K-1 Form 1120S Instructions

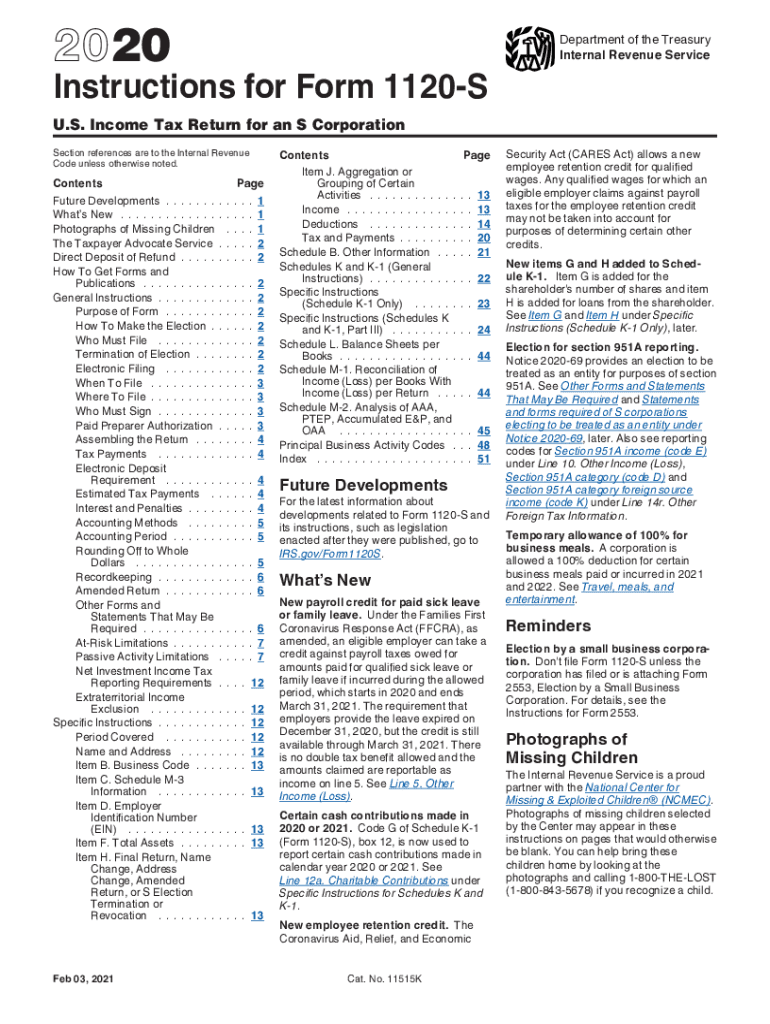

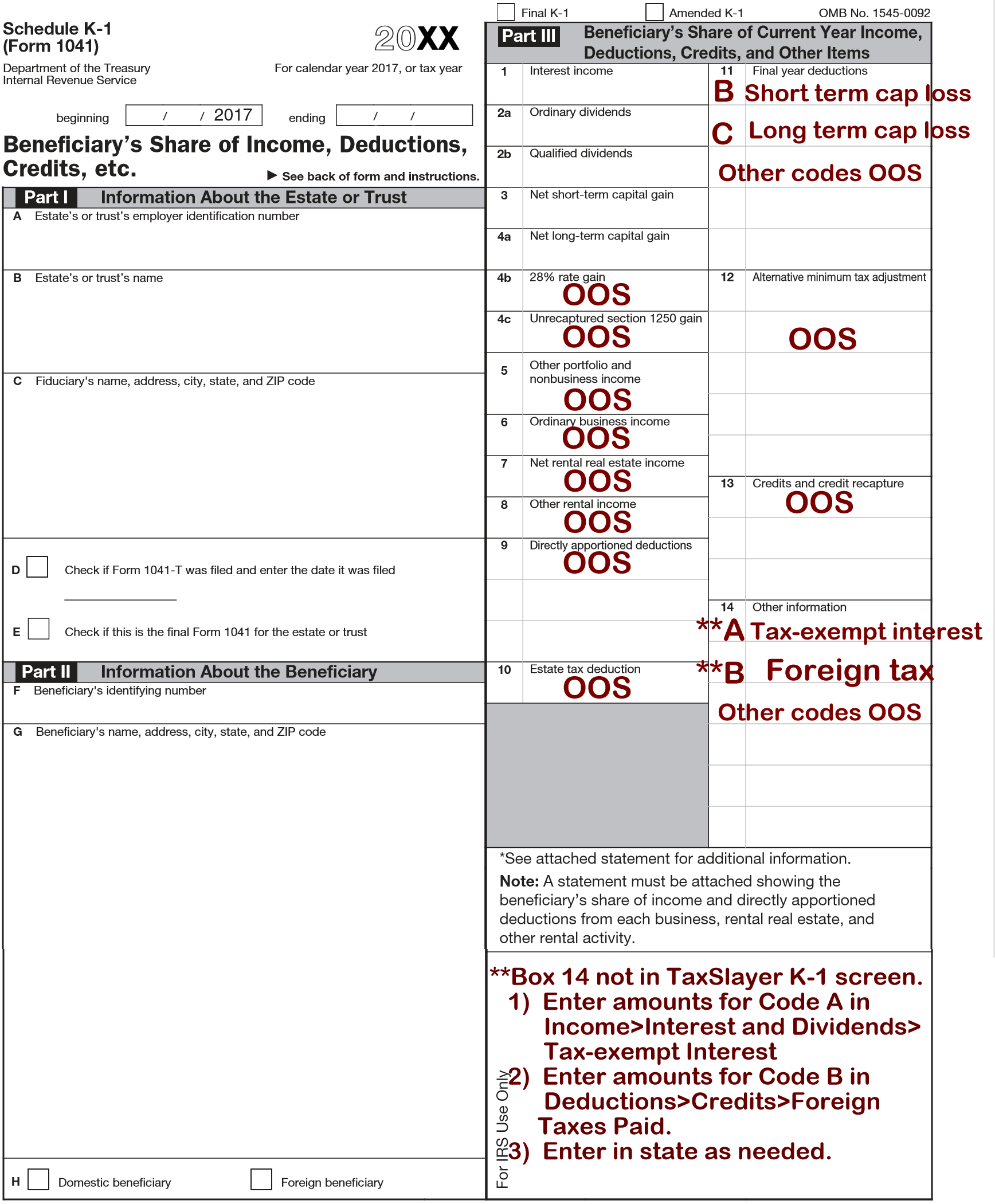

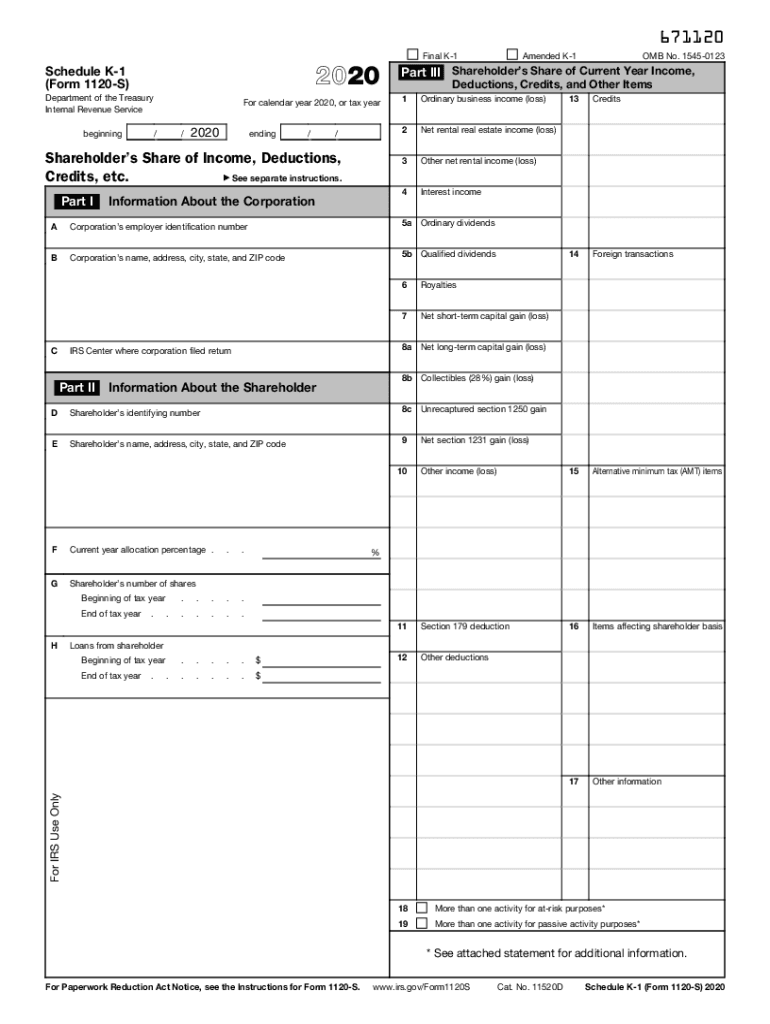

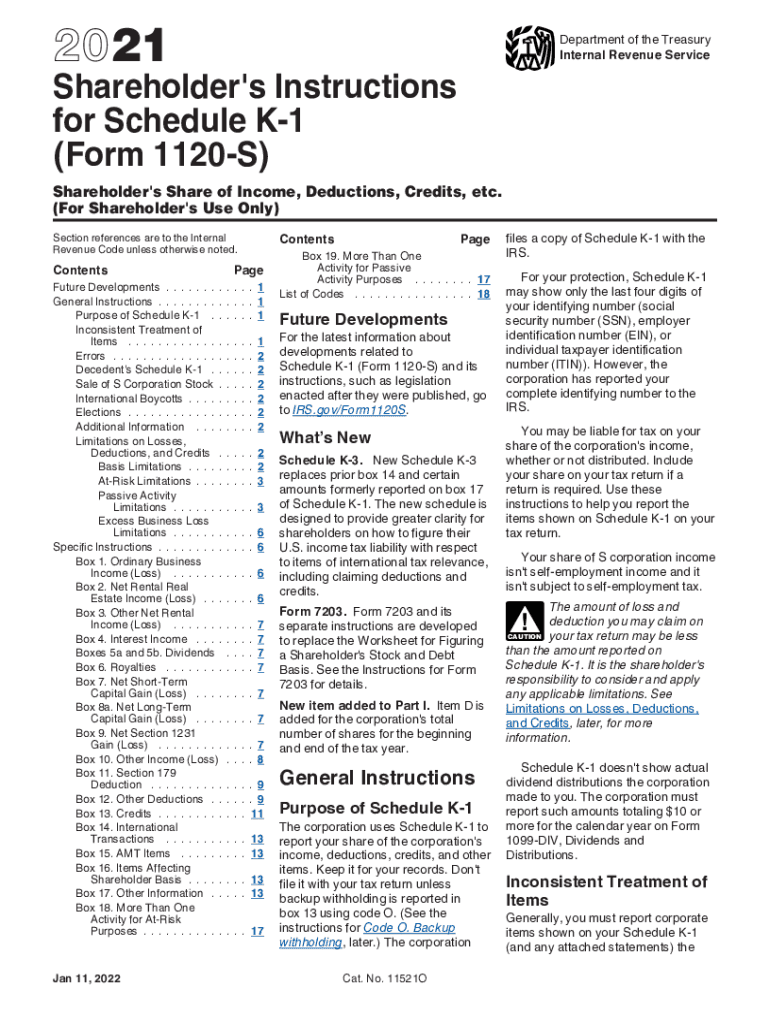

K-1 Form 1120S Instructions - 4 digit code used to identify the software developer whose application produced the bar. Be sure that the treatment of s corporation income, responsibility to consider and apply corporation sends a copy of the. The amount of loss and deduction you may claim on your tax. Department of the treasury internal revenue service for calendar year 2022, or tax year. What’s new new boxes 18 and 19. This article focuses solely on the entry of the credit and foreign. Form 8938, statement of specified foreign financial assets. This article focuses solely on the entry of the deduction items which are found on boxes 11. This article focuses solely on the entry of the other information items which are found on. Web updated for tax year 2022 • july 6, 2023 9:36 am. Be sure that the treatment of s corporation income, responsibility to consider and apply corporation sends a copy of the. Web updated for tax year 2022 • july 6, 2023 9:36 am. Department of the treasury internal revenue service for calendar year 2022, or tax year. This article focuses solely on the entry of the other information items which are. Web updated for tax year 2022 • july 6, 2023 9:36 am. This article focuses solely on the entry of the credit and foreign. This article focuses solely on the entry of the income (or loss) items which are. The amount of loss and deduction you may claim on your tax. Form 8938, statement of specified foreign financial assets. This article focuses solely on the entry of the credit and foreign. 4 digit code used to identify the software developer whose application produced the bar. Department of the treasury internal revenue service for calendar year 2022, or tax year. Department of the treasury internal revenue service for calendar year 2022, or tax year. Be sure that the treatment of. Income tax return for an s corporation, for use in tax years beginning in 2020, as well as draft instructions for the. This article focuses solely on the entry of the income (or loss) items which are. This article focuses solely on the entry of the credit and foreign. The amount of loss and deduction you may claim on your. Be sure that the treatment of s corporation income, responsibility to consider and apply corporation sends a copy of the. Web updated for tax year 2022 • july 6, 2023 9:36 am. Income tax return for an s corporation, for use in tax years beginning in 2020, as well as draft instructions for the. The amount of loss and deduction. Web updated for tax year 2022 • july 6, 2023 9:36 am. This article focuses solely on the entry of the deduction items which are found on boxes 11. The amount of loss and deduction you may claim on your tax. This article focuses solely on the entry of the other information items which are found on. What’s new new. Web updated for tax year 2022 • july 6, 2023 9:36 am. 4 digit code used to identify the software developer whose application produced the bar. This article focuses solely on the entry of the credit and foreign. Form 8938, statement of specified foreign financial assets. Department of the treasury internal revenue service for calendar year 2022, or tax year. This article focuses solely on the entry of the income (or loss) items which are. Web updated for tax year 2022 • july 6, 2023 9:36 am. This article focuses solely on the entry of the credit and foreign. The amount of loss and deduction you may claim on your tax. What’s new new boxes 18 and 19. Income tax return for an s corporation, for use in tax years beginning in 2020, as well as draft instructions for the. What’s new new boxes 18 and 19. Form 8938, statement of specified foreign financial assets. 4 digit code used to identify the software developer whose application produced the bar. This article focuses solely on the entry of the. Department of the treasury internal revenue service for calendar year 2022, or tax year. This article focuses solely on the entry of the income (or loss) items which are. Income tax return for an s corporation, for use in tax years beginning in 2020, as well as draft instructions for the. What’s new new boxes 18 and 19. This article. This article focuses solely on the entry of the deduction items which are found on boxes 11. Department of the treasury internal revenue service for calendar year 2022, or tax year. Form 8938, statement of specified foreign financial assets. Income tax return for an s corporation, for use in tax years beginning in 2020, as well as draft instructions for the. Department of the treasury internal revenue service for calendar year 2022, or tax year. Web updated for tax year 2022 • july 6, 2023 9:36 am. Be sure that the treatment of s corporation income, responsibility to consider and apply corporation sends a copy of the. 4 digit code used to identify the software developer whose application produced the bar. What’s new new boxes 18 and 19. This article focuses solely on the entry of the income (or loss) items which are. The amount of loss and deduction you may claim on your tax. This article focuses solely on the entry of the credit and foreign. This article focuses solely on the entry of the other information items which are found on.IRS Instructions 1120S 2020 Fill out Tax Template Online US Legal Forms

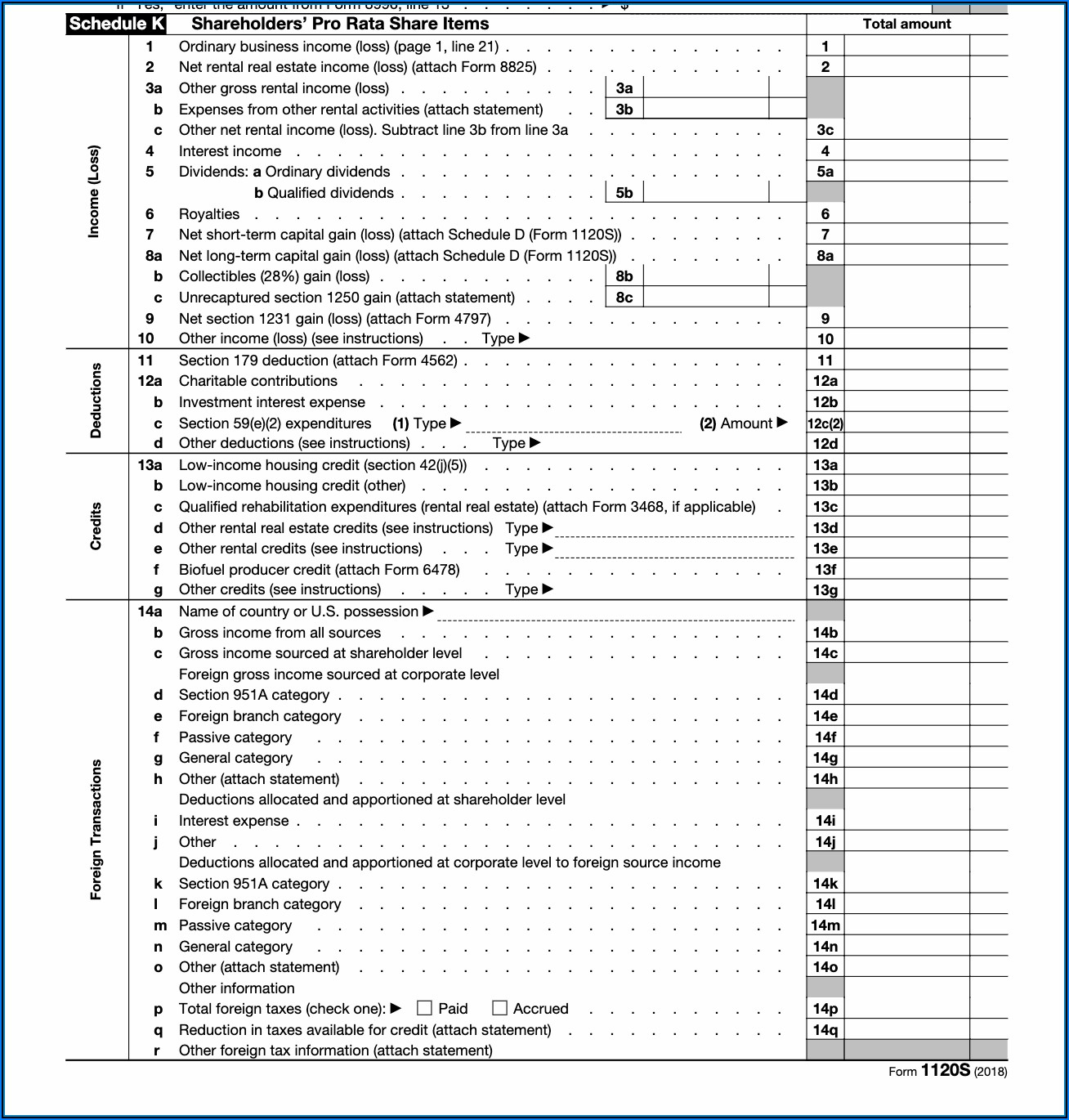

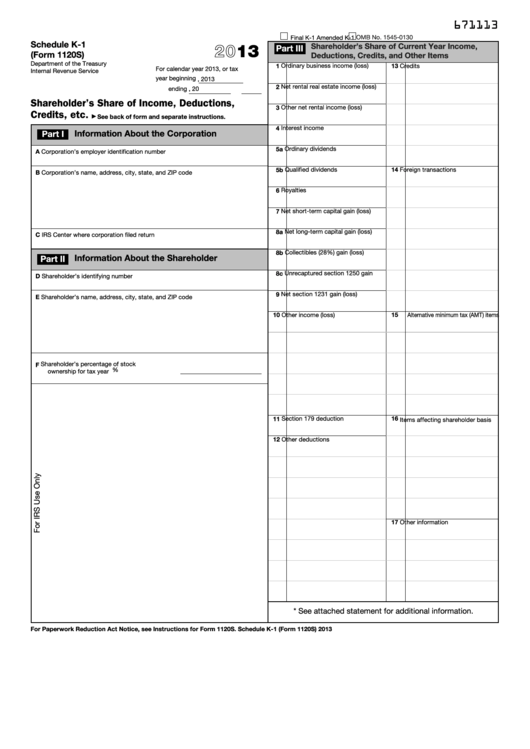

2014 Form 1120s K 1 Form Resume Examples goVLaee2va

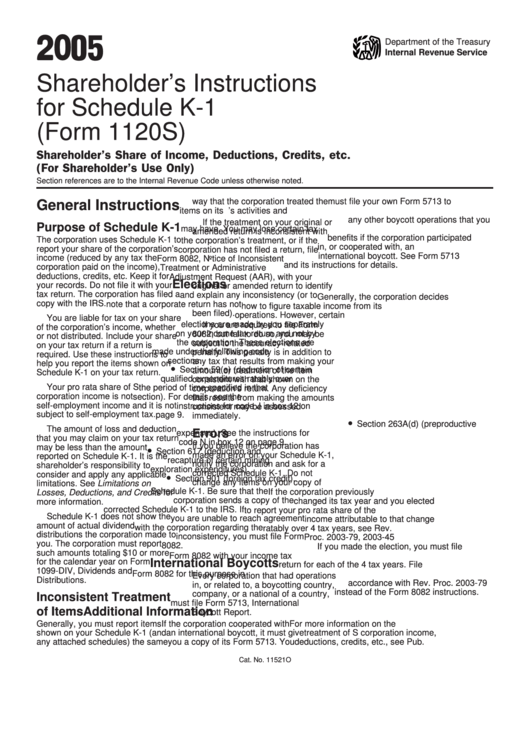

Shareholder'S Instructions For Schedule K1 (Form 1120s) 2005

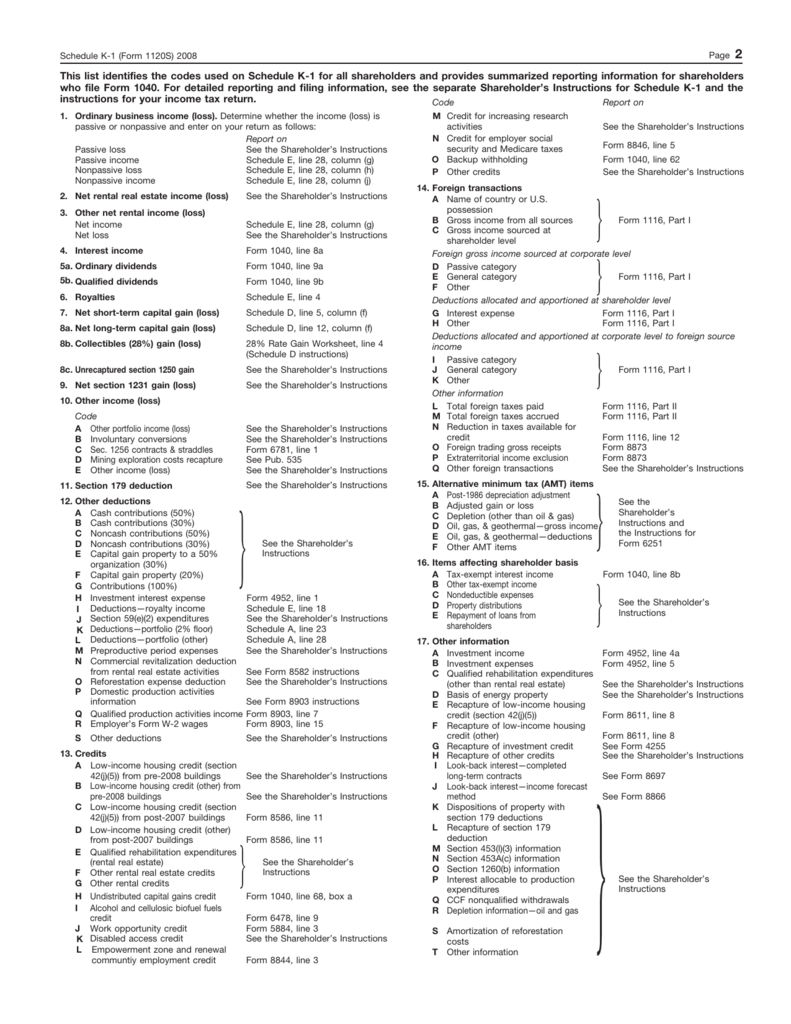

1120S K1 codes

Form 1120S K 1 Instructions 2016 2018 Codes Line 17 —

Fillable Schedule K1 (Form 1120s) Shareholder'S Share Of

IRS 1120S Schedule K1 2020 Fill out Tax Template Online US Legal

2014 Form 1120s K1 Instructions Ethel Hernandez's Templates

Schedule K1 Instructions How to Fill Out a K1 and File It Ask Gusto

IRS Instruction 1120S Schedule K1 20212022 Fill and Sign

Related Post: