Kansas Tax Extension Form

Kansas Tax Extension Form - If you make $70,000 a year living in kansas you will be taxed $11,373. Print your name, address, social security number, and. Web if you have a valid federal tax extension ( irs form 4868 ), you will automatically receive a kansas tax extension. Remember to include a copy of your approved federal. Kansas does not have a separate extension request form. Web an upcoming virtual workshop series for midwestern farm and ranch women will teach the basics of tax planning for agricultural operations. Ad signnow.com has been visited by 100k+ users in the past month Web servicemember civil relief act. Web if payment is not made on or before april 15, 2021, the tax due is subject to penalty and interest. Web or money order and make payable to kansas income tax. If you are not able to submit your returns by that deadline, you will need to. Web in order to automatically receive a kansas extension, you must first obtain a federal extension ( irs form 4868 ). The tax day is almost always the same date as the irs deadline. If you are filing an extension. Web an upcoming virtual. The deadline to file your 2022 individual income tax return is april 18th, 2023. Web amount paid with kansas extension. Check the box on the voucher for extension payment. Web or money order and make payable to kansas income tax. If you are accessing our site for the. Check the box on the voucher for extension payment. If you are accessing our site for the. Web tax day and deadlines for kansas income taxes. Remember to include a copy of your approved federal. Enter the amount paid with your request for an extension of time to file. Web no additional forms are required to benefit from the extension. Apr 4, 2023 / 10:30 am cdt. Check the box on the voucher for extension payment. Web in order to automatically receive a kansas extension, you must first obtain a federal extension ( irs form 4868 ). Remember to include a copy of your approved federal. The deadline to file your 2022 individual income tax return is april 18th, 2023. If you are accessing our site for the. If you are not able to submit your returns by that deadline, you will need to. Web if payment is not made on or before april 15, 2021, the tax due is subject to penalty and interest. Ad. Ad signnow.com has been visited by 100k+ users in the past month Check the box on the voucher for extension payment. Web an upcoming virtual workshop series for midwestern farm and ranch women will teach the basics of tax planning for agricultural operations. Make sure to include a copy of your federal extension with your. Thank you for using kansas. If you are filing an extension. If you are filing an extension of time to file your return, mark the appropriate box. Remember to include a copy of your approved federal. Apr 4, 2023 / 10:30 am cdt. Kansas has a state income tax that ranges between 3.1% and 5.7% , which is administered by the kansas department of revenue. The deadline to file your 2022 individual income tax return is april 18th, 2023. Remember to include a copy of your approved federal. Web servicemember civil relief act. Web an upcoming virtual workshop series for midwestern farm and ranch women will teach the basics of tax planning for agricultural operations. If you are entitled to a. Web amount paid with kansas extension. Web webfile is an online application for filing kansas individual income tax return that is fast and paperless way to file, and refunds can be deposited directly into your bank account What form does the state of kansas require to apply for. File your state taxes online; Print your name, address, social security number,. If you make $70,000 a year living in kansas you will be taxed $11,373. The deadline to file your 2022 individual income tax return is april 18th, 2023. Ad signnow.com has been visited by 100k+ users in the past month Enter the amount paid with your request for an extension of time to file. Web amount paid with kansas extension. The due dates for kansas individual estimated tax payments has not changed. Enter the amount paid with your request for an extension of time to file. Web no additional forms are required to benefit from the extension. If you are not able to submit your returns by that deadline, you will need to. If you are accessing our site for the. Web servicemember civil relief act. File your state taxes online; If you are filing an extension. Ad signnow.com has been visited by 100k+ users in the past month Make sure to include a copy of your federal extension with your. Web webfile is an online application for filing kansas individual income tax return that is fast and paperless way to file, and refunds can be deposited directly into your bank account Web tax day and deadlines for kansas income taxes. Apr 4, 2023 / 12:14 pm cdt. Remember to include a copy of your approved federal. Check the box on the voucher for extension payment. Web or money order and make payable to kansas income tax. Use this line only if. Print your name, address, social security number, and. Thank you for using kansas department of revenue customer service center to manage your department of revenue accounts. Payment remitted with original return.virtual series Tax Strategies for Midwestern Farm

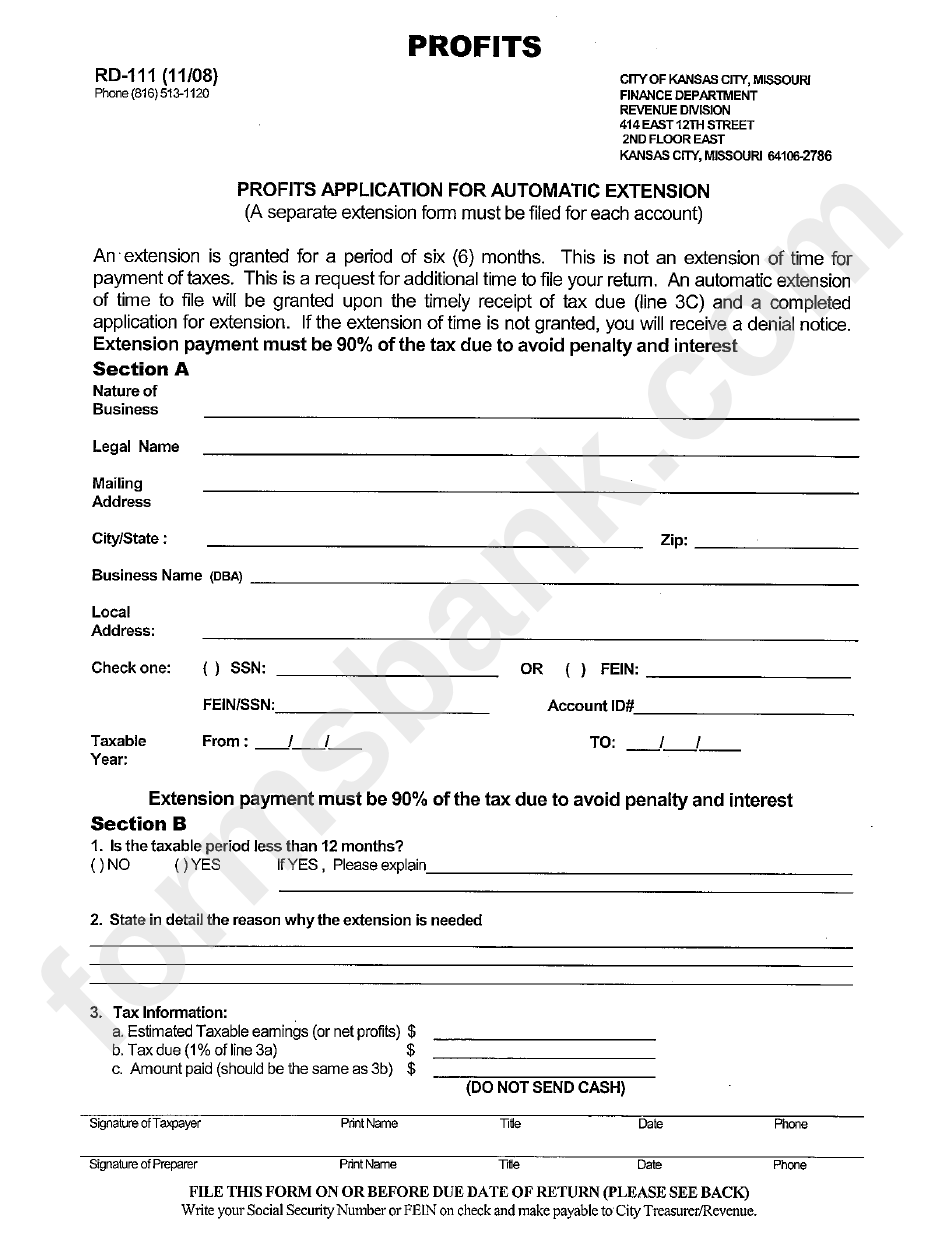

Form Rd111 Prifits Application For Automatic Extension City Of

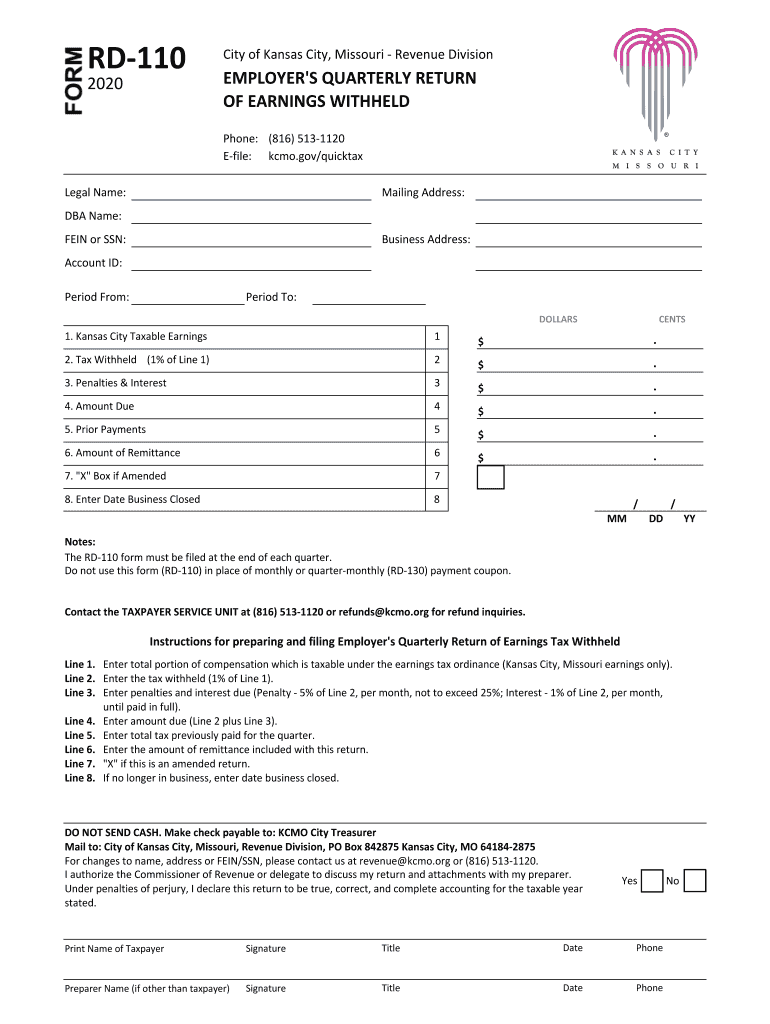

20202022 Form MO RD110 Fill Online, Printable, Fillable, Blank

Tax extension form 7004

Participant Guide 2018 · Participant Guide March 18 May 12, 2018 Here

virtual series Tax Strategies for Midwestern Farm

North carolina 2016 tax extension form stpassl

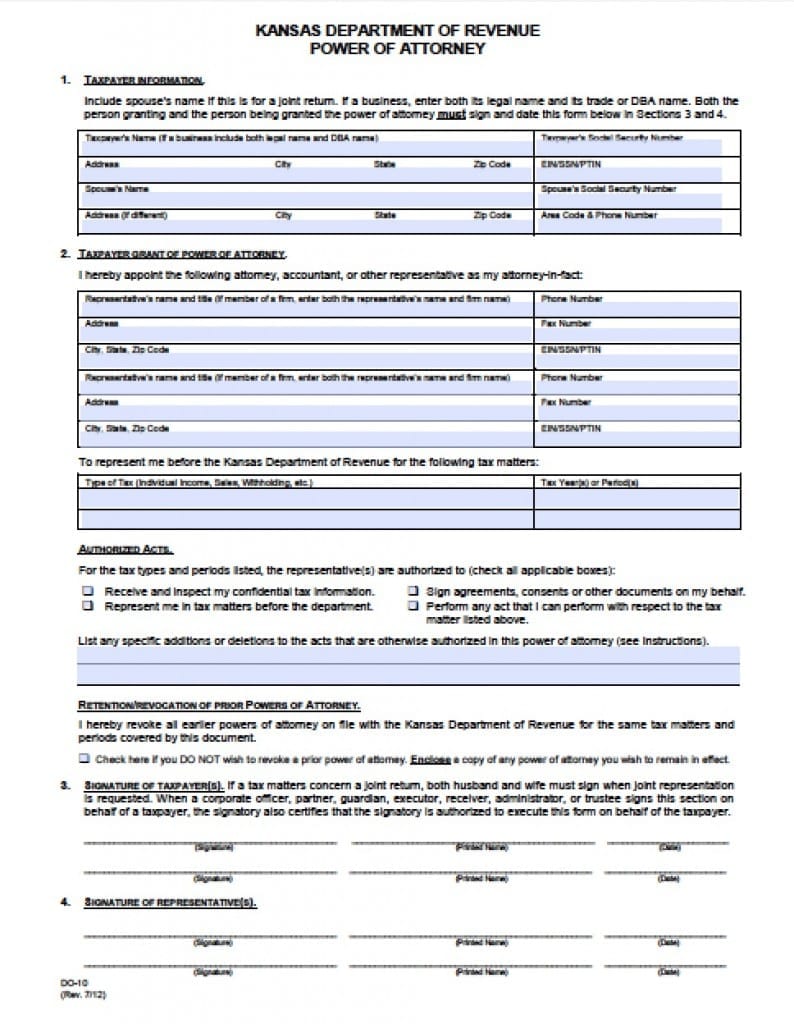

Free Kansas Power of Attorney Forms in Fillable PDF 9 Types Archives

2016 extension form irs kopreference

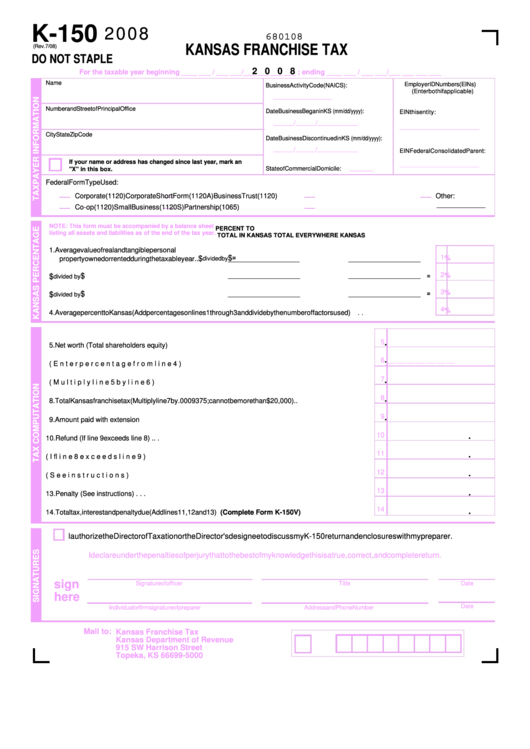

Form K150 Kansas Franchise Tax 2008 printable pdf download

Related Post: