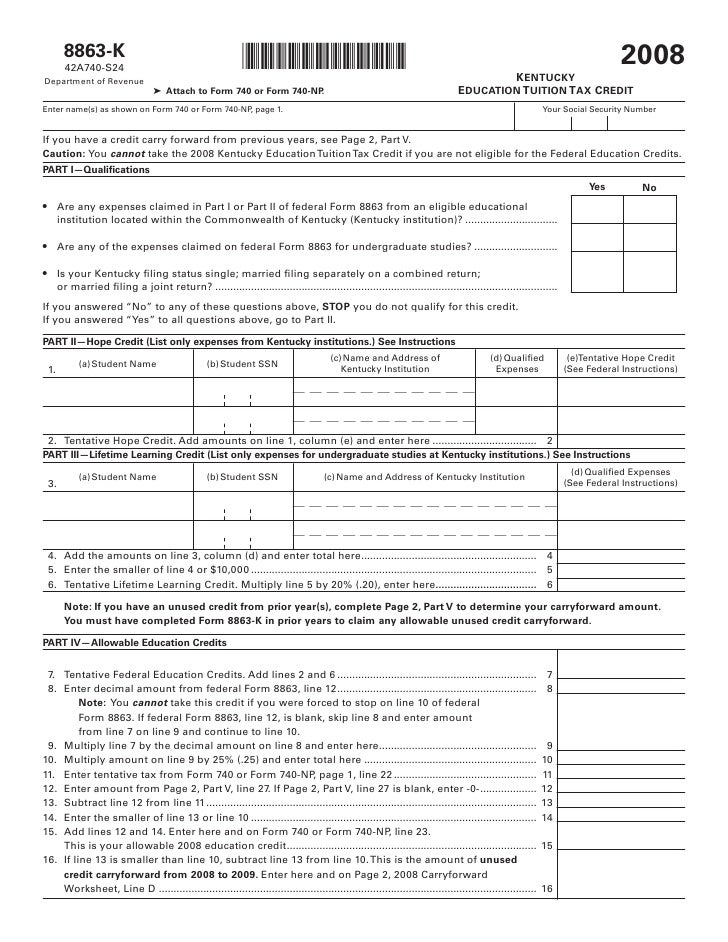

Kentucky Form 8863-K

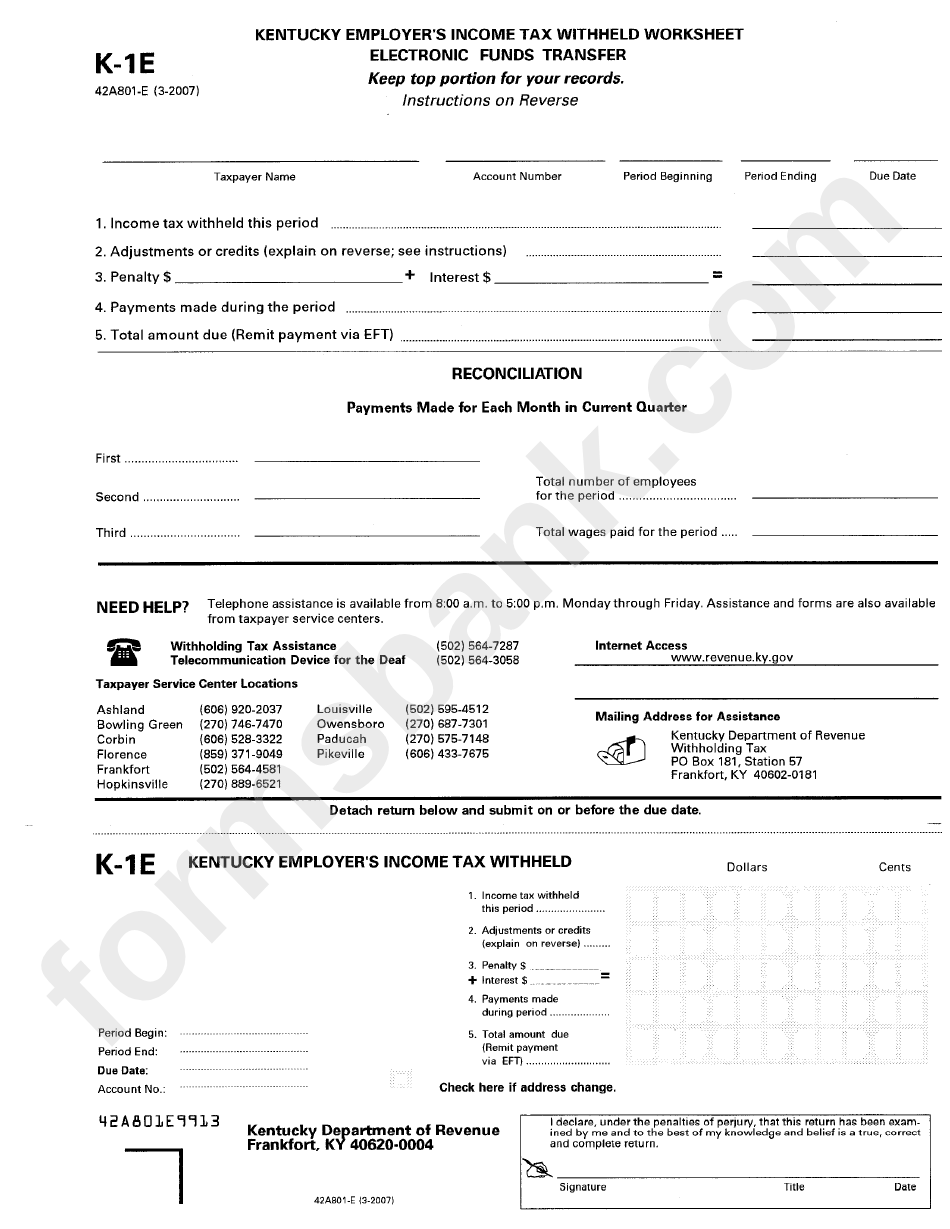

Kentucky Form 8863-K - The hope credit and the lifetime learning credit. Get ready for tax season deadlines by completing any required tax forms today. The hope credit and the lifetime. Easily fill out pdf blank, edit, and sign them. The american opportunity credit and the lifetime. You cannot take a kentucky education tuition tax credit if you are not eligible for the federal hope or lifetime learning credits. Fill & download for free. If you have an unused credit from prior year(s), complete part v to determine your carryforward amount. Web kentucky education tuition tax credit. You cannot take the 2017 kentucky. You cannot take the 2017 kentucky. Web kentucky tax form 8863 k: The hope credit and the lifetime learning credit. Kentucky information worksheet, information worksheet. Ad pdffiller.com has been visited by 1m+ users in the past month You cannot take a kentucky education tuition tax credit if you are not eligible for the federal hope or lifetime learning credits. Easily fill out pdf blank, edit, and sign them. Web you must attach the federal form 8863. Web kentucky education tuition tax credit. The hope credit and the lifetime. If you have an unused credit from prior year(s), complete part v to determine your carryforward amount. How to edit and fill out kentucky tax form 8863 k online. Kentucky information worksheet, information worksheet. Web you must attach the federal form 8863. If you have an unused credit from prior year(s), complete part v to determine your carryforward amount. The american opportunity credit and the lifetime. Fill & download for free. Web you must attach the federal form 8863. Read the following instructions to use. You cannot take the 2016 kentucky education tuition tax credit if you are not. Web kentucky individual form availability. Get ready for tax season deadlines by completing any required tax forms today. Fill & download for free. Kentucky education tuition tax credit. The hope credit and the lifetime learning credit. Kentucky education tuition tax credit. You cannot take the 2018 kentucky. Web you must attach the federal form 8863. Web kentucky education tuition tax credit. You cannot take the 2016 kentucky education tuition tax credit if you are not. The american opportunity credit and the lifetime. Web taxman taxman • 1.1k views. This form is for income. Get ready for tax season deadlines by completing any required tax forms today. Web kentucky tax form 8863 k: The hope credit and the lifetime. The american opportunity credit and the lifetime. The hope credit and the lifetime. Ad pdffiller.com has been visited by 1m+ users in the past month Web you must attach the federal form 8863. The hope credit and the lifetime. Web kentucky education tuition tax credit. You cannot take the 2018 kentucky. How to edit and fill out kentucky tax form 8863 k online. If you have an unused credit from prior year(s), complete part v to determine your carryforward amount. You cannot take the 2018 kentucky. The american opportunity credit and the lifetime. Web kentucky education tuition tax credit. The hope credit and the lifetime. Kentucky education tuition tax credit. The hope credit and the lifetime learning credit. Web taxman taxman • 1.1k views. You cannot take the 2018 kentucky. You cannot take the 2017 kentucky. Web kentucky education tuition tax credit. The american opportunity credit and the lifetime. Web you must attach the federal form 8863. If you have an unused credit from prior year(s), complete part v to determine your carryforward amount. This form is for income. How to edit and fill out kentucky tax form 8863 k online. The hope credit and the lifetime. Easily fill out pdf blank, edit, and sign them. Web kentucky individual form availability. Read the following instructions to use. Fill & download for free. Web kentucky tax form 8863 k: Get ready for tax season deadlines by completing any required tax forms today. Web you must attach the federal form 8863. Kentucky education tuition tax credit. If you have an unused credit from prior year(s), complete part v to determine your carryforward amount.Form K1e Kentucky Employer'S Tax Withheld Worksheet printable

Credit Limit Worksheet For Form 8863

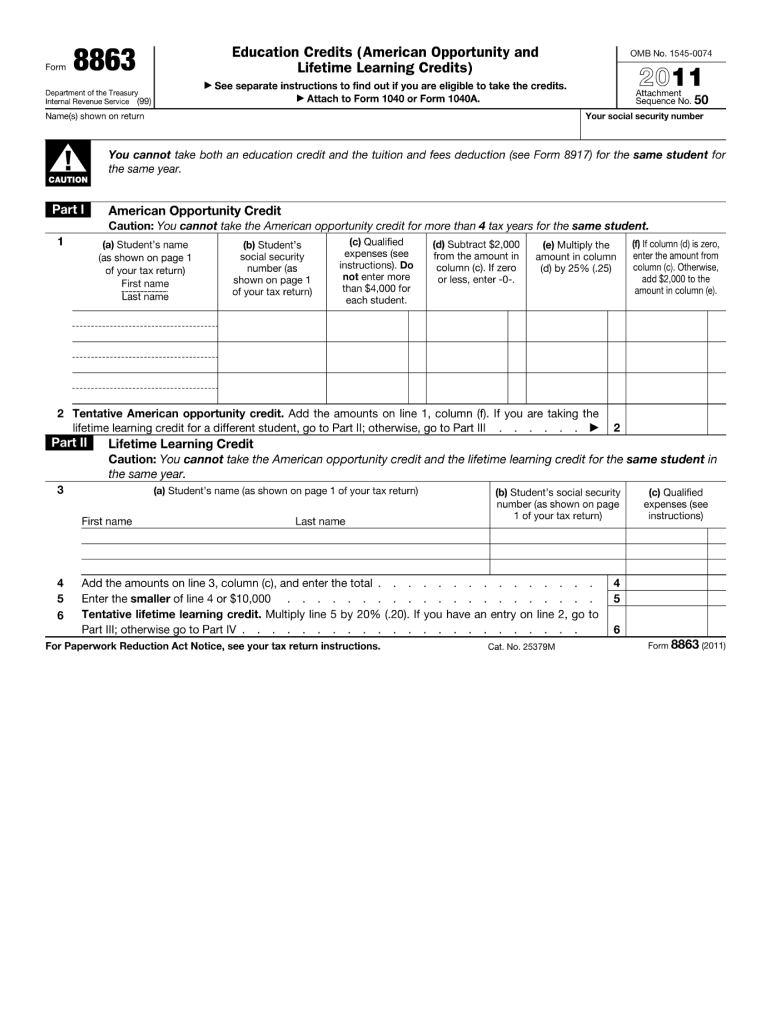

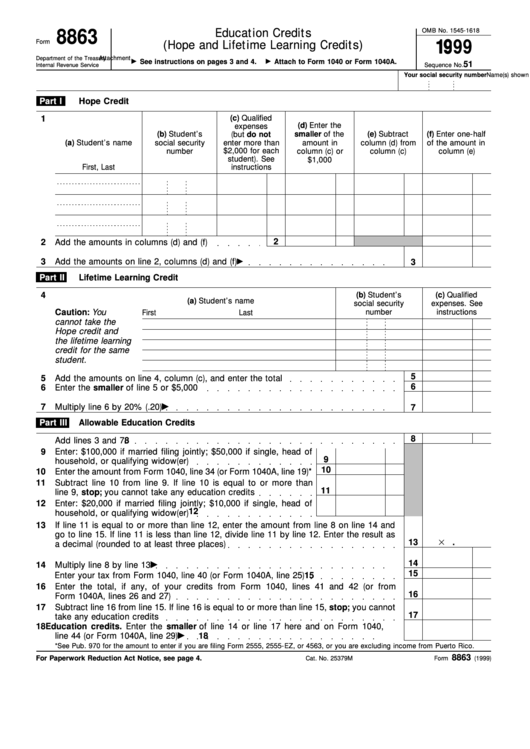

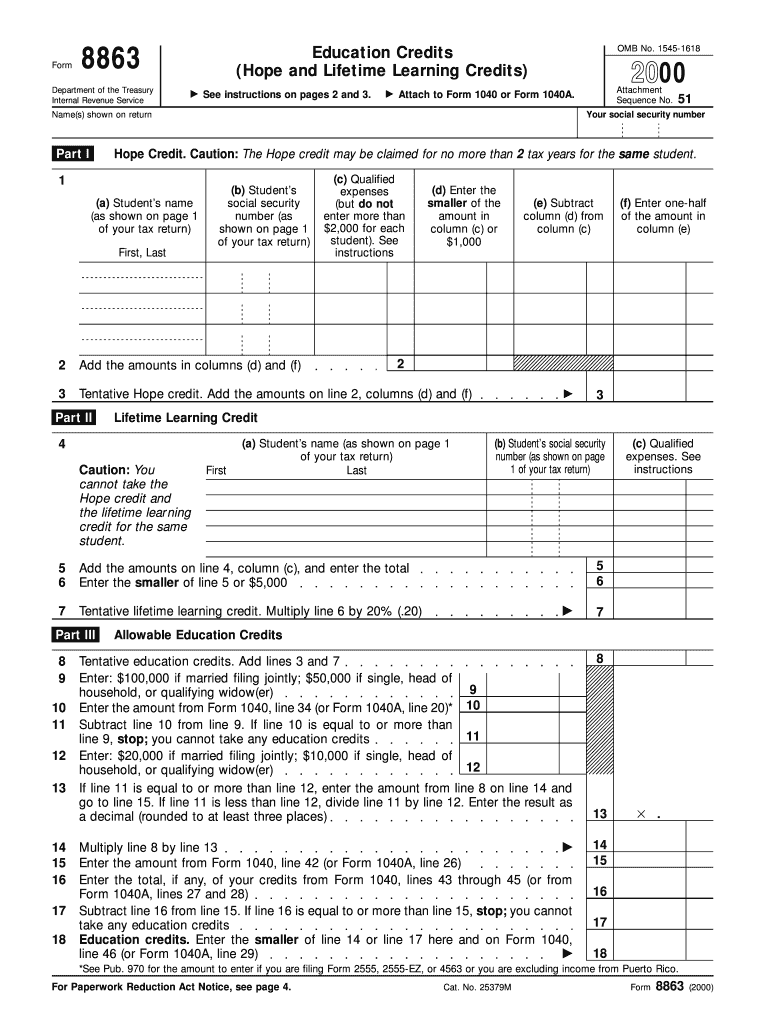

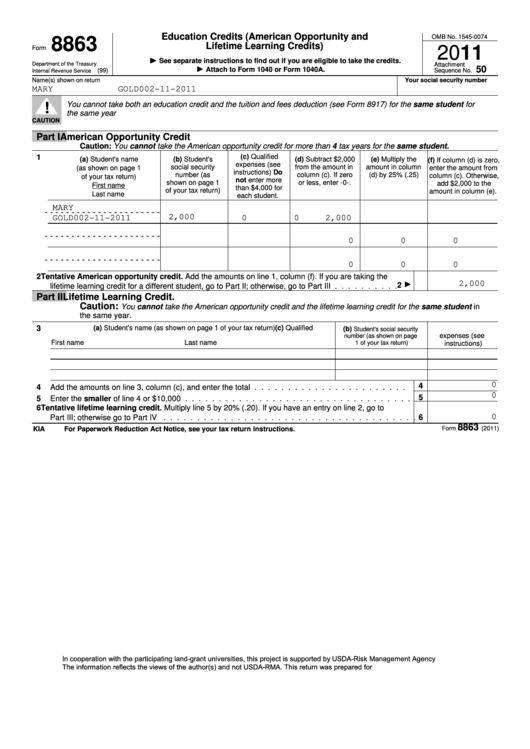

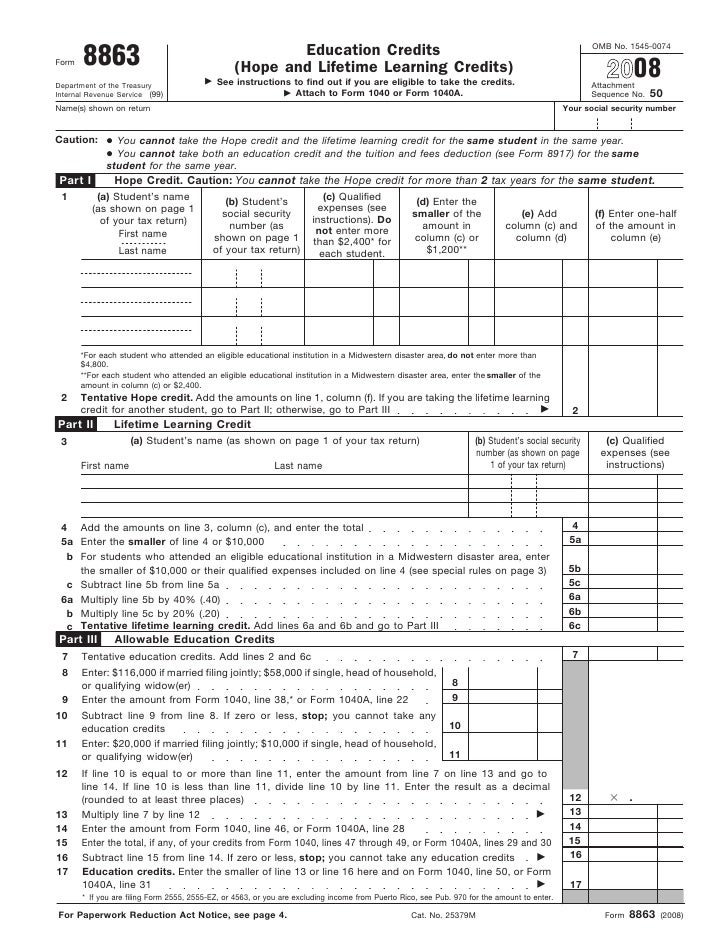

Fillable Form 8863 Education Credits (Hope And Lifetime Learning

Form 8863 Fill Out and Sign Printable PDF Template signNow

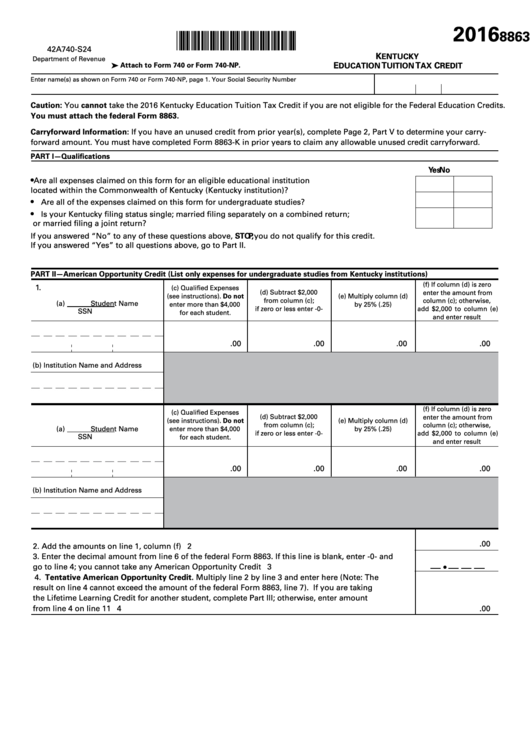

Form 8863K Kentucky Education Tax Credit 2016 printable pdf download

Form 8863 Credit Limit Worksheet

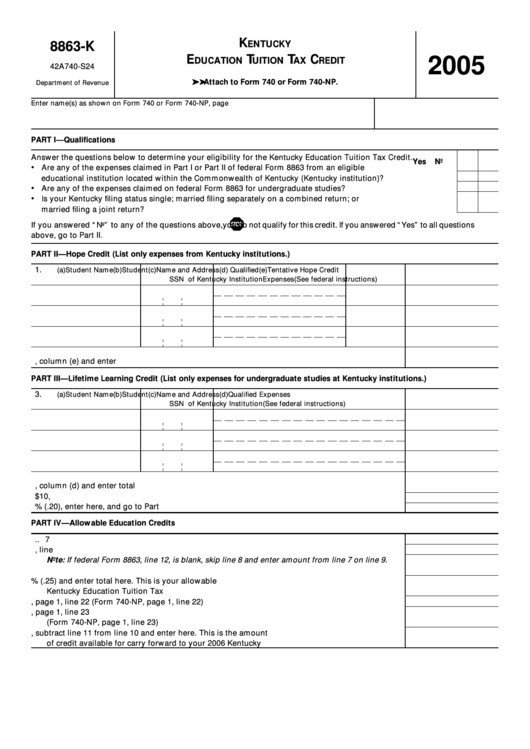

Fillable Form 8863K Education Tuition Tax Credit 2005 printable pdf

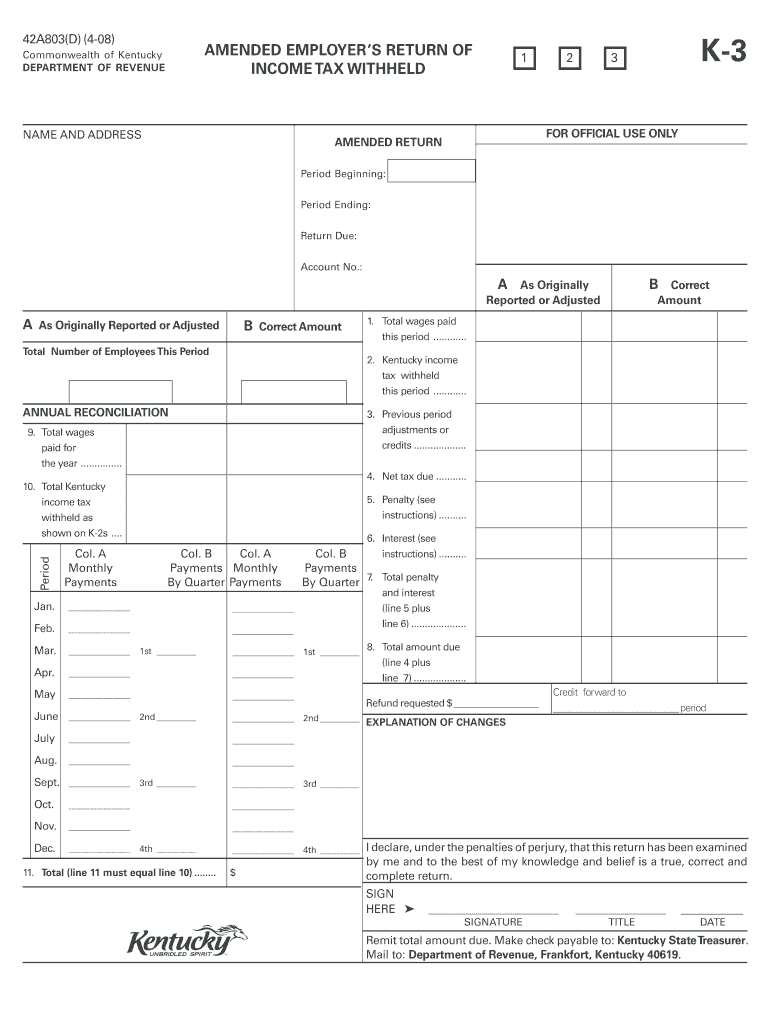

Revenue Ky Gov Form K 3 Fill Out and Sign Printable PDF Template

Form 8863Education Credits

8863K Kentucky Education Tuition Tax Credit Form 42A740S24

Related Post: