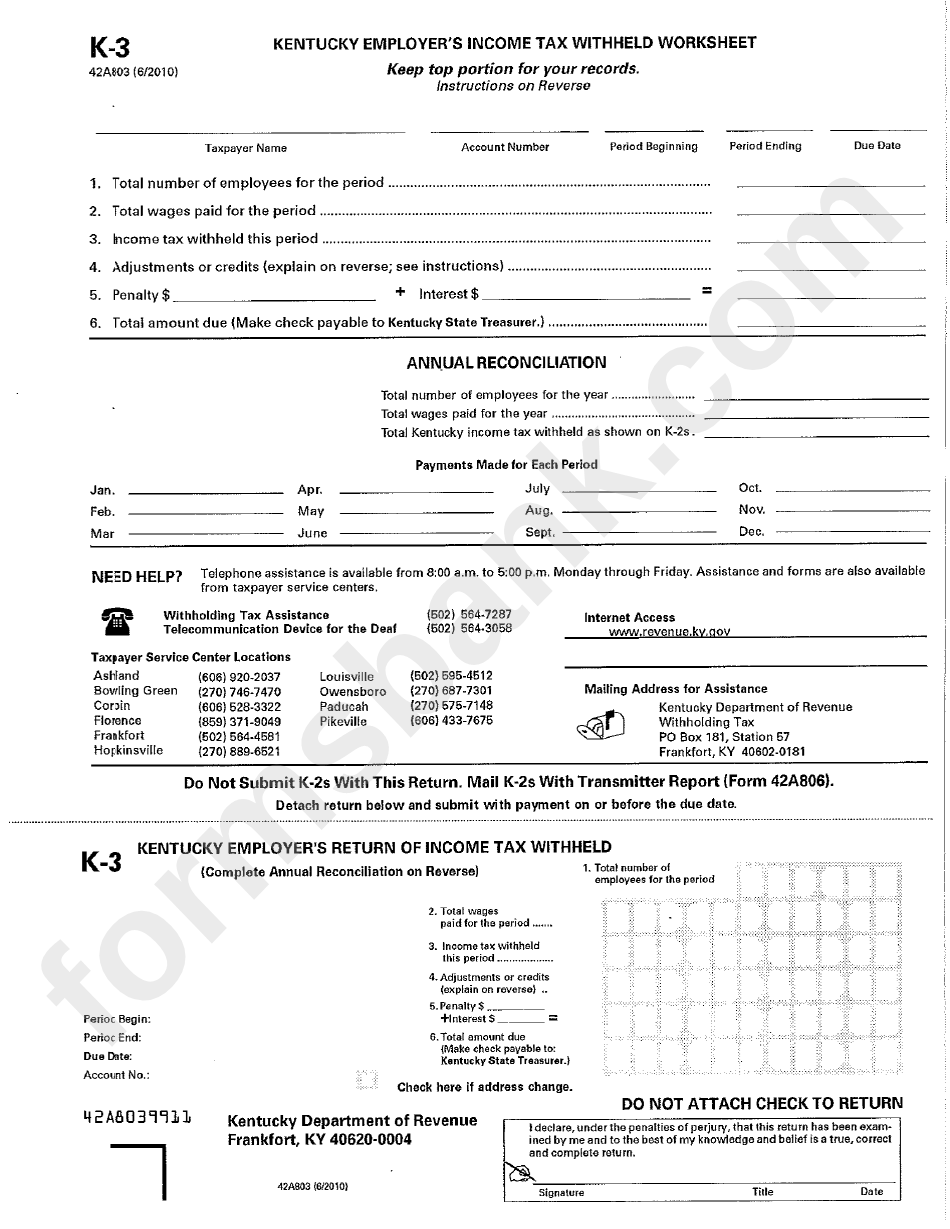

Kentucky Form K 3

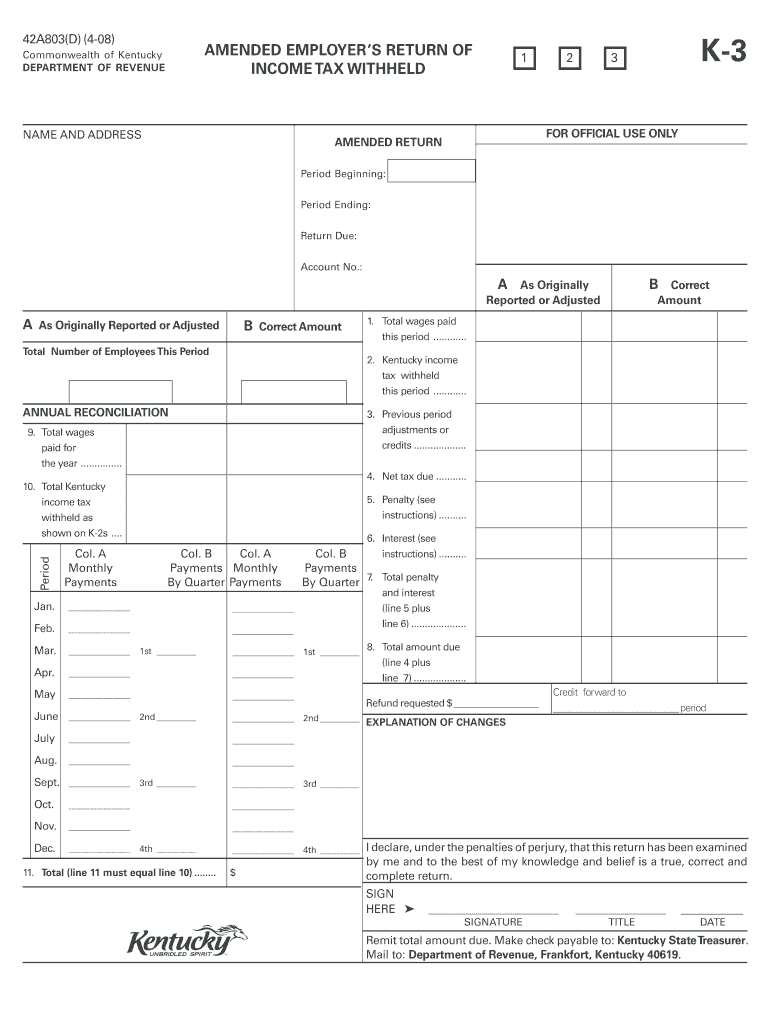

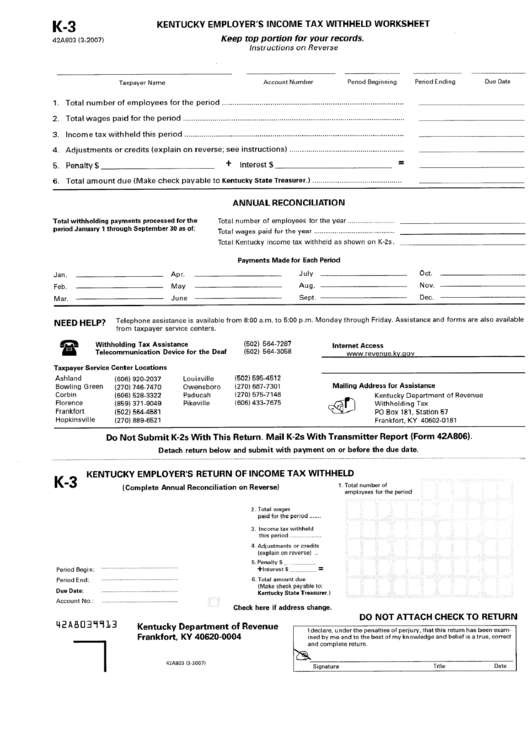

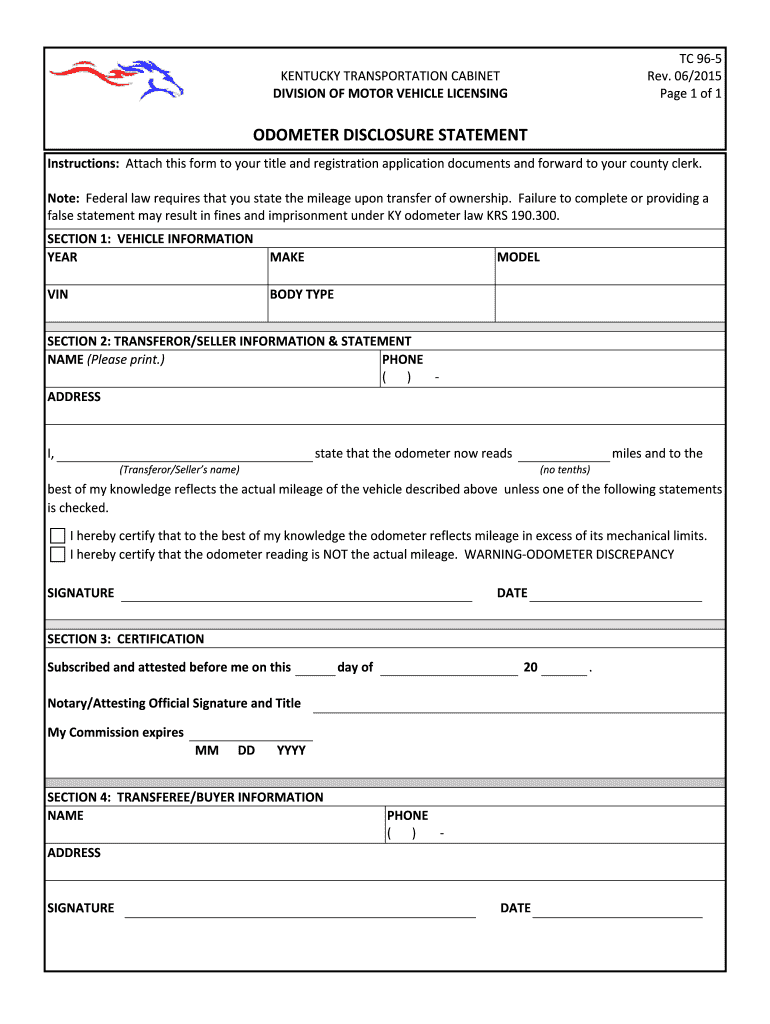

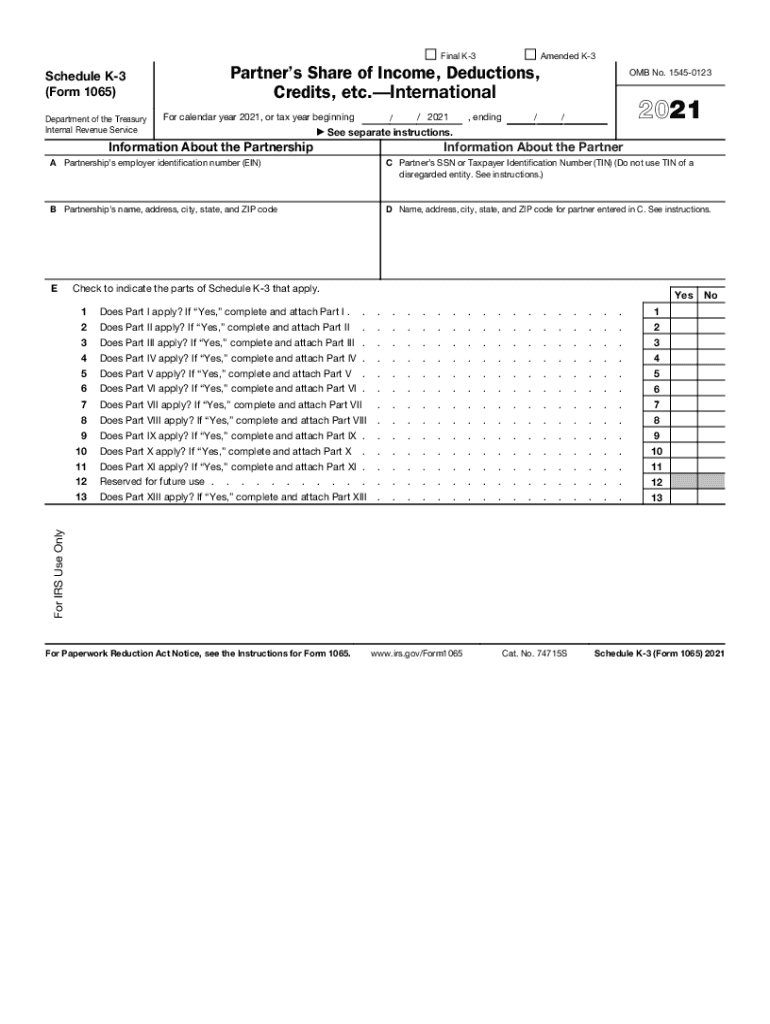

Kentucky Form K 3 - Web electronic submission of wage and tax information. Web download the taxpayer bill of rights. Partner’s share of income, deductions, credits, etc.—. The tax due is to be paid in. Get ready for tax season deadlines by completing any required tax forms today. To get started on the form, utilize the fill camp; The kentucky department of revenue conducts work under the authority of the finance and administration cabinet. If you are already registered, but have. Web development fund and kentucky standardbred breeders’ incentive fund: (updated january 9, 2023) 2. The kentucky department of revenue conducts work under the authority of the finance and administration cabinet. Register and subscribe now to work on 42a803(d) & more fillable forms. Partner’s share of income, deductions, credits, etc.—. Web we last updated the withholding tax instructions for employers in march 2022, so this is the latest version of form 42a003, fully updated for. Forms for starting a business in kentucky. Sign online button or tick the preview image of. Get ready for tax season deadlines by completing any required tax forms today. Enter the following for each statement: Web income tax liability thresholds—the 2022 filing threshold amount based upon federal poverty level is expected to be $13,590 for a family size of one. Register and subscribe now to work on 42a803(d) & more fillable forms. The kentucky department of revenue conducts work under the authority of the finance and administration cabinet. Web instructions for employers revised april 2021 commonwealth of kentucky department of revenue frankfort forms information forms 501 high street,. Complete, edit or print tax forms instantly. Web what is a kentucky. The tax due is to be paid in full at the time the return is filed. To register, use form 42a808. Web instructions for employers revised april 2021 commonwealth of kentucky department of revenue frankfort forms information forms 501 high street,. The tax due is to be paid in full at the time the return is filed. To get started. To get started on the form, utilize the fill camp; Once the form is completed, it may be filed electronically by clicking the. Web instructions for employers revised april 2021 commonwealth of kentucky department of revenue frankfort forms information forms 501 high street,. Web development fund and kentucky standardbred breeders’ incentive fund: Forms for starting a business in kentucky. Enter the following for each statement: The kentucky department of revenue conducts work under the authority of the finance and administration cabinet. Web instructions for employers revised april 2021 commonwealth of kentucky department of revenue frankfort forms information forms 501 high street,. Partner’s share of income, deductions, credits, etc.—. If you are already registered, but have. Web instructions for employers revised april 2021 commonwealth of kentucky department of revenue frankfort forms information forms 501 high street,. A as originally reported or. If you are already registered, but have. Forms for starting a business in kentucky. Get ready for tax season deadlines by completing any required tax forms today. Once the form is completed, it may be filed electronically by clicking the. The tax due is to be paid in full at the time the return is filed. Get ready for tax season deadlines by completing any required tax forms today. To get started on the form, utilize the fill camp; Web download the taxpayer bill of rights. Web what is a kentucky k 3? Forms for starting a business in kentucky. If you are already registered, but have. The tax due is to be paid in. Get ready for tax season deadlines by completing any required tax forms today. Once the form is completed, it may be filed electronically by clicking the. To register, use form 42a808. The tax due is to be paid in full at the time the return is filed. Department of the treasury internal revenue service omb no. Web download the taxpayer bill of rights. Web electronic submission of wage and tax information. Partner’s share of income, deductions, credits, etc.—. Get ready for tax season deadlines by completing any required tax forms today. Once the form is completed, it may be filed electronically by clicking the. Web income tax liability thresholds—the 2022 filing threshold amount based upon federal poverty level is expected to be $13,590 for a family size of one (singe, or married living. Register and subscribe now to work on 42a803(d) & more fillable forms. Department of the treasury internal revenue service omb no. Sign online button or tick the preview image of. (updated january 9, 2023) 2. Complete, edit or print tax forms instantly. The kentucky department of revenue conducts work under the authority of the finance and administration cabinet. Enter the following for each statement: Web what is a kentucky k 3? Forms for starting a business in kentucky. Web instructions for employers revised april 2021 commonwealth of kentucky department of revenue frankfort forms information forms 501 high street,. To register, use form 42a808. To get started on the form, utilize the fill camp; If you are already registered, but have. Complete, edit or print tax forms instantly. The tax due is to be paid in.Ky Revenue Form K 3 2021 essentially.cyou 2022

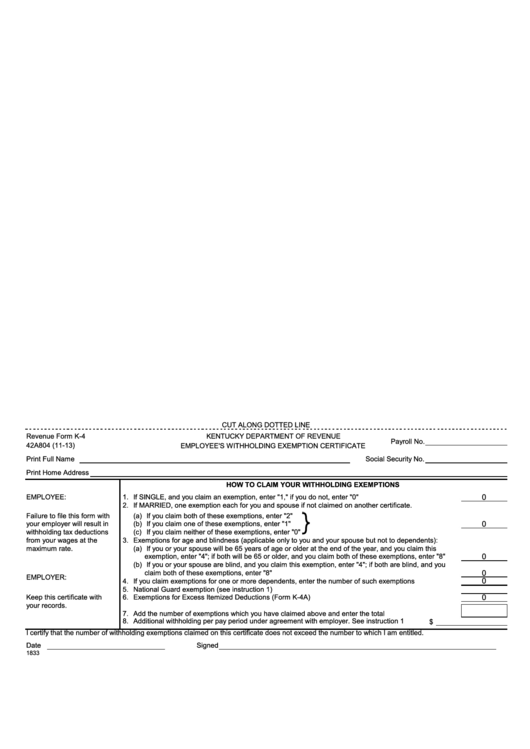

E Kentucky Form K4 Employee's Withholding Exemption Certificate 2022

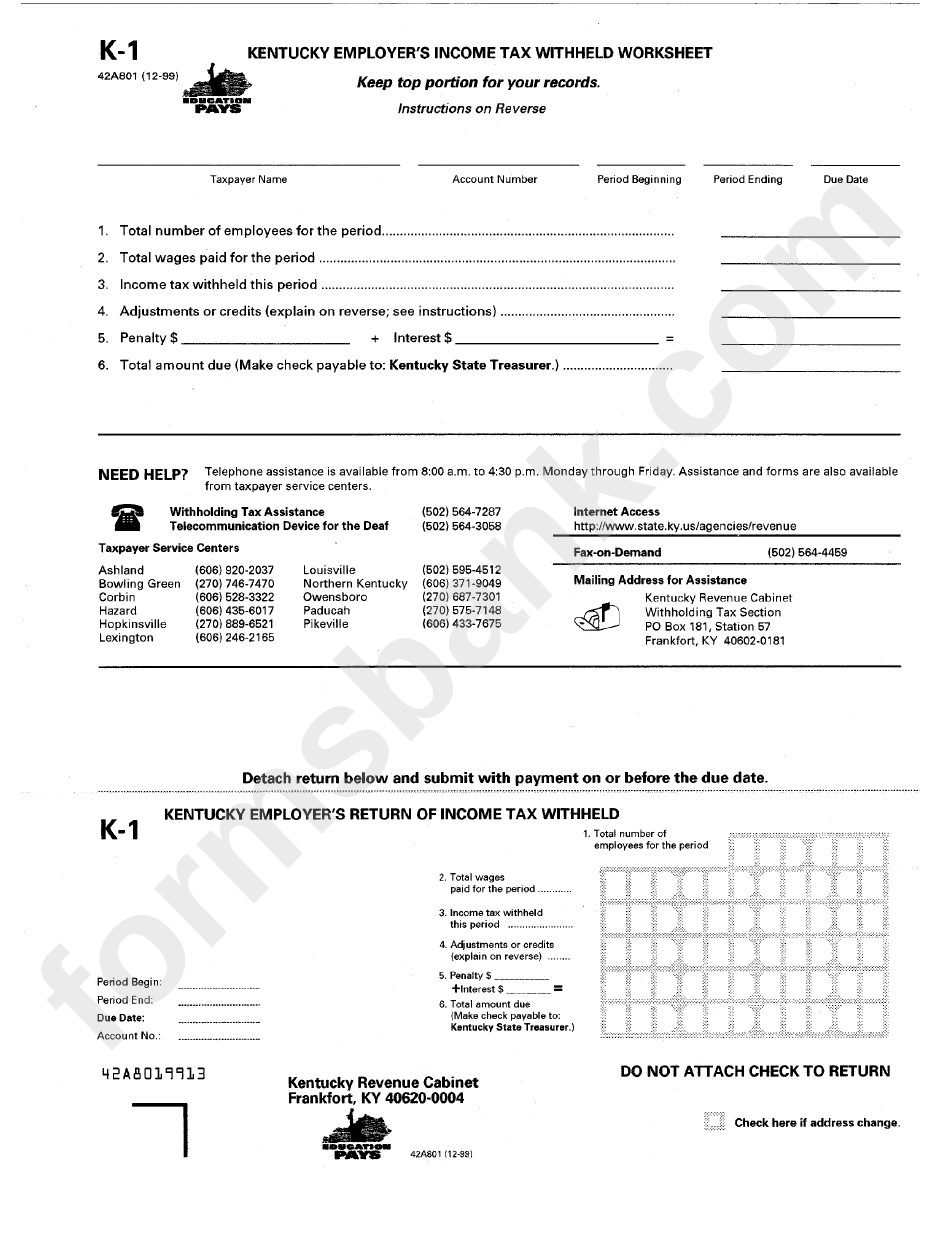

Ky State Tax Withholding Form

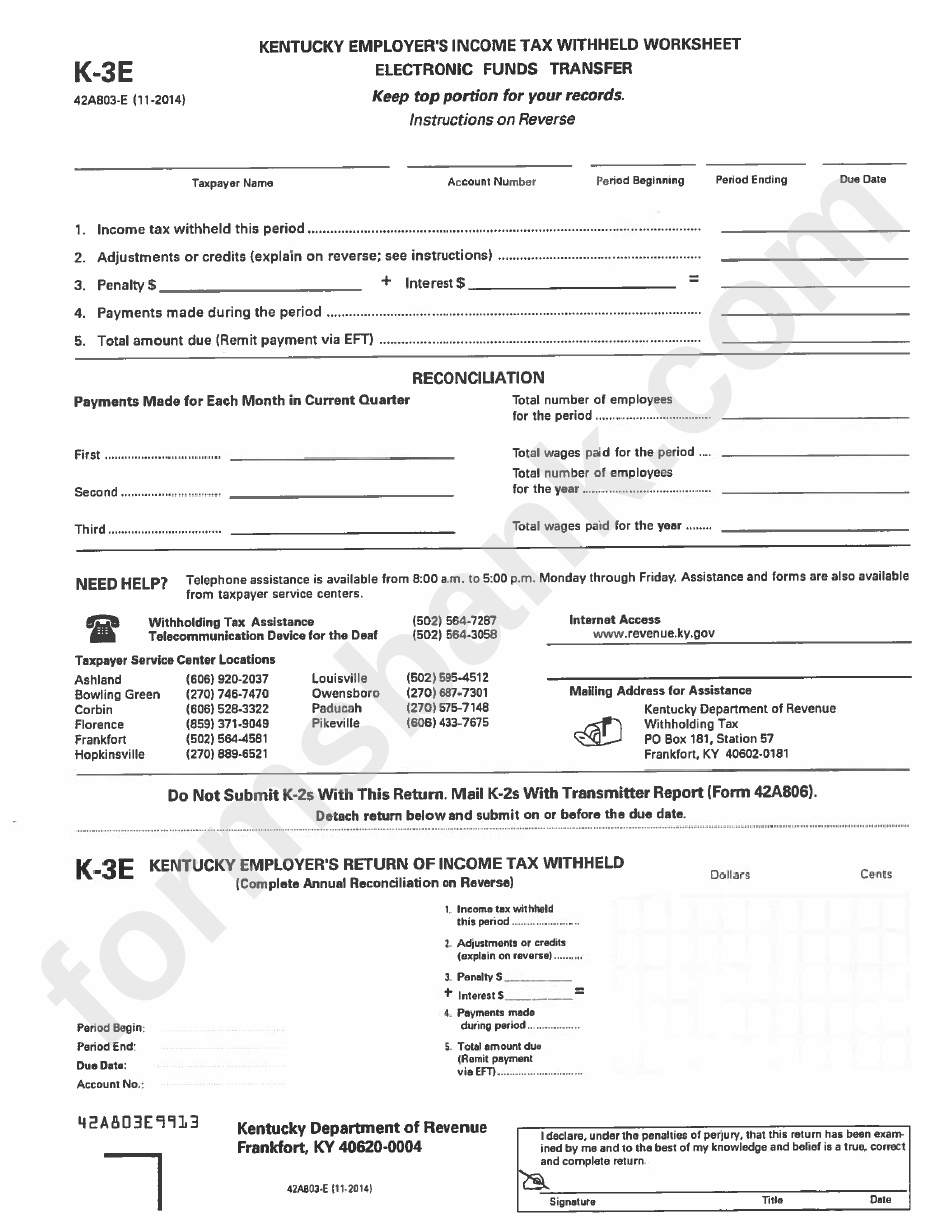

Form K3 Kentucky Employer'S Tax Withheld Worksheet printable

Revenue Ky Gov Form K 3 Fill Out and Sign Printable PDF Template

Form K3 Kentucky Employer'S Tax Withheld Worksheet Kentucky

Statement ky Fill out & sign online DocHub

IRS 1065 Schedule K3 20212022 Fill and Sign Printable Template

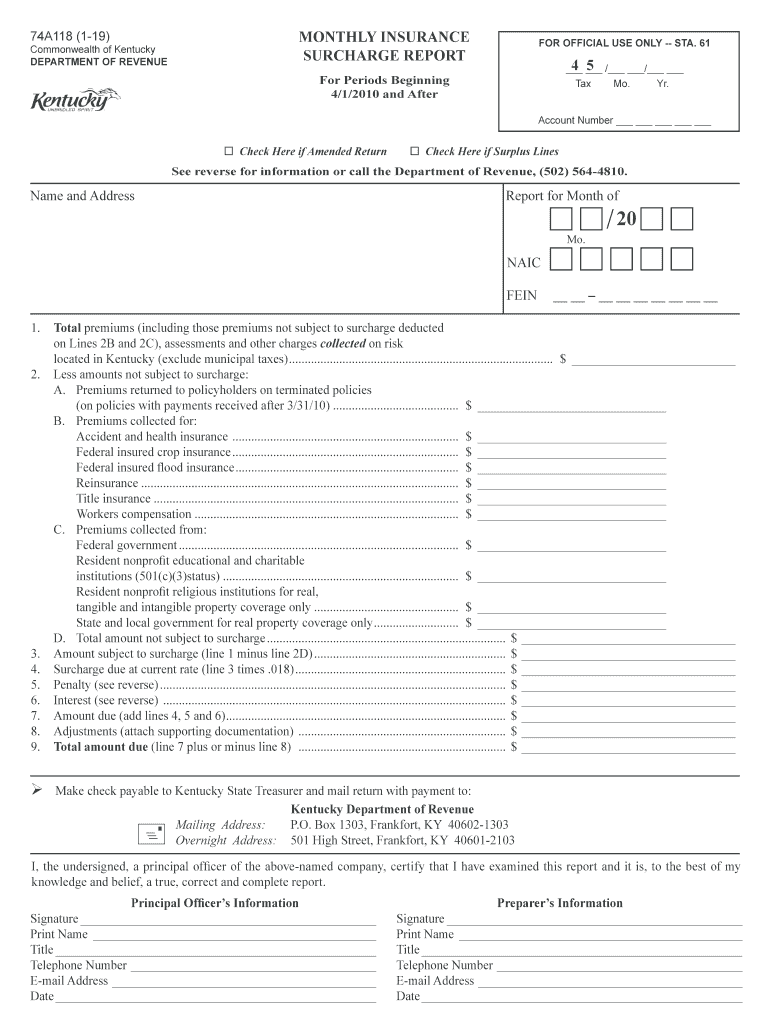

Ky Surcharge Fill Out and Sign Printable PDF Template signNow

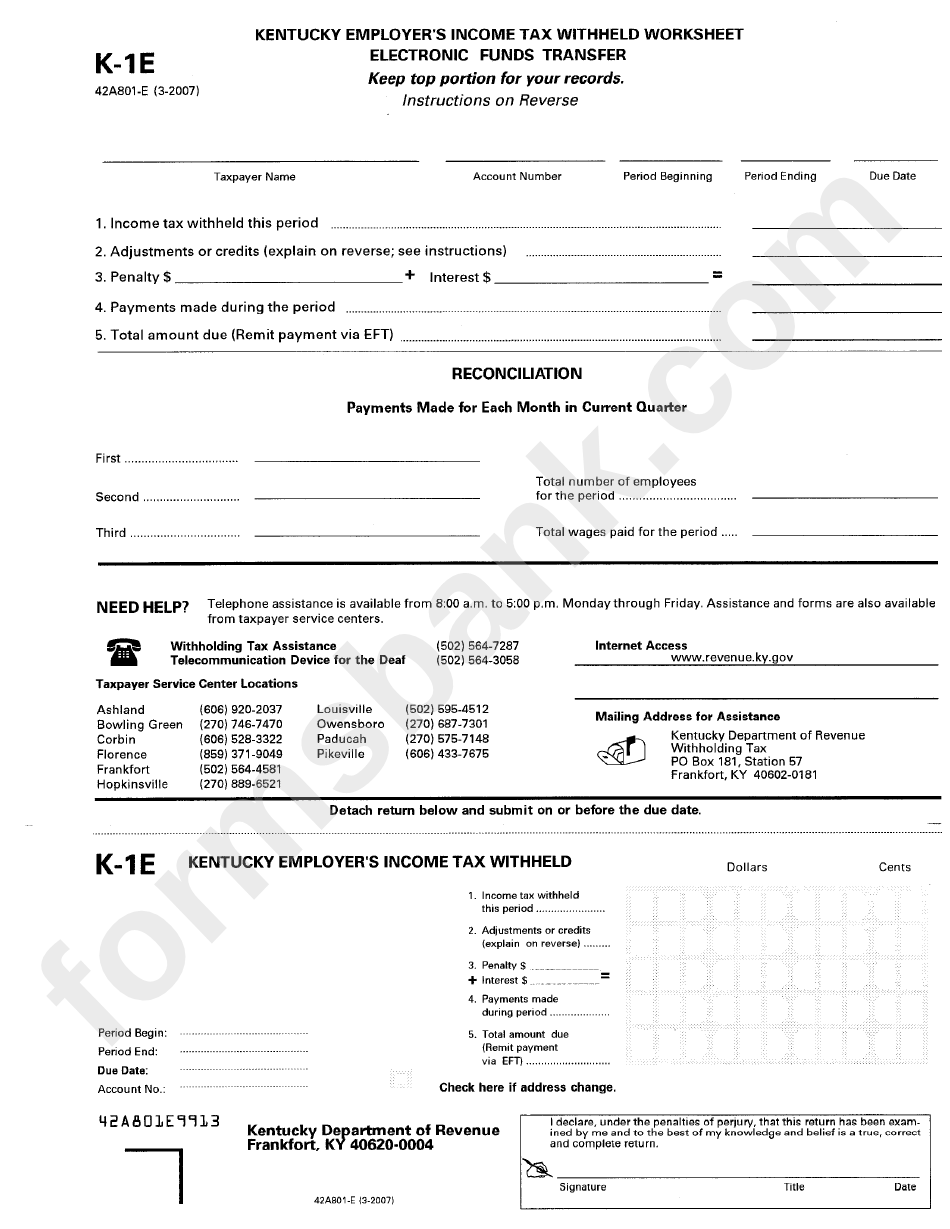

Form K3e Employer'S Tax Withheld Worksheet Eft printable

Related Post: