Kentucky Form 740Np Wh

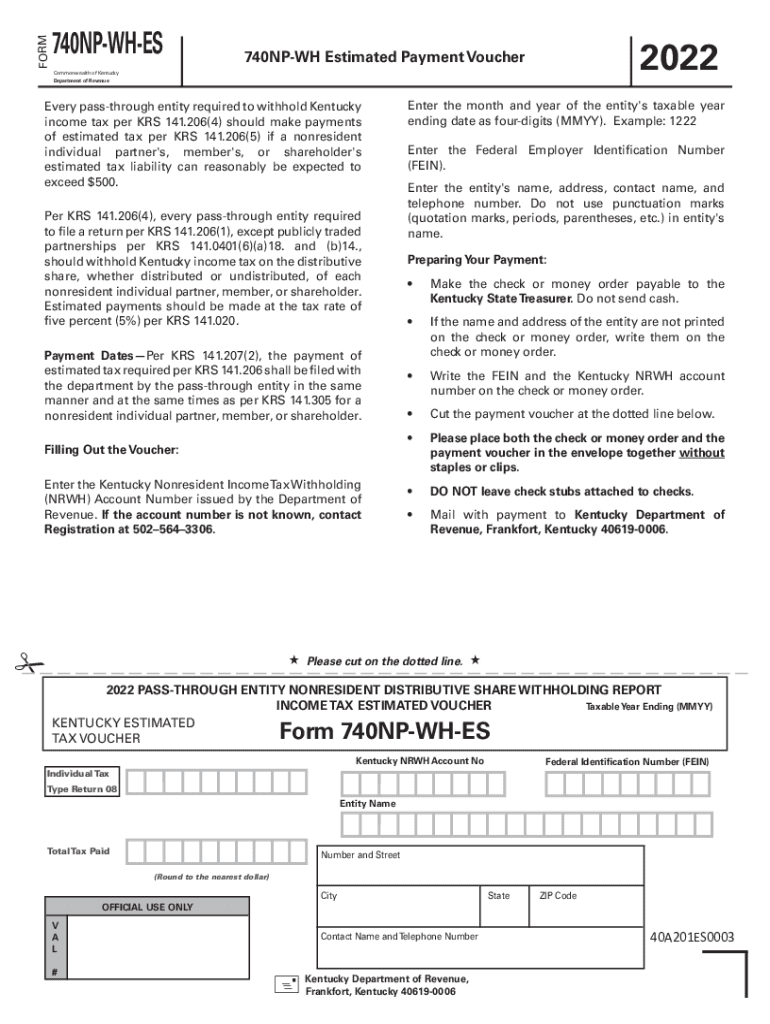

Kentucky Form 740Np Wh - Submit a copy of the federal form 7004 (application for automatic extension of time to file certain business income tax, information, and other returns). Kentucky schedule p— the pension exclusion. Also, nonresidents who qualify for the. Kentucky nonresident income tax withholding on distributive. Do not include your spouse’s name. Web filling out the voucher: Web we last updated the kentucky nonresident income tax withholding on net distributive share income transmittal report in february 2023, so this is the latest version of form. If both spouses earned only. Enter the kentucky nonresident income tax withholding (nrwh) account number issued by the department of revenue. Complete, edit or print tax forms instantly. If the account number is not. Web filling out the voucher: Kentucky nonresident income tax withholding on distributive. If both spouses earned only. Web enter only the taxpayer’s name for which the kentucky wages and salaries were earned in the name box above. Complete, edit or print tax forms instantly. If the account number is not. Kentucky schedule p— the pension exclusion. Web we last updated the kentucky nonresident income tax withholding on net distributive share income transmittal report in february 2023, so this is the latest version of form. Web filling out the voucher: Web we last updated the kentucky nonresident income tax withholding on net distributive share income transmittal report in february 2023, so this is the latest version of form. Submit a copy of the federal form 7004 (application for automatic extension of time to file certain business income tax, information, and other returns). If both spouses earned only. This form is. If the account number is not. If both spouses earned only. Web enter only the taxpayer’s name for which the kentucky wages and salaries were earned in the name box above. This form is for income earned in tax year 2022, with tax. Kentucky nonresident income tax withholding on distributive share income. This form is for income earned in tax year 2022, with tax. Submit a copy of the federal form 7004 (application for automatic extension of time to file certain business income tax, information, and other returns). Kentucky nonresident income tax withholding on distributive. Enter the kentucky nonresident income tax withholding (nrwh) account number issued by the department of revenue. Kentucky. Kentucky schedule p— the pension exclusion. Complete, edit or print tax forms instantly. Also, nonresidents who qualify for the. Web filling out the voucher: Web enter only the taxpayer’s name for which the kentucky wages and salaries were earned in the name box above. Also, nonresidents who qualify for the. Do not include your spouse’s name. If both spouses earned only. Web enter only the taxpayer’s name for which the kentucky wages and salaries were earned in the name box above. Submit a copy of the federal form 7004 (application for automatic extension of time to file certain business income tax, information, and other. This form is for income earned in tax year 2022, with tax. If both spouses earned only. Enter the kentucky nonresident income tax withholding (nrwh) account number issued by the department of revenue. Web we last updated the kentucky nonresident income tax withholding on net distributive share income transmittal report in february 2023, so this is the latest version of. This form is for income earned in tax year 2022, with tax. Complete, edit or print tax forms instantly. Kentucky schedule p— the pension exclusion. Do not include your spouse’s name. Also, nonresidents who qualify for the. Kentucky nonresident income tax withholding on distributive. Submit a copy of the federal form 7004 (application for automatic extension of time to file certain business income tax, information, and other returns). Kentucky nonresident income tax withholding on distributive share income. Web filling out the voucher: Do not include your spouse’s name. Also, nonresidents who qualify for the. Web enter only the taxpayer’s name for which the kentucky wages and salaries were earned in the name box above. Complete, edit or print tax forms instantly. Kentucky nonresident income tax withholding on distributive. Enter the kentucky nonresident income tax withholding (nrwh) account number issued by the department of revenue. If both spouses earned only. If the account number is not. Do not include your spouse’s name. Submit a copy of the federal form 7004 (application for automatic extension of time to file certain business income tax, information, and other returns). Web filling out the voucher: This form is for income earned in tax year 2022, with tax. Kentucky schedule p— the pension exclusion. Web we last updated the kentucky nonresident income tax withholding on net distributive share income transmittal report in february 2023, so this is the latest version of form. Kentucky nonresident income tax withholding on distributive share income.740np WH Es Form Fill Out and Sign Printable PDF Template signNow

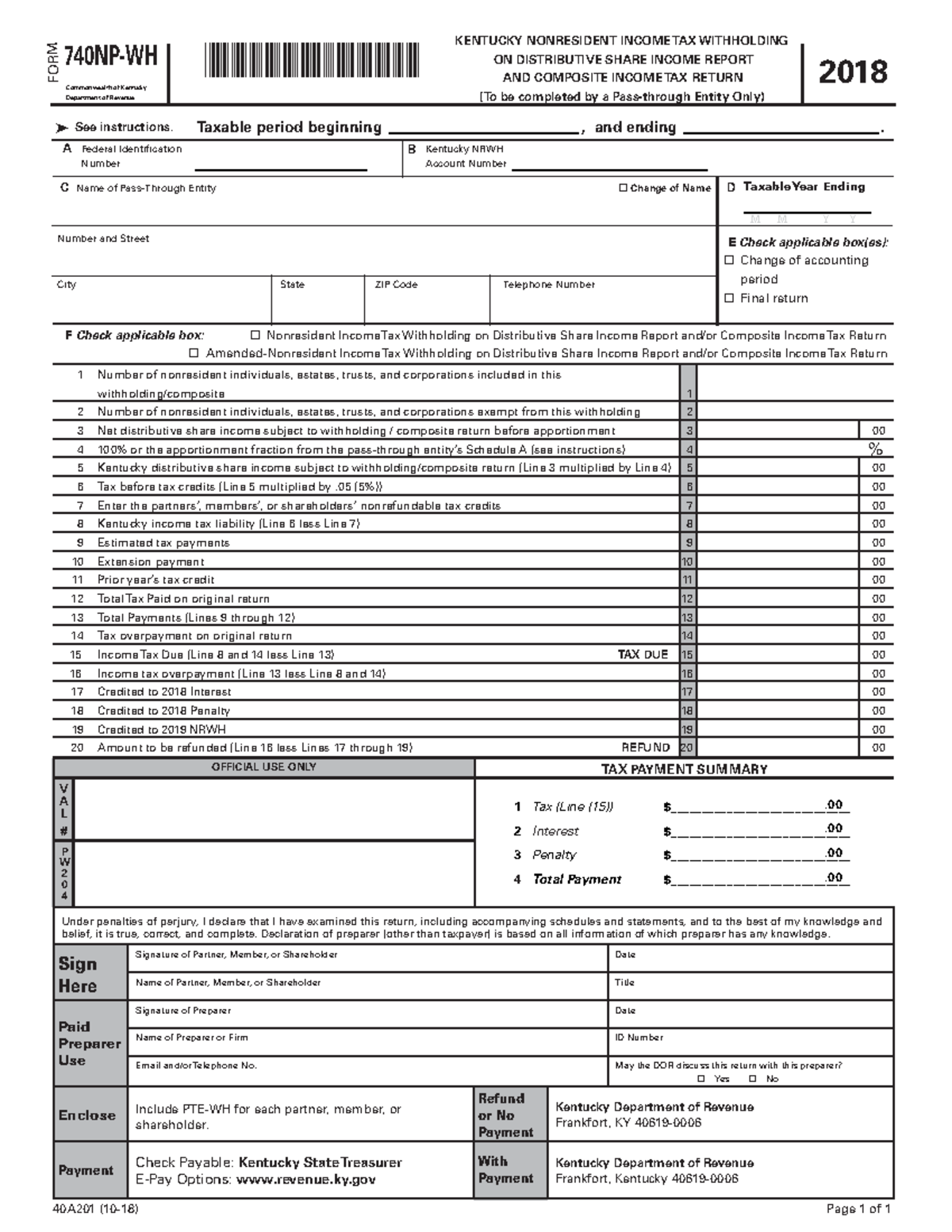

2018 kentucky form 740np wh ISOM 821 Data Management StuDocu

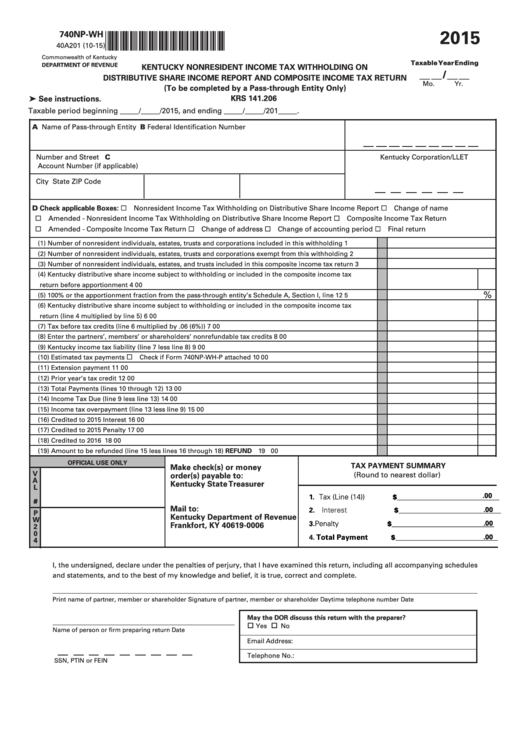

Form 740npWh Kentucky Nonresident Tax Withholding On

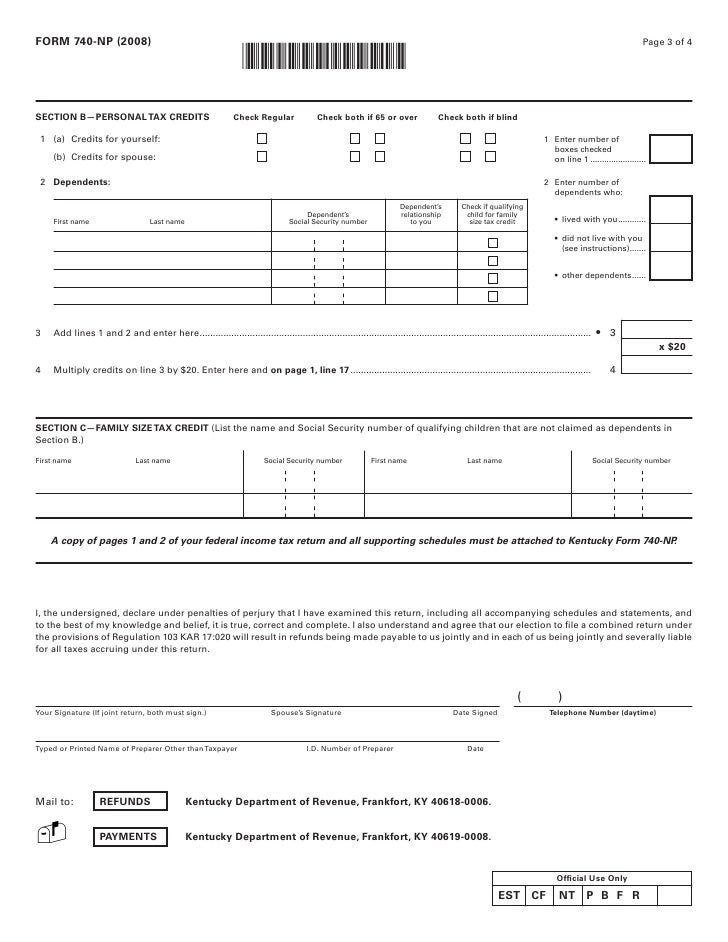

740NP 2008 Kentucky Individual Tax Return Nonresident or Pa…

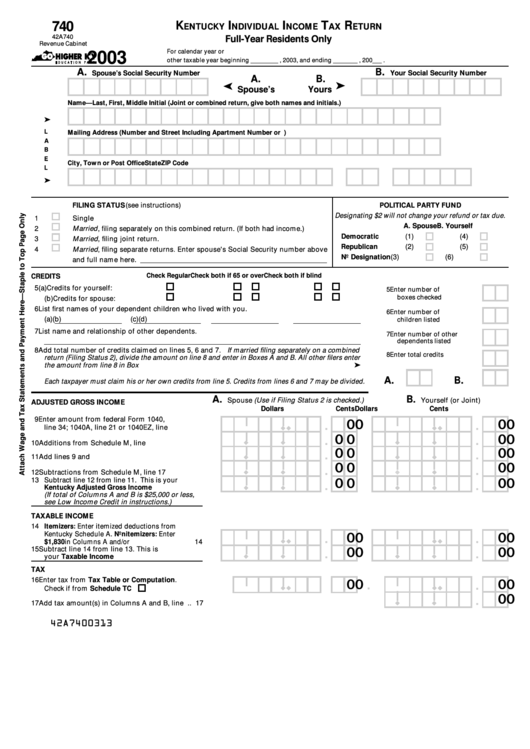

Form 740 Kentucky Individual Tax Return 2003 printable pdf

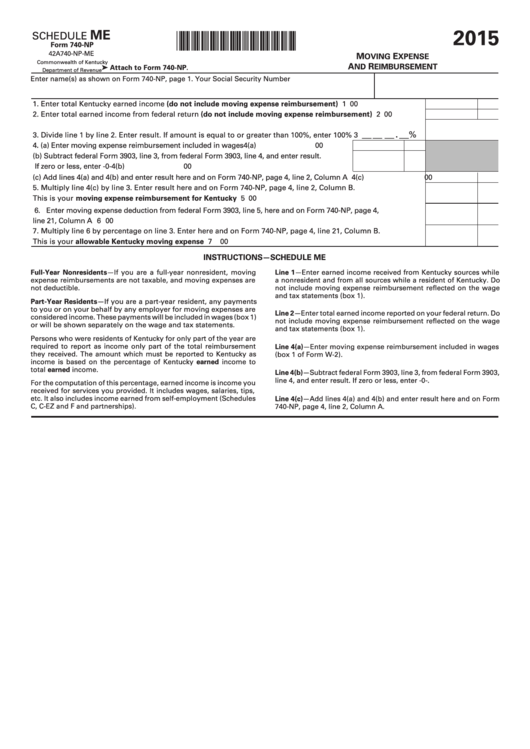

Fillable Schedule Me (Form 740Np) Kentucky Moving Expense And

740np Wh Form Fill Out and Sign Printable PDF Template signNow

dipitdesign Kentucky Tax Form 740

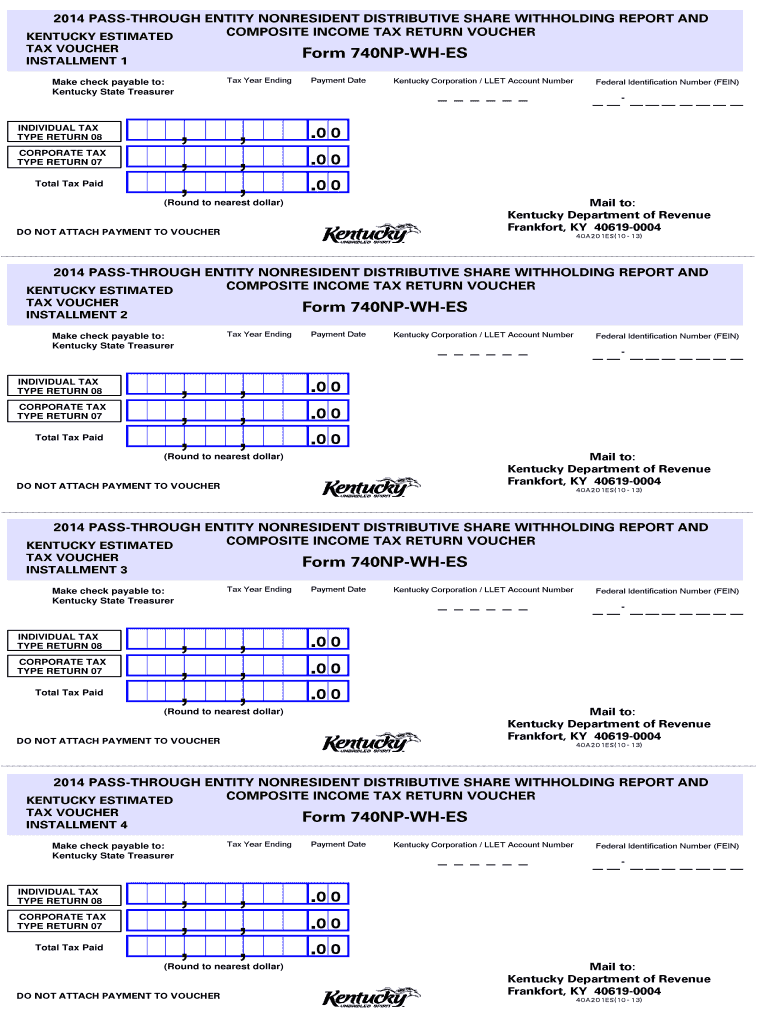

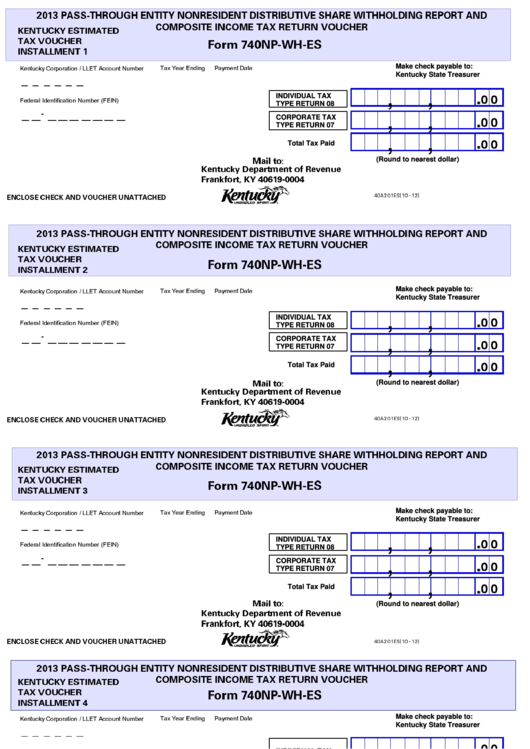

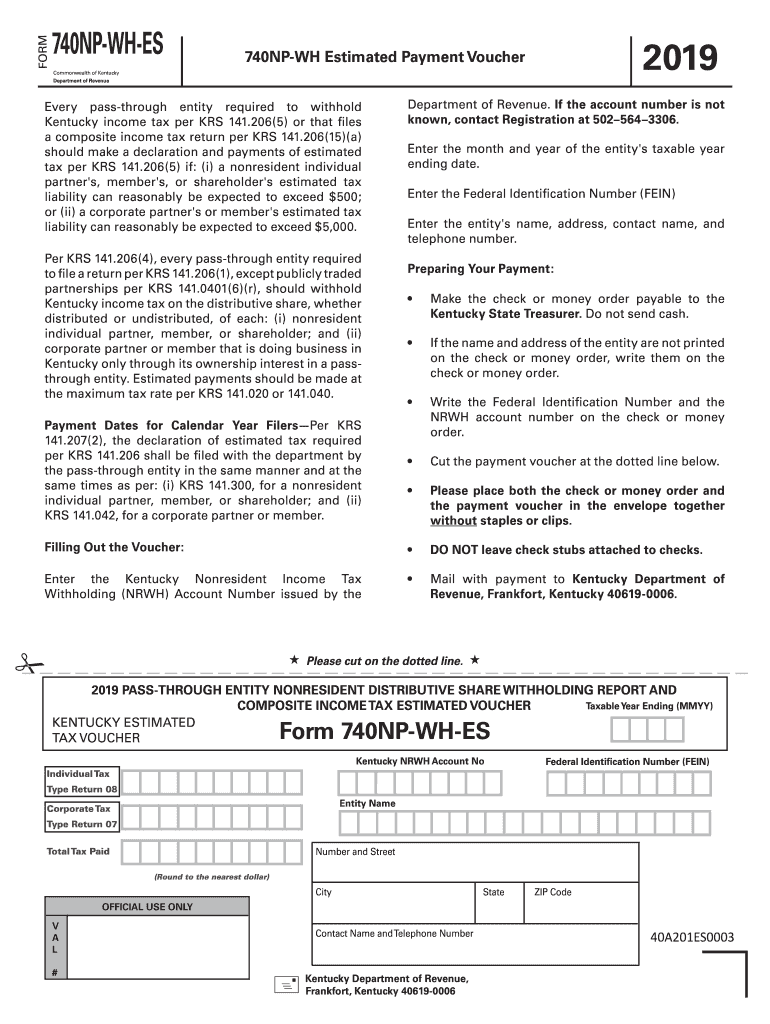

Fillable Form 740npWhEs (State Form 40a201es) PassThrough Entity

2019 Form KY DoR 740NPWHES Fill Online, Printable, Fillable, Blank

Related Post: