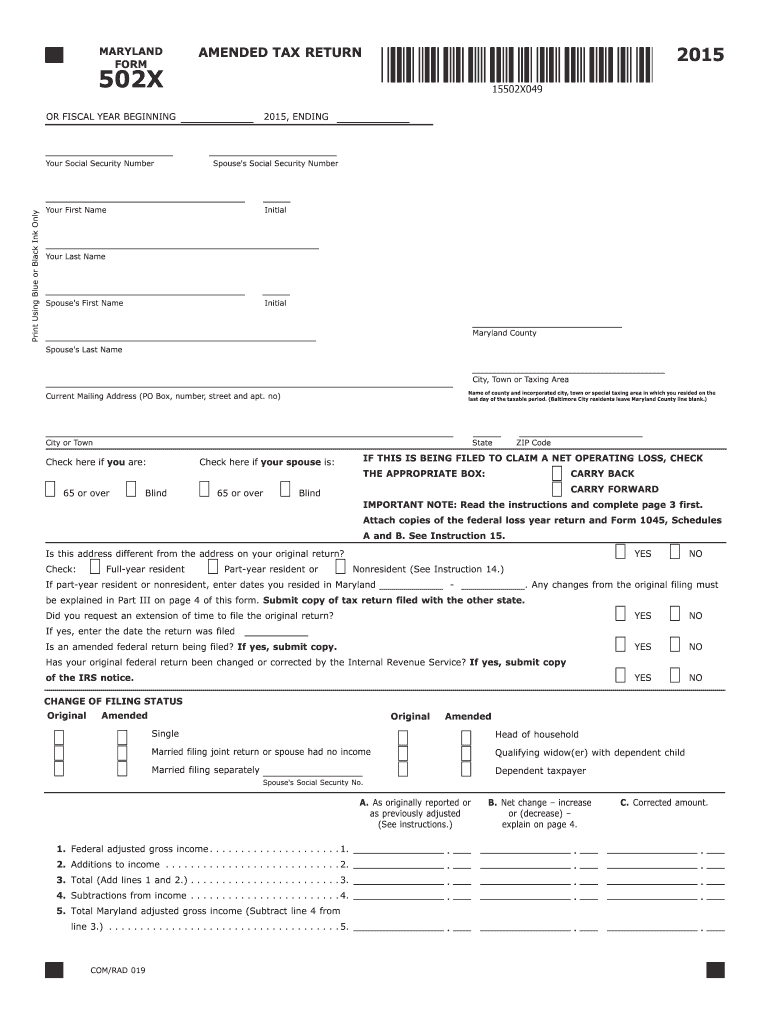

Maryland 502x Form Fill Out and Sign Printable PDF Template signNow

Fill Free fillable Form 505 2016 NONRESIDENT TAX RETURN

Fill Free fillable forms Comptroller of Maryland

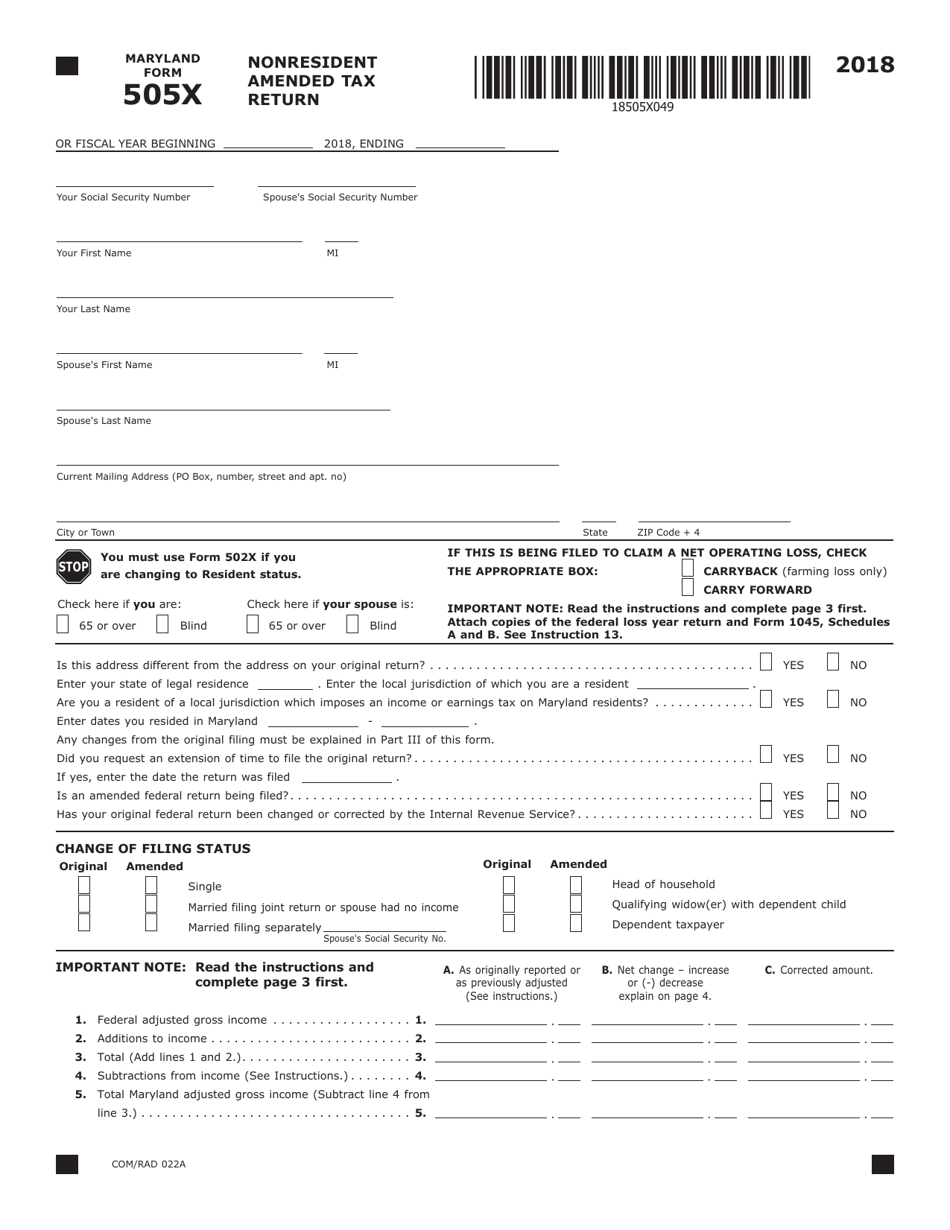

Form COM/RAD022A (Maryland Form 505X) Download Fillable PDF or Fill

Instructions For Form 505nr 2008 Maryland Nonresident Tax

Fillable Maryland Form 505nr Nonresident Tax Calculation

Related Post: