Kentucky Farm Exemption Form

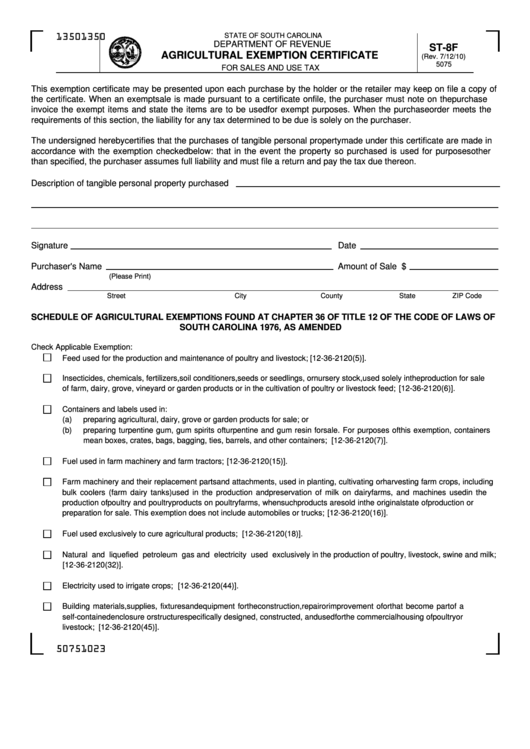

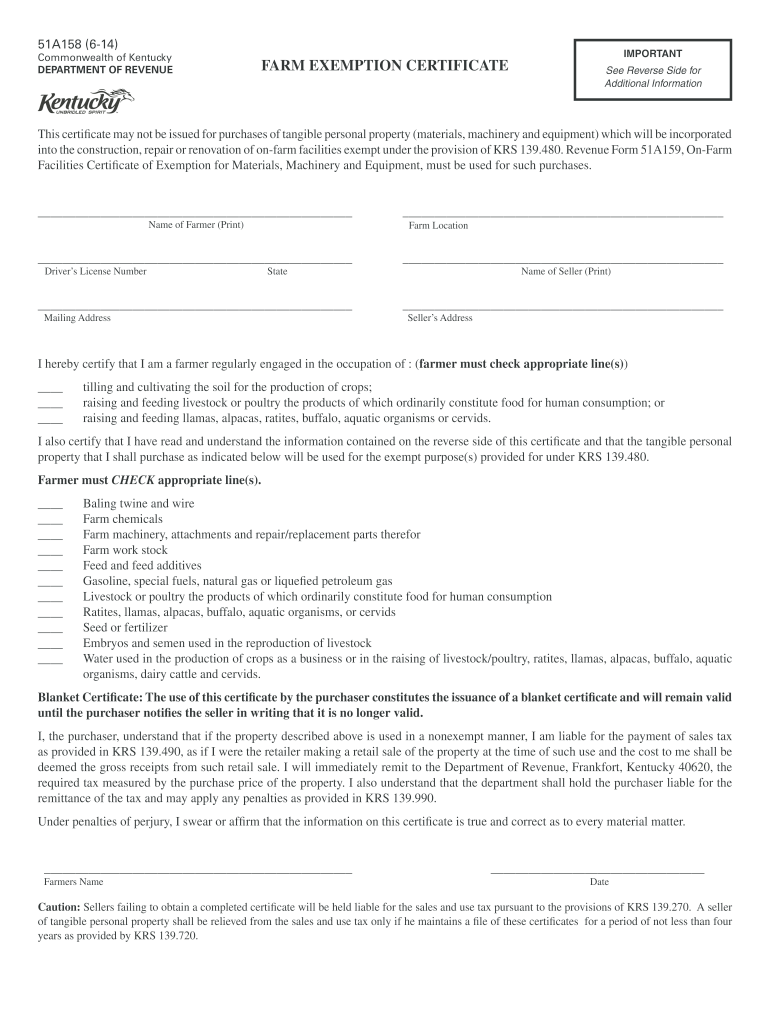

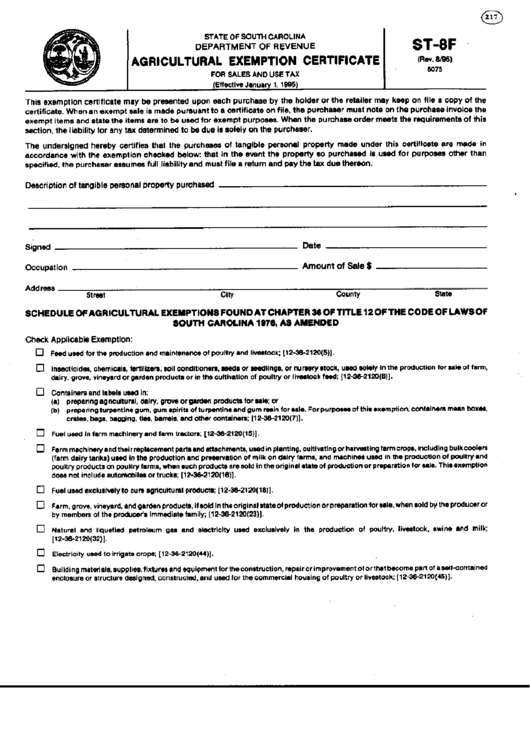

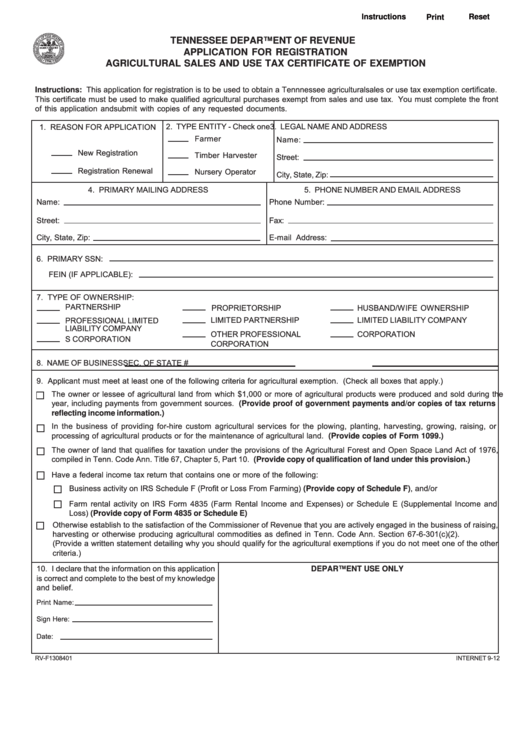

Kentucky Farm Exemption Form - Unlike the 2021 legislation, the new legislation does. The application deadline for farms with existing exemption certificates on file with farm suppliers was january 1, 2022. Easily fill out pdf blank, edit, and sign them. Web the deadline for applying for the new agriculture exemption number for current farmers is january 1, 2022. New kentucky law requires that farmers apply for an agriculture exemption number to make qualified purchases for the farm exempt. Web revenue form 51a158, farm exemption certificate, must be used for the purchase of feed/feed additives, farm machinery, farm work stock, water, gasoline, special fuels,. Residential, farm & commercial property; The application form 51a800 is currently. Web the deadline for applying for the new agriculture exemption number for current farmers is january 1, 2022. Find the right one for your farm needs! Save or instantly send your ready documents. Web these forms can be found through the kentucky department of revenue’s sales & use tax division website. Ad huge selection of tax exemption forms. Web kentucky tax exempt form 2022 rating. _____ in _____ county is exempt from the plumbing code under krs 318.015(3) and that the following statements are true and. Complete, edit or print tax forms instantly. Get your online template and fill it in. Ad huge selection of tax exemption forms. Download or email ky 51a158 & more fillable forms, register and subscribe now! New kentucky law requires that farmers apply for an agriculture exemption number to make qualified purchases for the farm exempt. Ad huge selection of tax exemption forms. Web the deadline for applying for the new agriculture exemption number for current farmers is january 1, 2022. Find the right one for your farm needs! Get your online template and fill it in. Web these forms can be found through the kentucky department of revenue’s sales & use tax division website. Web the deadline to apply for the new agriculture exemption number for current farmers is january 1, 2022. Unmined coal & other natural resources; Facilities certificate of exemption for. Home / about us / kentucky. Get your online template and fill it in. Web these forms can be found through the kentucky department of revenue’s sales & use tax division website. Residential, farm & commercial property; Farm businesses in kentucky are exempt from paying sales tax on supplies required for the production of crops and livestock, certain. Web kentucky tax exempt form 2022 rating. Web the application for the agriculture exemption number, form. Residential, farm & commercial property; ★ ★ ★ ★ ★. New kentucky law requires that farmers apply for an agriculture exemption number to make qualified purchases for the farm exempt. Save or instantly send your ready documents. Web the deadline for applying for the new agriculture exemption number for current farmers is january 1, 2022. Web the application for the agriculture exemption number, form 51a800, is available at www.revenue.ky.gov under sales tax forms. Get your online template and fill it in. Unmined coal & other natural resources; Unlike the 2021 legislation, the new legislation does. Home / about us / kentucky. Web what is the application process? • complete the online application for agriculture exemption number, form 51a800. New kentucky law requires that farmers apply for an agriculture exemption number to make qualified purchases for the farm exempt. Effective january 1, 2023, all purchases in the state of kentucky that are agricultural tax exempt must. Ad huge selection of tax exemption. The application for the agriculture exemption number, form 51a800,. Listeria monocytogenes can grow in a cold environment and lead to high. Web the application for the agriculture exemption number, form 51a800, is available at www.revenue.ky.gov under sales tax forms. How to fill out and sign kentucky farm tax exempt form online? New kentucky law requires that farmers apply for an. The kentucky department of agriculture forms. The application deadline for farms with existing exemption certificates on file with farm suppliers was january 1, 2022. Unlike the 2021 legislation, the new legislation does. Web revenue form 51a158, farm exemption certificate, must be used for the purchase of feed/feed additives, farm machinery, farm work stock, water, gasoline, special fuels,. Web the application. Complete, edit or print tax forms instantly. Web aug 8, 2021 updated sep 17, 2021. Web the application for the agriculture exemption number, form 51a800, is available at www.revenue.ky.gov under sales tax forms. Facilities certificate of exemption for. • complete the online application for agriculture exemption number, form 51a800. Effective january 1, 2023, all purchases in the state of kentucky that are agricultural tax exempt must. Web kentucky tax exempt form 2022 rating. Web what is the application process? Web the deadline for applying for the new agriculture exemption number for current farmers is january 1, 2022. Unmined coal & other natural resources; Residential, farm & commercial property; _____ in _____ county is exempt from the plumbing code under krs 318.015(3) and that the following statements are true and. Web the deadline for applying for the new agriculture exemption number for current farmers is january 1, 2022. The application for the agriculture exemption number, form 51a800,. Get your online template and fill it in. Web the deadline to apply for the new agriculture exemption number for current farmers is january 1, 2022. Web revenue form 51a158, farm exemption certificate, must be used for the purchase of feed/feed additives, farm machinery, farm work stock, water, gasoline, special fuels,. Farm businesses in kentucky are exempt from paying sales tax on supplies required for the production of crops and livestock, certain. Easily fill out pdf blank, edit, and sign them. Ad huge selection of tax exemption forms.Tax Exempt Form For Agriculture

Kentucky farm tax exempt Fill out & sign online DocHub

Fillable Form St8f Agricultural Exemption Certificate printable pdf

Kentucky Sales Tax Farm Exemption Form Fill Online, Printable

Blank Nv Sales And Use Tax Form / Kentucky Sales Tax Farm Exemption

Partial exemption certificate farm equipment Fill out & sign online

Form St 8f Agricultural Exemption Certificate Printable Pdf Download

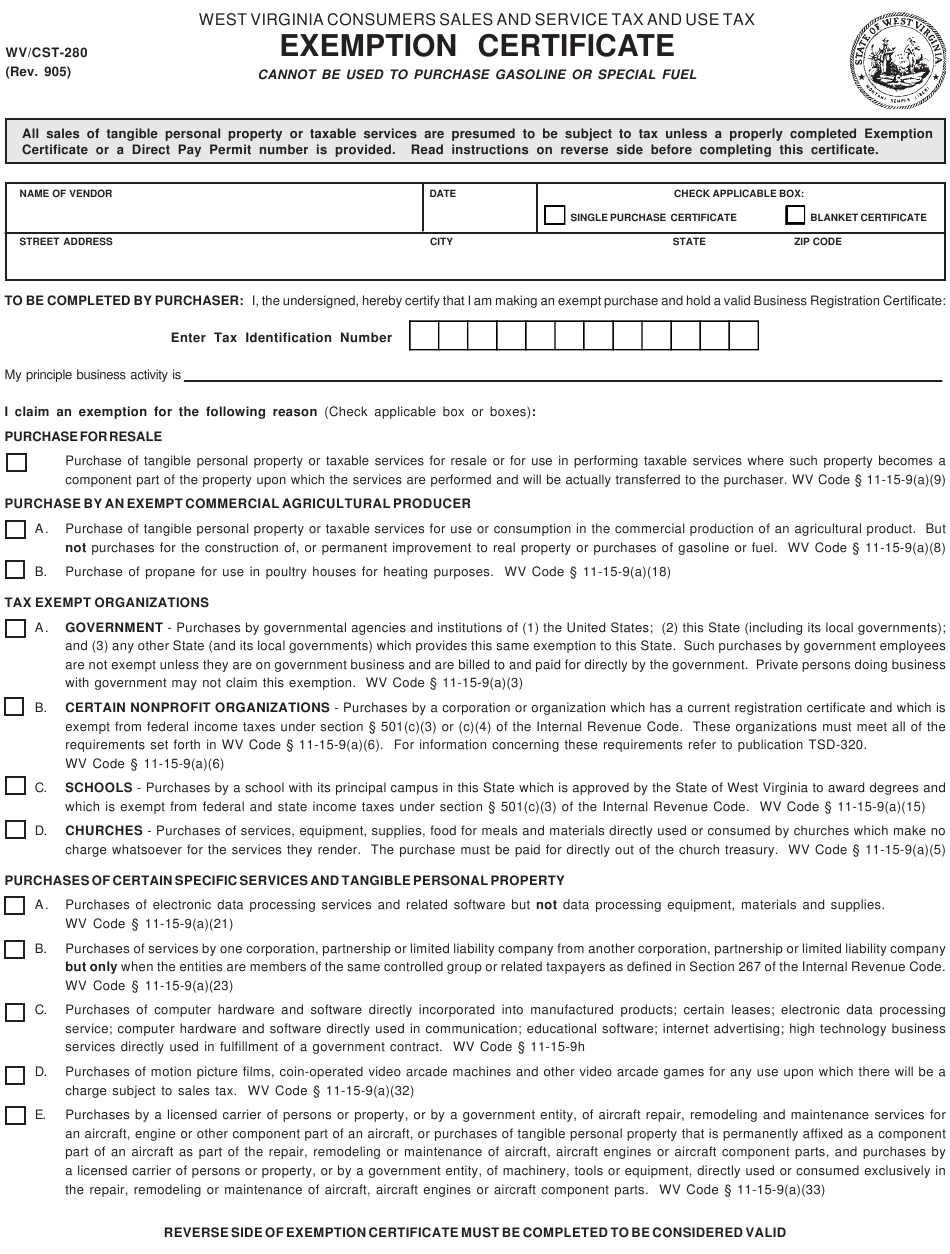

Wv Farm Tax Exemption Form

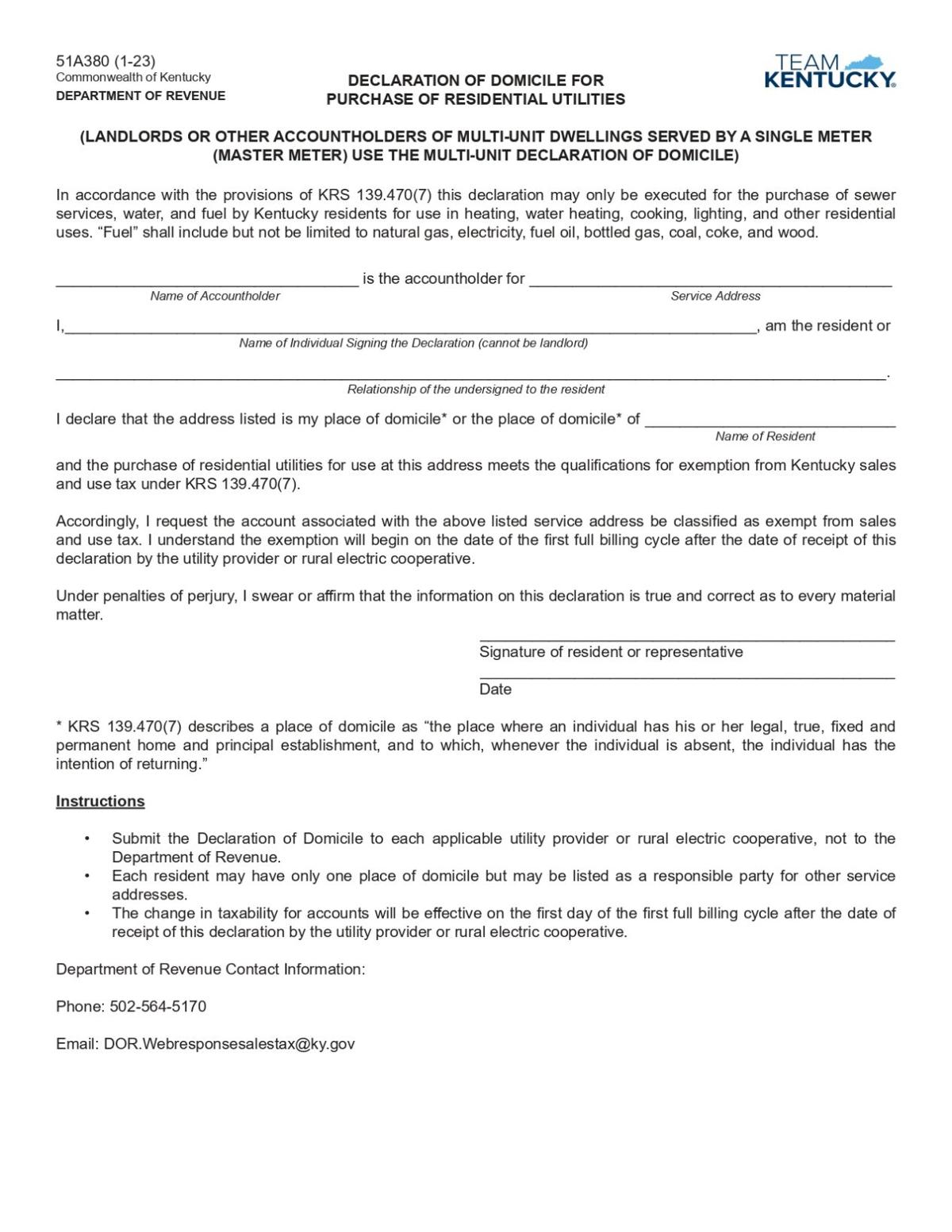

Utility companies ask Kentucky customers to fill out exemption form to

Blank Nv Sales And Use Tax Form / Kentucky Sales Tax Farm Exemption

Related Post: