Kentucky 740 Tax Form

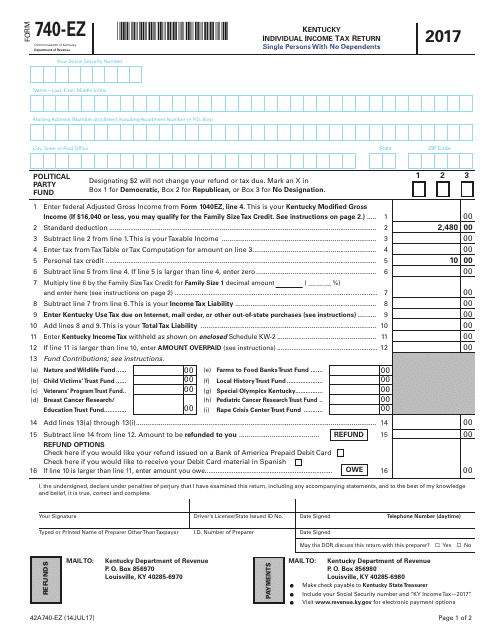

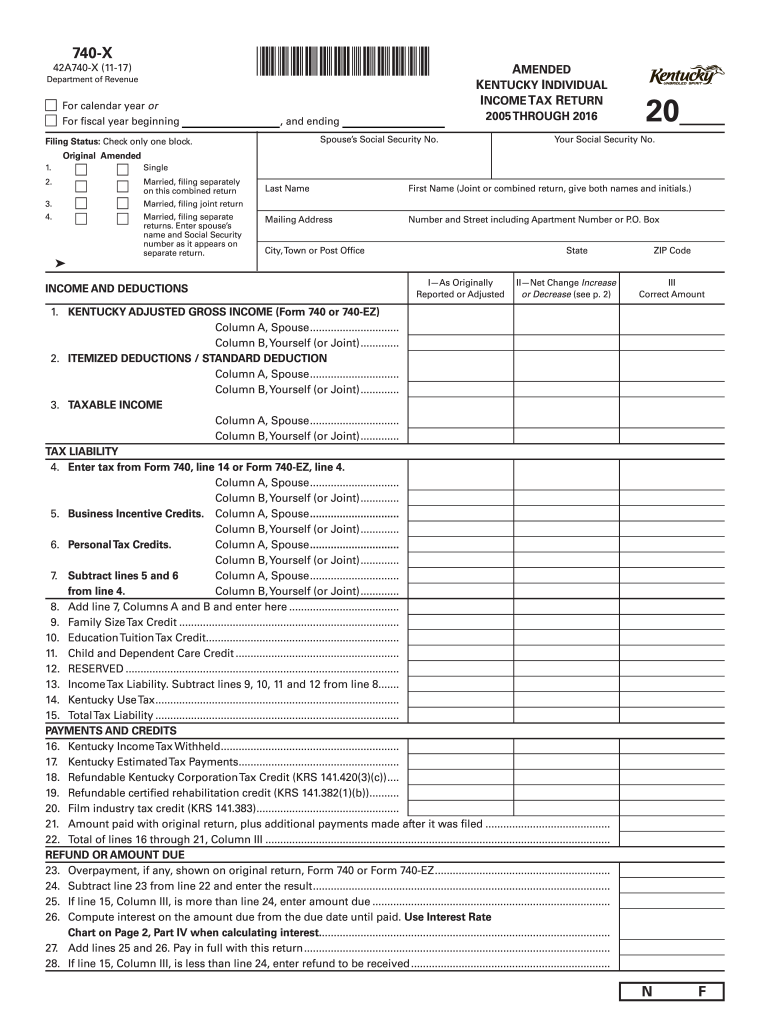

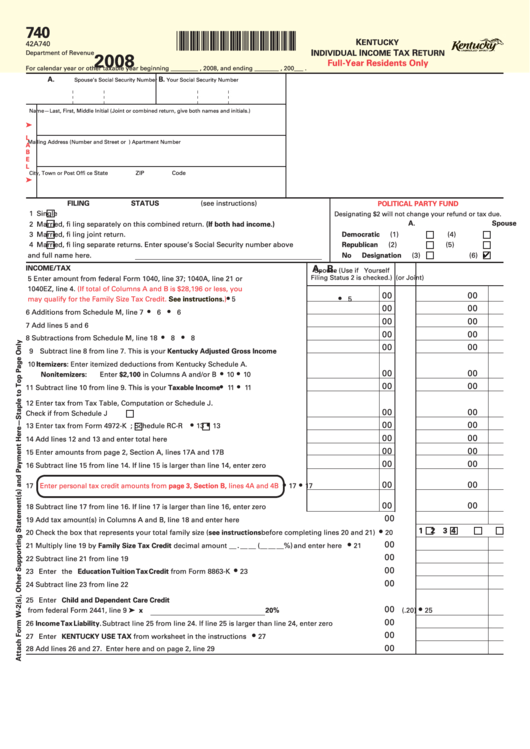

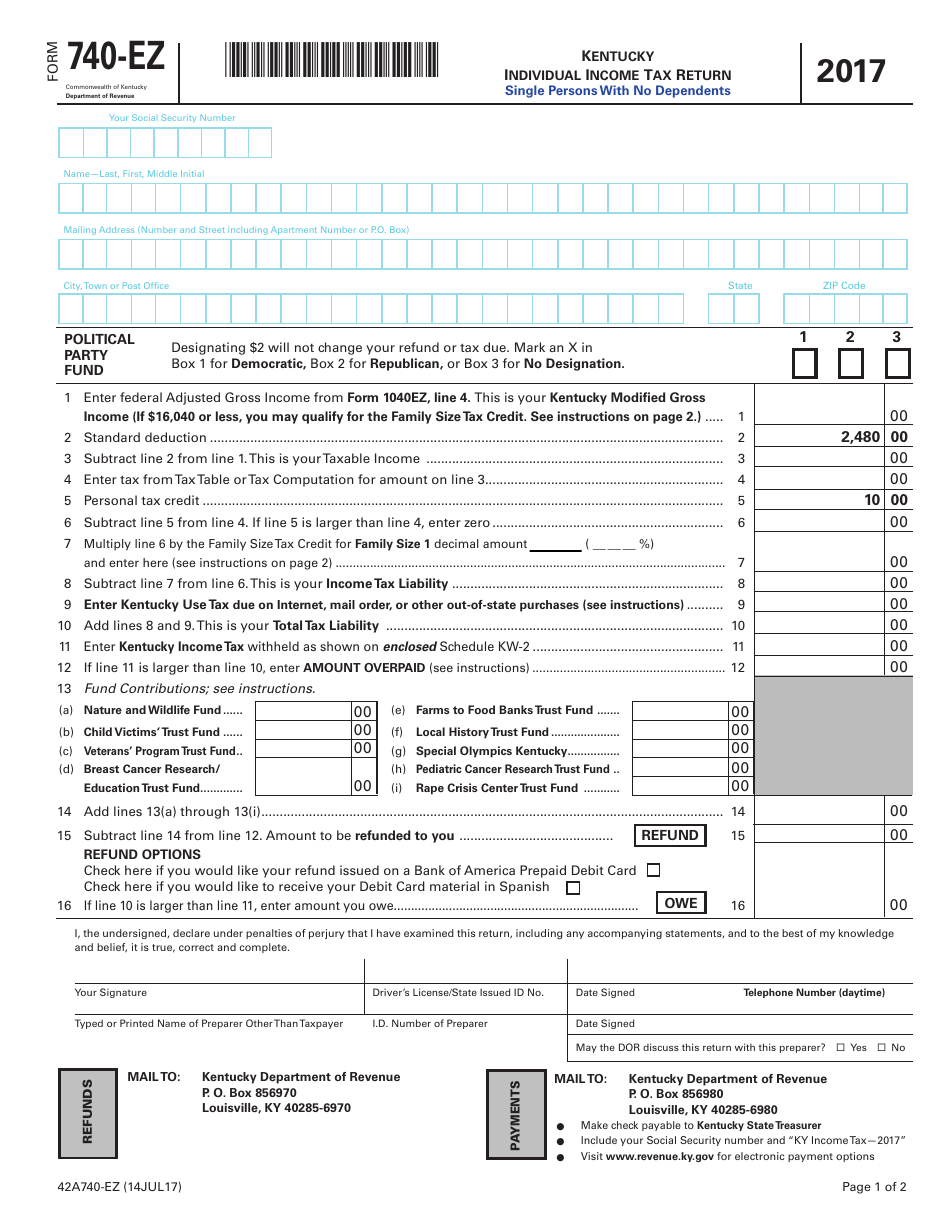

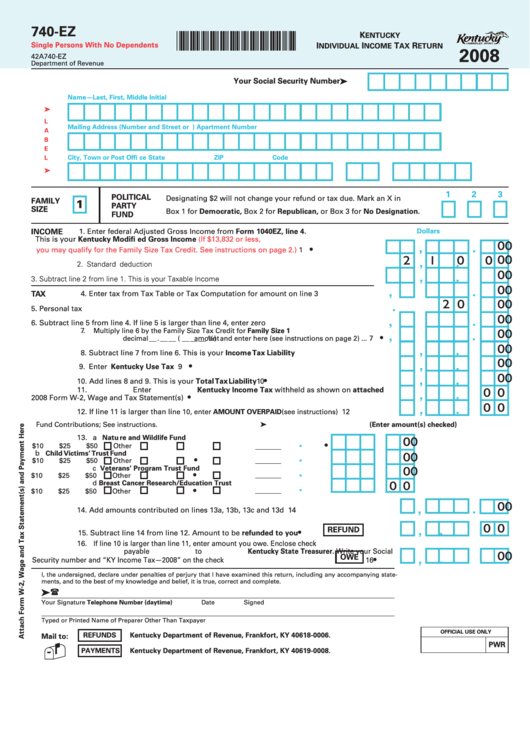

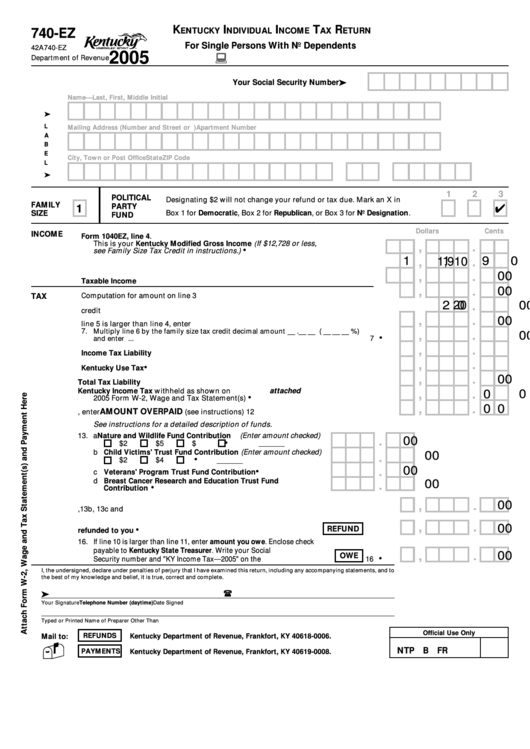

Kentucky 740 Tax Form - Web which form should i file? 27 28 add lines 26 and 27. 20 check the box that represents your total family size. ★ ★ ★ ★ ★. • moved into or out of kentucky during the taxable year. • had income while a kentucky resident. Web this form may be used by both individuals and corporations requesting an income tax refund. Ky file users should familiarize themselves with kentucky forms by reading the instructions. Web we last updated kentucky form 740 in february 2023 from the kentucky department of revenue. Form 740 is the kentucky income tax return for use by all taxpayers. 00 00 00 00 00 00 00 00 00 00 00 00 00 00 00 00 00 00 00 00 00 00 00 00. Web which form should i file? Also see line 27 of form 740 and the optional use tax table and use tax calculation worksheet in the 740 instructions. How to fill out and sign ky 740.. • had income from kentucky sources. Web we last updated the form 740 individual full year resident income tax instructions packet in february 2023, so this is the latest version of income tax instructions, fully updated for tax year 2022. We will update this page with a new version of the form for 2024 as soon as it is. Web. This form is for income earned in tax year 2022, with tax returns due in april 2023. We will update this page with a new version of the form for 2024 as soon as it is. • had income from kentucky sources. Web we last updated the form 740 individual full year resident income tax instructions packet in february 2023,. Web kentucky income tax form 740es. Upload, modify or create forms. • moved into or out of kentucky during the taxable year. Web which form should i file? Web we last updated kentucky form 740 in february 2023 from the kentucky department of revenue. Form 740 is the kentucky income tax return for use by all taxpayers. • had income while a kentucky resident. • • • out your kentucky forms. Form 40a102 application for extension of time to. Web please click here to see if you are required to report kentucky use tax on your individual income tax return. Form 740 (2022) page 3 of 3 i, the undersigned, declare under penalties of perjury that i have. Printable kentucky income tax form 740es. The current year form 740 and 740. Web we last updated kentucky form 740 in february 2023 from the kentucky department of revenue. Kentucky will begin processing 2022 returns on february 6, 2023. Web we last updated the form 740 individual full year resident income tax instructions packet in february 2023, so this is the latest version of income tax instructions, fully updated for tax year 2022. Ky file users should familiarize themselves with kentucky forms by reading the instructions. This pdf packet includes form 740, supplemental. Web which form should i file?. We will update this page with a new version of the form for 2024 as soon as it is. Ky file users should familiarize themselves with kentucky forms by reading the instructions. Complete, edit or print tax forms instantly. Send filled & signed form or save. Web which form should i file? This form is for income earned in tax year 2022, with tax returns due in april 2023. • had income from kentucky sources. This is your total tax liability. • moved into or out of kentucky during the taxable year. Web please click here to see if you are required to report kentucky use tax on your individual income tax. If you do not have income tax withheld from your paychecks by an employer, you may have to. Form 740 is the kentucky income tax return for use by all taxpayers. While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers who earn money that is not subject to withholding (such as self employed income,. What you should know before you begin: Web which form should i file? Form 740 (2022) page 3 of 3 i, the undersigned, declare under penalties of perjury that i have. • moved into or out of kentucky during the taxable year. Web please click here to see if you are required to report kentucky use tax on your individual income tax return. How to fill out and sign ky 740. Open form follow the instructions. We will update this page with a new version of the form for 2024 as soon as it is. Send filled & signed form or save. 00 00 00 00 00 00 00 00 00 00 00 00 00 00 00 00 00 00 00 00 00 00 00 00. • had income while a kentucky resident. Upload, modify or create forms. While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers who earn money that is not subject to withholding (such as self employed income, investment. Complete, edit or print tax forms instantly. 27 28 add lines 26 and 27. This pdf packet includes form 740, supplemental. • had income from kentucky sources. Try it for free now! These 2021 forms and more are available: This form is for income earned in tax year 2022, with tax returns due in april 2023.Form 740EZ Download Fillable PDF or Fill Online Kentucky Individual

Kentucky form 740 Fill out & sign online DocHub

Fillable Form 740 Kentucky Individual Tax Return FullYear

Form 740EZ Download Fillable PDF or Fill Online Kentucky Individual

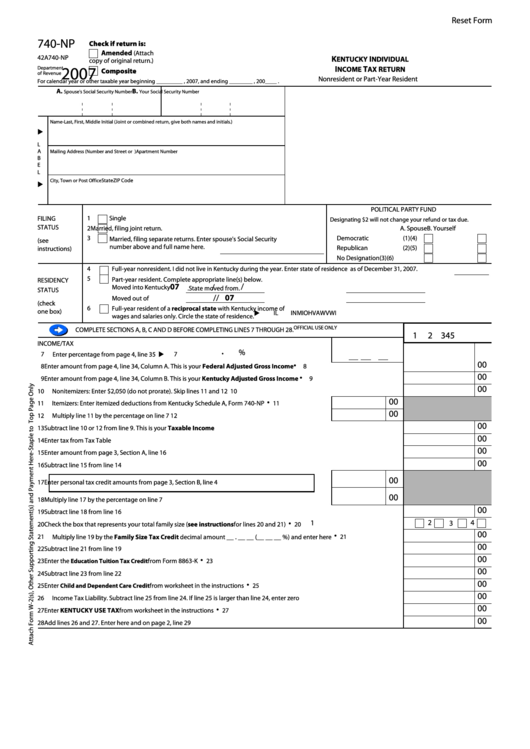

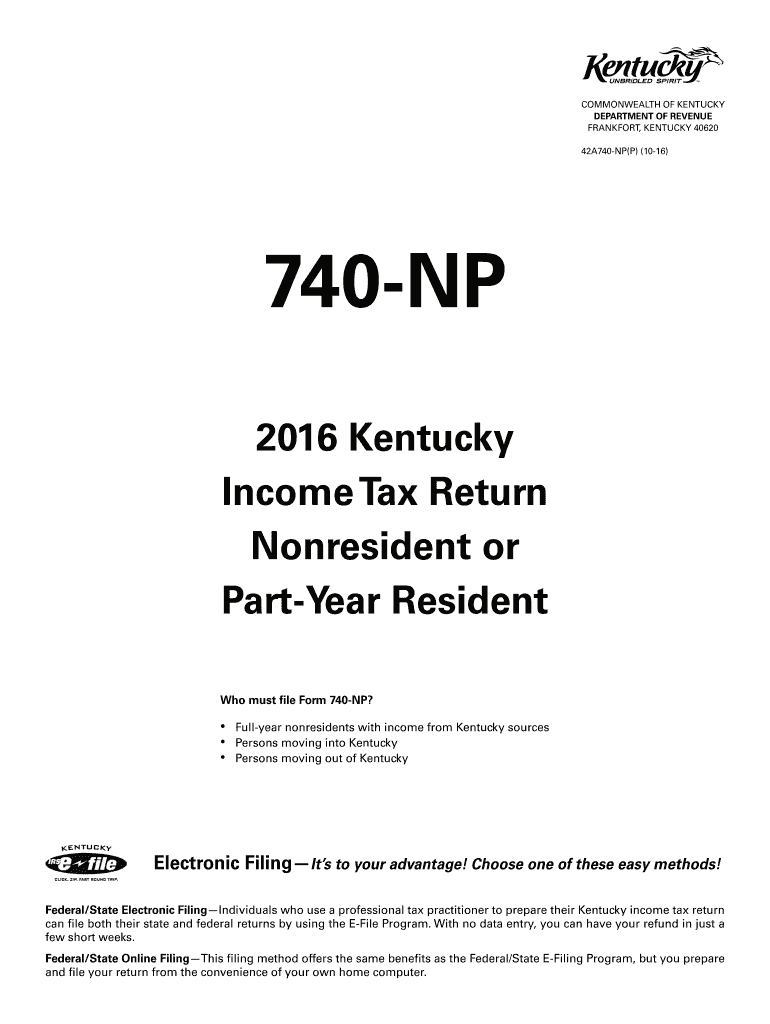

Fillable Form 740Np Kentucky Individual Tax Return

Kentucky Fillable Form 740 Np WH Instructions Fill Out and Sign

Form 740Ez Kentucky Individual Tax Return 2008 printable

Fillable Form 740Ez Kentucky Individual Tax Return 2005

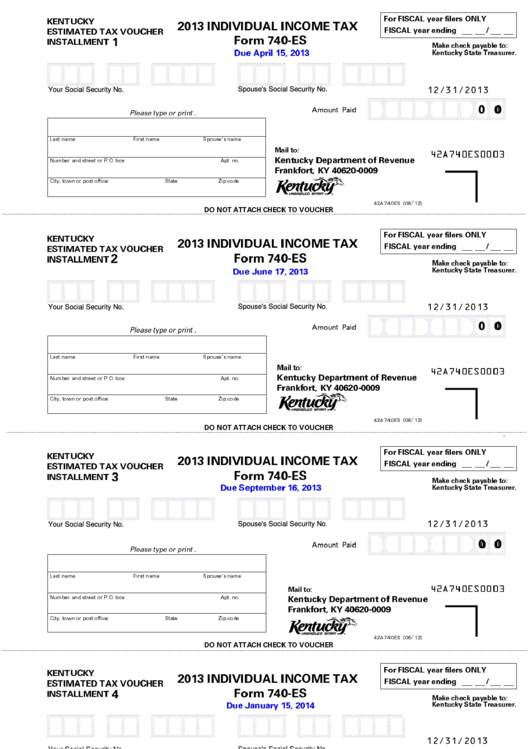

Fillable Form 740Es Individual Tax Kentucky Estimated Tax

Kentucky Tax Form 740 P How to Fill Out Fill Out and Sign Printable

Related Post: